The rout in EM assets, signs of softening global growth, and tough rhetoric from the White House on trade (NAFTA in particular) have conspired to create fertile grounds for downward pressure on the CAD. Much of the bad news…

Our Global Investment Strategy team recommended this position past June as a means to benefit from potential China downside, and U.S. upside. A weaker yuan and Chinese economy will raise raw material costs to Chinese firms.…

Highlights We review last year's "Three Tantalizing Trades" and offer four additional ones: Trade #1: Long June 2019 Fed funds futures contract/short Dec 2020 Fed funds futures contract Trade #2: Long USD/CNY Trade #3…

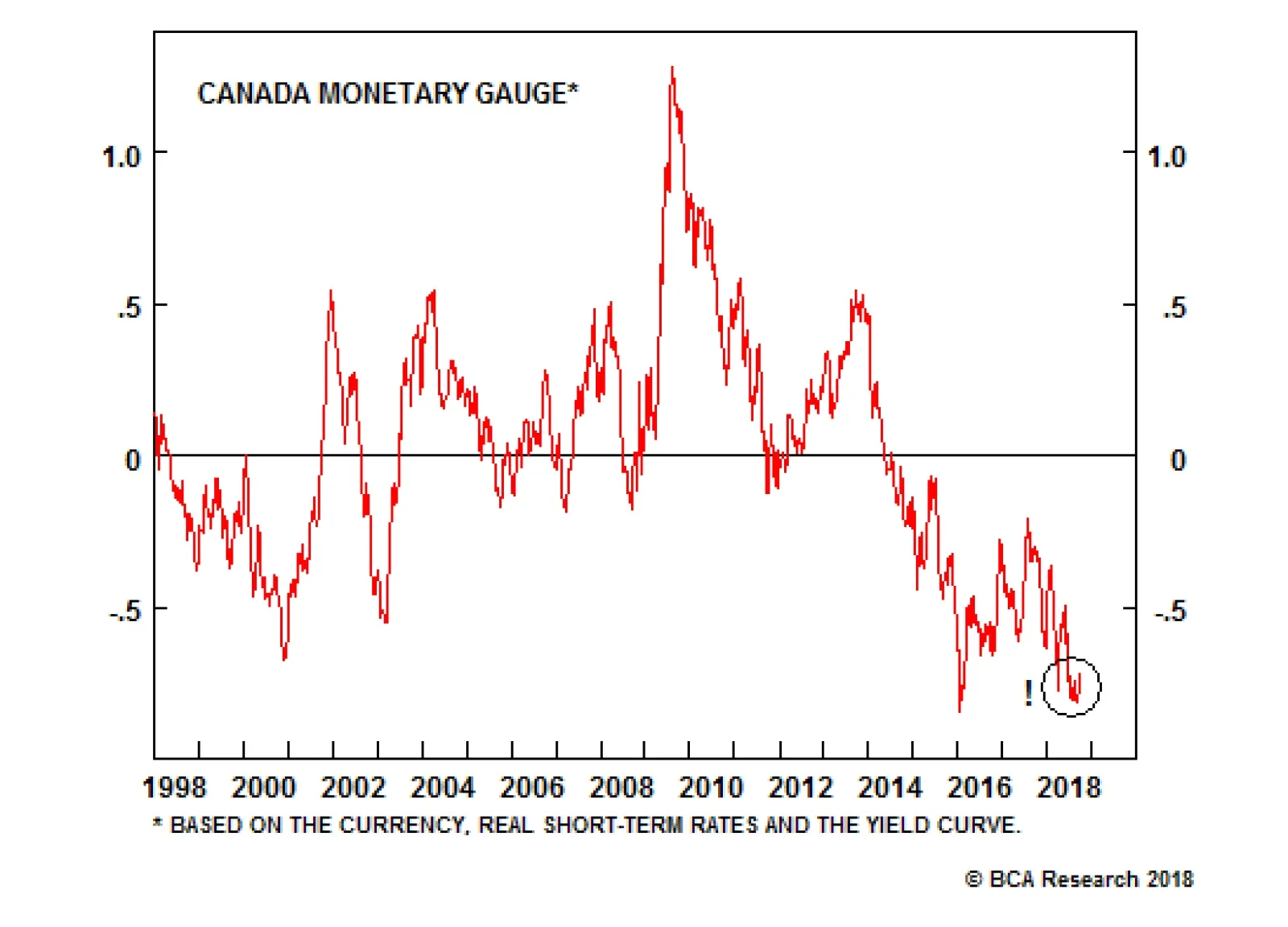

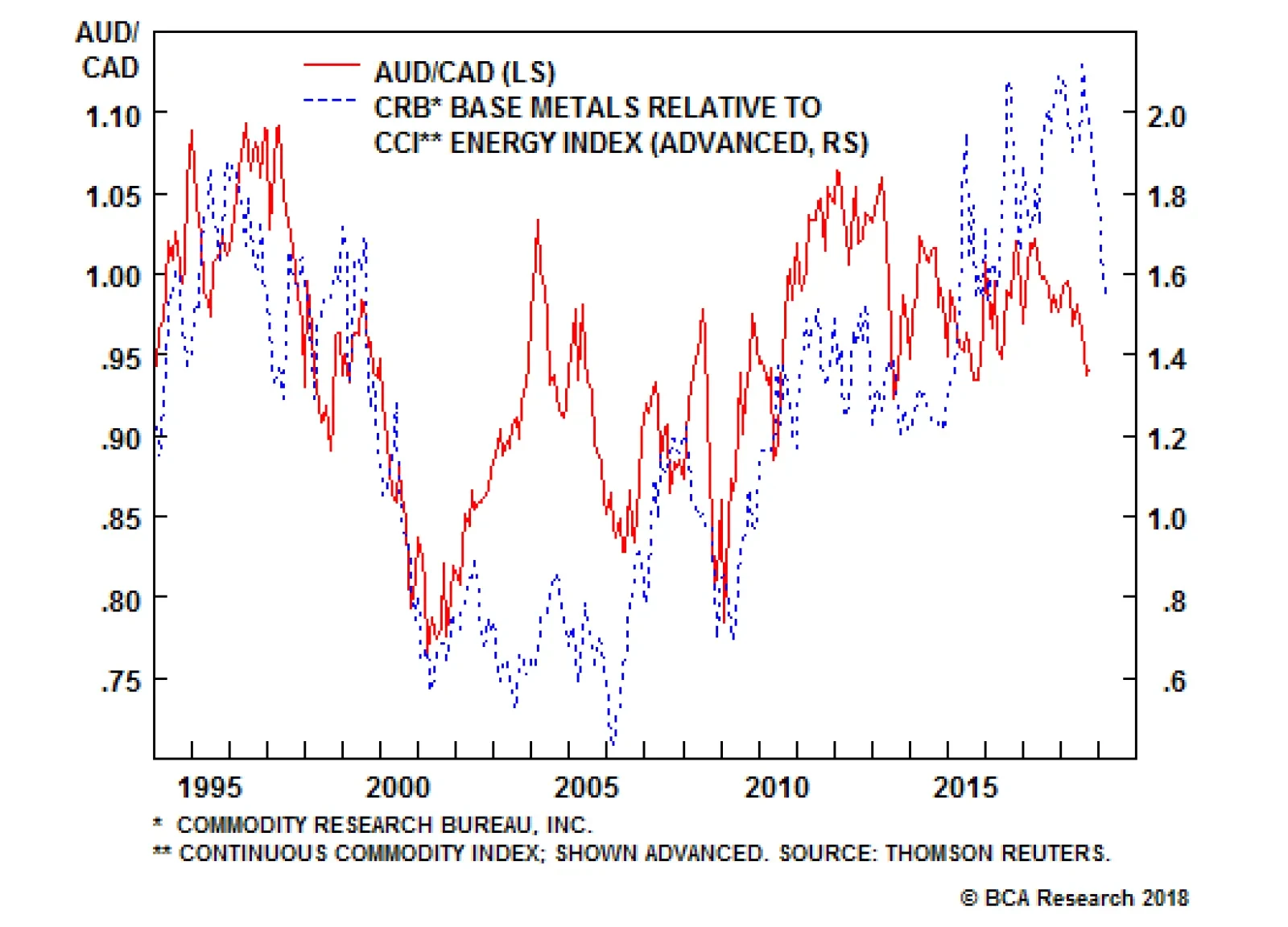

Highlights The U.S. dollar is likely to correct further over the coming weeks. The CAD should benefit as it is cheap and oversold, and the inflationary back-drop warrants tighter monetary conditions. This will be a bear market rally,…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. The message now conveyed by the Monitors is that divergences between the cyclical pressures faced by the individual central banks…

Highlights It has not been a lot of fun being a corporate bond investor in 2018. Global credit markets have struggled to deliver positive returns, amid a news flow that has been overwhelming at times. Geopolitical uncertainty, shifting…

Highlights Duration Checklist: An update of our medium-term Duration Checklist highlights that the strategic backdrop for global government bonds remains bearish. A below-benchmark overall portfolio duration stance is still warranted…

Highlights The fundamental case to buy the dollar and sell non-U.S. risk assets is currently extremely obvious. This suggests that investors likely have already placed their bets. As such, the case for a counter-trend correction…