The possibility of Chinese real estate developer Evergrande’s collapse threatens the stability of the country’s economy and financial markets through multiple facets. The company accounts for an outsized share of outstanding…

Highlights Global growth is peaking, but US growth is losing momentum relative to its peers. This has historically been negative for the greenback. Chinese monetary policy is no longer on a tightening path, and might ease going…

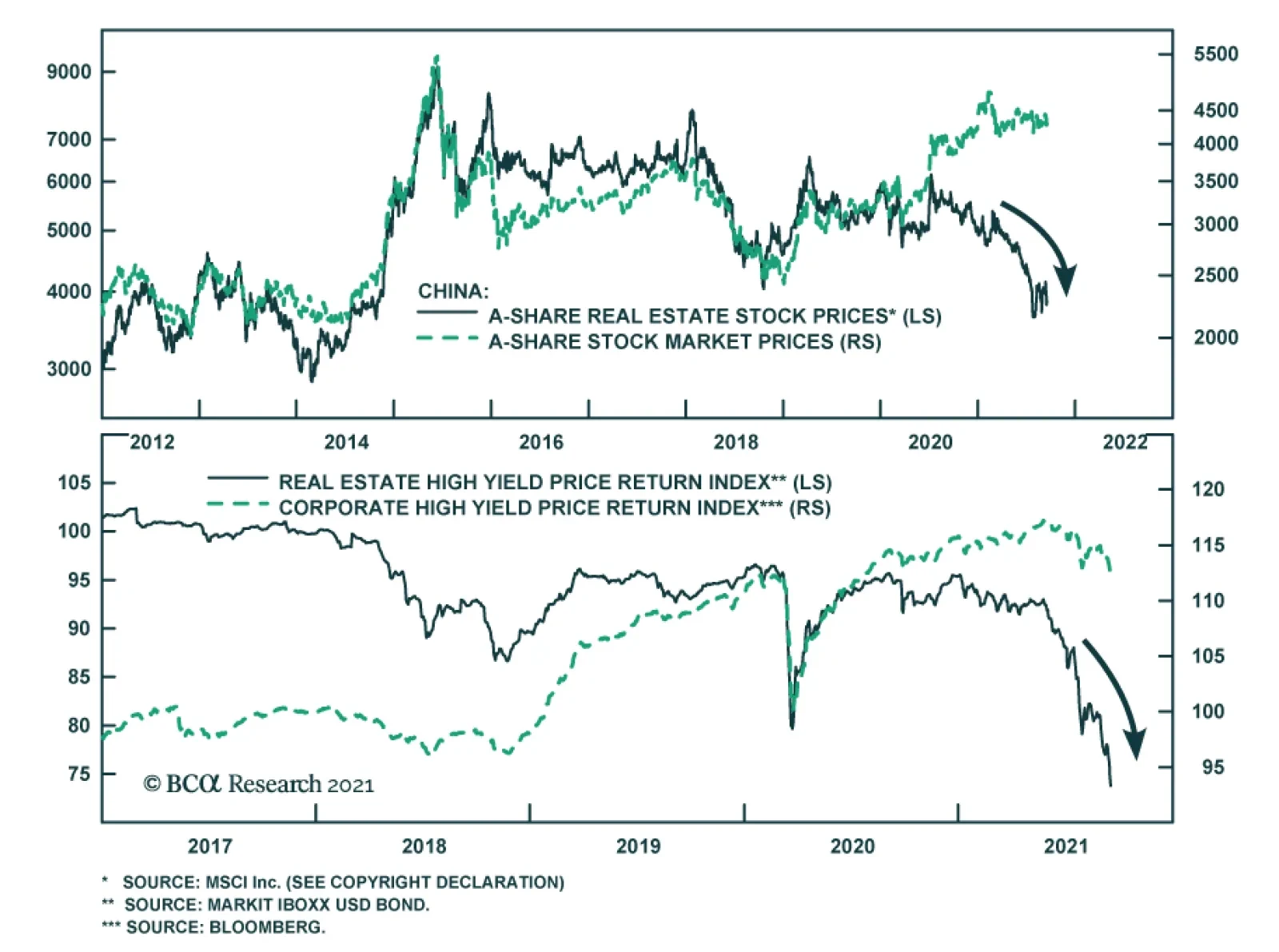

BCA Research's Emerging Markets Strategy service expects Evergrande’s partial default to reinforce credit tightening in China. Evergrande will likely default on some of its liabilities but there will be a bailout or roll-…

BCA Research's China Investment Strategy service recommends a new trade: long Chinese industrial stocks/short A-shares. Chinese onshore stocks in the infrastructure, materials, and industrial sectors recently advanced…

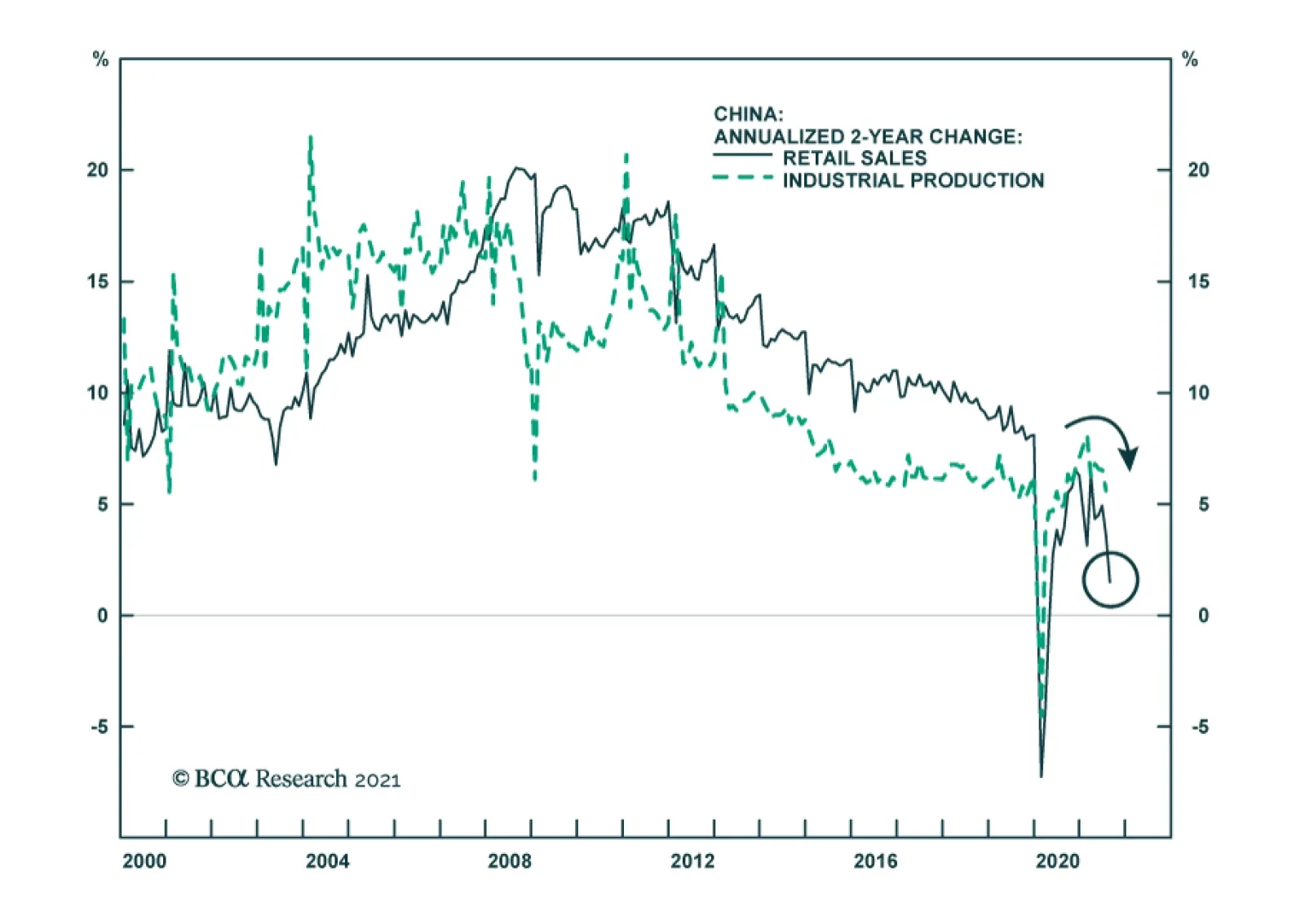

Chinese macro data releases for August surprised to the downside and indicate that the domestic economic slowdown is ongoing. Most notably, retail sales decelerated sharply to 2.5% y/y, significantly slower than the expected 7.0…

Dear Client, Next week, in lieu of our regular weekly report, I will be hosting two webcasts where I will discuss our view on China’s economy and financial markets. I will also address the topics that our clients are most concerned…

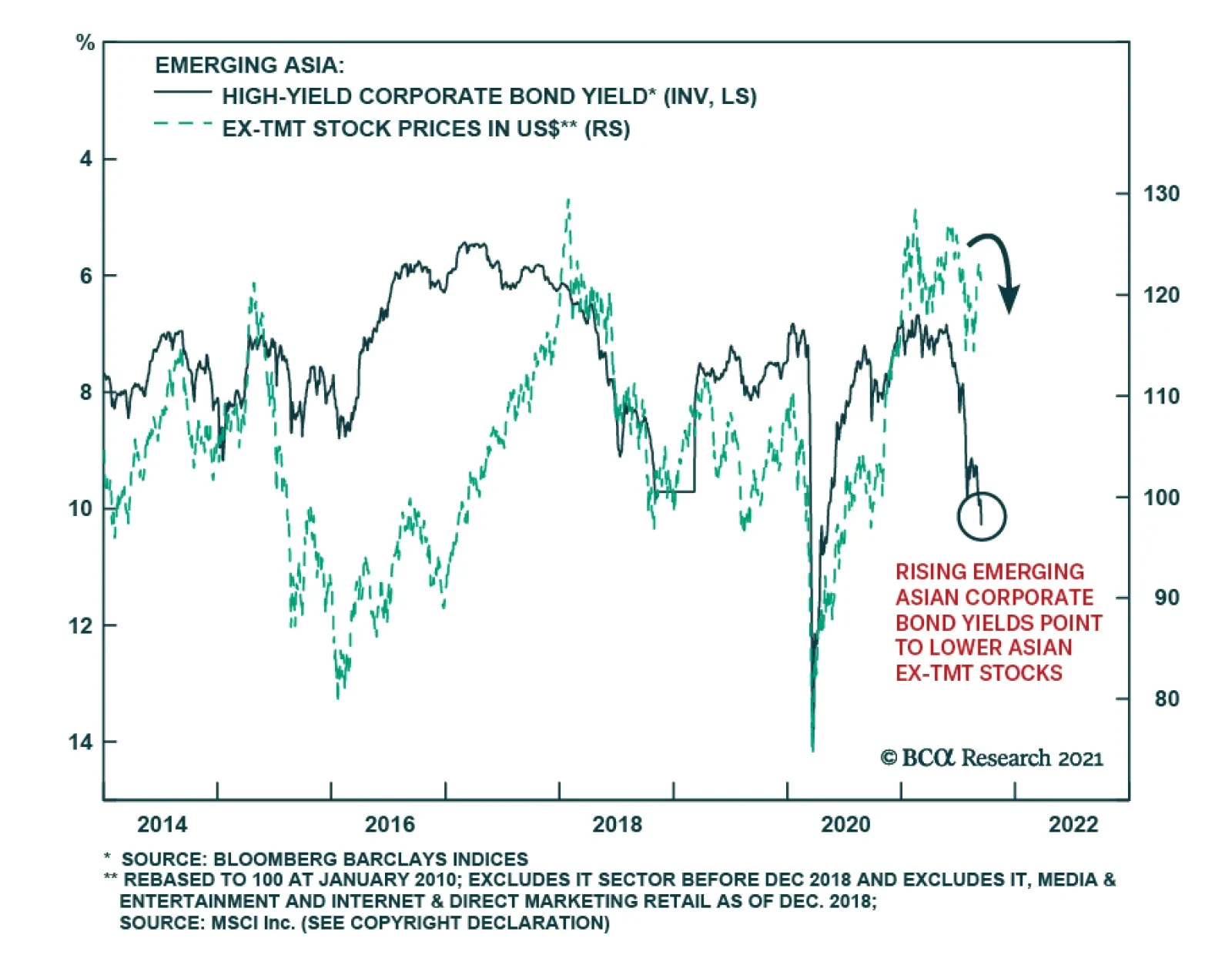

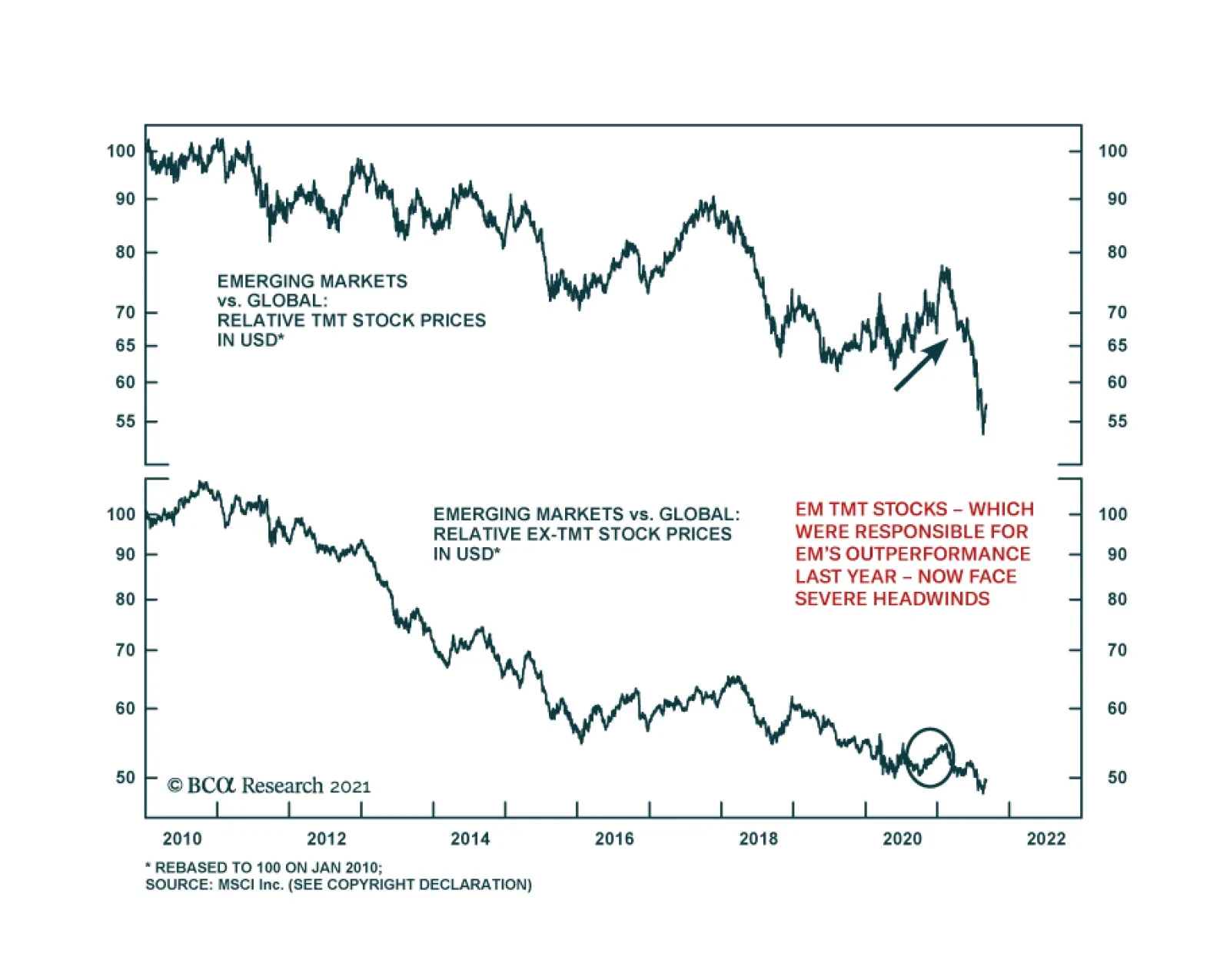

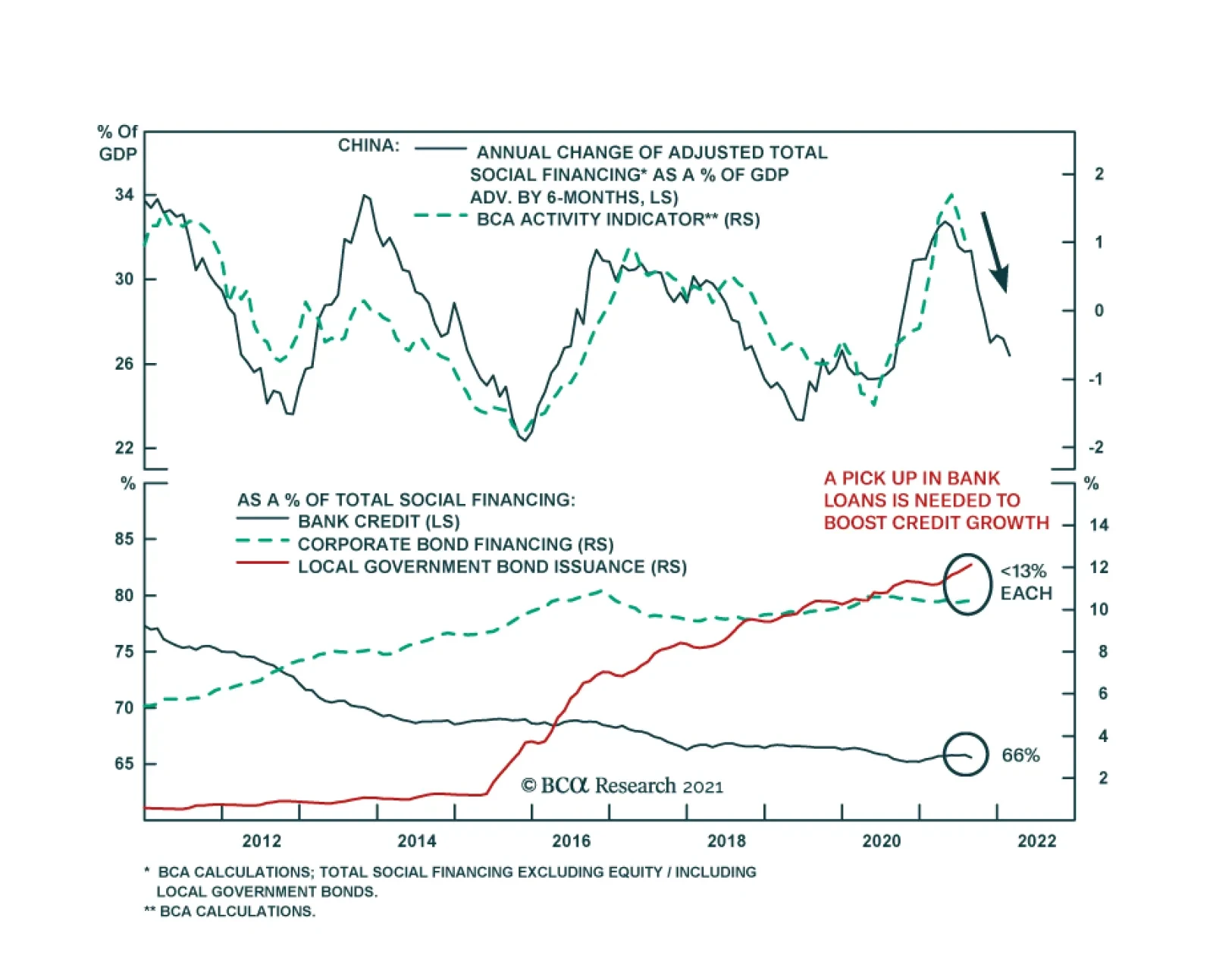

Given that Chinese credit has a lagged impact on domestic activity (see The Numbers), China's economy is unlikely to bottom before the end of Q1 2022. In addition to the economic slowdown, regulatory pressures also pose risks…

As expected, Chinese credit numbers for August improved relative to July. Aggregate financing increased CNY 2.96 trillion from July's CNY 1.08 trillion and was slightly above consensus estimates of CNY 2.80 trillion. New bank…

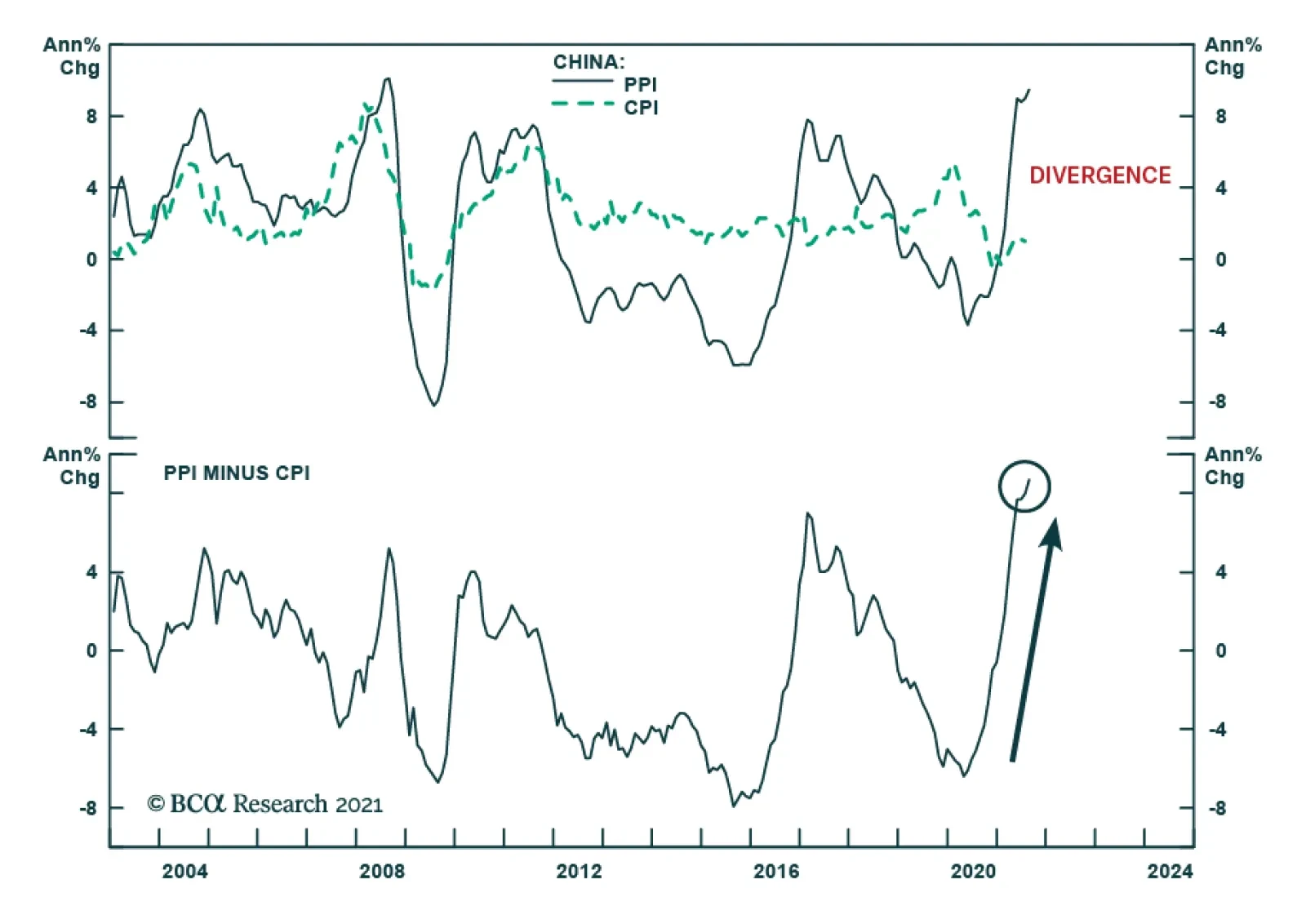

The gap between Chinese producer prices and consumer prices widened to a 31-year high in August. CPI inflation slowed to 0.8% y/y and fell below expectations it would remain unchanged at July's 1.0%. Meanwhile, PPI…

Highlights The US Climate Prediction Center gives ~ 70% odds another La Niña will form in the August – October interval and will continue through winter 2021-22. This will be a second-year La Niña if it forms, and…