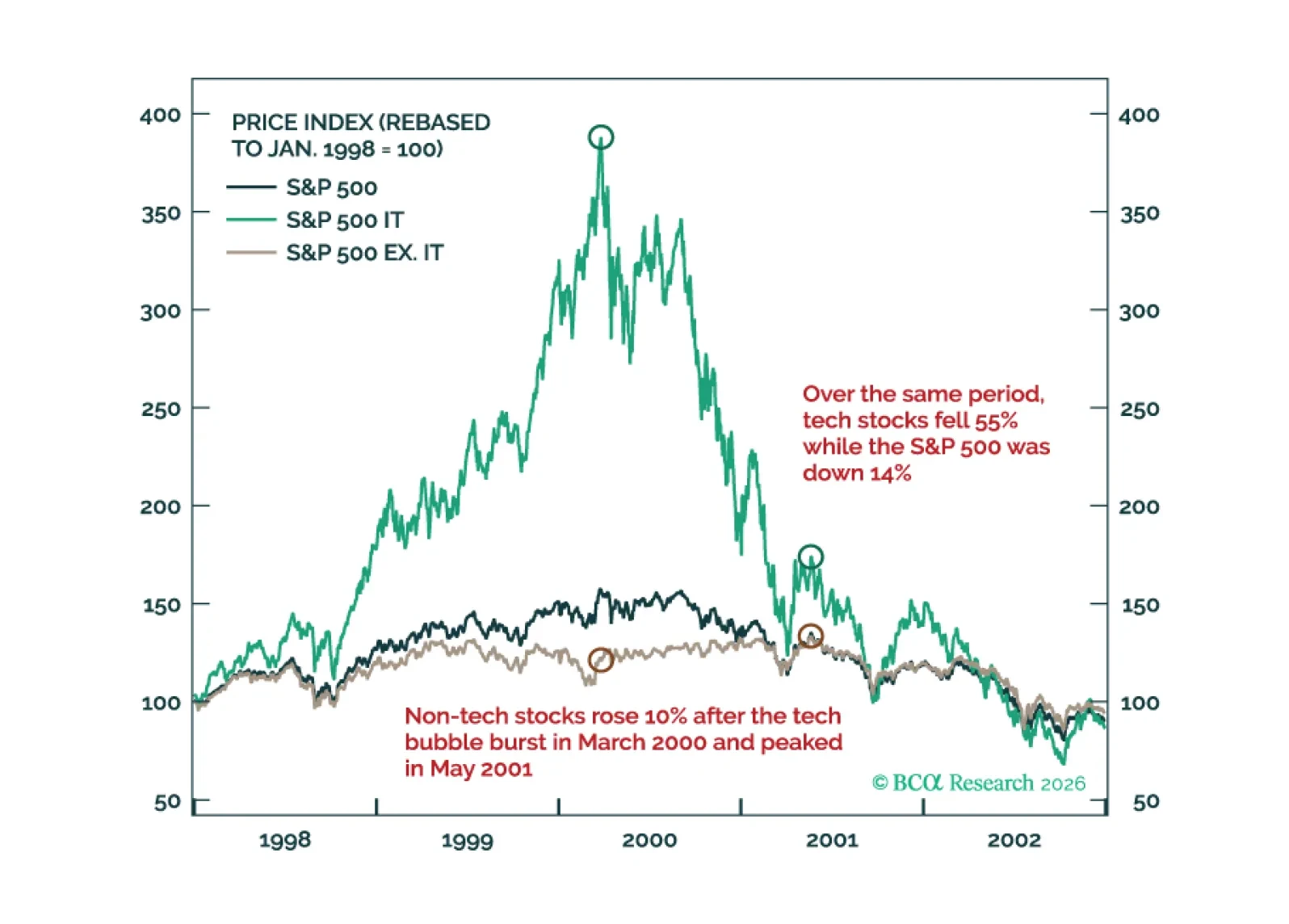

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

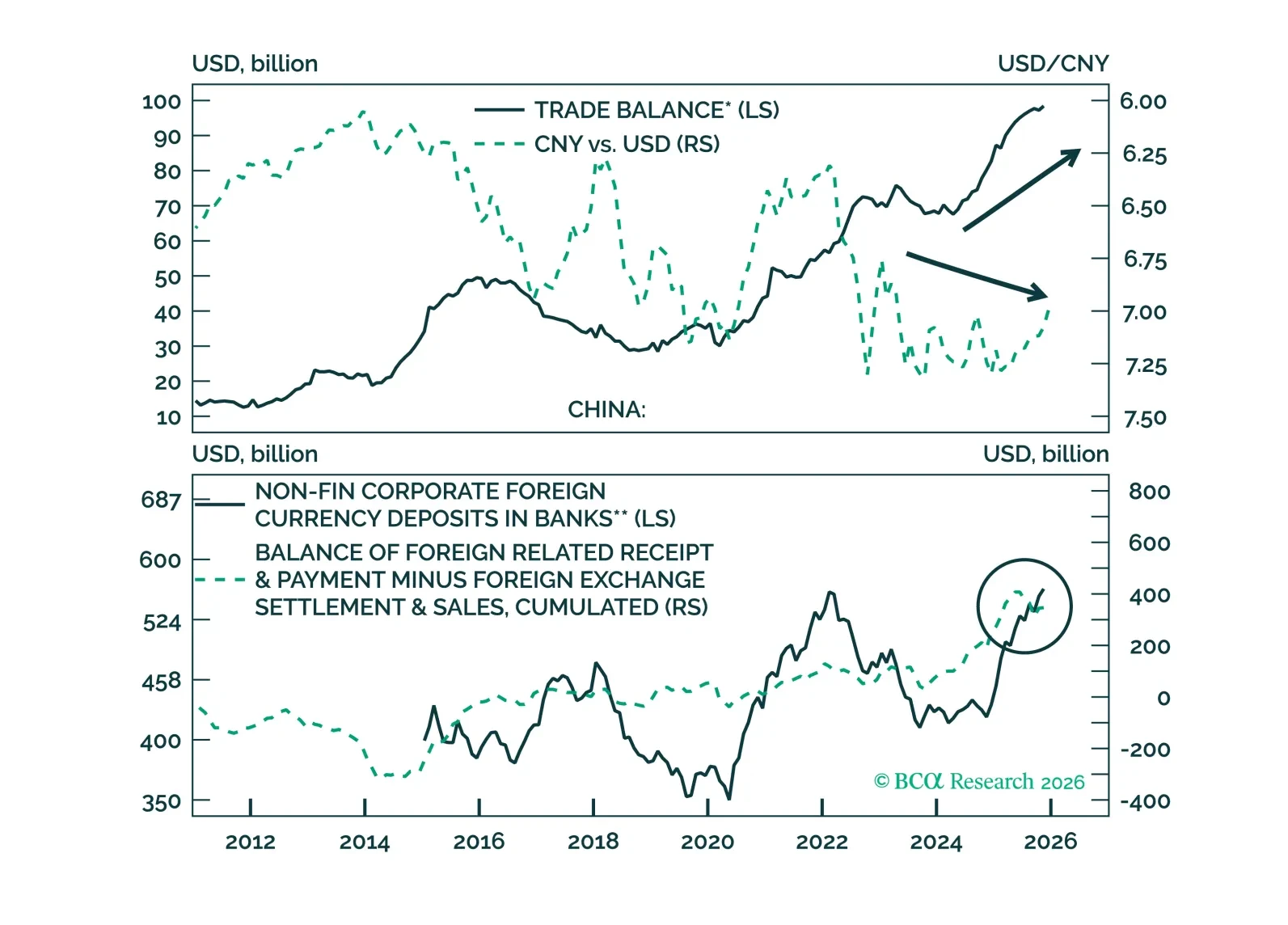

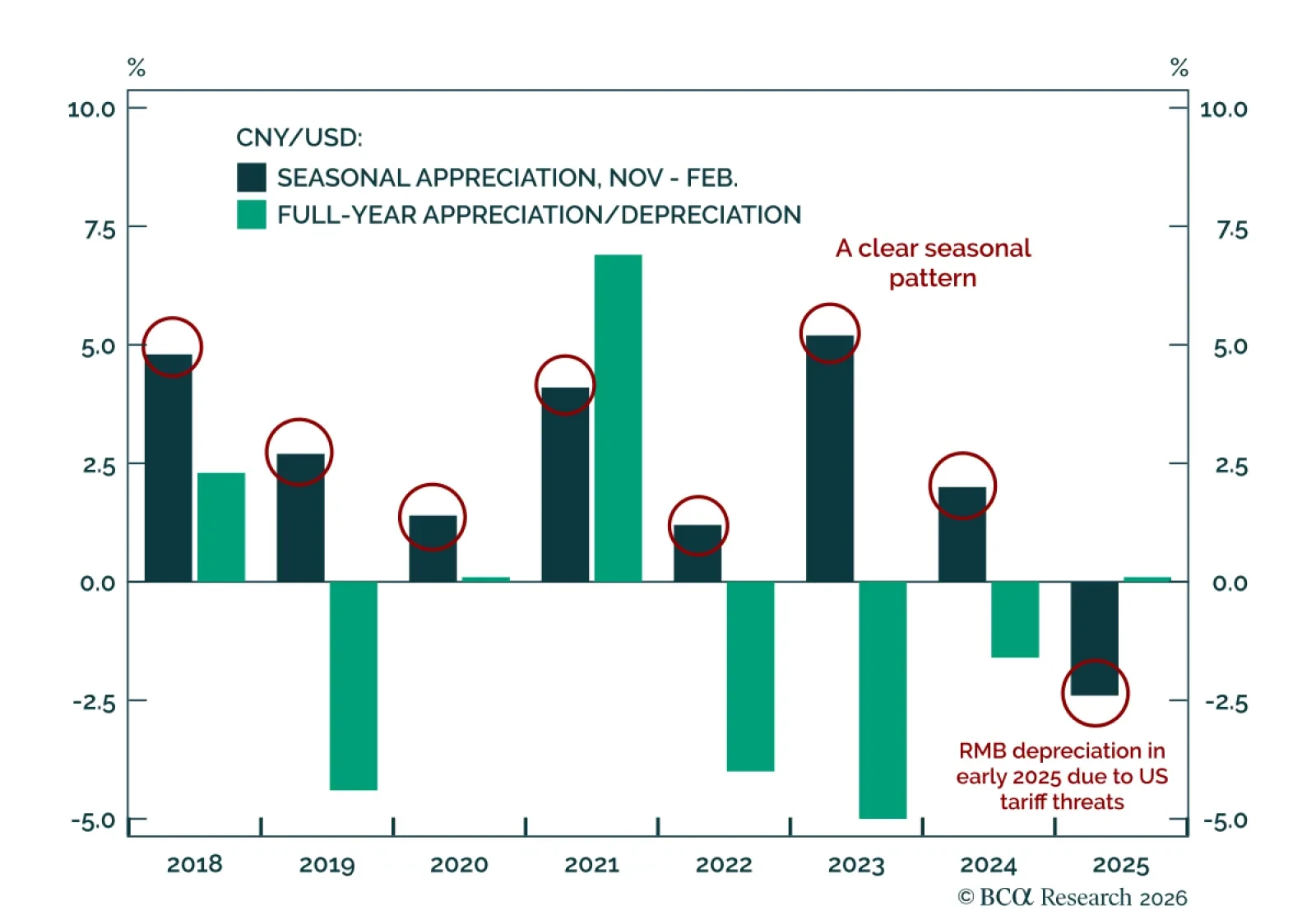

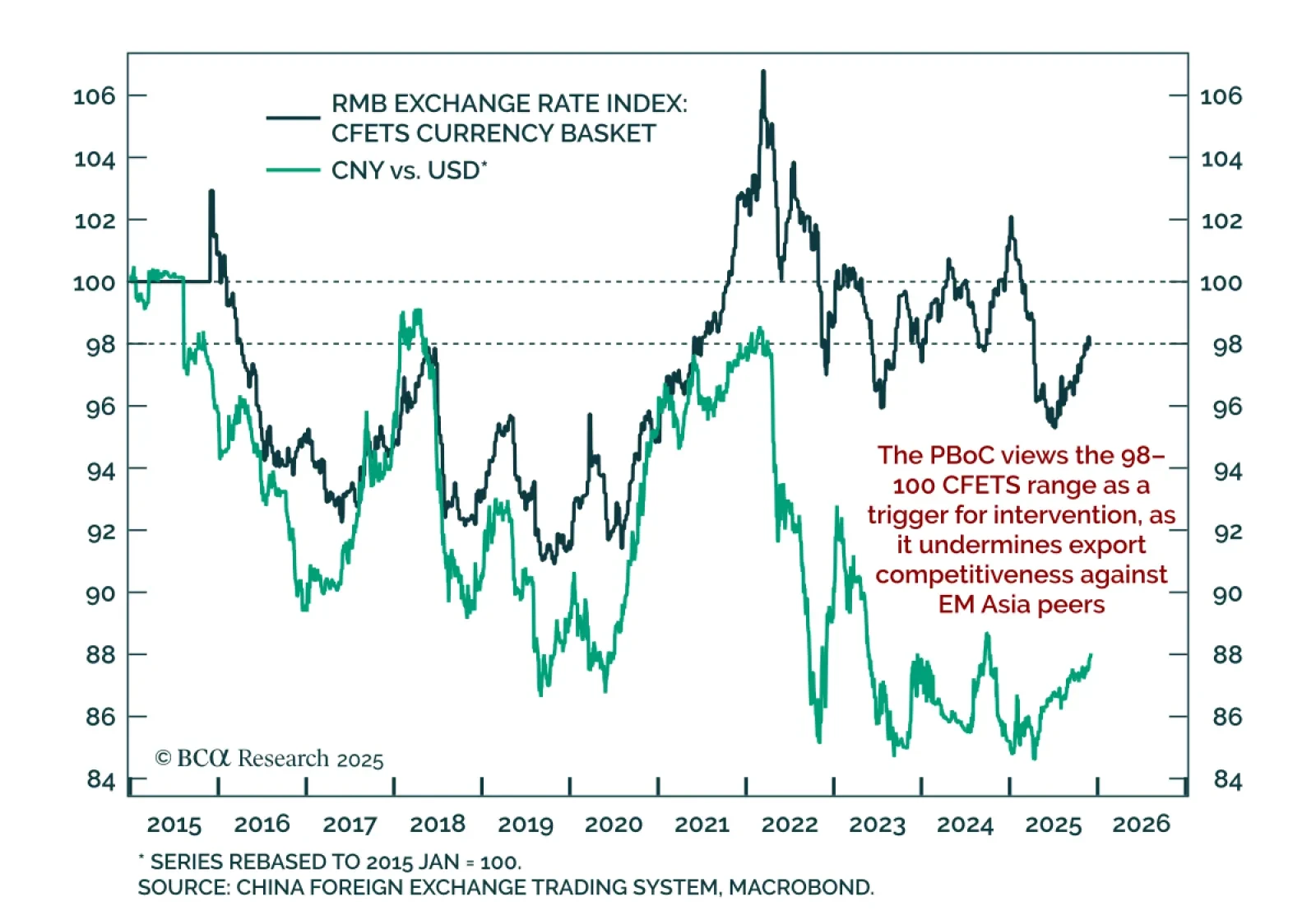

Our China Investment strategists expect the RMB to retrace against the US dollar in Q1, but see upside resuming later in 2026 as stronger stimulus and structural tailwinds return. While the currency typically appreciates between…

We explain the underlying catalysts for the RMB’s seasonal appreciation, and assess the upside potential for the currency in 2026.

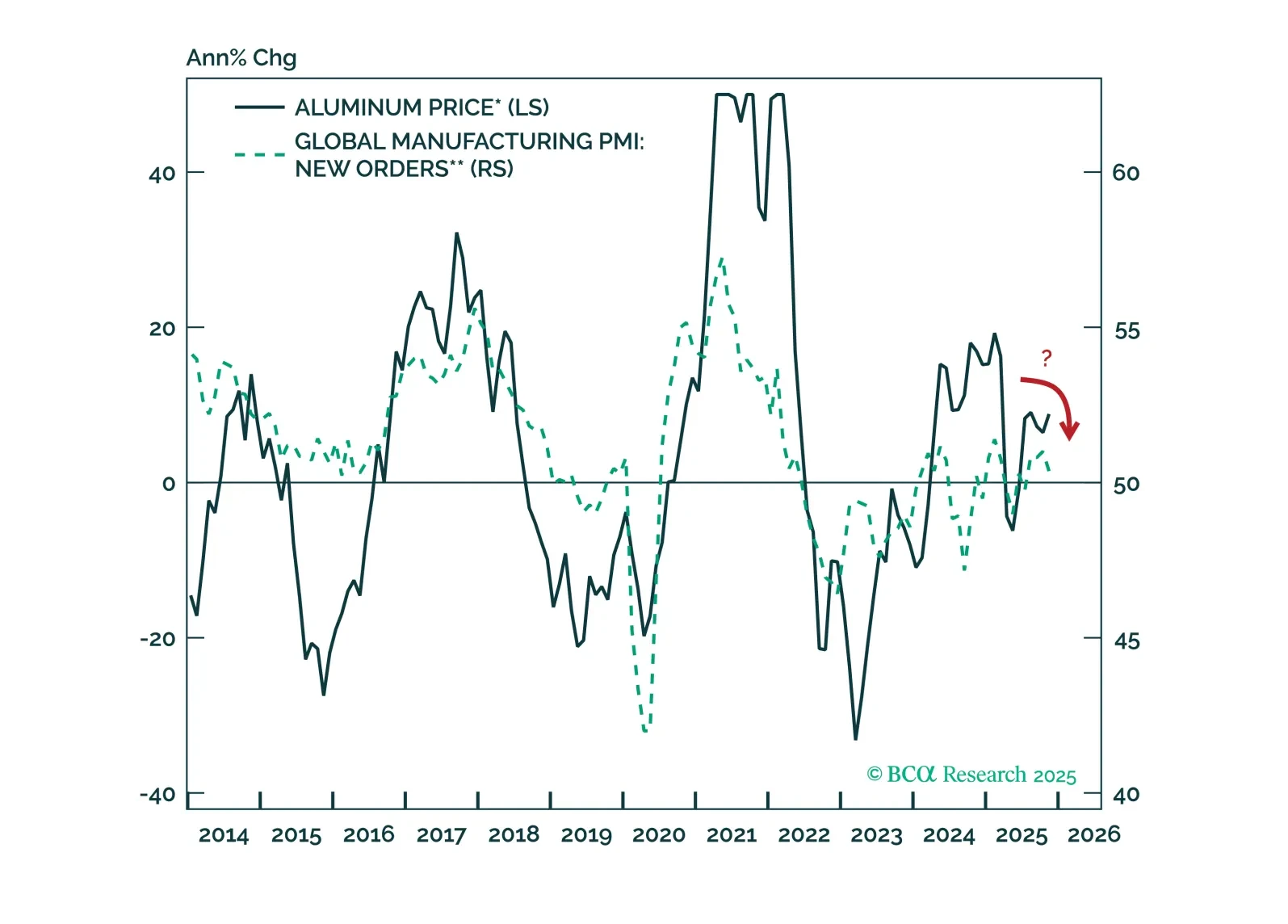

The forces that have recently propelled aluminum prices will remain supportive over the near term. However, beyond the coming months, aluminum prices will retreat as bearish cyclical pressures overwhelm over the course of 2026.

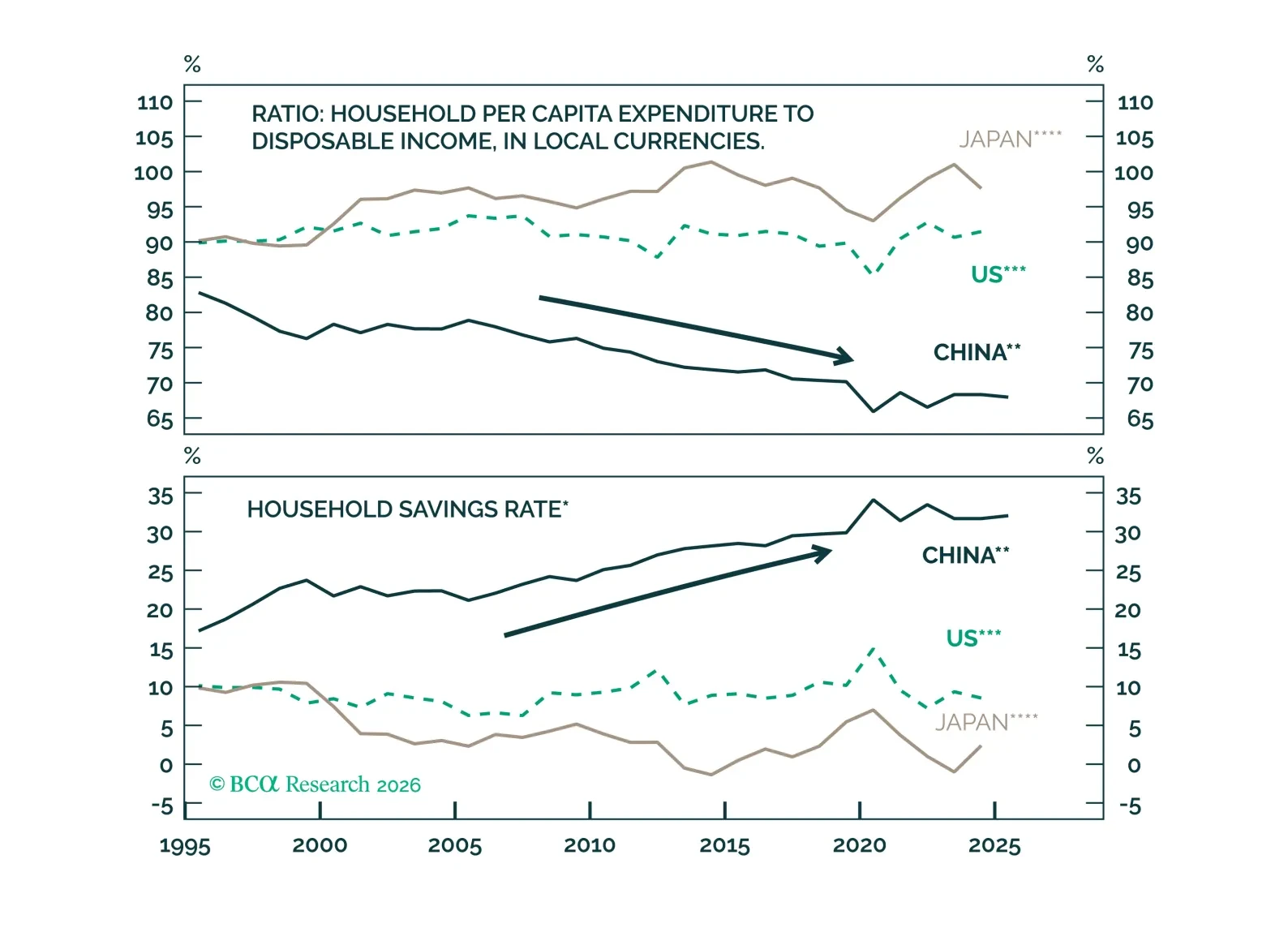

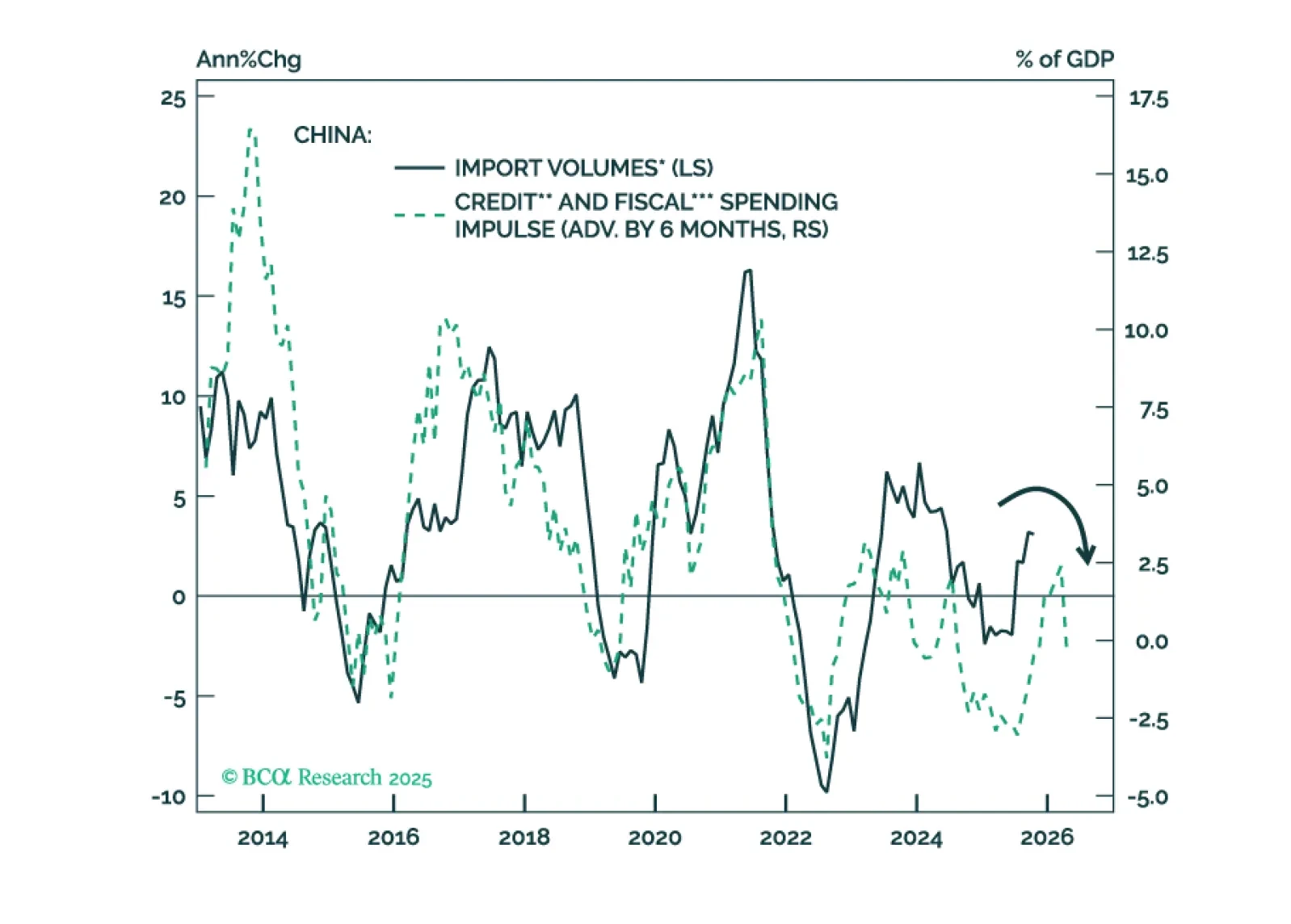

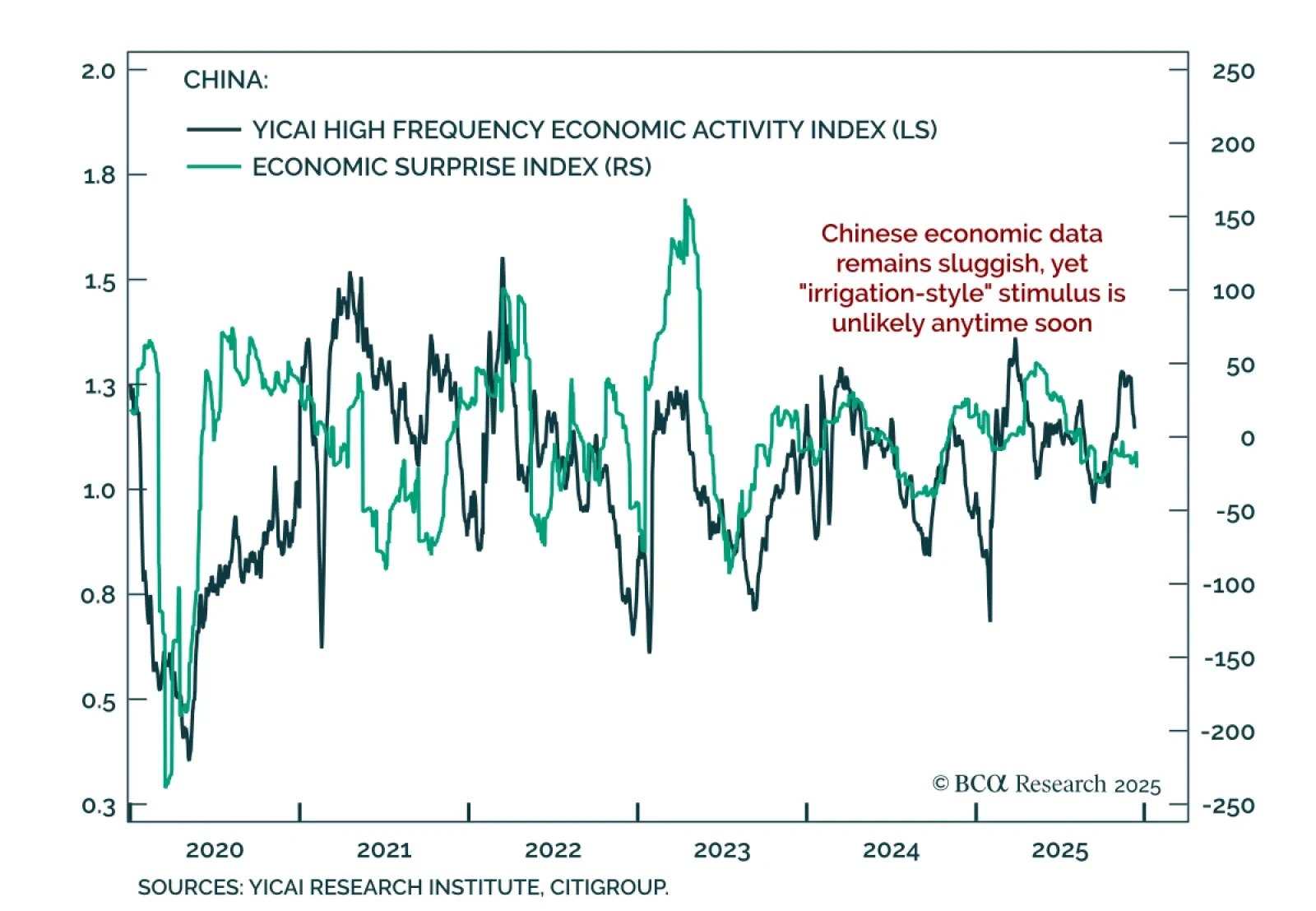

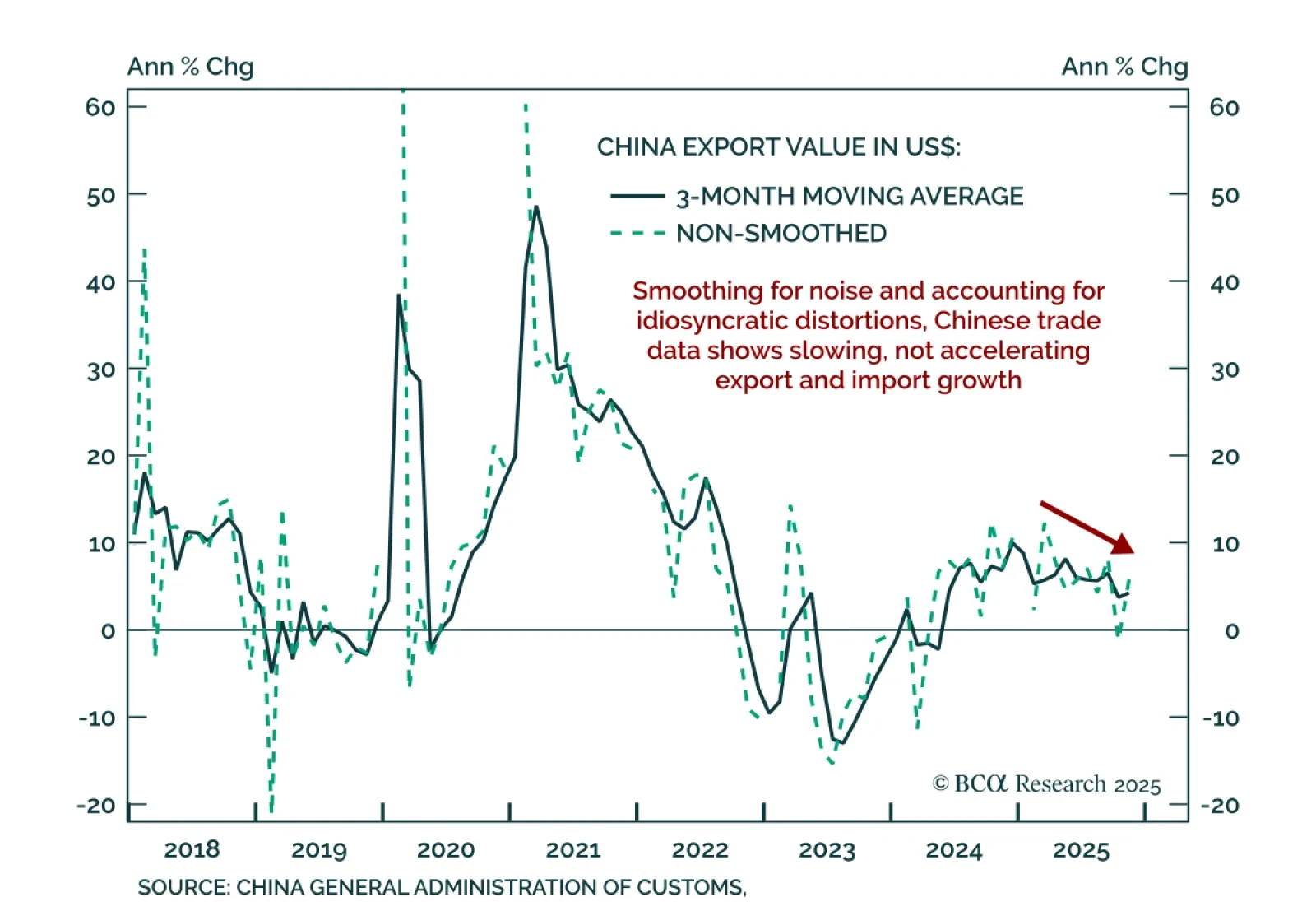

Maintain a defensive commodity allocation as China’s growth pulse remains weak and export strength proves misleading. China’s November hard data were unequivocally sluggish. Fixed asset investment fell 2.6% y/y, retail sales slowed…

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

Maintain a defensive commodity stance as China’s export strength reflects distortions, not a global trade upturn. Chinese November exports beat estimates, rising 5.9% y/y in USD terms (5.7% in CNY), while imports rose less than 2%.…

Expect CNY appreciation toward 6.5-6.8 over the next 12 months as structural supports outweigh near-term FX management. China set a significantly weaker-than-expected fixing, its largest weak-side deviation since February 2022. State…