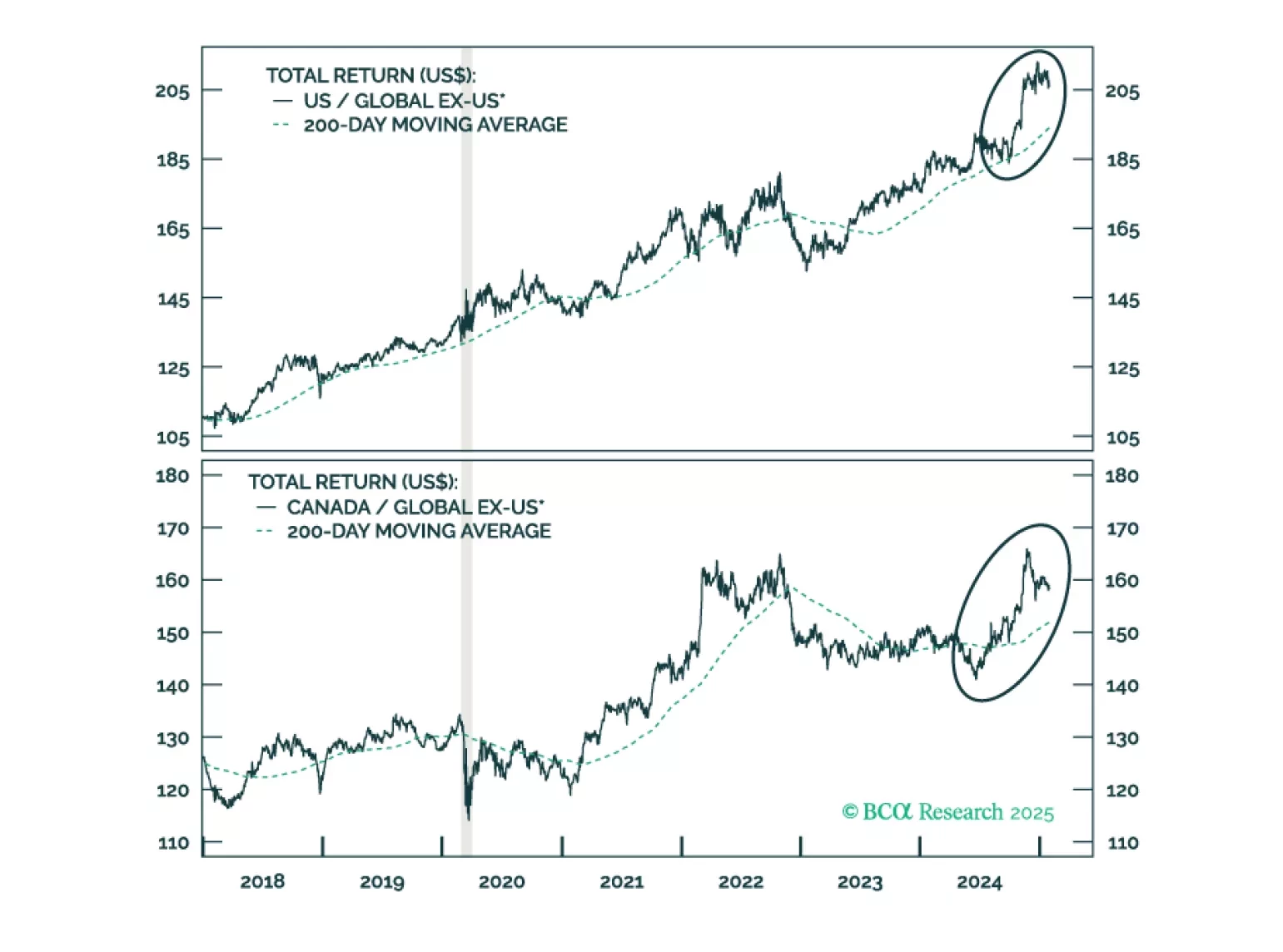

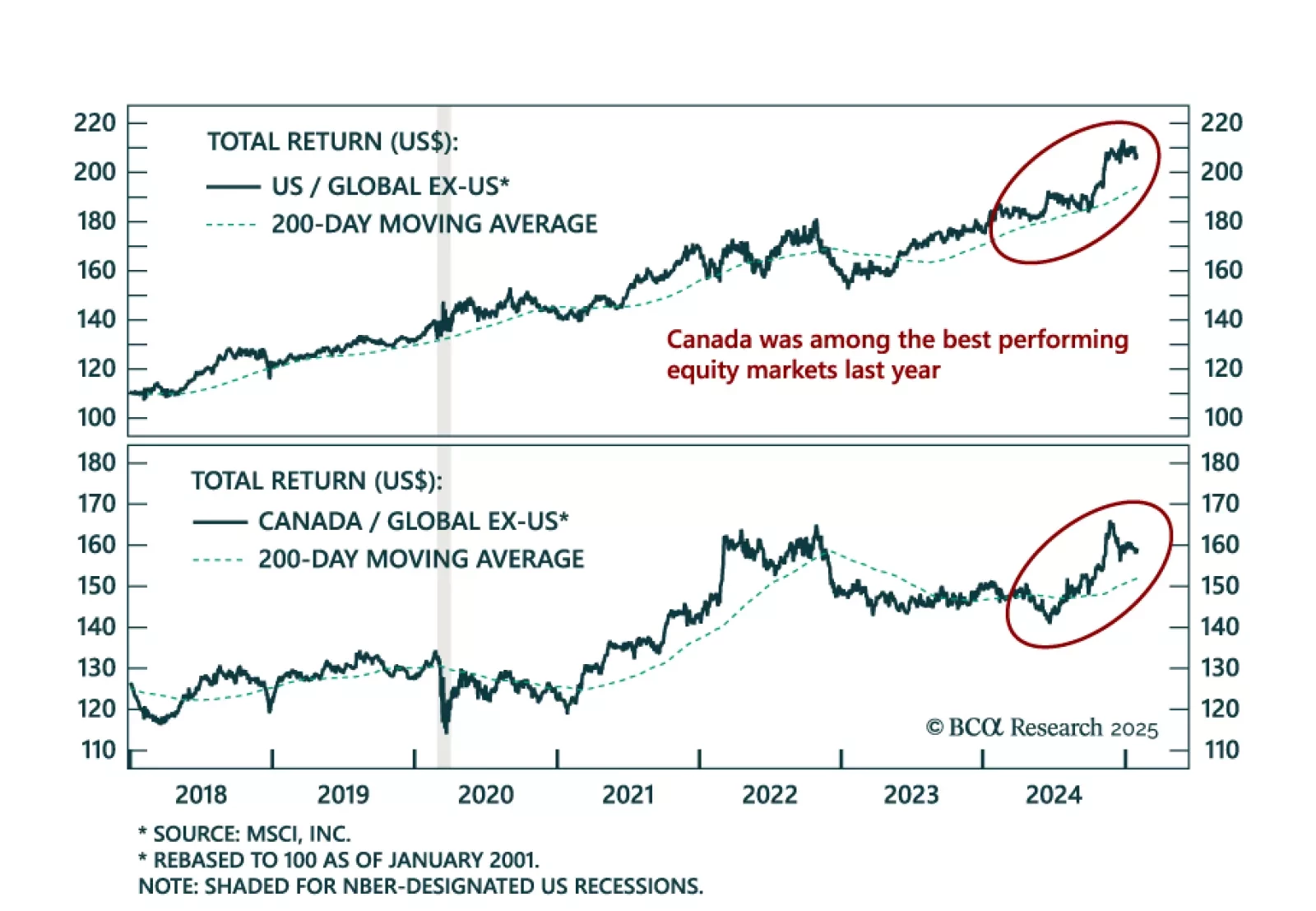

Our colleagues from The Bank Credit Analyst revisited the outlook for Canadian stocks after they outperformed global ex-US stocks in late 2024. The outperformance was driven by financials and tech. While Canadian tech gains were…

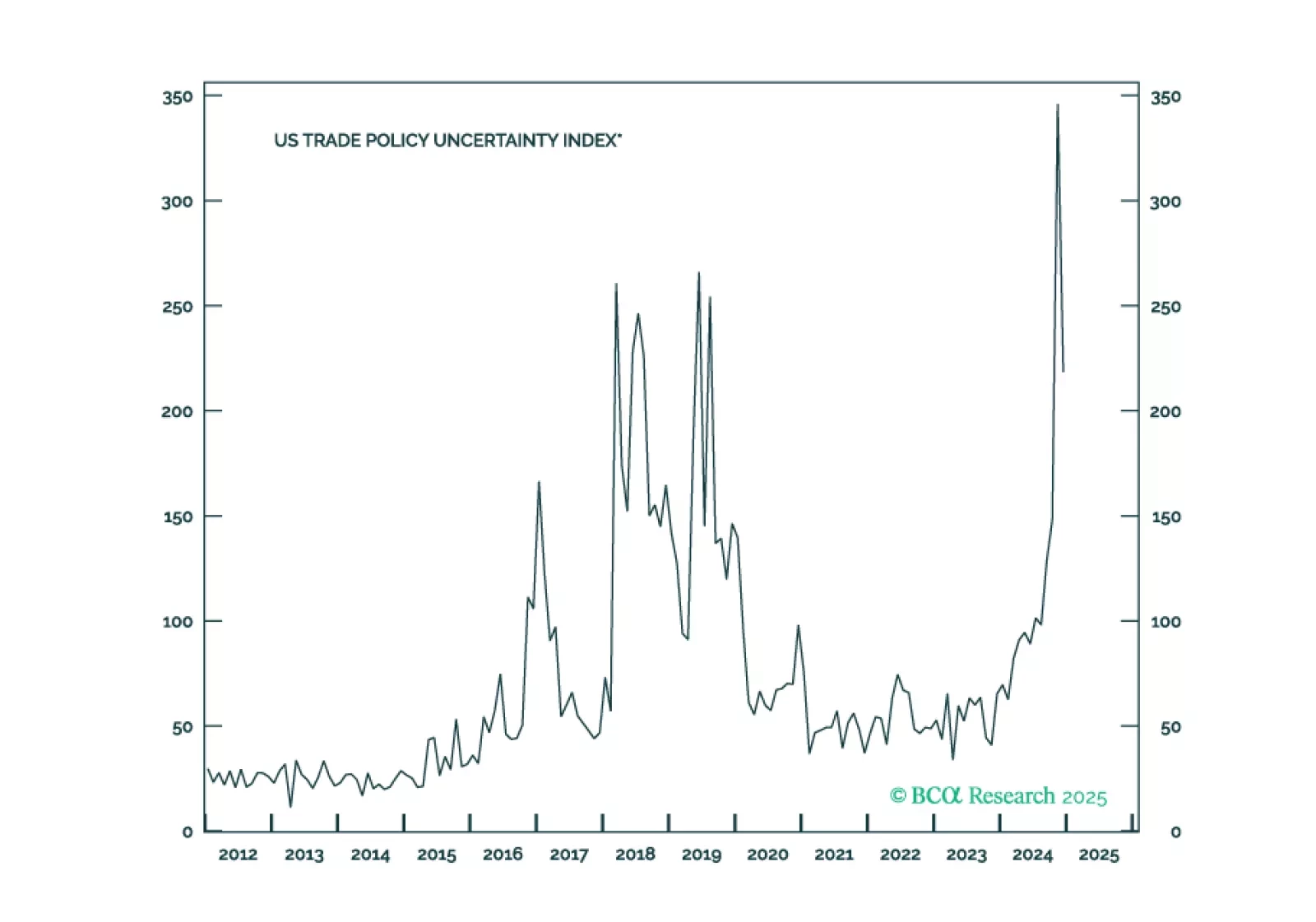

In Section I, Doug highlights that recent trade developments and news from the AI space are both consistent with a conservative investment stance. US final demand was robust in Q4, but the economy is still walking a tightrope as…

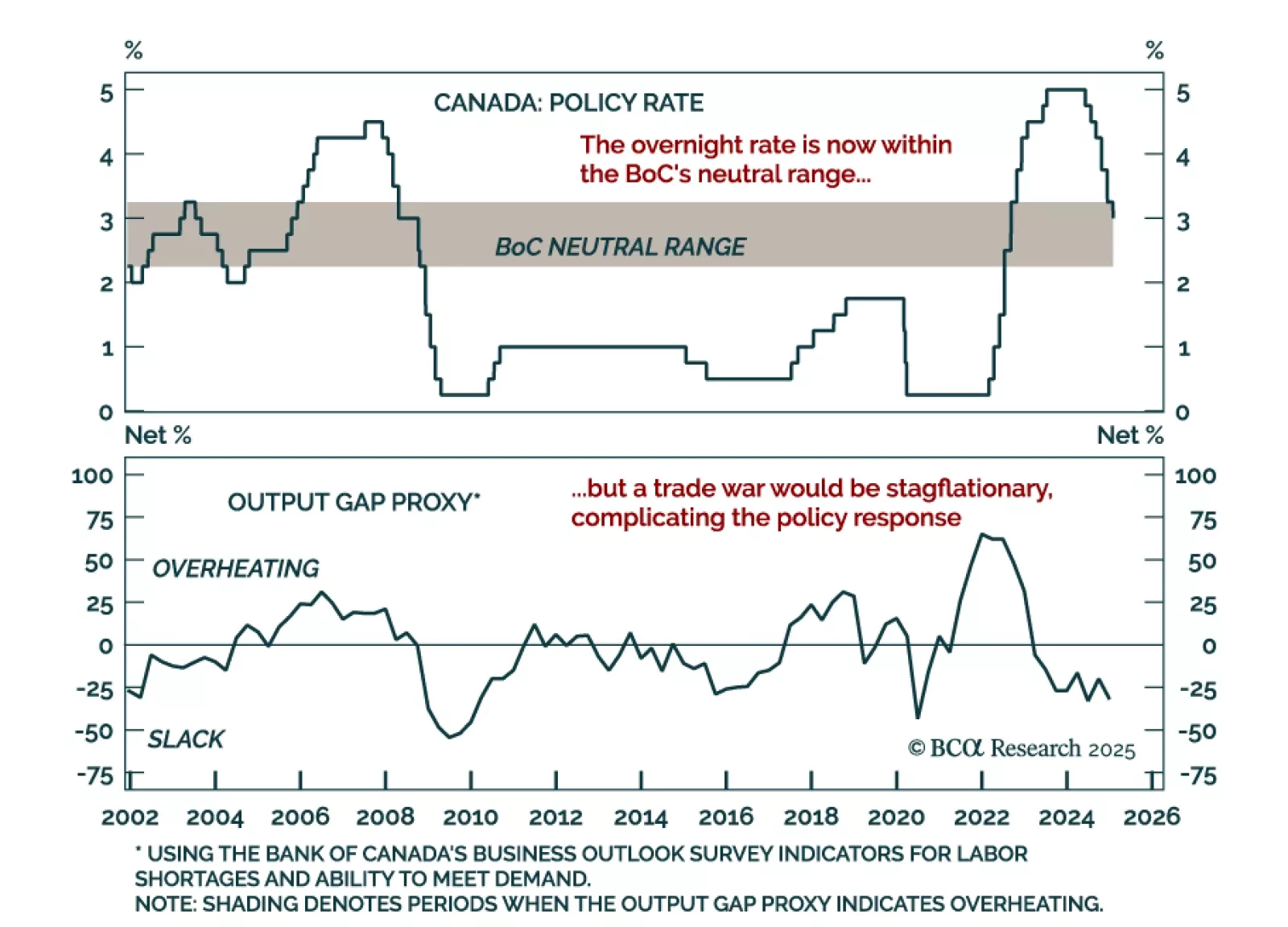

The Bank of Canada cut by 25 bps to 3% as expected, and announced the end of quantitative tightening. This sixth consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range.…

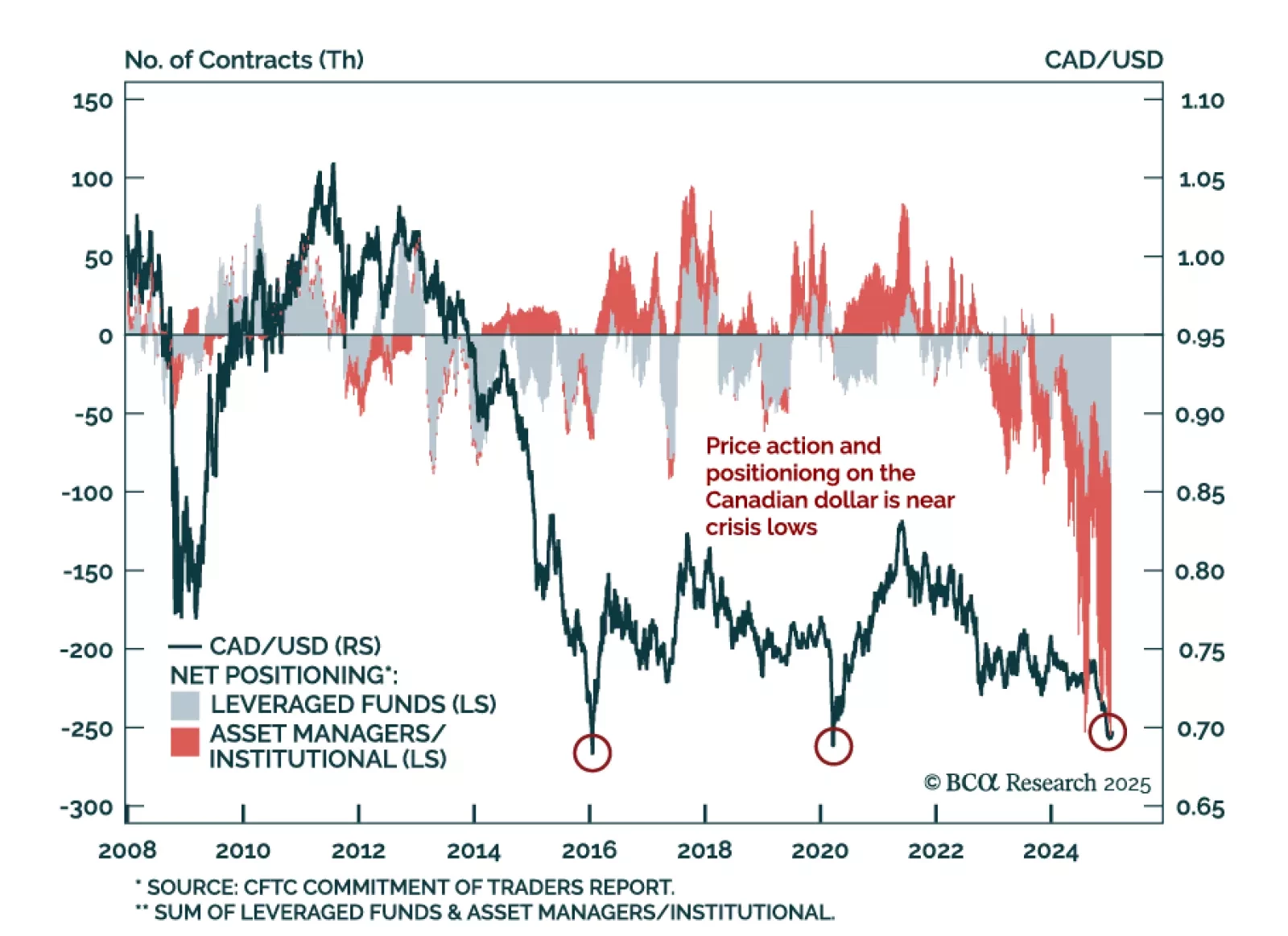

This Insight looks at what investors should do with CAD and fixed-income assets, given the rate cut by the Bank of Canada today.

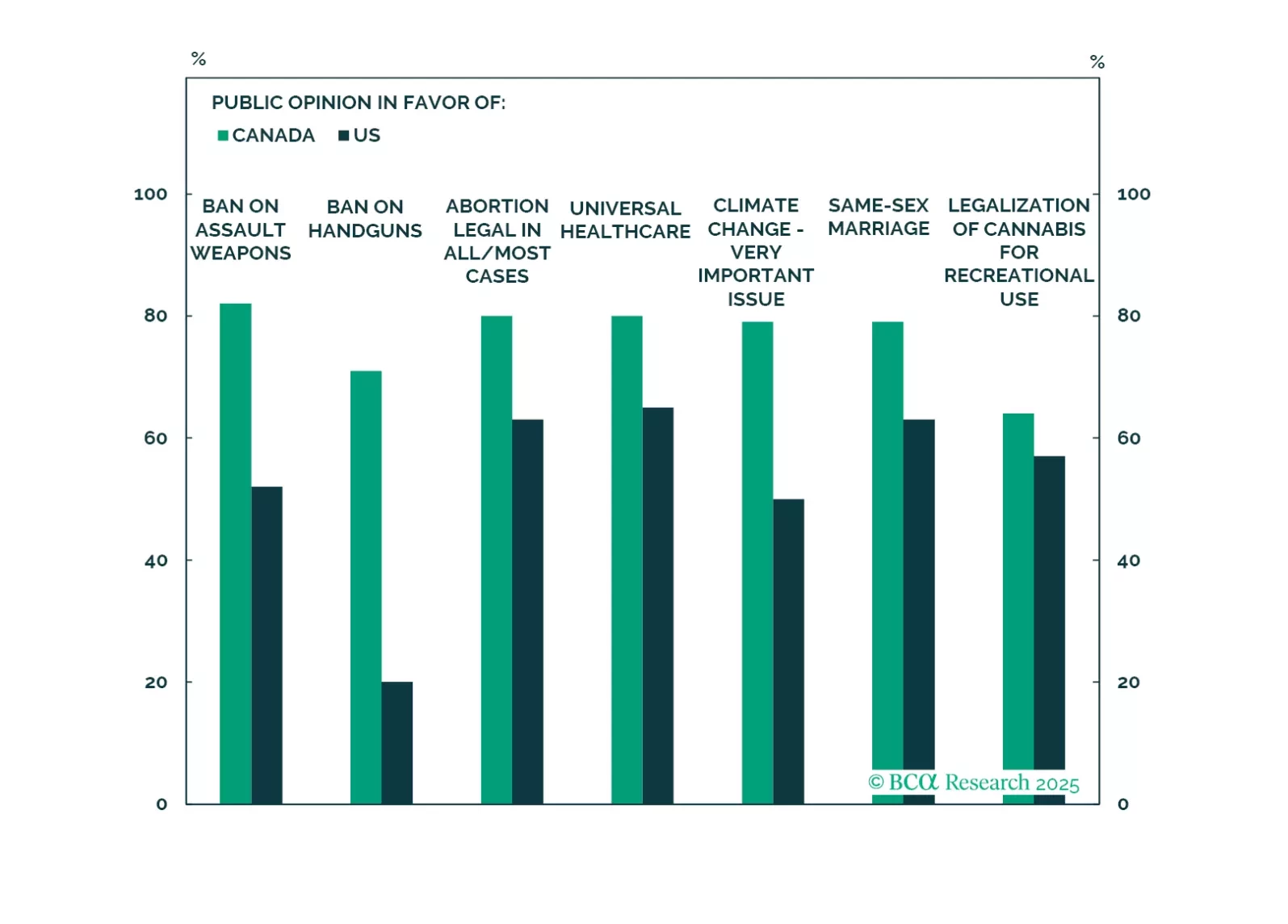

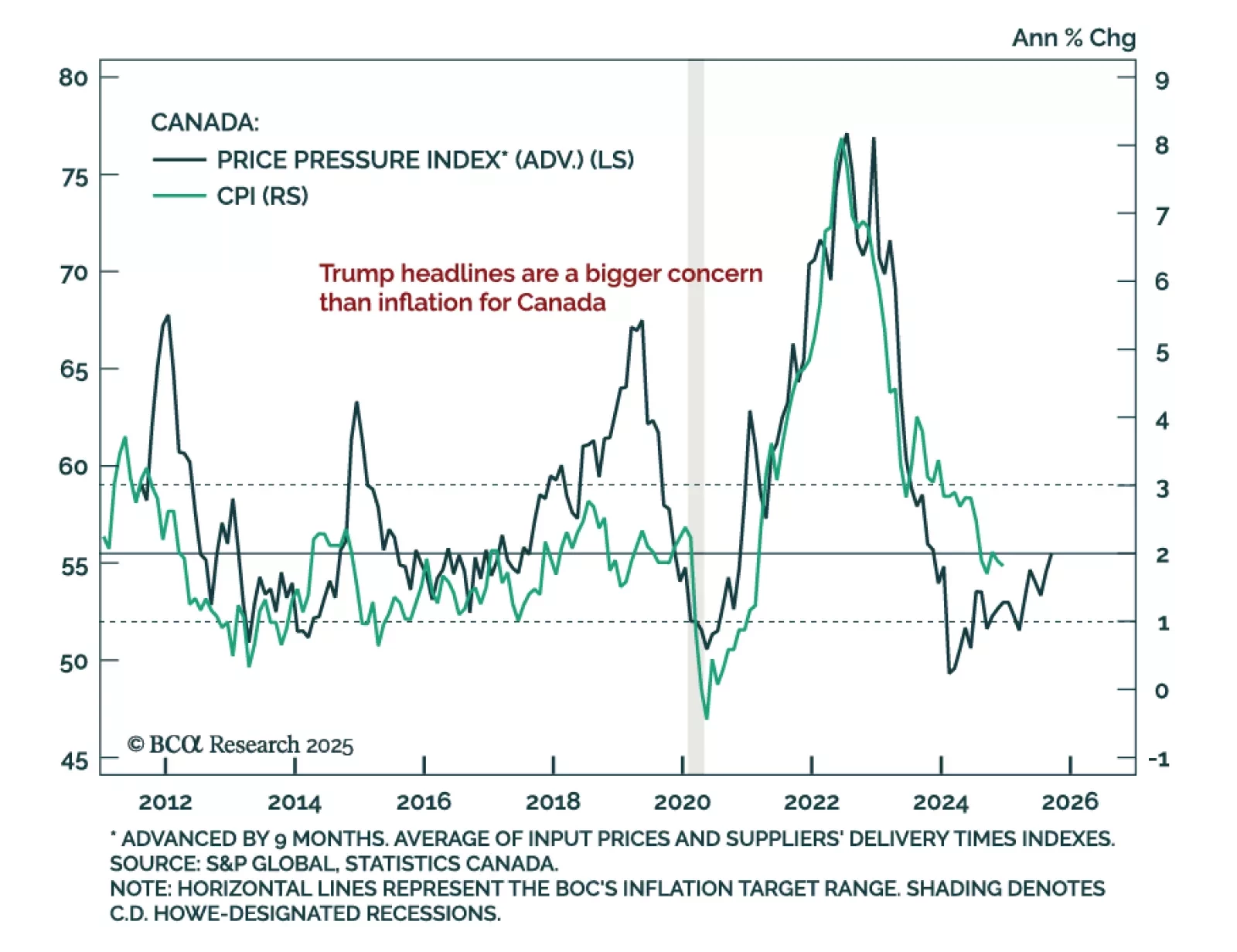

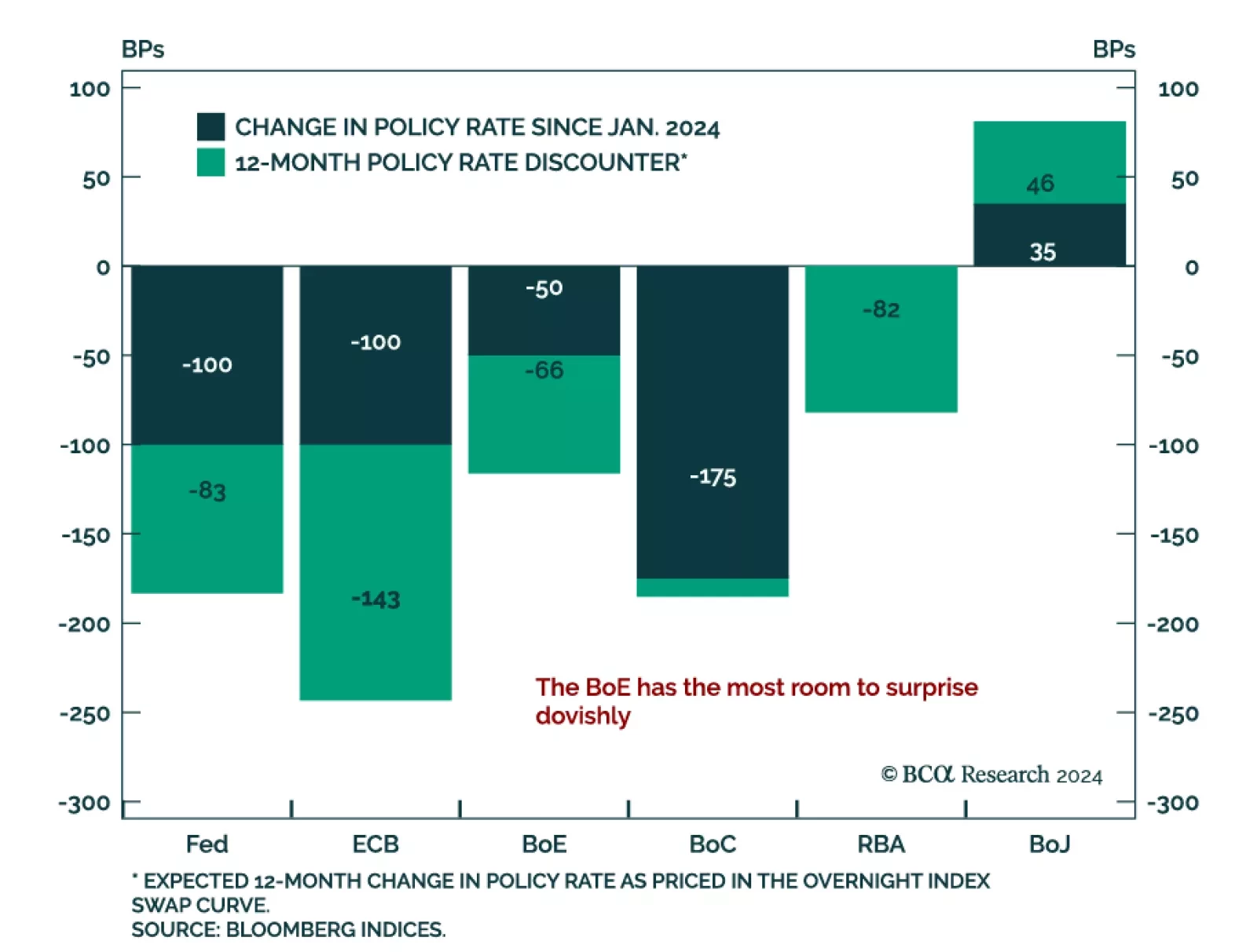

Until recently, Canada had been flying under the radar, yet it presents an interesting macro case. The Bank of Canada hiked rates in lockstep with the Fed, but it began cutting earlier due to a more fragile Canadian economy. Domestic…

The December Canadian CPI was roughly in line with estimates, with headline inflation ticking down to 1.8% y/y from 1.9% in November. The BoC’s core inflation measures, median and trim, also decreased from 2.6% to 2.4% and 2.5%,…

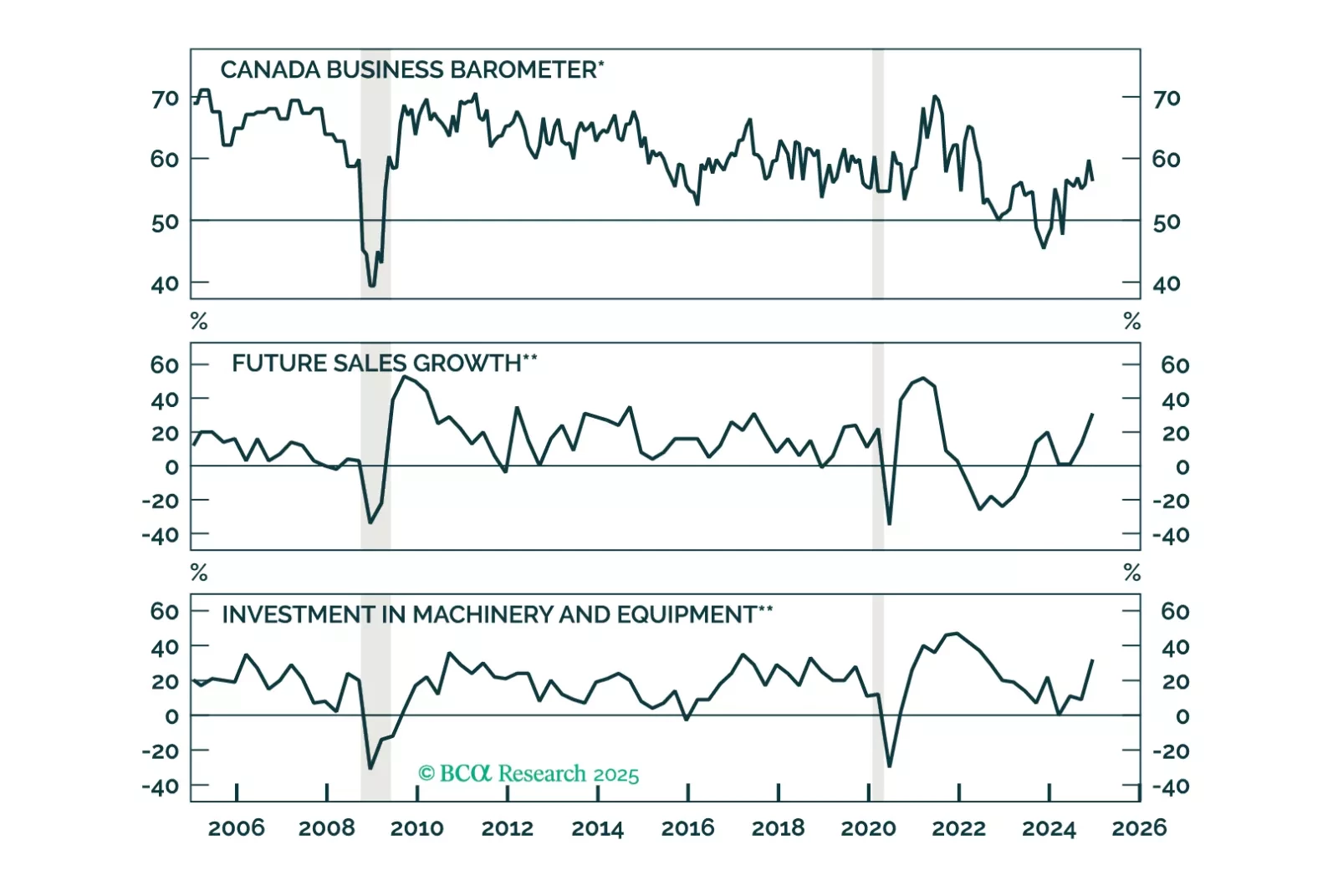

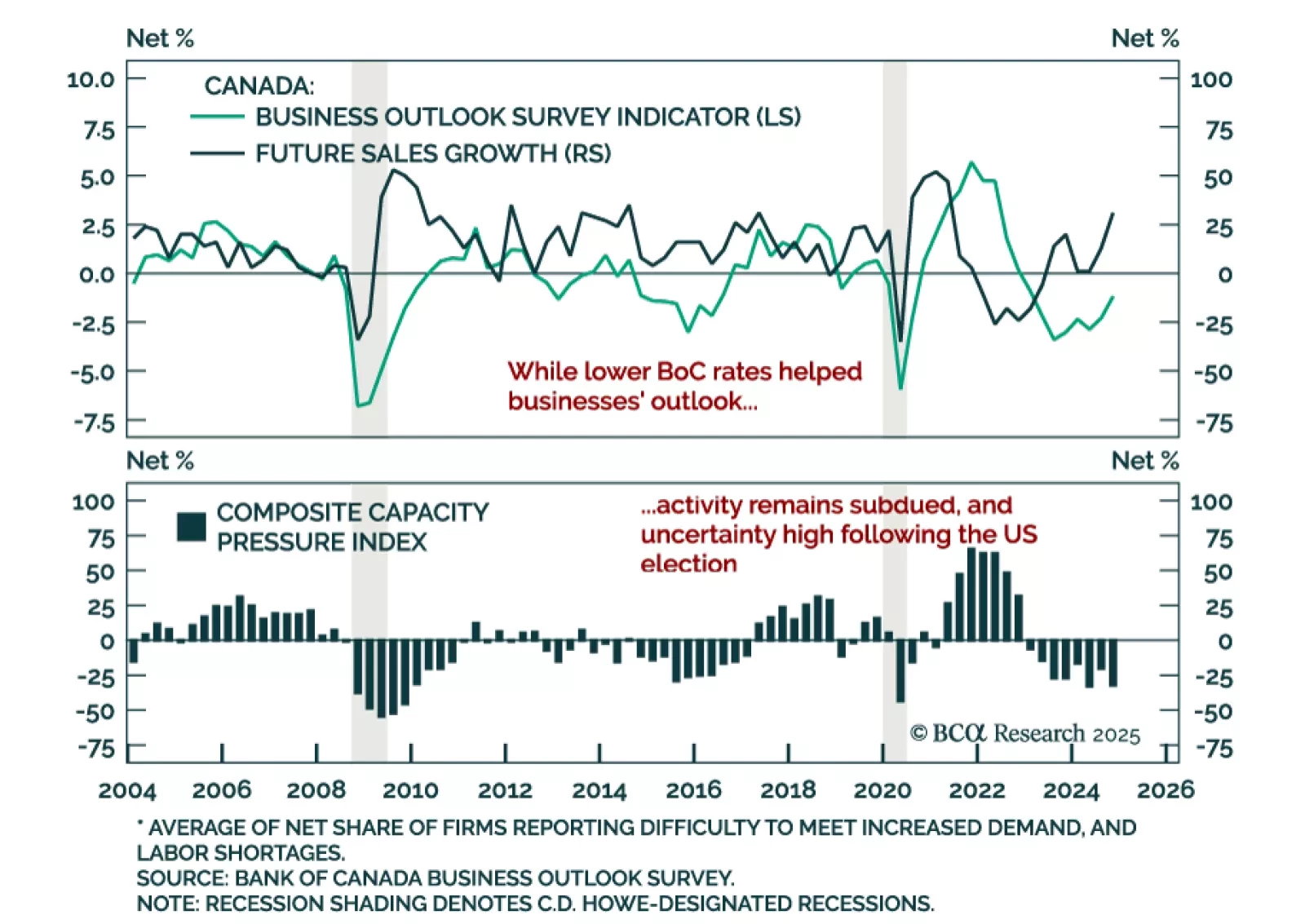

The Q4 2024 Bank of Canada’s Business Outlook Survey showed improving business optimism, with the overall index ticking up to -1.2, and a net 31% of surveyed businesses expecting higher sales, compared to 13% in Q3. Improved…

Our Global Fixed Income and FX strategists published their 2025 outlook, and provide five key views for the year ahead. Duration revival: After three years of underperformance versus cash, government bonds will…