Dear Client, In addition to this short weekly report, you will also receive a Special Report on investment themes over the next decade, penned by our colleagues in the US Equity Strategy and Geopolitical Strategy services. The…

Dear Client, In addition to this short weekly report, you will also receive our 2020 outlook, published by the Bank Credit Analyst. Next week, I will be on the road visiting clients in South Africa. I hope to report my discussions and…

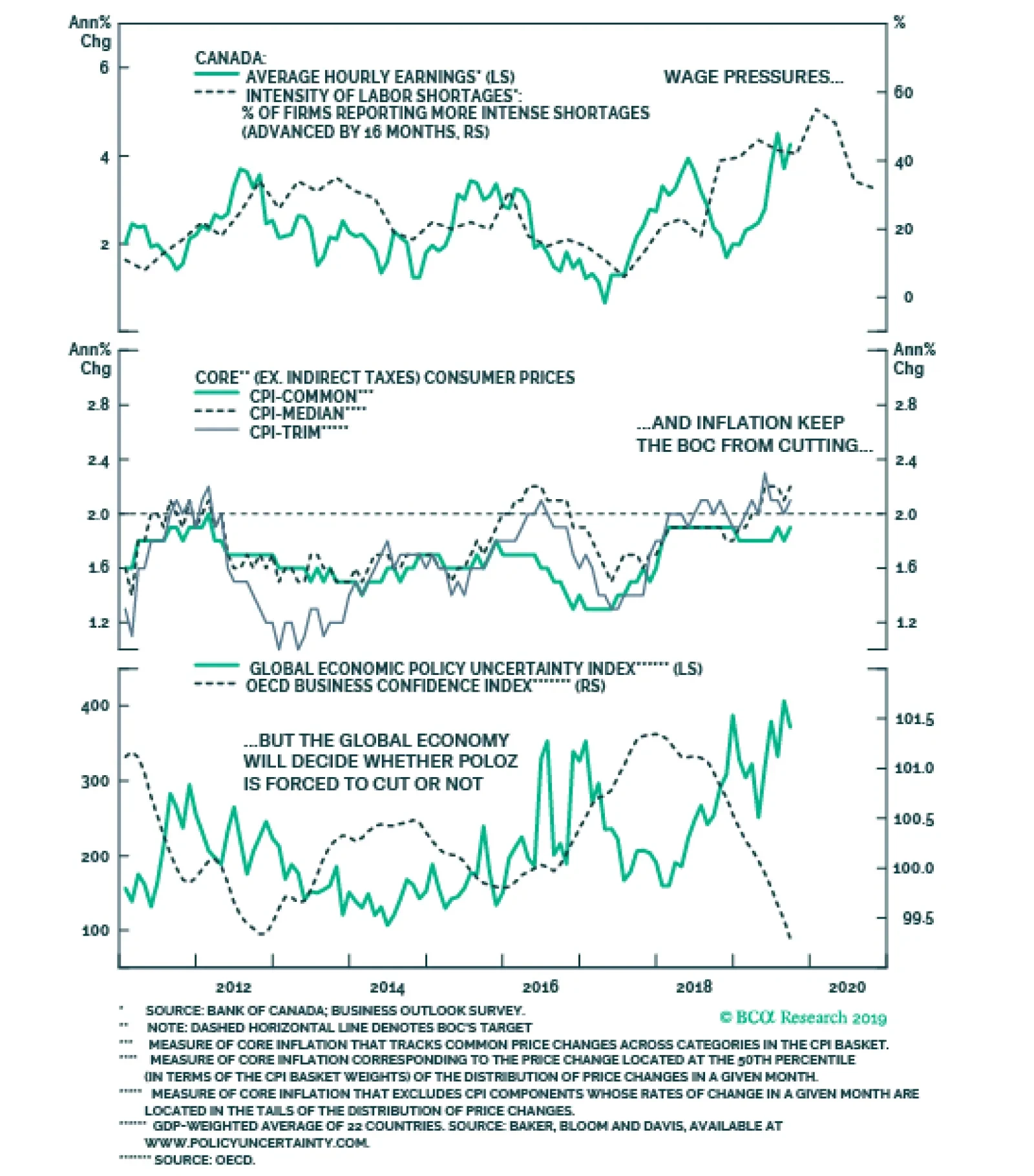

In October, Governor Poloz highlighted that the underpinnings supporting the Canadian consumer remain firm. The main factor behind the BoC’s discussion of an “insurance cut” is the weakness in capital spending.…

Highlights The mood among investors is shifting from the recessionary gloom of this past summer. Equities worldwide are rallying, buoyed by a combination of dovish monetary policies, tentative signs of bottoming global growth and…

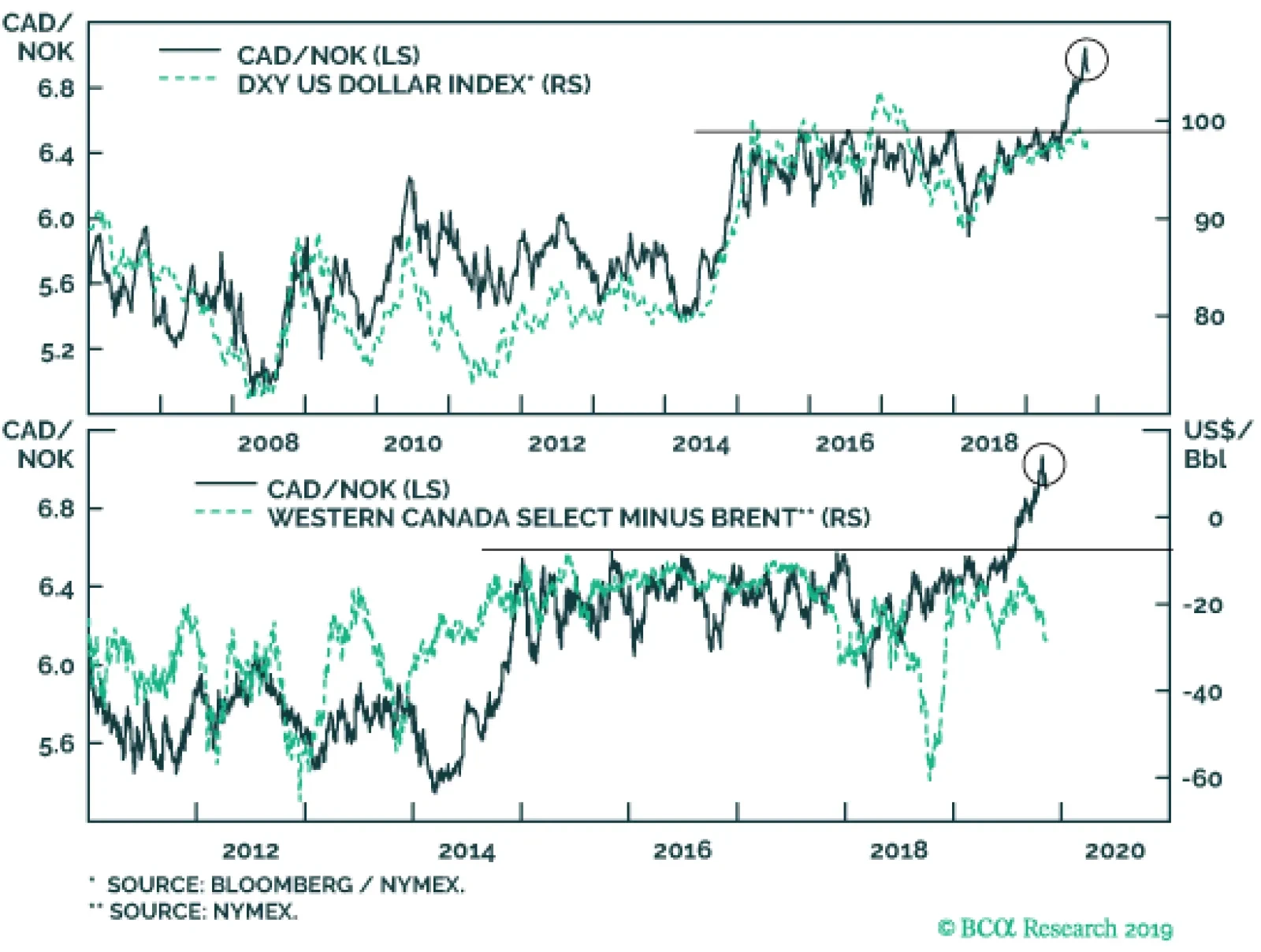

The Norges Bank has been hawkish in spite of the dovish tilt by most other central banks. As such, the underperformance of the Norwegian krone, especially versus the euro, has been quite perplexing in the face of diverging…

Highlights The correlation between oil and petrocurrencies has shifted in recent years. It no longer makes sense going long petrocurrencies versus the US dollar blindly. One of the reasons has been the impressive and prominent output…

Highlights Global: Global growth momentum is bottoming out, leading indicators are improving, inflation is subdued, and central bankers are biased to maintain accommodative monetary policies. This is a bullish “sweet spot”…

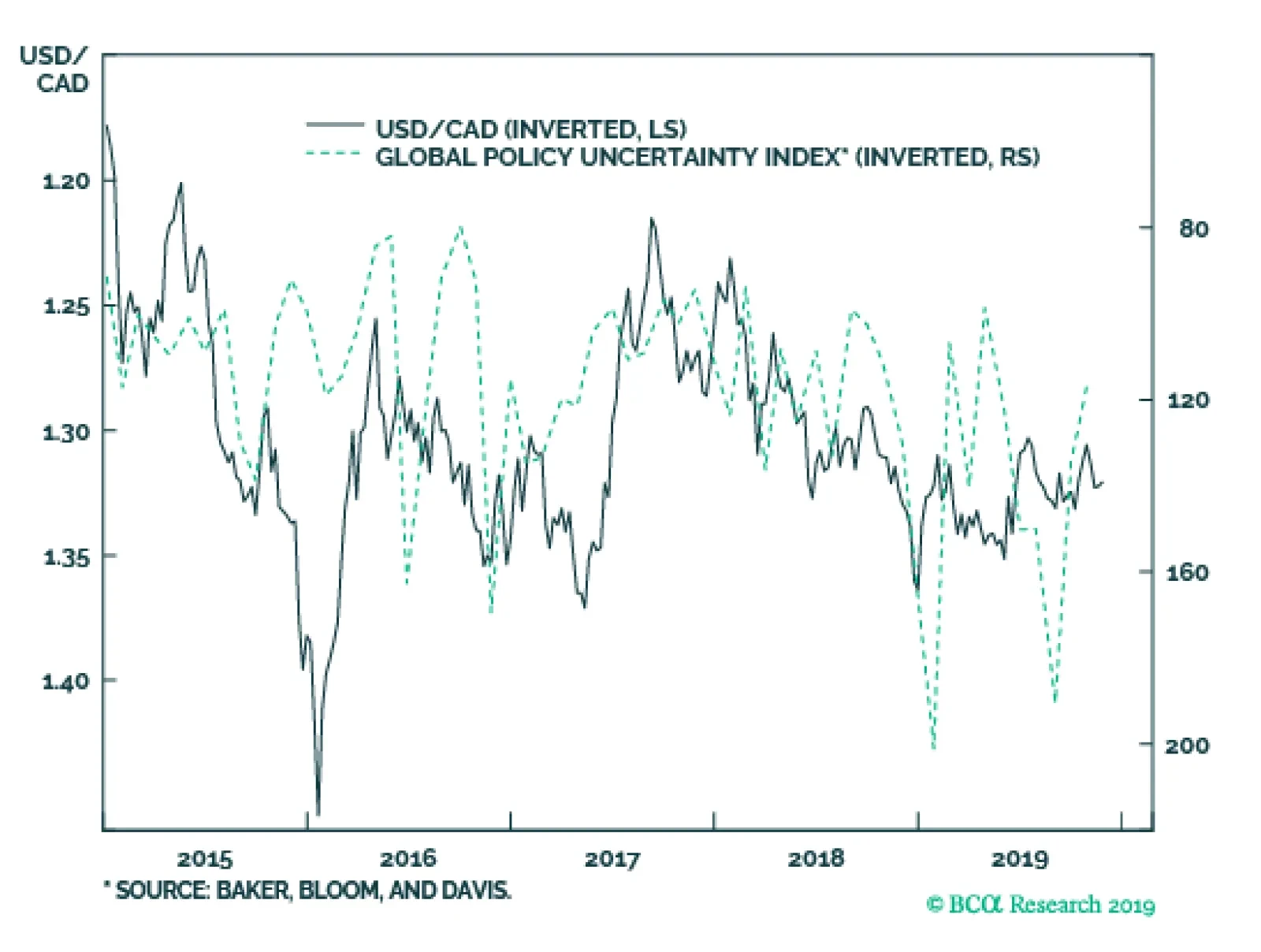

Highlights An expansion in the Federal Reserve’s balance sheet will increase dollar liquidity. This should be negative for the greenback, barring a recession over the next six to 12 months. Interest rate differentials have…

Following the BoC’s press conference, Canadian 10-year yields collapsed 15 basis points and the CAD depreciated 0.6% versus the USD, on a day when the greenback was weak. During Governor Poloz's press conference, market…