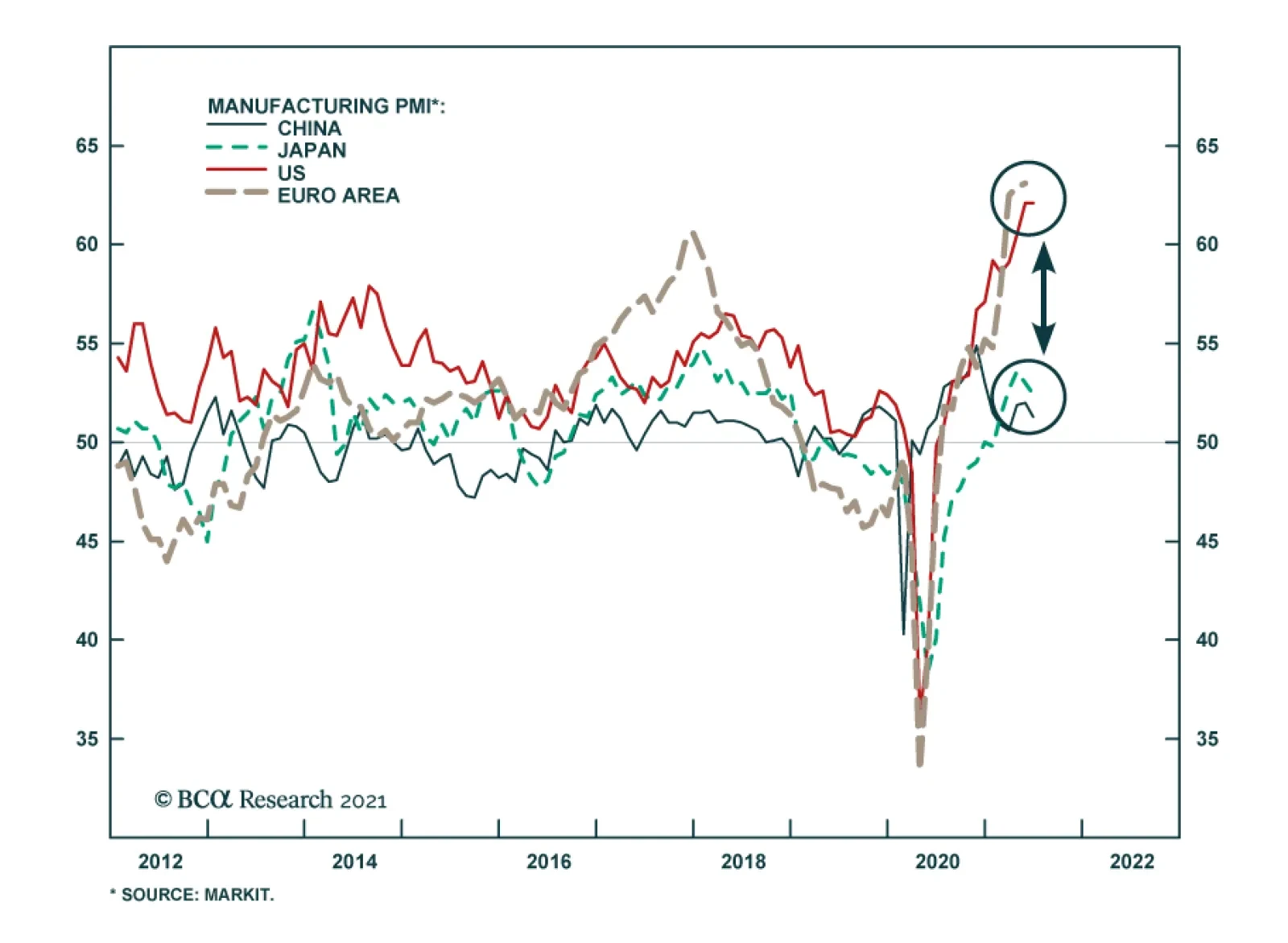

Global manufacturing PMI in June was at robust 54.4, indicating that more than 50% of global manufacturing industries continue expanding. Such a robust reading of global manufacturing PMI was despite the weakness in Asian…

Highlights Three distinct forces are likely to make South Asia’s geopolitical risks increasingly relevant to global investors. First, India’s tensions with China stem from China’s growing foreign policy assertiveness…

Highlights Gold is – and always will be – exquisitely sensitive to Fed policy and forward guidance, as last month's "Dot Shock" showed (Chart of the Week). Its price will continue to twitch – sometimes…

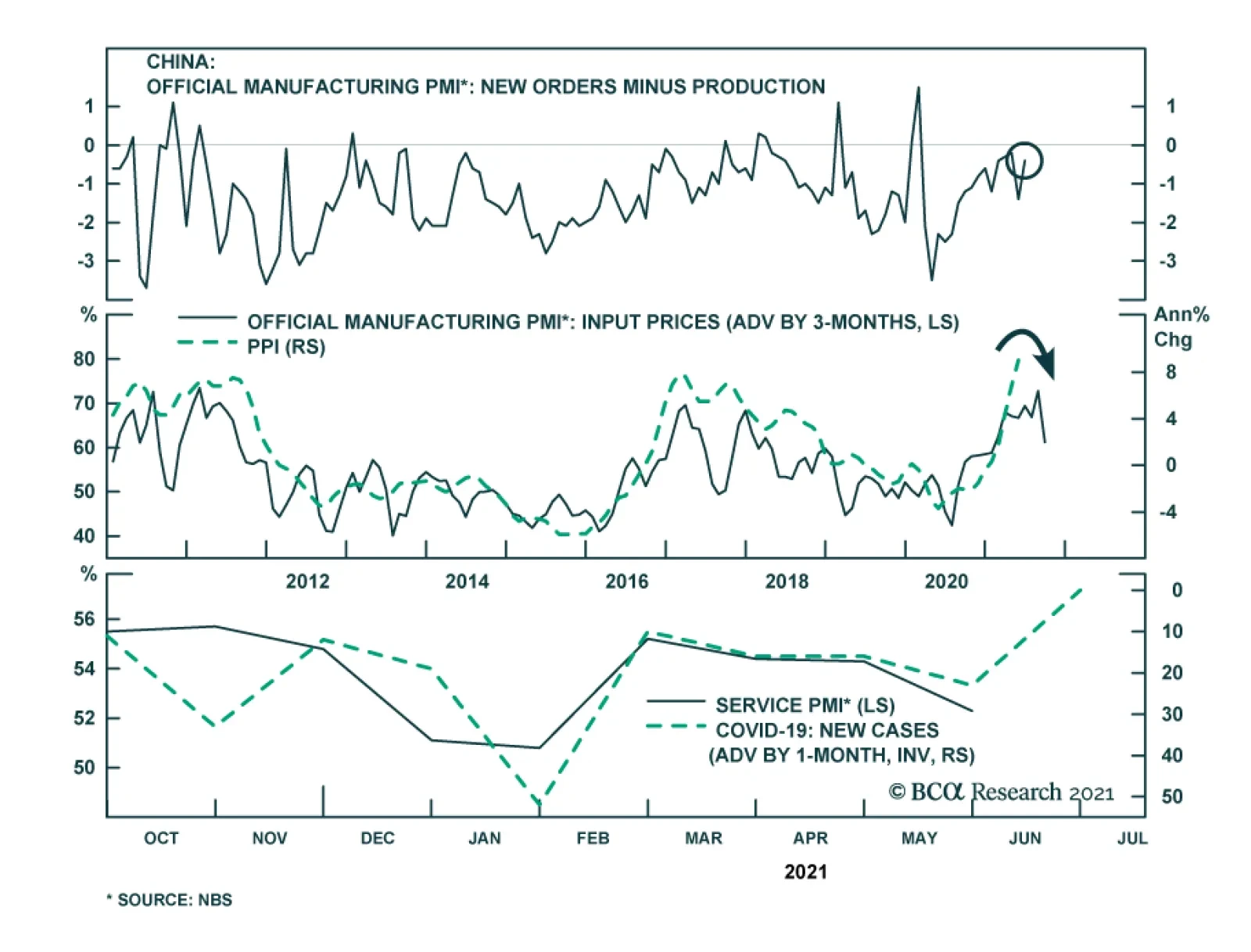

China’s official manufacturing PMI inched down to 50.9 in June from 51.0 in May, extending its downward trend that started in March. Its sub-indexes, however, sent mixed signals. While the new export orders, production and…

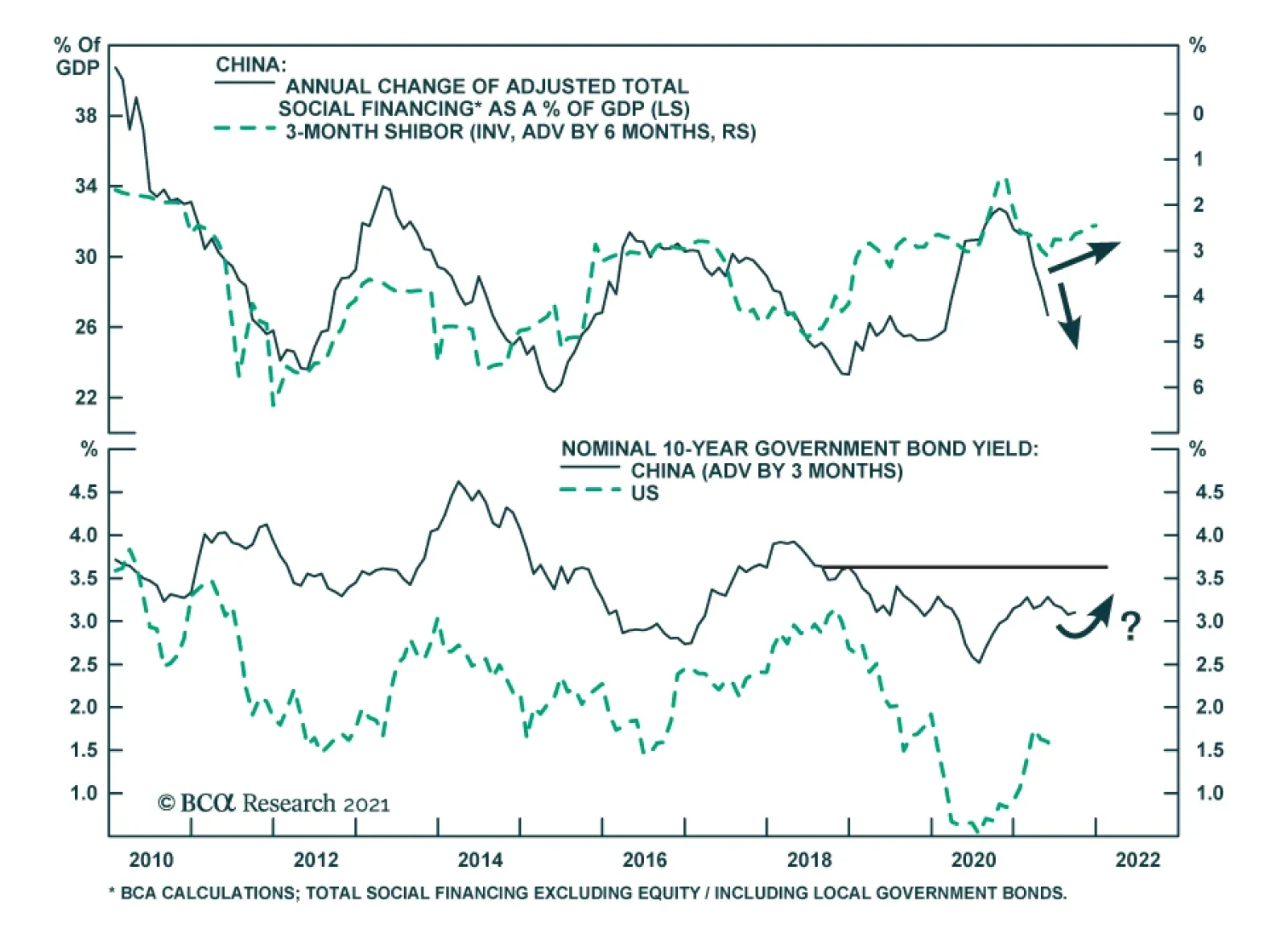

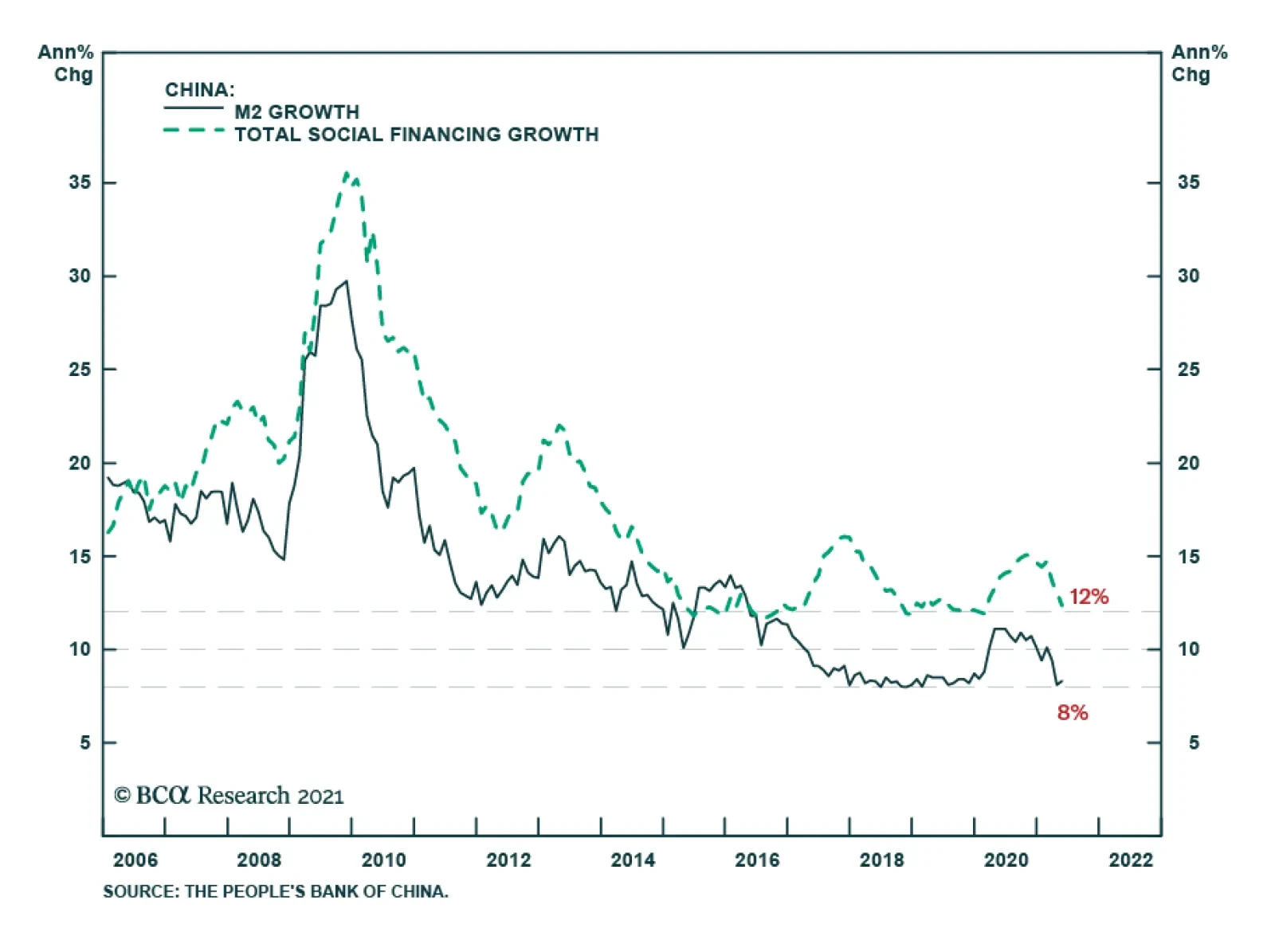

BCA Research’s China Investment Strategy service published their mid-year outlook for China today. They maintain an underweight stance on Chinese stocks, but recommend investors watch for signs of policy easing. Pressures…

Dear Client, China Investment Strategy will take a summer break next week. We will resume our publication on July 14th. Best regards and we wish you a happy and healthy summer. Jing Sima, China Strategist Highlights A USD…

BCA Research’s Geopolitical Strategy service recommends that on a tactical basis, investors stay defensive on global risk assets even if the cyclical outlook remains bright. The Xi administration’s re-…

Highlights The US is withdrawing from the Middle East and South Asia and making a strategic pivot to Asia Pacific. The third quarter will see risks flare around Iran and the US rejoin the 2015 Iranian nuclear deal. The result is…

Highlights Entering 2H21, oil and metals' price volatility will rise as inventories are drawn down to cover physical supply deficits brought about by the re-opening of major economies ex-China. As demand increases and oil and…

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…