Executive Summary Will The War Stall The Expected Downturn In Inflation This Year? The Russia/Ukraine conflict is impacting financial markets across numerous channels – uncertainty, risk aversion, growth expectations…

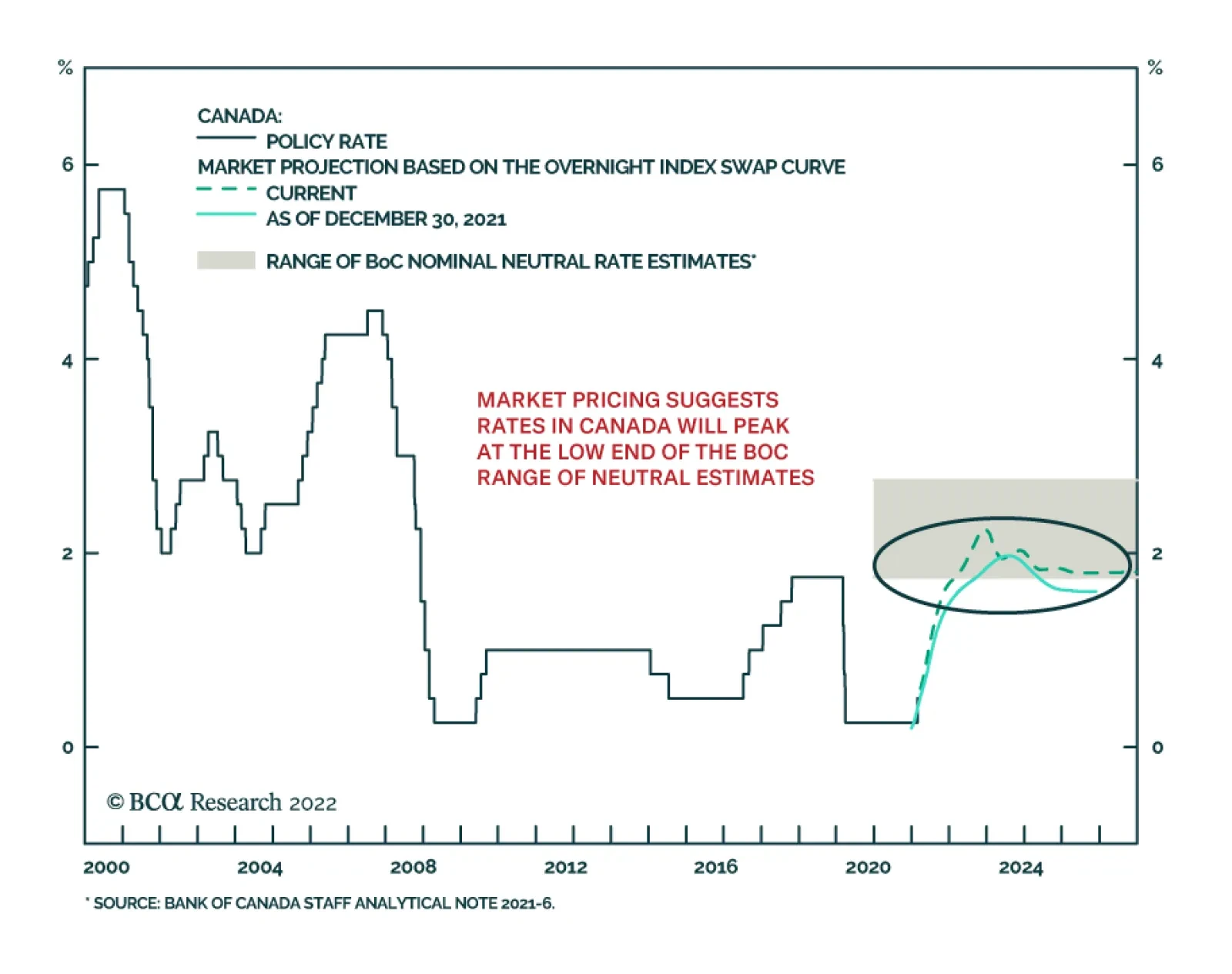

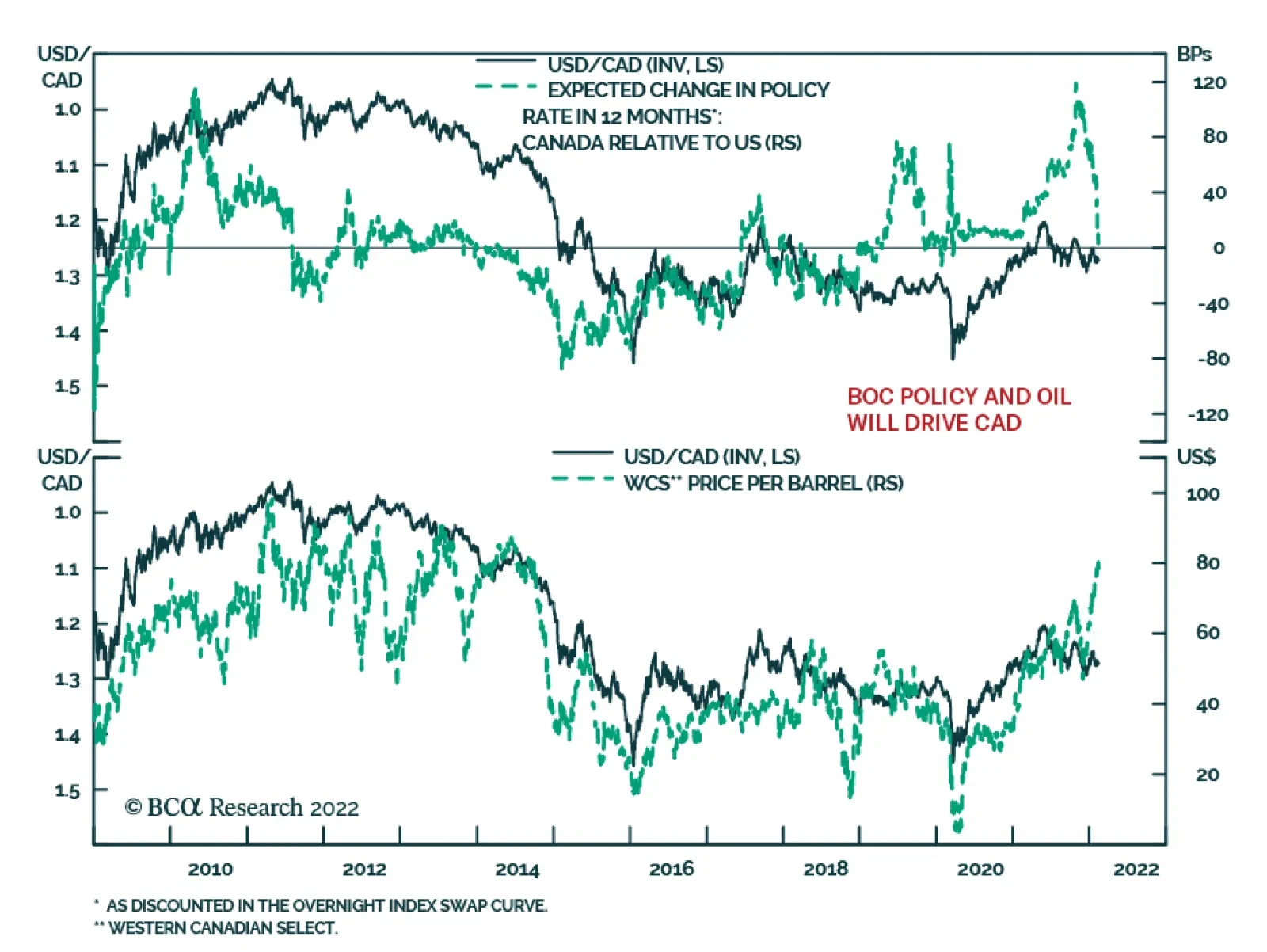

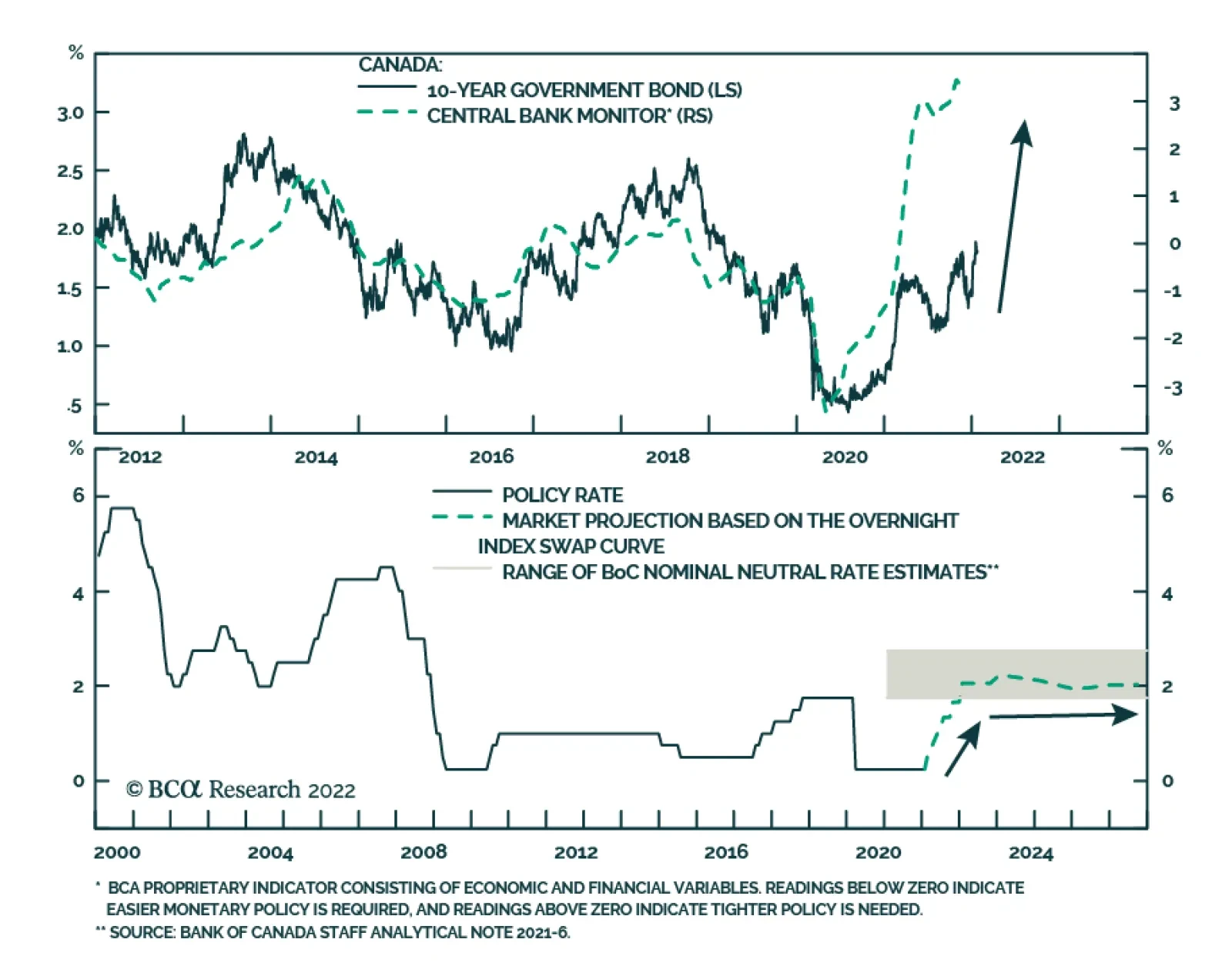

The Bank of Canada (BoC) raised its policy interest rate by 25bps to 0.5% yesterday, commencing the start of the first rate hike cycle since 2018. The move was no surprise after BoC Governor Tiff Macklem signaled at the January…

Executive Summary Upgrade Global Duration Exposure To Neutral The Russian invasion of Ukraine is a stagflationary shock that comes at a difficult time for developed market central banks that have been laying the groundwork…

Dear client, In addition to this weekly report, we sent you a Special Report from our Geopolitical Strategy service, highlighting the risk from the Russo-Ukrainian conflict. Kind regards, Chester Executive Summary The Ukraine…

Canada’s CPI inflation rate increased in January, reinforcing the case for the Bank of Canada to start hiking interest rates at its March 2 meeting. Headline CPI inflation rose to 5.1% y/y from 4.8%, while the three core…

Feature This week, we present the third edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook – a review of central bank surveys of bank lending standards and loan demand. The data from…

BCA Research is proud to announce a new feature to help clients get the most out of our research: an Executive Summary cover page on each of the BCA Research Reports. We created these summaries to help you quickly capture the main points…

The Bank of Canada kept the policy rate unchanged at 0.25% at its Wednesday meeting but signaled that a rate hike at its March 2 meeting is likely. Governor Tiff Macklem highlighted “a significant shift in monetary policy…