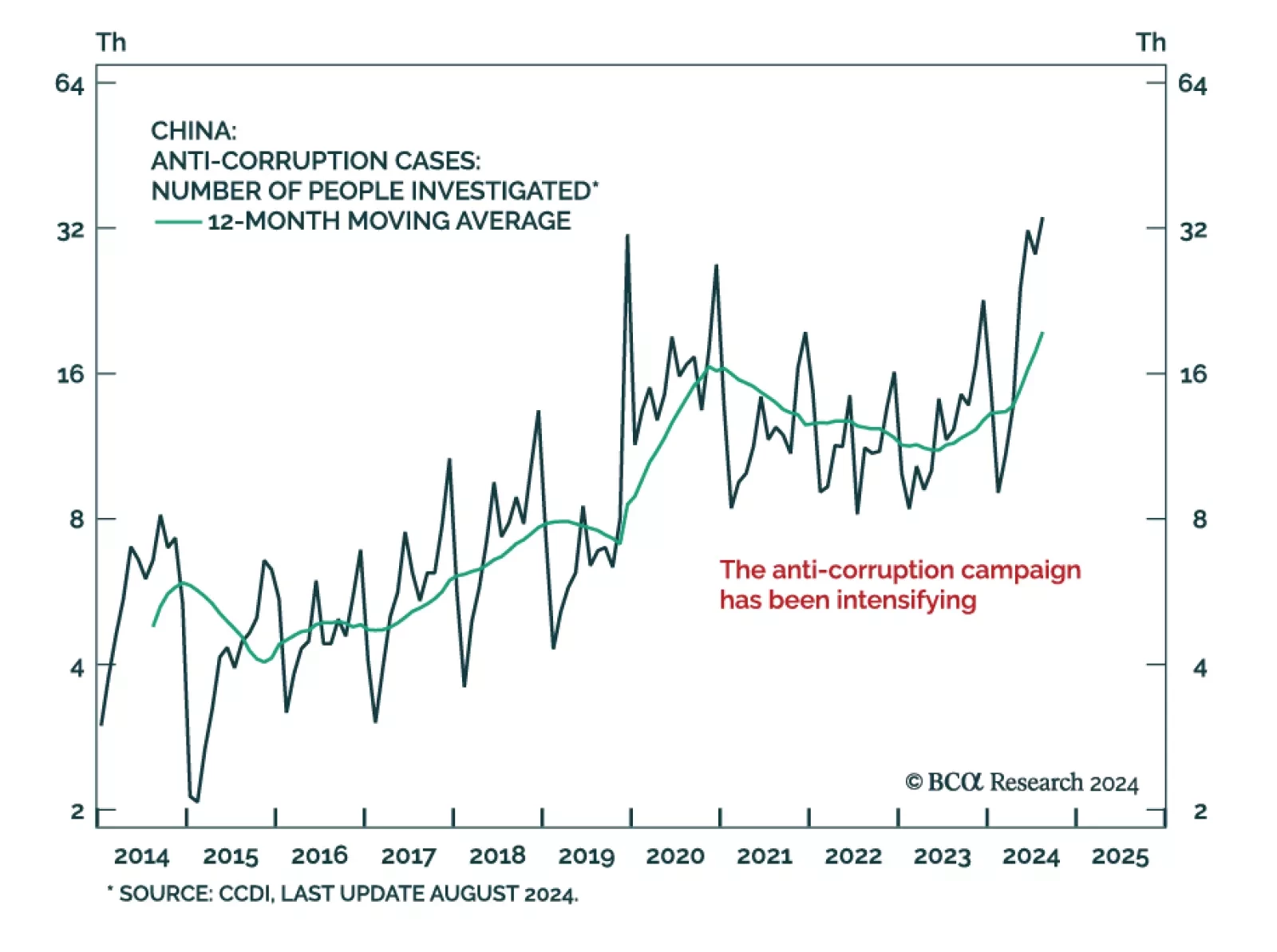

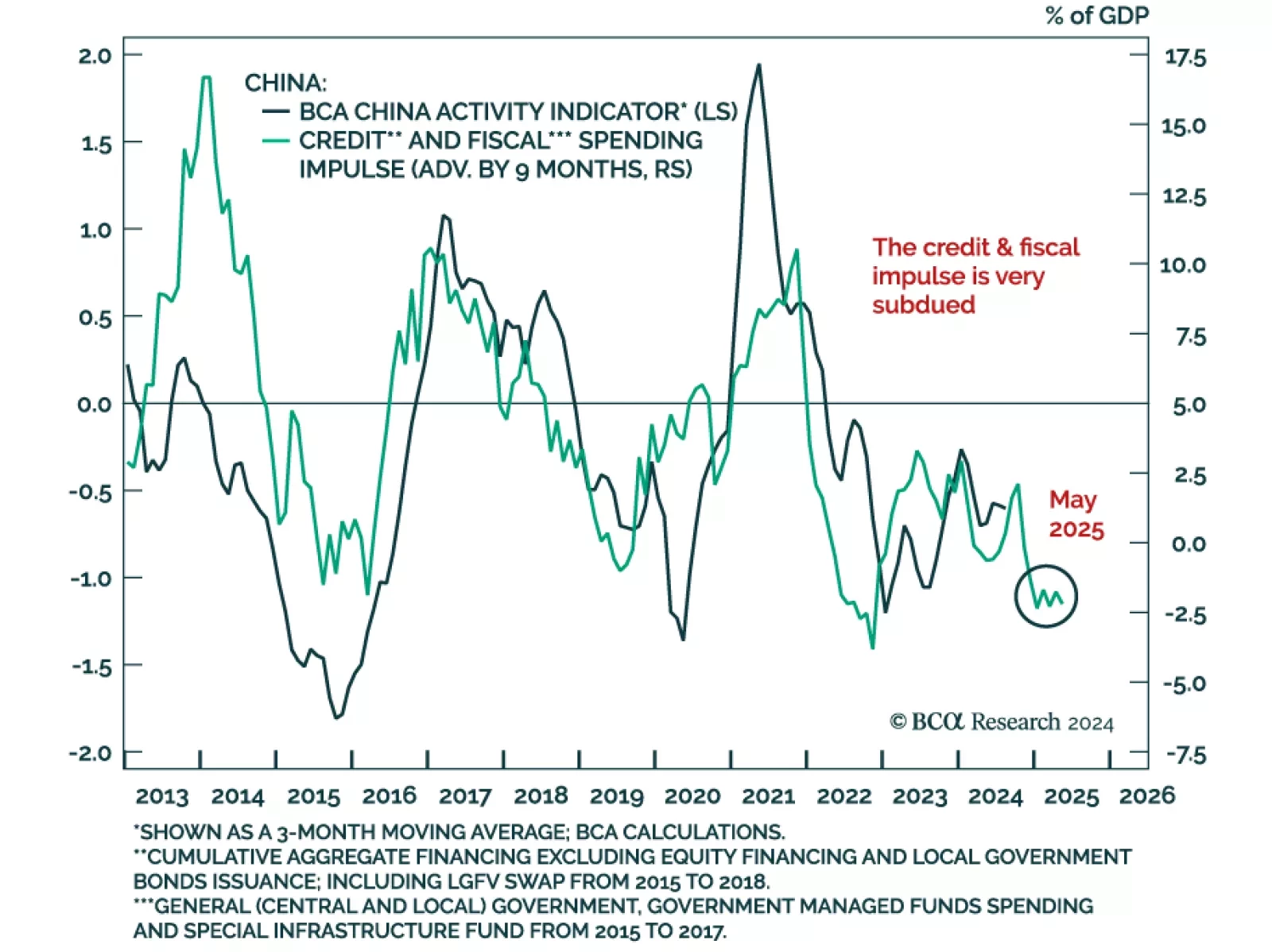

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

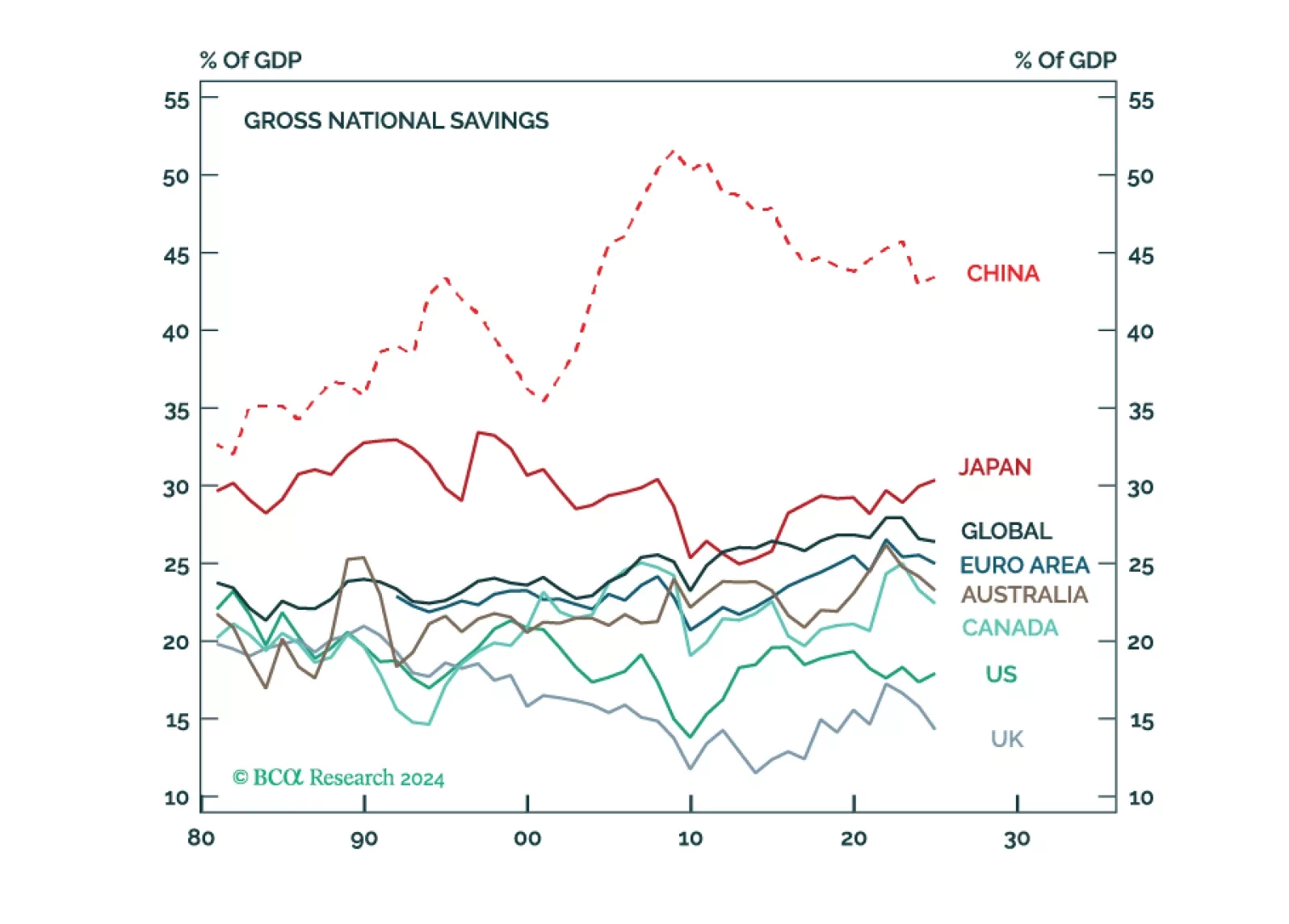

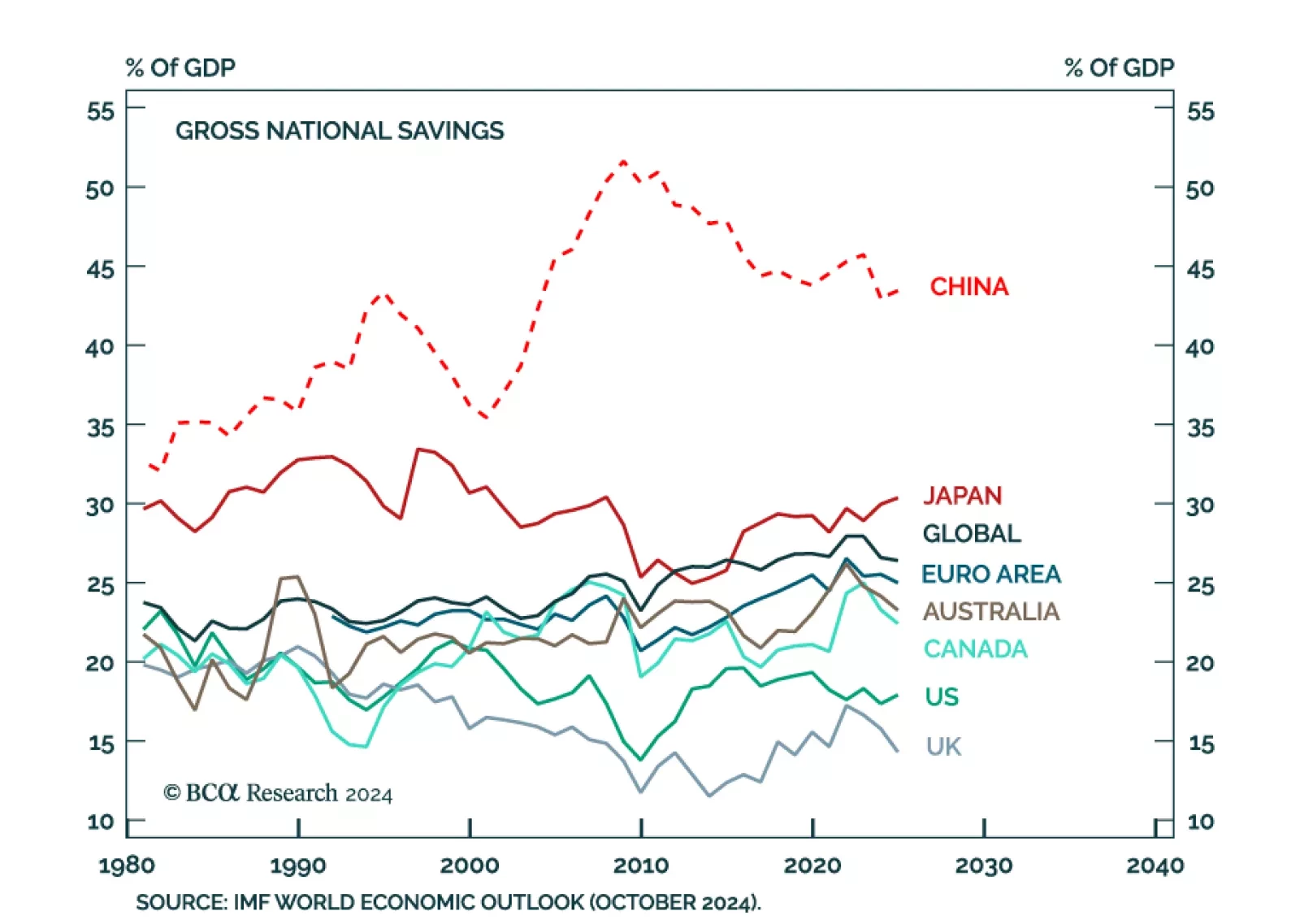

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

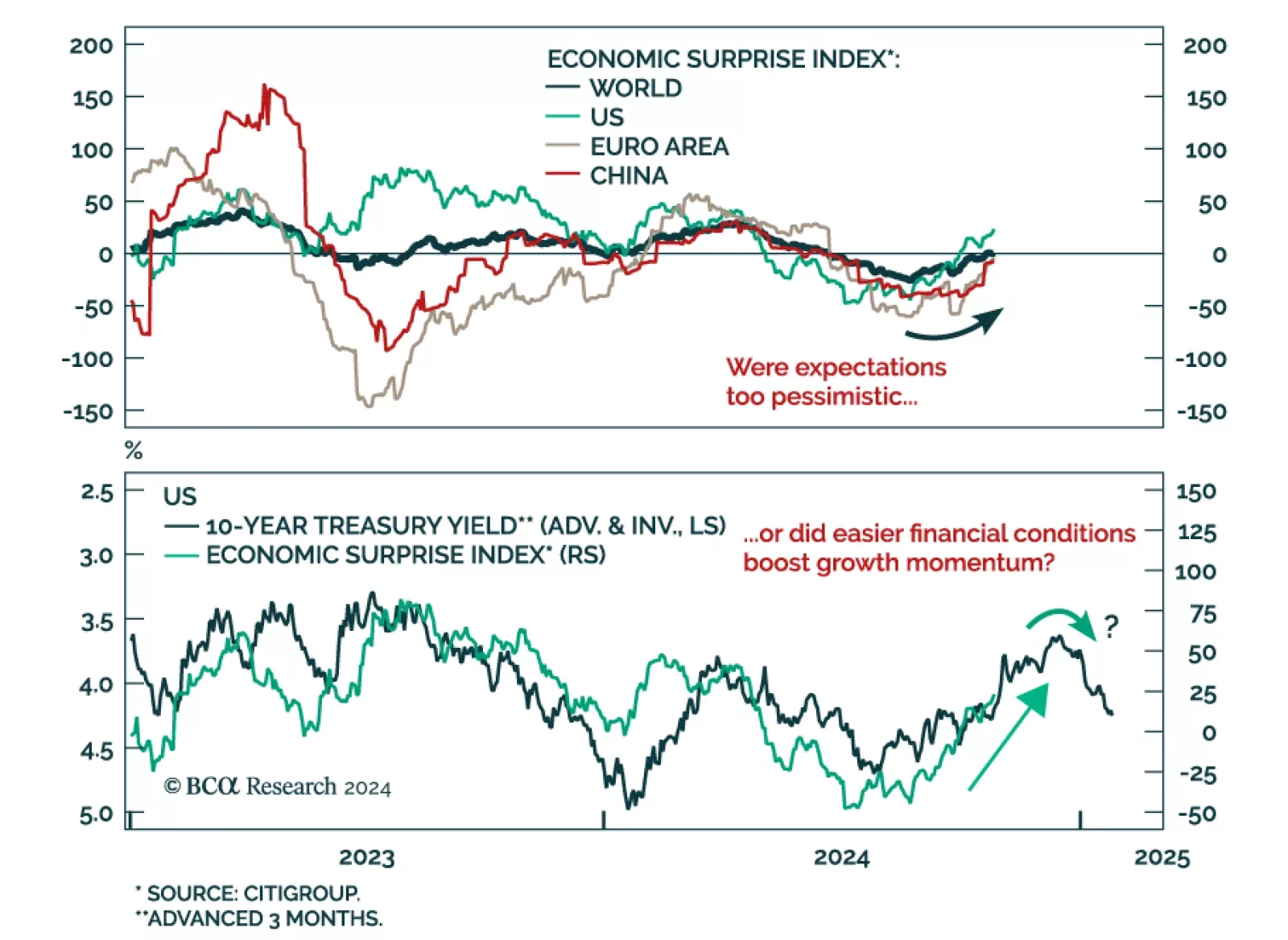

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”

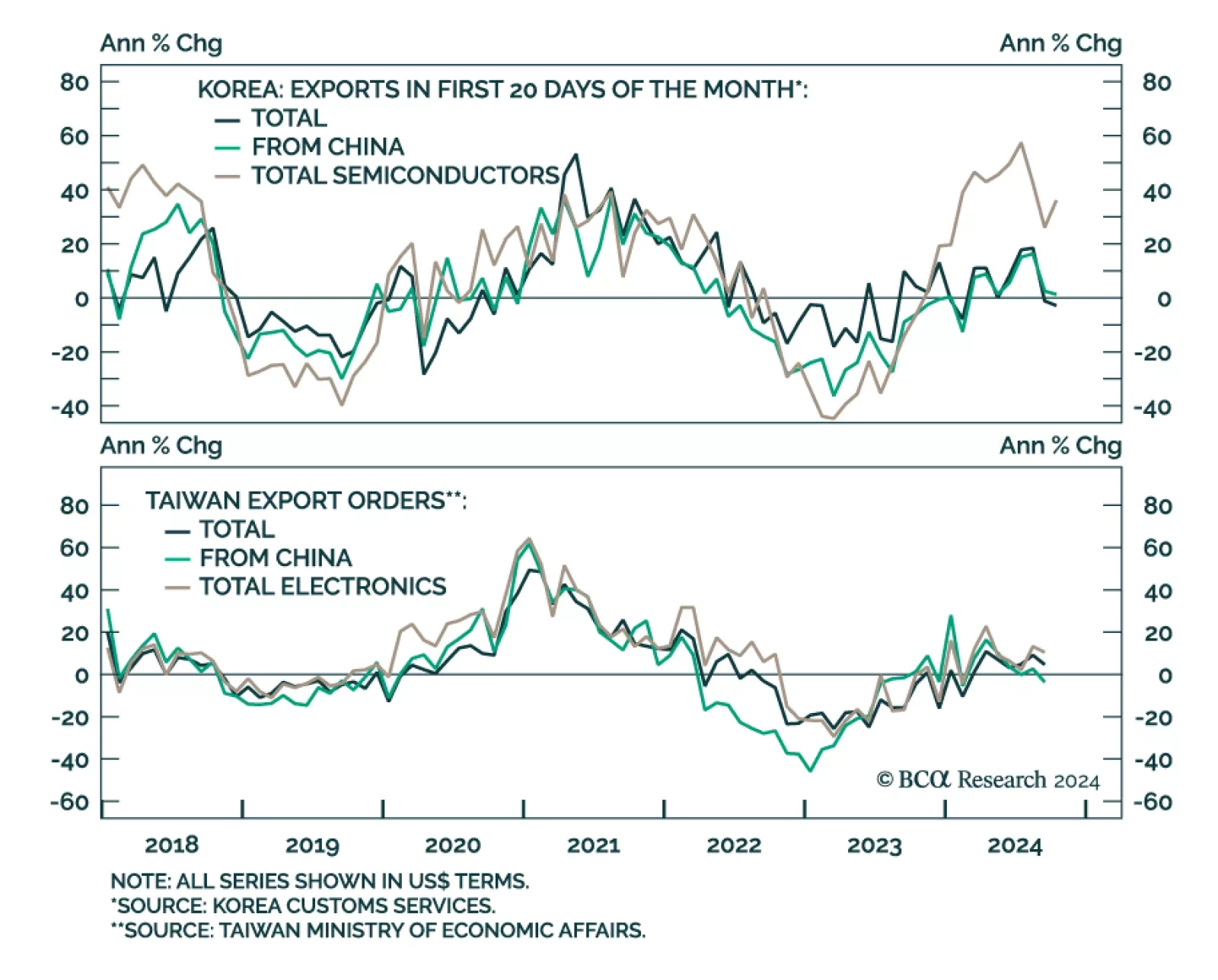

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…

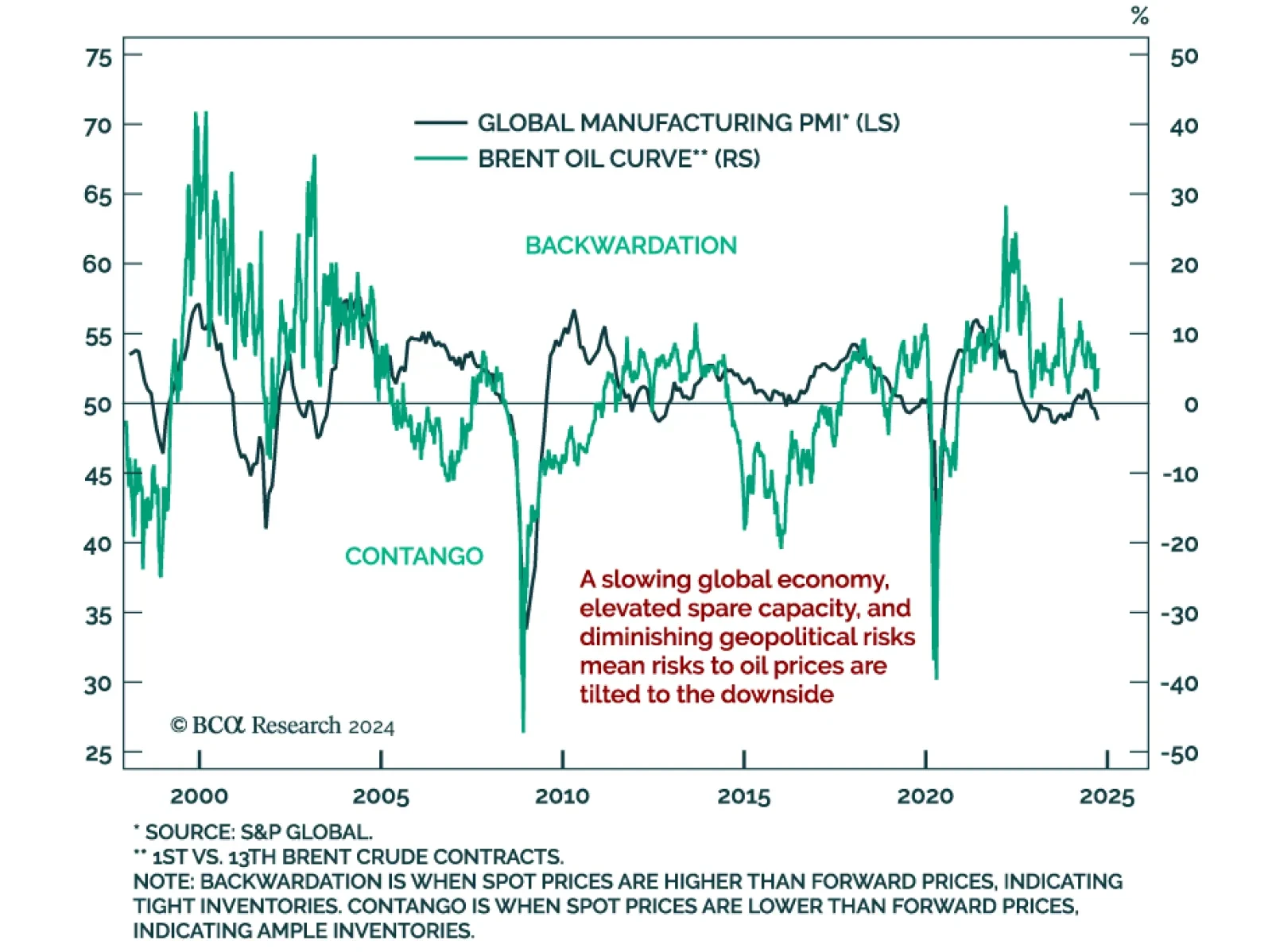

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

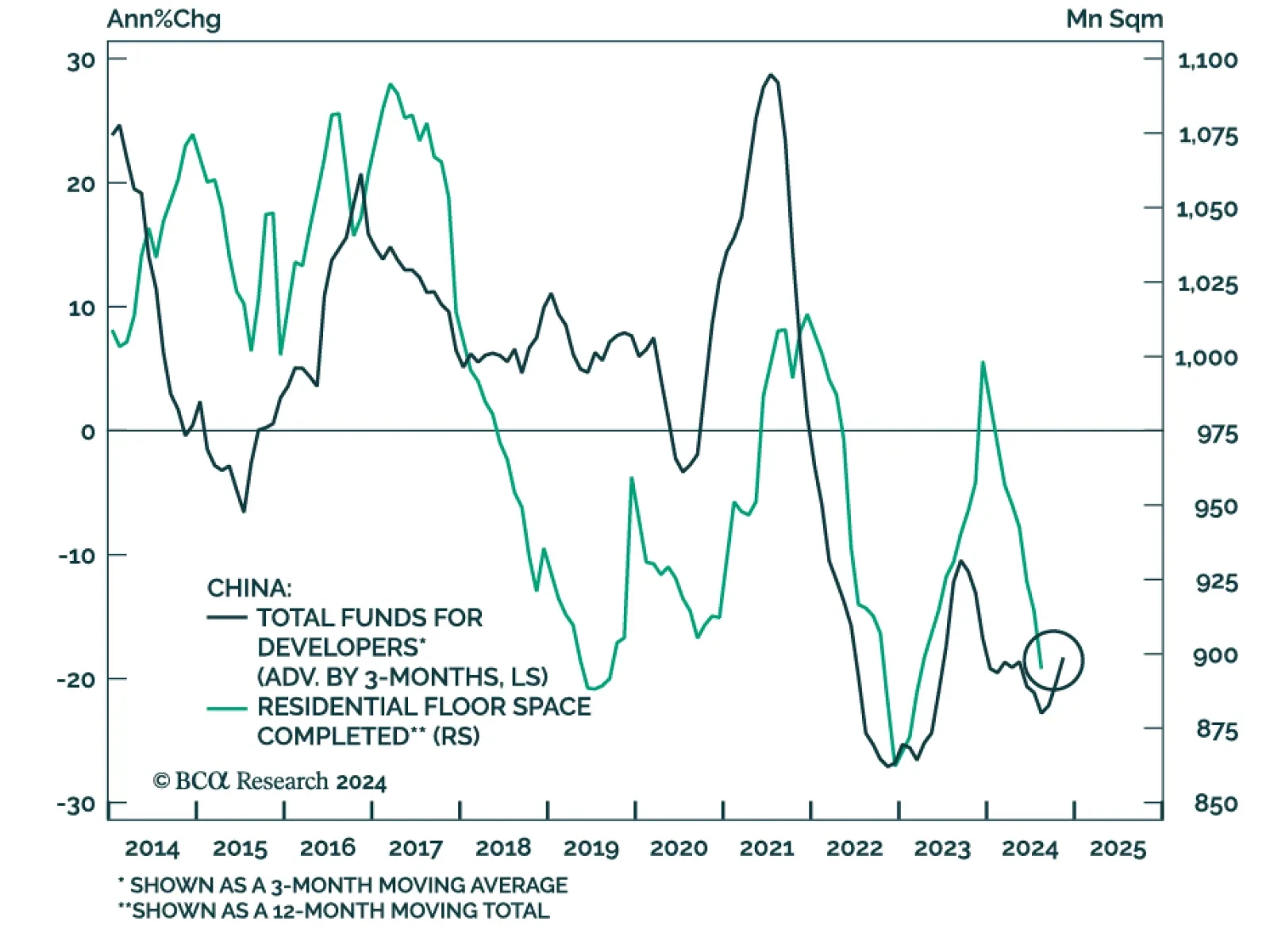

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

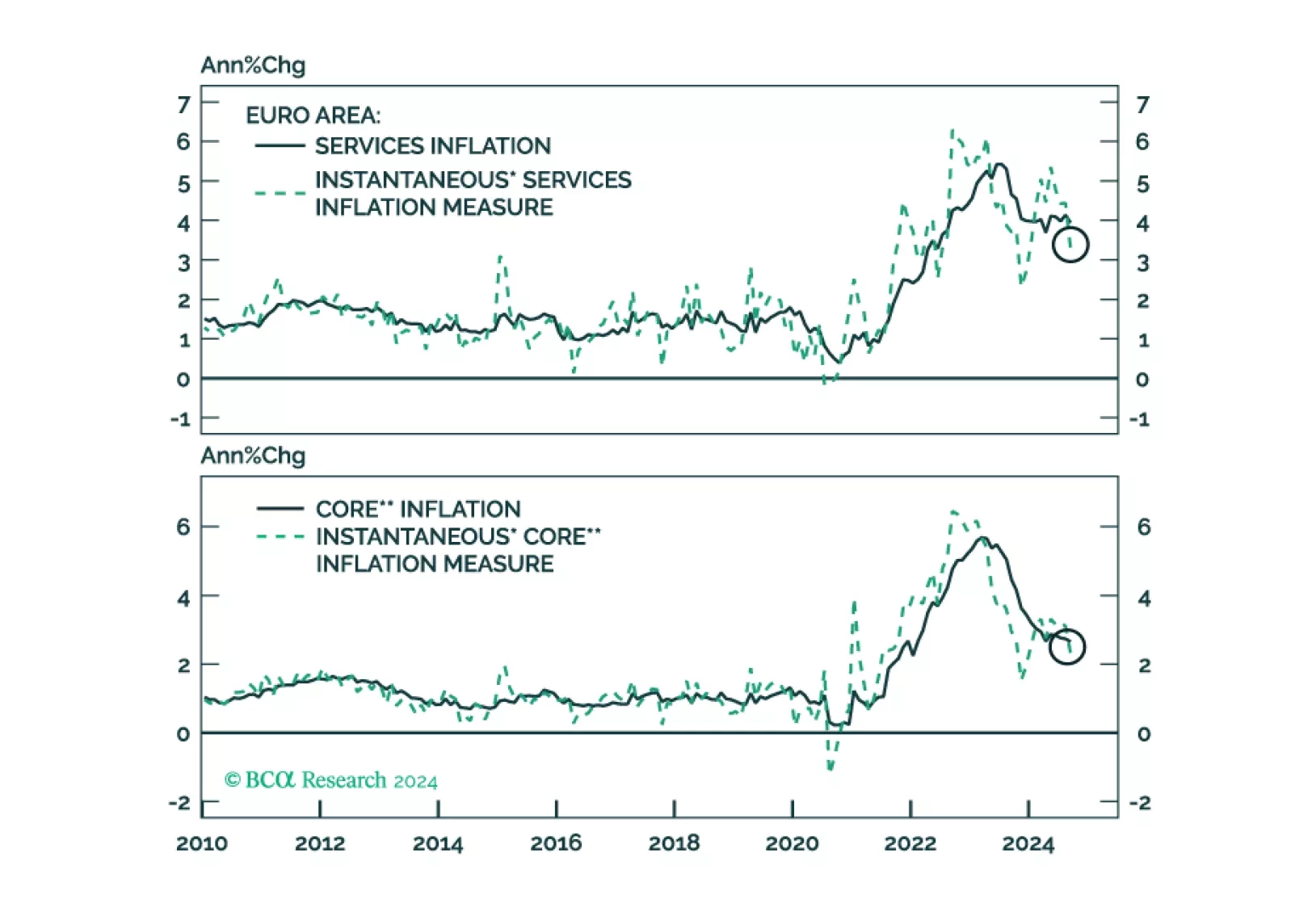

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

China’s Housing Administration Chief held a press conference yesterday to unveil two property-sector stimulus plans. According to our China strategists, the details were underwhelming and led to a decline in Chinese…

While recent cross-asset developments have sent a risk-on signal, with equities and bond yields both higher, the commodity complex has recently been sending a more somber message. “Dr. Copper” is a bellwether for…