Highlights Federal Reserve: Market turbulence will not dissuade the Fed from starting to hike rates in March, with longer-term consumer inflation expectations climbing steadily higher. Given the choice of fighting high inflation or…

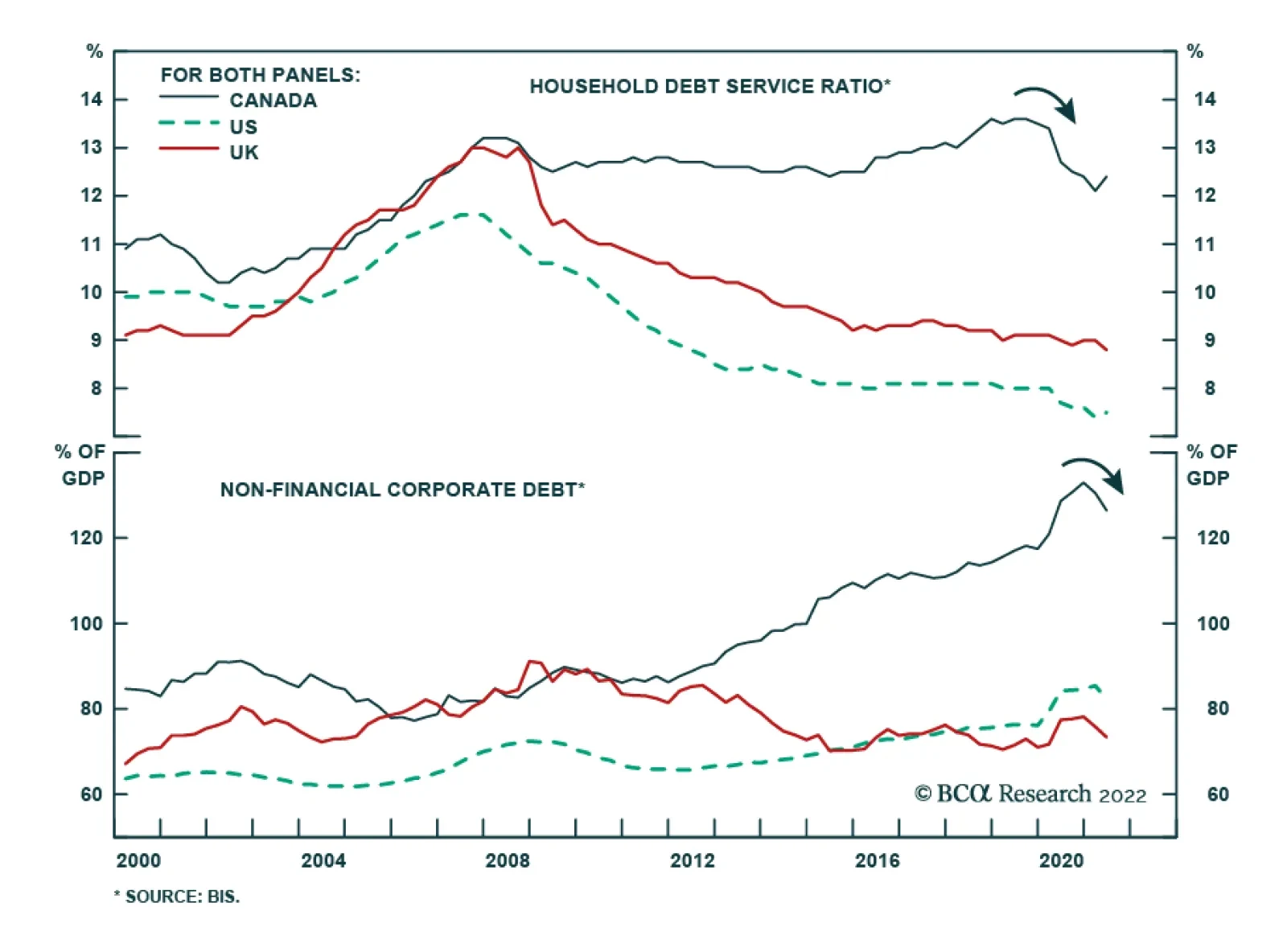

Market participants have aggressively increased their rate hike expectations for Canada over the coming year. Recent data supports this shift. Canada’s headline inflation rate rose to a fresh 30-year high of 4.8% in…

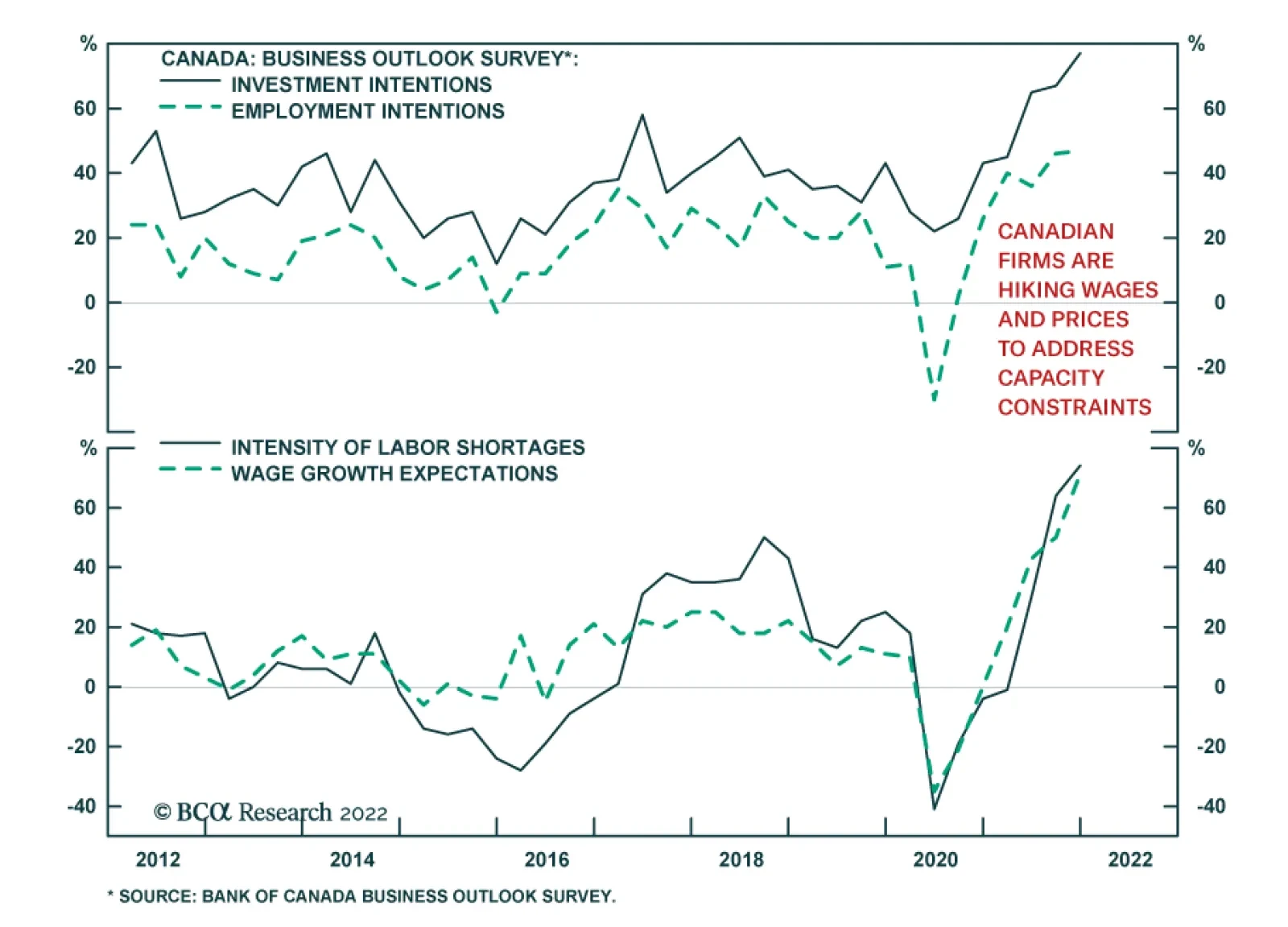

The Bank of Canada’s Q4 Business Outlook Survey reveals that Canadian firms continue to face capacity pressures. The headline BoS indicator strengthened to 6 in Q4 from 4.6 in Q3. This increase reflects an improvement in…

Highlights 2022 Key Views & Allocations: Translating our 2022 global fixed income Key Views into recommended positioning within our model bond portfolio results in the following conclusions to begin the year. Target a moderate…

Highlights Global growth will remain above-trend in 2022, although with more divergence between regions than at any time during the pandemic (US strong, Europe steady, China slowing). Global inflation will transition from being driven…

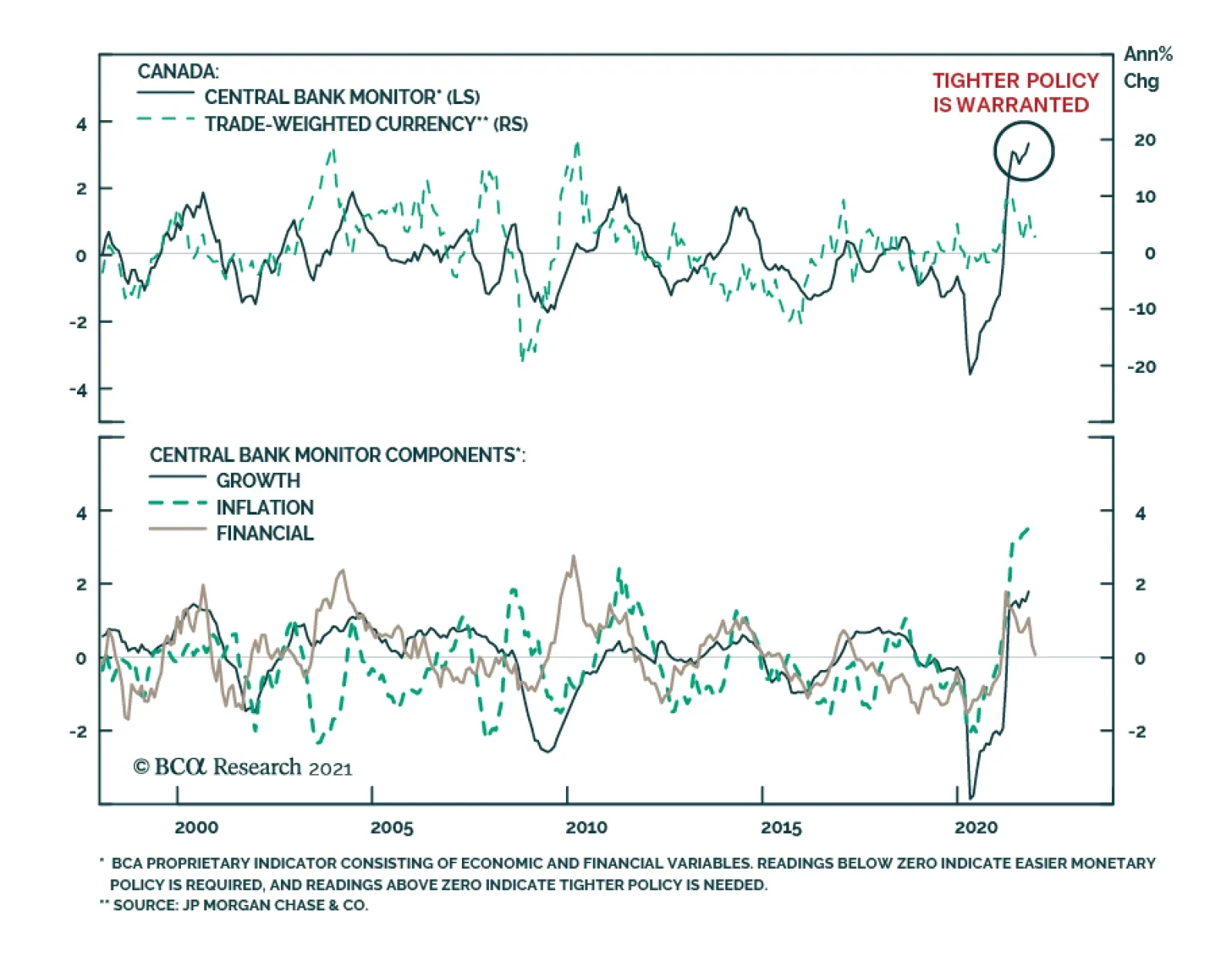

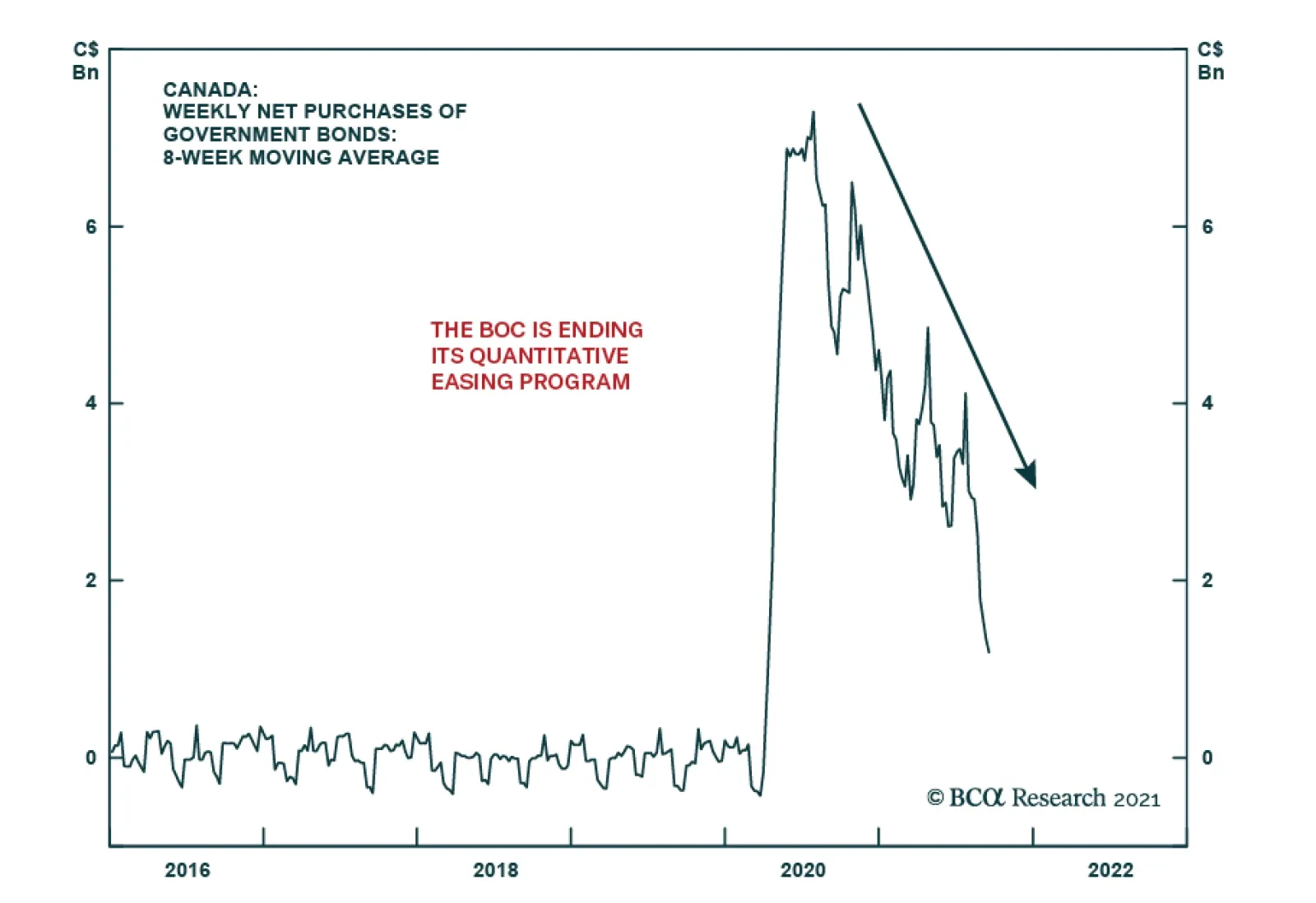

As expected, the Bank of Canada kept interest rates unchanged at its Wednesday meeting and remains in the reinvestment phase to maintain its holdings of Canadian government bonds stable. The post-meeting statement acknowledged…

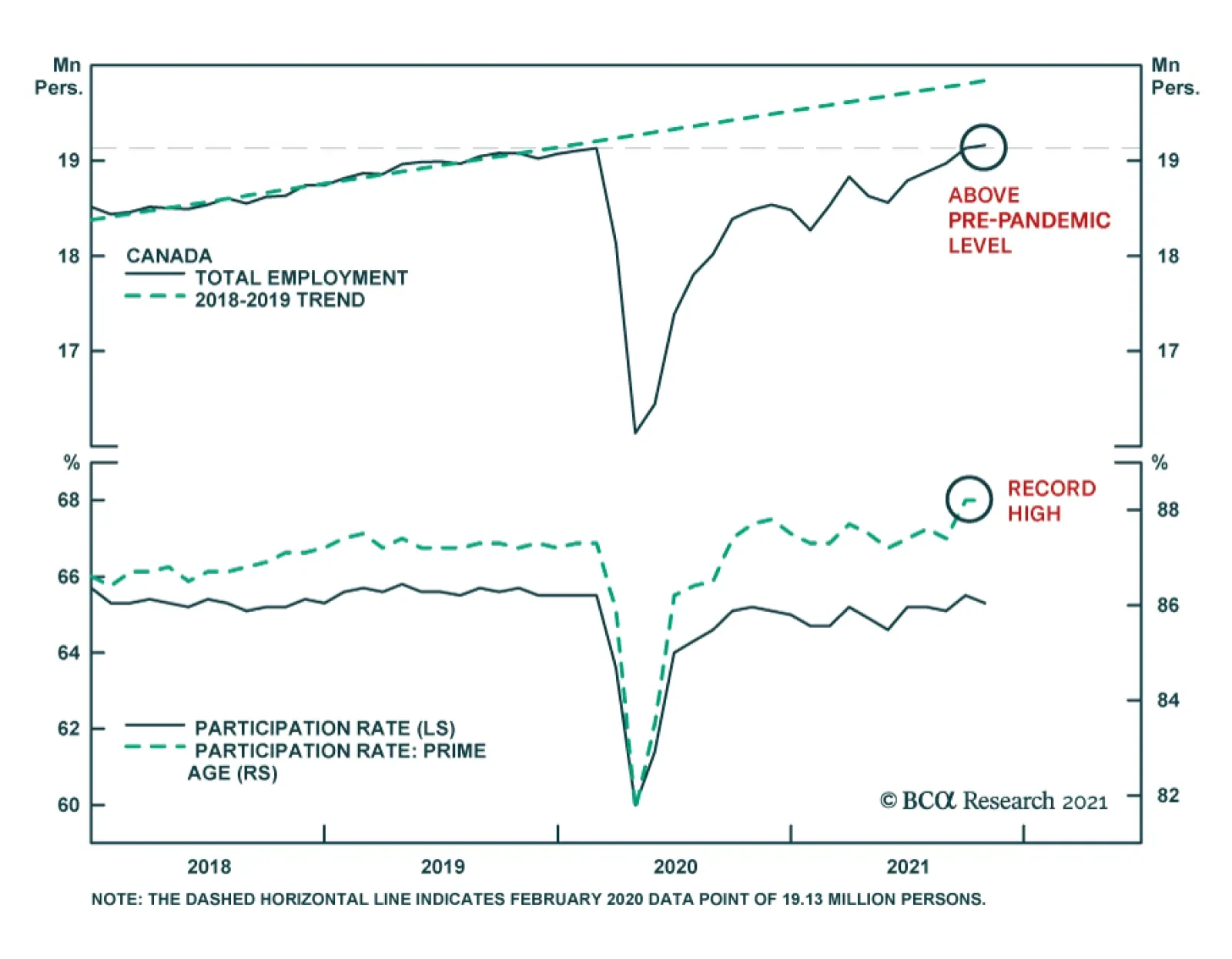

Canada’s labor force survey revealed that the pace of job gains slowed in October after employment returned to its pre-pandemic level in September. Employment increased by 31.2 thousand – below the anticipated 41.6…

The Bank of Canada delivered a hawkish surprise on Wednesday. It announced the end of its quantitative easing program. Instead it is shifting to the reinvestment phase whereby it will only purchase bonds to replace maturing ones…

Highlights Bank of Canada: Rising inflation, high capacity utilization, and monetary policy constraints will force the Bank of Canada to taper further and move up the timing of its first rate hike to H1/2022. Stay underweight Canadian…