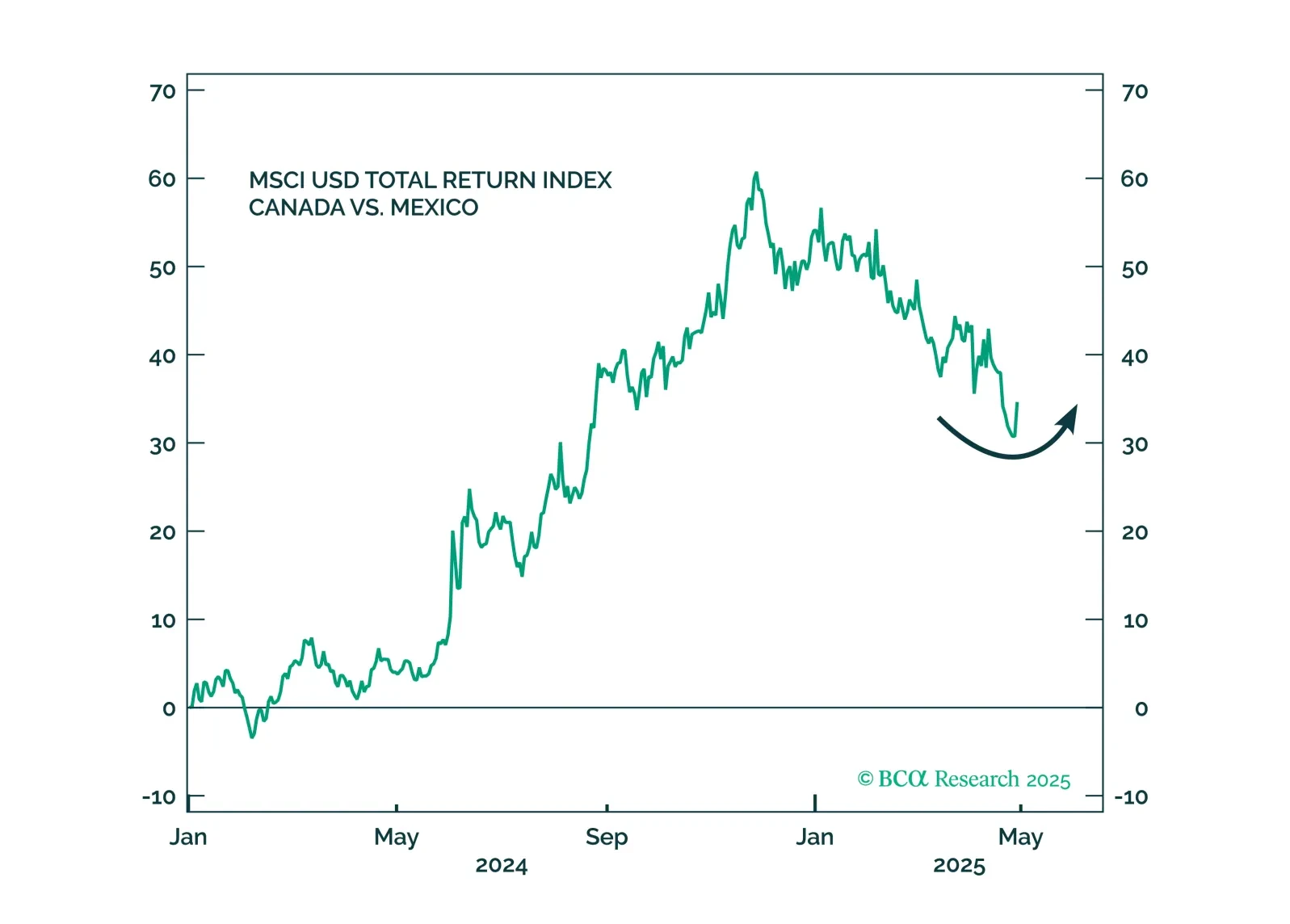

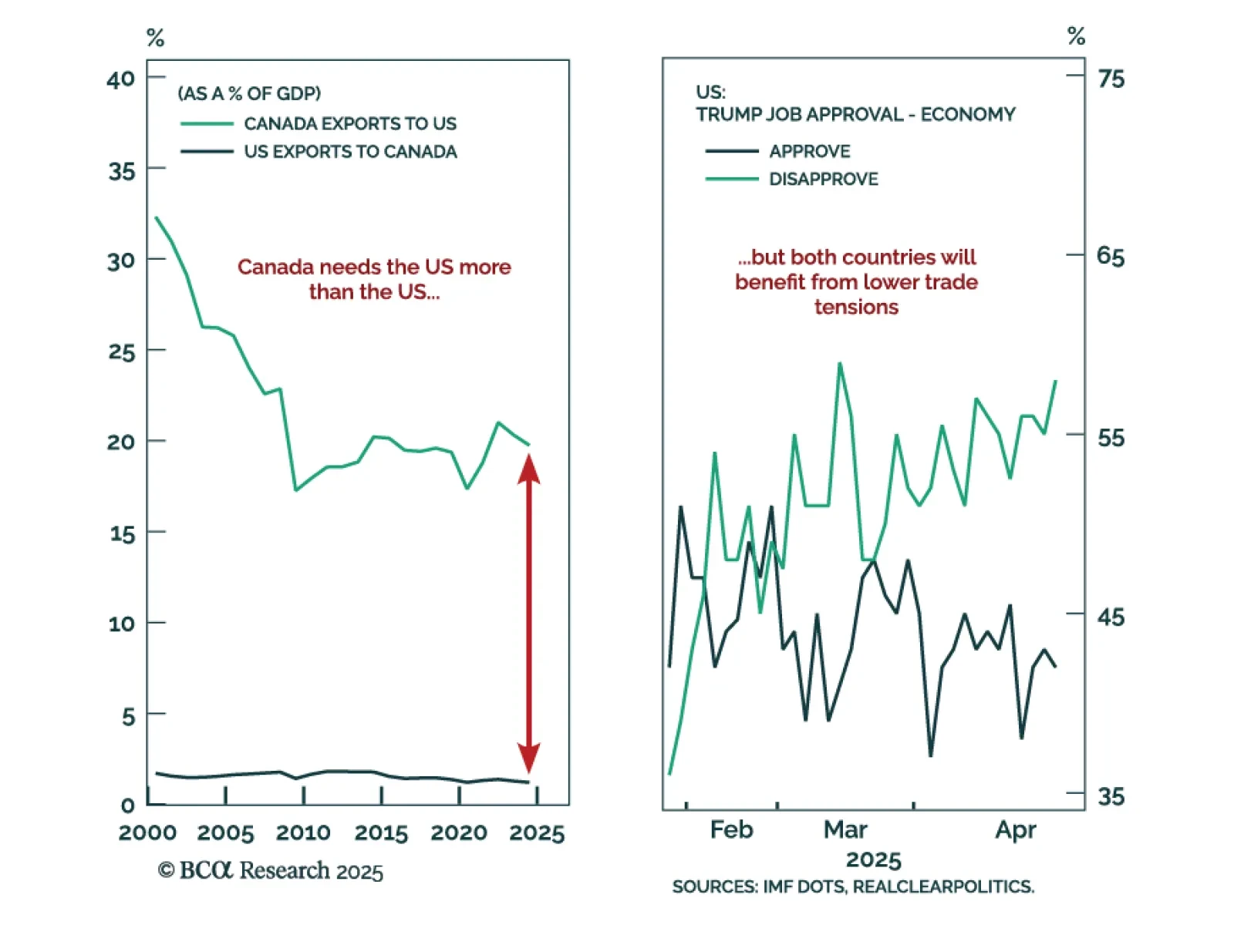

The Carney-Trump summit signals an early shift toward trade de-escalation, creating a tactical tailwind for risk assets. President Trump referred to the Canada-US relationship as a “wonderful marriage.” Moreover, both leaders…

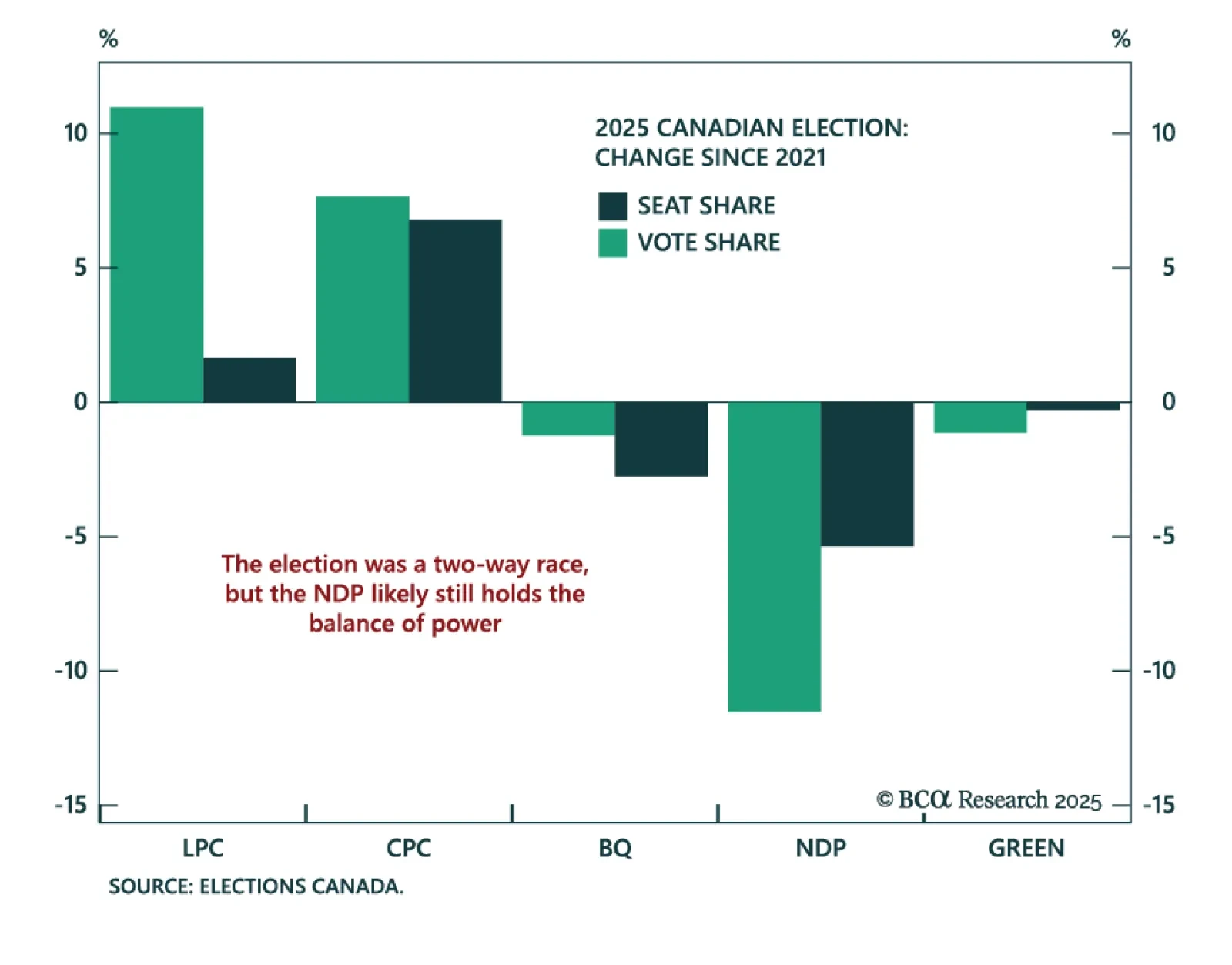

Canada’s election outcome and macro backdrop support our neutral stance on CGBs and long CAD/USD structural positioning. Mark Carney’s Liberals retained power in Monday’s federal election and are likely to form a minority government…

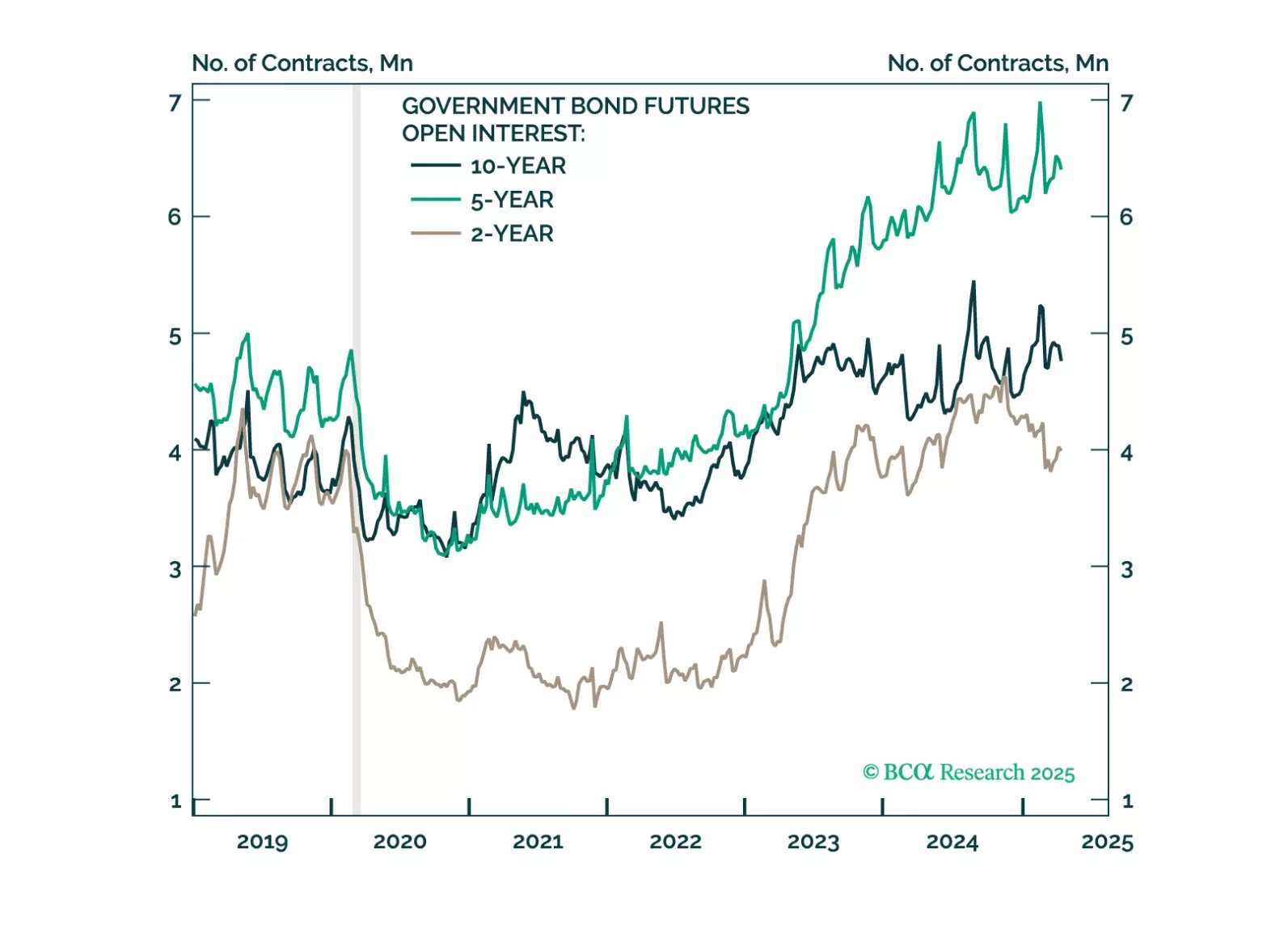

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

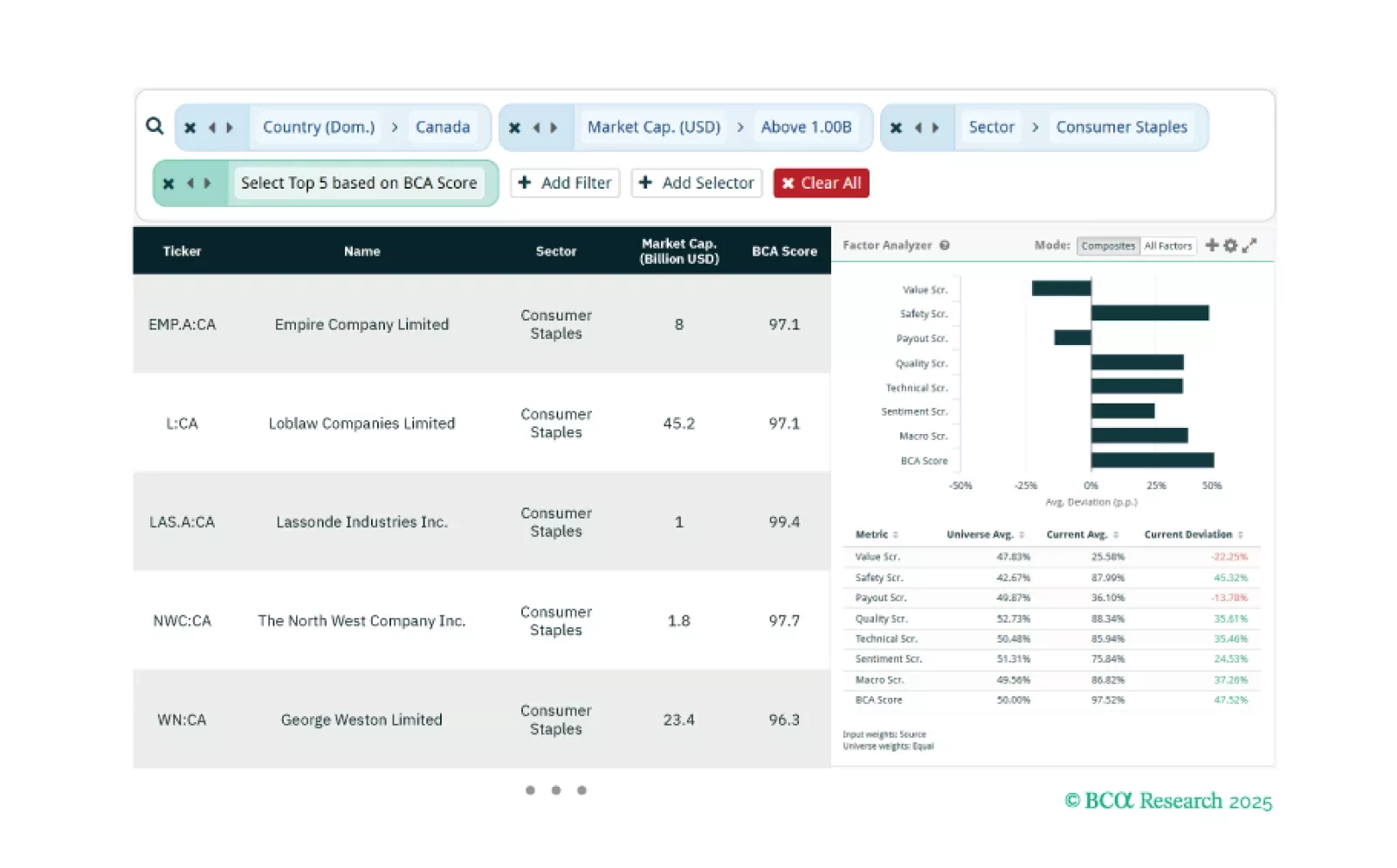

This week, our three screeners cover equity plays in: Canadian Consumer Staples, high-beta Swedish equities, and factor plays across global equities.

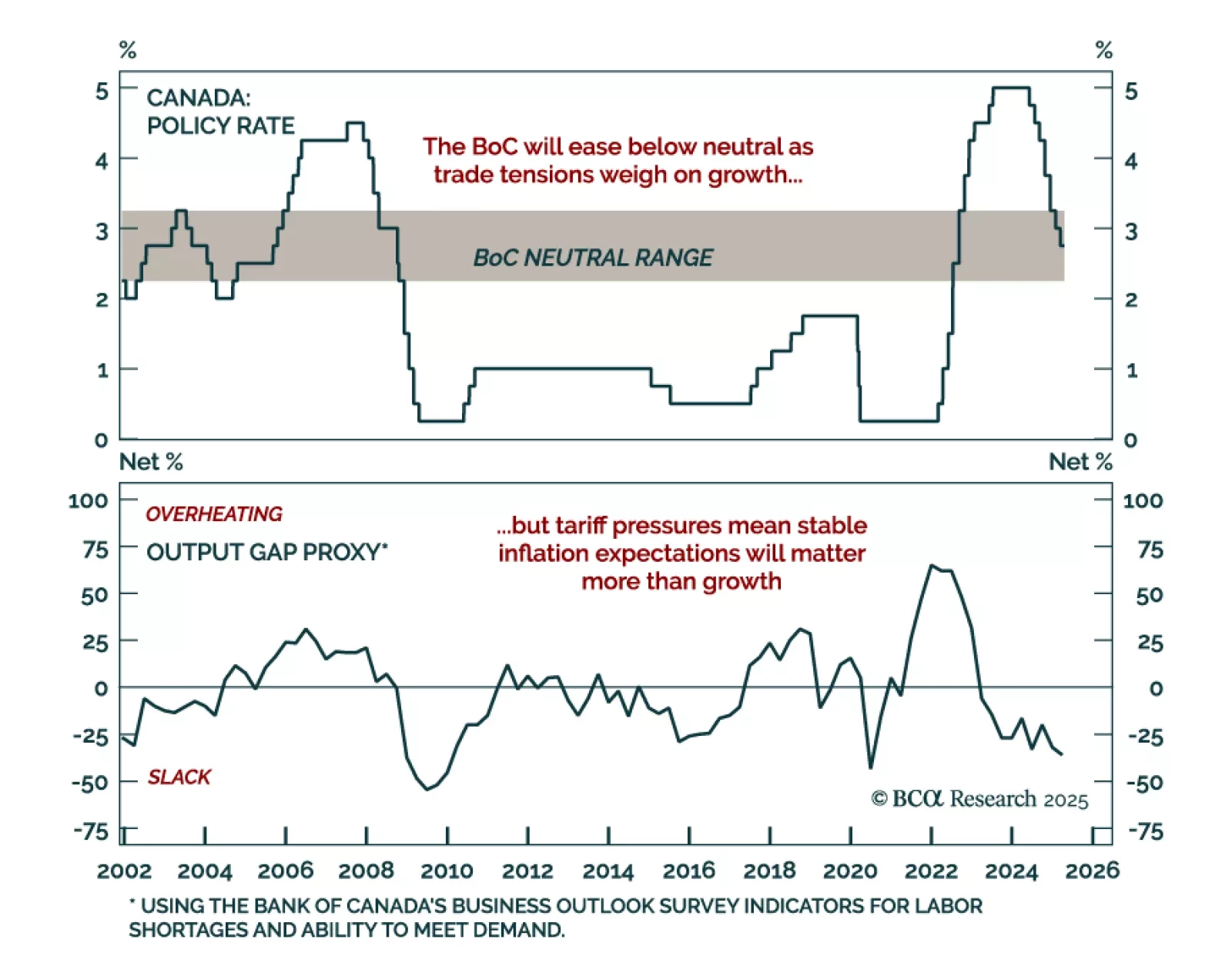

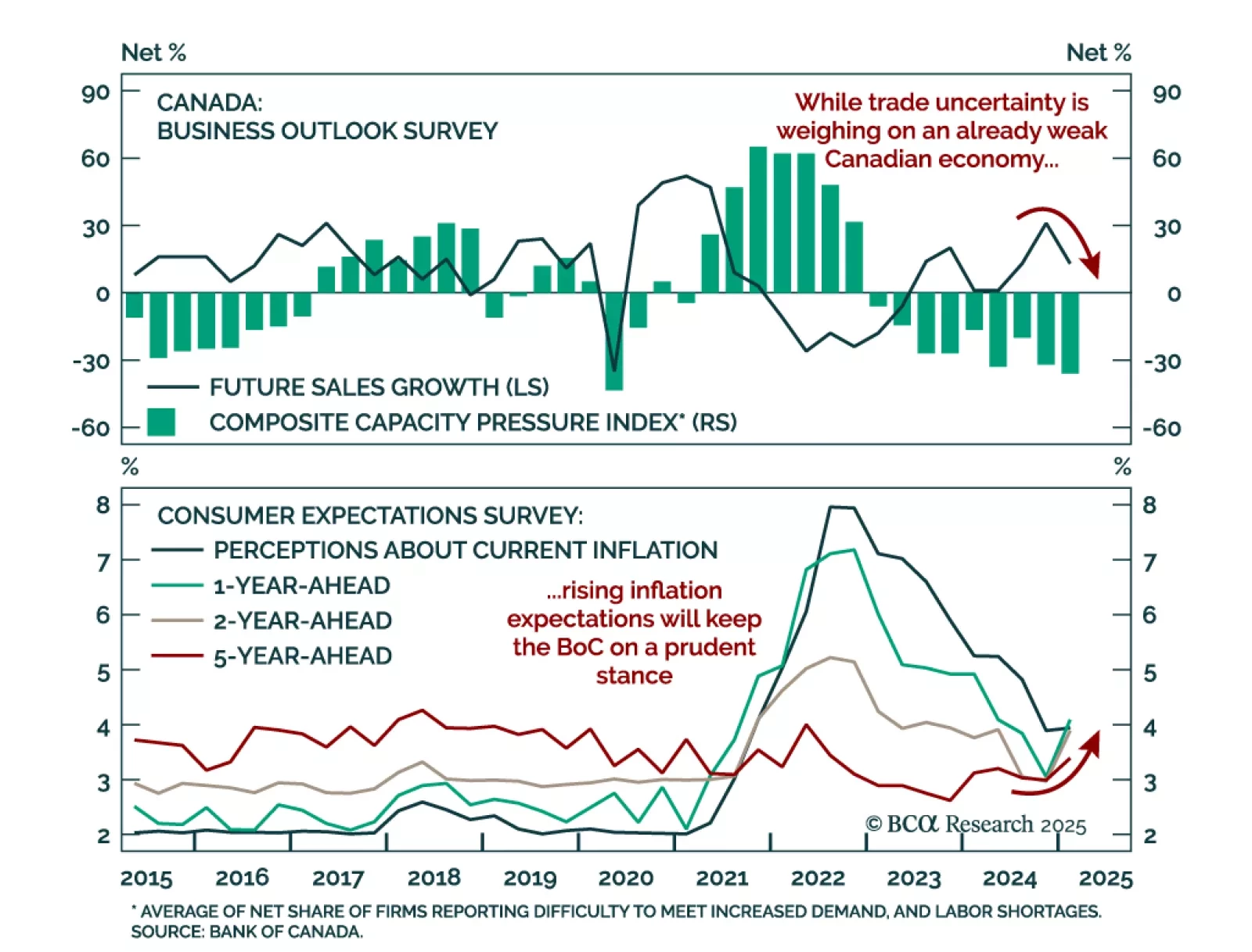

After seven consecutive cuts brought policy into neutral territory, the BoC held its deposit rate at 2.75% reinforcing our neutral-to-negative stance on Canadian government bonds. With policy now within the 2.25%-3.25% neutral range…

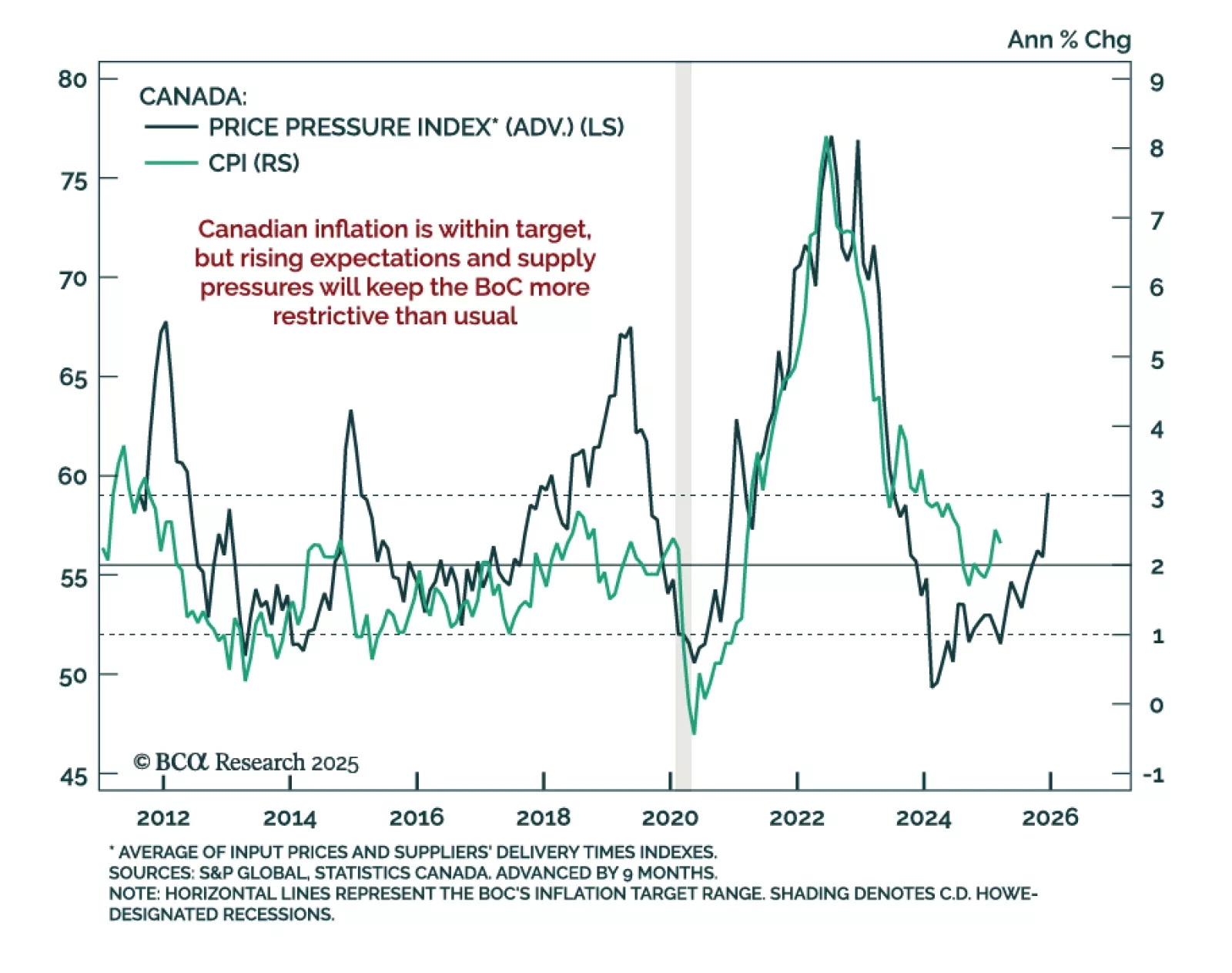

Cooler inflation will not shift the BoC’s stance, as stagflation limits potential easing, keeping us neutral on Canadian bonds. In March, headline CPI slowed more than expected to 2.3% y/y from 2.6%. However, lower energy prices…

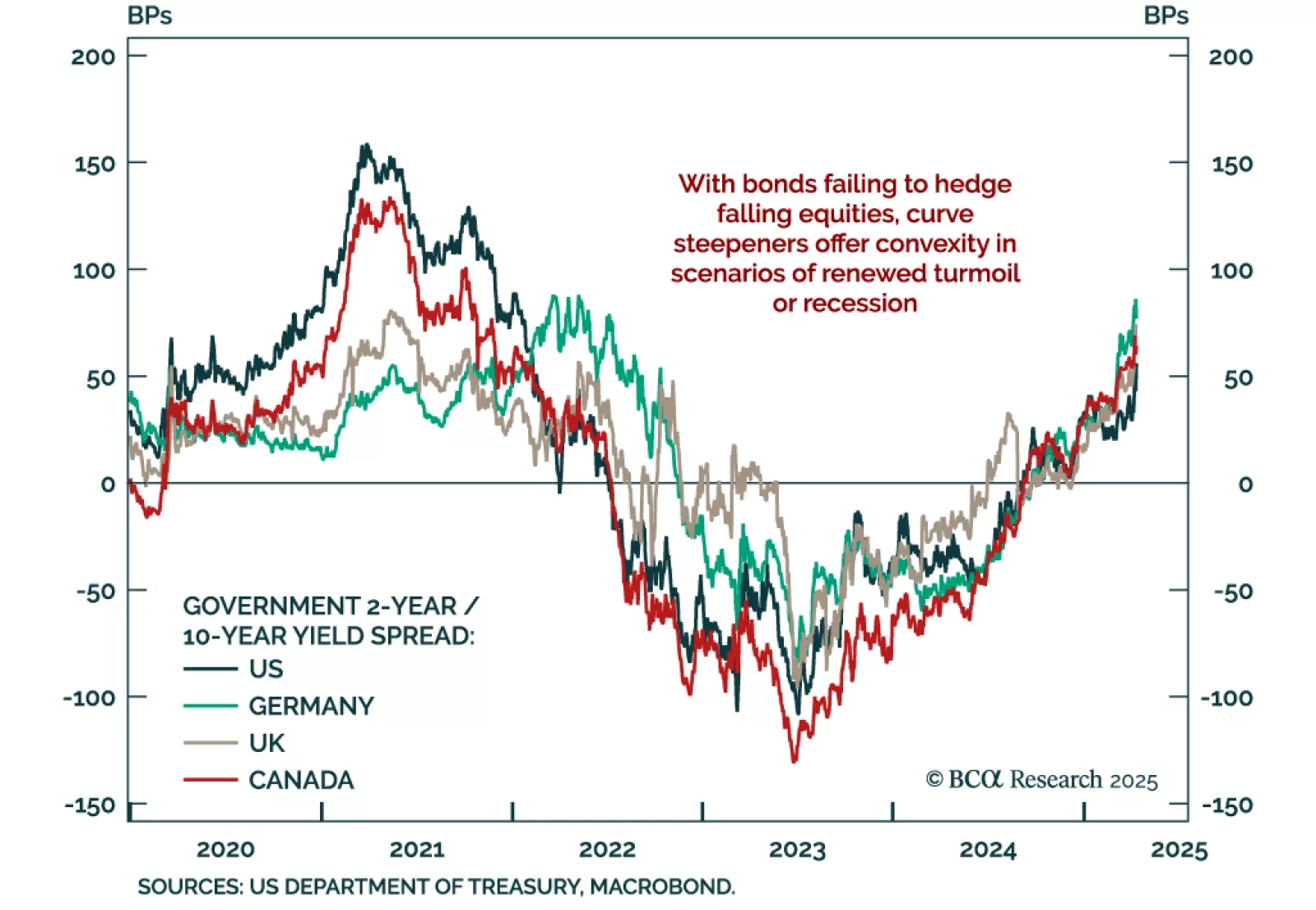

Bonds are failing to deliver defensive convexity; asset allocators should look to tactical curve steepeners for protection. Despite rising growth fears, Treasury yields have risen sharply at the long end. This is a clear break from…

Canada’s difficult macro outlook is already priced, supporting a neutral stance on Canadian government bonds within a global fixed-income portfolio. We continue to recommend a small long CAD/USD position, where bad news is well…

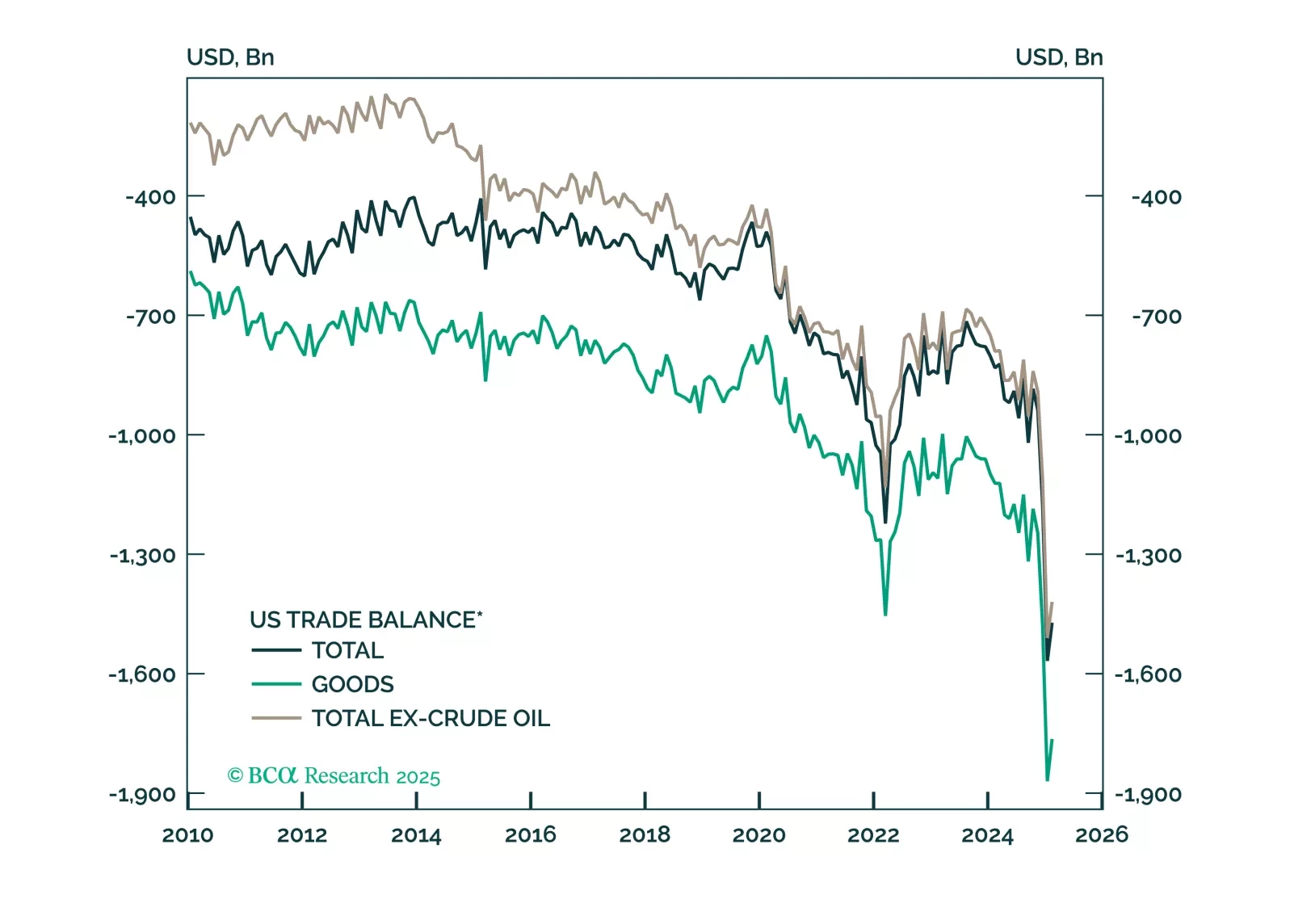

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.