In this insight, we look at whether the recent data justifies a shift by the BoC, and some potential trades.

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

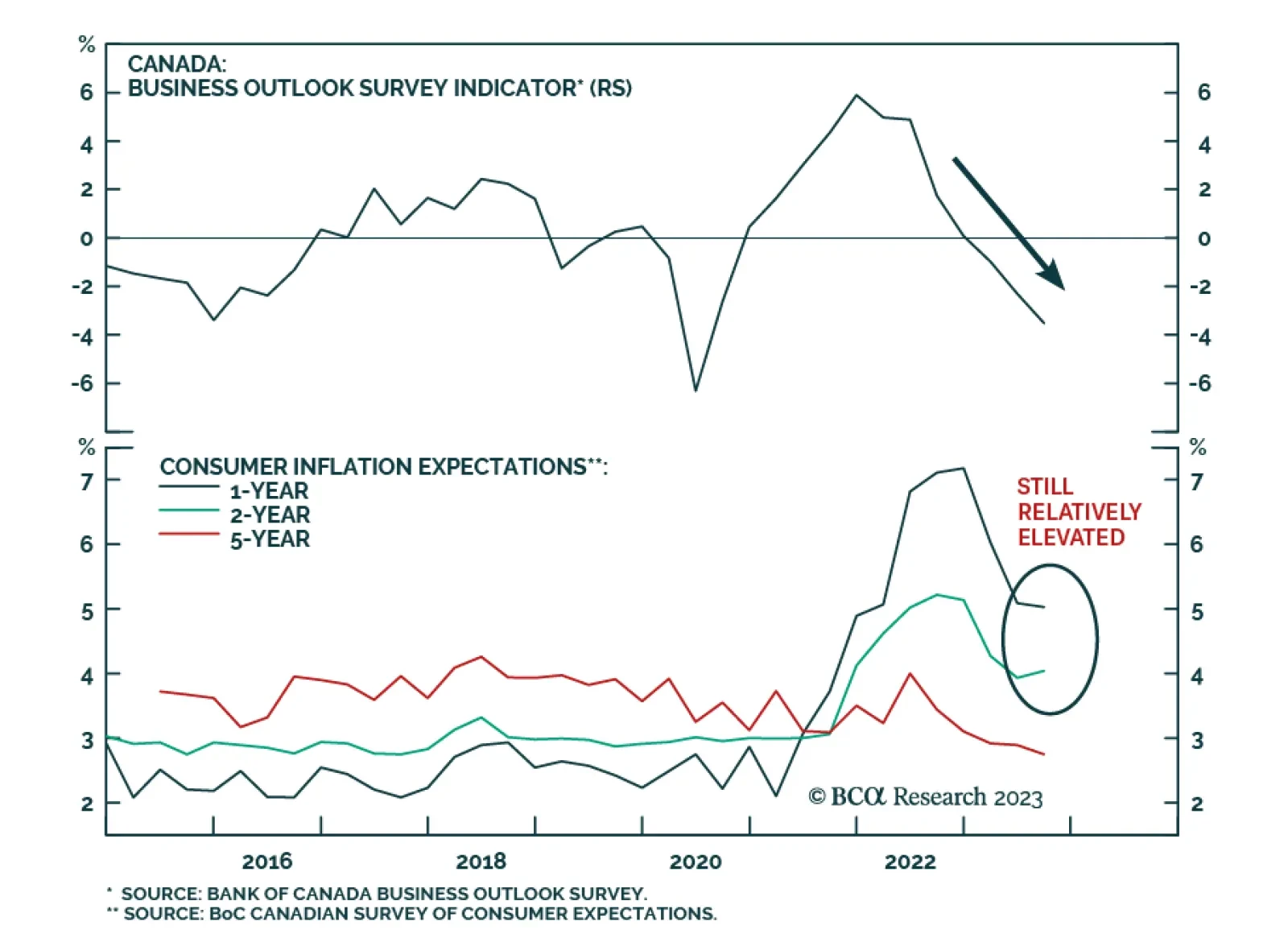

Results of the Banks of Canada’s Q3 business and consumer surveys reveal that the aggressive tightening cycle is dampening economic agents’ sentiment. Putting aside the sharp decline at the onset of the pandemic in Q2…

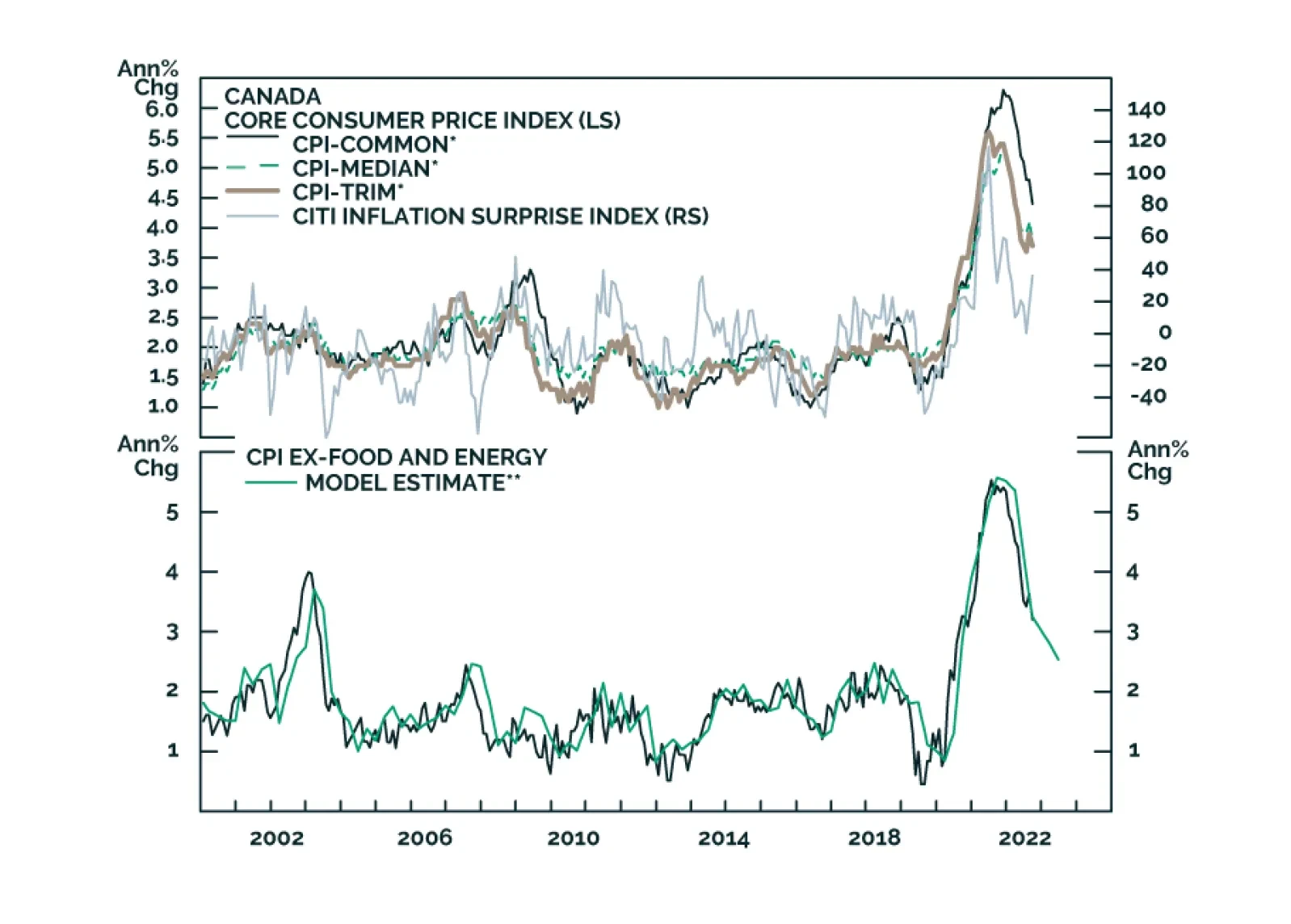

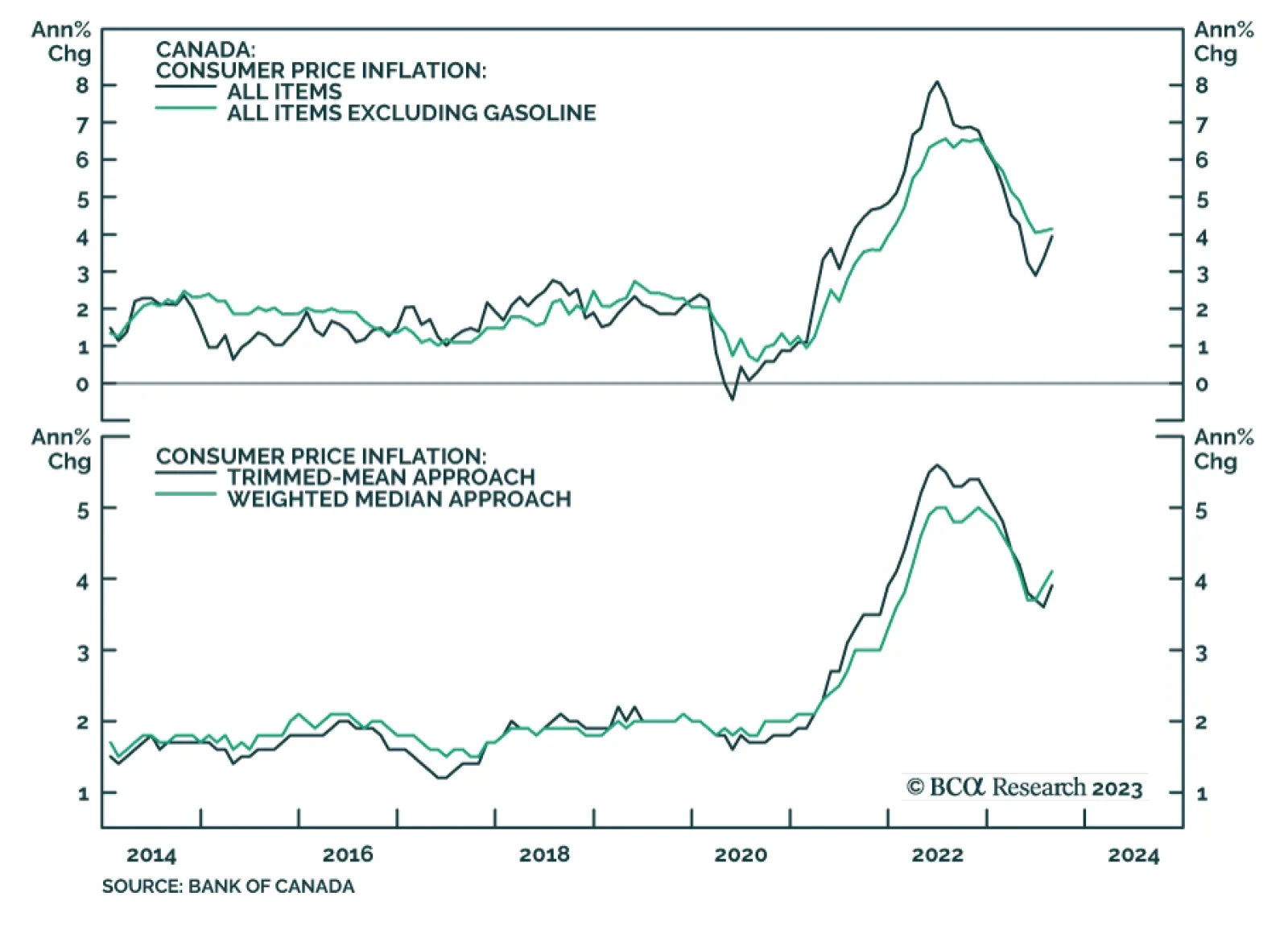

Tuesday’s release of Canadian CPI in August raised concerns that inflationary pressures are picking up again. Headline CPI inflation rose from 3.3% y/y to 4.0% y/y – above expectations of 3.8% y/y and marking the…

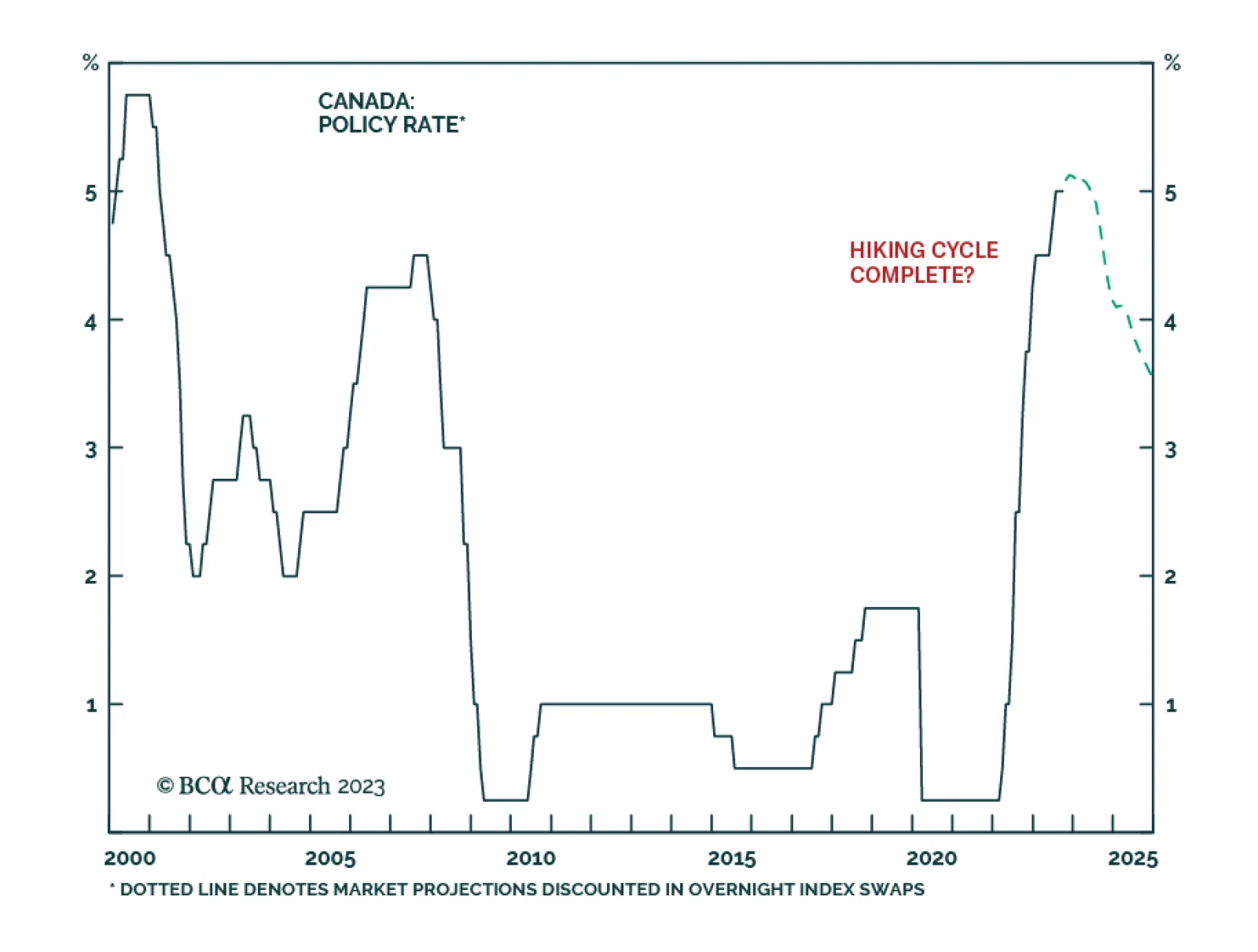

As expected, the Bank of Canada kept its policy rate unchanged at 5% on Wednesday. In particular, the central bank highlighted that domestic economic growth deteriorated. Indeed, last week’s GDP release showed the…

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…