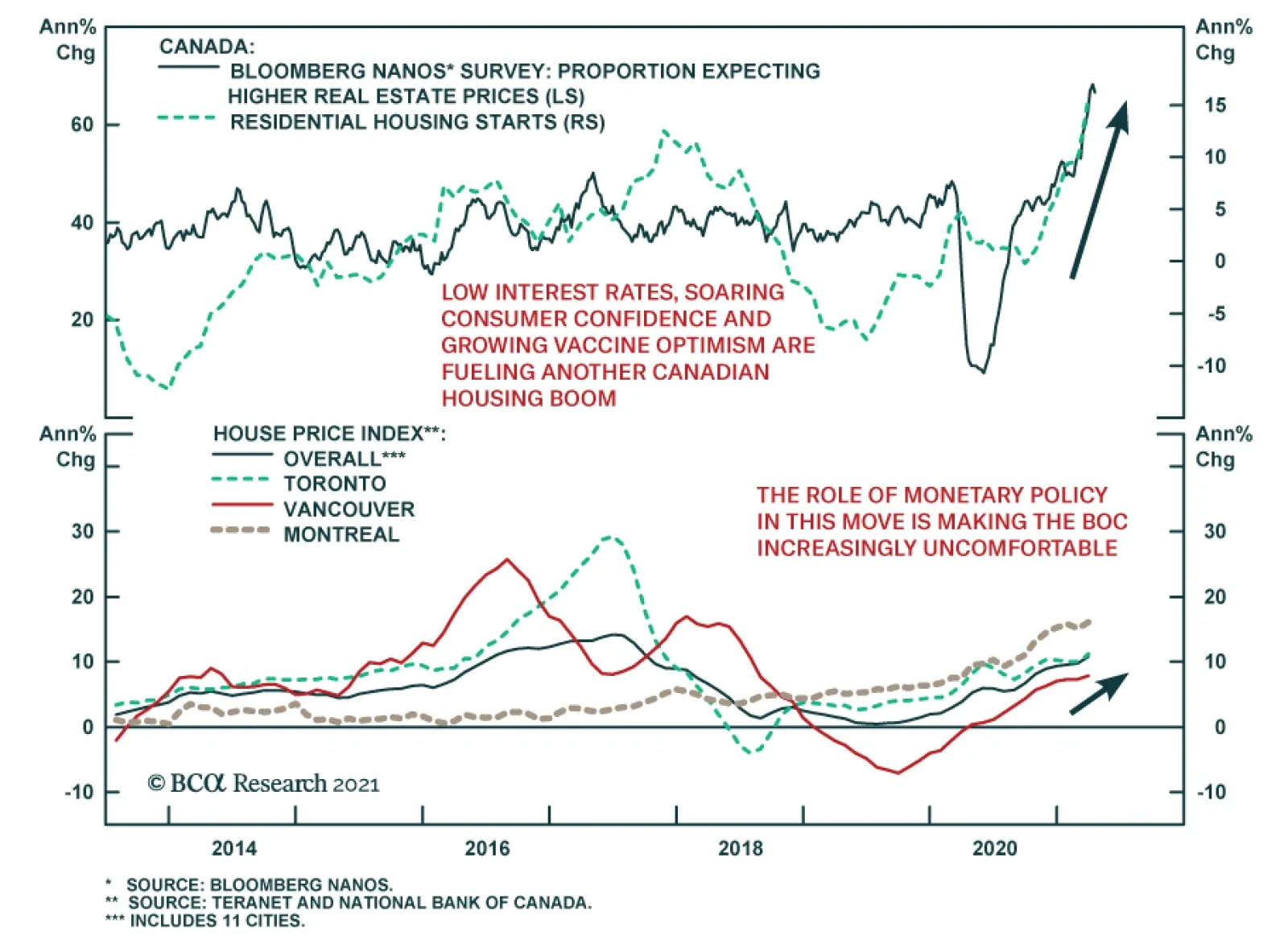

The Bank of Canada’s big moment arrived. Starting next week, the central bank will reduce weekly government debt purchases to C$3 billion/week from C$4 billion/week. The tapering decision comes on the back of a significant…

This is an important week for Canadian financial markets, full of implications for the future path of economic growth, monetary policy, interest rates and the currency. The week started off with a booming data point. Canadian…

Highlights Chart of the WeekThe Bond Bear Mantle Being Passed To Canada? US Treasuries: The steady climb of US bond yields has left longer-maturity Treasuries in an oversold position. However, underlying growth and inflation…

Highlights There are tentative signs that US growth outperformance is ebbing. The recovery in the manufacturing sector abroad is already taking leadership from the US. This trend will soon rotate to the service sector. As such, long-…

Highlights Global Inflation: The case for maintaining a strategic overall allocation to inflation-linked bonds (ILBs) versus nominal government debt in dedicated global fixed income portfolios remains intact. Global growth expectations…

Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights Q1/2021 Performance Breakdown: Our recommended model bond portfolio outperformed the custom benchmark index by +55bps during the first quarter of the year. Winners & Losers: The government bond side of the portfolio…

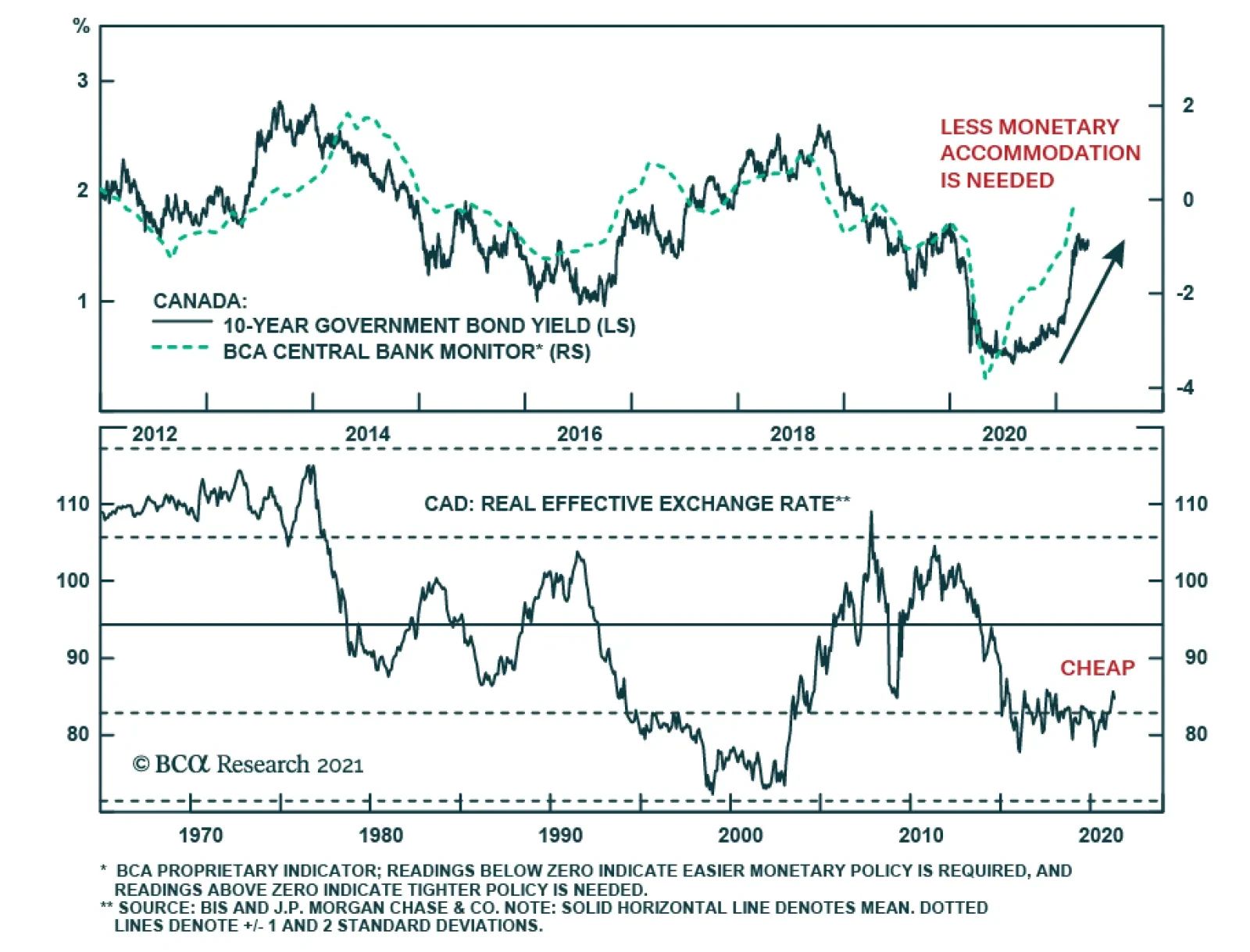

Highlights Central Bank Expectations: Market expectations of short-term interest rate moves over the next few years are inching higher. The potential for markets to offer a greater bond-bearish challenge to the current highly dovish…

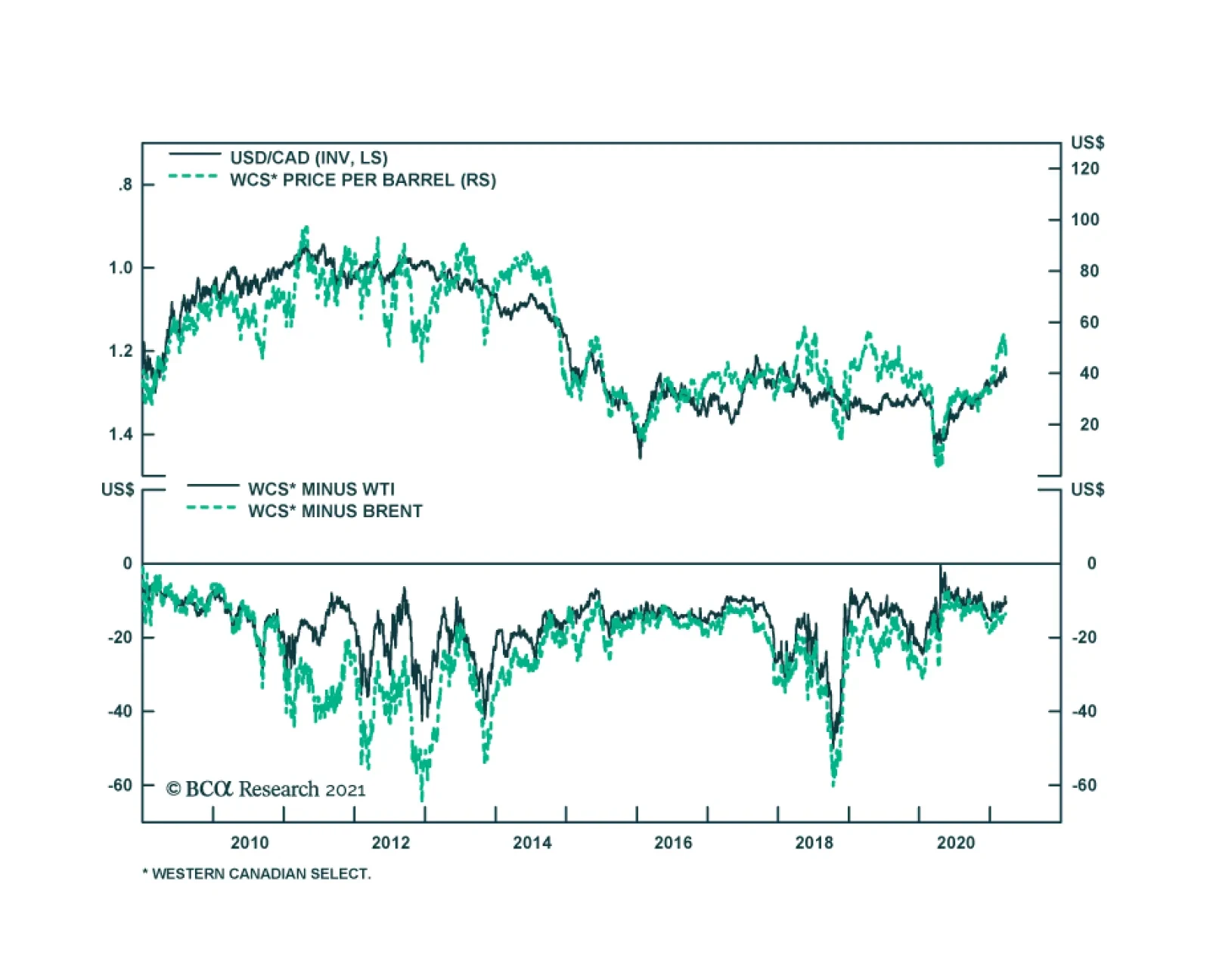

Crude oil prices peaked in early March this year, but among the commodity and G10 currencies, the Canadian dollar has fared relatively better. Since the peak in oil prices, NOK, AUD and NZD are down over 1%. The CAD is however up…

Highlights Global Duration: Markets are correctly interpreting the $1.9 trillion US fiscal stimulus package as a factor justifying higher global growth expectations and bond yields. Maintain a below-benchmark stance on overall global…