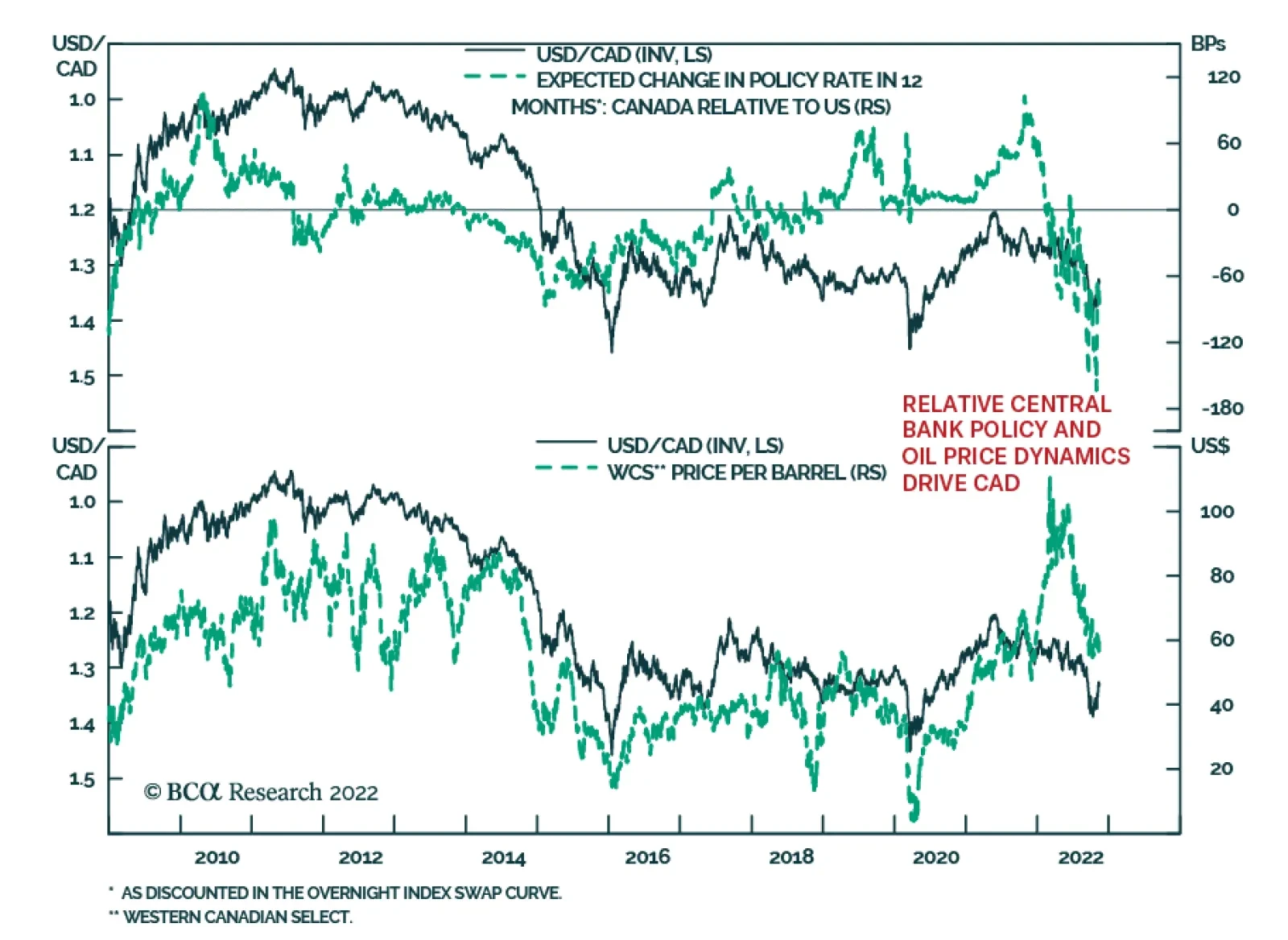

Although the Canadian dollar has been underperforming its G10 peers since the greenback’s September 27 peak, it has held up relatively well on a year-to-date basis. Going forward, both the outlook for BoC policy vis-…

The messages from the deteriorating fundamental backdrop (tight monetary policy, slowing global growth) and improved credit valuation (elevated 12-month breakeven spreads) are giving conflicting signals on corporate bond strategy. We…

The Canadian economy unexpectedly added a whopping 108 thousand jobs in October – ten times the amount anticipated – and significantly above the 21 thousand increase in September. Job gains in October alone recouped…

Older workers have deserted the labour force in the US and the UK, but not so in the Euro area and Japan. The result is that wage inflation is red hot in the US and the UK, but not so in the Euro area and Japan. Hence, the Bank of…

This week’s report examines the state of the global monetary tightening cycle and addresses some frequently asked questions about the Fed’s QT program. New yield curve trades are recommended for the US and German yield curves.

Falling inflation will allow bond yields to decline in the major economies over the next few quarters. As such, we recommend that investors shift their duration stance from underweight to neutral over a 12 month-and-longer horizon…

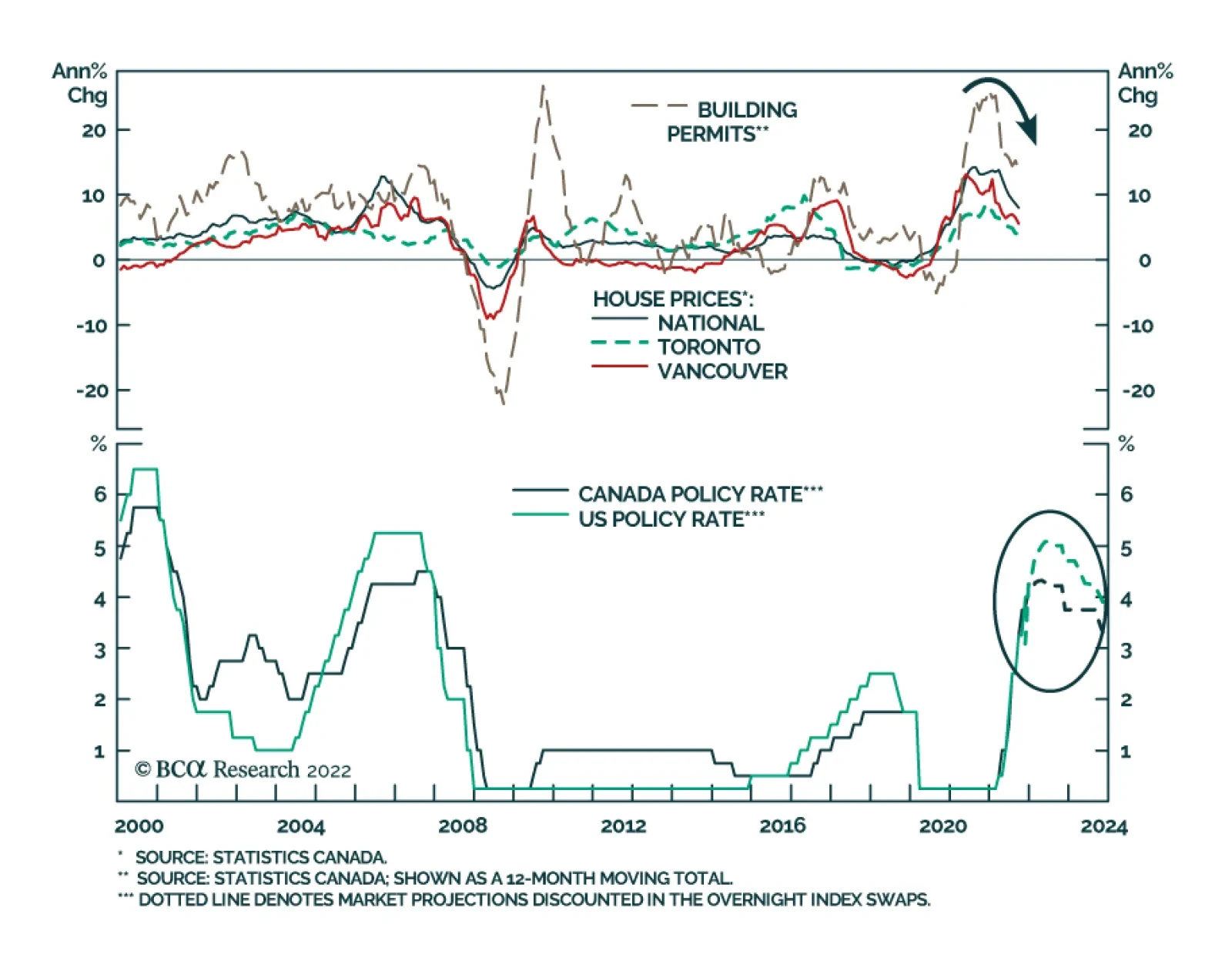

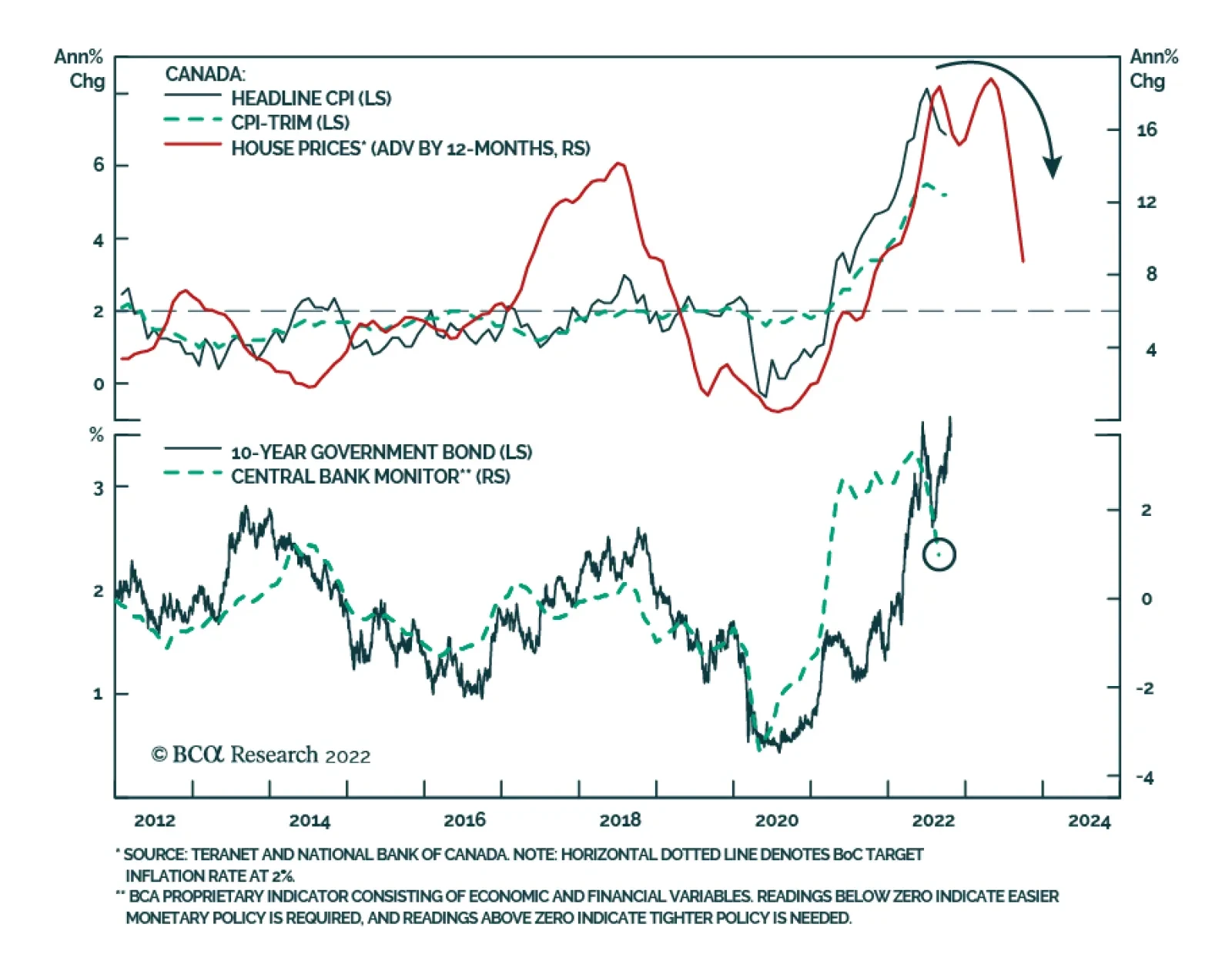

The Bank of Canada unexpectedly slowed the pace of its interest rate increases on Wednesday, delivering a 50bp hike against anticipations of another 75bp rise. The decision reflects an attempt to balance between stubbornly…

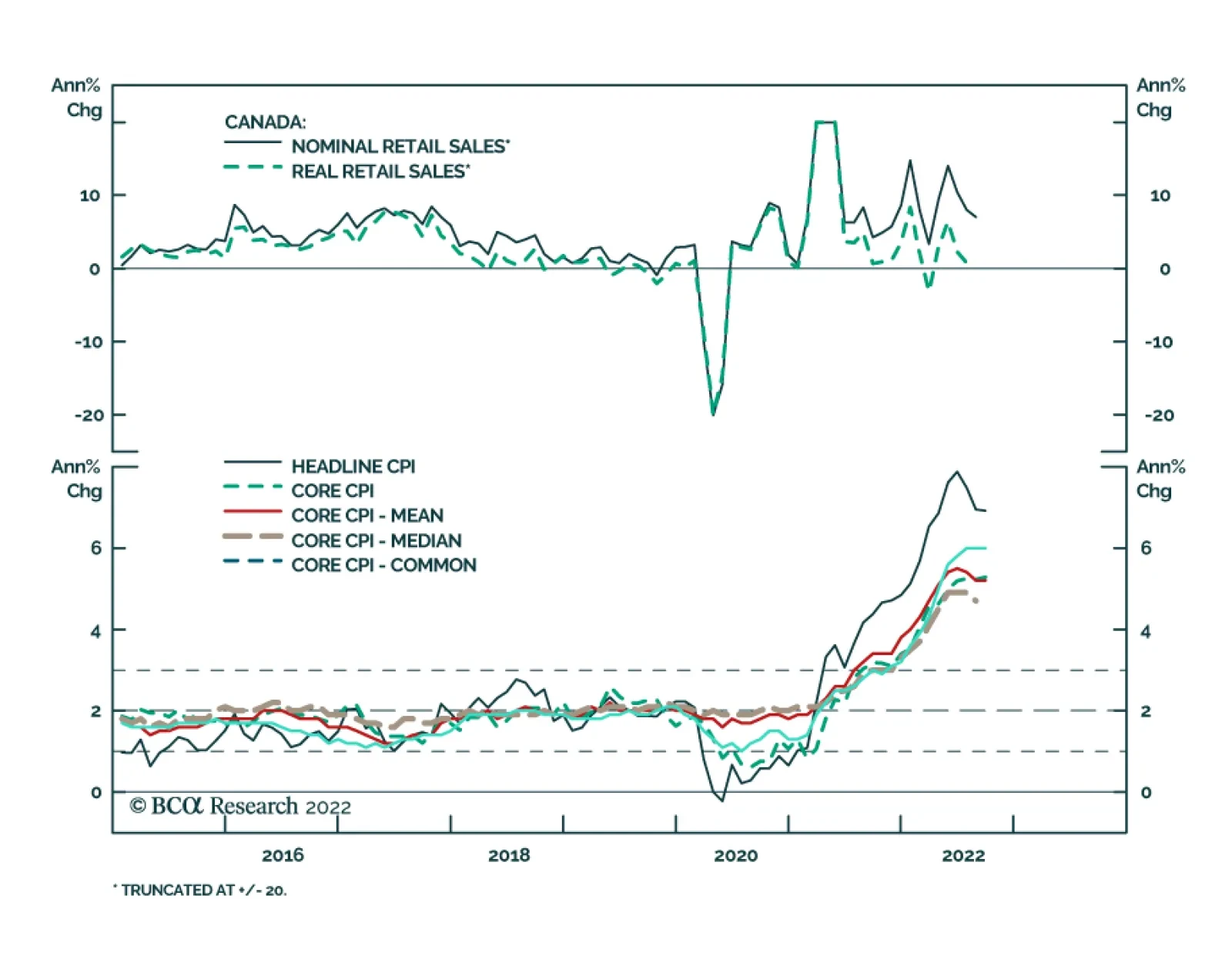

Retail sales in Canada grew by a stronger-than-expected 0.7% m/m in August, following a 2.2% contraction in the prior month. In particular, food & beverage store sales led the increase, expanding 2.4%. Most encouragingly,…

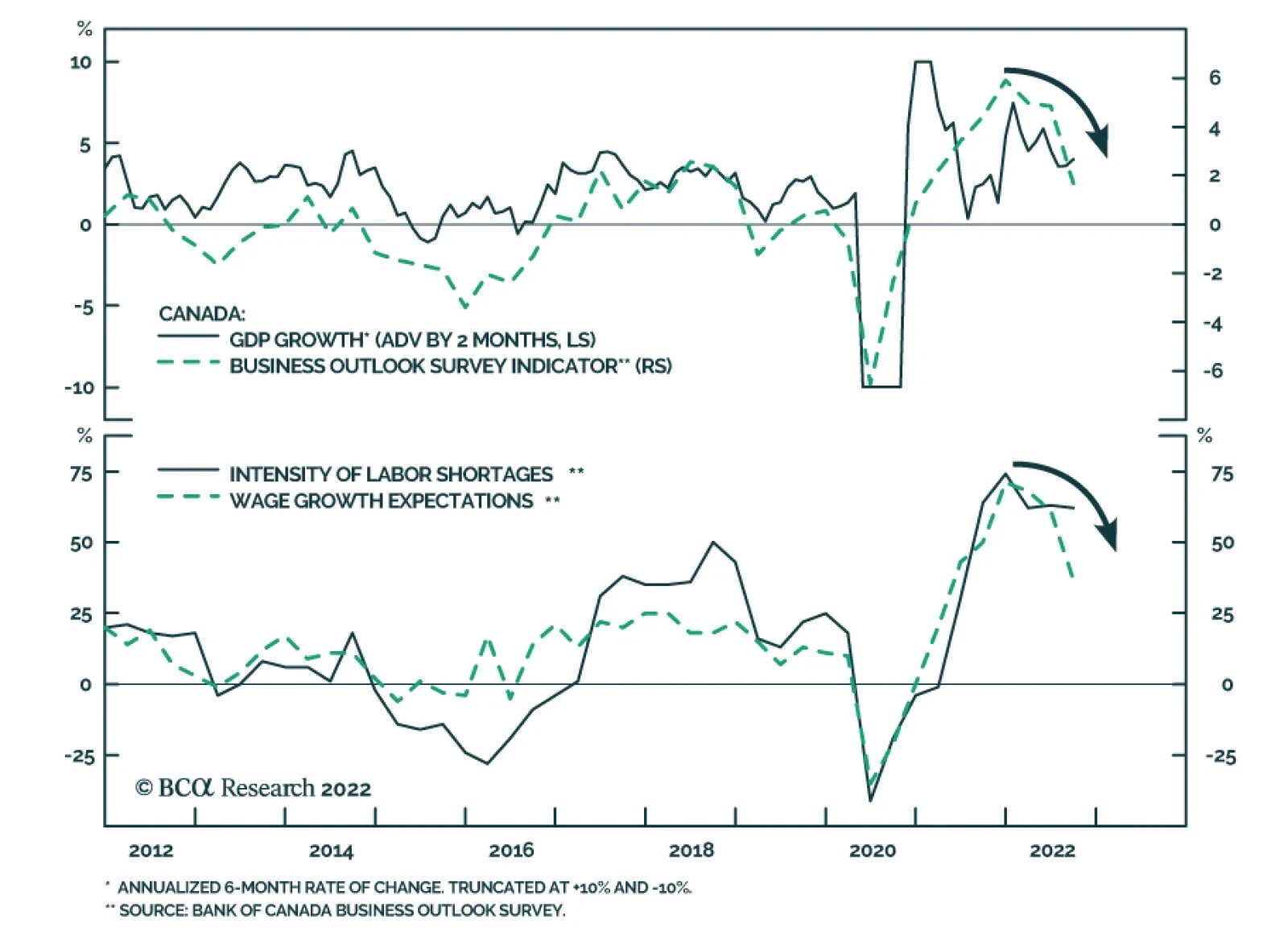

The Bank of Canada’s Q3 Business Outlook Survey reveals that weaker sales growth expectations are dampening confidence among Canadian businesses. The BOS indicator dropped from 4.87 in Q2 to 1.69 in Q3 – the weakest…