Highlights We recently upgraded our recommended investment stance on global corporate bonds to overweight on a tactical (3 to 6 months) basis.1 Feature That change was mostly based on our view that global financial conditions had…

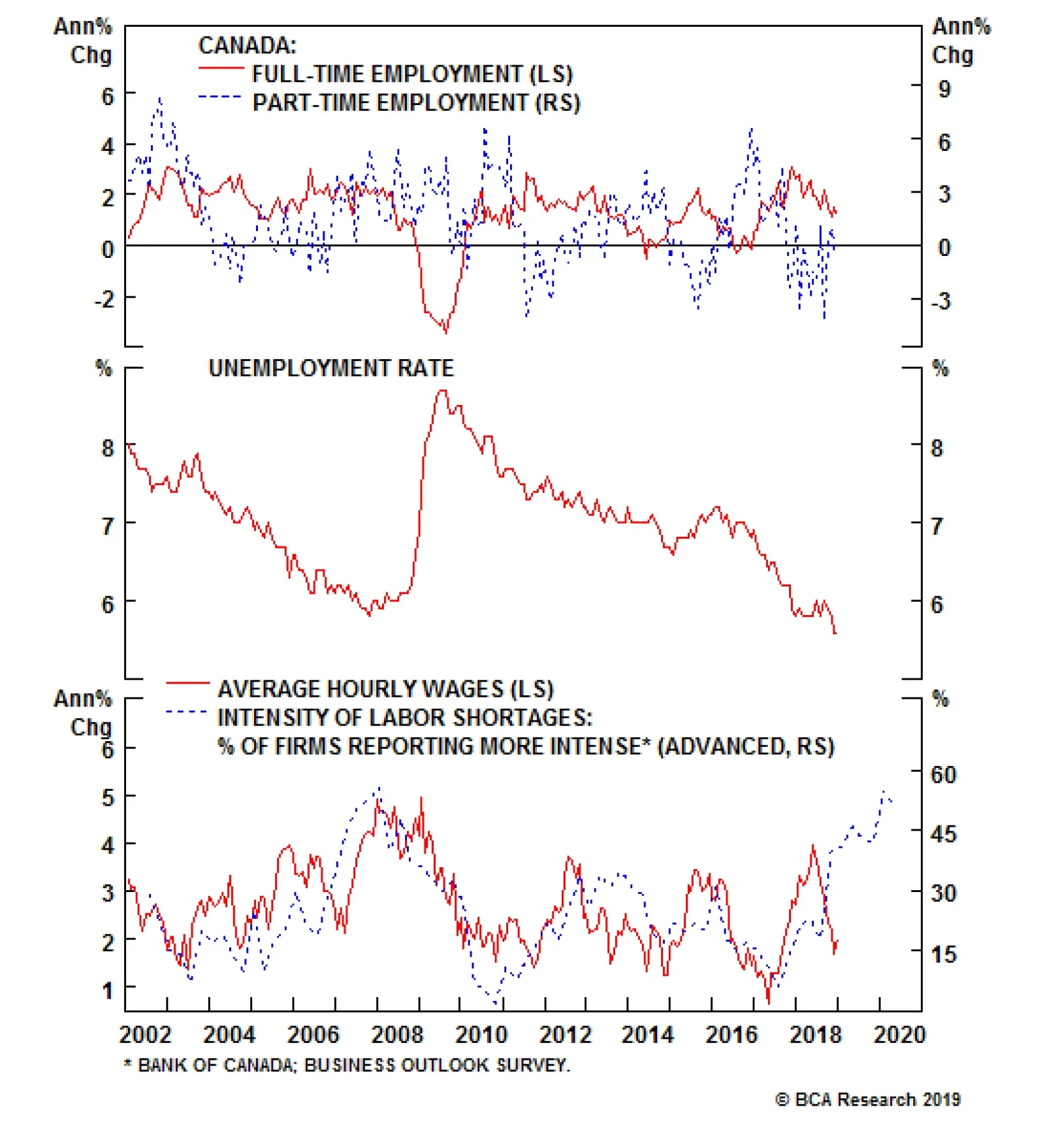

Unlike the very strong labor market conditions seen in the U.S. last December, the Canadian data came in slightly below expectations. Investors anticipated 10,000 Canadian jobs to be created in December against actual data of…

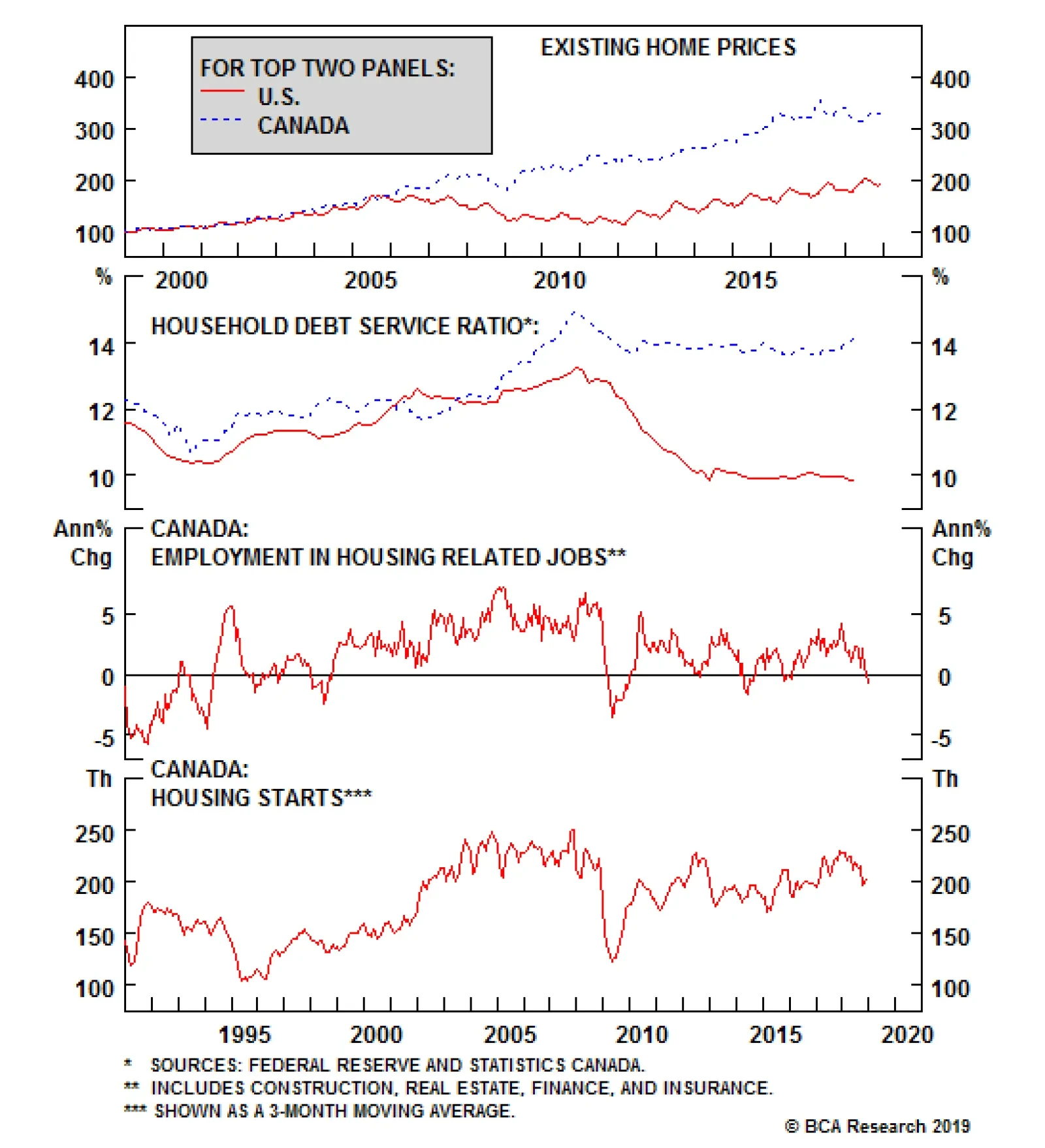

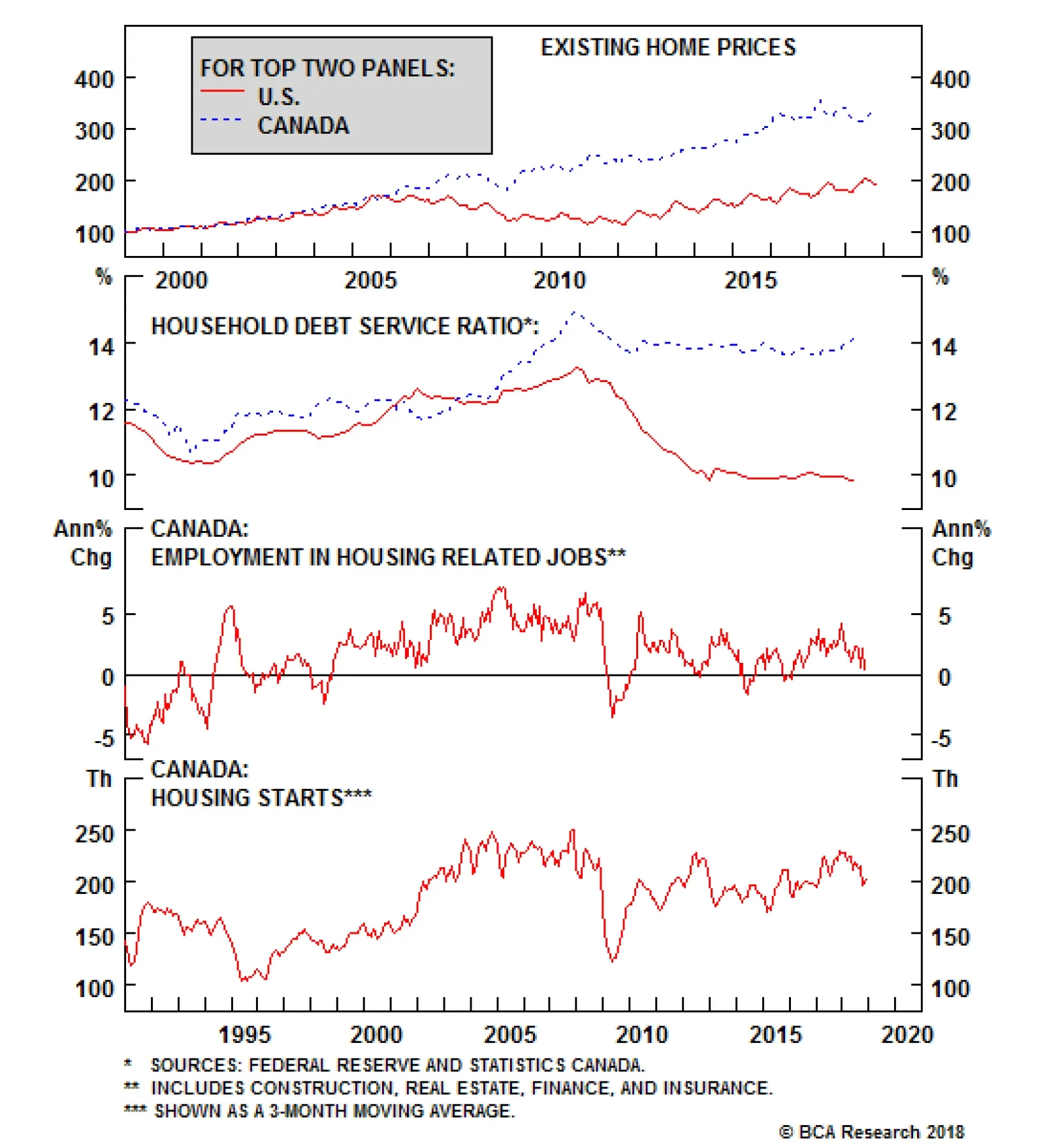

Two of the Canadian industries that witnessed contracting jobs in December were construction and finance. This is important because employment trends in construction, finance, and real estate tend to provide good signals for…

Dear Client, This is our last publication of 2018. We wish all our clients a Merry Christmas and a Happy New year! We will be back on January 3, 2019. Thank you, The Commodity & Energy Strategy Team! Because they missed…

Highlights Dear Client, This is the final Global Fixed Income Strategy report for 2018. We will return with our first report of the new year on January 8th, 2019. Our entire team wishes you a very happy holiday season and a prosperous…

Rudi Dornbusch, a preeminent academic on international economics in the post-war period, once said that: “None of the post-war expansions died of old age. They were all murdered by the Fed.” Beyond noticing from…

According to excellent research from Ed Leamer on the role of housing in post-war U.S. business cycles, nine of 11 recessions were preceded by substantial problems in housing, and in seven of 11 recessions residential investment…

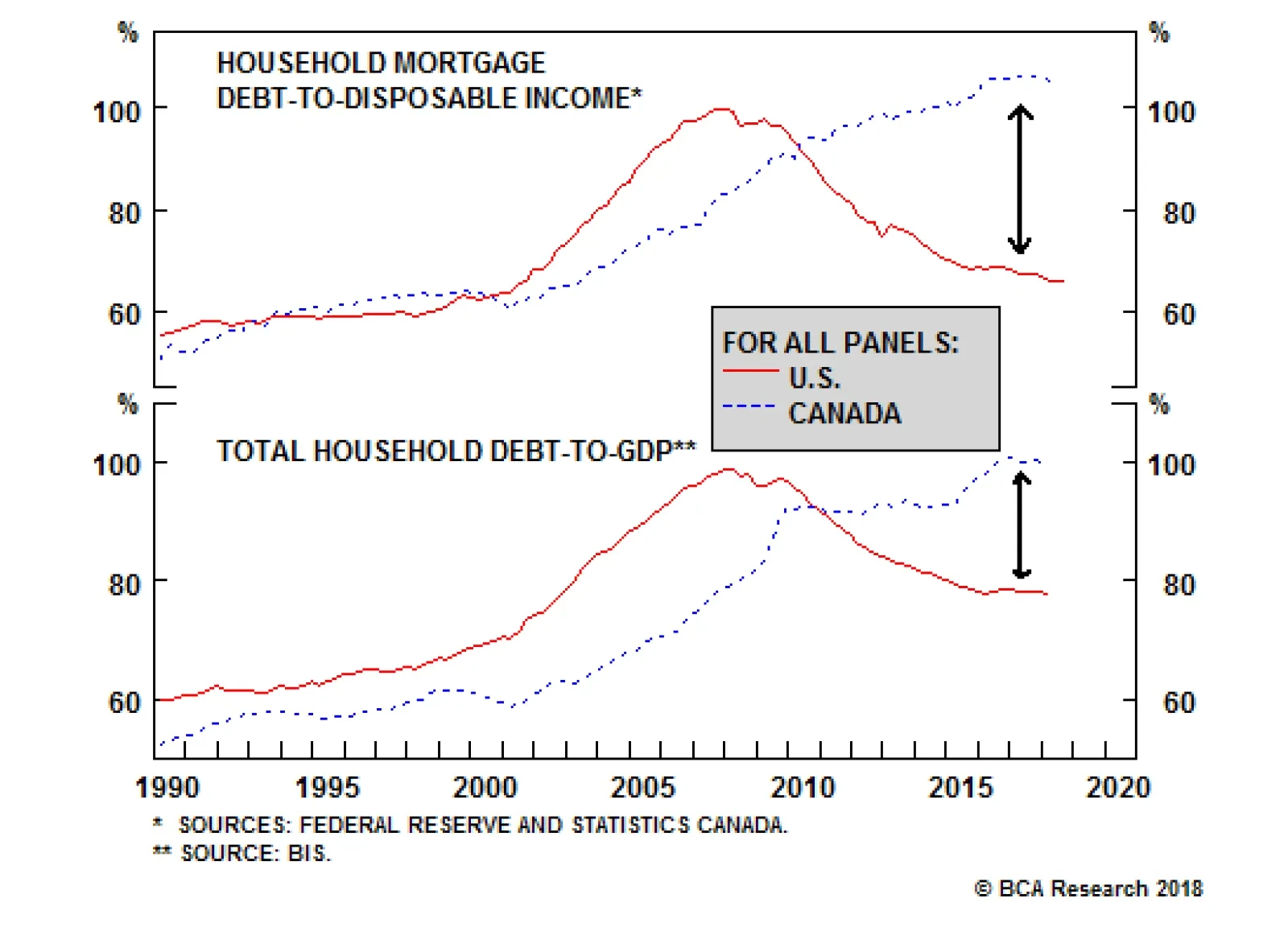

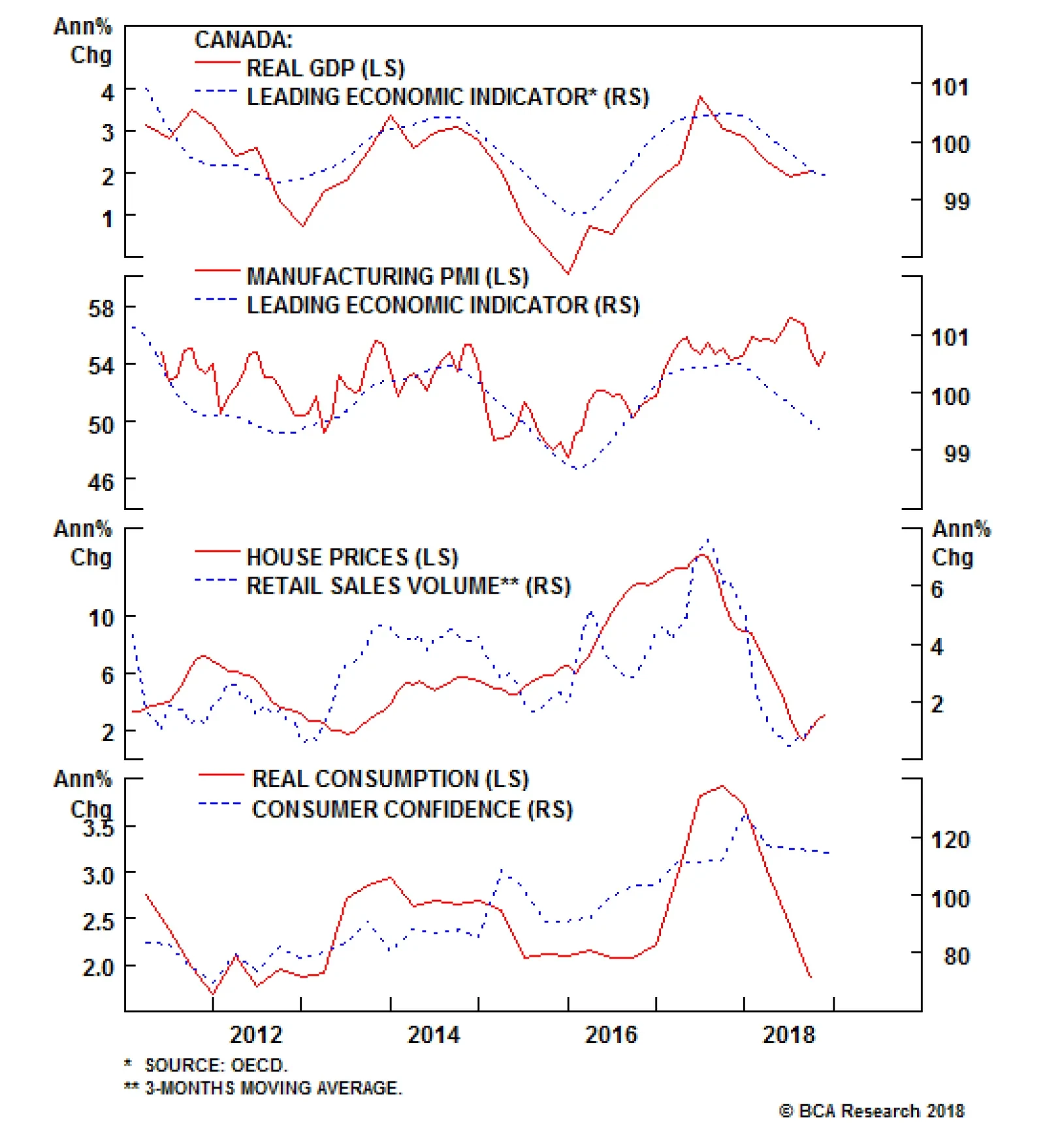

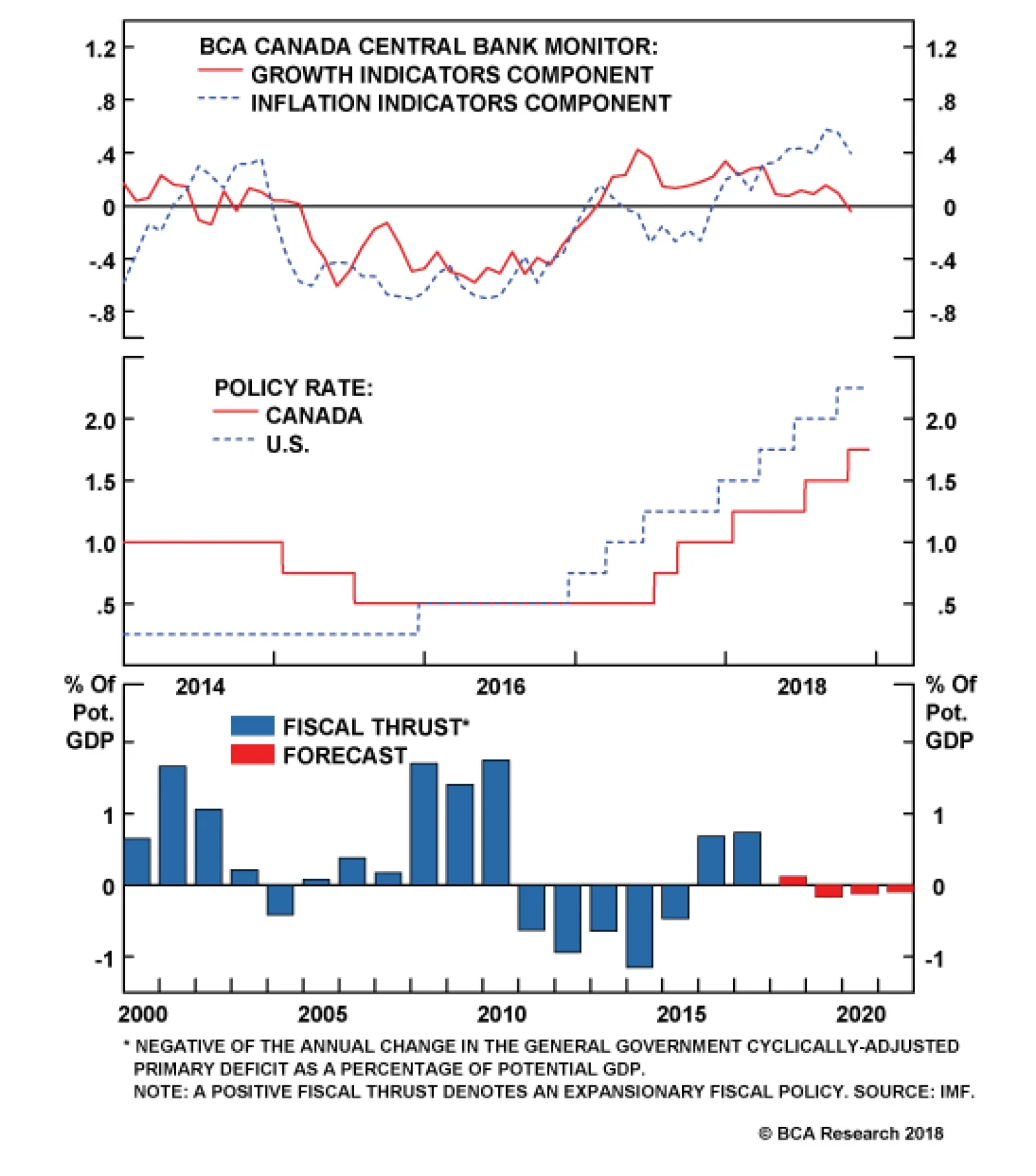

Beyond the numerous headwinds that will be created for the Canadian economy once the housing market begins to buckle, there are already signs of stress. Canada’s Leading Economic Indicator (LEI) is currently heralding a…

Last week the BoC telegraphed a pause in its hiking campaign in response to weaker-than-expected economic data and growing questions on whether the Fed will keep raising rates. We do not interpret this recent dovish tilt in their…