Highlights Global financial markets are currently dealing with a fresh round of uncertainty related to U.S.-China trade tensions. Yet while equities and government bond yields have fallen in response to the U.S. imposition of tariffs and…

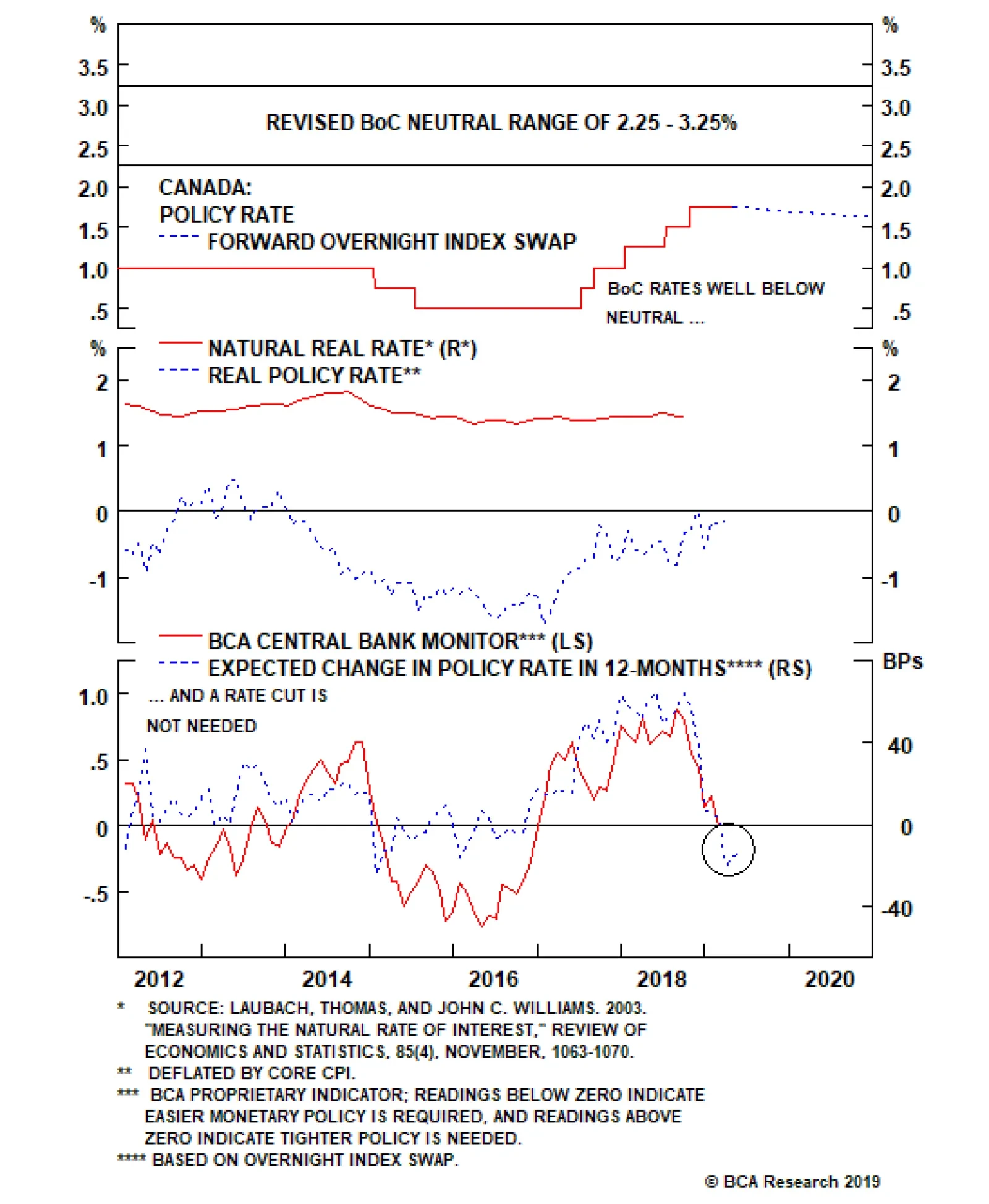

The problem for the BoC is that its policy rate of 1.75% remains well below its own estimated neutral range, which is now 2.25%-3.25%. A similar message comes when looking at the neutral real rate (“r-star”) estimate…

The BoC places a lot of weight on the Business Outlook Survey (BoS) in determining its economic forecasts, and in setting monetary policy. Thus, it is no surprise that in the official statement following the April 24…

Highlights U.S.: The Fed remains decidedly neutral, despite market expectations (and White House pressure) for lower U.S. interest rates. Treasury yields are mispriced and should grind higher over the next 6-12 months, led first by…

Highlights Central bankers appear to be in a rush to boost inflation expectations before the next economic downturn. This in practice should be stimulative for the global economy. Historically, currencies of small, open economies are…

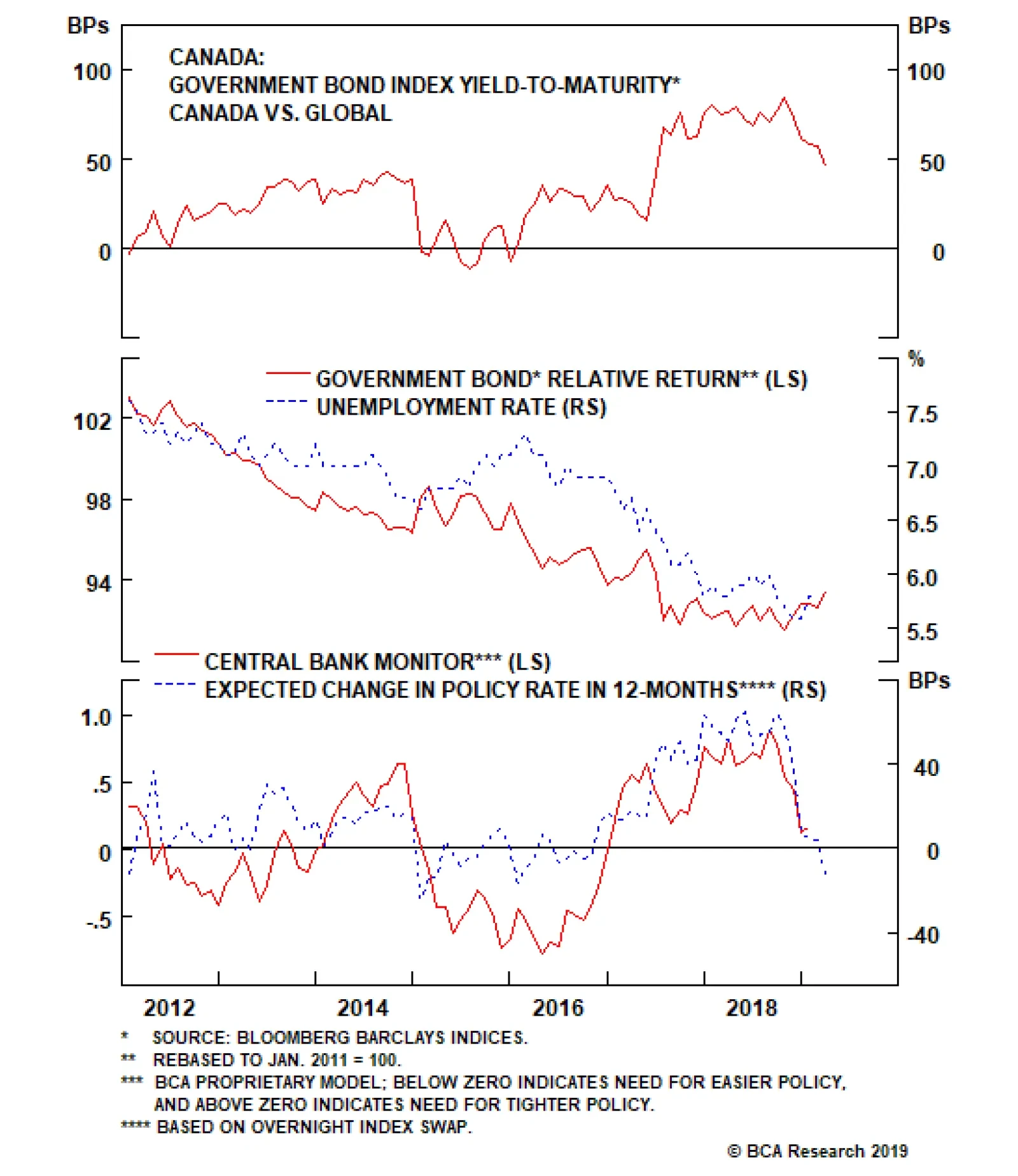

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of our country Monitors are now forecasting monetary policy on hold, apart from Australia and New Zealand where looser policy is…

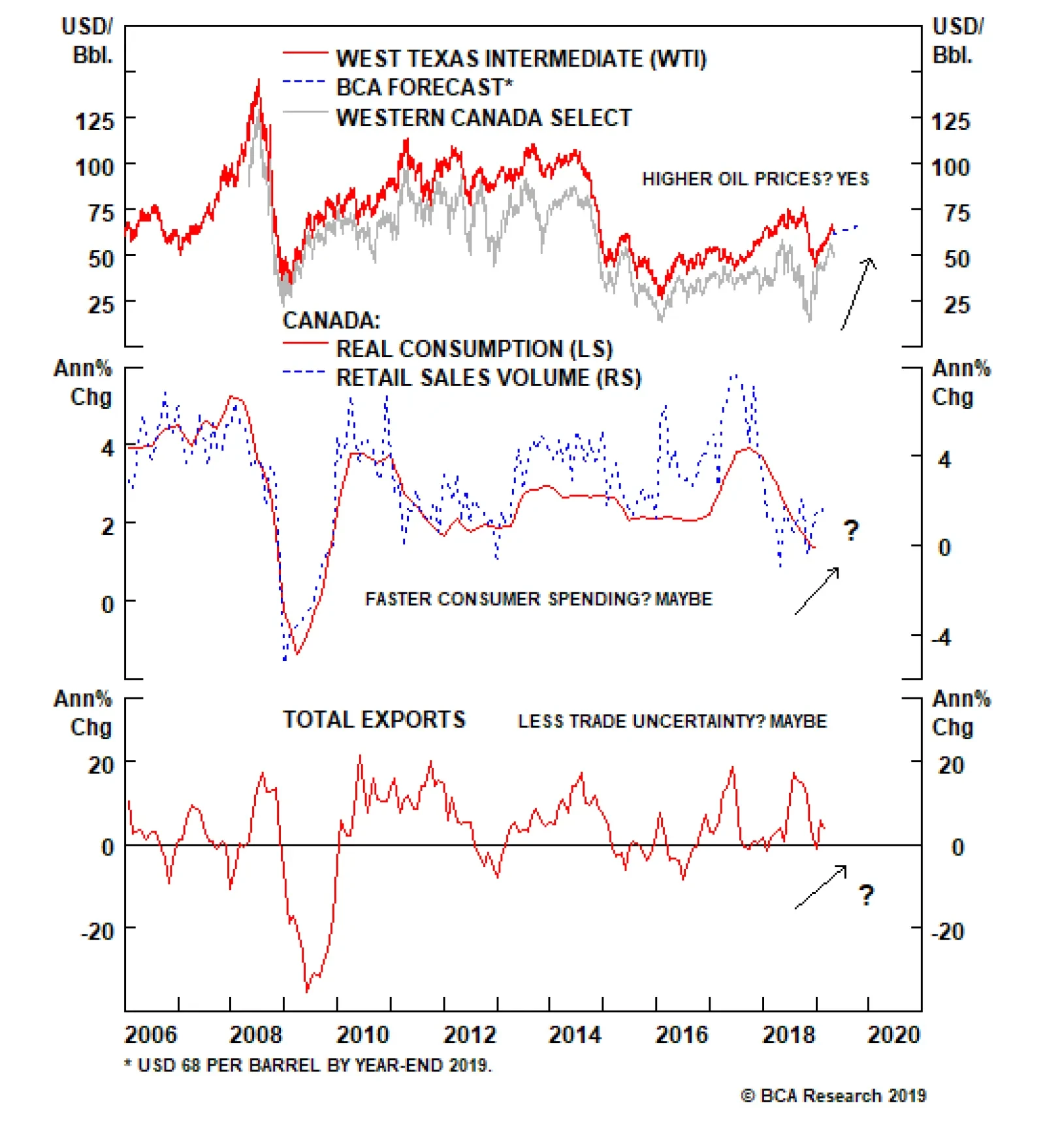

Highlights The correlation between oil and petrocurrencies has deeply weakened in recent years. One of the reasons has been the prominence of new, important producers, notably the U.S. Oil prices should trend towards $75/bbl by year-…

Canadian government bonds have been clawing back much of the relative underperformance that occurred in 2017 and 2018 when the Bank of Canada (BoC) was delivering multiple rate hikes. The spread between the yields on the…

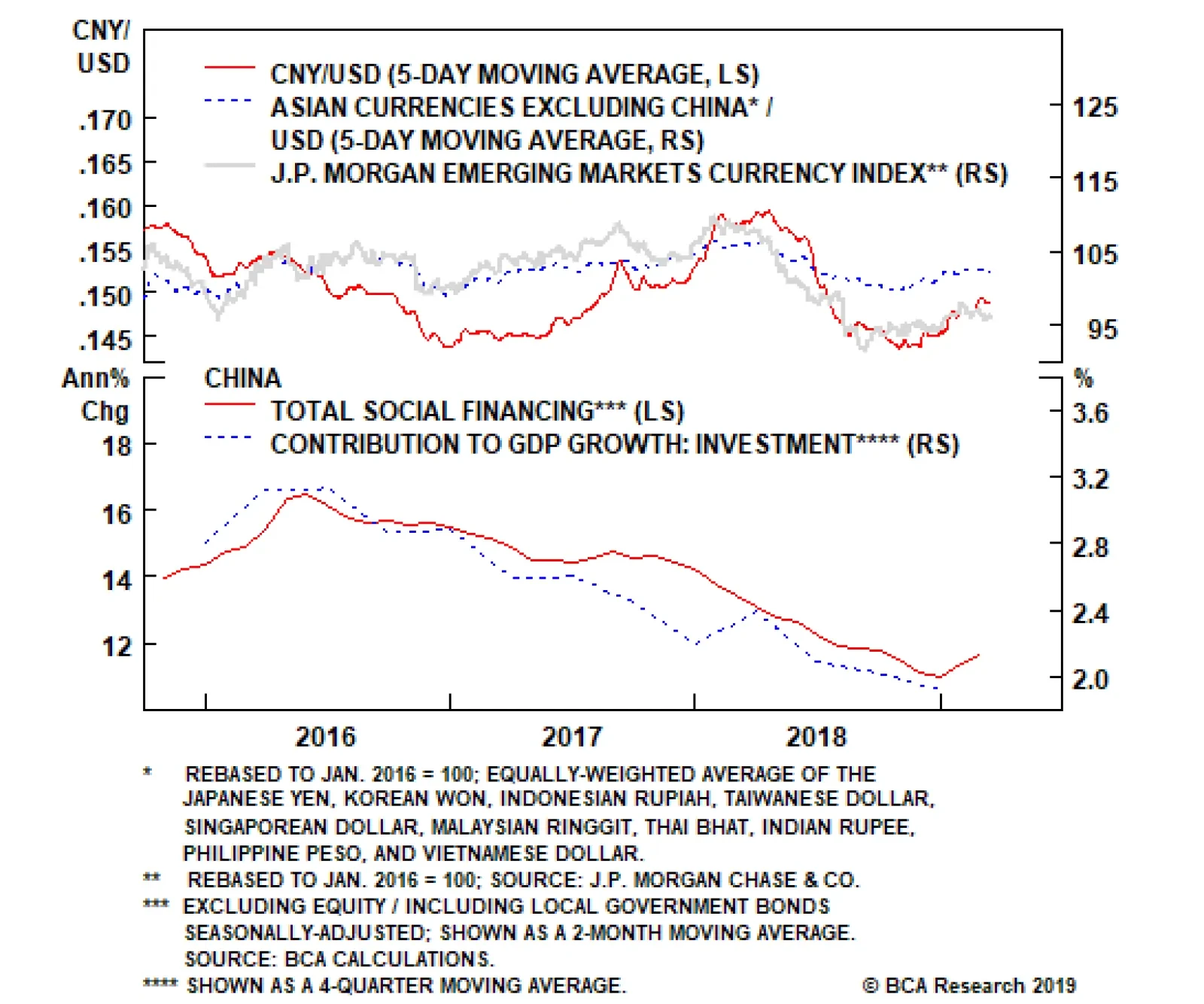

Highlights Global Spread Product: The current low-volatility backdrop, triggered by more dovish central banks, will be maintained until there is more decisive evidence that global growth is rebounding. That will not occur until the…

An improvement in leading economic indicators in the spring will set the stage for a reacceleration in global growth and a decline in the dollar in the second half of this year. The combination of stronger growth and a weaker…