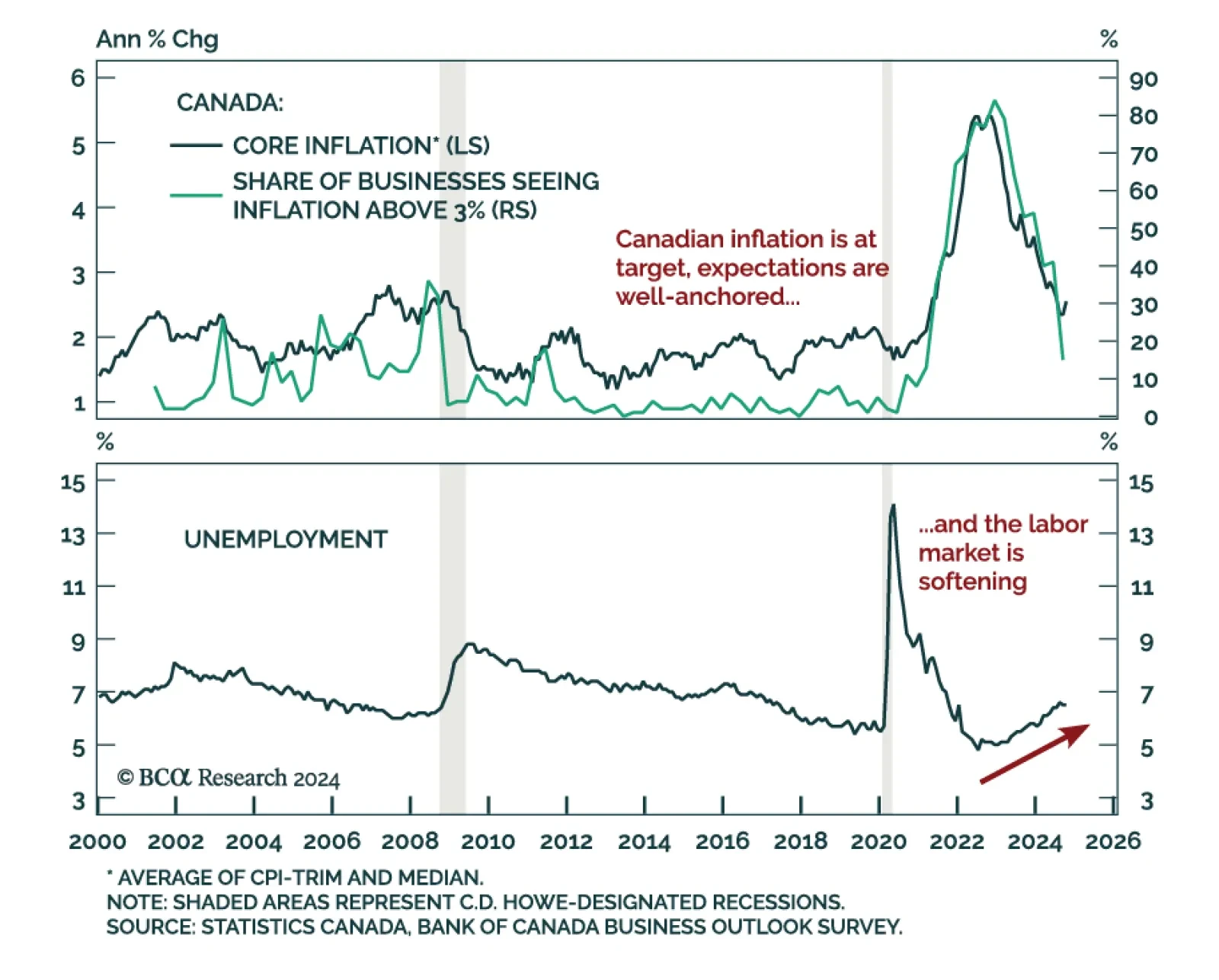

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…

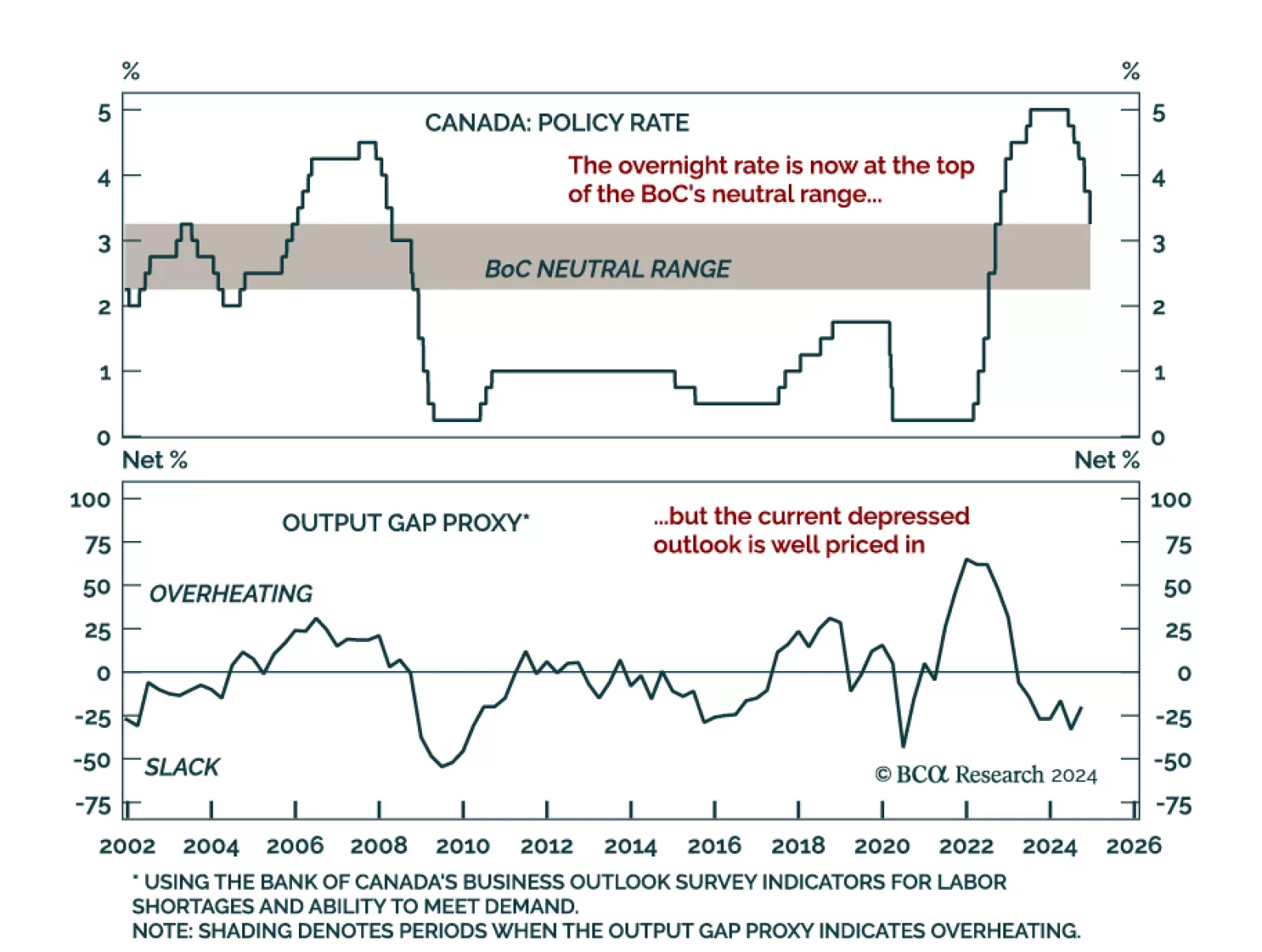

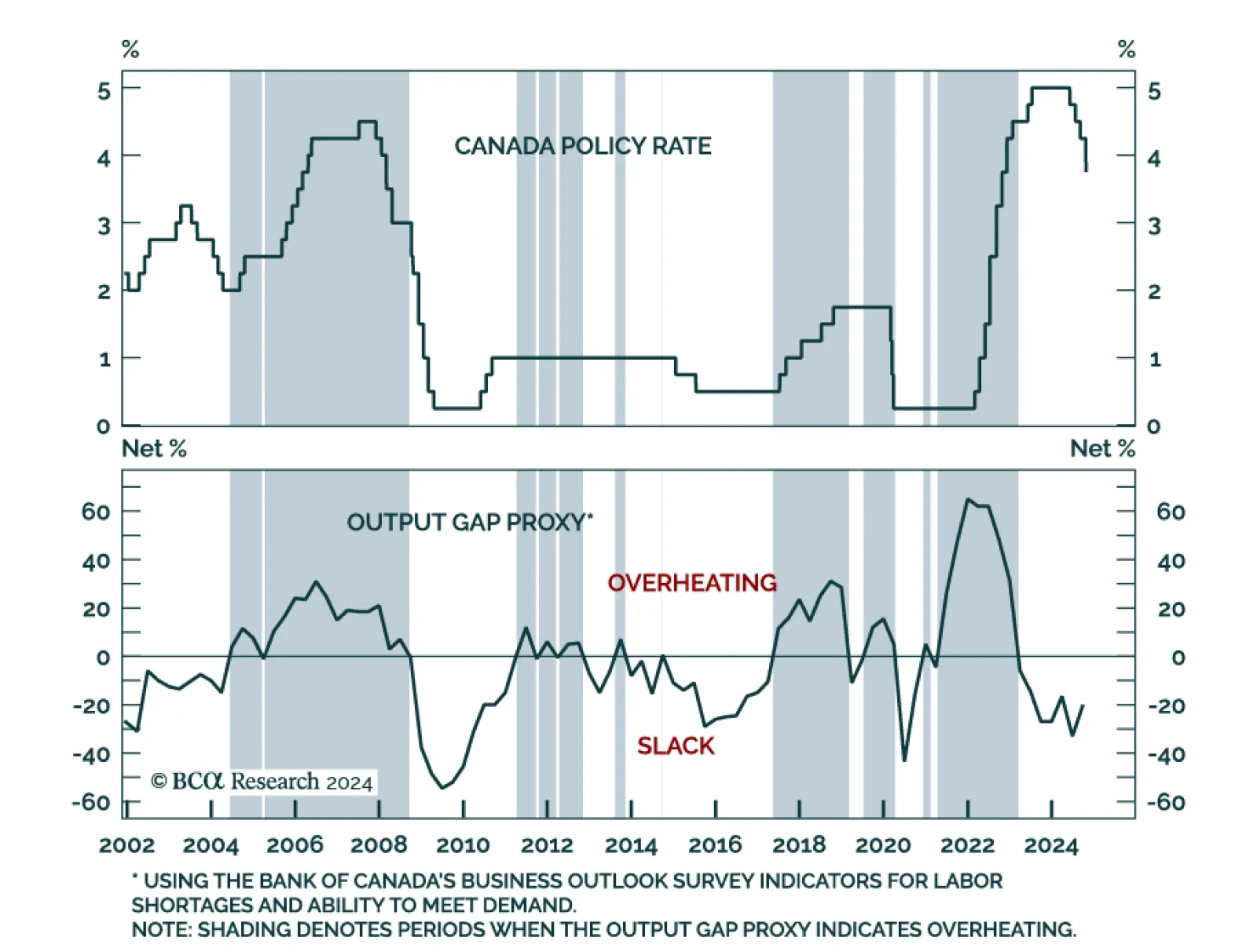

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…

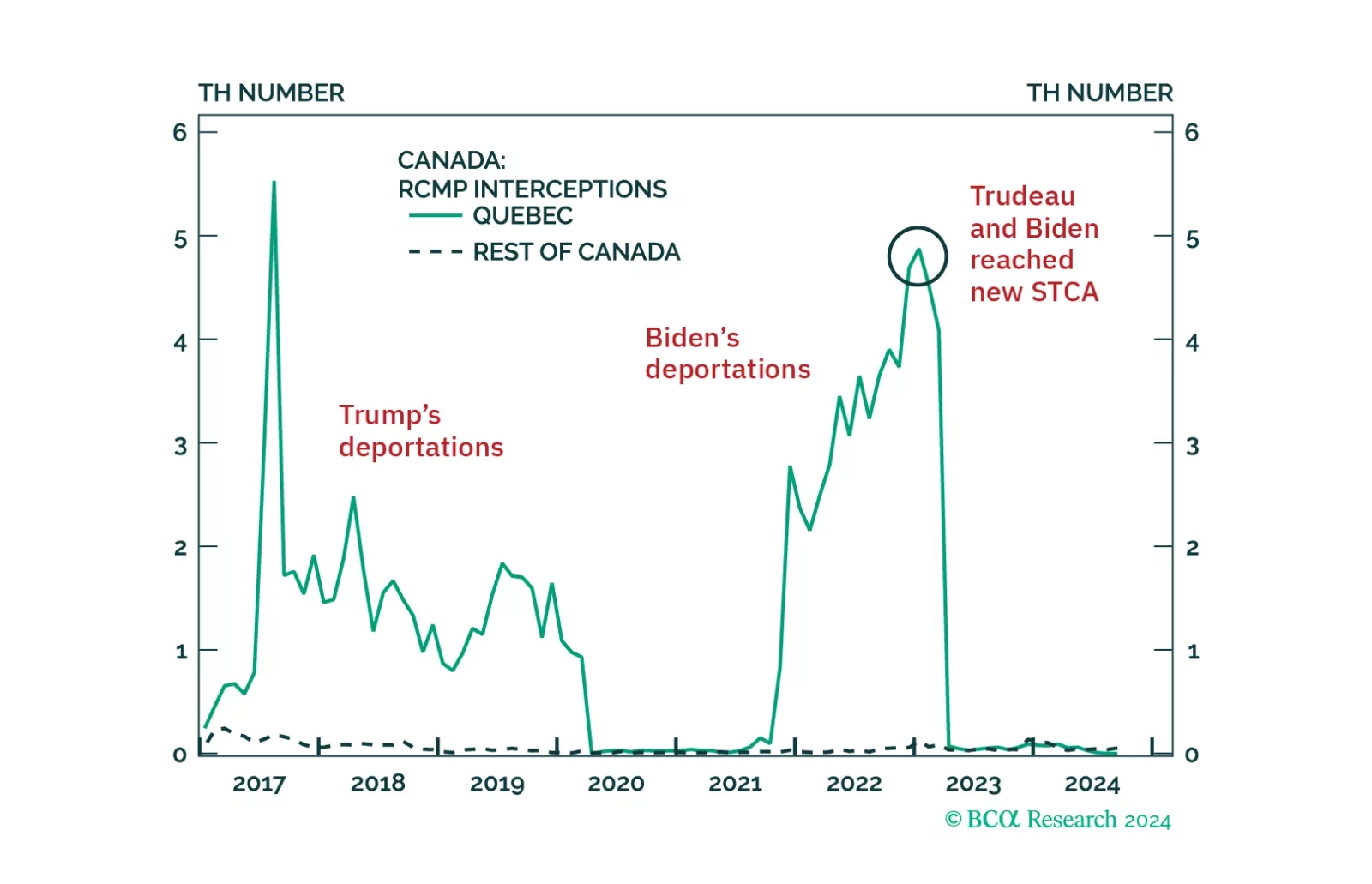

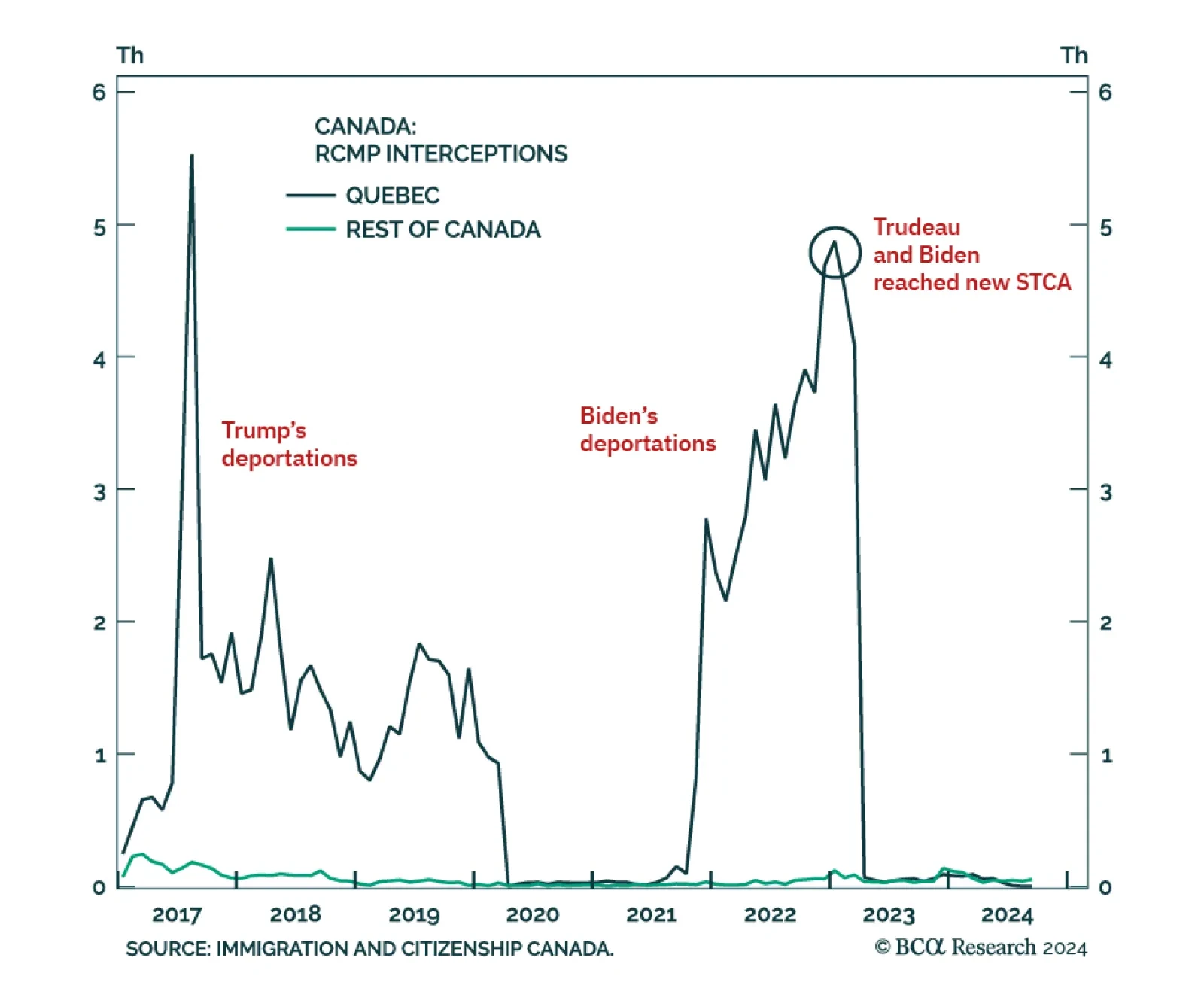

As 2024 closes out a busy electoral calendar for North America, our Geopolitical strategists look at Canada, where an election will be held by October 2025. Canada is poised for a likely change in leadership next year.…

Canadian inflation was slightly hotter than expected in October, re-accelerating to 2.0% y/y from 1.6% in September. The BoC’s favored core measures, median and trim, re-accelerated to 2.5% and 2.6% respectively, and CPI-…

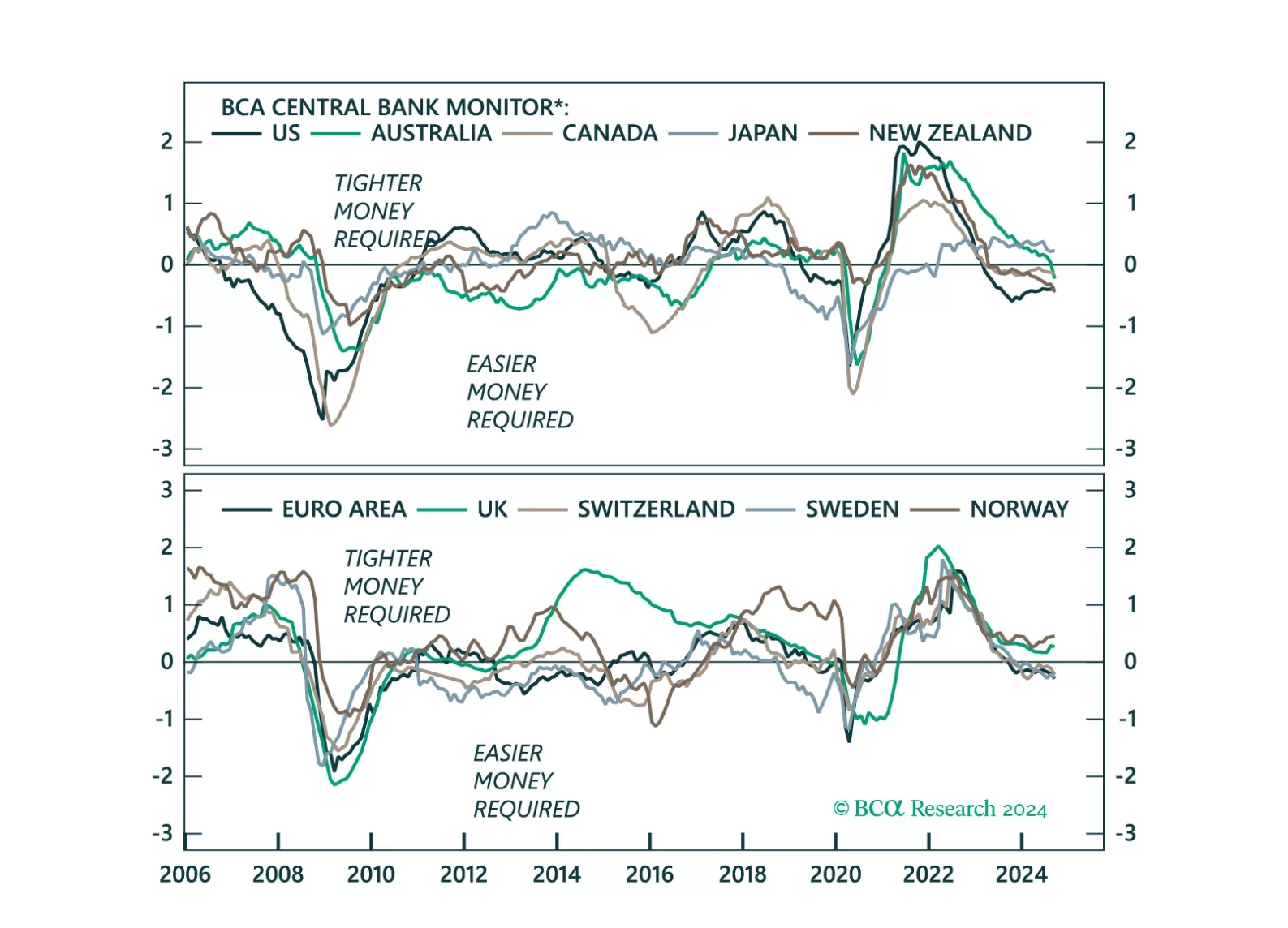

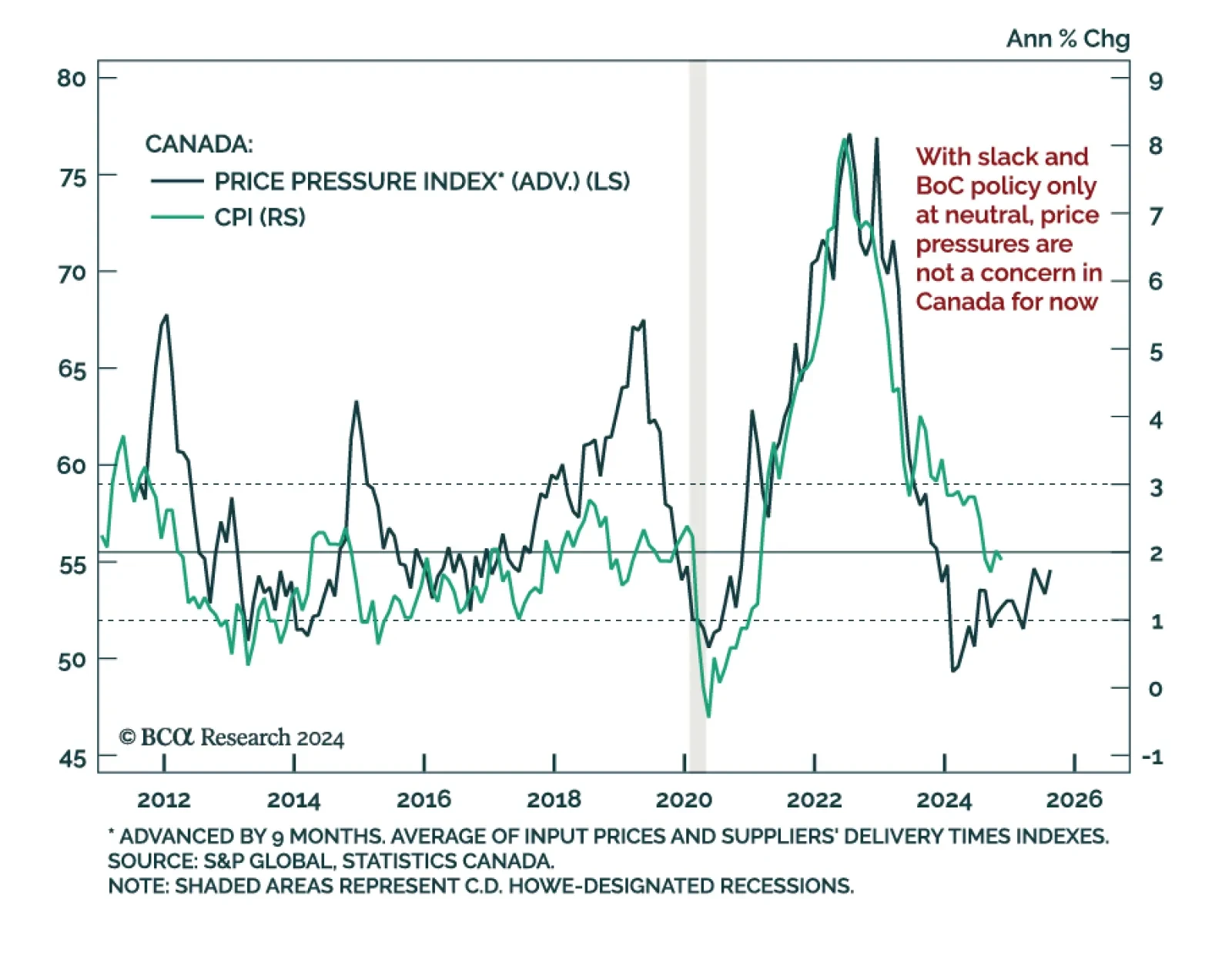

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

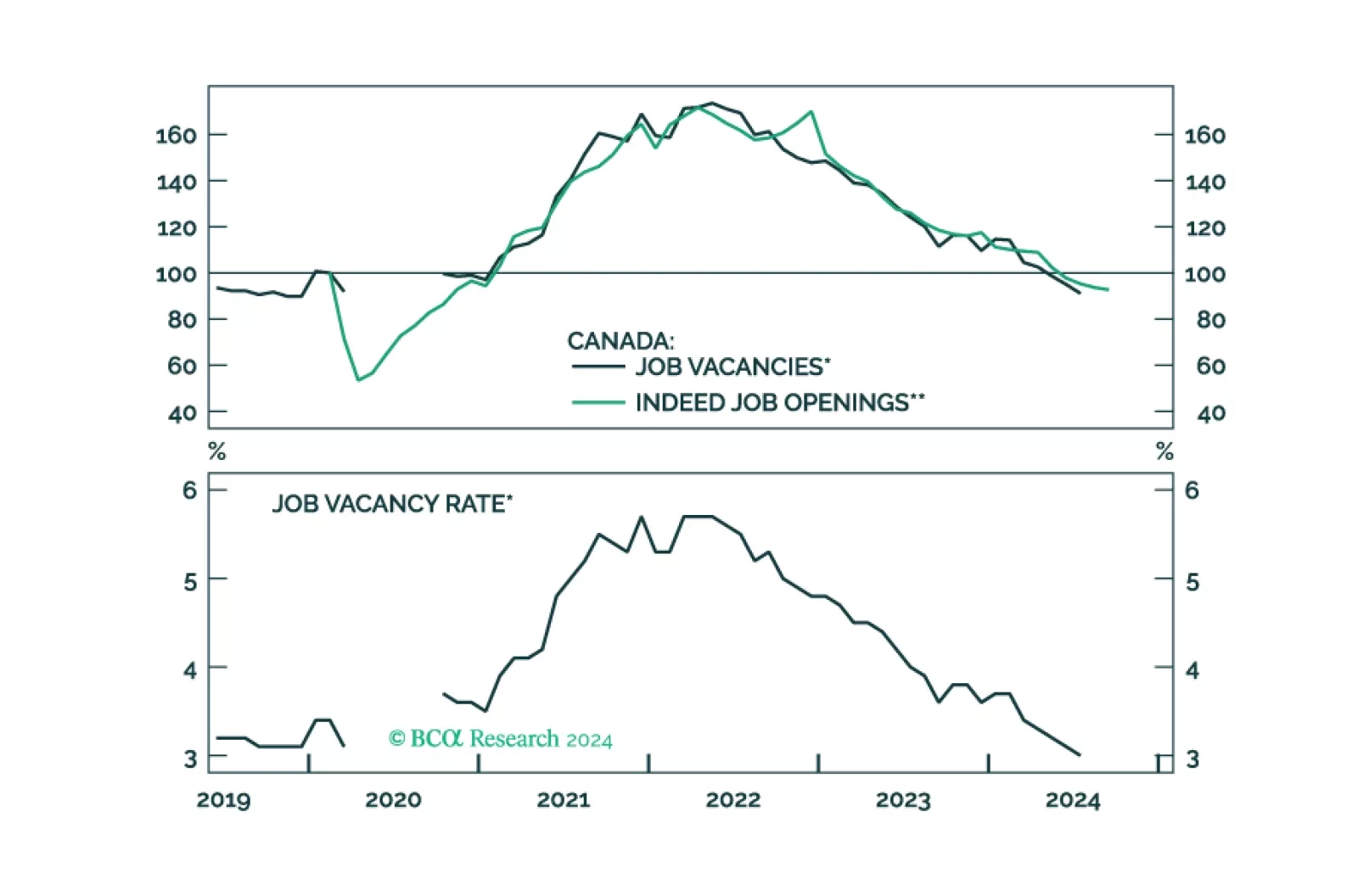

In this Insight, we evaluate if there is more juice in our macro bet of being long June 2025 CORRA versus SOFR futures, and correspondingly, being short the CAD, for investors with a 1-3 month horizon.

After cutting three times already since June, the Bank of Canada fulfilled market expectations and cut the overnight rate by 50 bps to 3.75%. The BoC sees risks around inflation as roughly balanced over its projection horizon,…

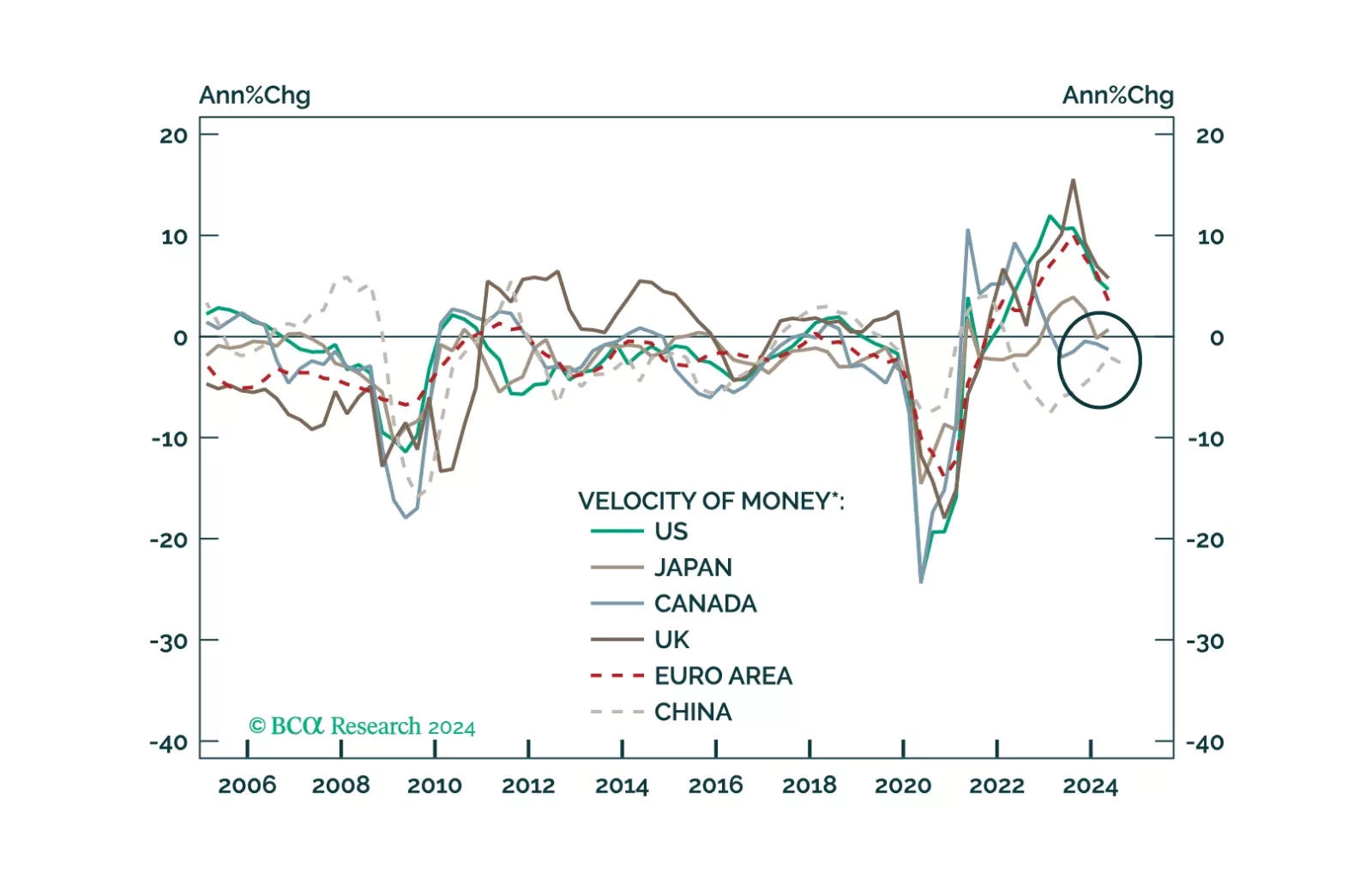

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.