We expected the Bank of Canada to cut rates this morning, but we did not anticipate 50bps of easing. In response to the BoC move, the Canadian OIS curve shifted down for the near months, but the yearend expected short rate…

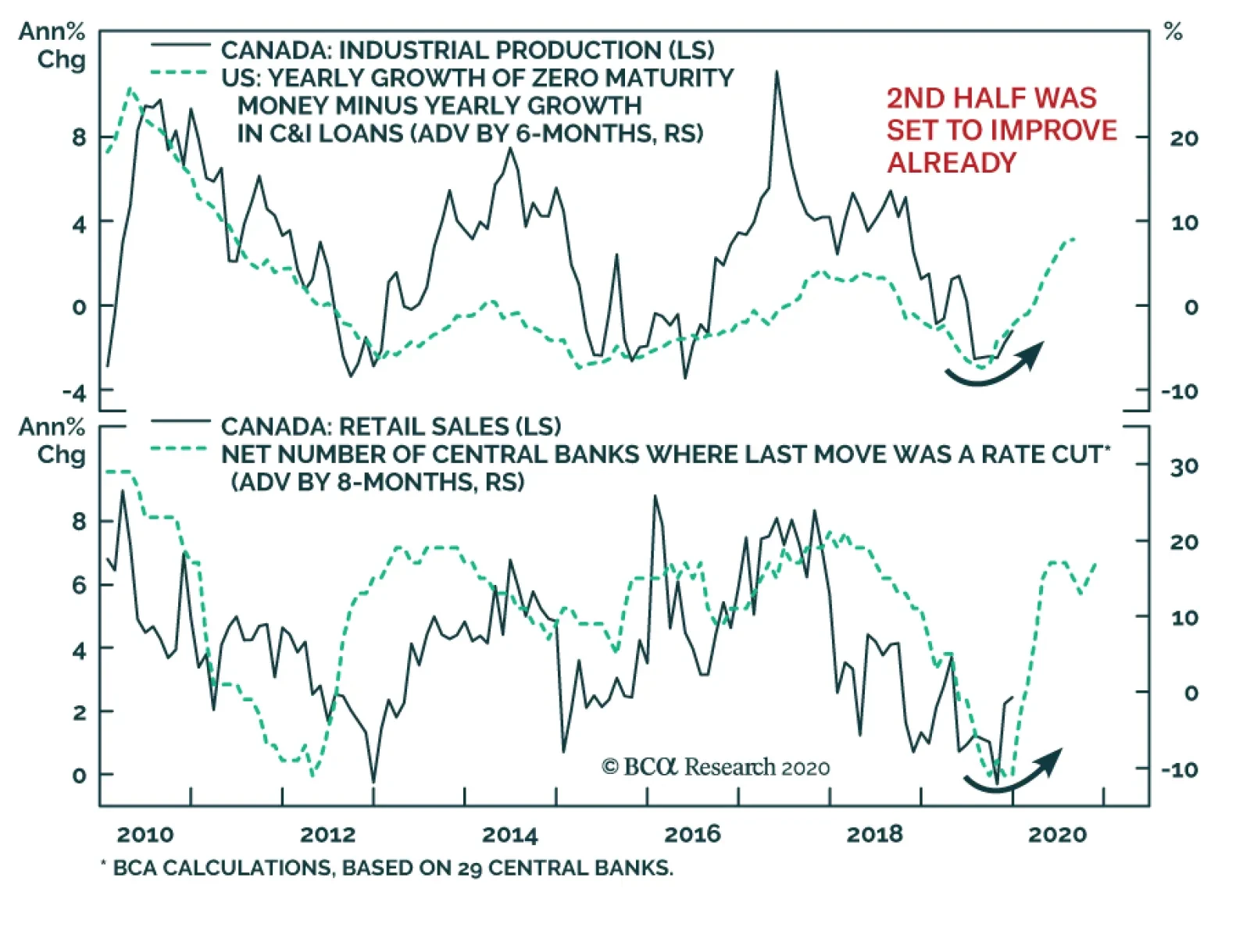

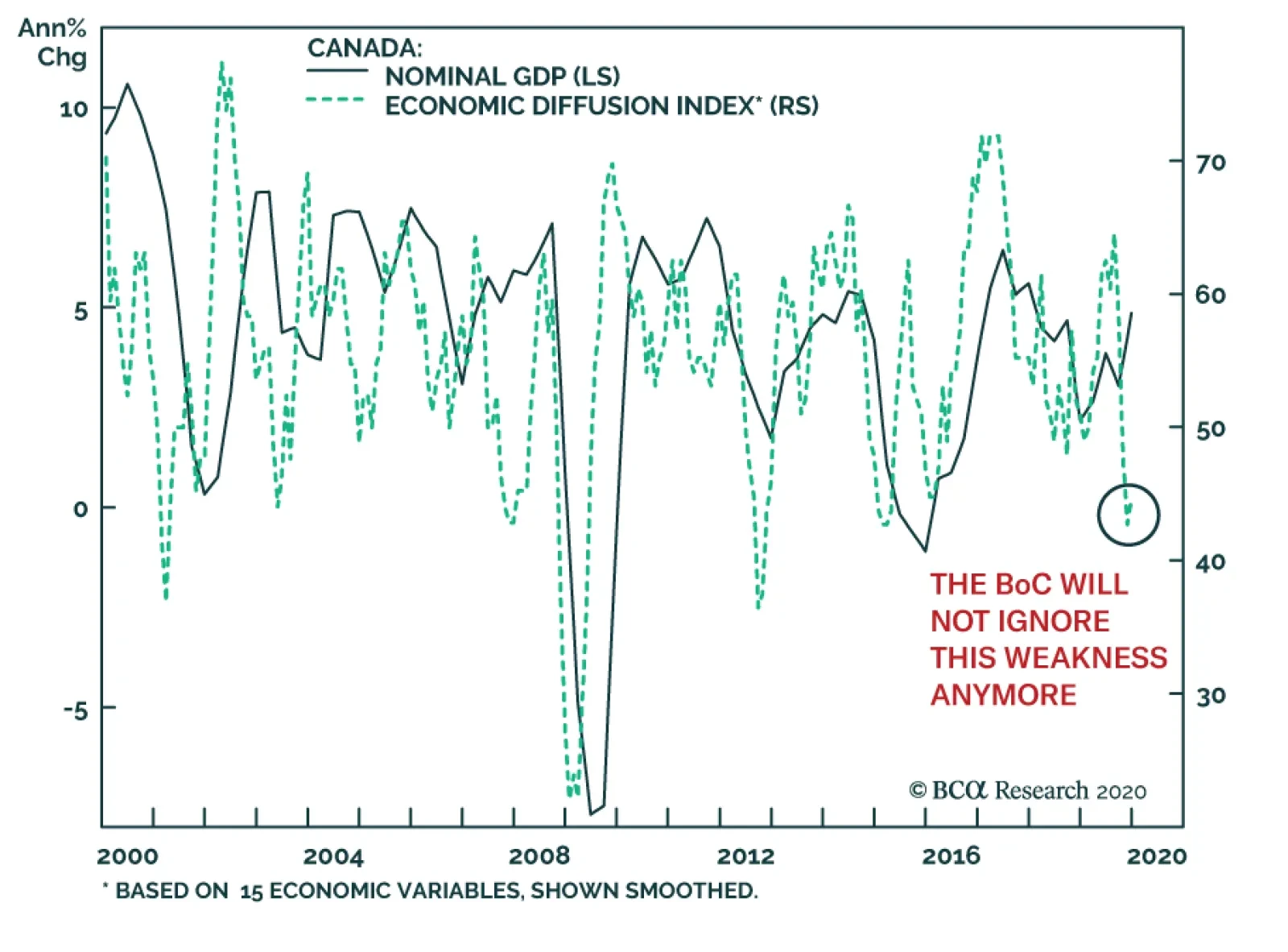

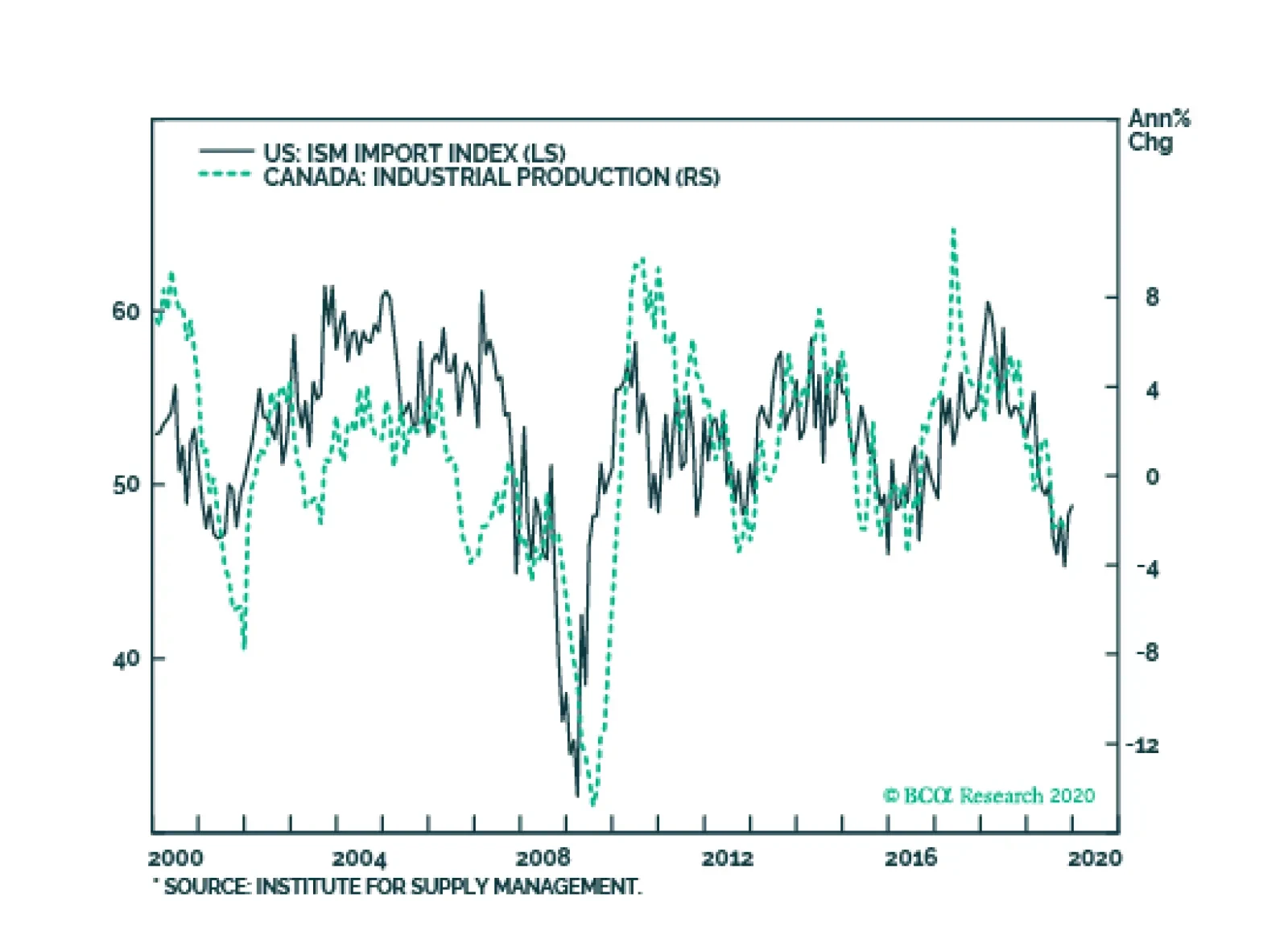

Until now, the Bank of Canada was torn. On the one hand, weaknesses in the industrial sector and retail sales have been depressing our Canadian Economic Diffusion Index, arguing that the recent rebound in nominal GDP growth would…

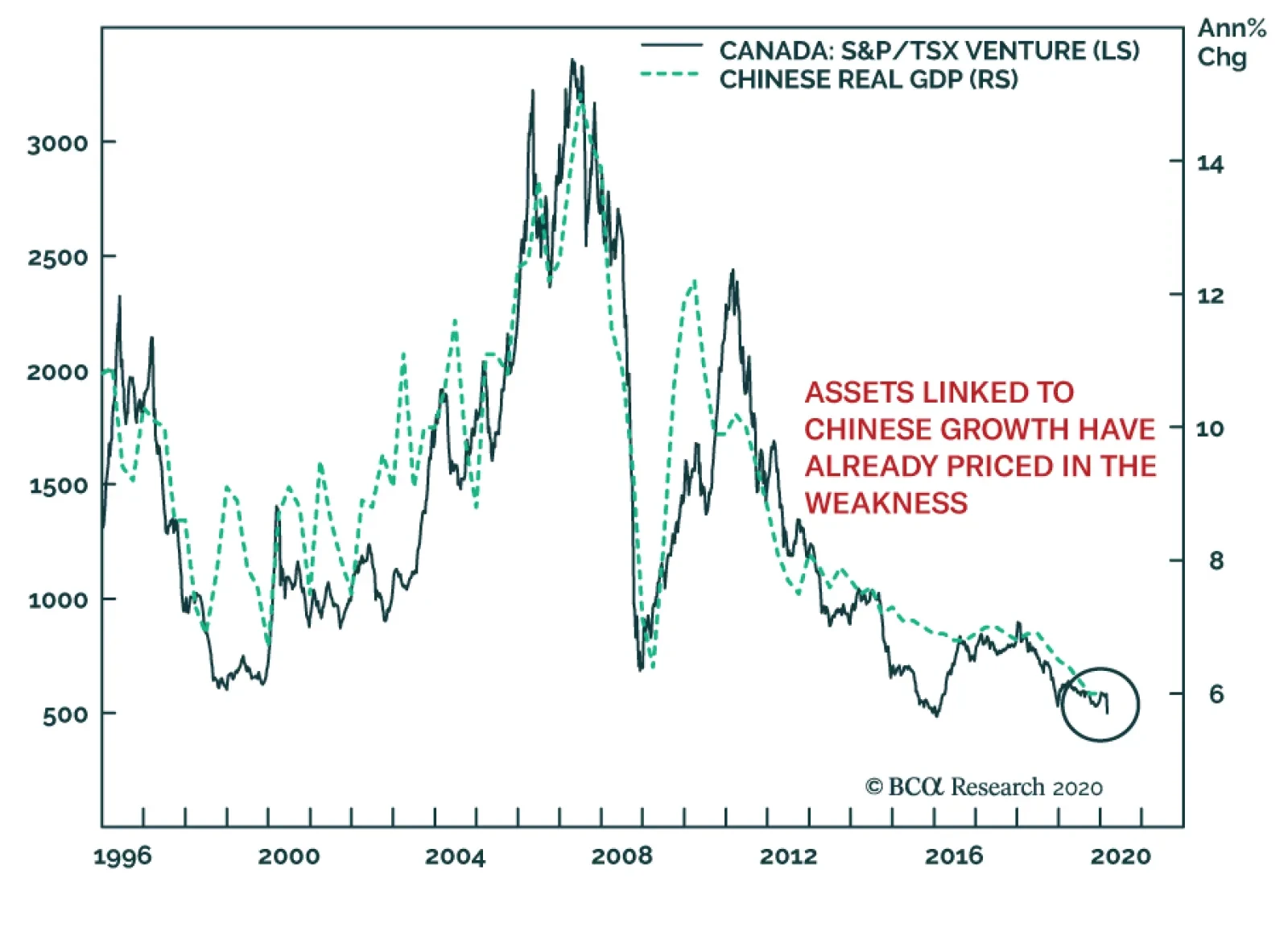

The Canadian S&P/TSX venture index is mostly composed of very speculative stocks, with an overweight allocation in resources and energy. This combination makes this index highly sensitive to investors’ expectations…

Highlights The elevated uncertainty about global growth stemming from the COVID-19 virus in China has not only made investors more anxious, but central bankers as well. This means that, only six weeks into the year, policymakers may…

As expected, the BoC kept interest rates at 1.75%. While the BoC highlighted that the economy possesses more slack than originally estimated, it refrained from committing policy to any path this year. After all, while the…

Highlights We expect both the Australian dollar and Chinese RMB to move higher in the coming months. A key catalyst is broad-based weakness in the US dollar. The composition of goods benefiting from the US-China Phase I deal are a…

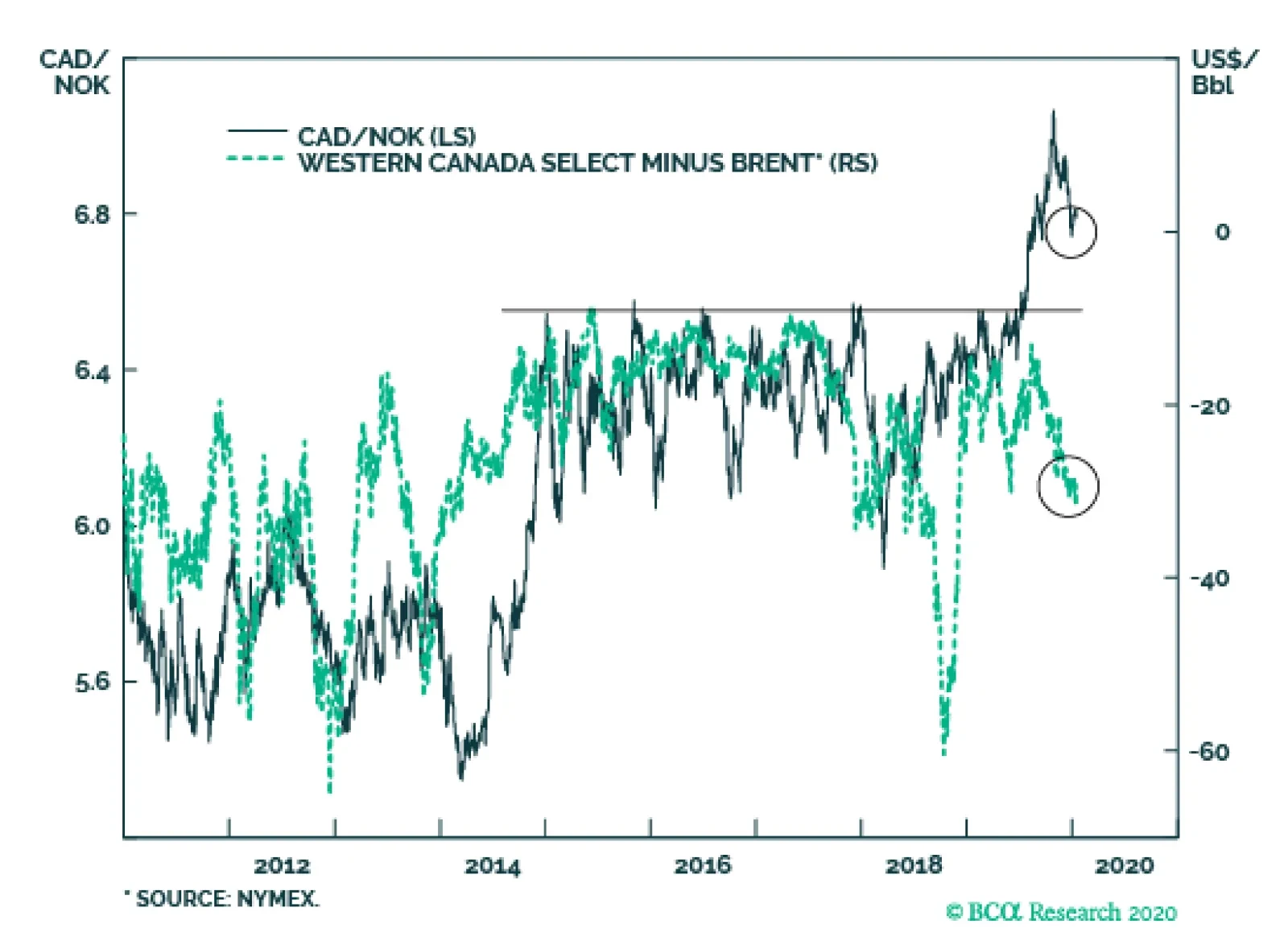

Rising oil prices will go a long way towards improving Canada’s and Norway’s trade balances. In the case of Norway, net trade fell in 2019 due to lower exports of oil and natural gas, but still stands at 5.1% of GDP.…

Highlights Remain short the DXY index. The key risk to this view is a US-led rebound in global growth, or a pickup in US inflation that tilts the Federal Reserve to a relatively more hawkish bias. Stay long a petrocurrency basket. The…

Highlights 2020 Model Bond Portfolio Positioning: Translating our 2020 global fixed income Key Views into recommended positioning within our model bond portfolio comes up with the following conclusions: target a moderately aggressive…