Banks have had a strong run and may continue to outperform, supported by a rebound in capital market activity, improving momentum in the core banking business, and the potential for rerating driven by deregulation. While risks remain…

Please join Chief Private Markets & Alternatives Strategist Brian Payne for a Webcast on Wednesday, February 26, at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

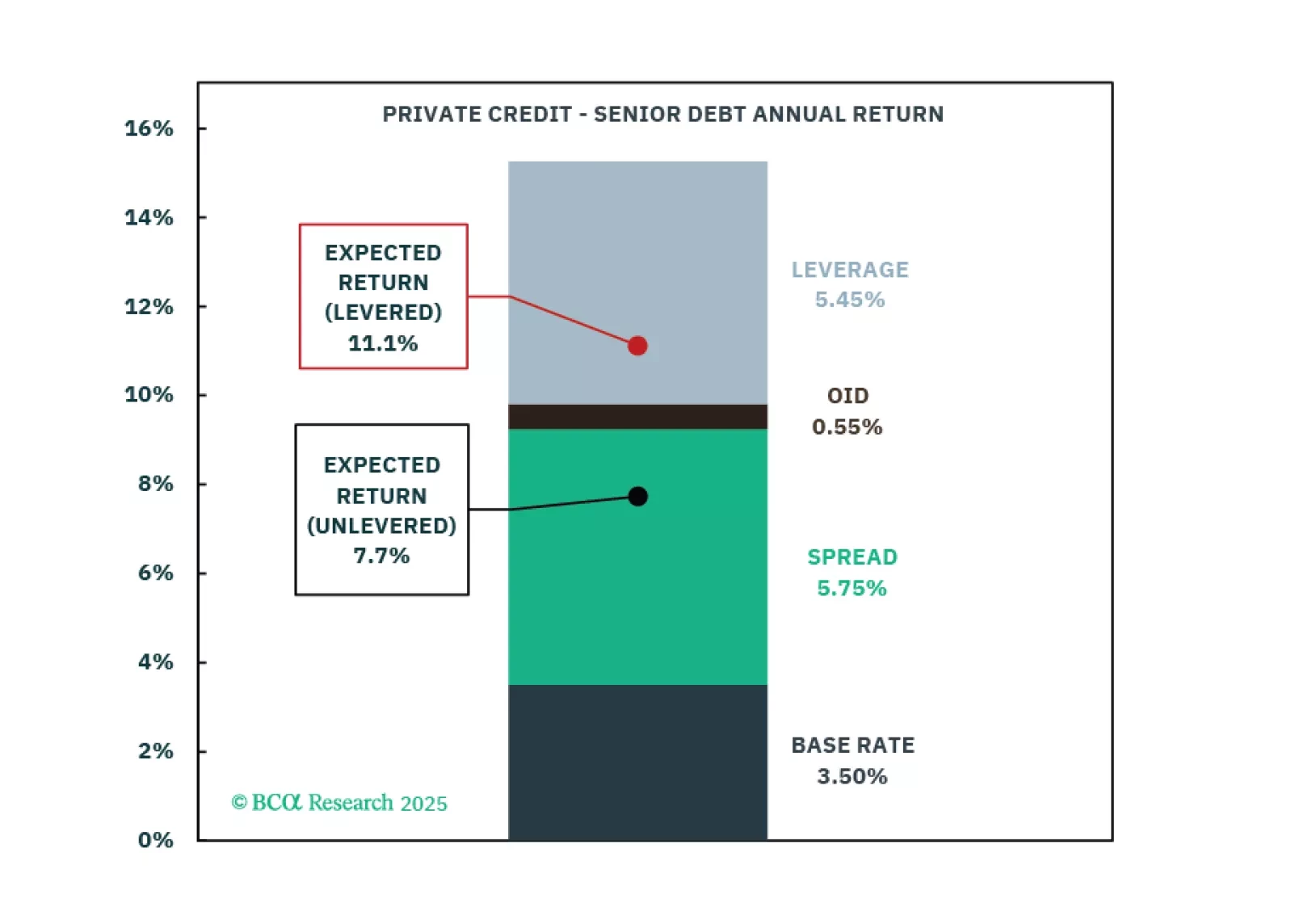

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

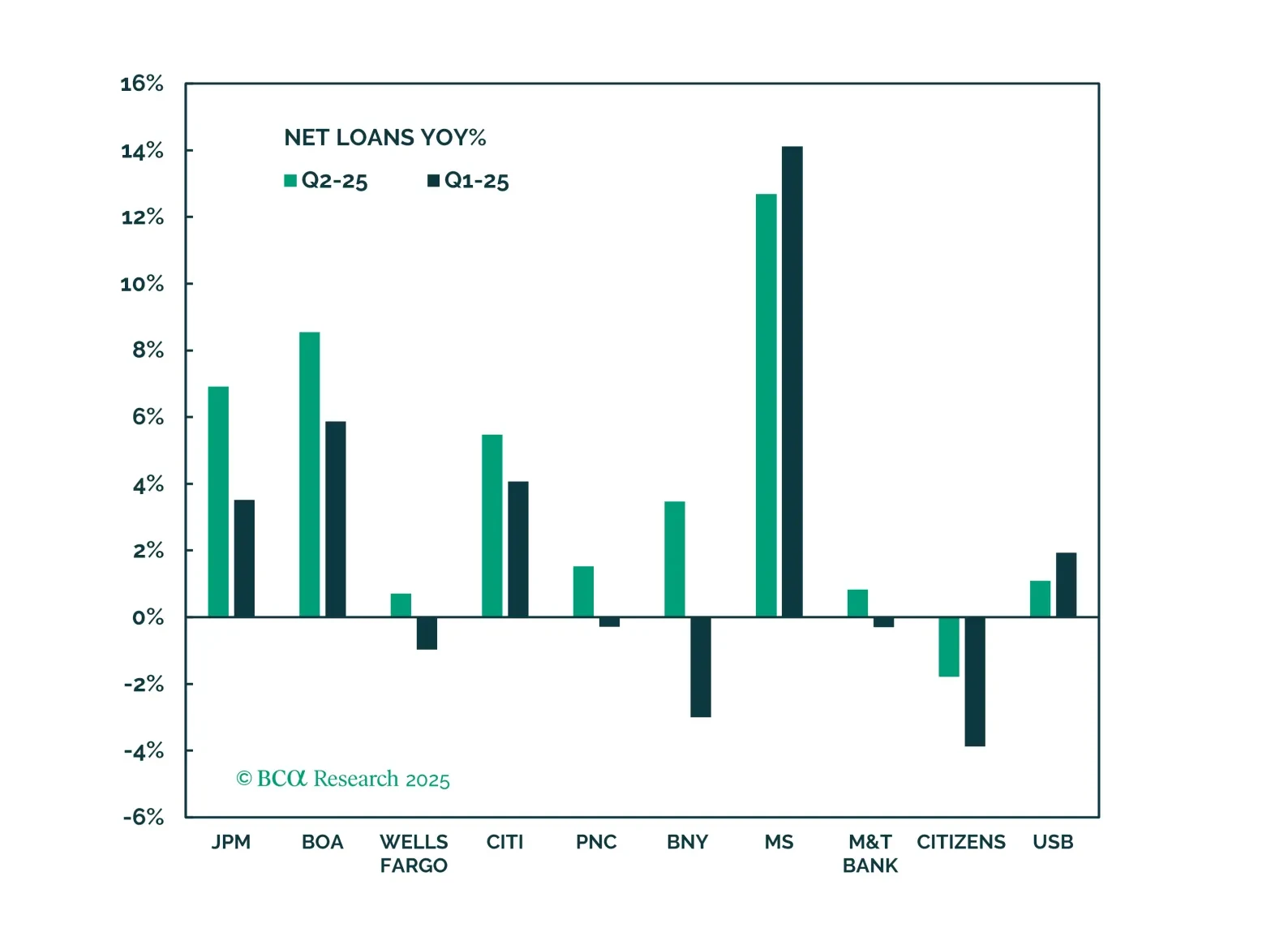

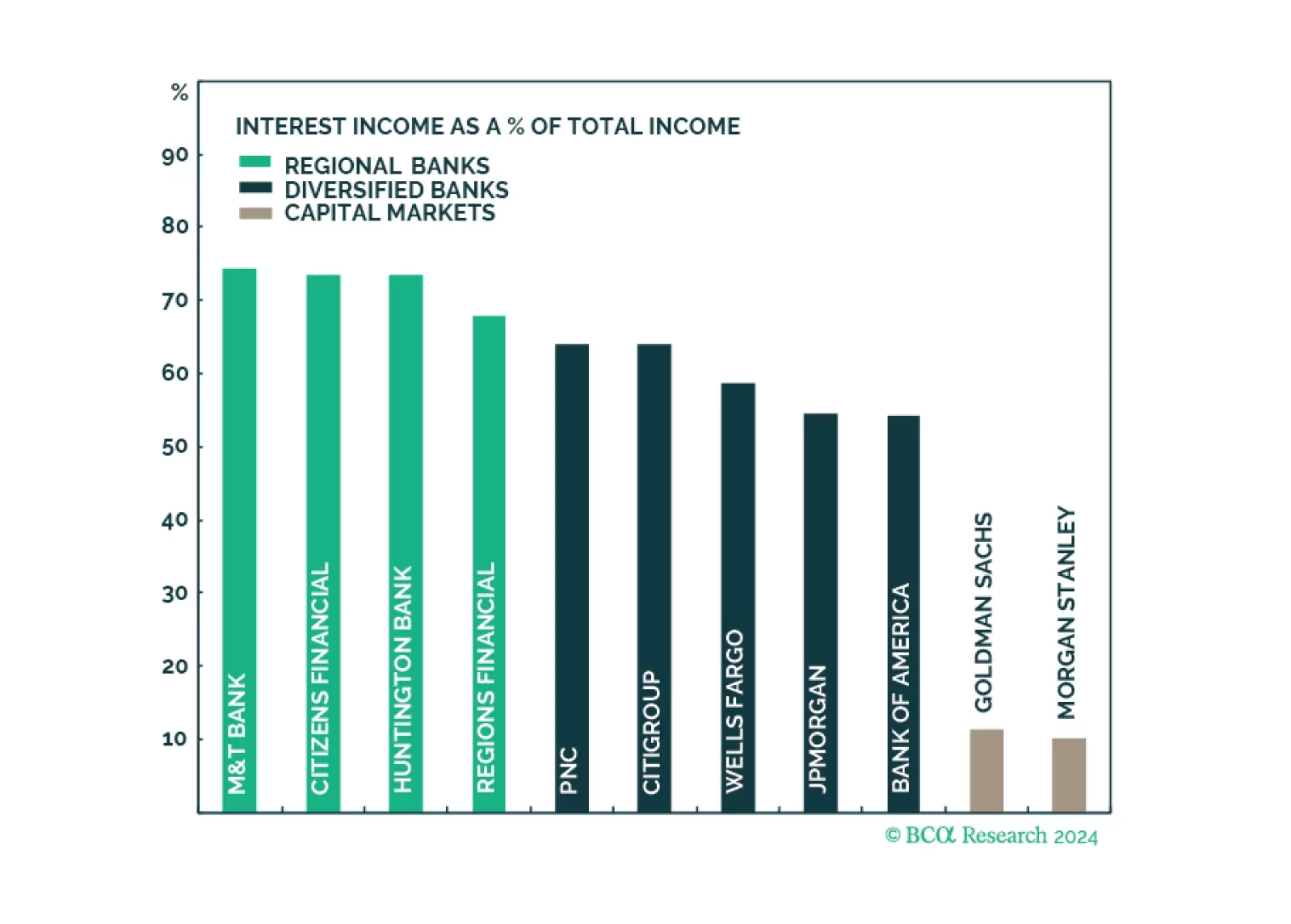

Banks have had an amazing run, and while such strong performance is unlikely to repeat, there is still oomph left in the trade thanks to a more favorable regulatory environment, stronger demand for loans, a steeper yield curve, and a…

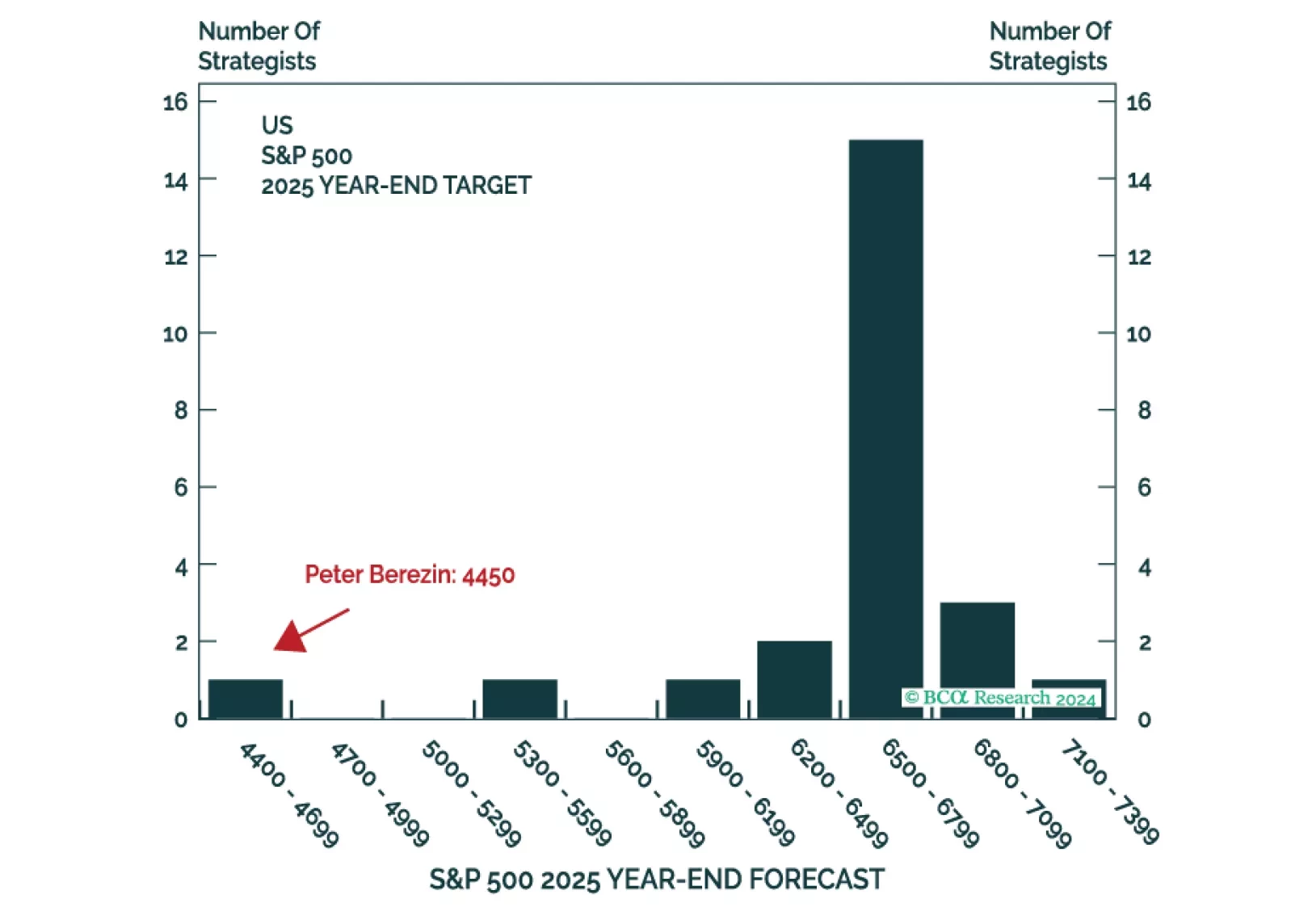

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

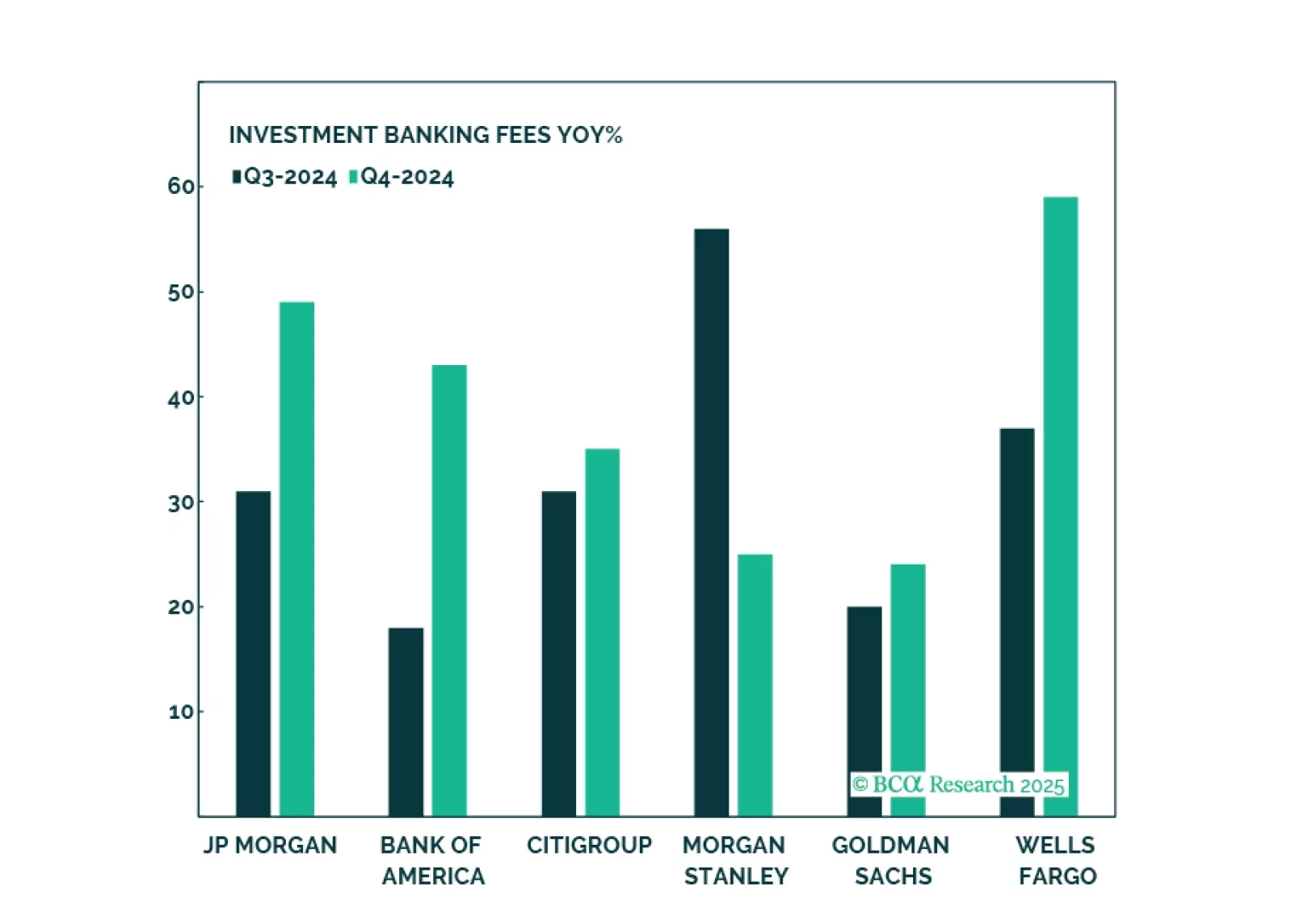

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

Overweight Capital markets stocks have come out of hibernation recently and are on the cusp of breaking out – in a bullish fashion – of their 18-month trading range. Total mutual fund assets are expanding at a…

Highlights Portfolio Strategy There are high odds that China’s real GDP deceleration will continue for the next decade, casting a shadow over the profit prospects of the S&P 1500 metals & mining index. A structural below…

Highlights Portfolio Strategy Expensive valuations leave no room to maneuver in the S&P real estate index that has to contend with a higher interest rate backdrop and deteriorating cash flow growth fundamentals. Trim to…