China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

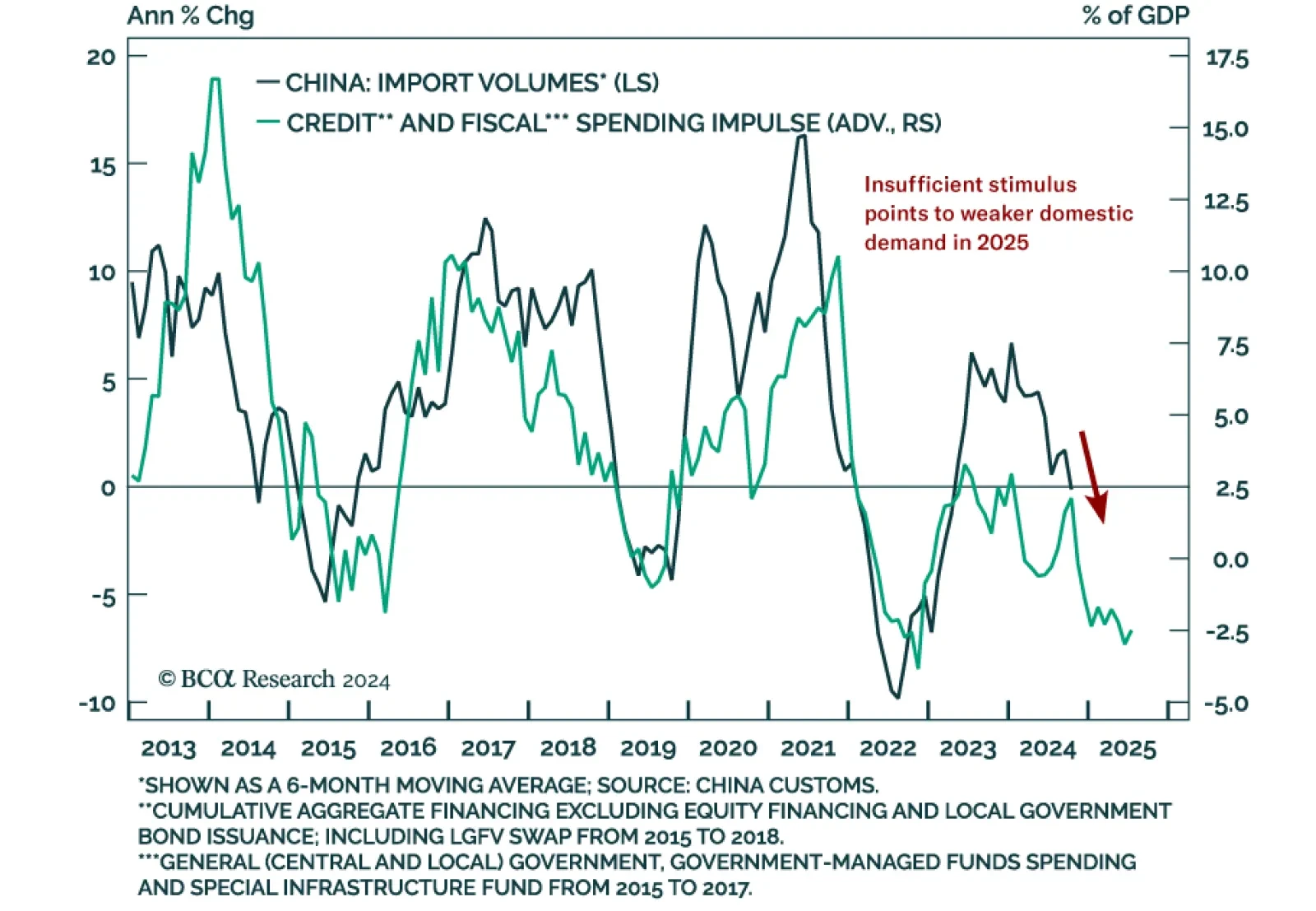

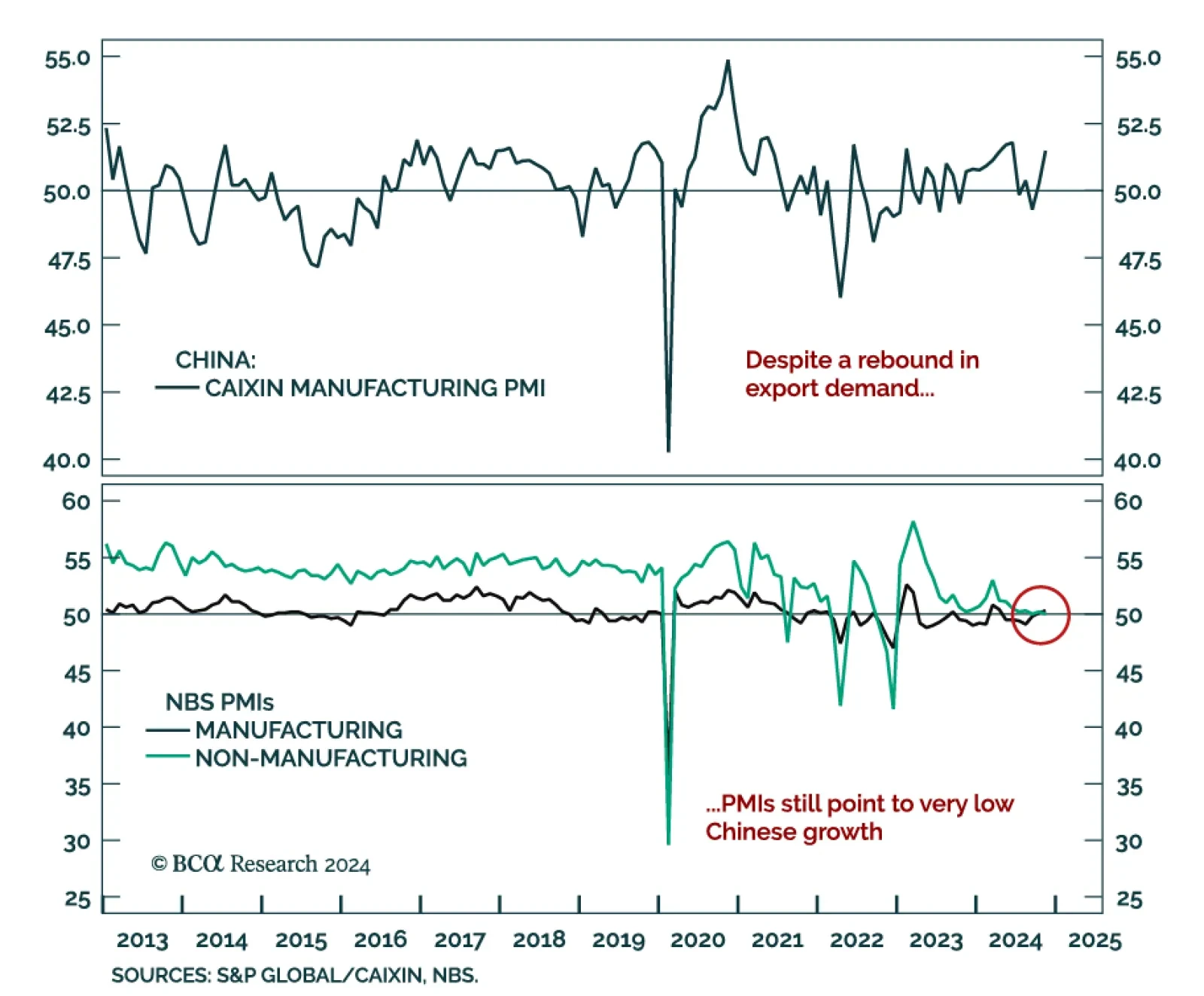

China’s November trade balance increased to CNY 692.8 bln on the back of slowing-but-still-growing exports (down to 5.8% y/y from 11.2% in October), and a worsening imports contraction (-4.7% y/y vs. -3.7% in October). In…

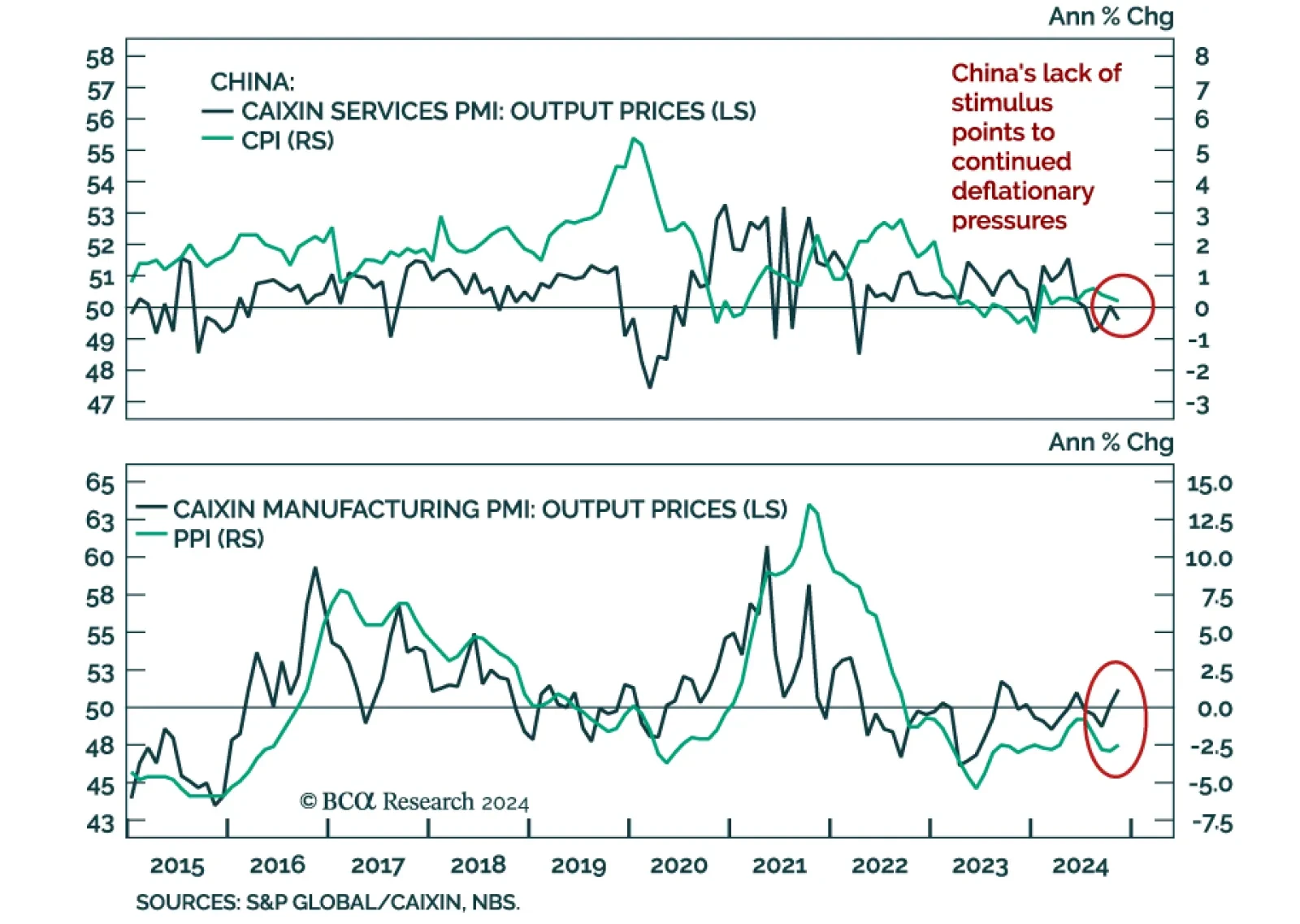

Chinese deflationary pressures intensified in November, with CPI ticking down to 0.2% y/y from 0.3% in October. Producer prices deflation eased, with prices falling 2.5% y/y, less than -2.9% y/y a month prior. The weak data…

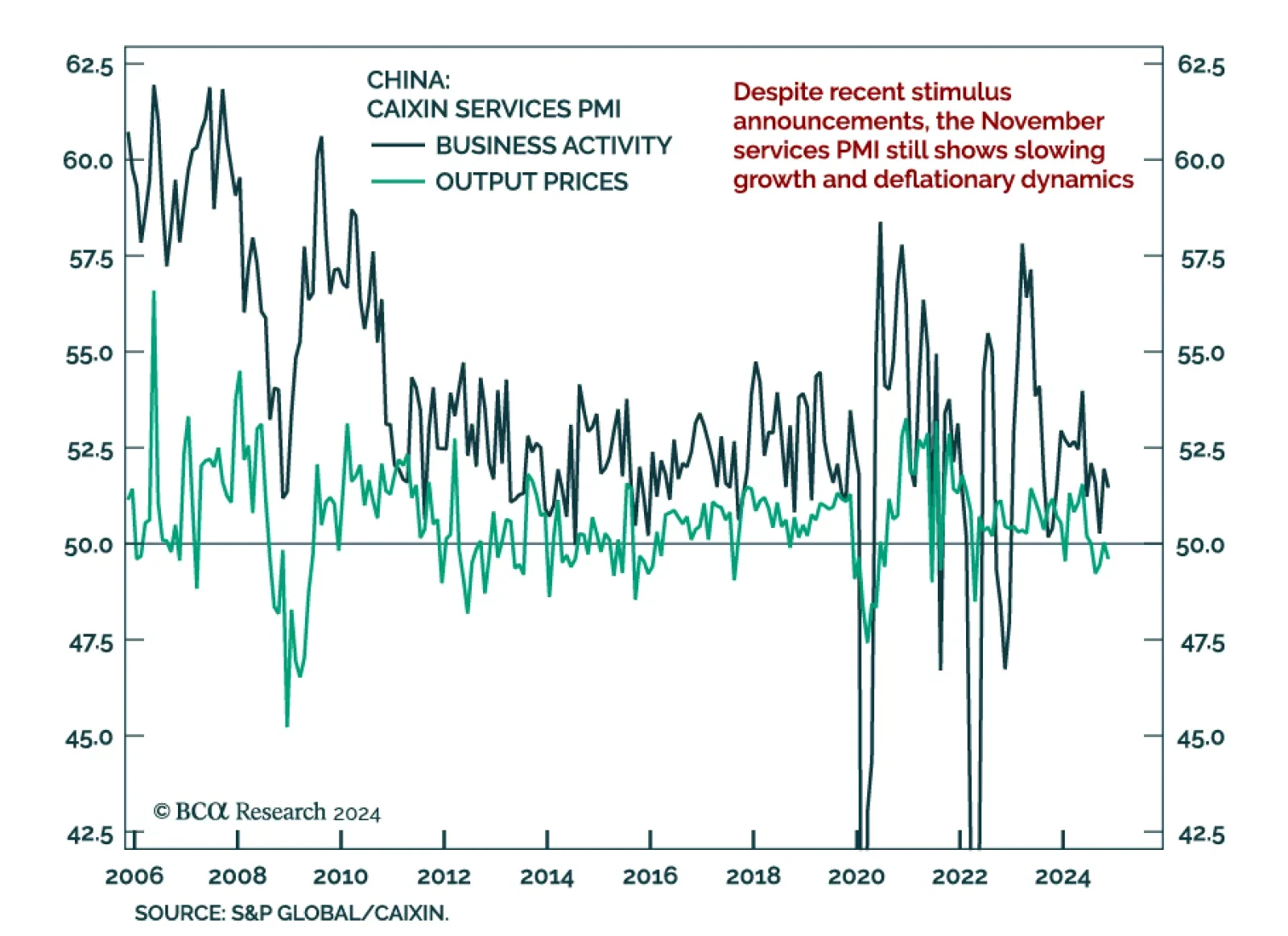

The November Caixin services PMI ticked down to 51.5, which along with a rising manufacturing PMI pushed the composite up to 52.3 from 51.9. Components such as new orders and employment also ticked down, and output prices fell to…

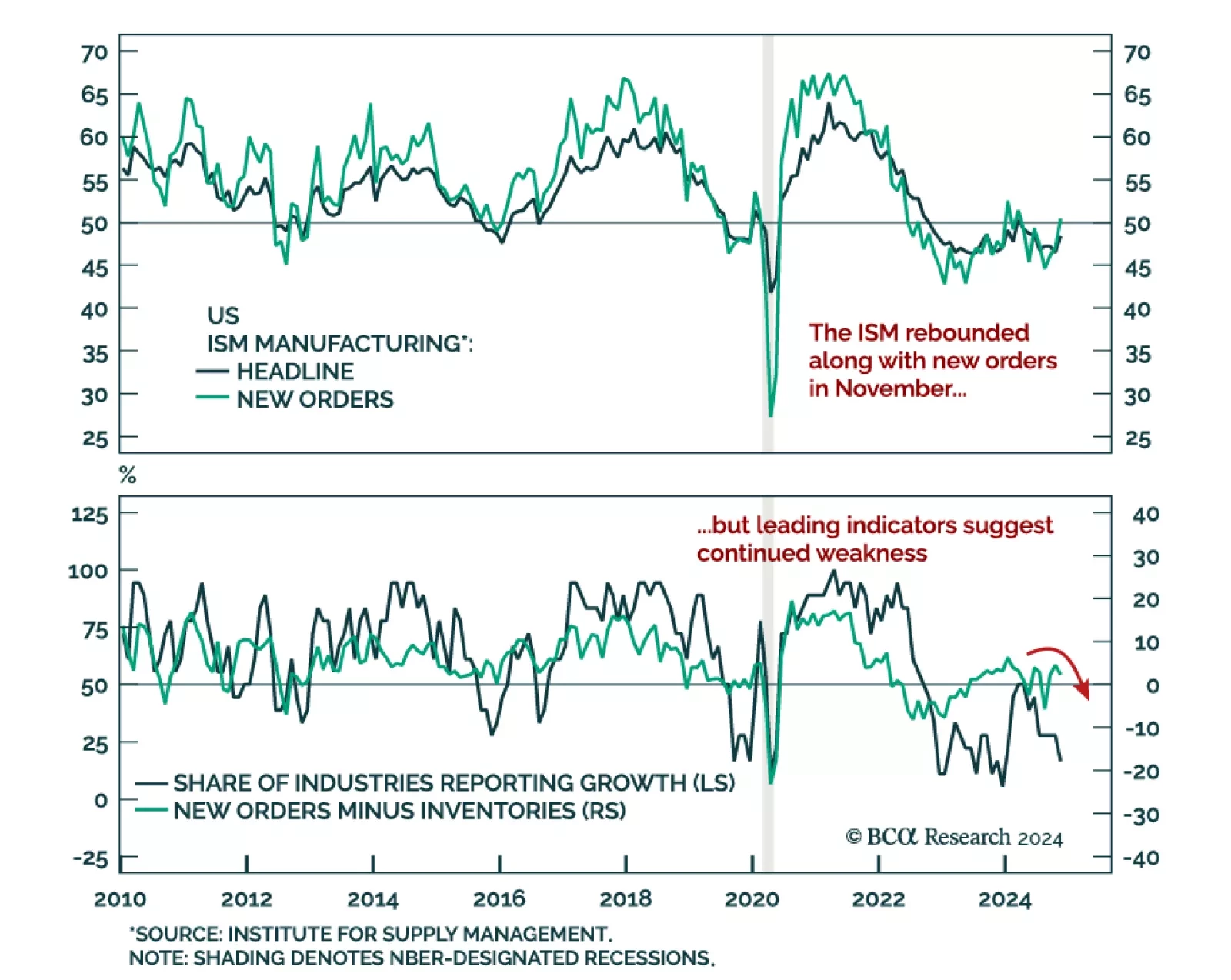

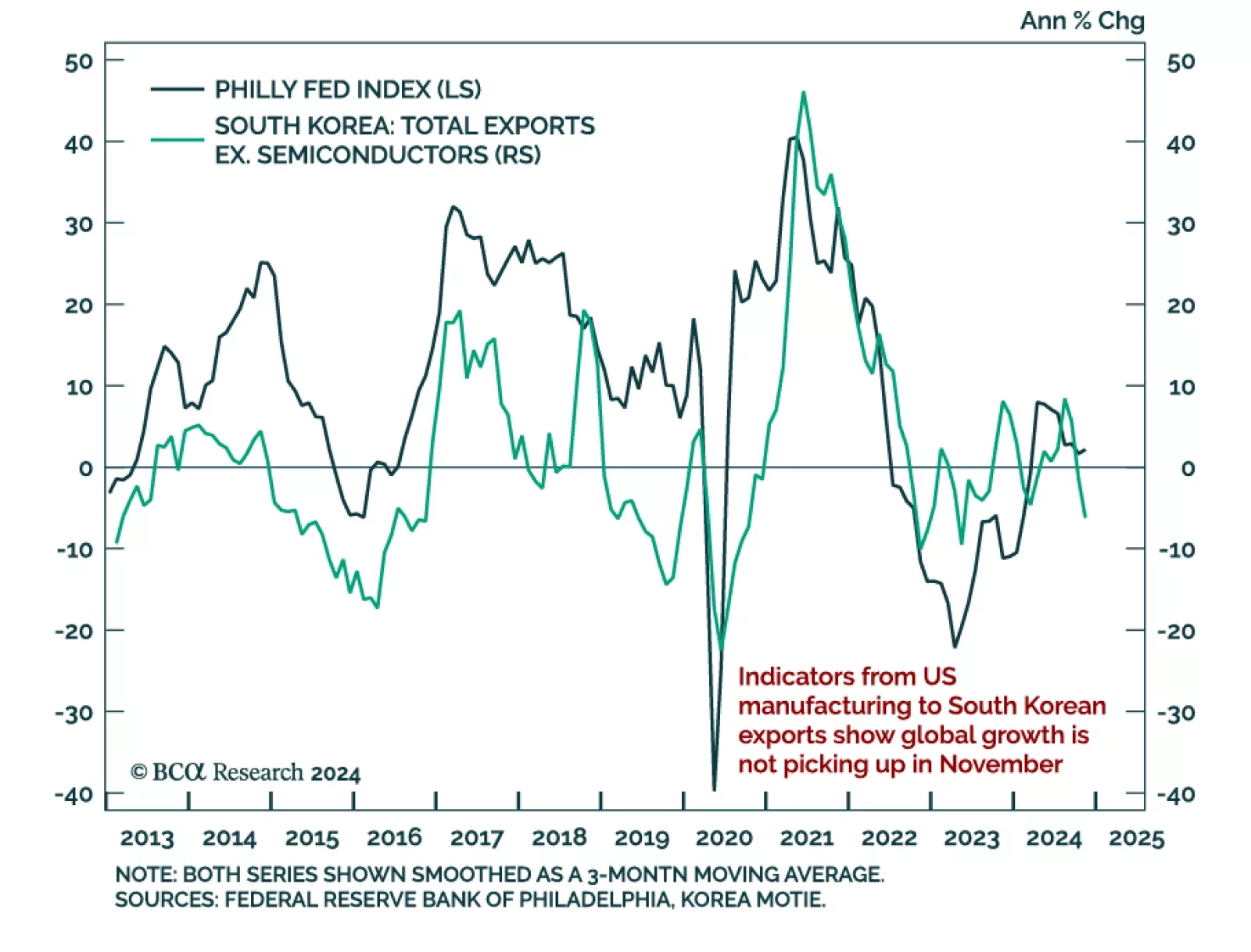

The November ISM Manufacturing index beat expectations, increasing to 48.4 from 46.5 in October. The improvement was partly driven by the new orders component, which increased to 50.4 from 47.1. Price pressures moderated.…

China’s November PMIs were mixed, and reflected very low growth. The official composite PMI was unchanged at 50.8, driven by a small uptick in manufacturing to 50.3 and a small downtick of services to 50. The Caixin…

This week we conduct a thorough audit of our open positions by revisiting the original basis and subsequent performance of all 13 cyclical recommendations. Following the review, we recommend closing 6 of the 13 positions.

The November Philly Fed manufacturing survey missed expectations and fell to -5.5 vs. 10.3 in October. New orders and shipments softened although they still indicate growth. Most indicators of current activity decreased, while…