Highlights The chaotic US withdrawal from Afghanistan is symbolic – the US is conducting a strategic pivot to Asia Pacific to confront China. US-Iran negotiations are the linchpin of this pivot. If they fail, war risk will…

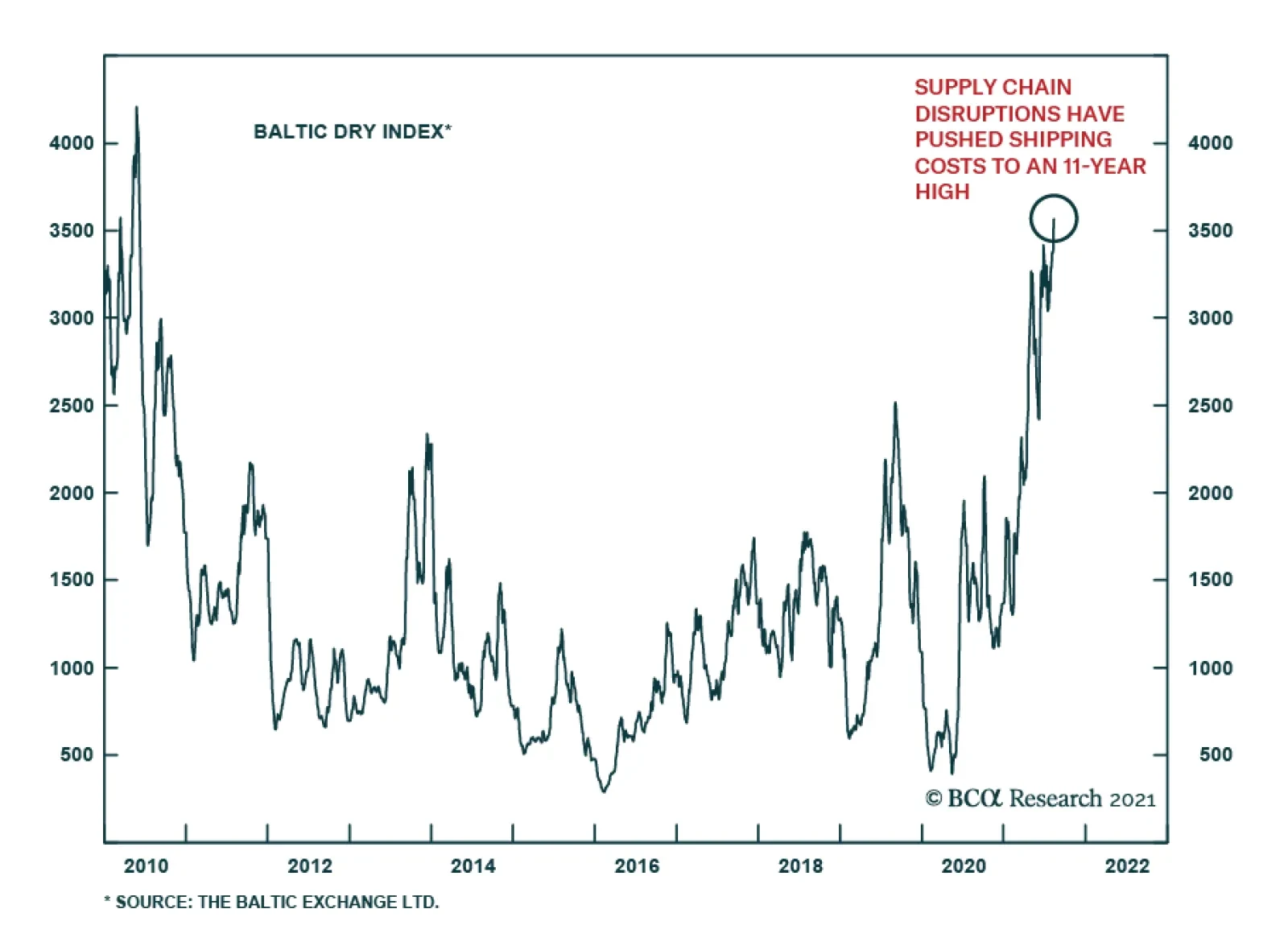

On Friday, the Baltic Dry Index jumped to an 11-year high on the back of the partial closure of the world’s third busiest port. The shutdown of China’s Ningbo-Zhoushan port comes as Beijing battles a resurgence in COVID-19…

Highlights Global growth is peaking, which makes it important to monitor the risks for signs that it is time to reduce equity exposure. We are especially focused on five risks: 1) The emergence of vaccine-resistant Covid variants; 2) a…

Highlights Going into the new crop year, we expect the course of the broad trade-weighted USD to dictate the path taken by grain and bean prices (Chart of the Week). Higher corn stocks in the coming crop year, flat wheat stocks and…

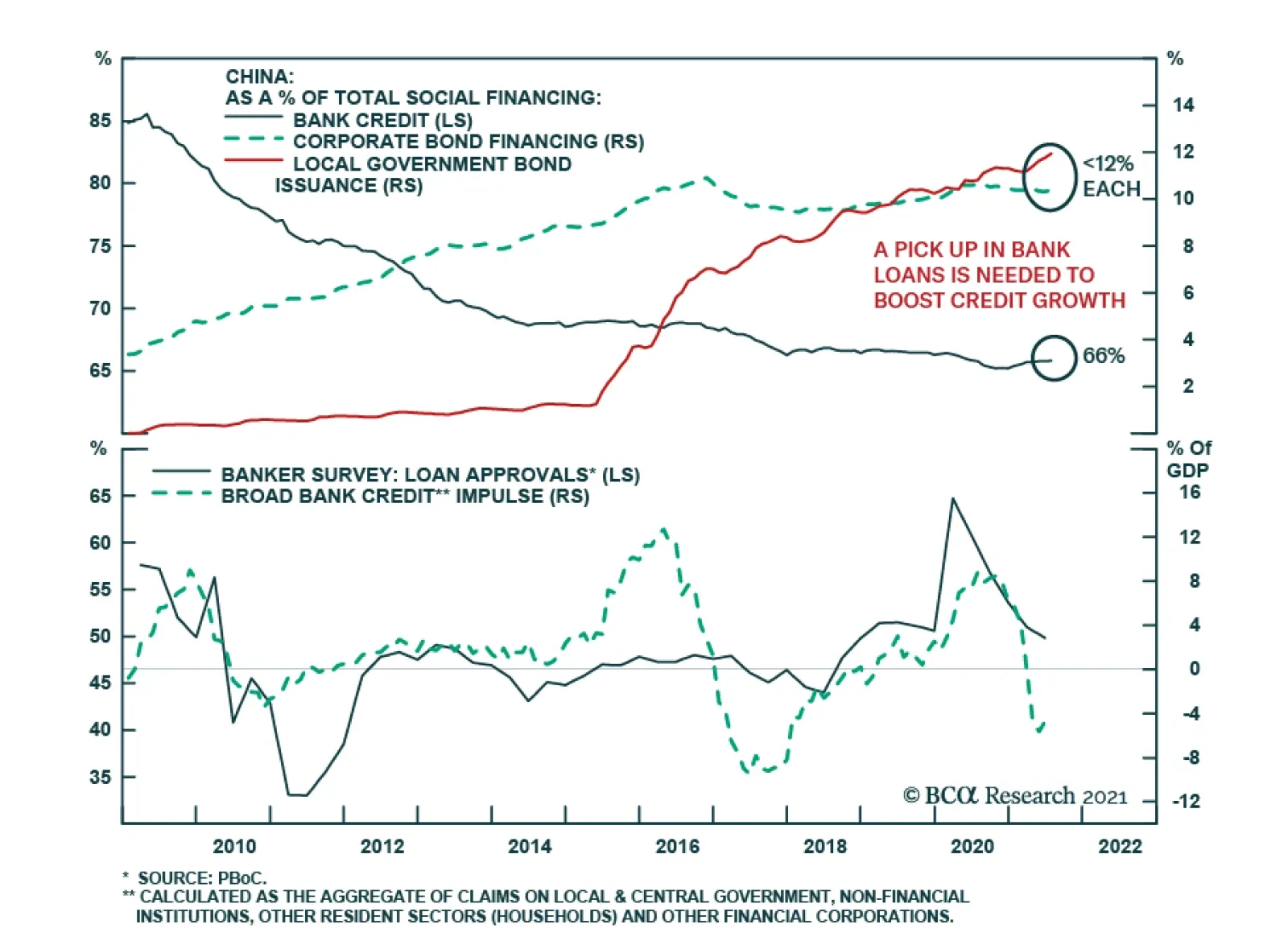

Chinese money and credit data was significantly weaker than anticipated in July. Aggregate financing fell to CNY 1.06 trillion from June’s CNY 3.7 trillion, missing expectations of a CNY 1.7 trillion increase. Similarly, M0, M1,…

Dear client, In addition to this abridged Strategy Report, we are sending a report written by Arthur Budaghyan, Chief Strategist of BCA’s Emerging Market Investment service. Arthur shares his thoughts on the future of Chinese…

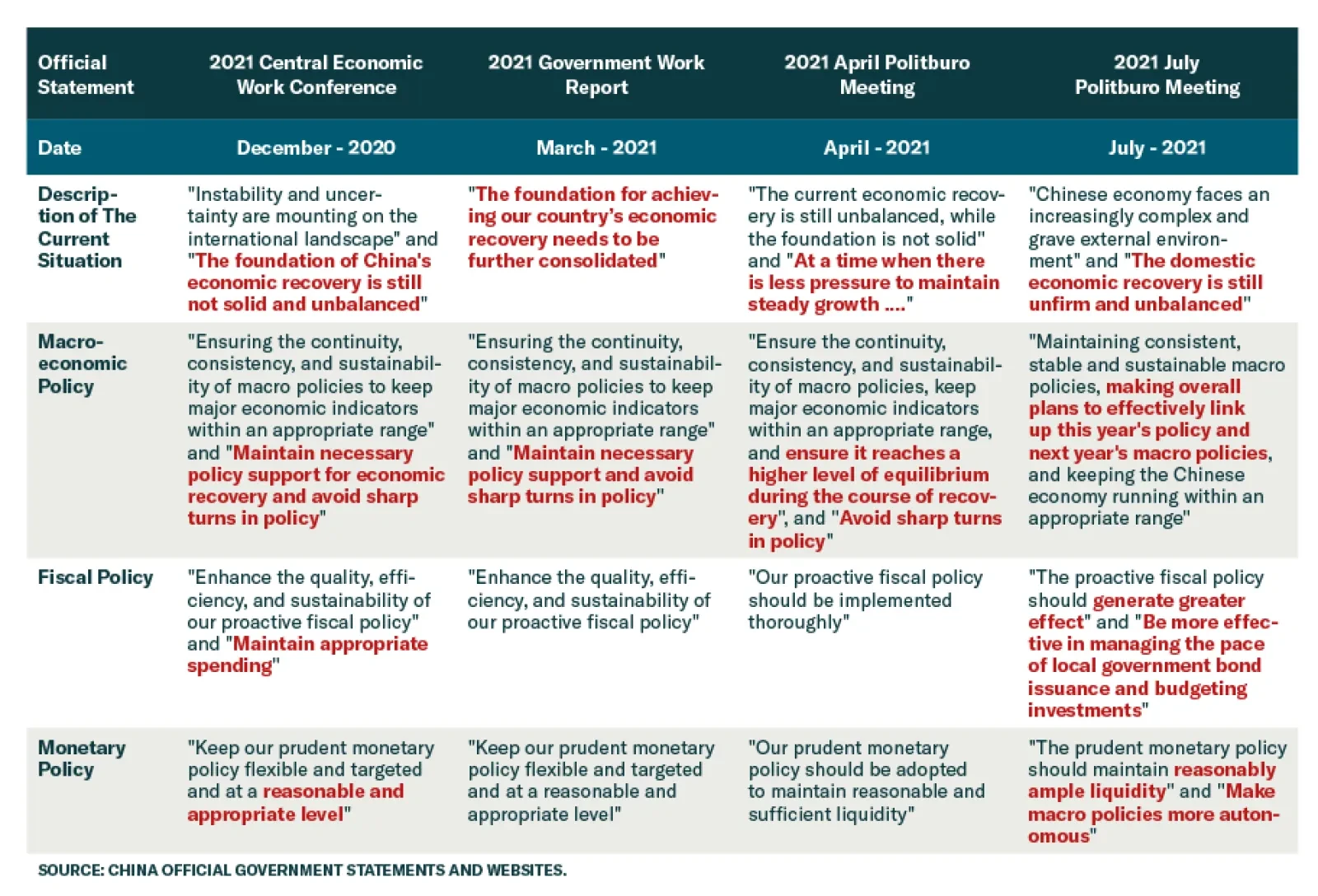

China’s policymakers are responding to their domestic economic and political constraints, which should point to more accommodative policies over the coming 12 months. Our Geopolitical Strategy’s key view for 2021 held that…

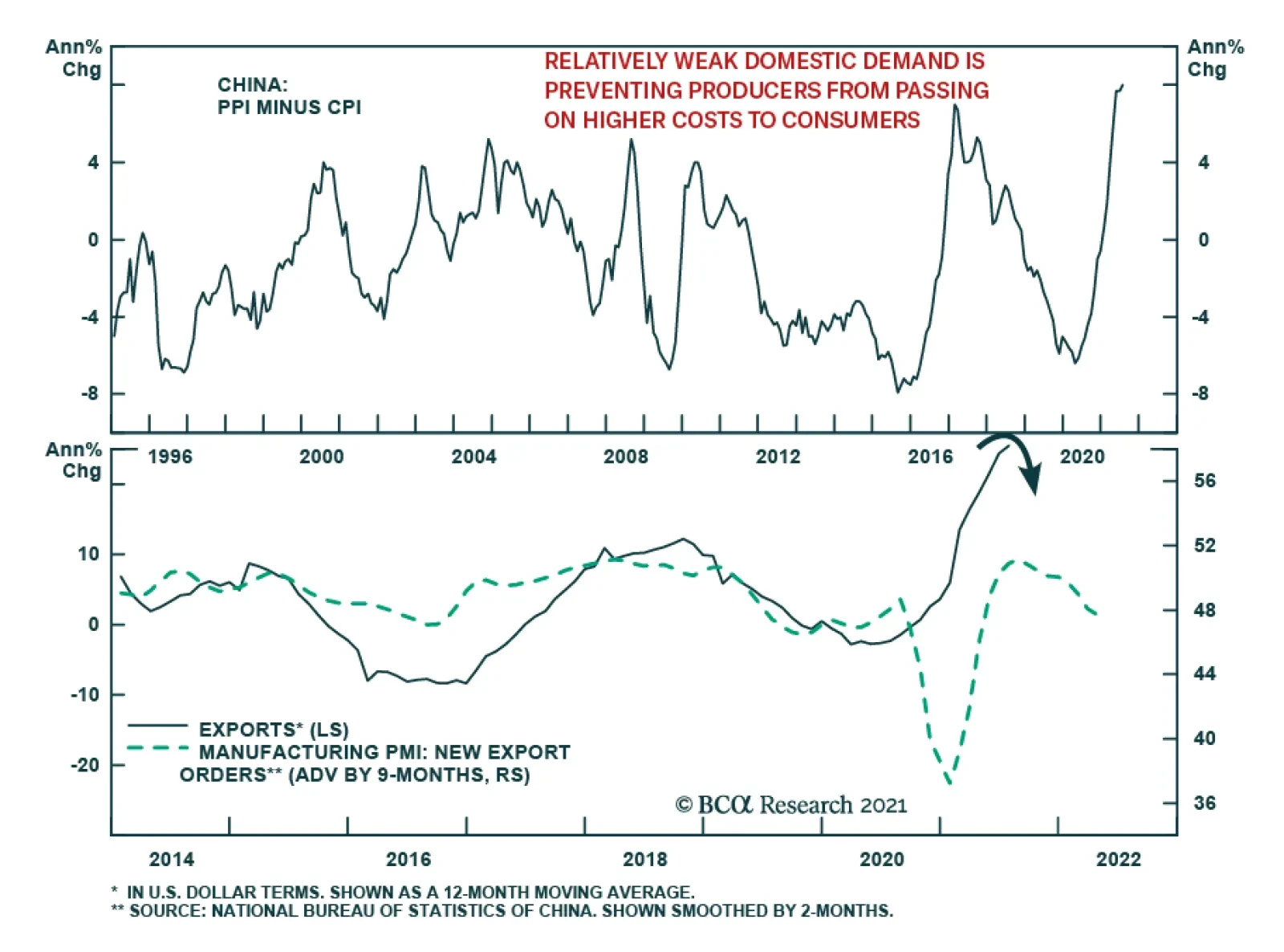

Chinese producer prices accelerated to 9.0% y/y in July, above expectations PPI would remain at 8.8%. Similarly, core CPI rose to a 18-month high of 1.3% y/y from 0.9%. Policymakers are unlikely to respond to signs of price…