Highlights Duration: Global manufacturing growth will rebound near the end of this year. Much like in 2016, this will result in higher global bond yields on a 12-month horizon. Investors should keep portfolio duration close to…

Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…

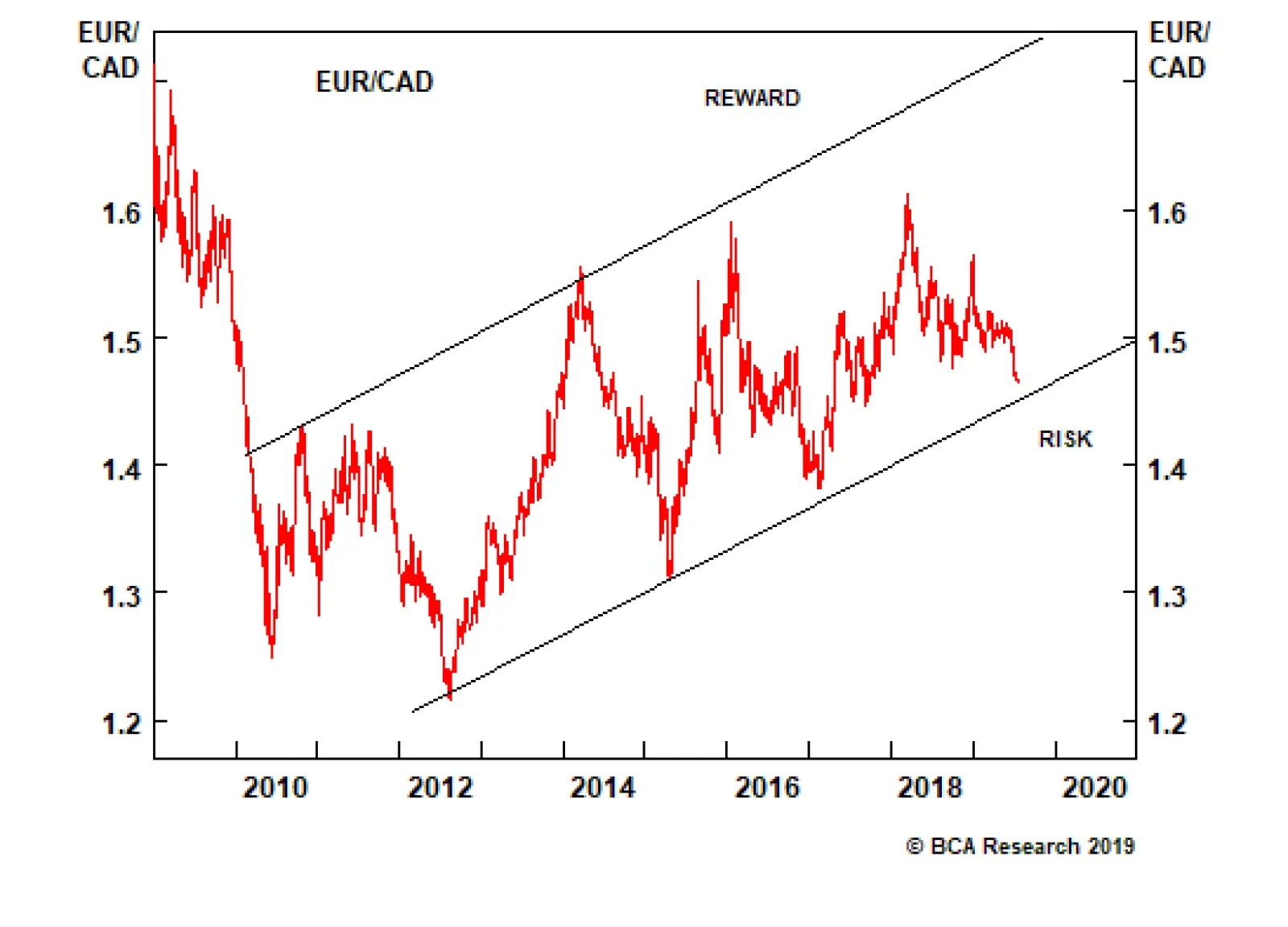

The EUR/CAD has reached an important technical level, and either a major breakdown or a powerful bounce will follow. With Canadian data firing on all cylinders and the euro area in the depths of a manufacturing slowdown, the…

Dear Clients, In addition to this Weekly Report, you will also be getting a Special Report authored by some of our top strategists on global growth. The manufacturing recession that began in early 2018 has lasted longer than most…

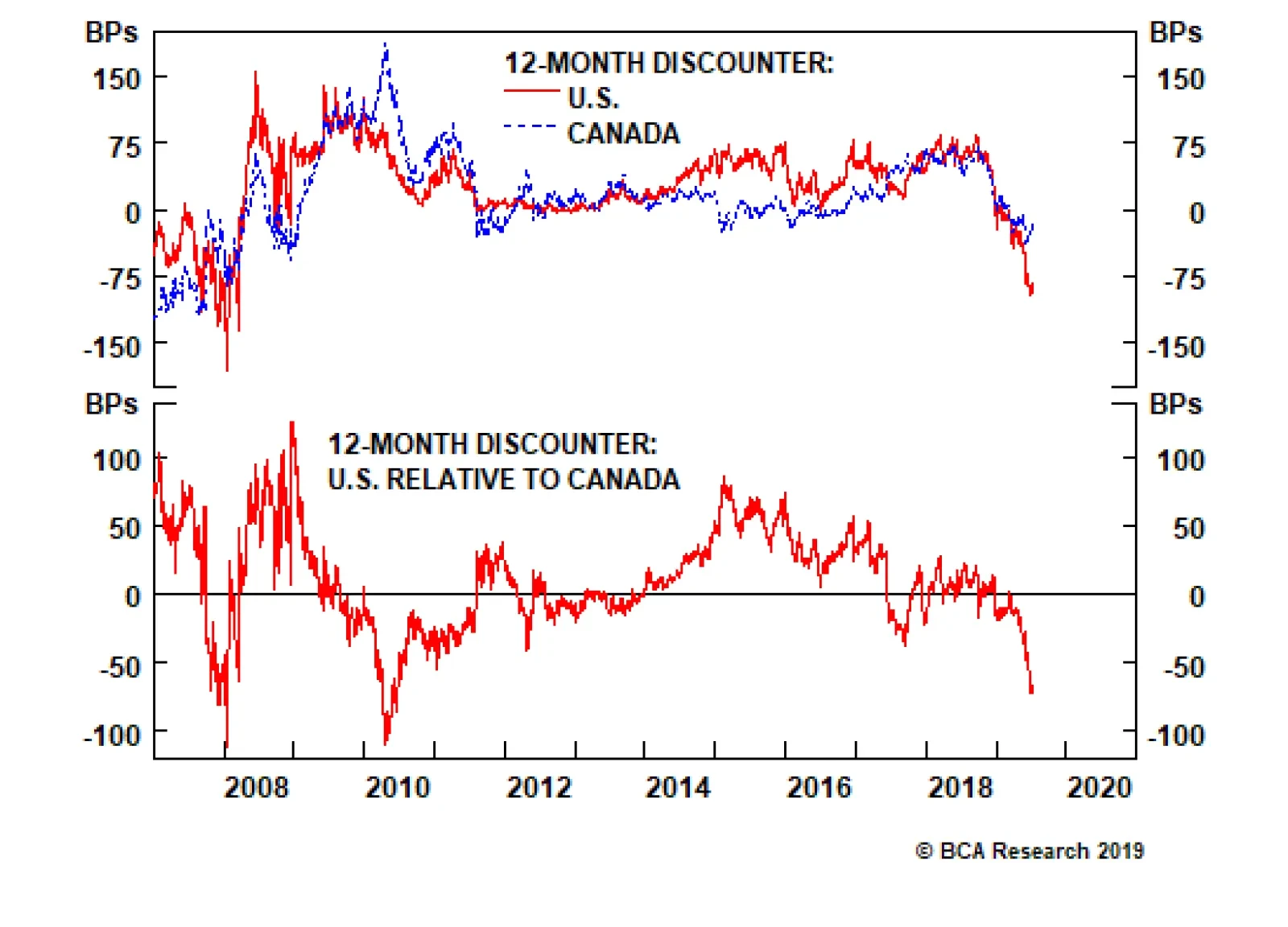

Canadian data has been firing on all cylinders of late, so it was no surprise that Governor Stephen Poloz decided to keep interest rates on hold today. That said, details in its monetary policy report were notably cautious…

Highlights The sharp fall in the bond-to-gold ratio is an important signal to pay heed to. It might suggest that confidence in the U.S. dollar is finally waning. If correct, the sharp rally in crypto currencies over the past few…

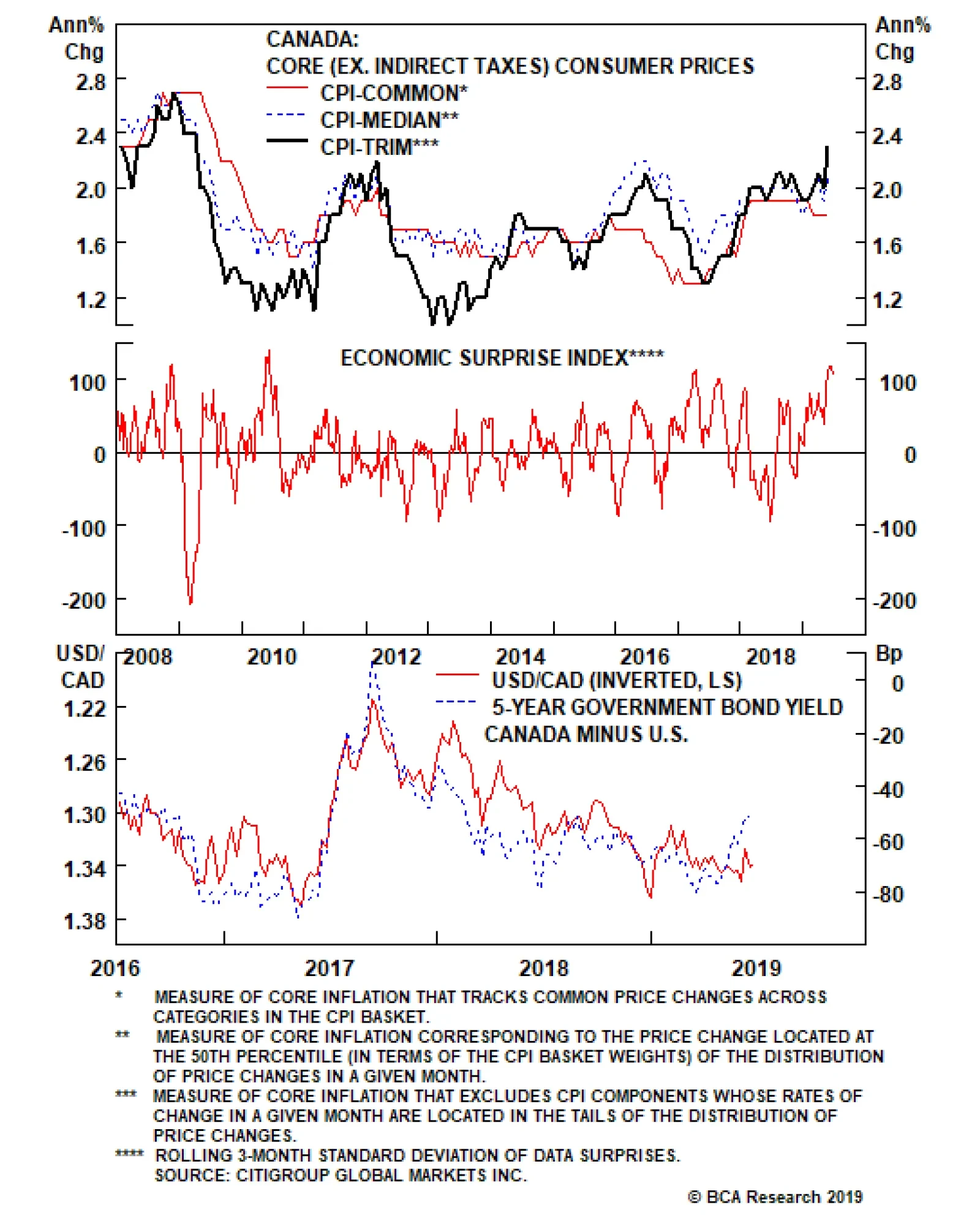

This morning’s CPI report showed that Canadian core inflation continues to accelerate. The average of the three measures followed by the Bank of Canada moved up to 2.1% in May from 1.9% in April. Underlying inflation…