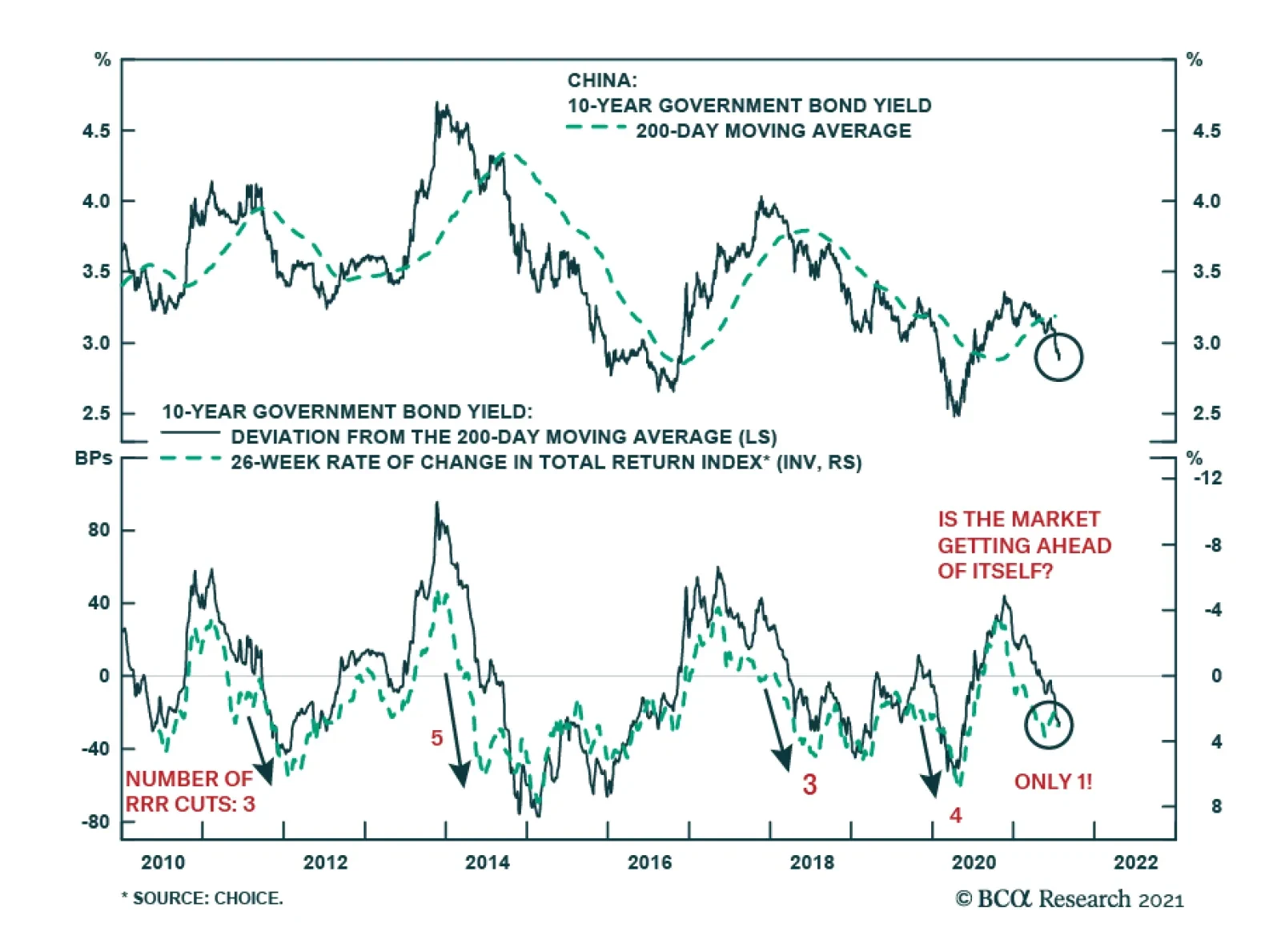

BCA Research’s China Investment Strategy service argues that the Chinese bond market is vulnerable to a near-term reassessment of policy and growth. The RRR cut exacerbated China’s nascent bond market rally as…

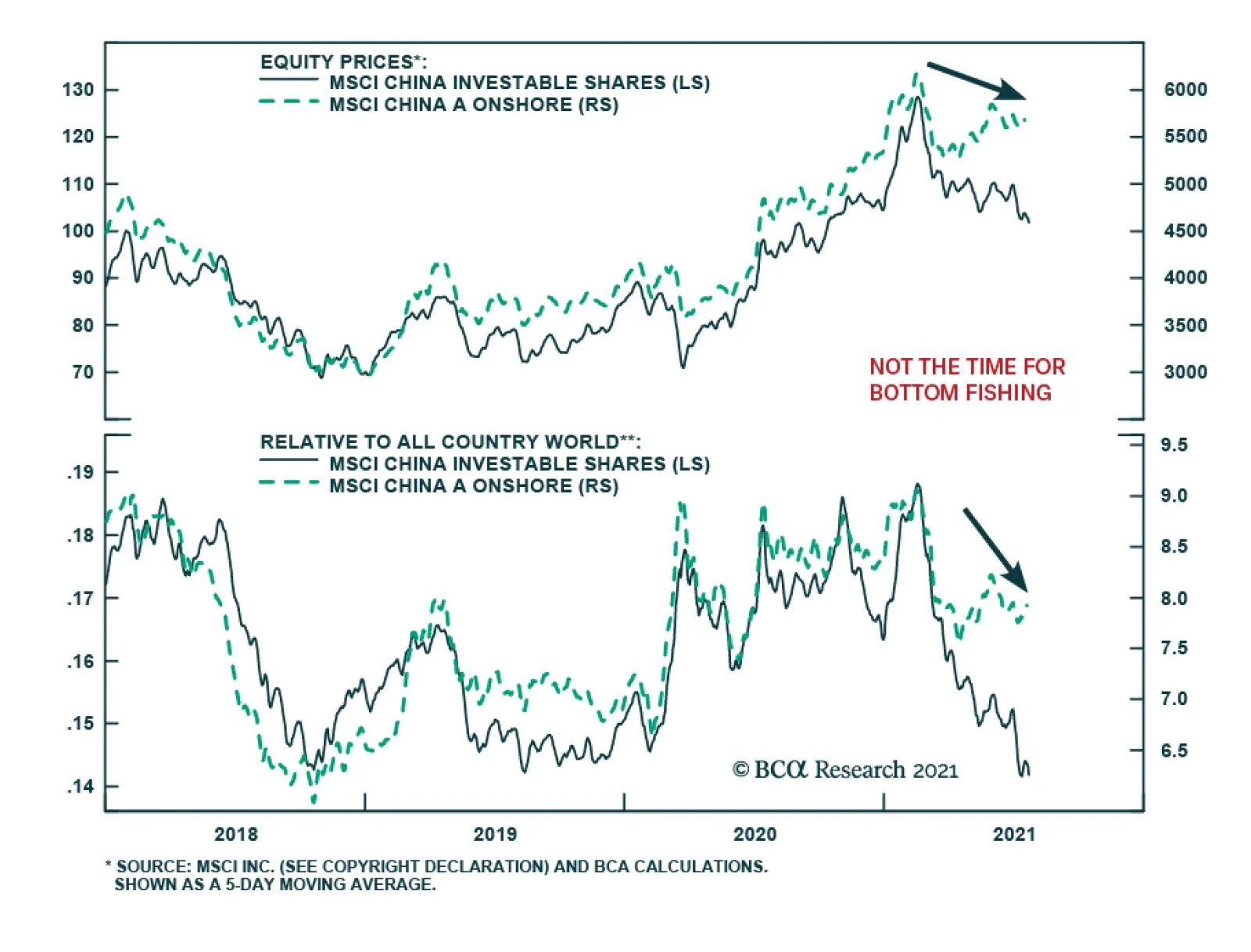

Highlights China’s broad equity market performance since the PBoC cut its reserve requirement ratio (RRR) is consistent with our view. While the central bank’s policy tone remains dovish, a single reduction in the RRR rate…

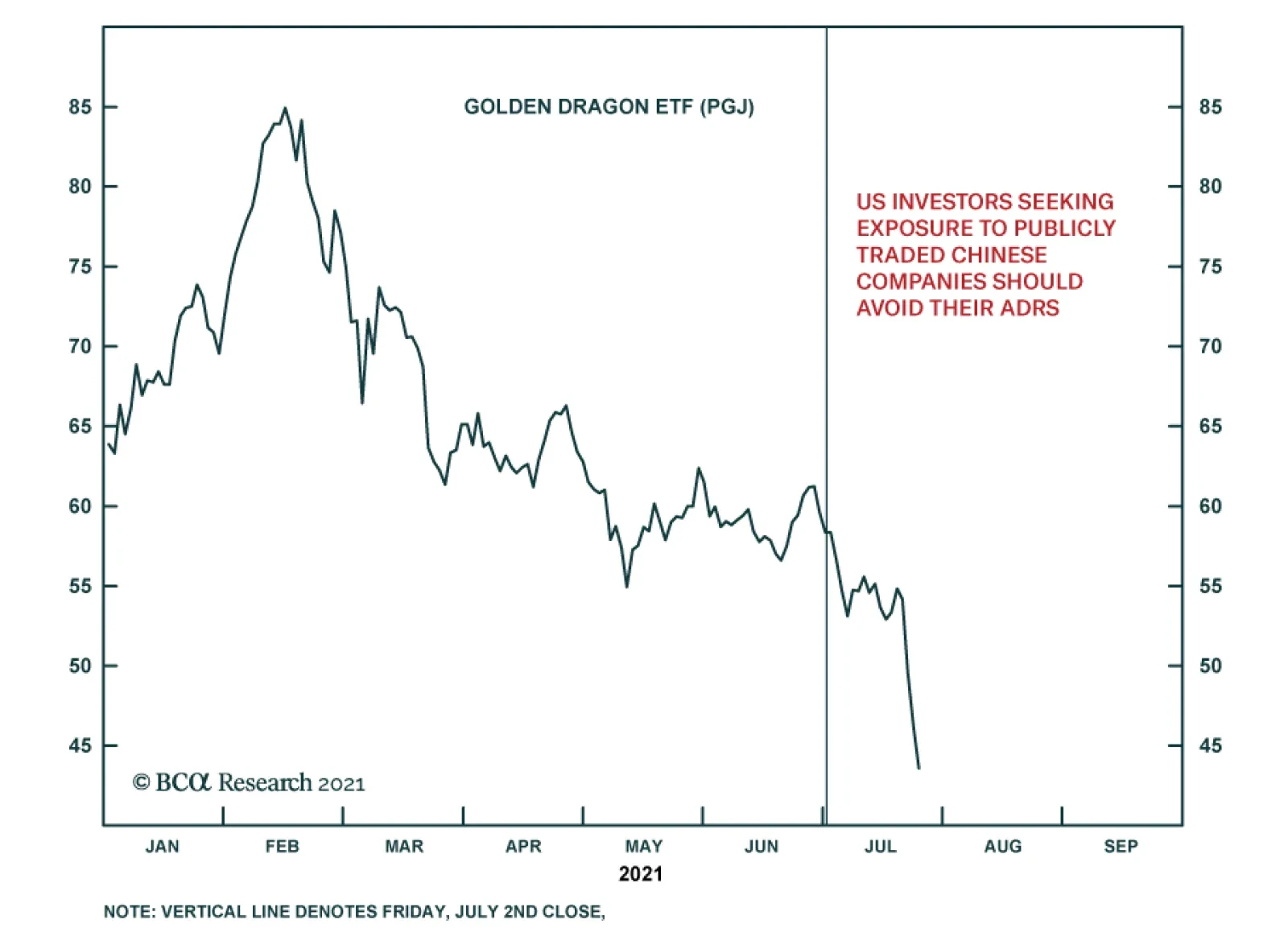

As described in yesterday’s Country Focus Daily Insight, private education is the latest sector to draw unwelcome scrutiny from Chinese regulators. Our China strategists view the move as another step in a deliberate…

Chinese shares sold off sharply on Monday. The trigger for the selloff was a crackdown on the private education industry as Beijing announced reforms that will ultimately restrict these companies’ ability to generate profits…

Highlights The Delta variant will continue causing jitters but there is much greater evidence today than there was in early 2020 that humanity can curb the virus, both with vaccines and government stimulus. Delta jitters will…

Dear Client, We will be presenting our quarterly webcast next week, and, as a result, will not be publishing on 29 July 2021. We will cover our major calls for the quarter and provide a look-ahead. I look forward to…

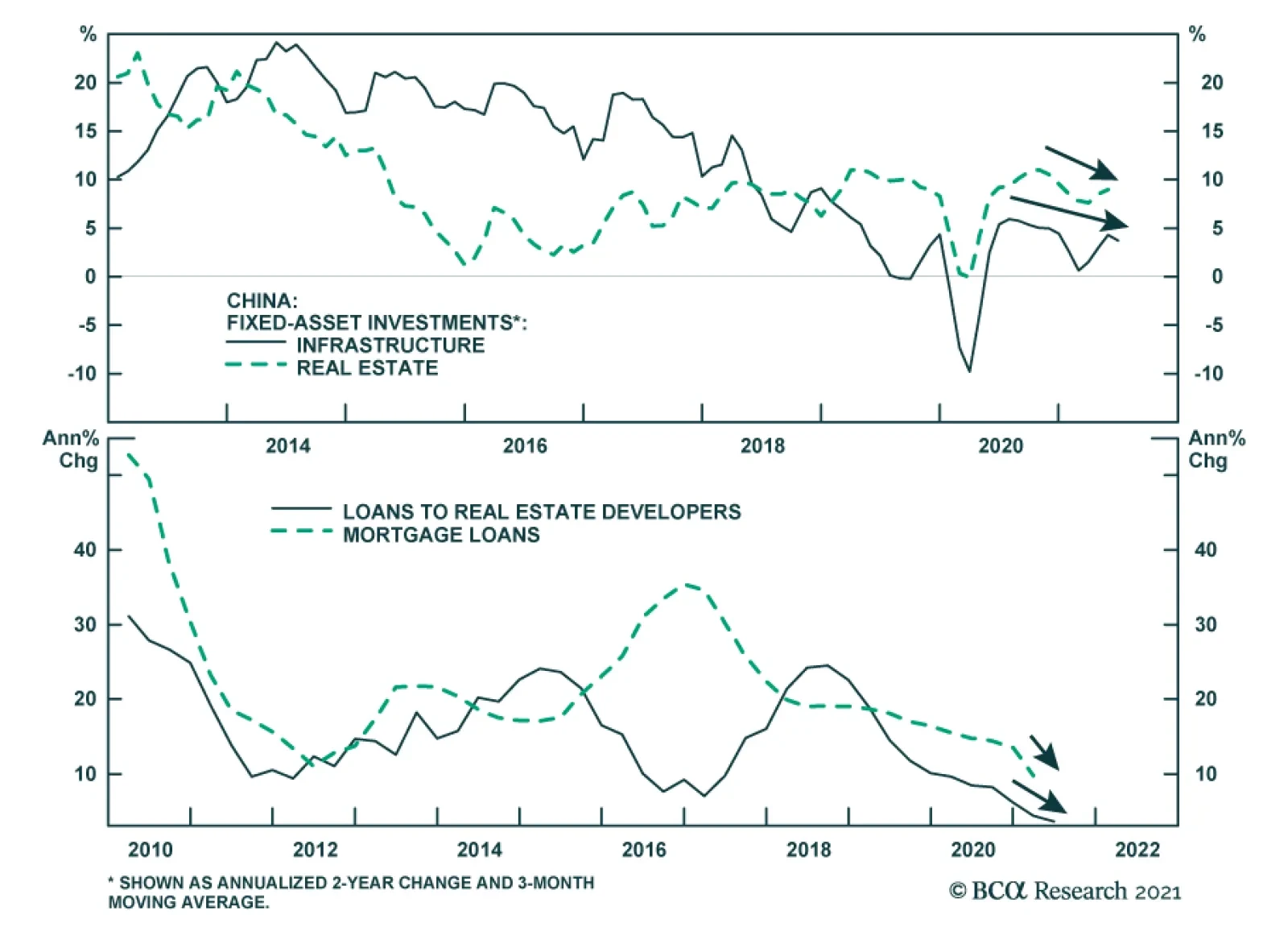

BCA Research’s China Investment Strategy service concludes that a softening economy will weigh on Chinese corporate profits in 2H21. June’s economic data indicate that slight improvements in some sectors, including…

Feature June’s economic data and second-quarter GDP indicate that China’s economic recovery may have peaked. Slight improvements in some sectors, including manufacturing investment, exports and consumption, were offset by…

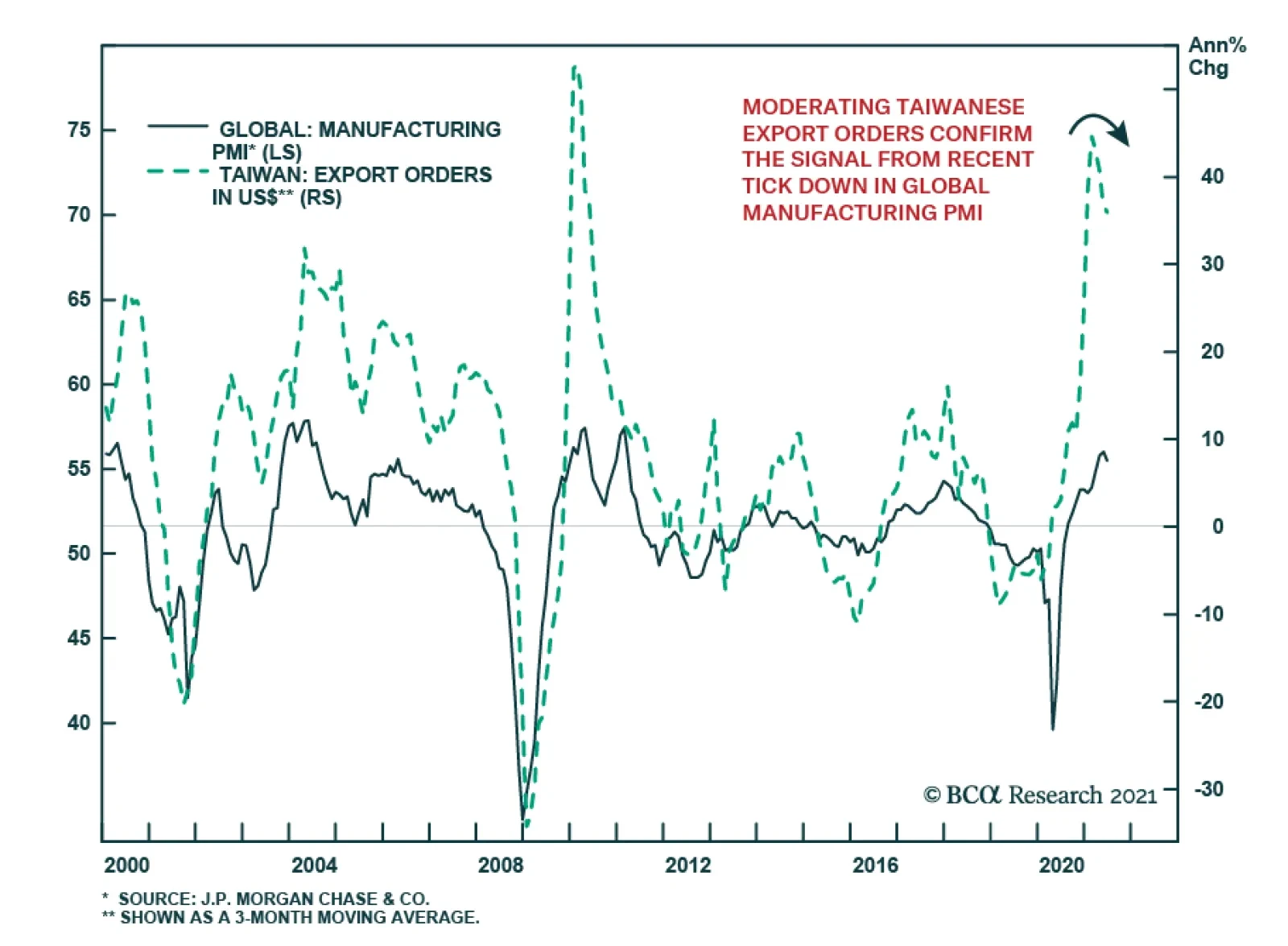

Taiwanese export orders slowed to 31.1% y/y in June from 34.5% y/y, but beat expectations of a sharper deceleration to 30.0% y/y. This brings export orders in the first half of the year to a record USD309.9 billion, which is a 39…

Highlights The ECB has changed its inflation target, but its credibility remains weak. Inflation will not allow the ECB to tighten policy anytime soon. Instead, the ECB will have to add to its asset purchase program next year and may…