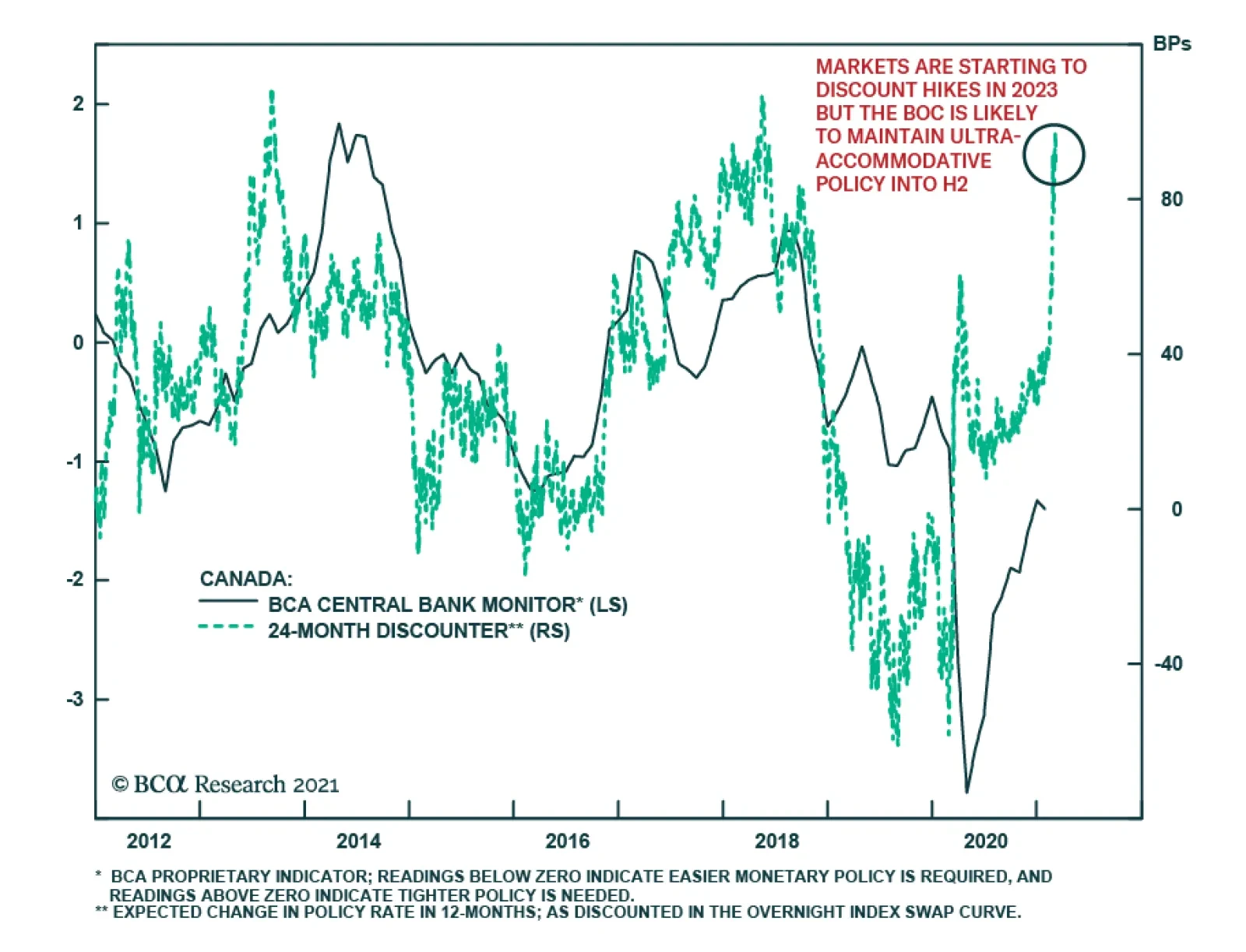

Canadian government bond yields fell sharply last Wednesday on the Bank of Canada’s more dovish than expected statement in which significant labor market slack was highlighted as a justification for maintaining an…

The Bank of Canada did not adjust policy at its Wednesday meeting. The overnight rate was held at 0.25% and the current pace of government bond purchases was maintained at a minimum CAD4 billion/week. Canadian bond markets…

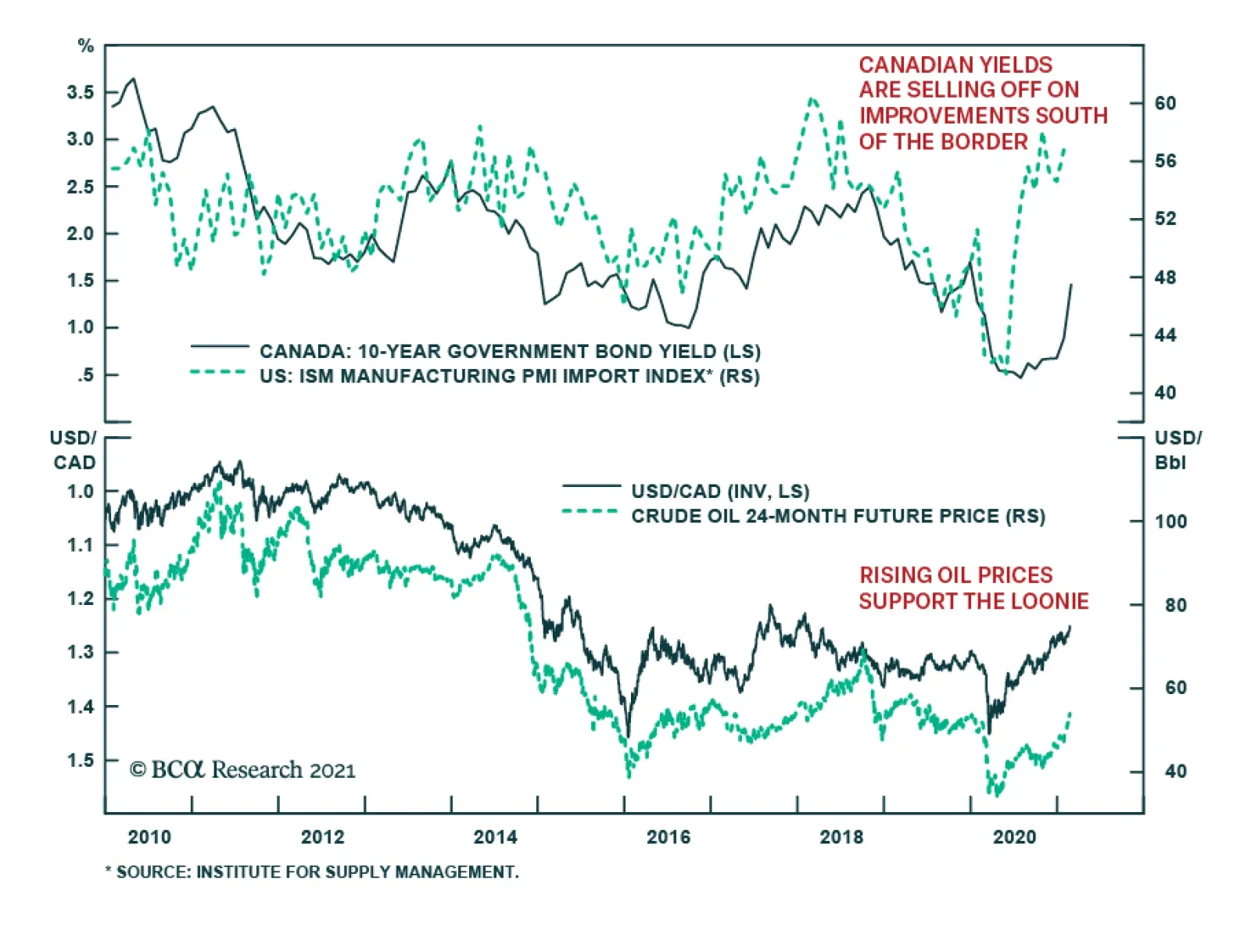

Highlights Rising Global Yields: The increased turbulence in global bond markets is part of the adjustment process to a more positive outlook for global economic growth. Rising real yields are now the main driver of nominal yield…

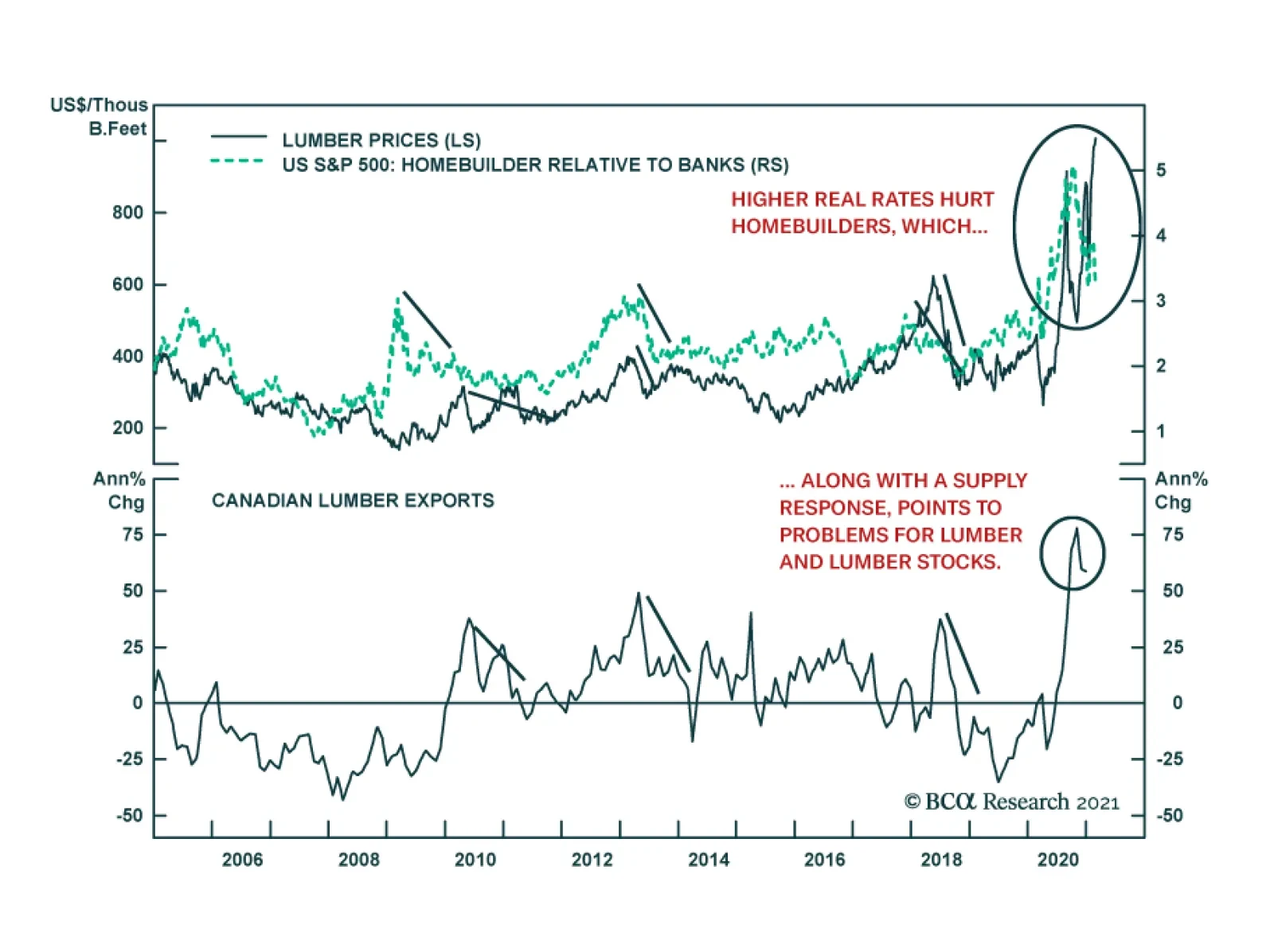

In January, we were too early recommending investors sell Canadian lumber stocks. Since then, the price of lumber only rose further, allowing these names to accrue additional gains. Despite this setback, the outlook for lumber…

Canadian government bond yields have been playing catch-up recently. 10-year yields are up more than 40 basis points since the beginning of the month, which represents a steep acceleration following a similar increase over the…

Highlights The pandemic is not yet over, but it appears that infections have peaked in the developed world and in most of the major developing economies. Economic growth will reaccelerate as social distancing abates and vaccination…

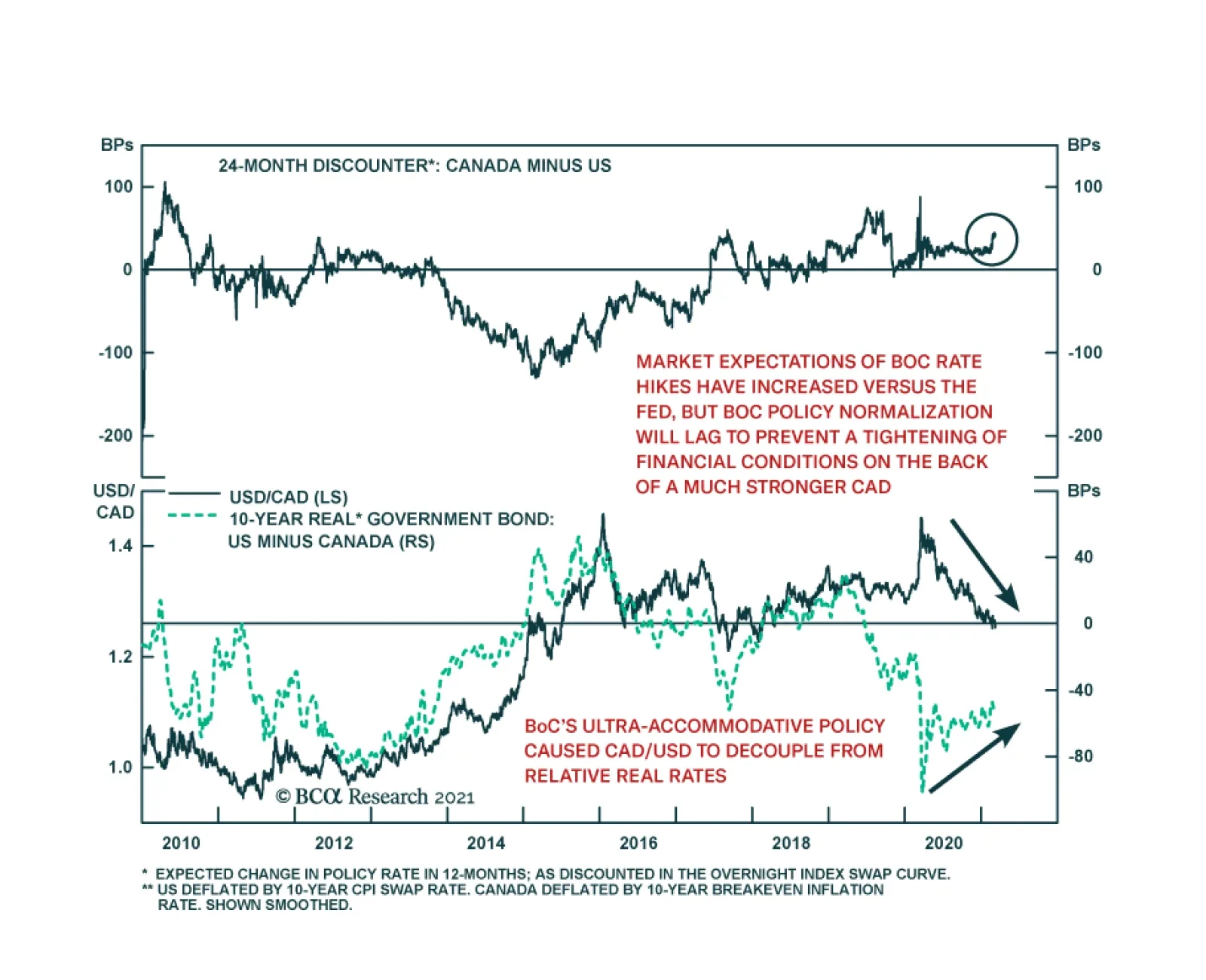

Highlights A rise in global bond yields has rarely been a reliable precursor of a stronger dollar. This is because the dollar reacts to interest-rate differentials, rather than the level of global yields. Changes in the dollar…

Highlights This week, we present the second edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook—a review of central bank surveys of bank lending standards and loan demand. Feature…

Highlights Global Yields: The fall in global bond yields over the past two weeks represents a corrective pullback from an overly rapid rise in inflation expectations, especially in the US. The underlying reflationary themes that drove…