Highlights Inflation-Linked Bonds: The plunging price of oil has put renewed downward pressure on global bond yields via lower inflation expectations. With oil prices set to recover over the next 6-12 months as the global economy…

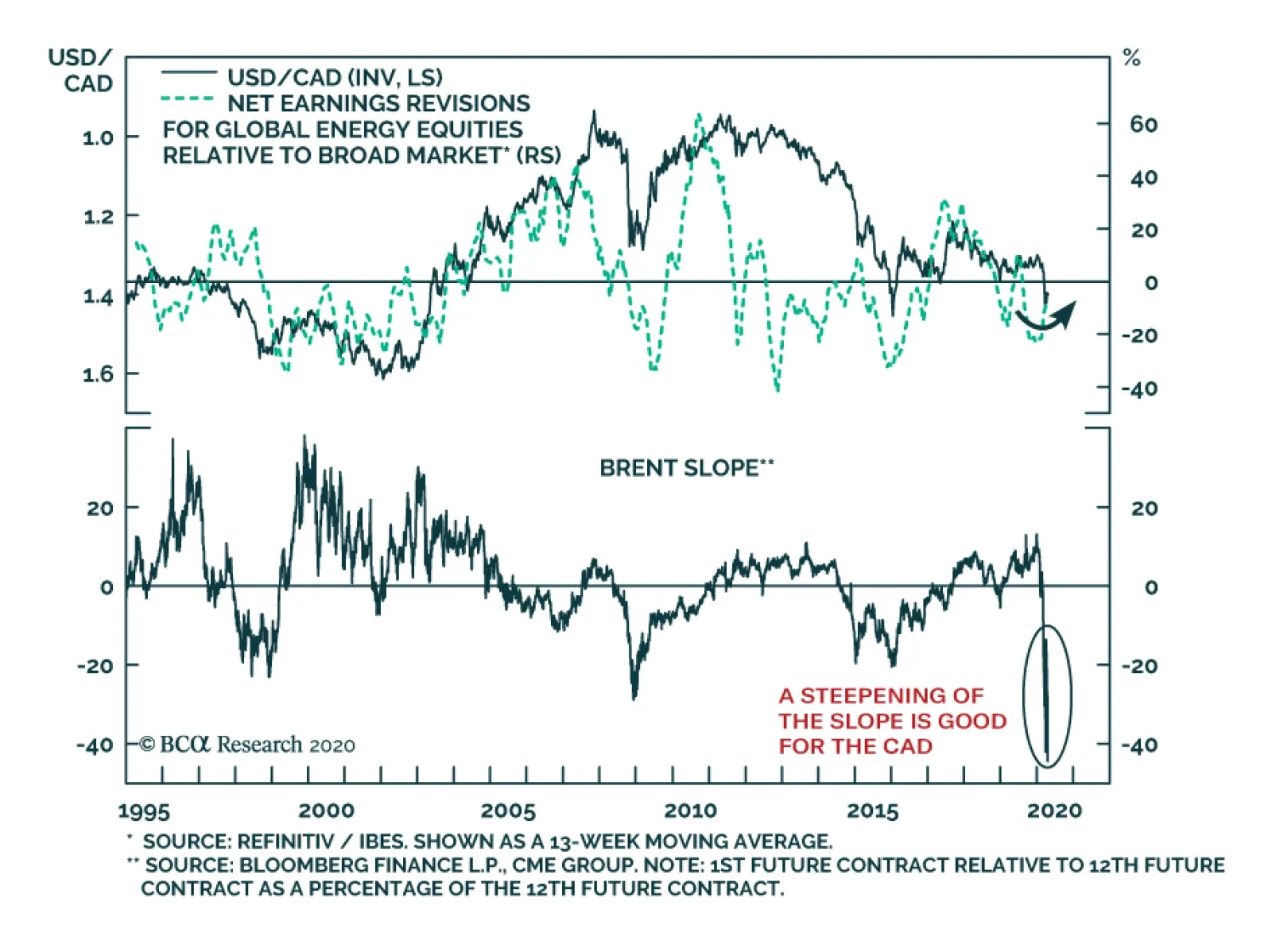

Despite the weakness in spot oil prices this week, the Canadian dollar has not made new lows. Is this divergence a sign that the CAD could experience a period of strength versus the USD? Energy market-based indicators suggest…

Highlights Oil prices are up strongly from their lows, but conditions for a durable bottom may not yet be in place. The main hiccup is that an air pocket will likely remain under global oil demand until most social-distancing measures…

Highlights The Federal Reserve’s temporary FIMA repo facility will go a long way in helping ease dollar-funding stress outside the US. However, with the duration of the lockdown highly uncertain, a liquidity crisis could…

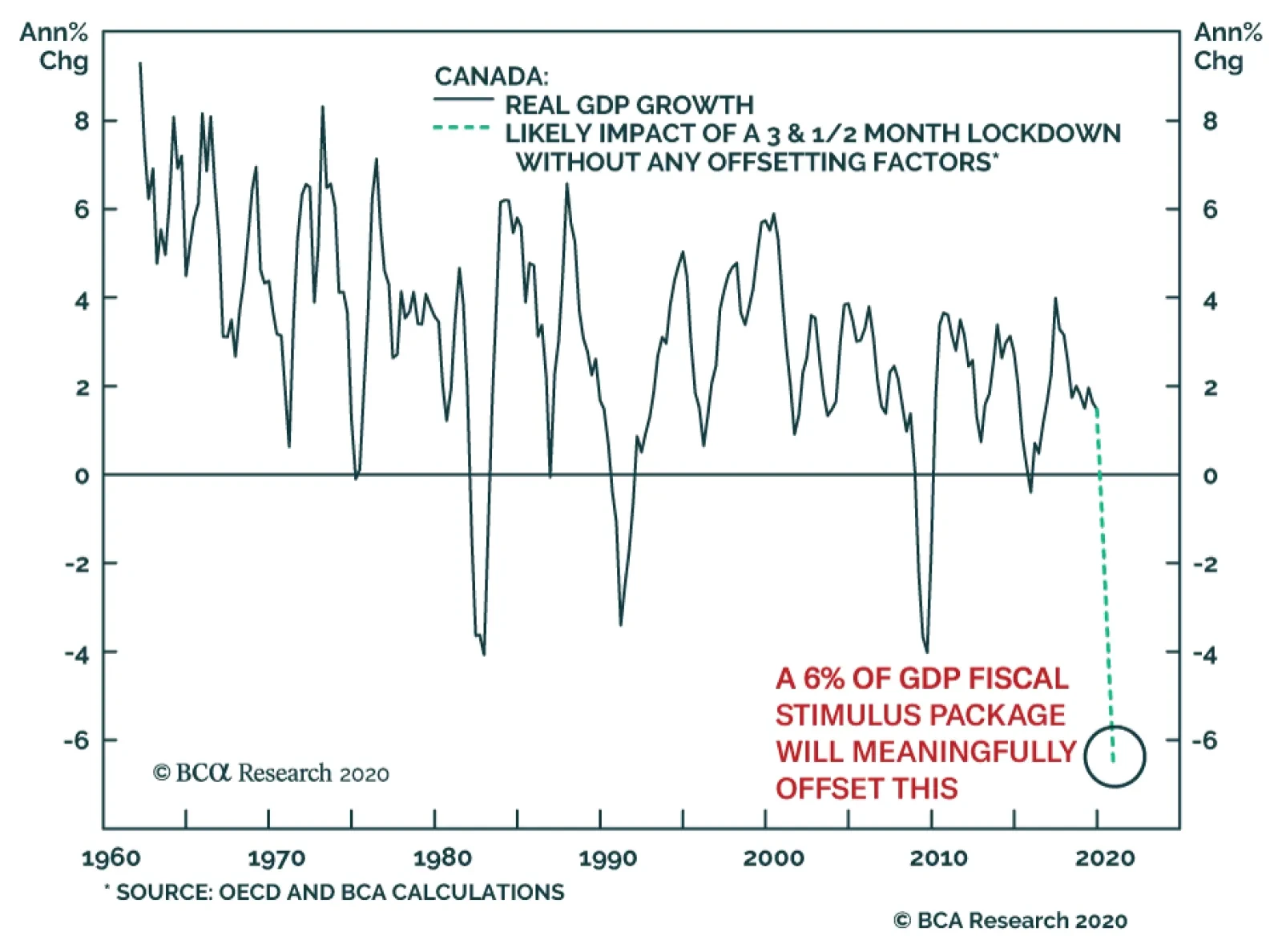

Yesterday the OECD released its estimate of the economic impact of COVID-19 lockdown policies around the world. The sobering conclusion of the OECD’s work is that the initial direct impact of the shutdowns could be a decline in the…

In an emergency meeting last Friday, the Bank of Canada lowered the overnight target rate by 50 basis points rate to 0.25%. Meanwhile, it also launched two new programs to restore liquidity to financial markets. The…

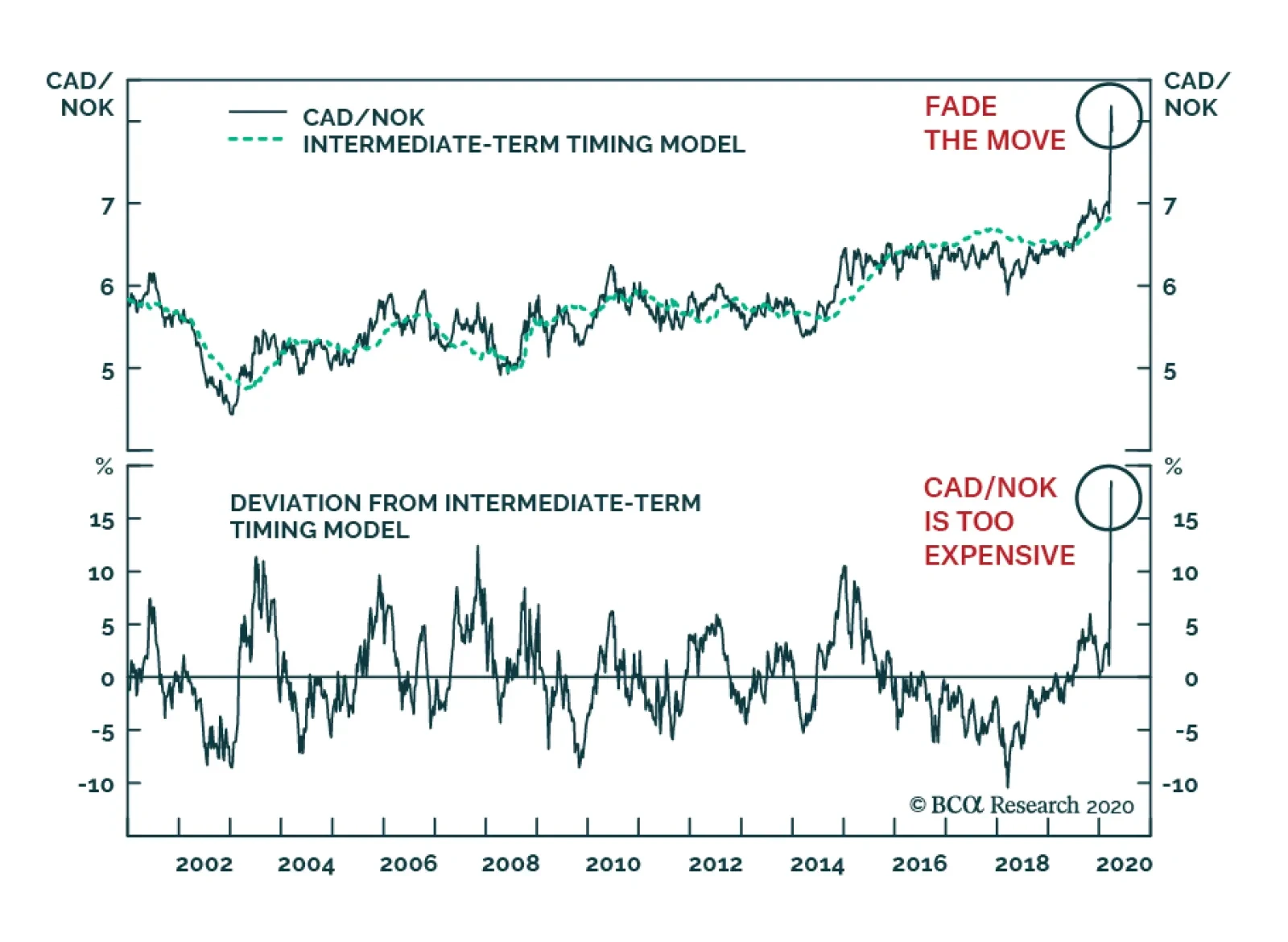

The Norwegian Krone was one of the great victims of the combined catastrophe created by both COVID-19 and the oil price collapse. Oddly, the Canadian dollar has been weak, but not nearly as much as the NOK. As a result, CAD/NOK…

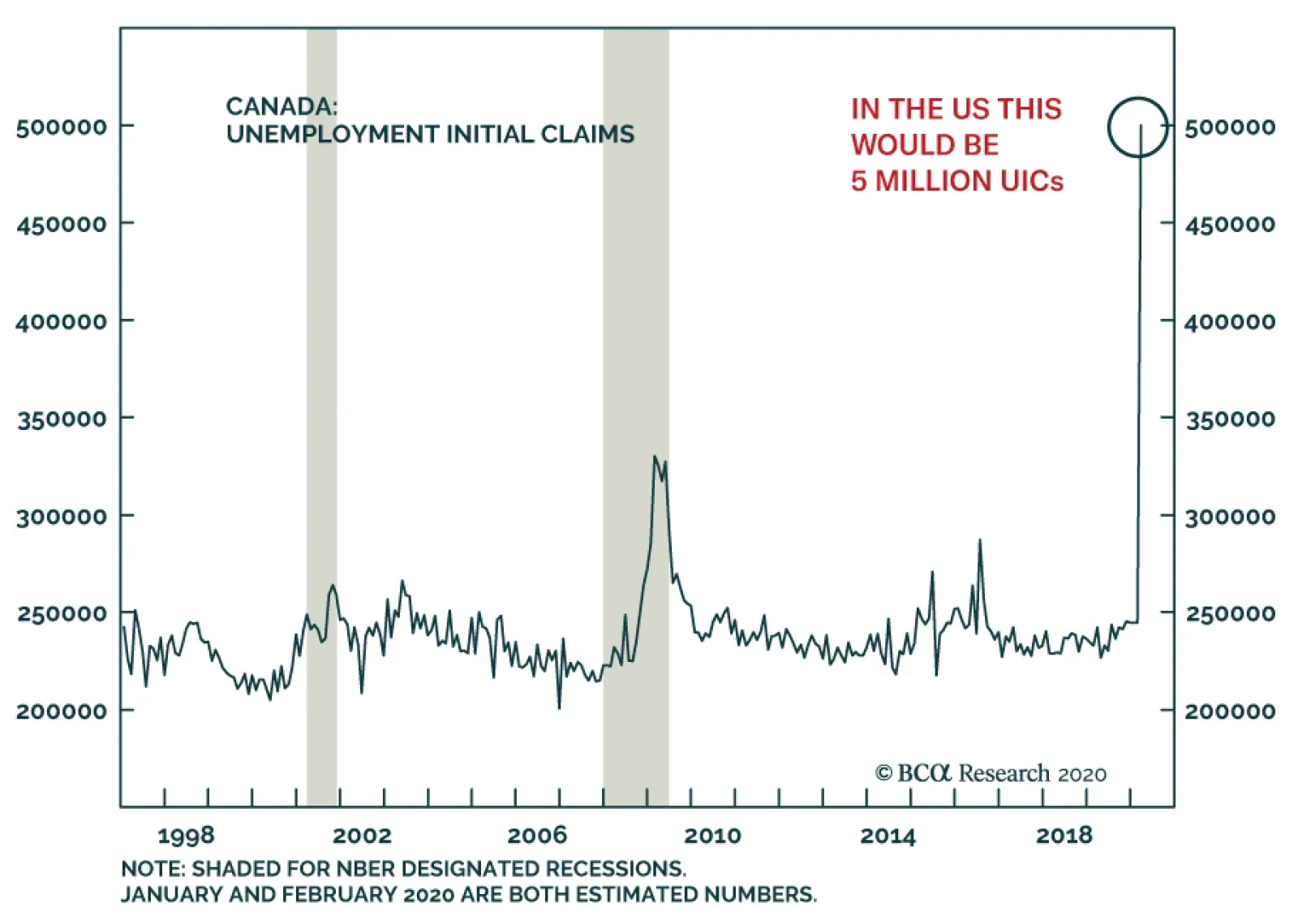

Canadian employment insurance claims surged to 500 thousand last week. This is a country with one-tenth of the population of the US. This number is important in two regards. First, it forewarns of a violent collapse in…

Highlights Policy Responses: The COVID-19 pandemic has become a full-blown global crisis and recession. Governments and central bankers worldwide are now responding with aggressive monetary easing and fiscal stimulus. Markets will not…

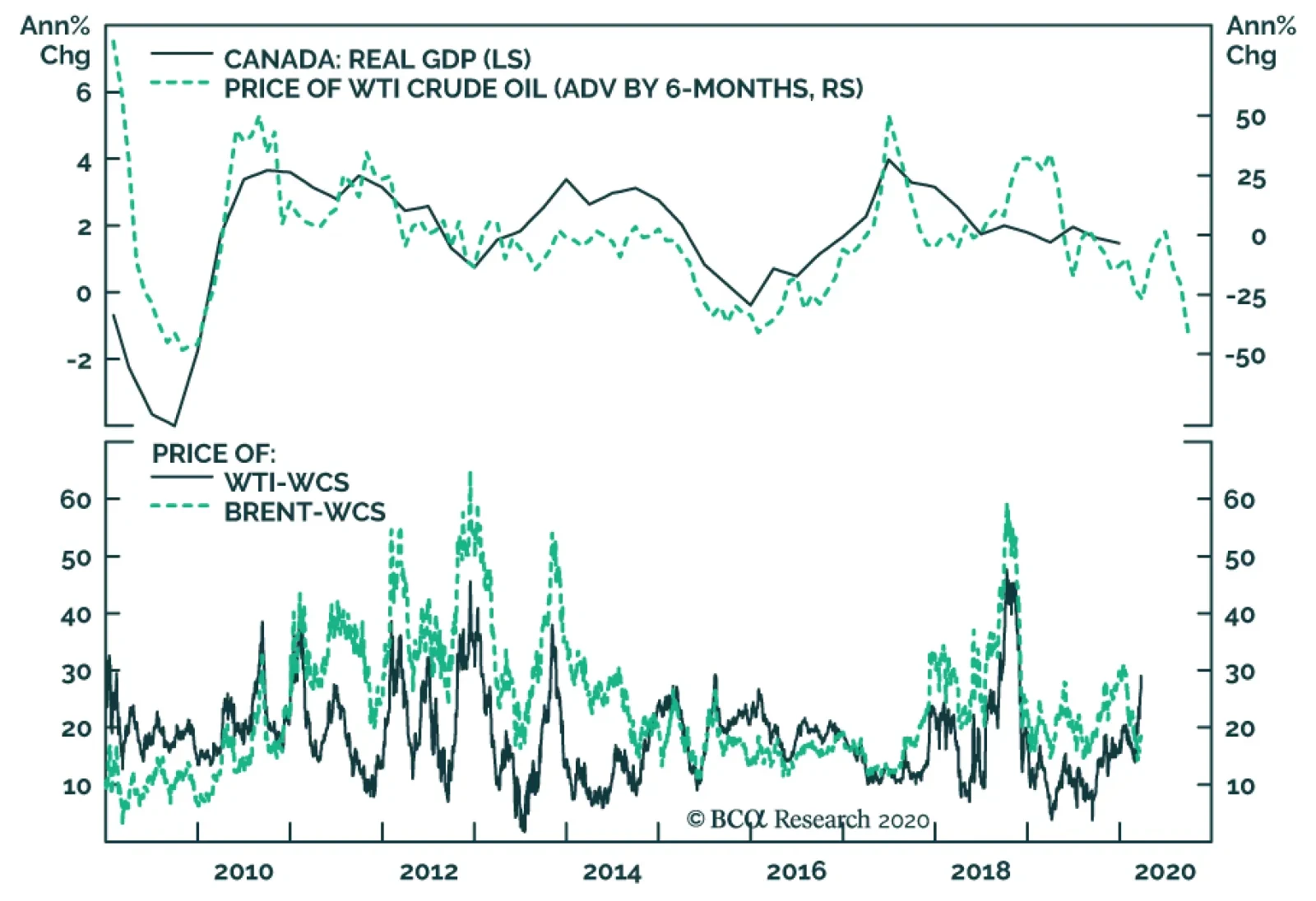

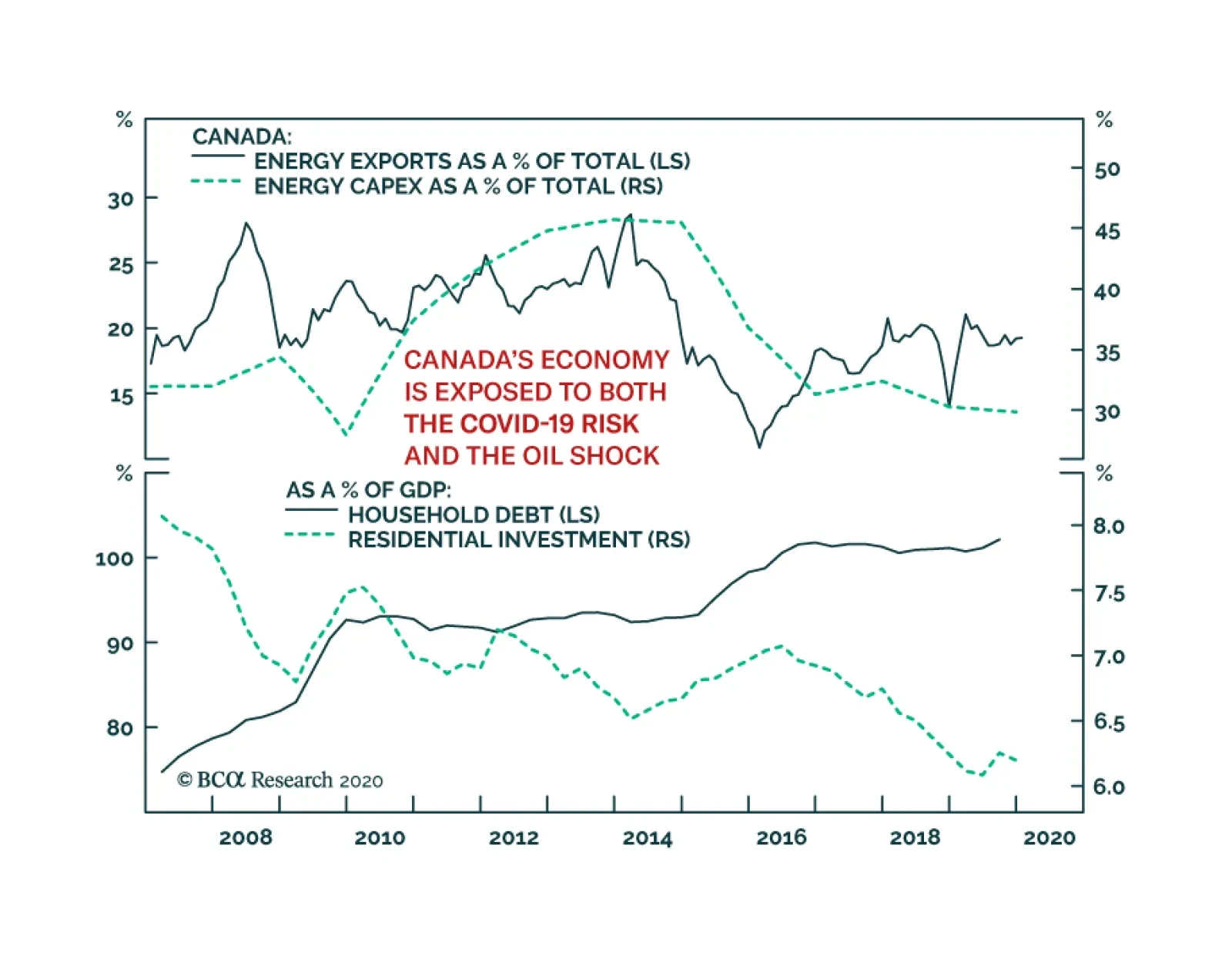

The combined impact of COVID-19 and the Saudi-Russian oil war will be particularly challenging for the Canadian economy. Energy represents nearly 20% of Canadian exports and the breakeven price for Canadian oil sands producers is…