Executive Summary Summarizing Our Main Investment Themes In One Chart Our current strategic recommendations are centered around four key themes: global inflation will slow over the rest of 2022, Europe remains too weak to…

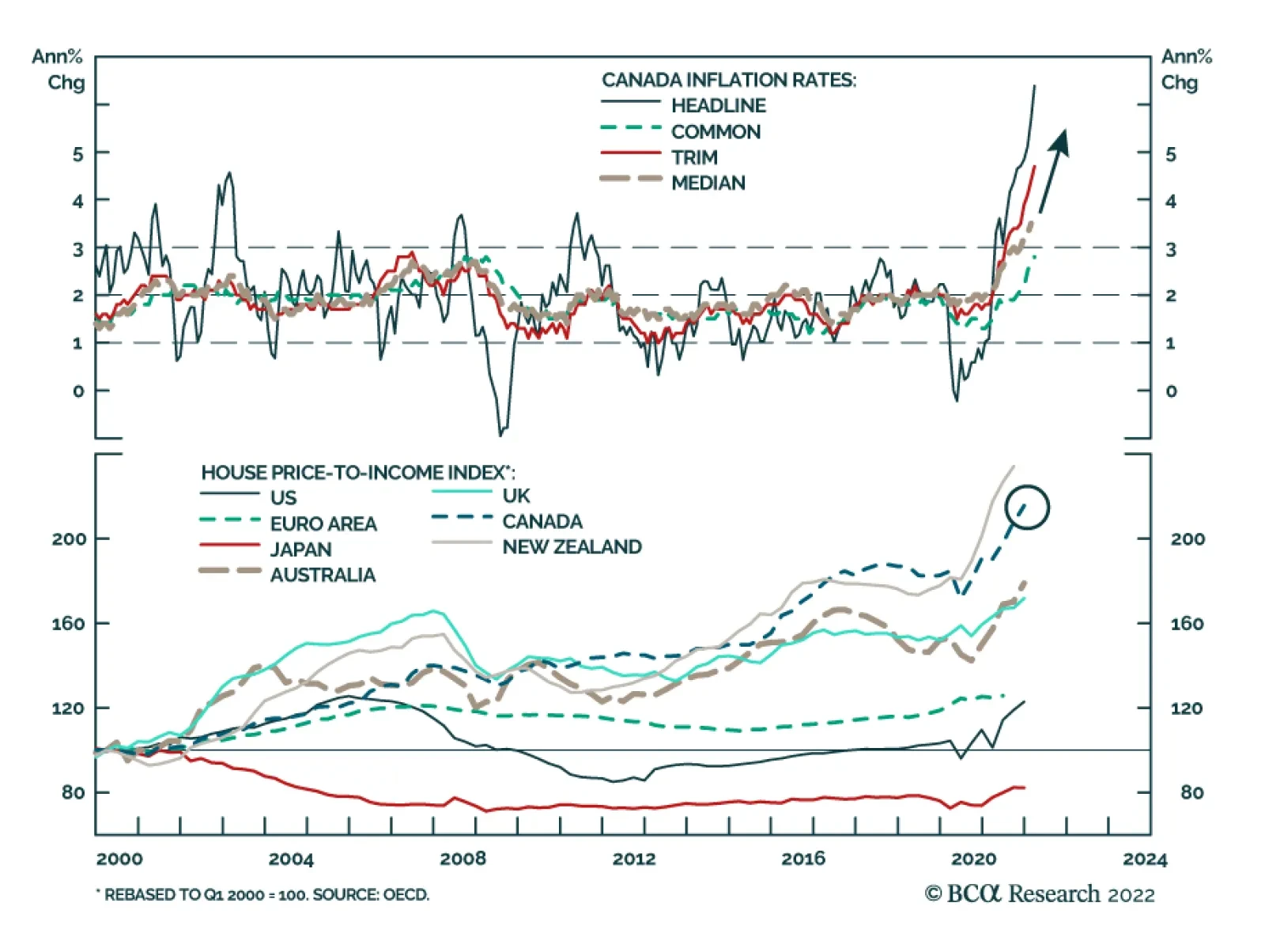

Canada’s CPI inflation rate surged from 5.7% y/y to a fresh 31-year high of 6.7% y/y in March, beating expectations of a milder increase to 6.1% y/y. The underlying measures of inflation are more subdued, but still…

Executive Summary A Good Time For A Pause In The Bond Bear Market The global government bond selloff looks stretched from a technical perspective, and a consolidation phase is likely over the next few months as global…

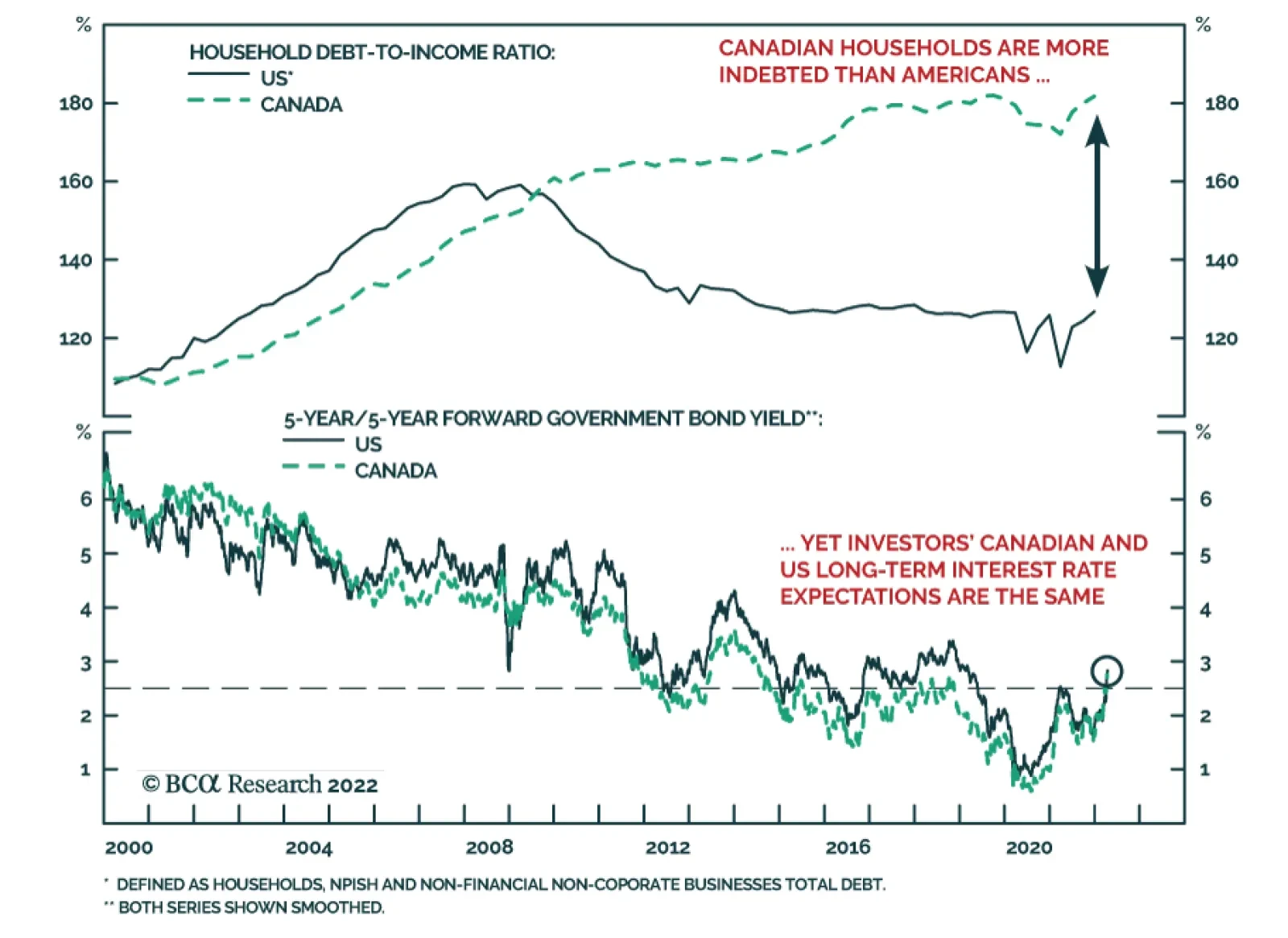

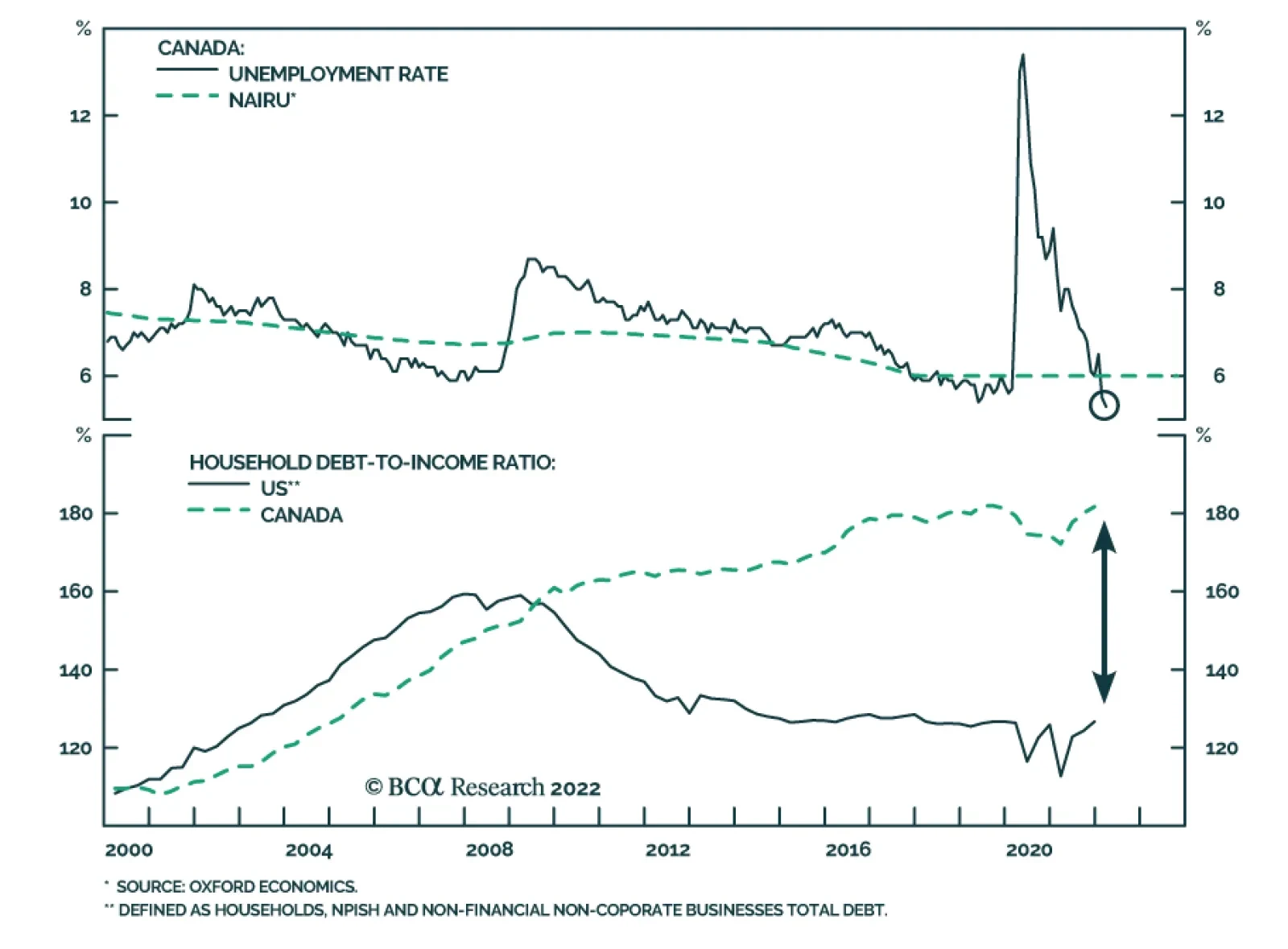

While we expect low housing inventory to mute the negative impact of rising mortgage rates on the US housing sector (see The Numbers), the same cannot be said for Canada. Canadian households’ debt to income ratio is…

Executive Summary Macron Still Favored, But Le Pen Cannot Be Ruled Out Macron is still favored to win the French election but Le Pen’s odds are 45%. Le Pen would halt France’s neoliberal structural reforms,…

Canada’s March labor force survey generated a positive surprise, underscoring the strength of the Canadian economy. The unemployment rate fell by 0.2 percentage points to 5.3% – the lowest in records that go back to…

Executive Summary The Dollar Has Broken Above Overhead Resistance Most central banks continue to dial up their hawkish rhetoric, led by the Fed. This is putting upward pressure on the dollar (Feature Chart). The big…

Executive Summary Our recommended model bond portfolio outperformed its custom index by a robust +48bps in Q1/2022 – an impressive performance given the significant uncertainties stemming from the Ukraine war, surging commodity…

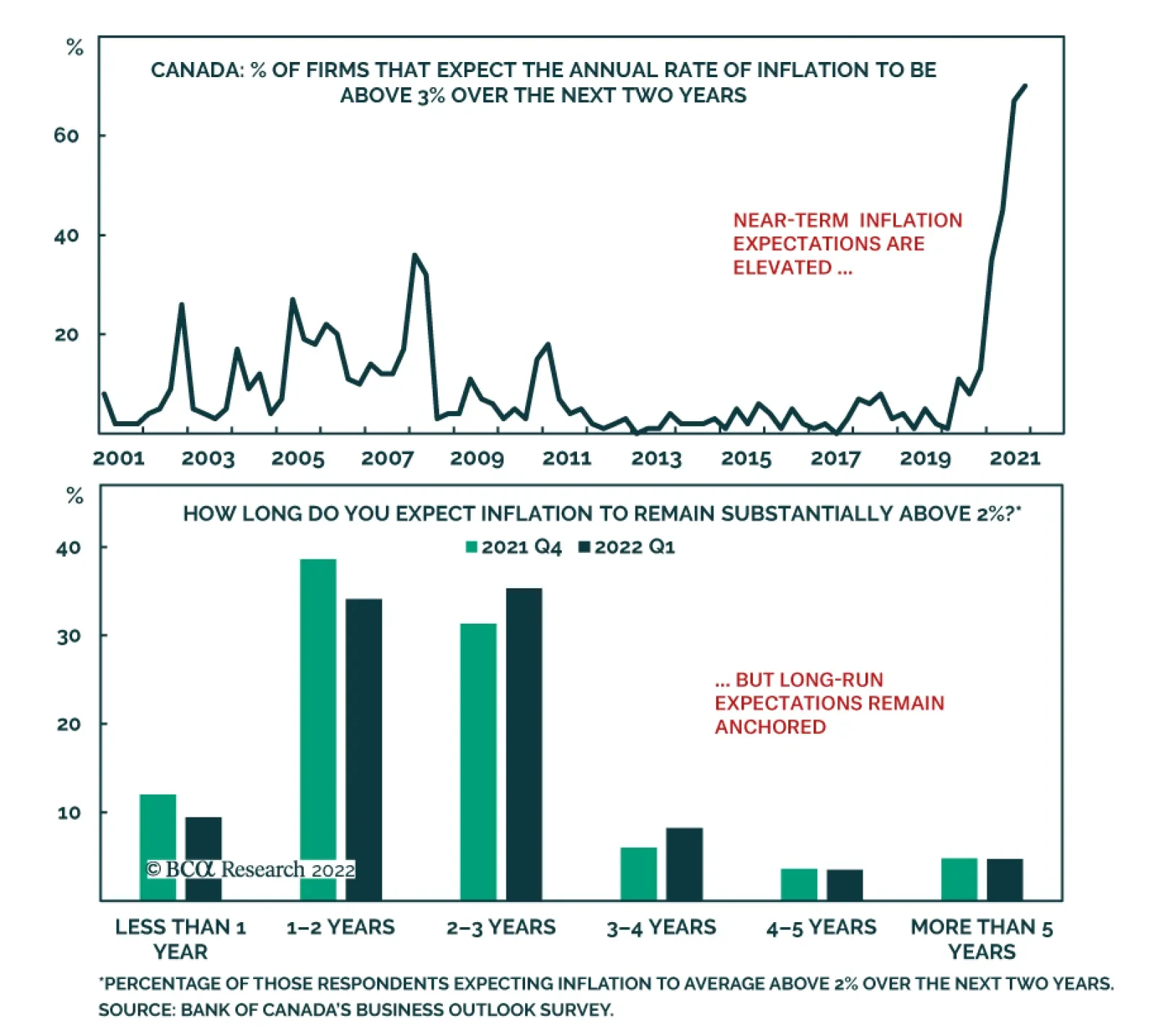

The Bank of Canada’s Business Outlook Survey indicator declined from the record high of 5.9 in Q4 2021 to a still elevated 4.98 in Q1 2022. Although businesses anticipate the pace of sales growth to moderate, they expect…

Executive Summary Refreshing Our Tactical Trade List Our current list of tactical trade recommendations centers around two broad themes that predate the Ukraine conflict – rising global inflation expectations and…