Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

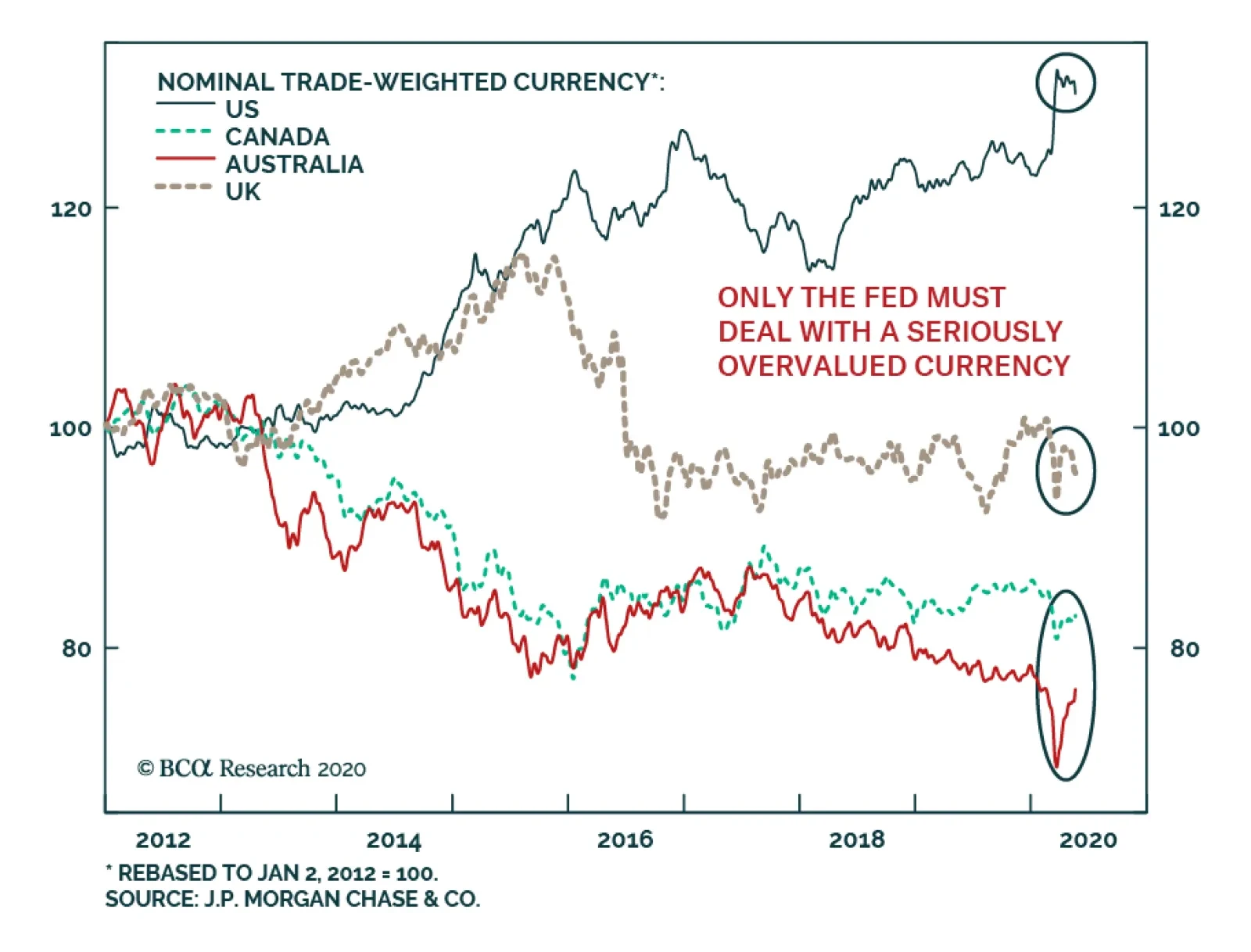

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

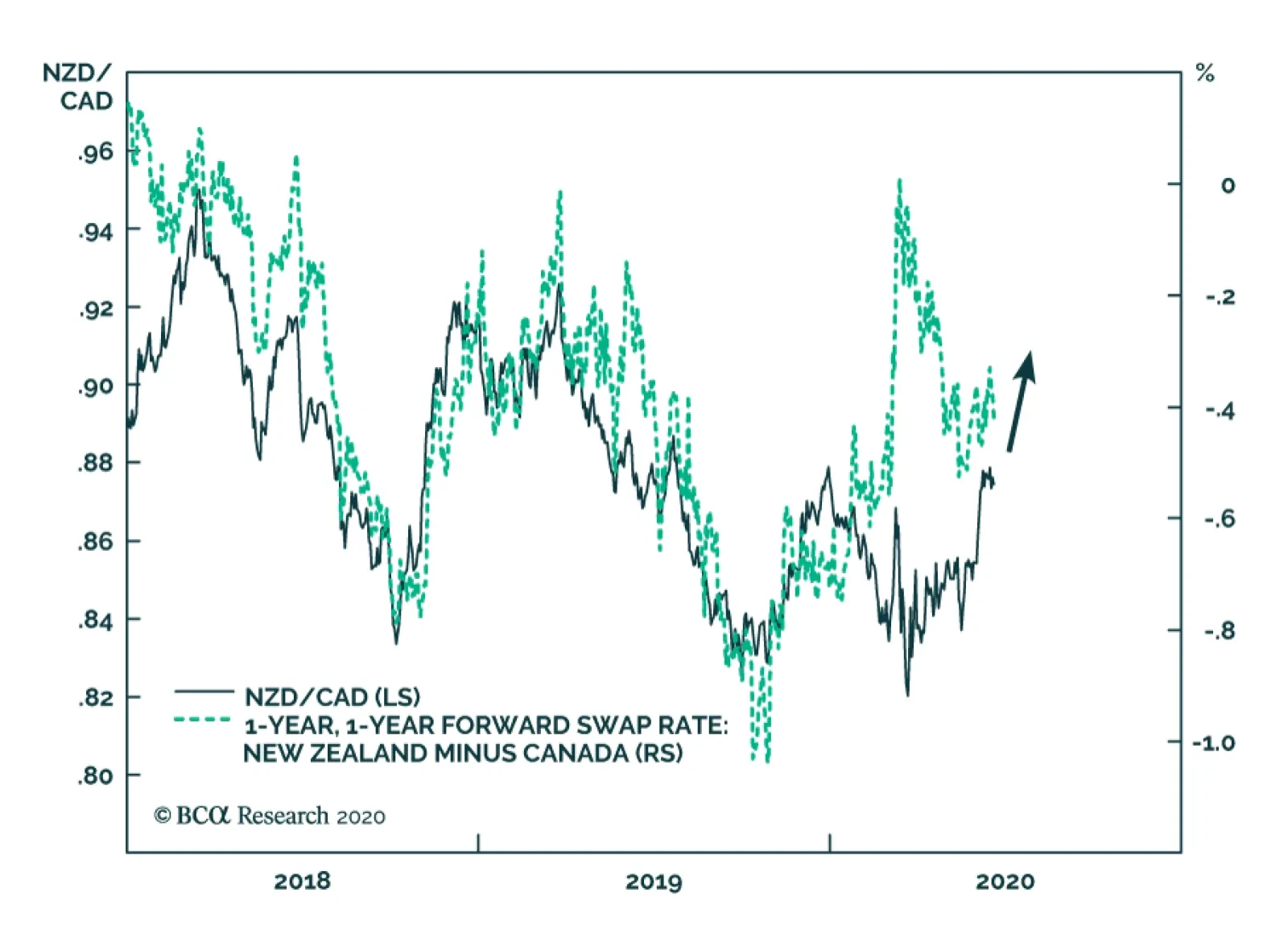

NZD/CAD is likely to appreciate over the coming six to nine months. For the past two and a half years, the NZD/CAD cross has closely followed the 1-year/1-year forward swap rate differential between Canada and New Zealand. We…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

Yesterday, BCA Research's Global Fixed Income Strategy service concluded that among the major countries without negative interest rates (the US, UK, Canada, and Australia), longer-term borrowing rates do not need to fall…

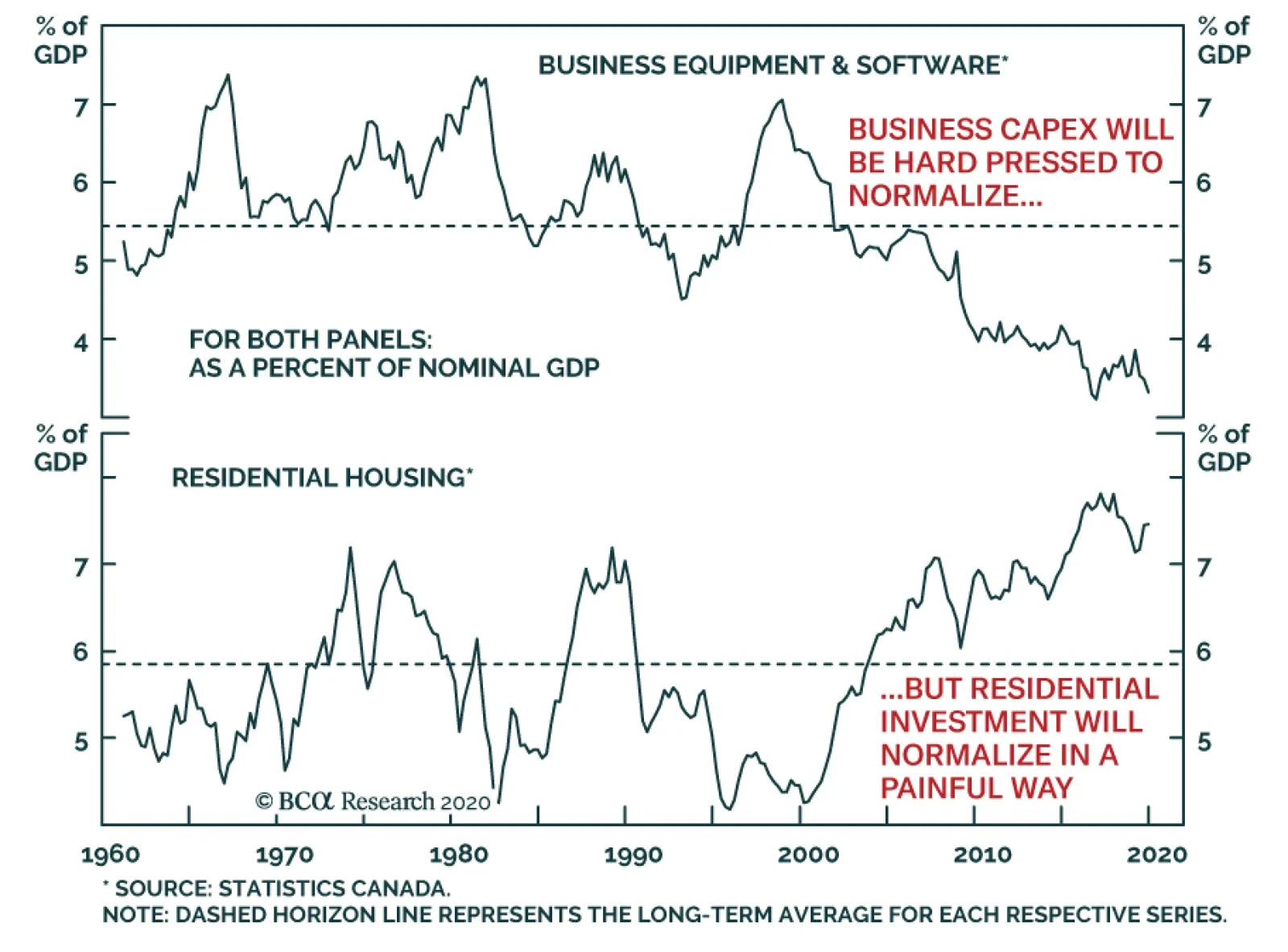

The cyclical sectors of the Canadian economy only represent 24% of GDP, which is in line with the historical average. However, this normal share hides some important disparities which create a large vulnerability for the Canadian…

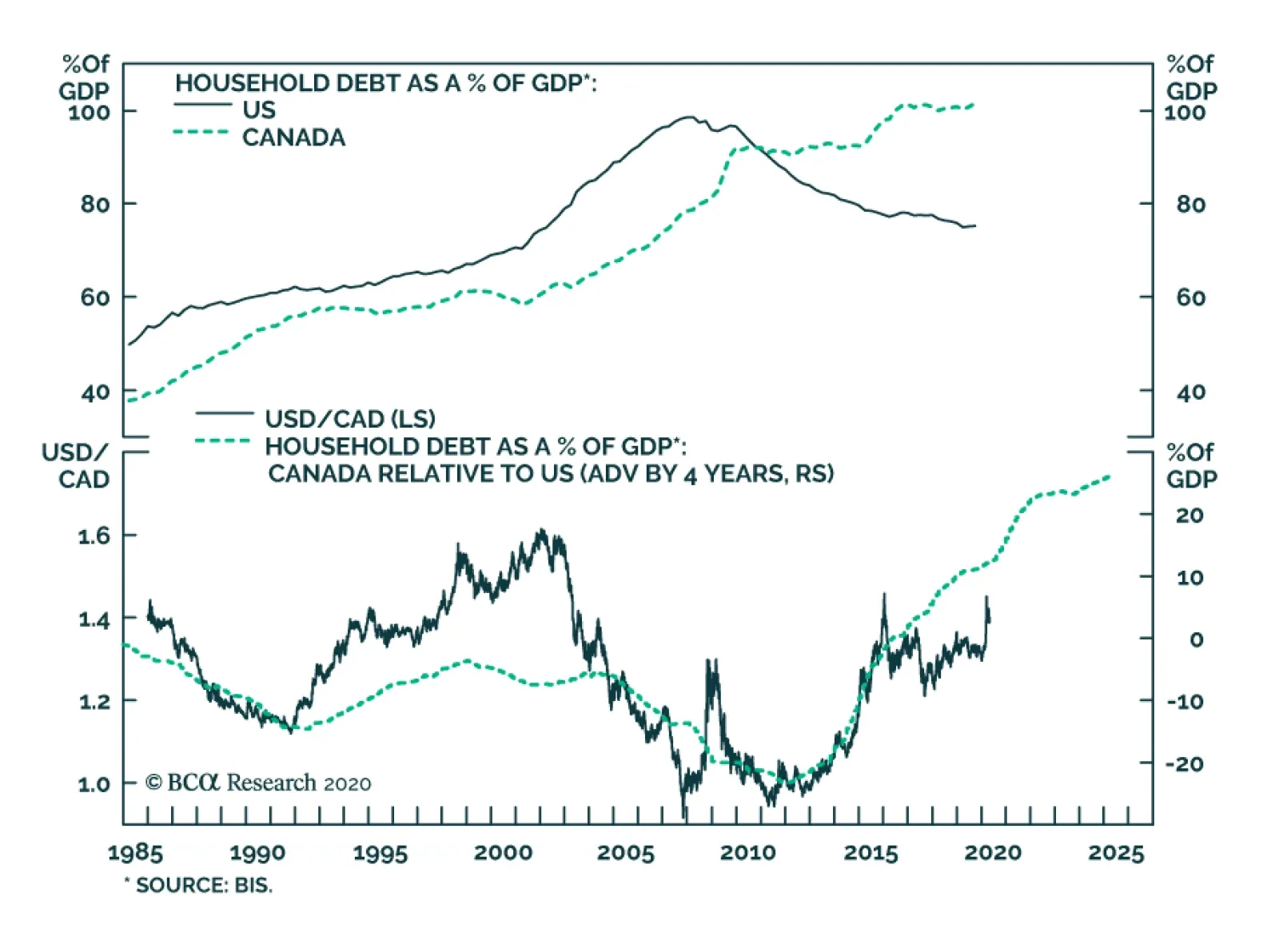

Last Friday, BCA Research's Foreign Exchange Strategy service highlighted various reasons why the CAD will not benefit as much from a rebound in oil prices as in previous instances. There has been a paradigm shift in oil production…

Highlights Competitive devaluation will remain the dominant policy landscape in the near term. This means that paradoxically, currencies with high and/or positive long-term interest rates remain at risk. The CAD may be the next shoe…