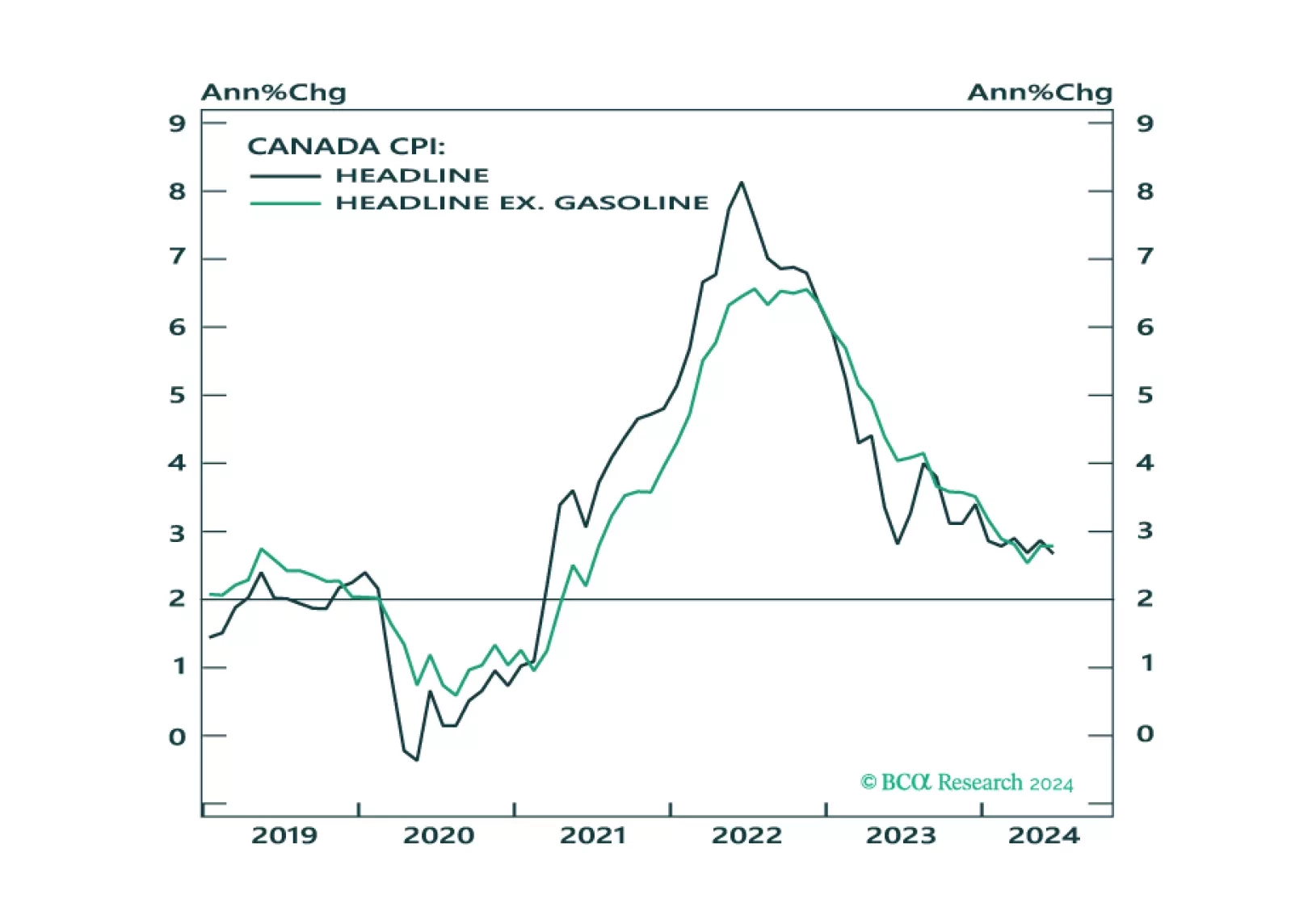

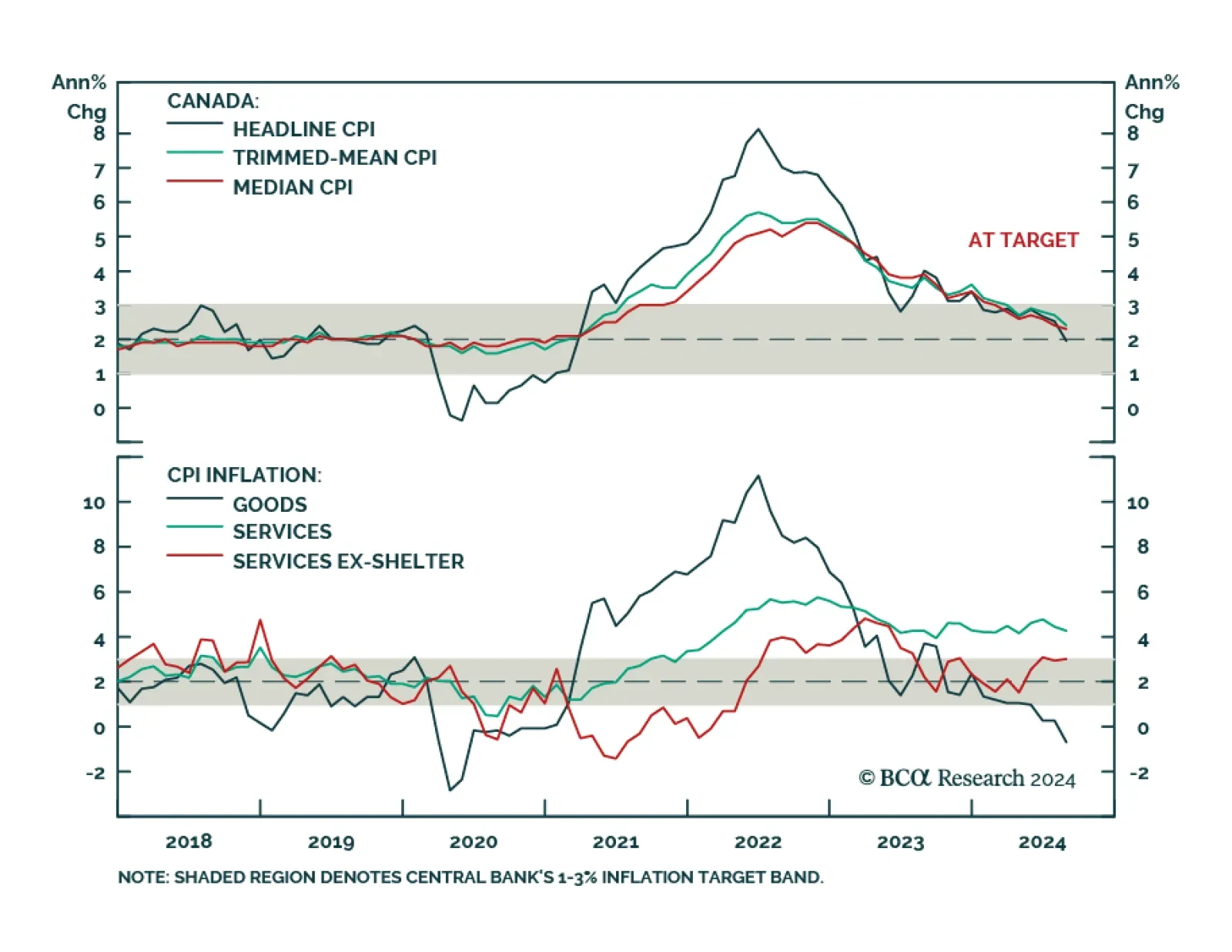

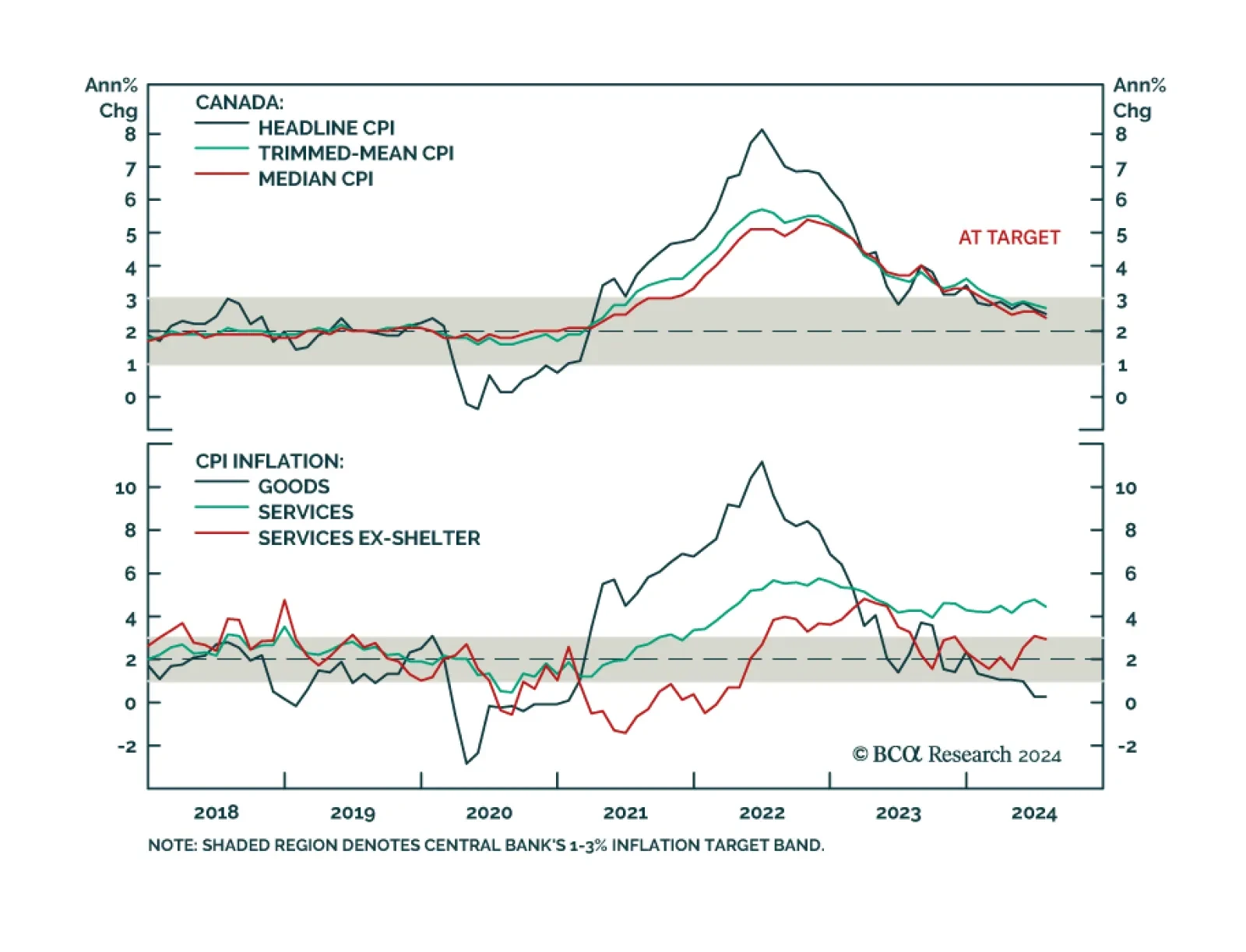

Canadian headline inflation rose 1.6% year-over-year in September, lower than the expected 1.8% and down from 2.0% in August. This was also its slowest pace since February 2021. The decrease was mainly driven by gasoline prices,…

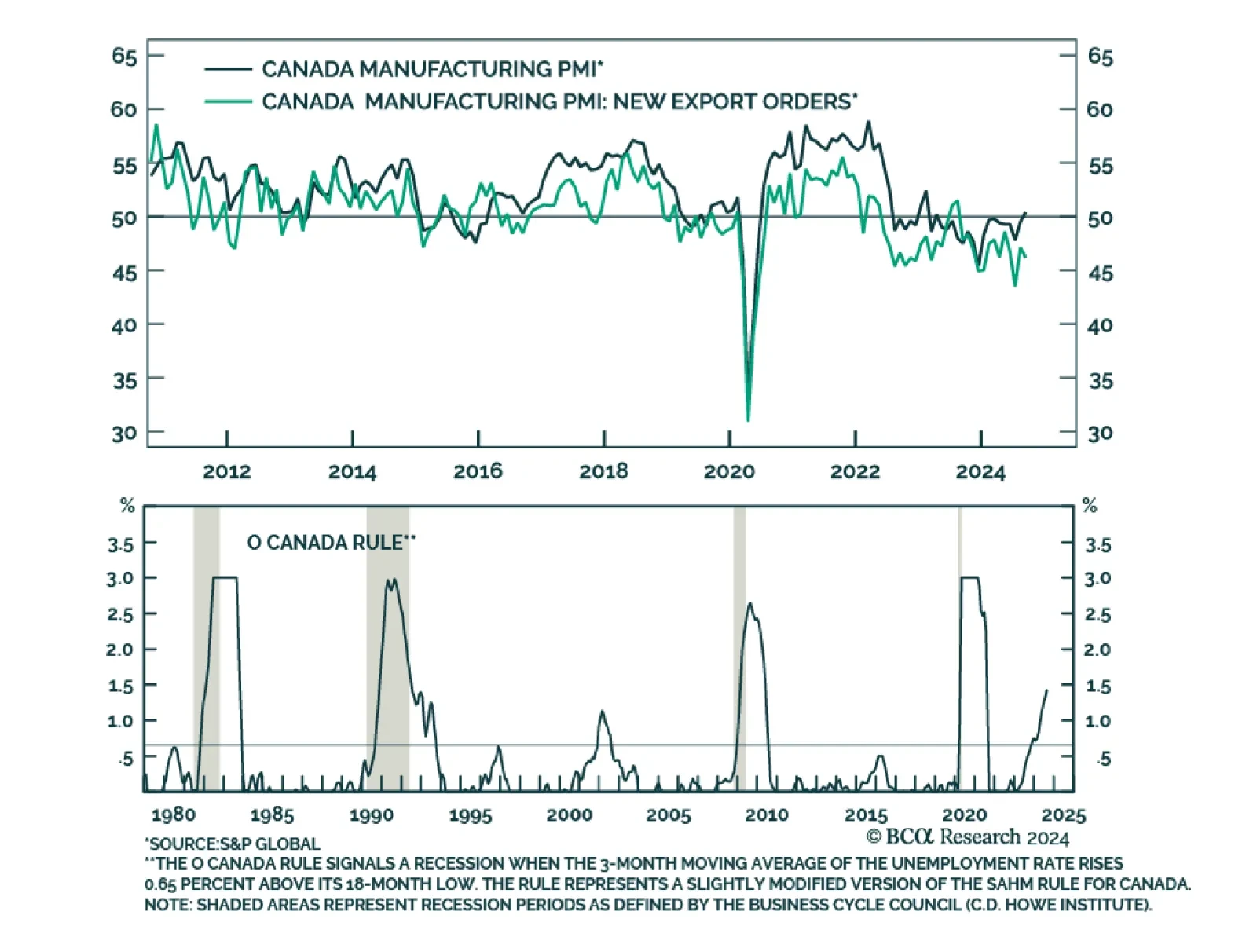

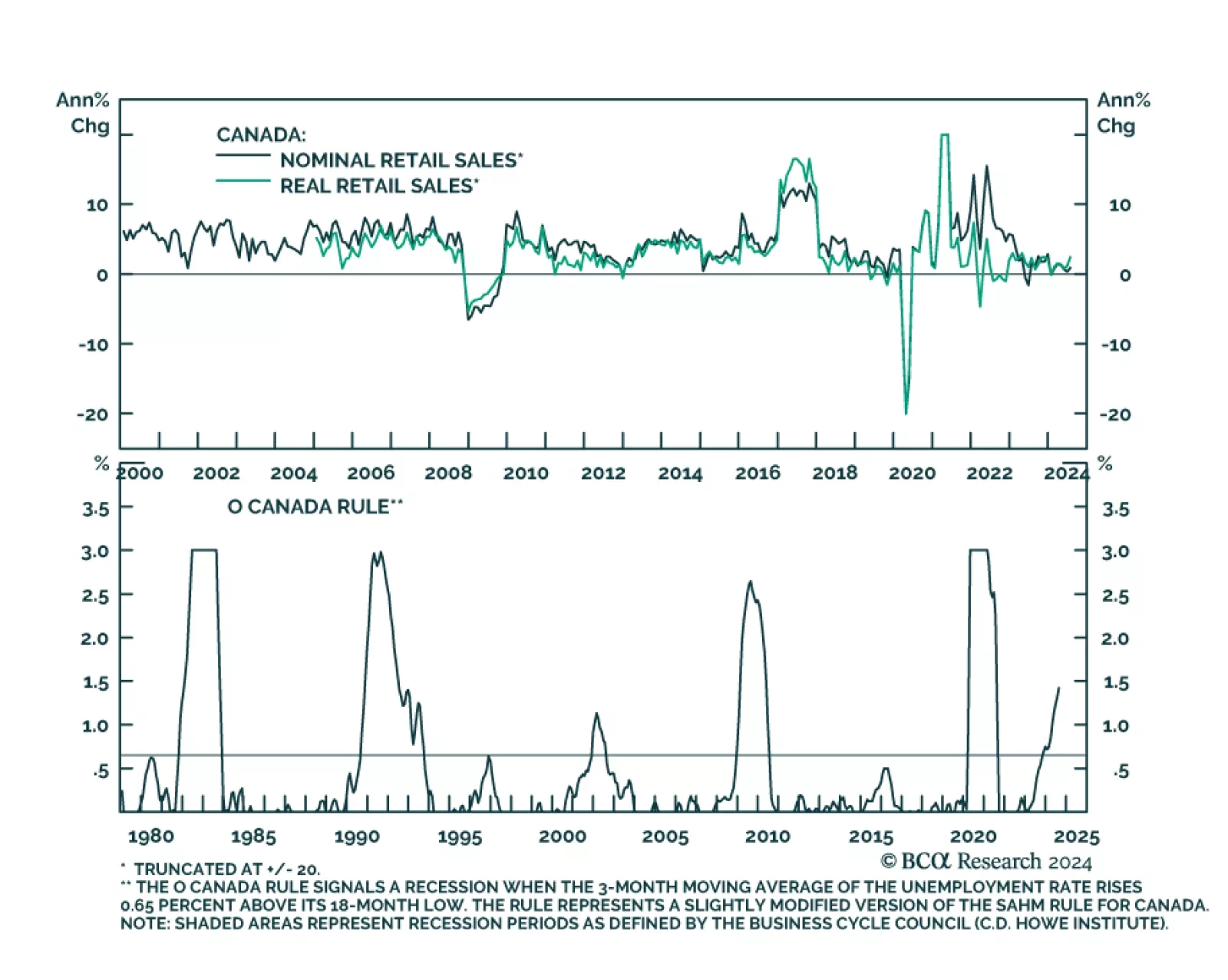

The S&P Global Canada Manufacturing PMI improved from 49.5 to 50.4 in September, breaking a 17-month contraction streak. It corroborated solid broad-based retail sales growth in July and August. Confidence in the outlook also…

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

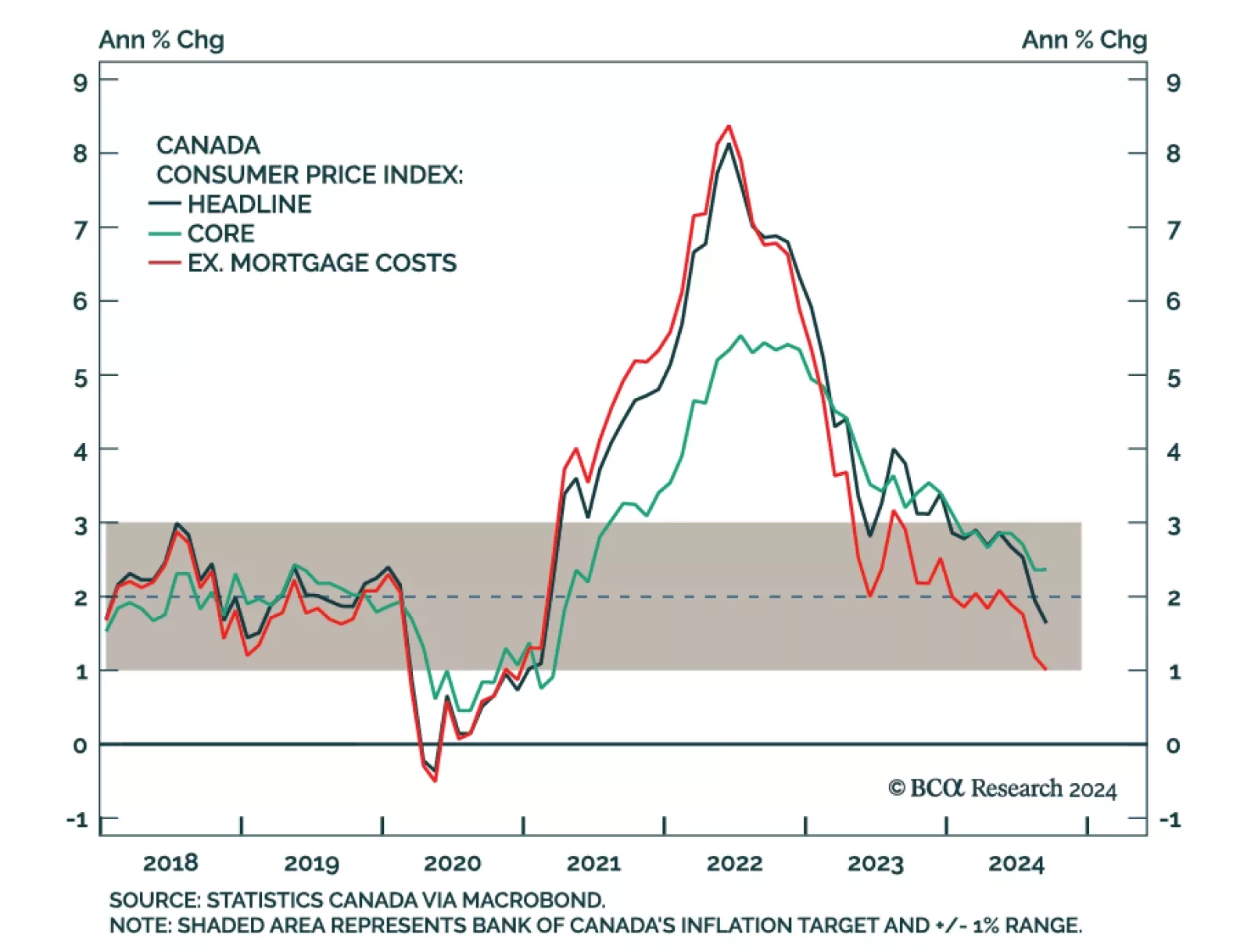

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…

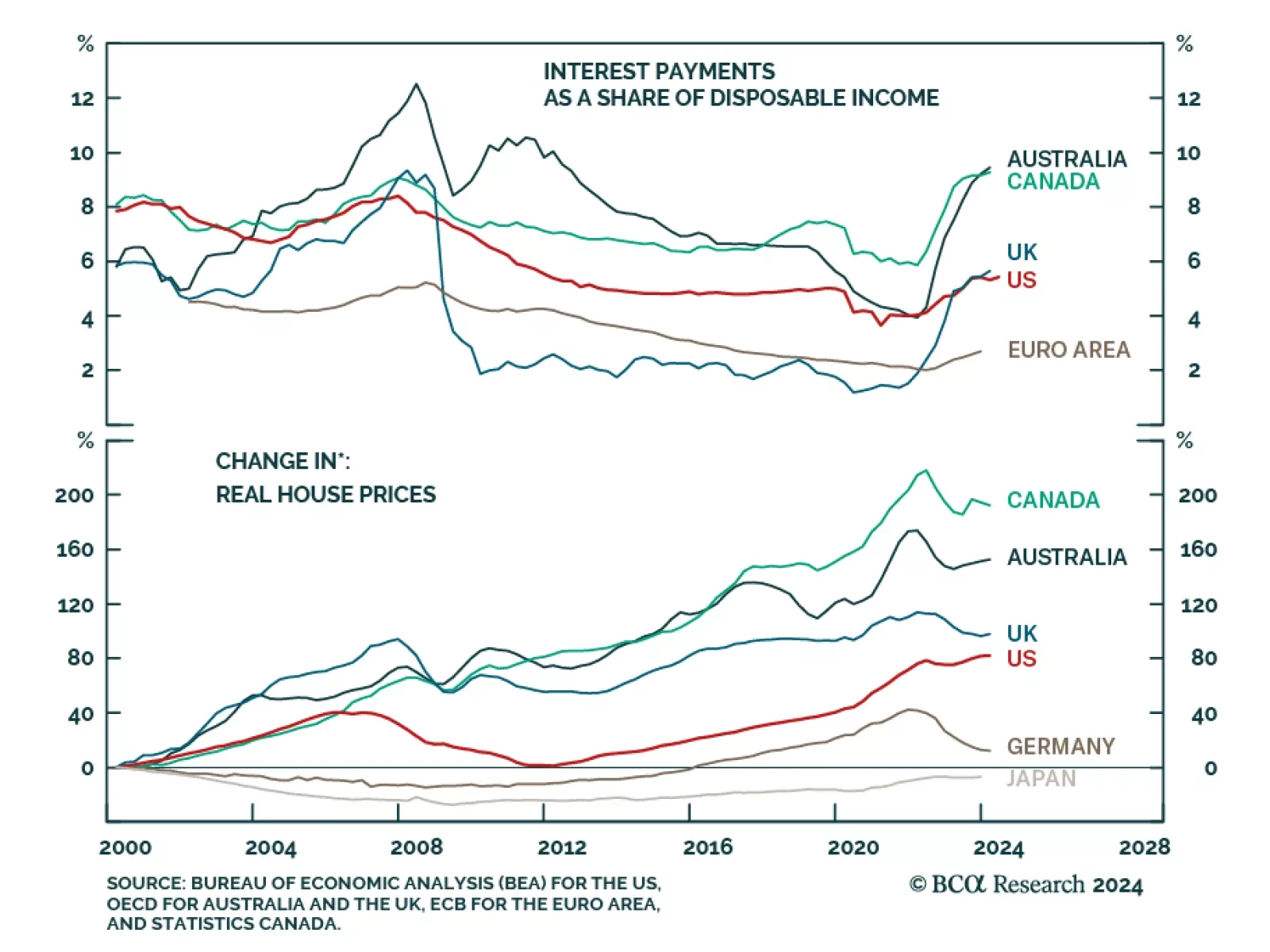

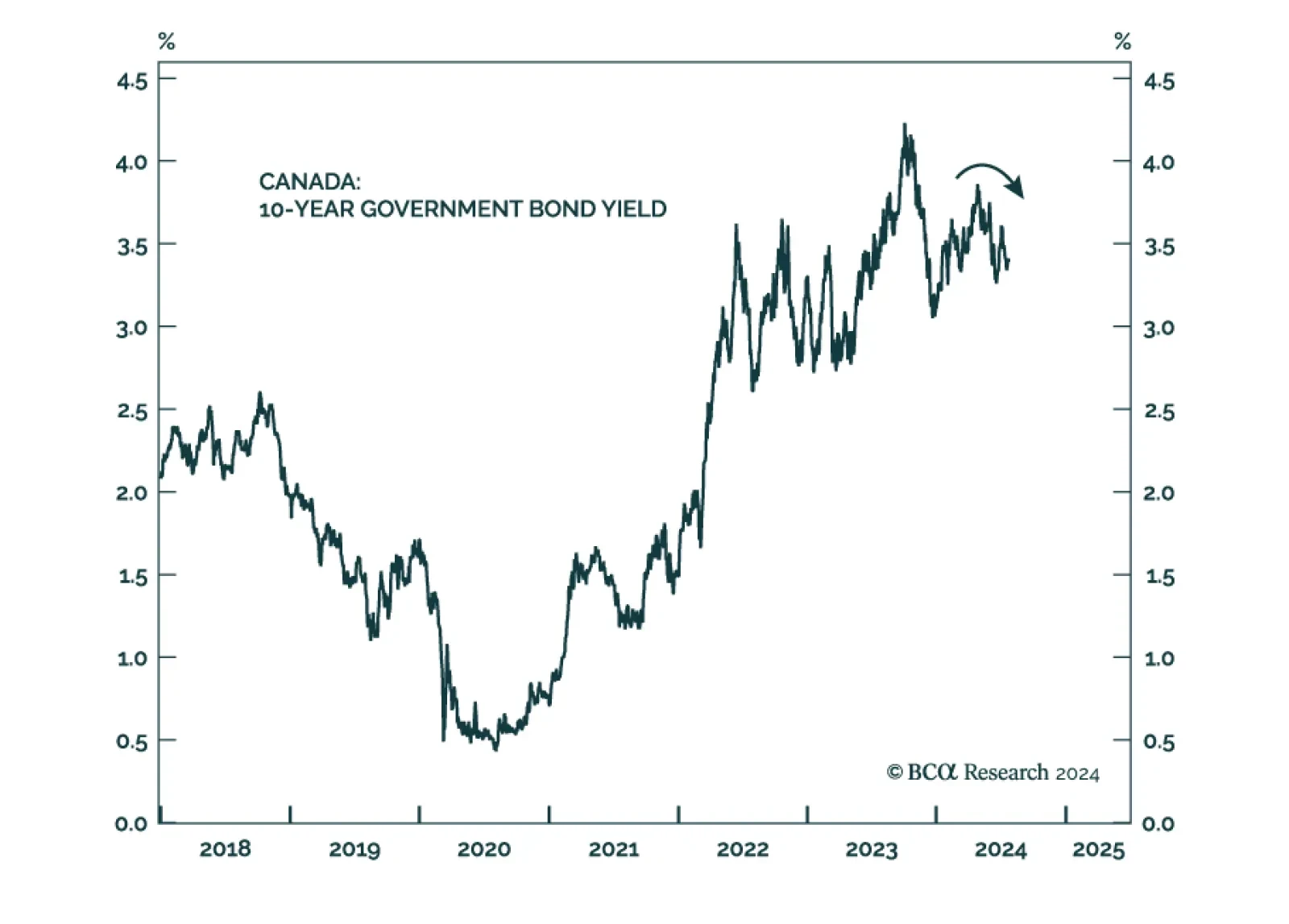

In a widely expected move, the Bank of Canada (BoC) cut interest rates by a quarter of a percentage point for a third consecutive month in September, lowering the benchmark overnight rate to 4.25%. Policymakers also signaled…

Canadian headline CPI decelerated from 2.7% y/y to 2.5% in July, the slowest pace in over 3 years. Notably, core median and trimmed-mean CPI eased further than expected, to 2.4% and 2.7% y/y respectively, 0.1 ppt below…

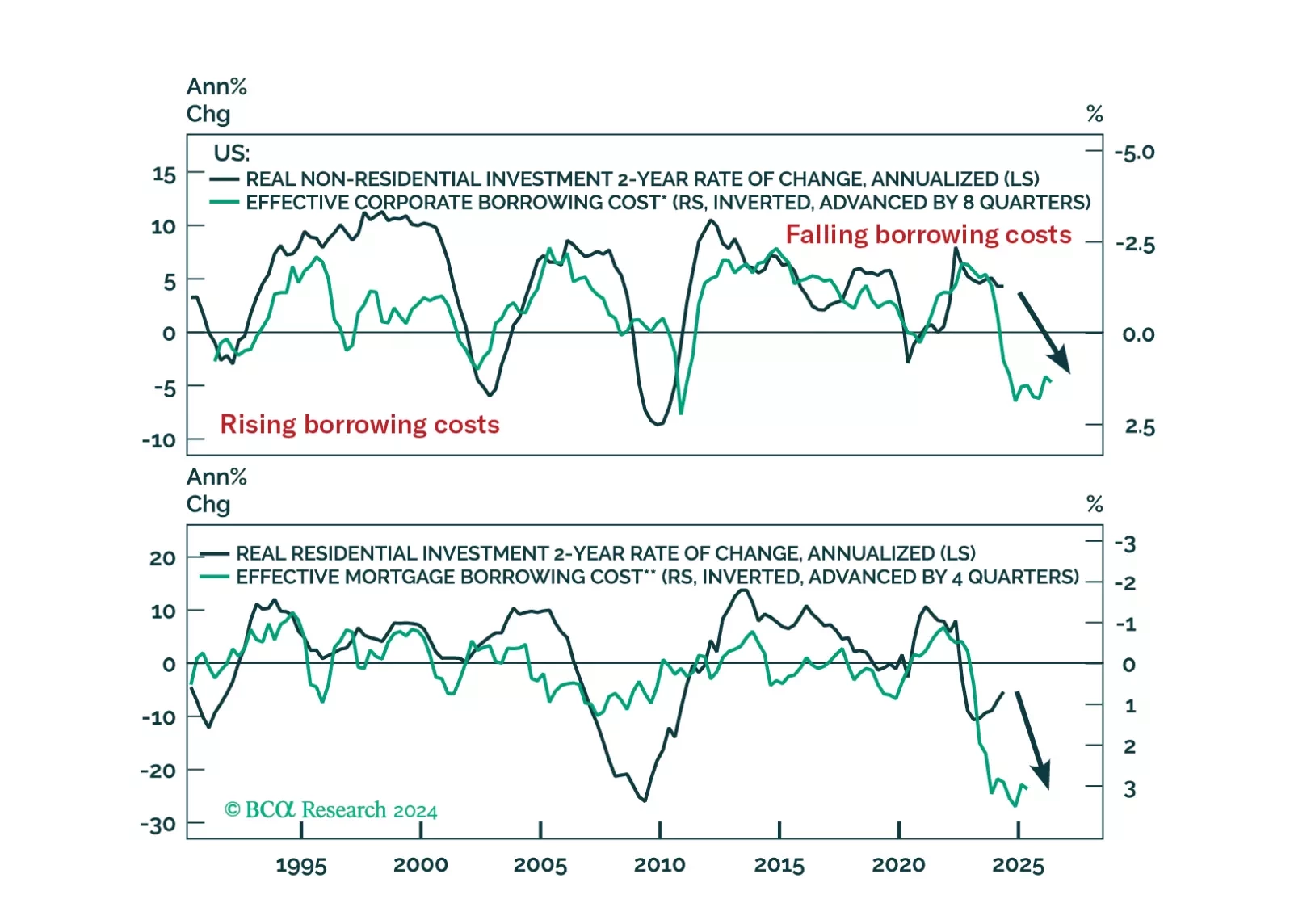

We have high conviction that continued labor market softening will tip the US economy into a recession by year-end or early next year. It will reverberate to the rest of the world given that the US has been the main driver of…

The Bank of Canada (BoC) reduced its policy rate by 25bps for the second meeting in a row on Wednesday. We highlighted in a recent Insight that the soft June inflation print and weakening labor market increased the odds of more…

In this Insight, we look into the recent CPI release in Canada, and the possible implications for fixed-income market trades.