Our preferred tactical global fixed income trades for the rest of 2022 into early 2023 are all expressions of our views on relative monetary policy shifts within the main developed market economies. These involve bets on a…

We continue to anticipate that the Fed won’t pause its tightening cycle until Q1 or Q2 of 2023, and current labor market trends certainly give no indication that a Fed pause (or “pivot”) is imminent.

This week, we present our quarterly review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for Q3/2022. We also discuss the model portfolio’s expected performance over next 3-6 months after our recent…

Executive Summary Upward Repricing Of Bond Yields Continues In this report, we discuss our move last week to shift to a below-benchmark overall global duration stance in more detail. Our strongest conviction view on…

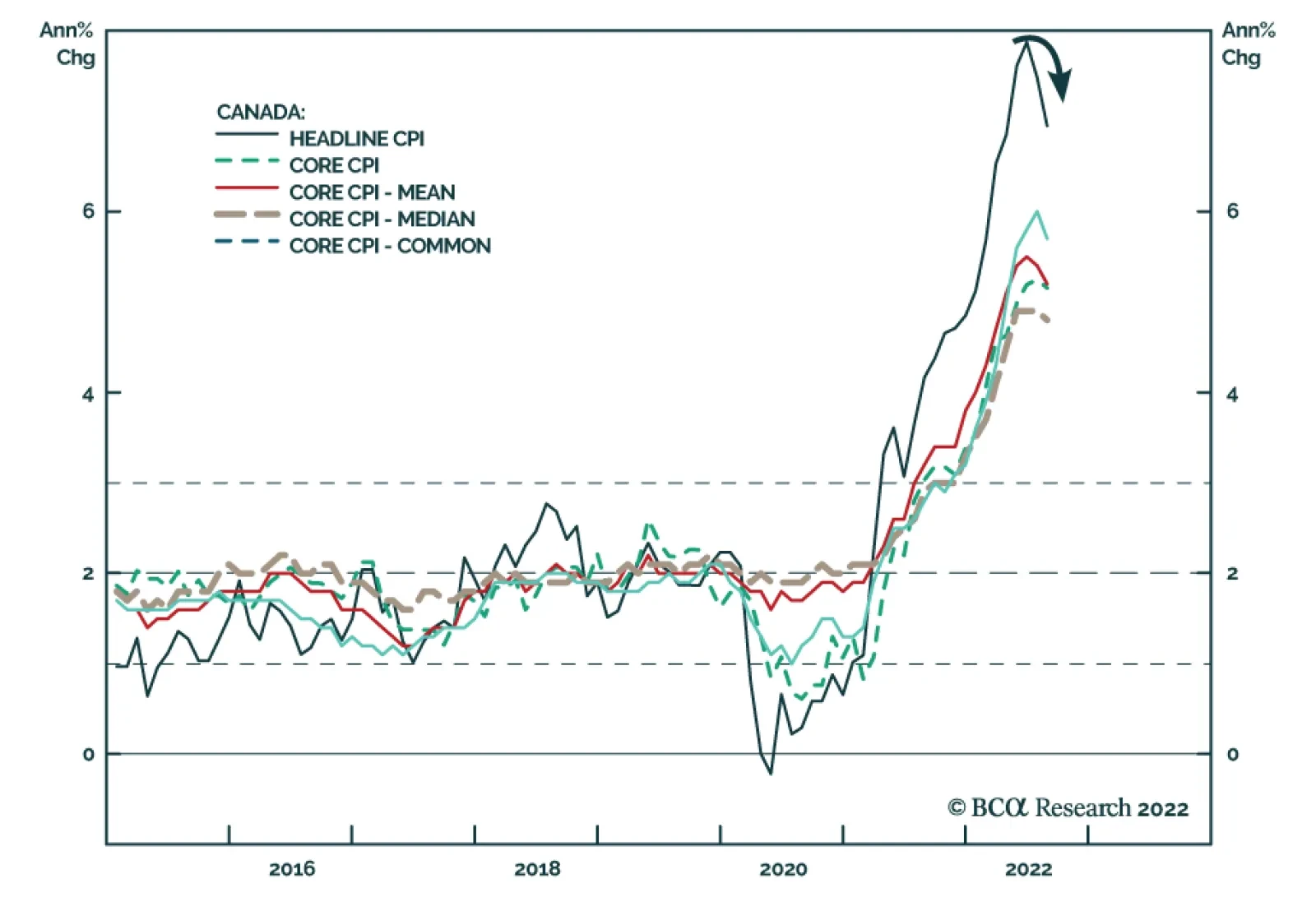

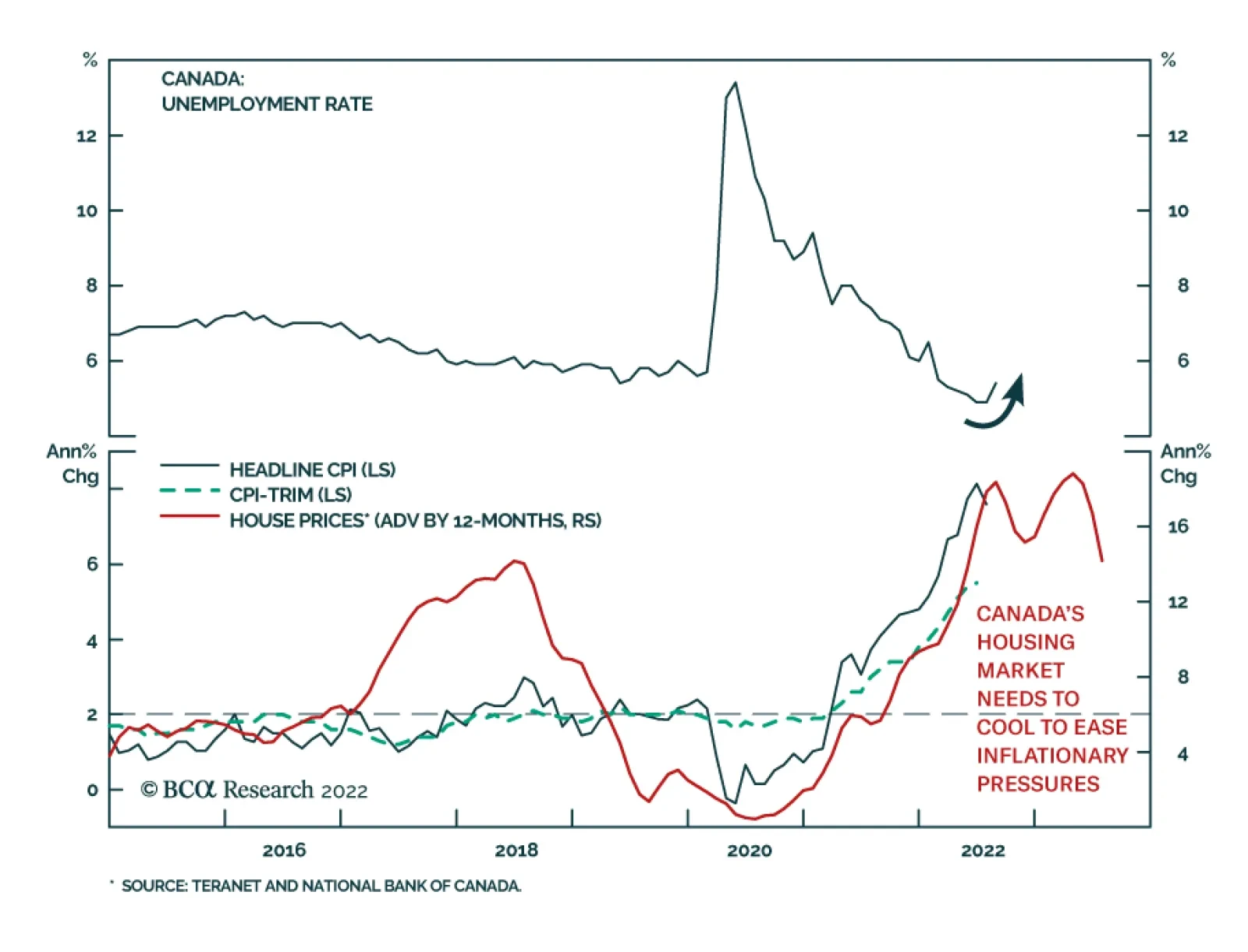

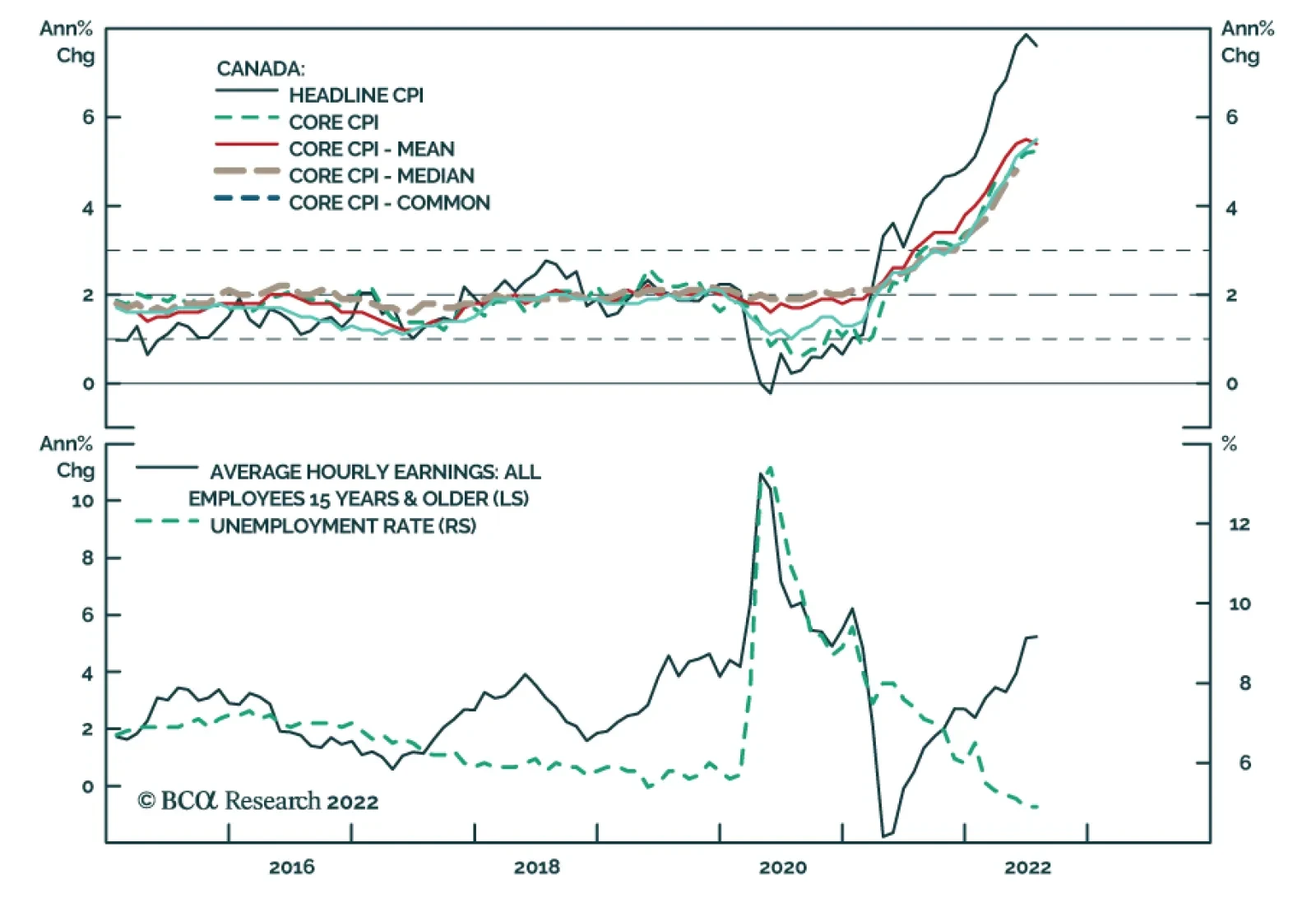

Canadian headline inflation eased to 7.0% y/y (-0.3% m/m) in August, down from 7.6% y/y (0.1% m/m) in July. Notably, this is a positive surprise to consensus estimates which had expected a less pronounced deceleration to 7.3% y/y…

On Friday, markets got a dismal Labor Market report for Canada. The market consensus expected 15 thousand jobs to be added in August, however 39.7 thousand jobs were lost. This marks the third consecutive monthly decline, bringing…

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…

Canadian headline inflation rose at a slower 7.6% y/y (0.1% m/m) pace in July, down from 8.1% y/y (0.7% m/m) in June. Decelerating gasoline prices were the main contributor to easing inflation. Excluding gasoline, CPI rose 6.6…

Listen to a short summary of this report. Executive Summary Chart 1The Dollar Has Broken Below The First Line Of Support The softer CPI print in the US boosted growth plays and pushed the DXY index below…