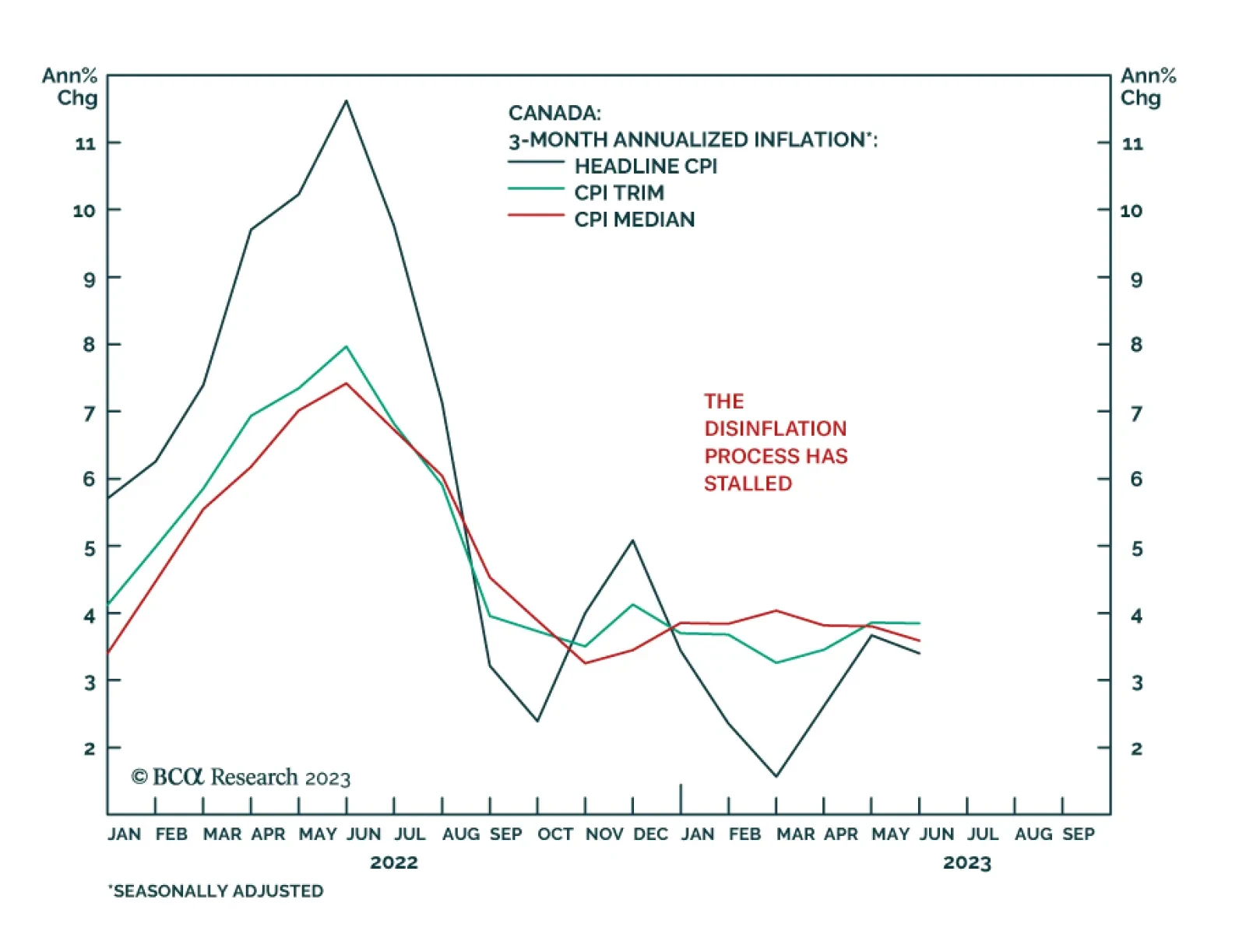

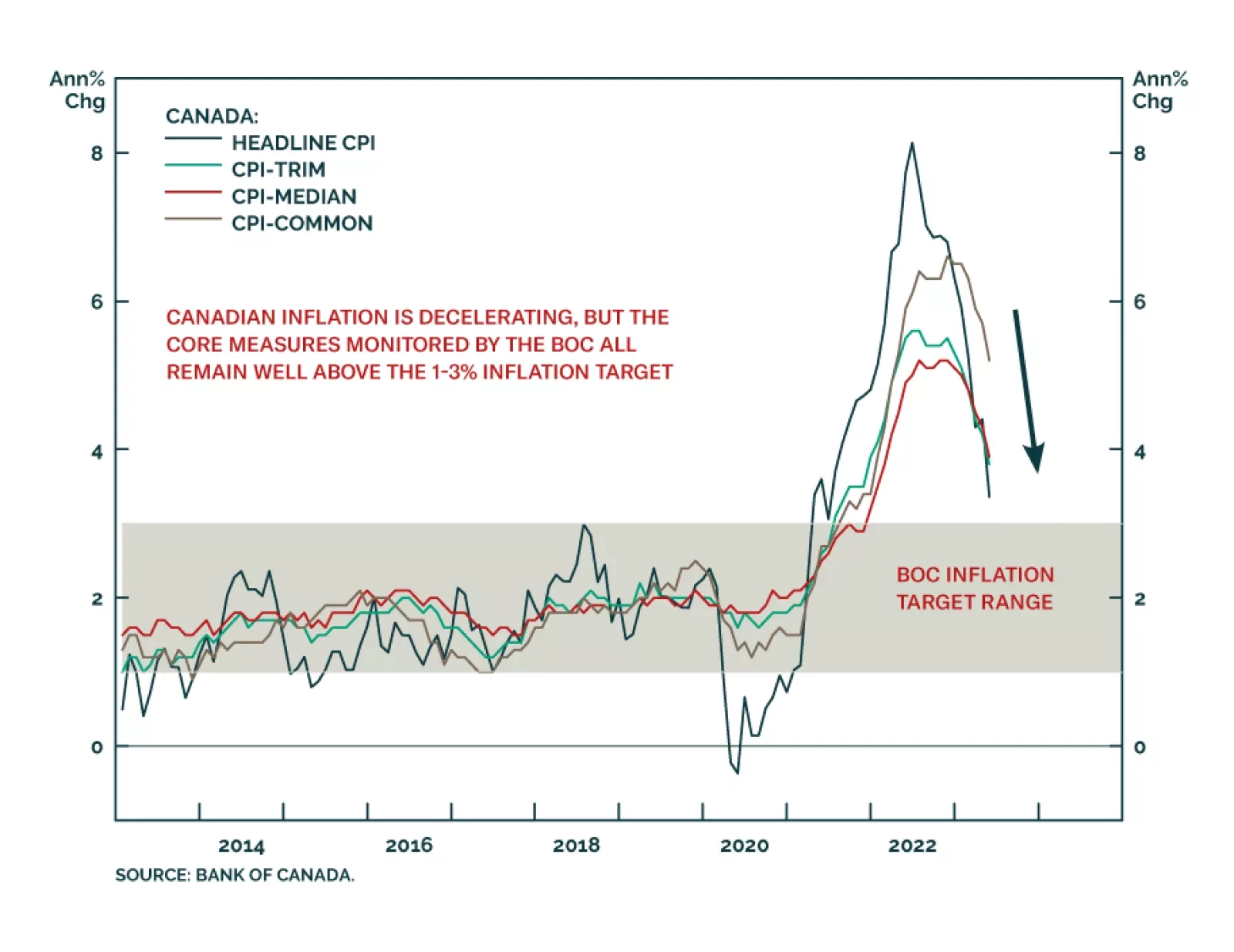

Canada’s CPI release showed headline CPI inflation cooled from 3.4% y/y to 2.8% in June – below estimates calling for a less pronounced moderation to 3.0% y/y. This marks inflation’s first return to the Bank of…

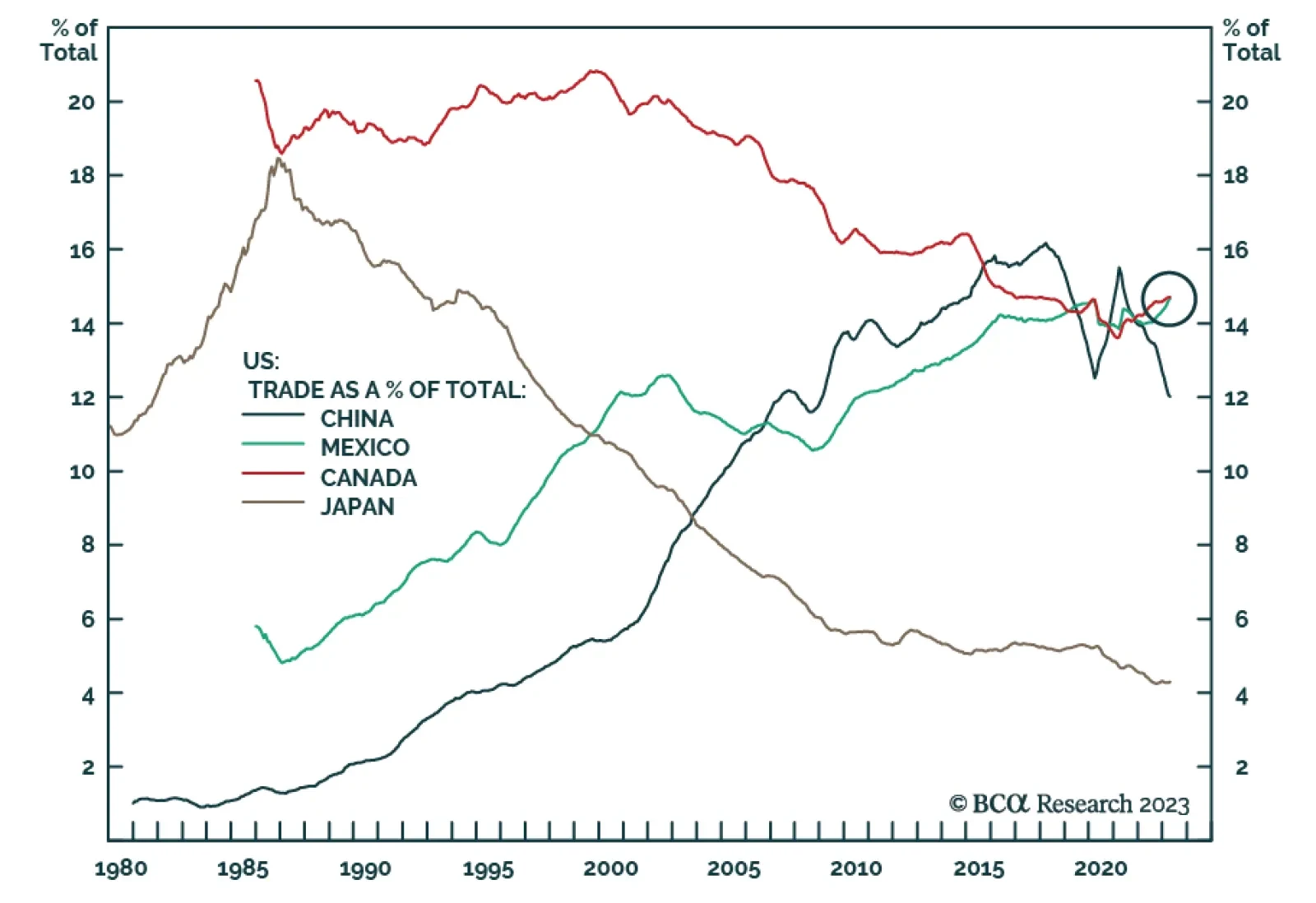

China’s slowdown confirms BCA’s Geopolitical Strategists’ view that persisting structural challenges would cause China’s economic reopening to disappoint (see The Numbers). In this context, Canada and…

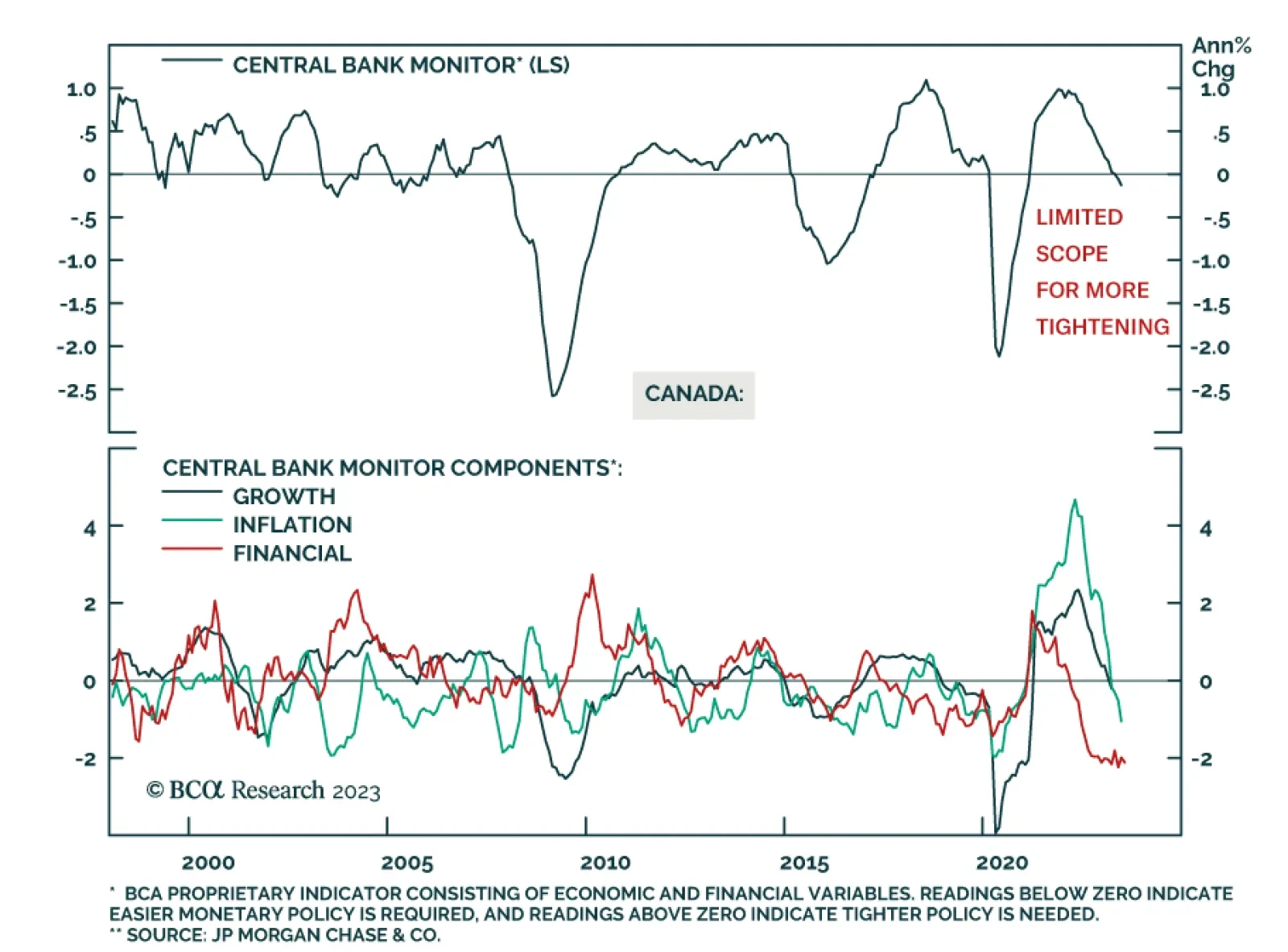

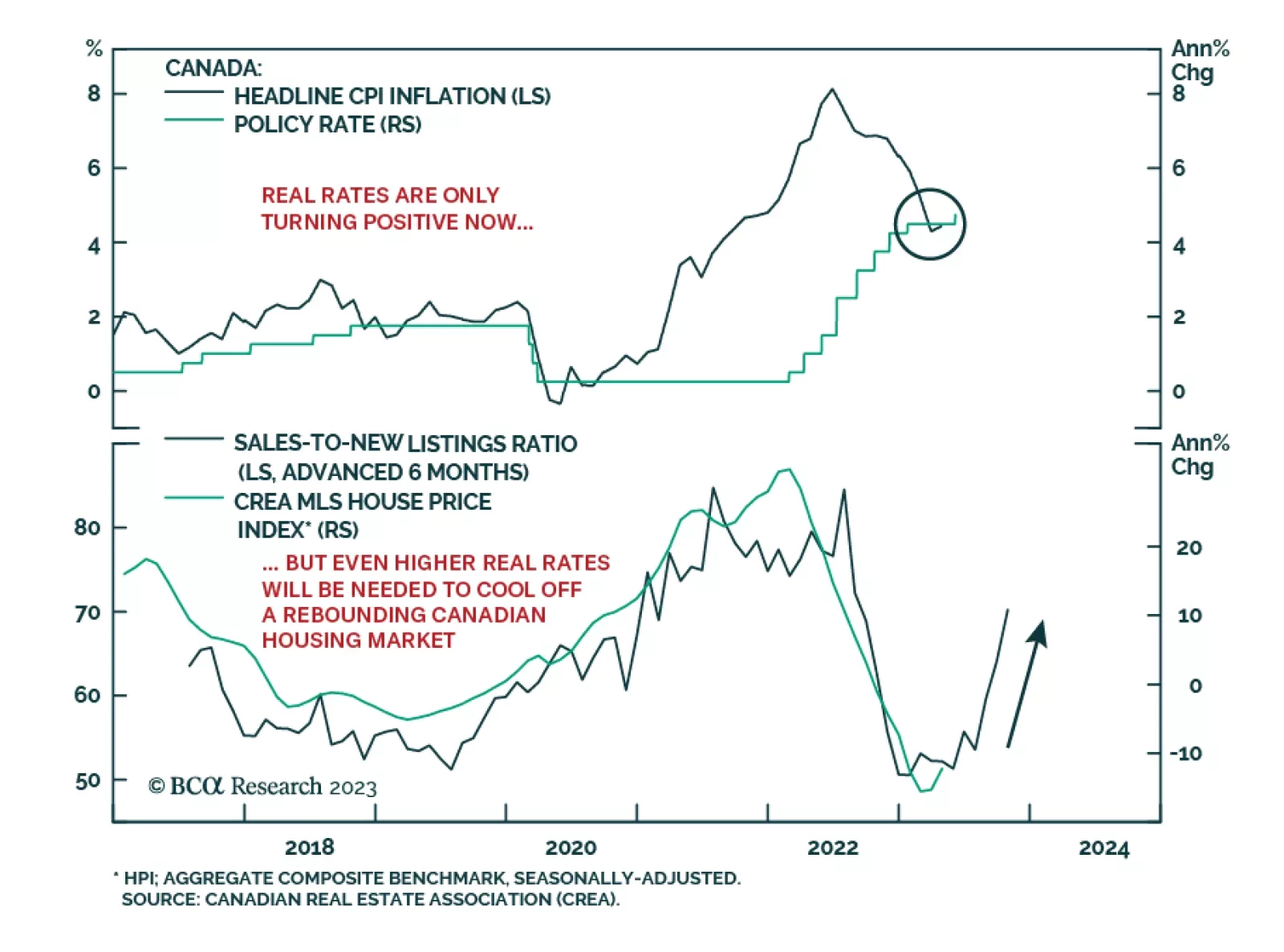

As expected, the Bank of Canada raised interest rates for the second consecutive month after restarting its tightening campaign last month. At 5.0%, the policy rate now stands 4.75 percentage points above where it was at the…

Canadian hiring surprised to the upside in June. The 60 thousand increase in employment last month – the highest since January – came in triple expectations of a 20 thousand rise and follows a 17 thousand decline in…

Canadian inflation slowed in May, slowing to 3.4% on a year-over-year basis from 4.4% in April. This matched market expectations, with the monthly increase of 0.4% (versus 0.7% in April), slightly lower than the 0.5% consensus…

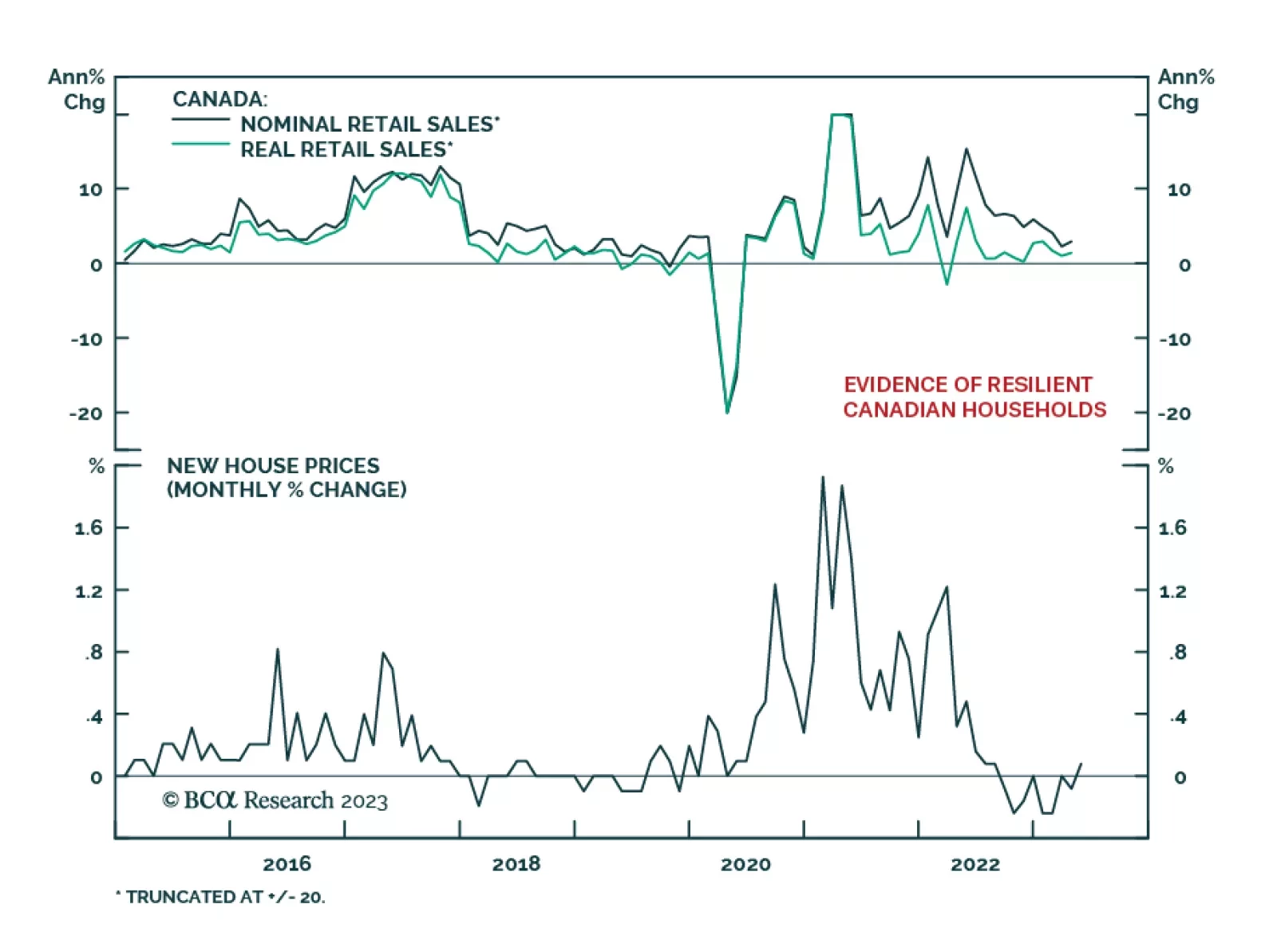

Recent economic data reveal that Canadian household conditions remain resilient. Retail sales surprised to the upside in April. The 1.1% m/m increase follows two consecutive monthly declines and beat expectations of a 0.4% m/m…

A preview of what to expect from next week’s FOMC meeting.

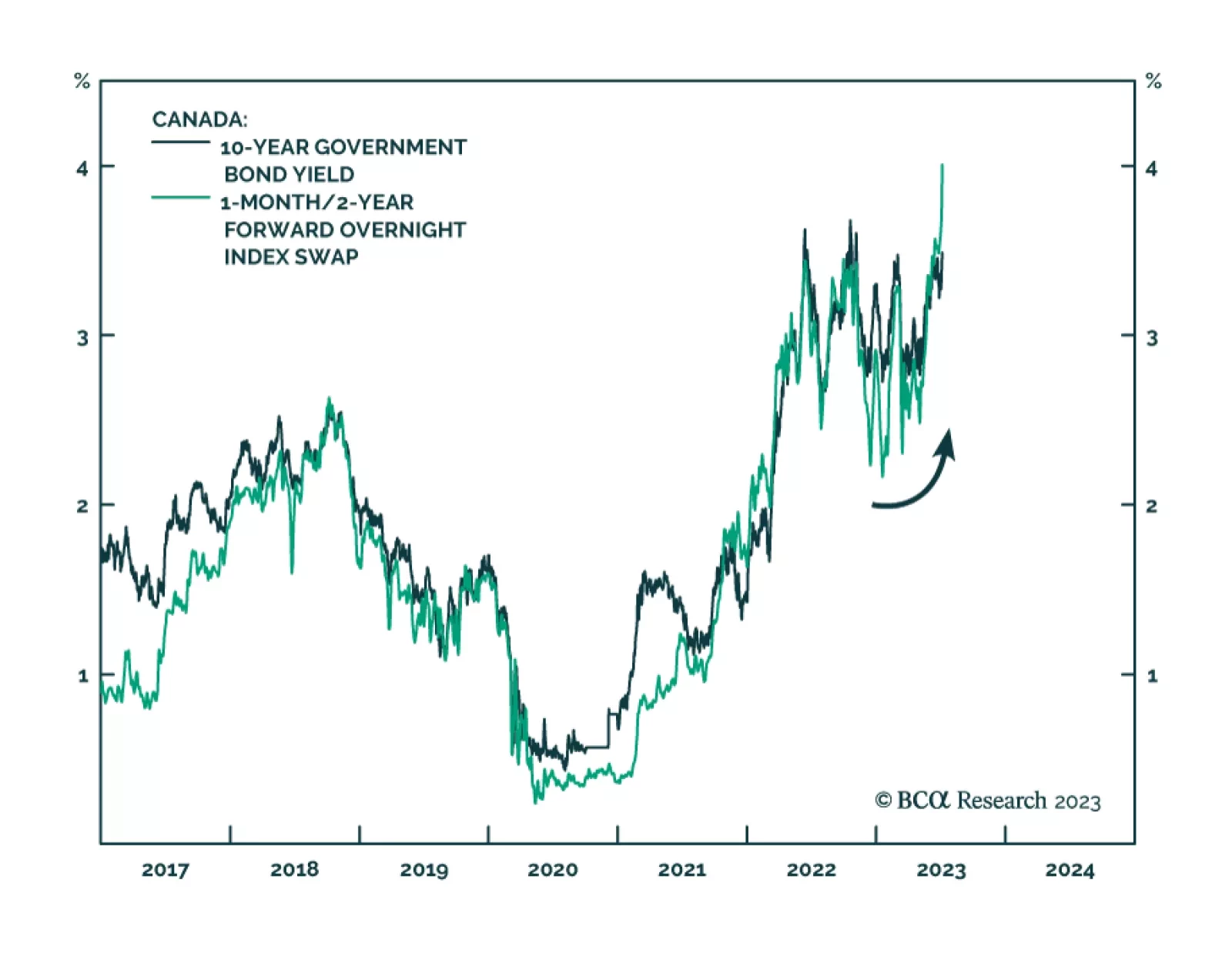

In this Insight, we answer a few crucial questions: Do the BoC and RBA decisions have any impact on what we can expect from other major central banks next week? Are there any profitable trades that can be put on, given the recent…

In this Insight, we answer a few crucial questions: Do the BoC and RBA decisions have any impact on what we can expect from other major central banks next week? Are there any profitable trades that can be put on, given the recent…

The Bank of Canada (BoC) surprised markets with a 25bp hike yesterday, bringing the policy rate up to a 22-year high of 4.75%. This ended the pause on rate hikes announced back in March, which only ended up lasting two meetings.…