Last week the BoC telegraphed a pause in its hiking campaign in response to weaker-than-expected economic data and growing questions on whether the Fed will keep raising rates. We do not interpret this recent dovish tilt in their…

The health of a country’s financial sector is a critical part of its ability to grow. The clear differences between the Spanish and Italian economy since the euro area crisis illustrates that point. Spain handled its…

OPEC 2.0’s meeting next week in Vienna once again will feature a full cast of dignitaries representing member states, including the energy ministers from the Kingdom of Saudi Arabia (KSA) and Russia, Khalid al-Falih and Alexander…

Dear Client, Early next week, we will be sending you our BCA Outlook 2019 - our annual dialogue with the bearishly inclined Mr. X and his family. In this report, BCA editors will highlight the most impactful themes for the global…

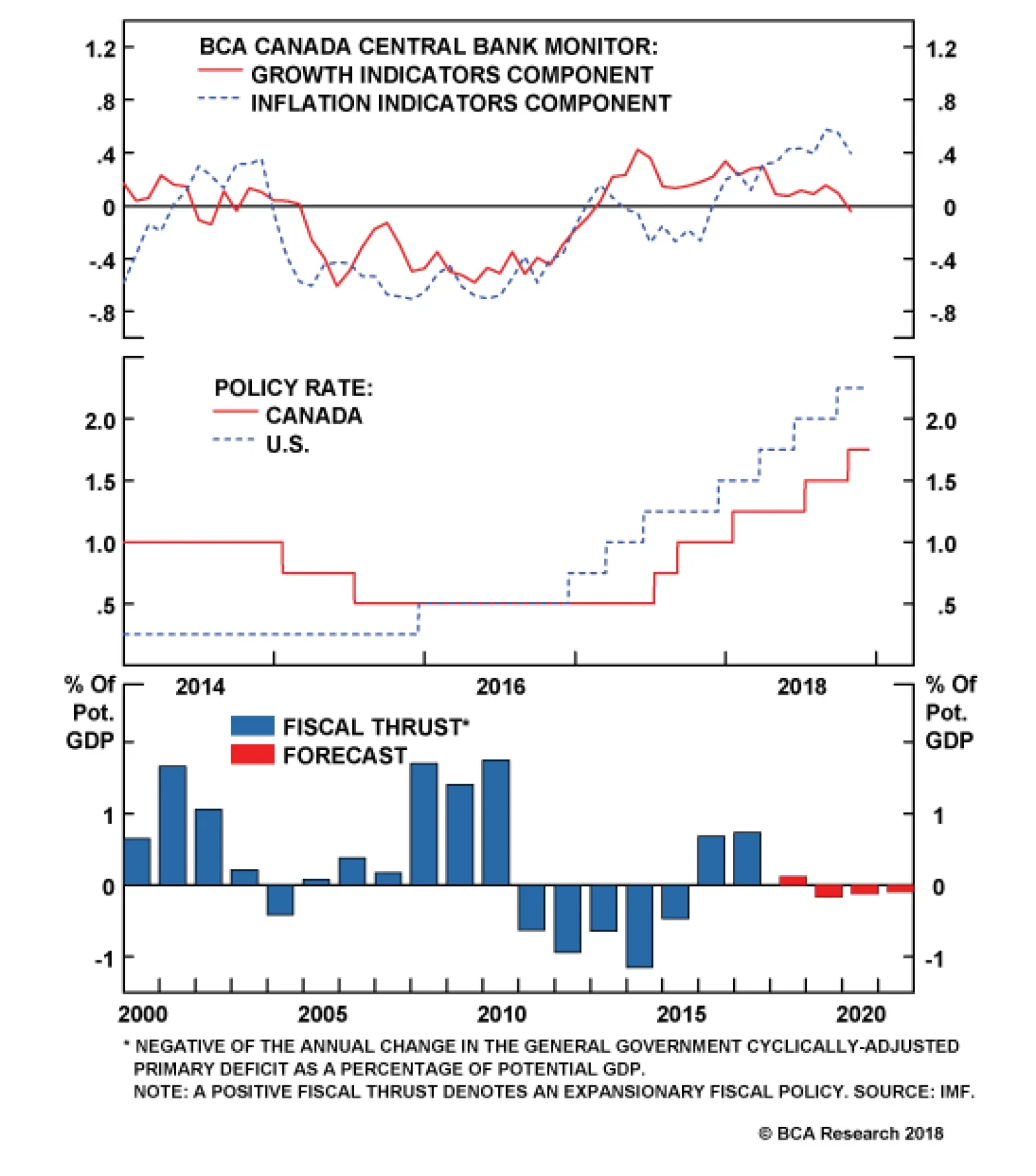

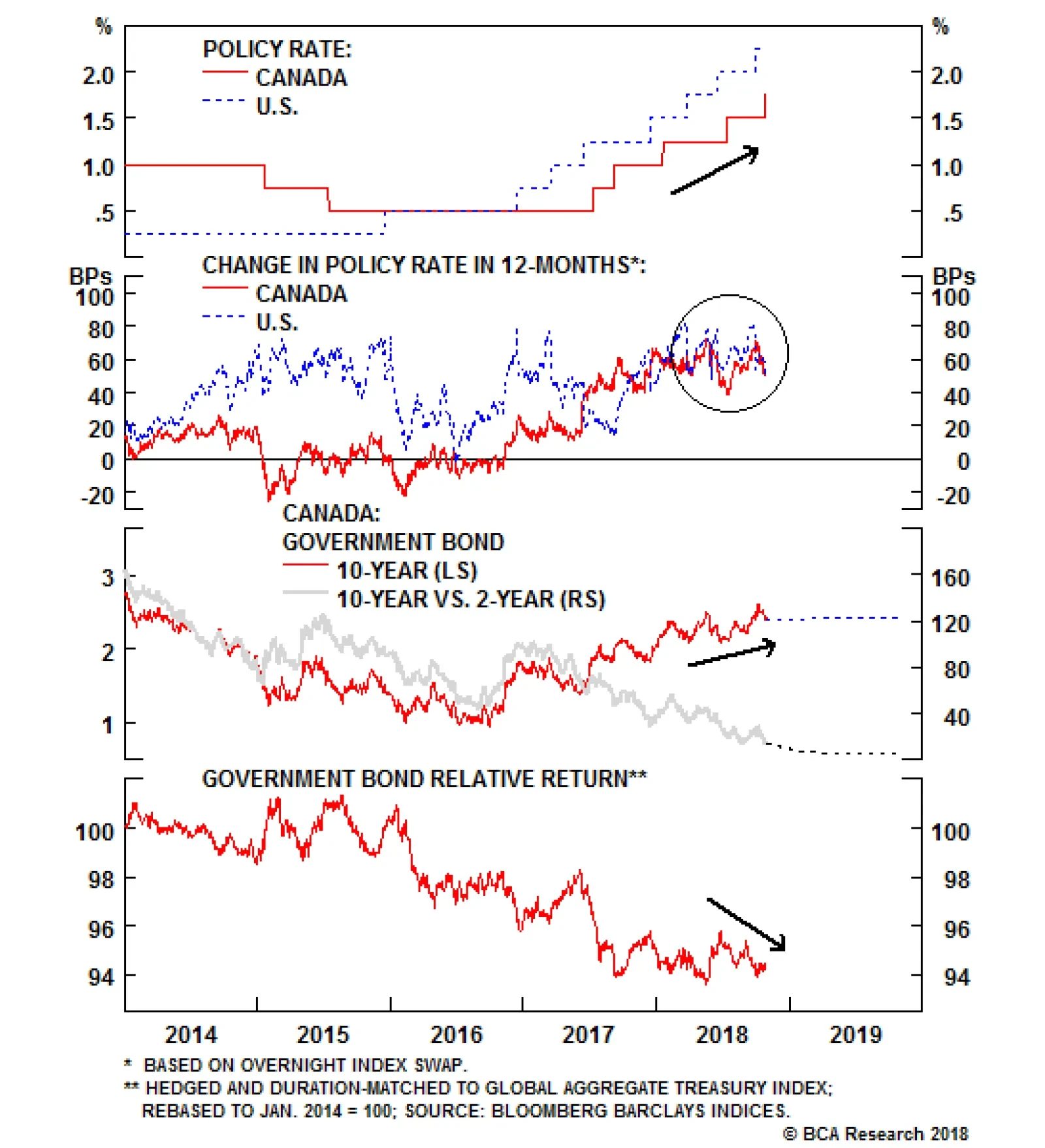

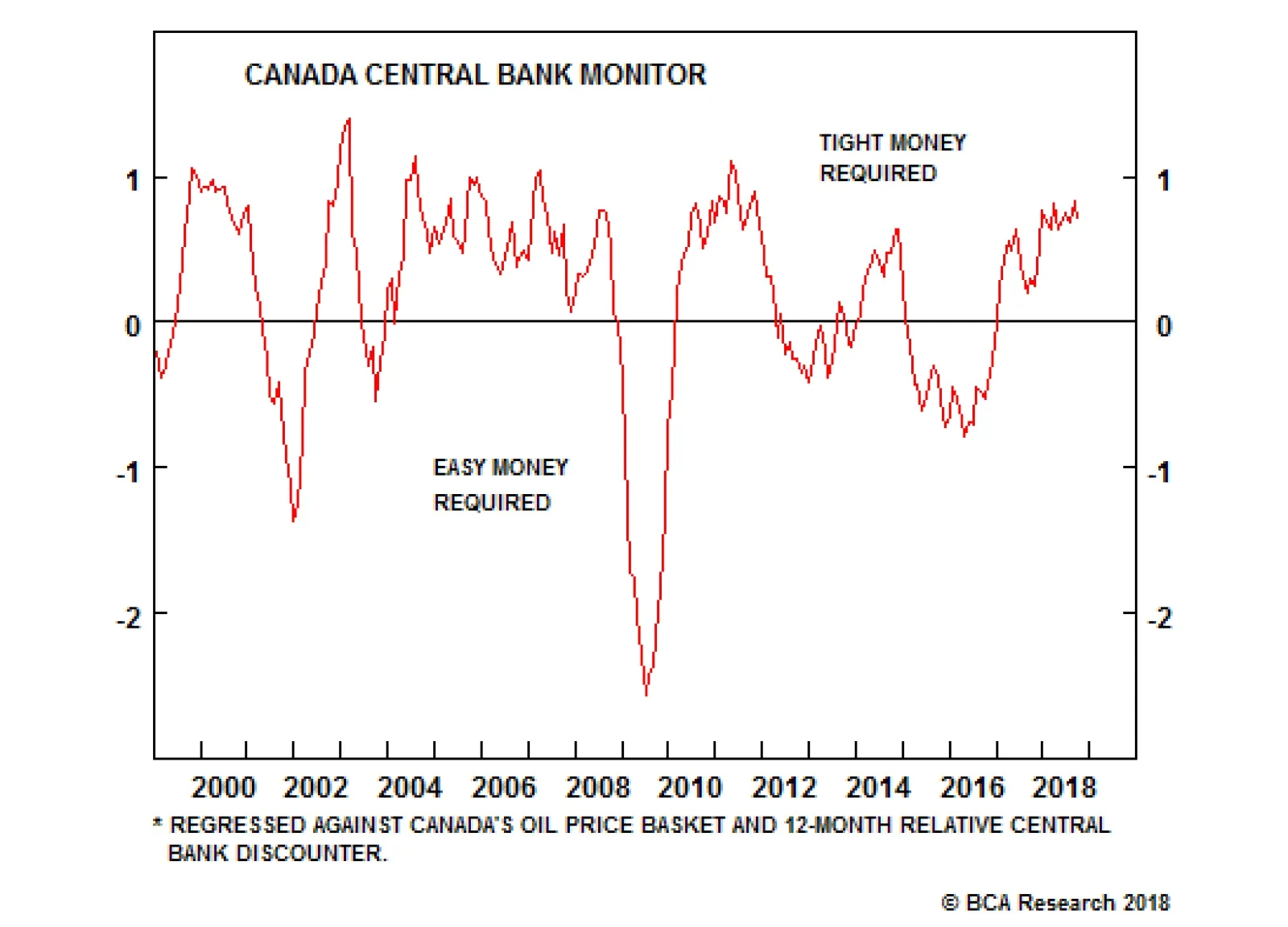

With the Canadian economy operating at full employment and with inflation at target, the BoC seems determined to push the policy rate back up towards their estimated 2.5%-3.5% range for the neutral rate. This means another 75-…

Highlights Growth Scare: Despite the recent pickup in global equity market volatility, bond volatility remains subdued. Until there is more decisive evidence of a deeper pullback in global growth that is impacting the mighty U.S.…

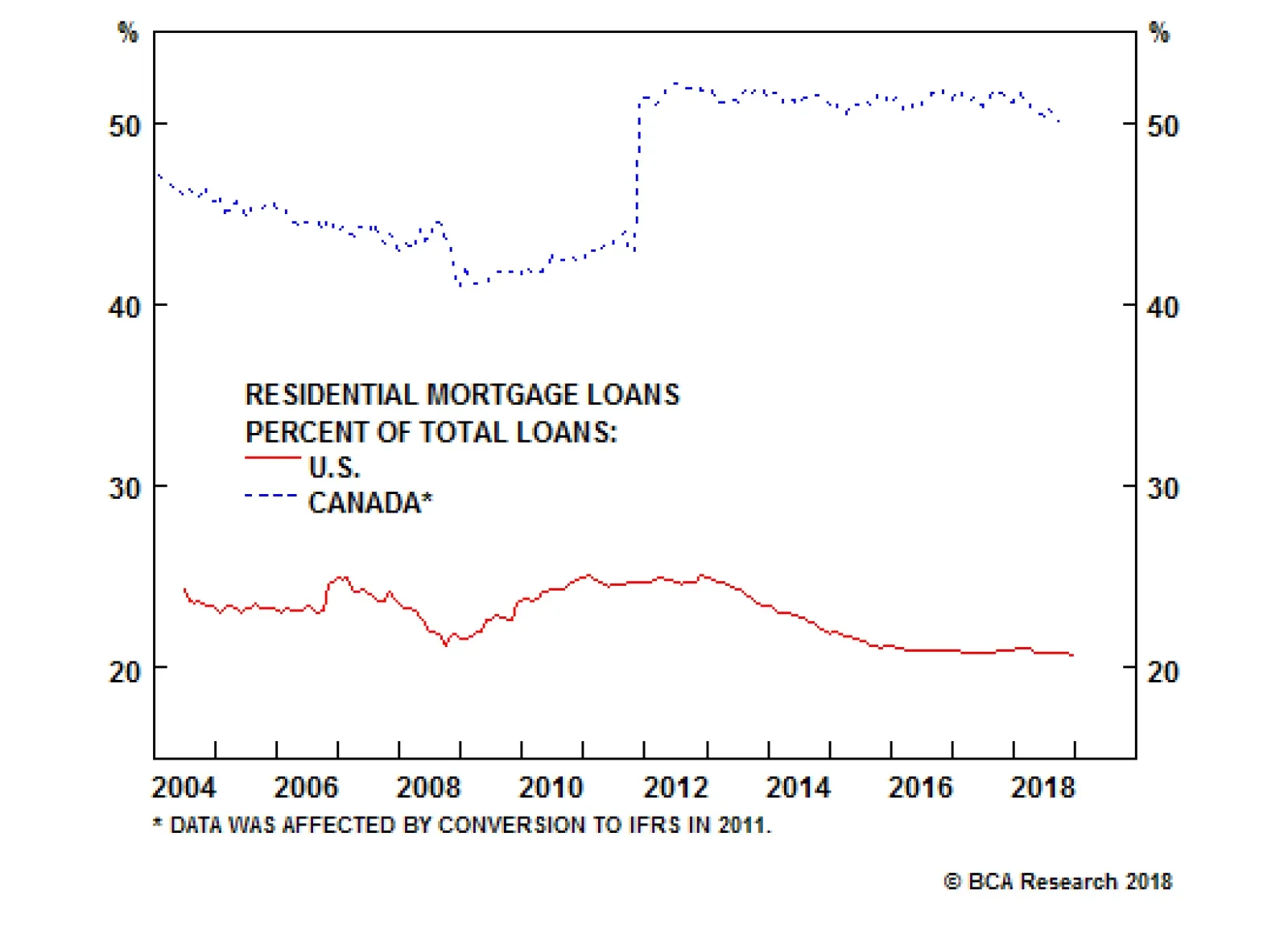

The removal of uncertainty related to the U.S.-Canada trade negotiations gave the Bank of Canada (BoC) plenty of room to move toward a tighter monetary policy stance. Our Global Fixed Income Strategy team think this is…

Highlights The Fed remains on a tightening course as the U.S. economy has no spare capacity, yet growth in the rest of the world is suffering as EM financial conditions are tightening. It will take more pain for the Fed to capitulate…