Highlights Confidence vs. Inflation: Global bond yields are lacking direction at the moment. The variant is setting a near-term ceiling on bond yields while the medium-term floor is established by inflation. The inflation pressures…

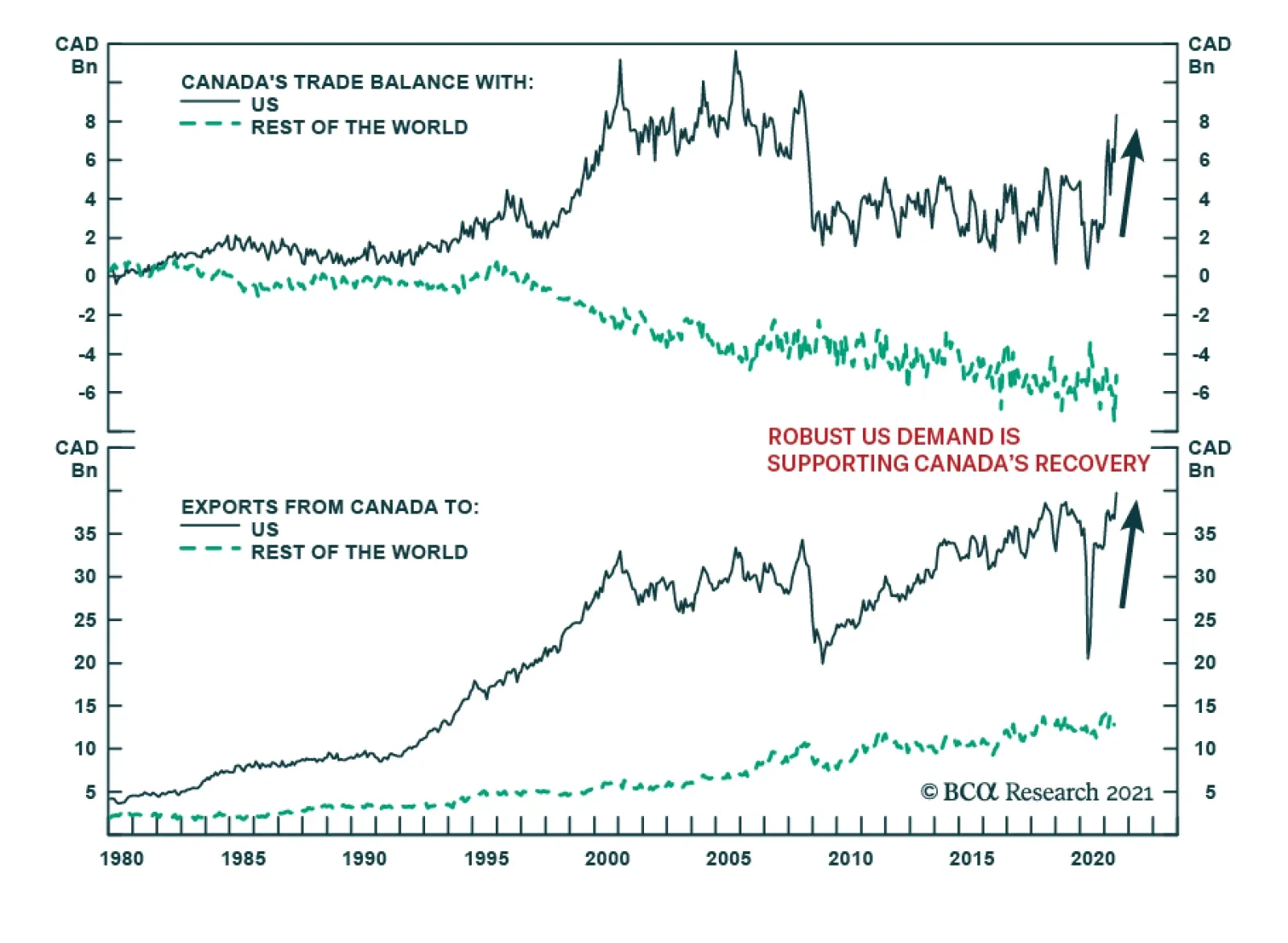

The US trade deficit jumped 6.7% to a record USD75.7 billion in June, a good USD 1.5 billion above expectations. The wider deficit reflects a 2.1% increase in US imports, which outpaced the 0.6% rise in exports. Strong imports…

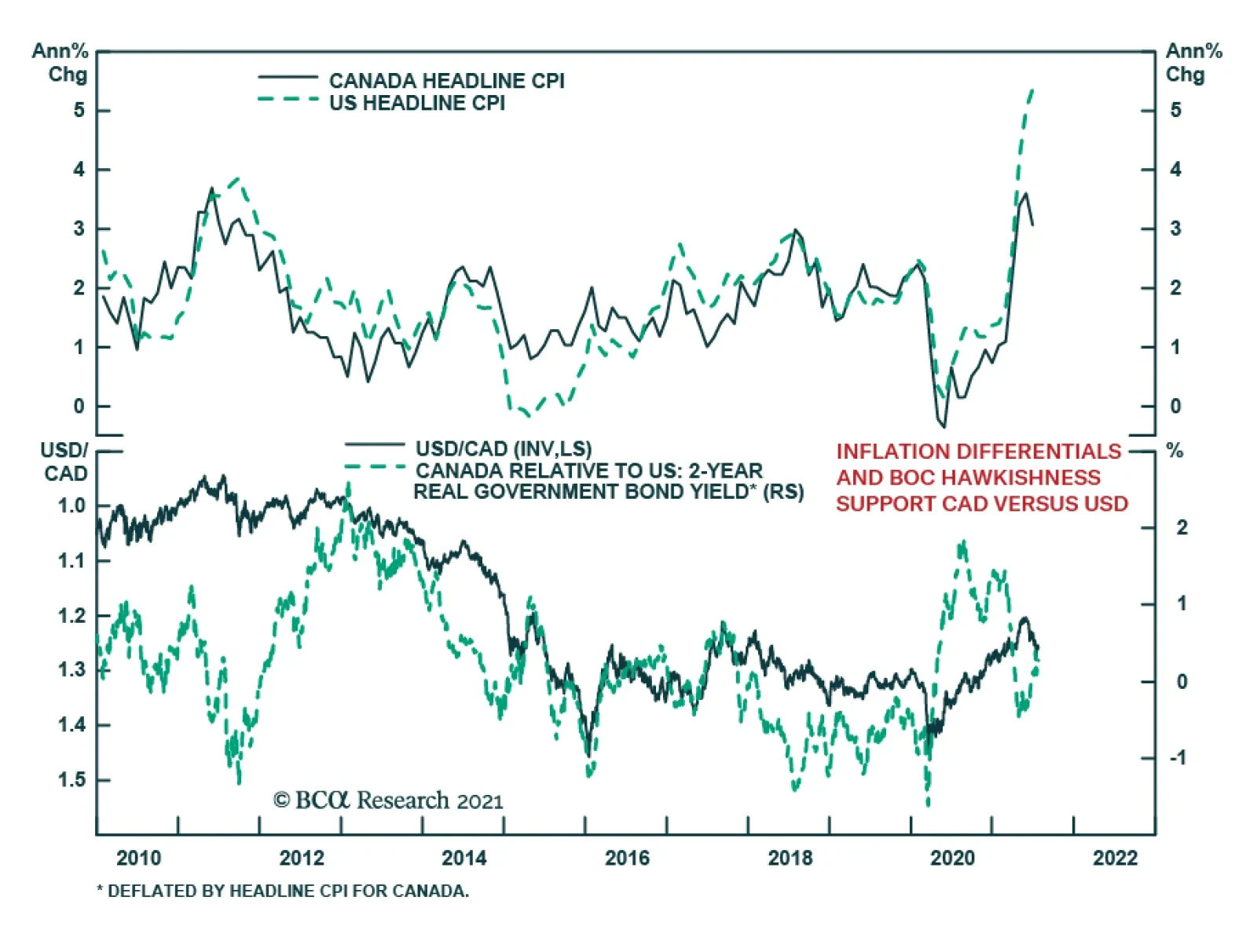

Canada’s June CPI inflation report suggests that inflationary pressures are moderating. The headline index eased to 3.1% y/y from 3.6%, falling below expectations of 3.2%. The deceleration is corroborated by softer prints…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

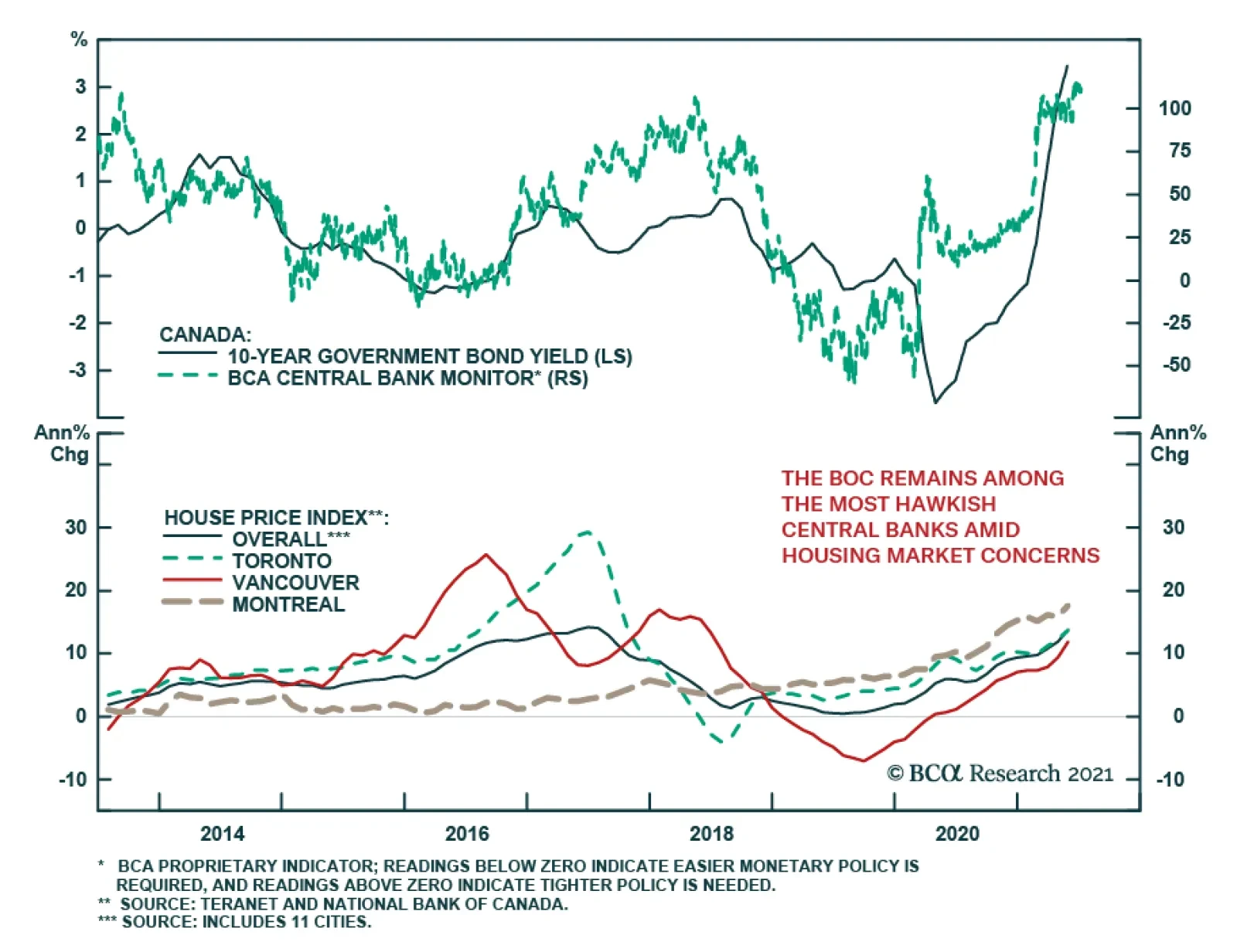

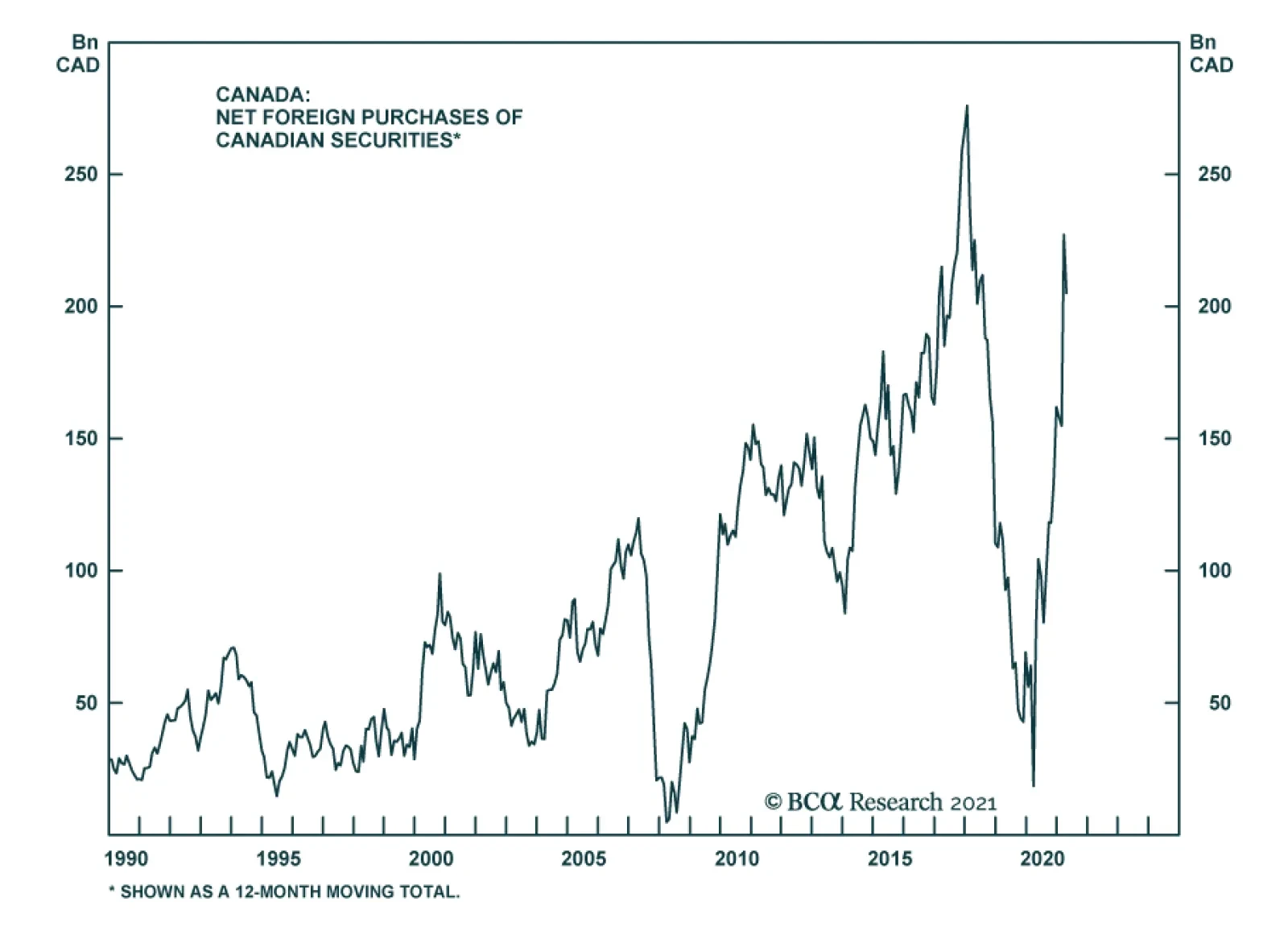

The Bank of Canada cemented its position as one of the most hawkish major central banks on Wednesday by taking another step towards normalizing policy. Governor Tiff Macklem announced the central bank will reduce its weekly…

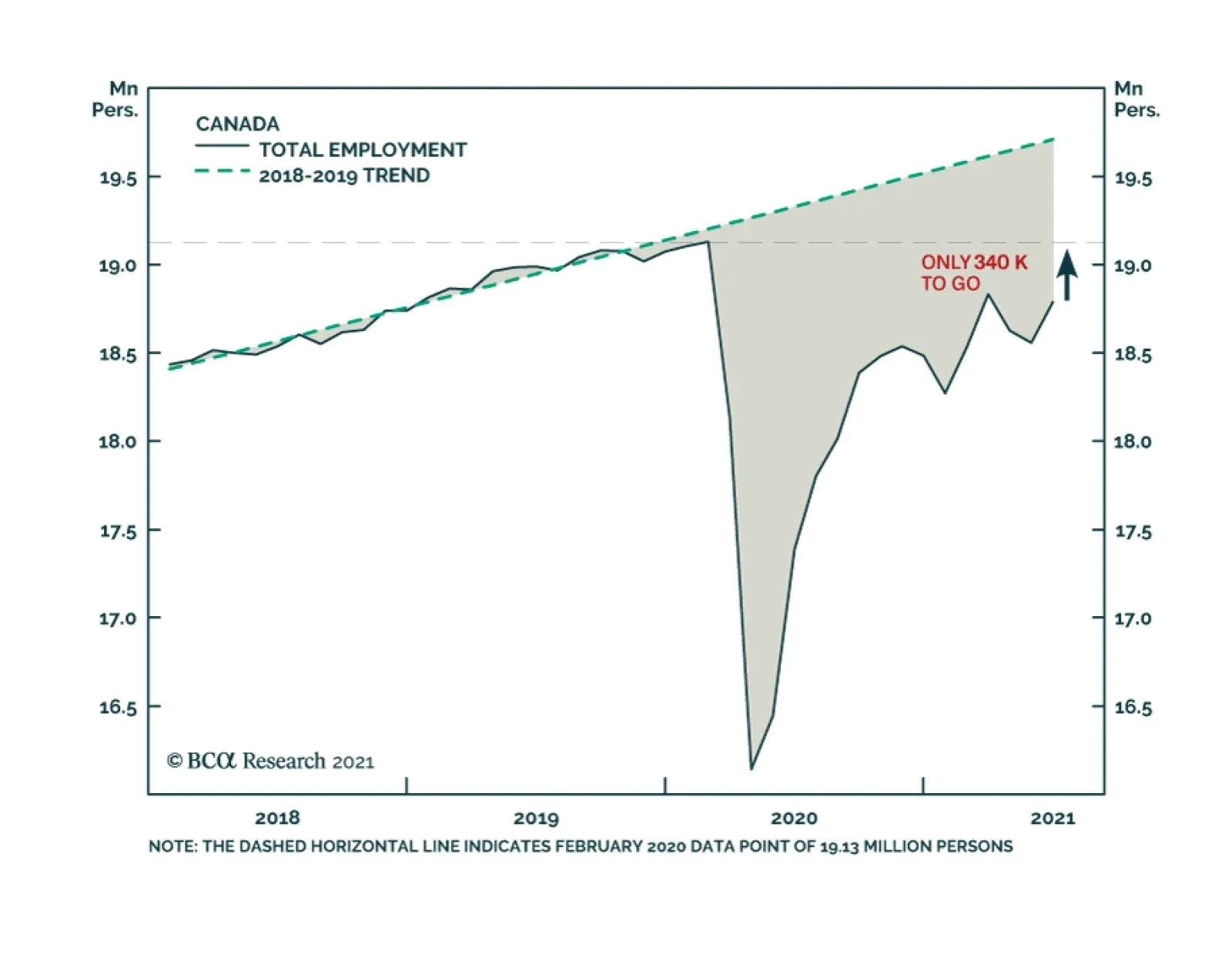

Canadian employment growth in June was robust at 231,000, a big improvement over the losses incurred over the prior two months. The latest month’s growth was driven mainly by a 264,000 increase in part-time jobs: full-time…

GFIS Model Bond Portfolio Q2/2021 Performance Review & Current Allocations: Hitting A Few Roadblocks

Highlights Q2/2021 Performance Breakdown: Our recommended model bond portfolio underperformed the custom benchmark index by -6bps during the second quarter of the year. Winners & Losers: The government bond side of the portfolio…

The Canadian economy is humming. The latest evidence came out of the most recent quarterly Business Outlook Survey, a key barometer of the Canadian economy for investors. The Business Outlook Survey indicator hit the…

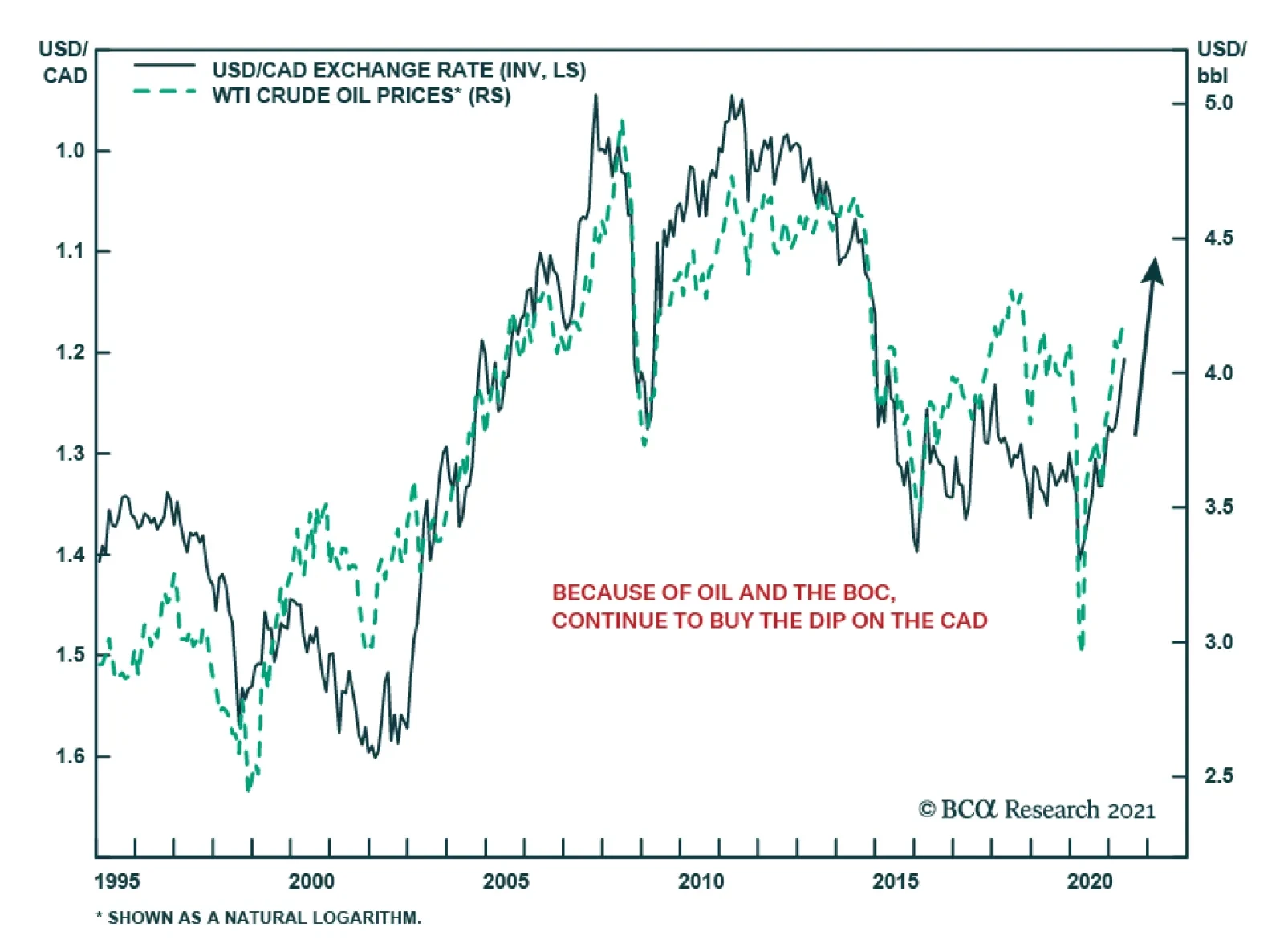

The price of oil remains the biggest driver of USD/CAD, even if the relationship between the two assets is not as close as it once was. Crude and the USD still display a strong negative correlation. Oil is a very pro-cyclical…