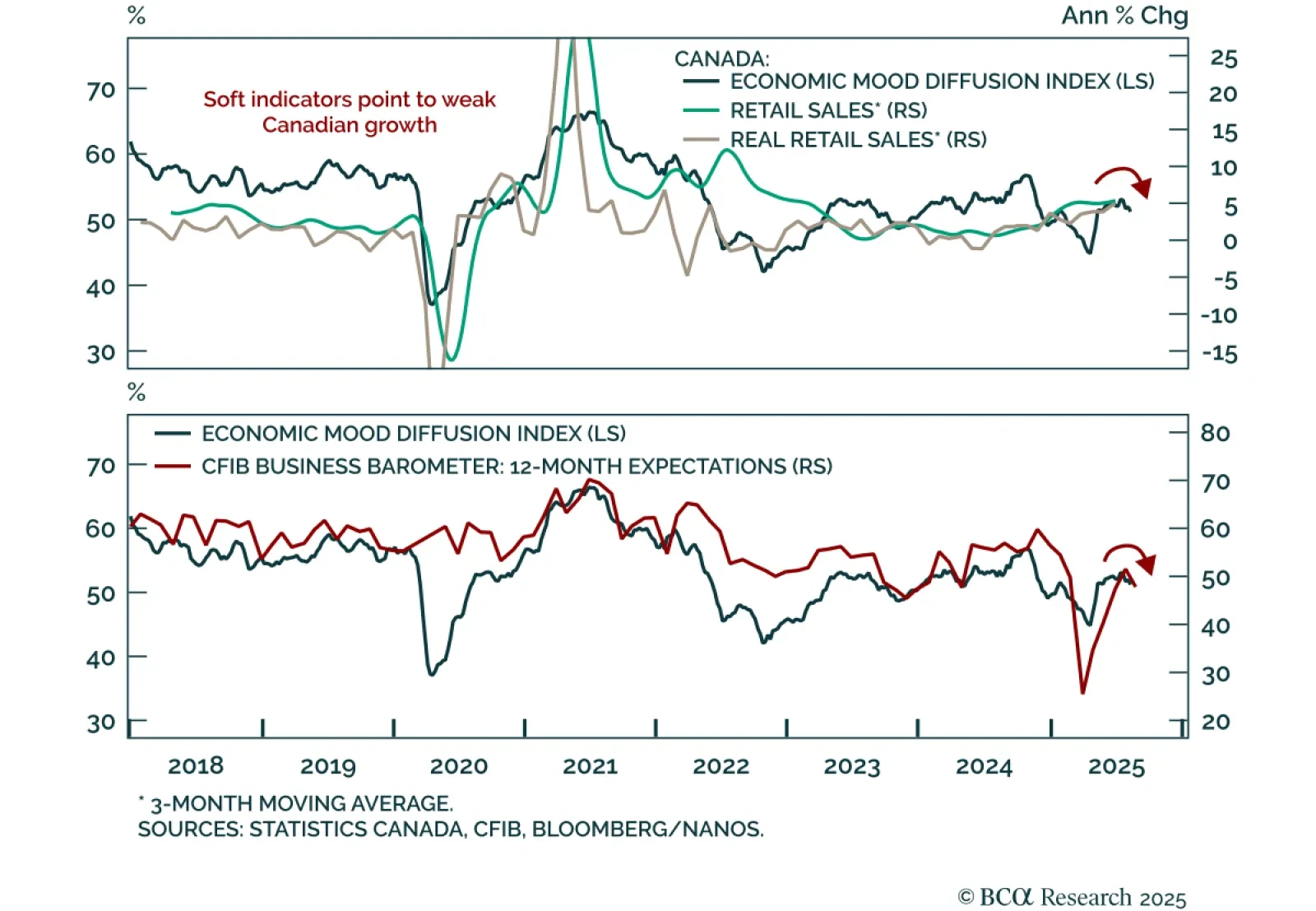

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

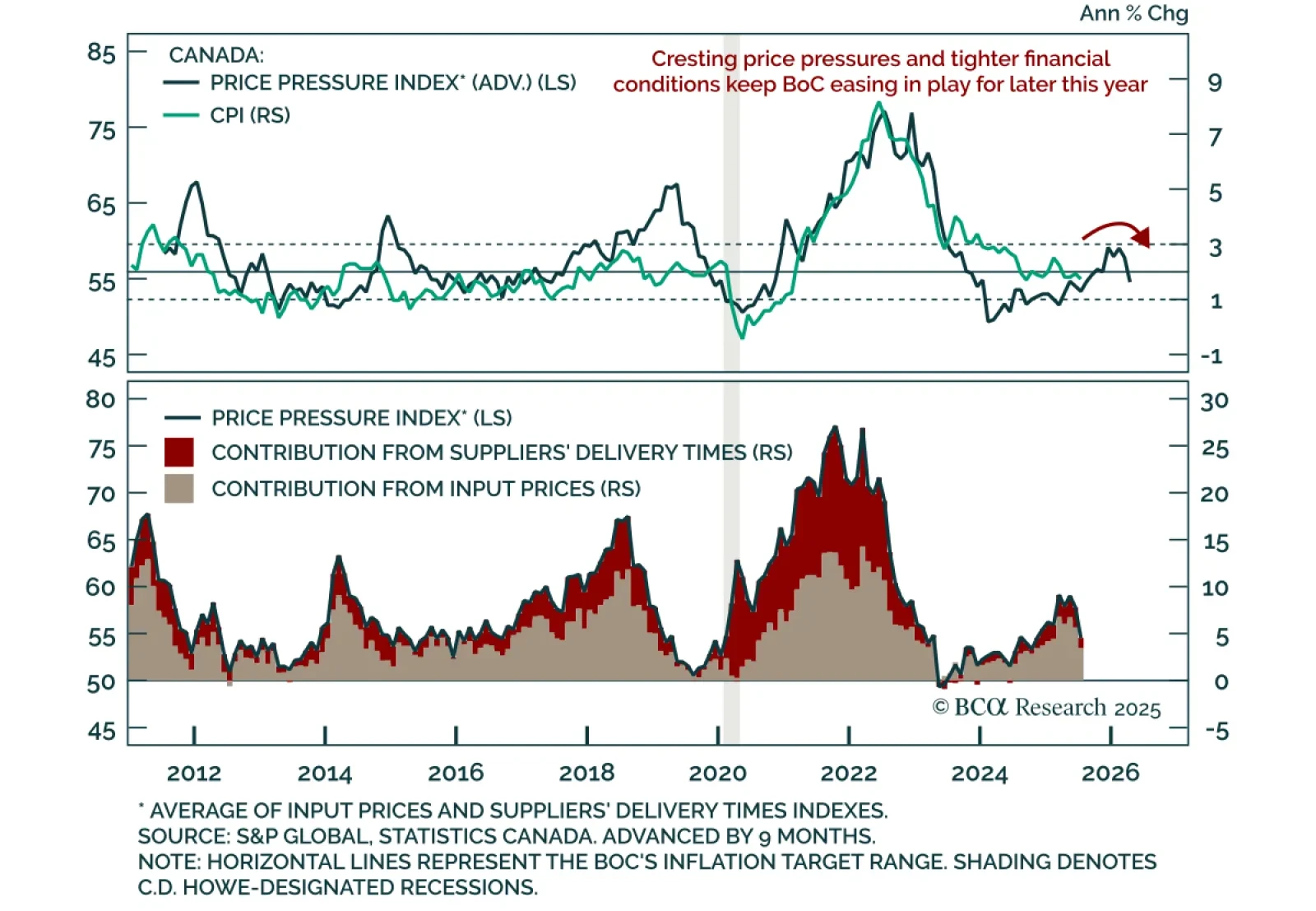

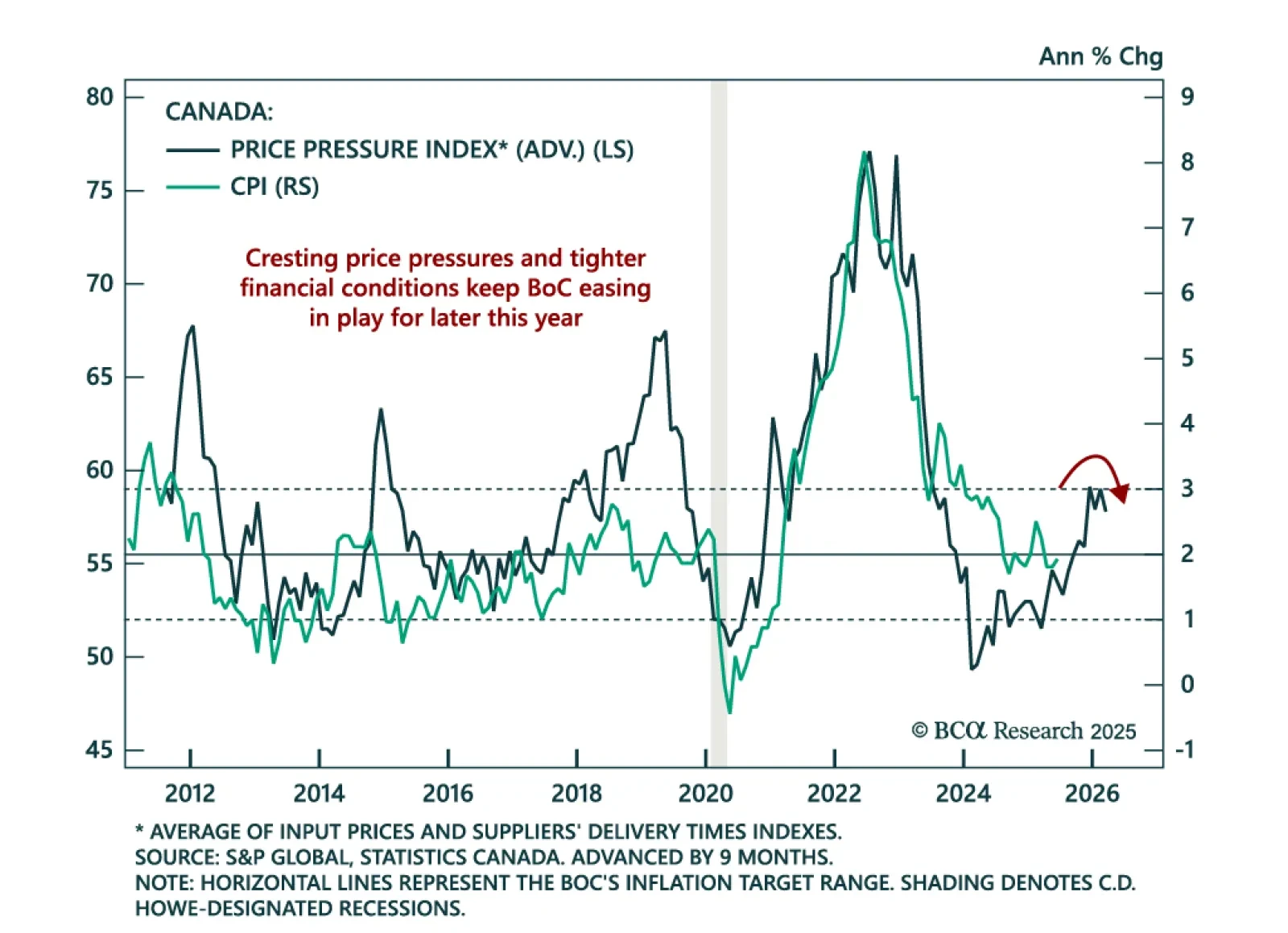

July’s softer Canadian inflation, set against lingering macro weakness, reinforces the case for more BoC easing than markets are currently pricing. Headline CPI slowed to 1.7% y/y from 1.9%, below expectations, driven by lower…

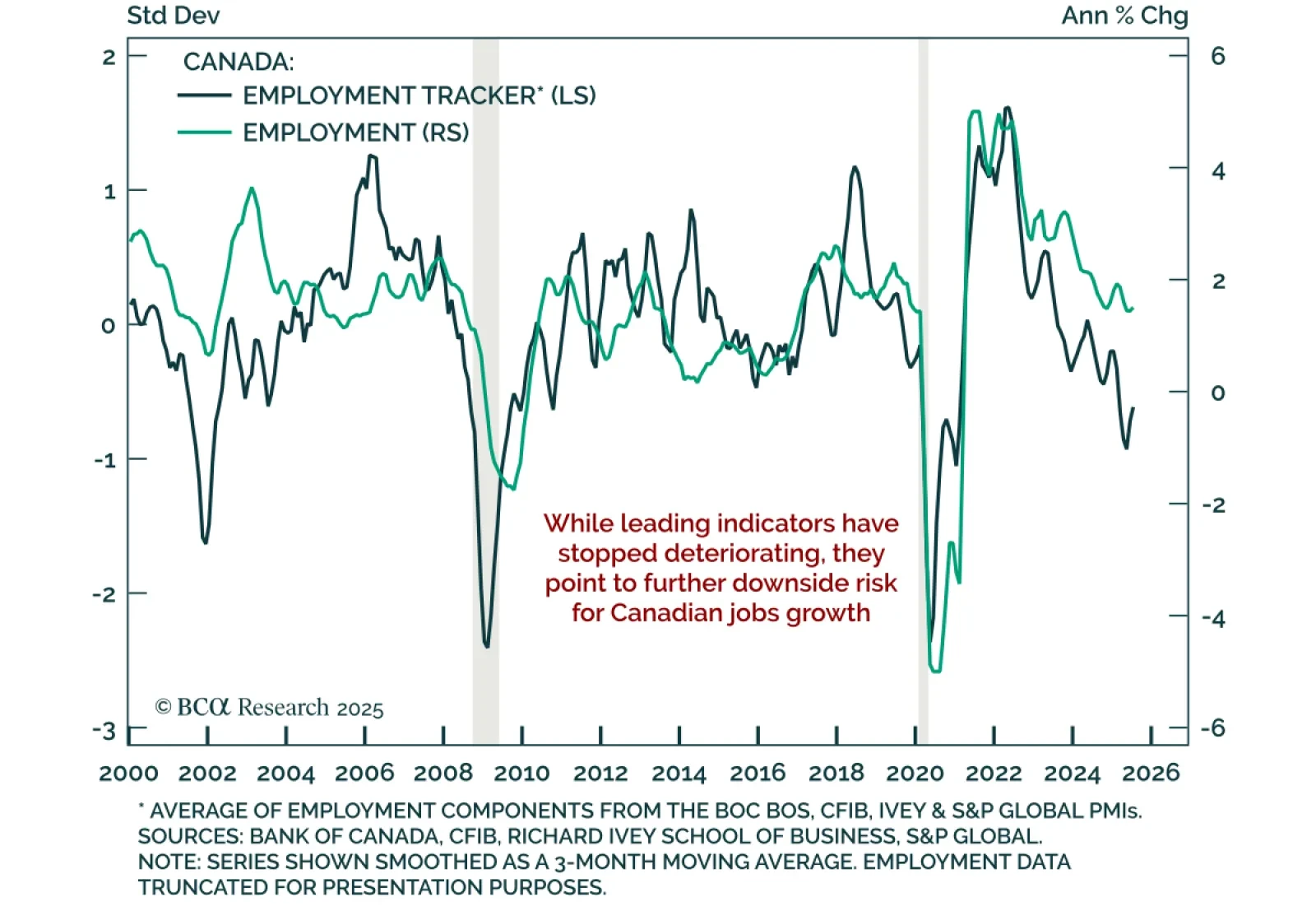

Canada’s July jobs report was mixed, but persistent slack and trade headwinds support our overweight in Canadian bonds and preference for 5s10s steepeners. Employment fell by 40.8k, driven by a 51k drop in full-time jobs, yet…

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

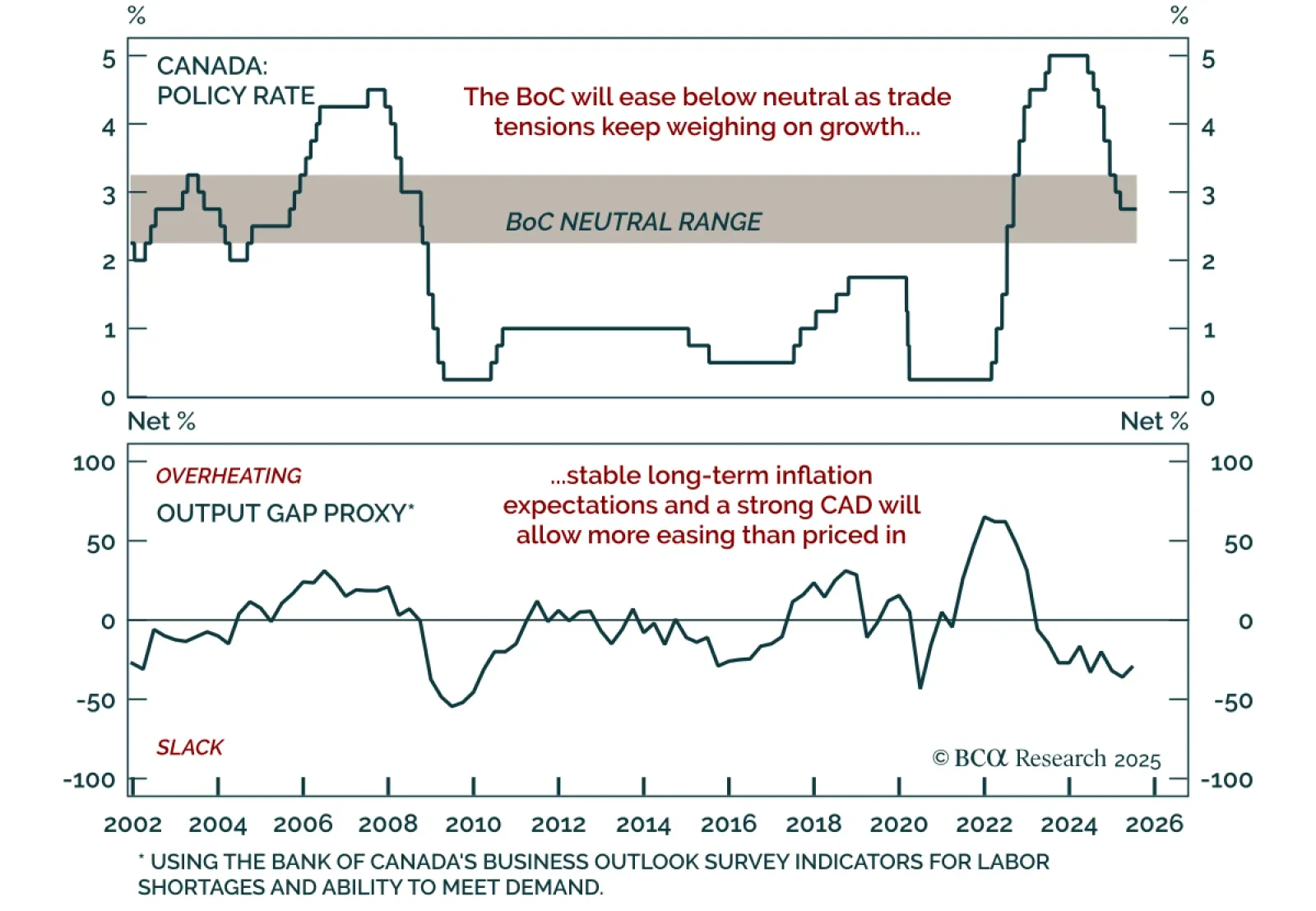

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

The Bank of Canada continues to hold its policy rate amid trade uncertainty and shows little concern about the potential economic damage from tariffs. We judge the risks differently and view a bet on more rate cuts this year as…

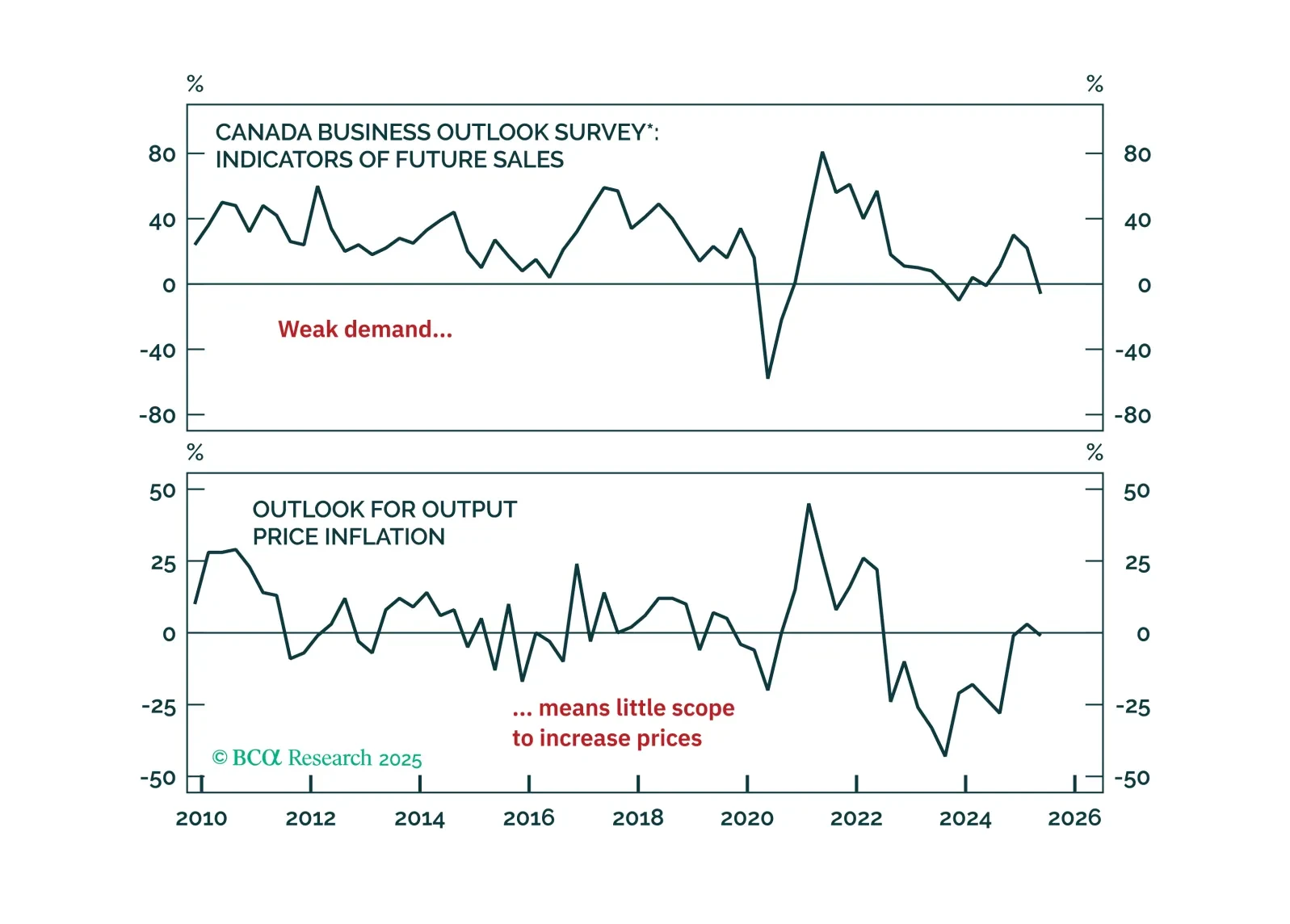

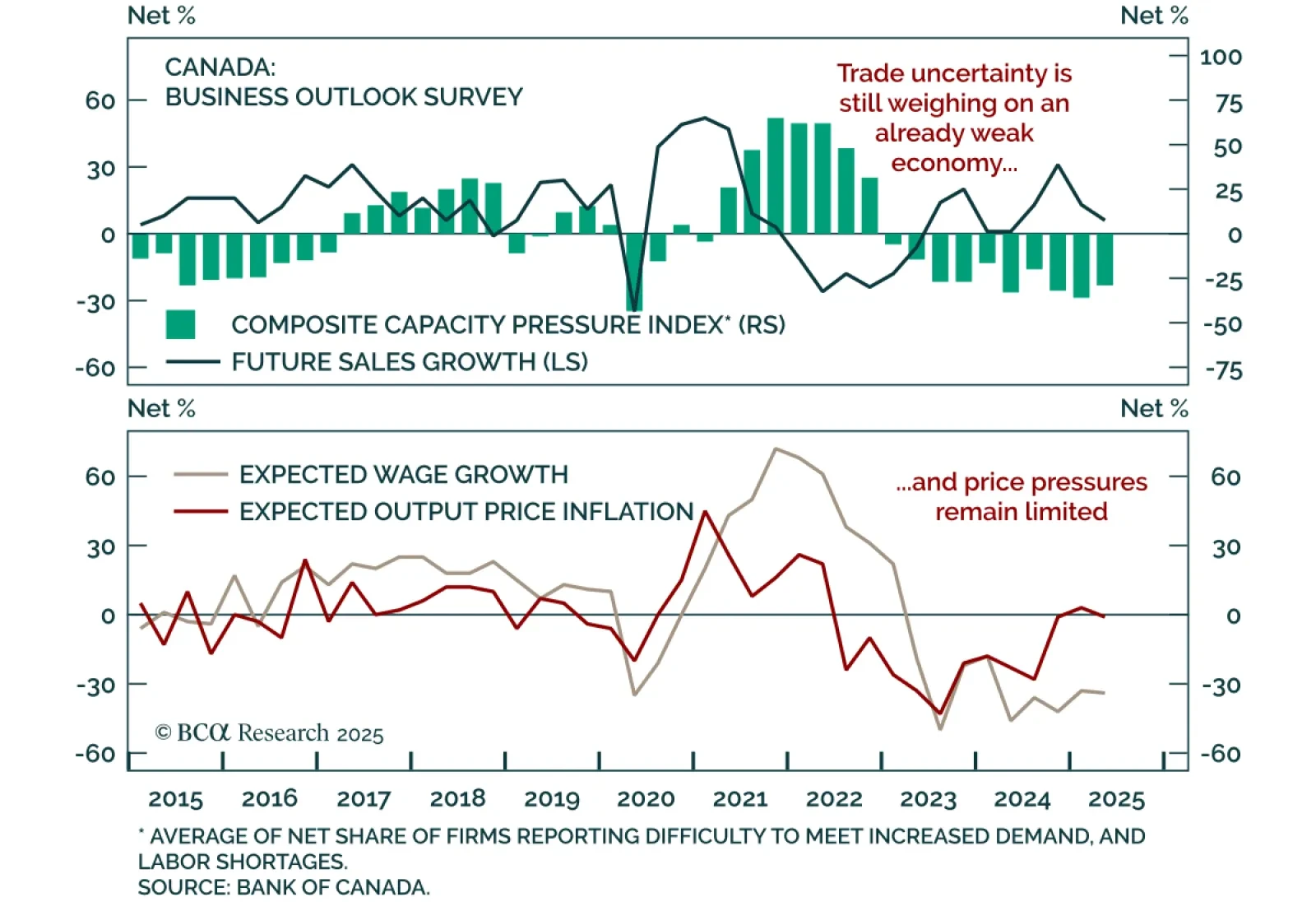

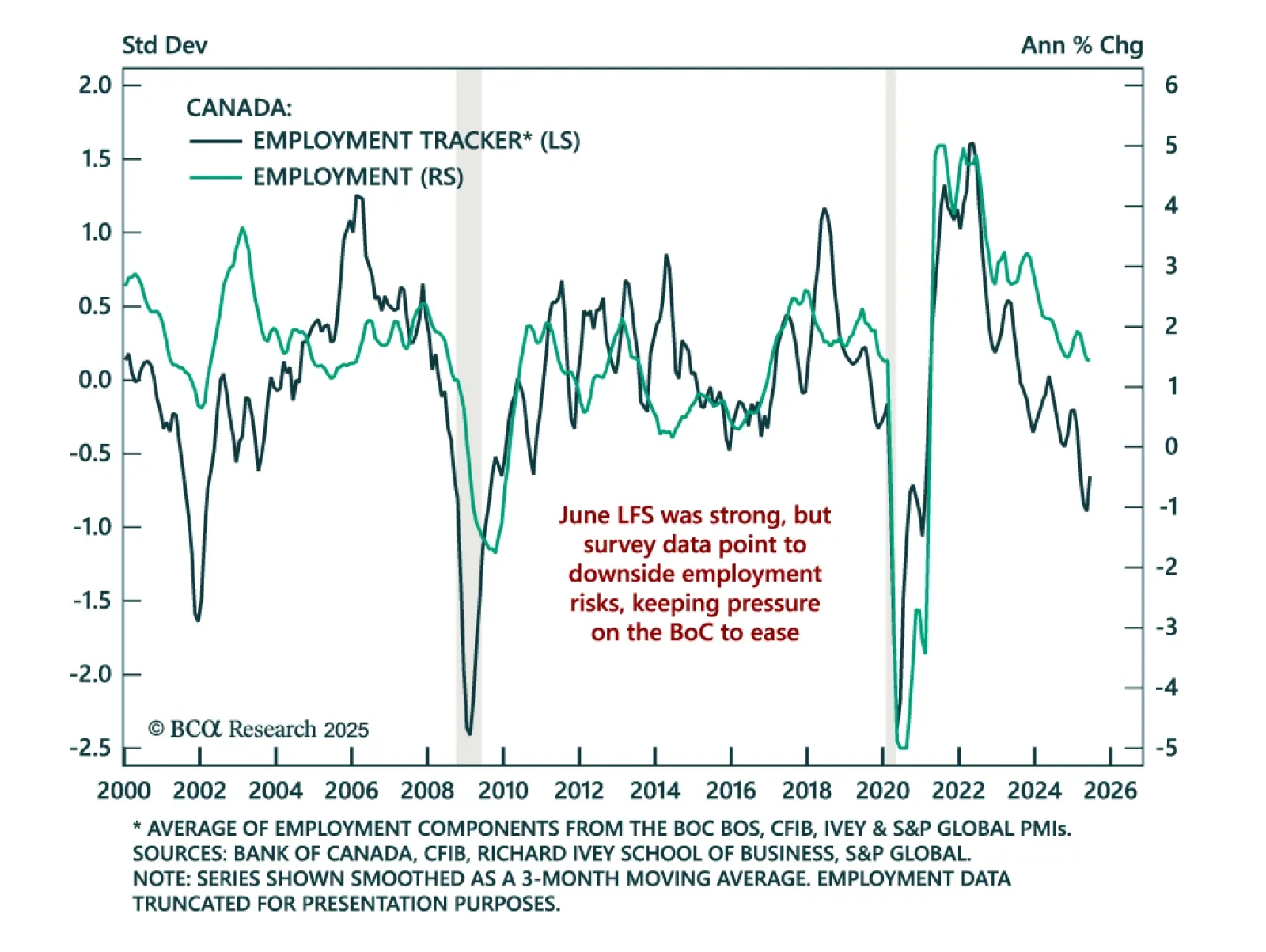

The Q2 Business Outlook Survey showed weaker sentiment and subdued hiring and investment intentions, reinforcing the case for deeper BoC rate cuts and our overweight in Canadian bonds. The BOS indicator ticked down to -2.4 from -2.1…

Canada’s inflation re-acceleration makes a BoC July cut unlikely, but softening growth and tight financial conditions keep easing on the table. June headline inflation rose to 1.9% y/y from 1.7%, roughly in line with expectations.…

June’s strong Canadian jobs data does not argue against further easing and a CGBs overweight. Employment rose by 83.1k versus expectations for no growth, the first increase since January. The unemployment rate fell to 6.9% from 7.0…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.