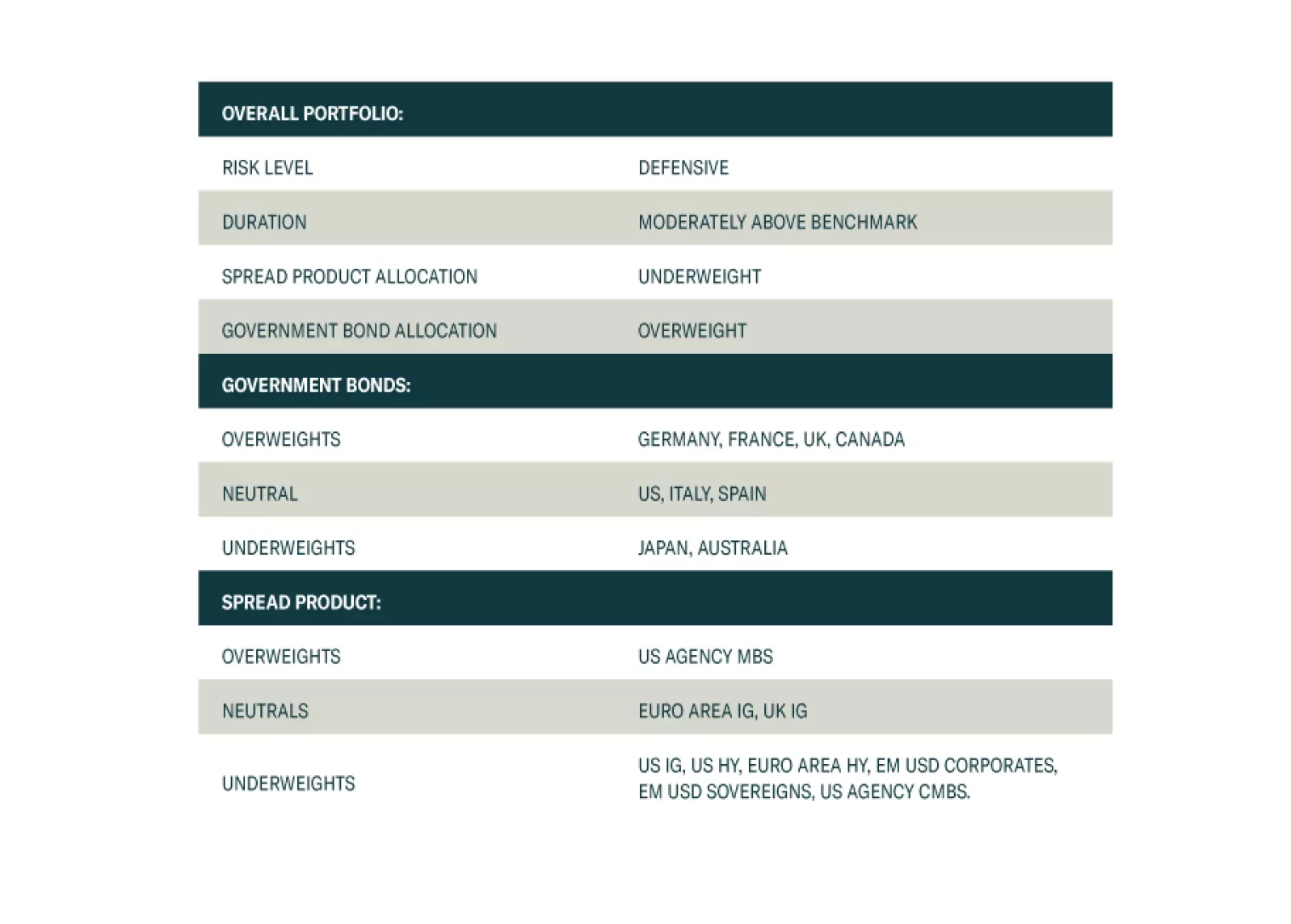

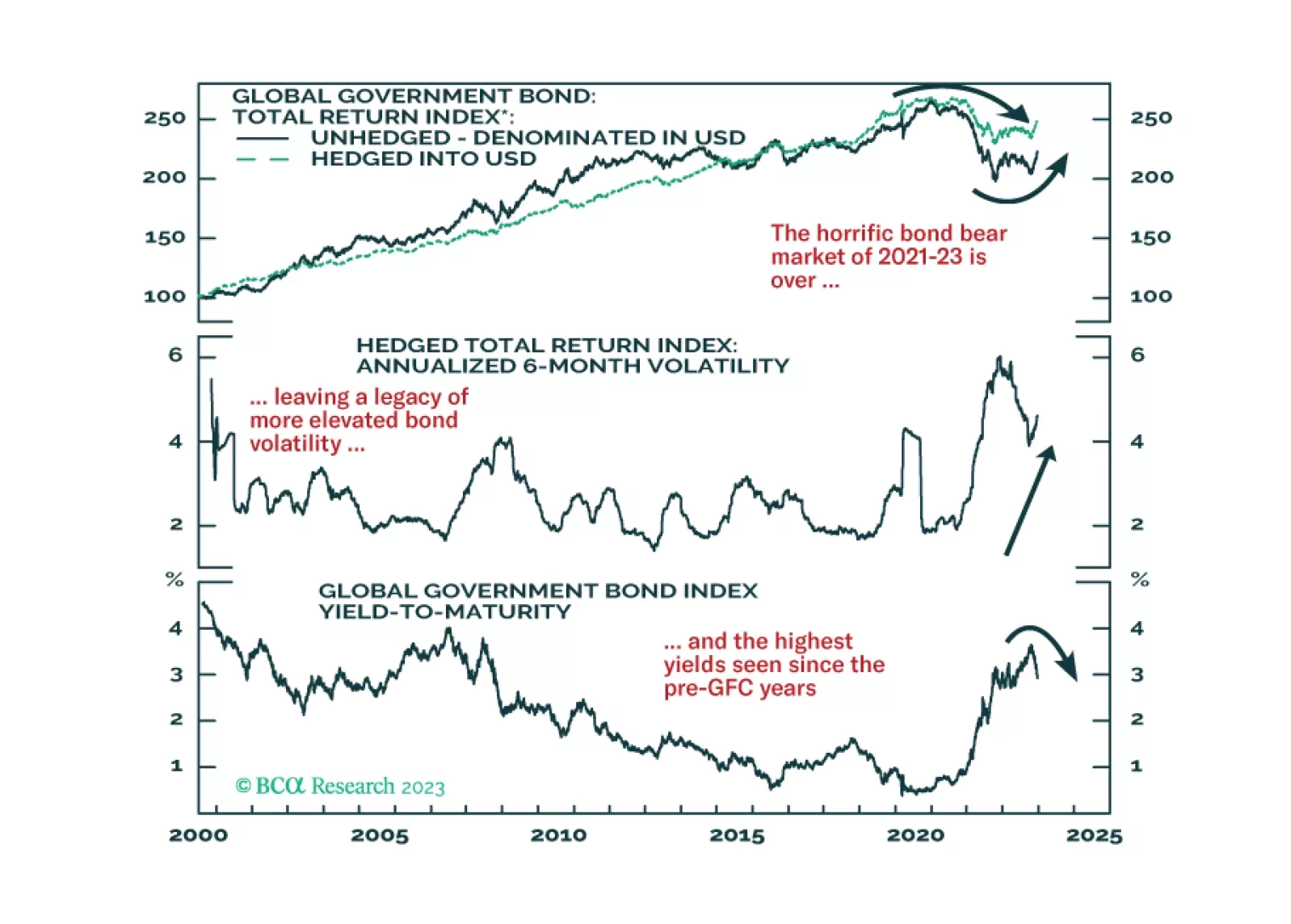

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…

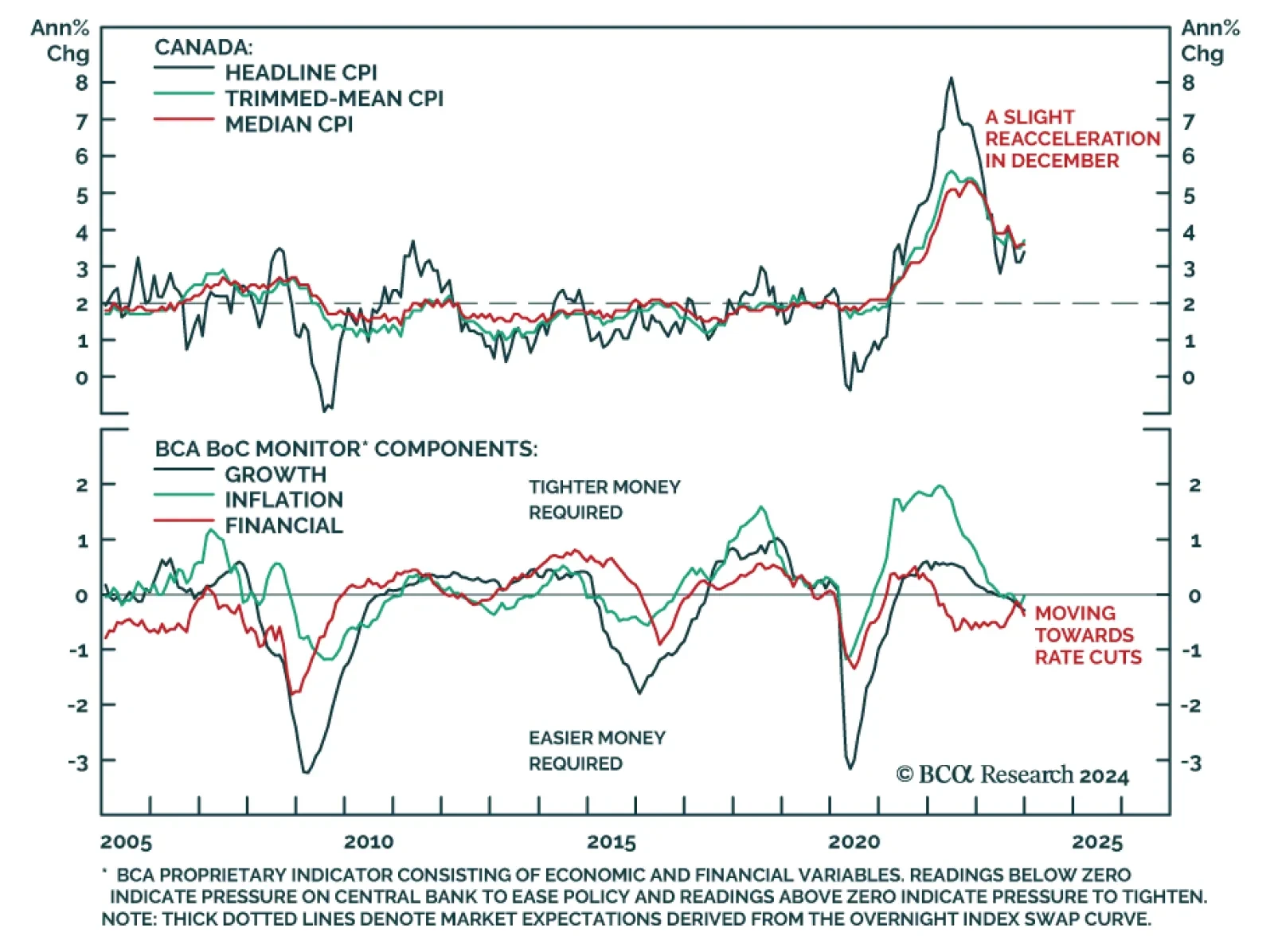

The Bank of Canada (BoC) kept rates steady at yesterday’s monetary policy meeting, leaving its policy rate at 5%. The central bank presented updated economic projections in a new Monetary Policy Report (MPR), which were…

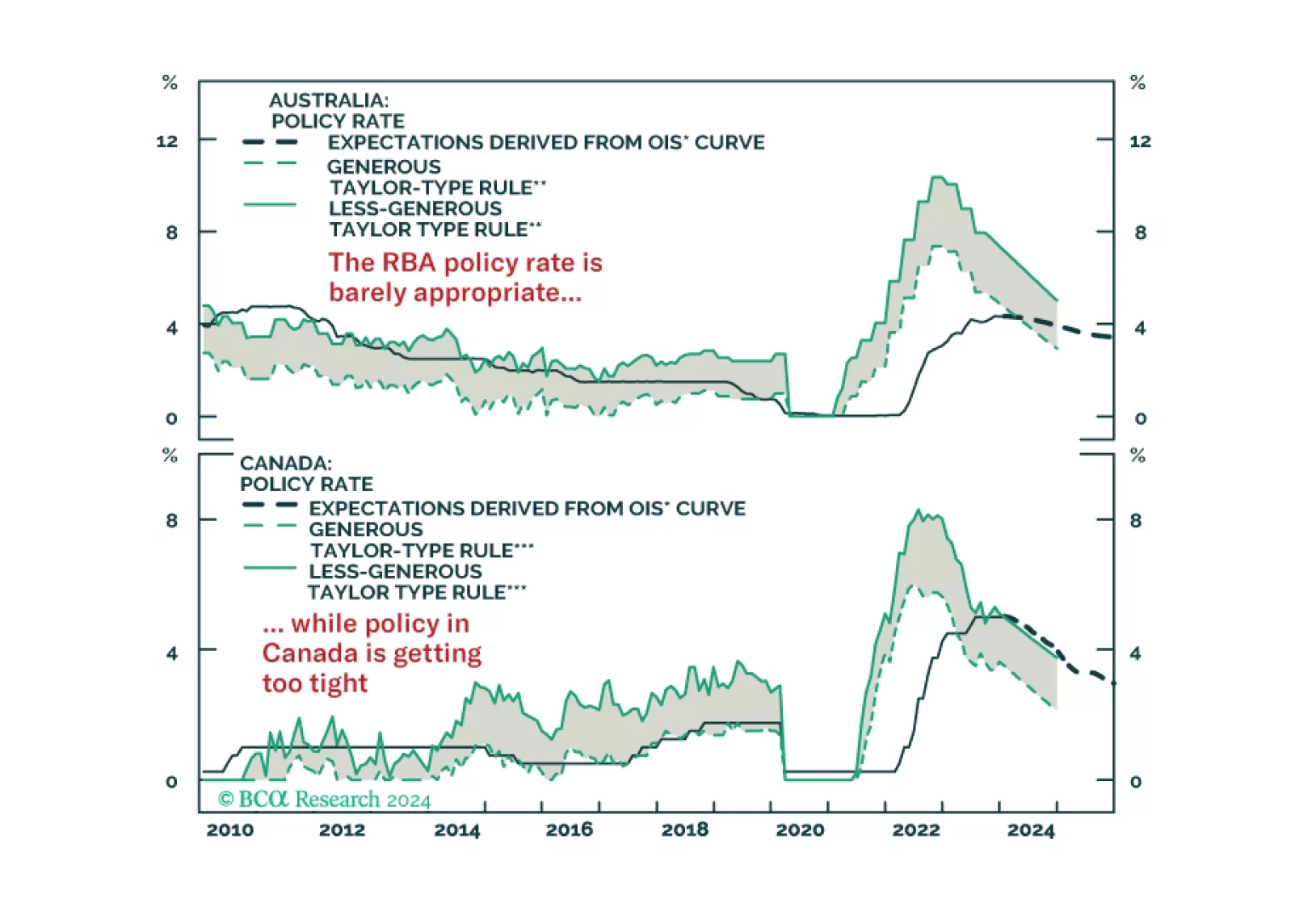

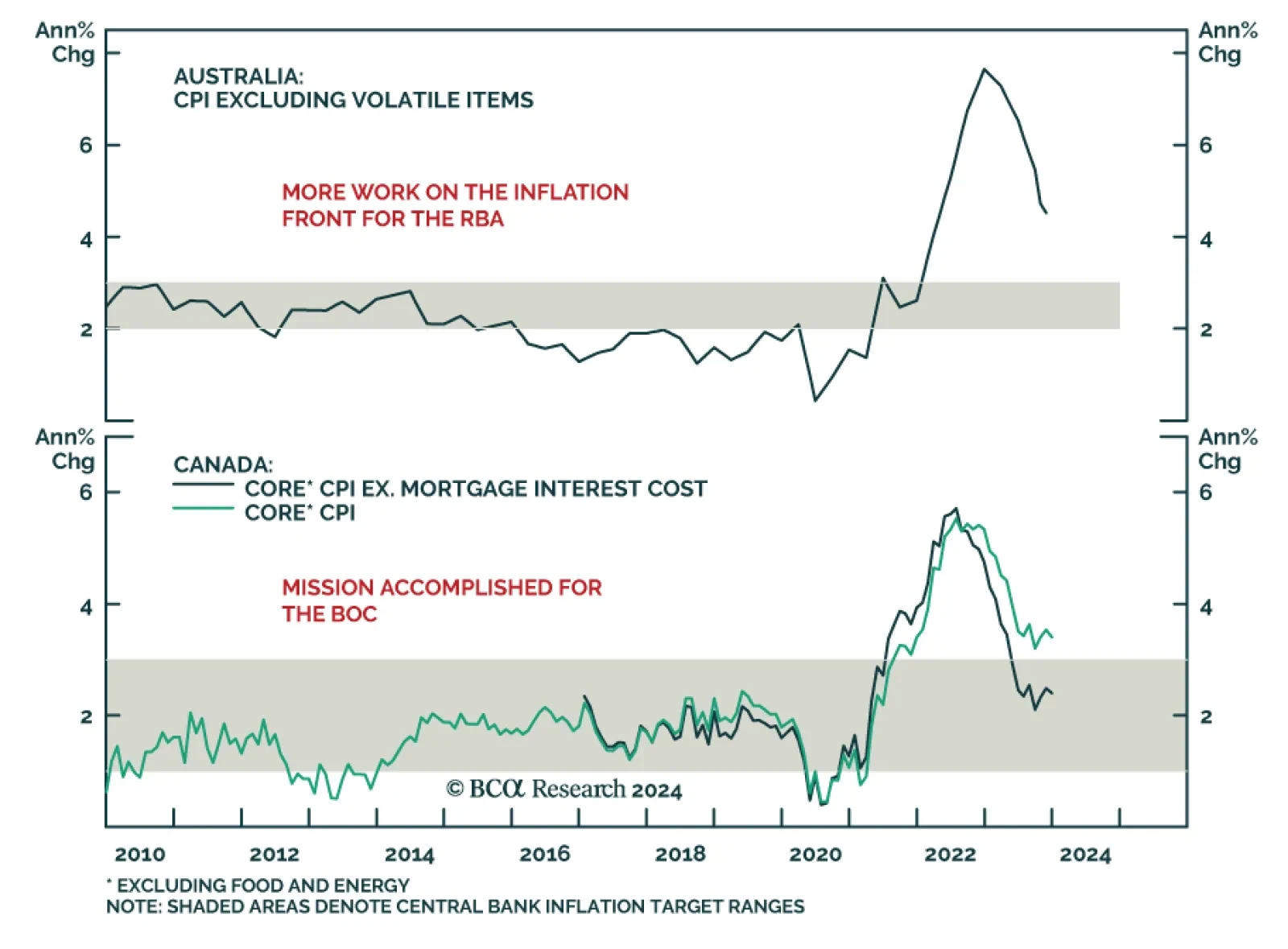

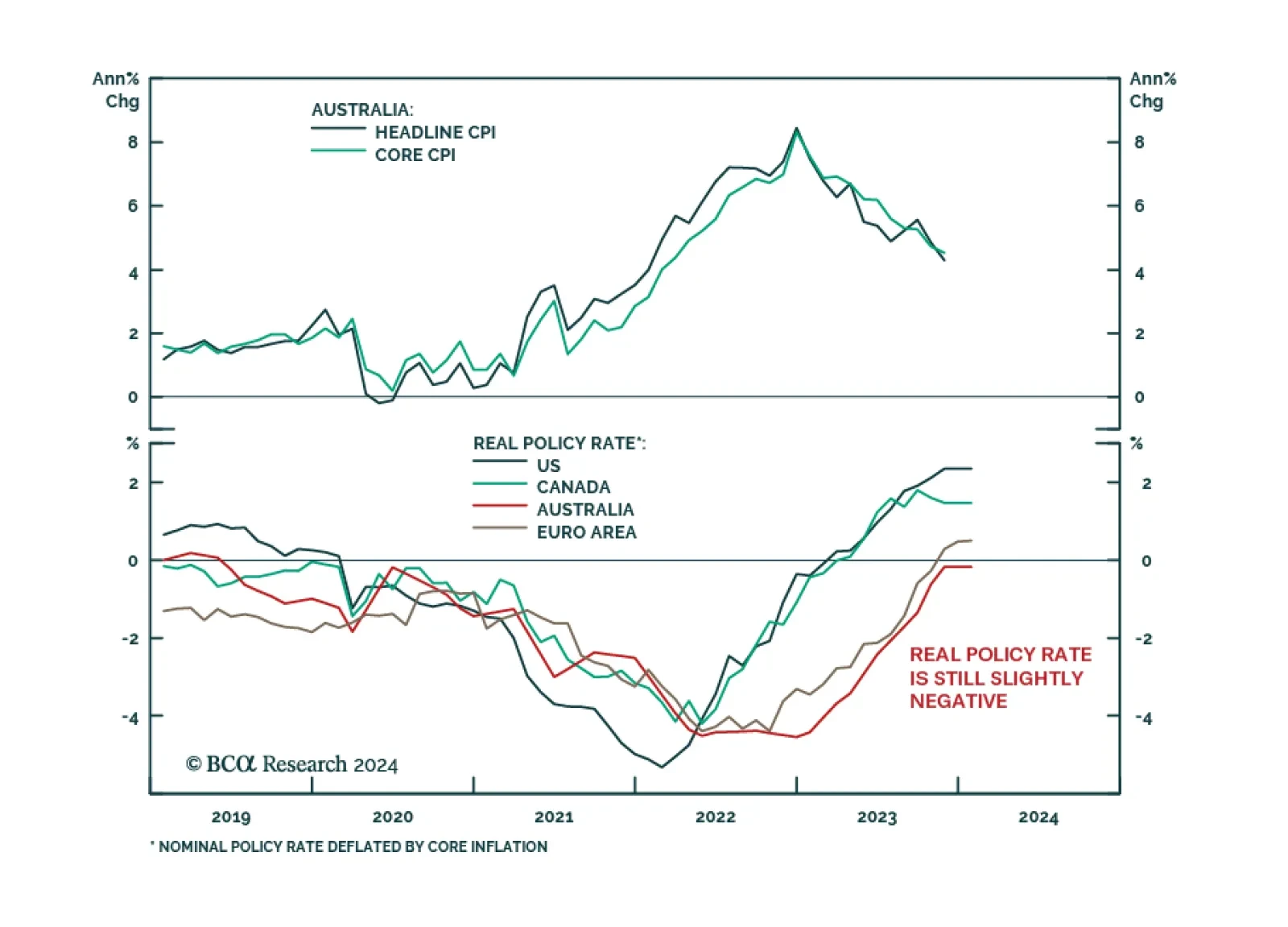

Ahead of today’s Bank of Canada (BoC) meeting and the Reserve Bank of Australia (RBA) meeting on February 6th, our Global Fixed Income Strategists compared the monetary policy outlooks for both central banks. In Canada,…

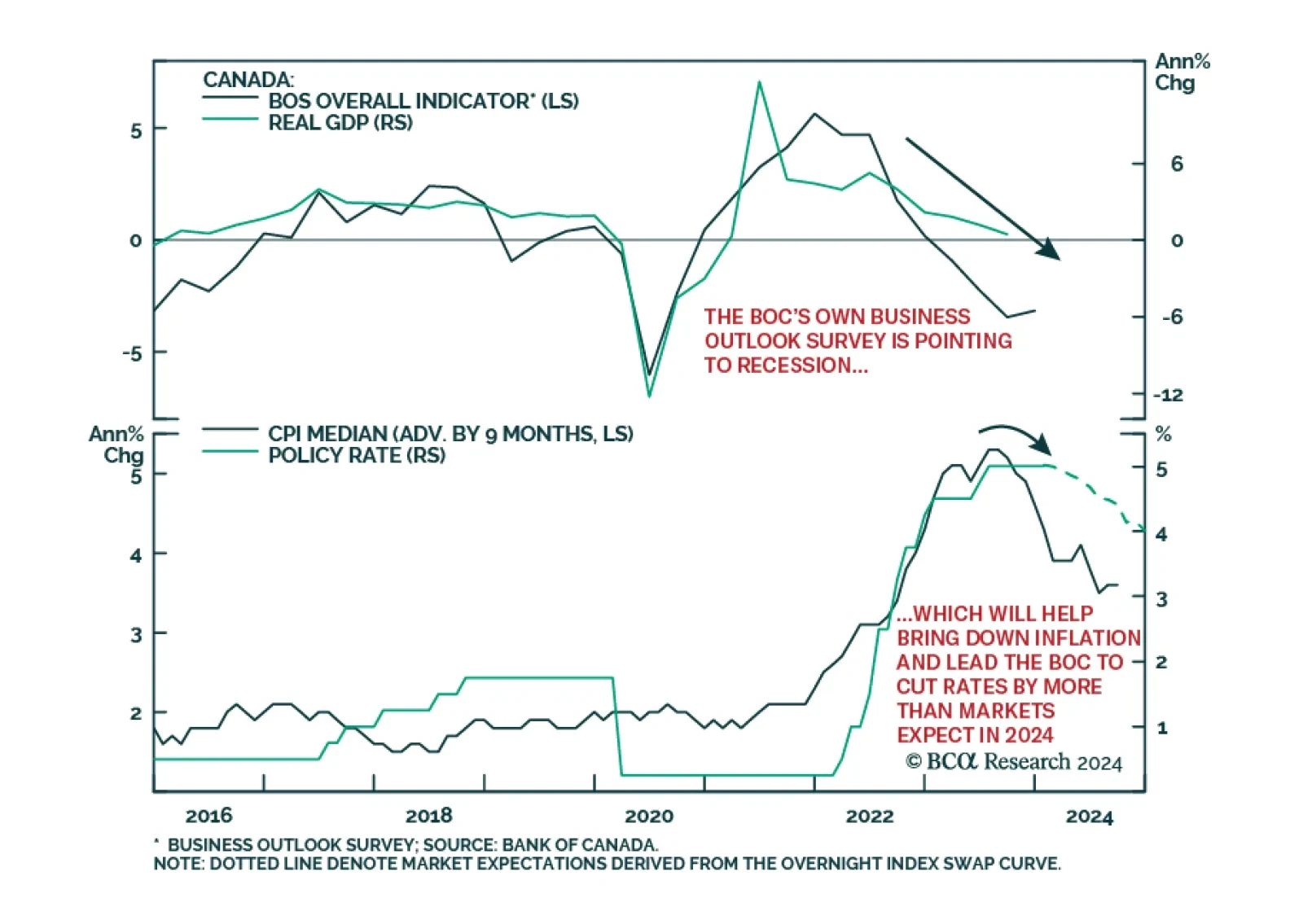

In this Strategy Insight, we assess the monetary policy path for Australia and Canada in 2024 and we discuss how to profit from a growing divergence between the two economies.

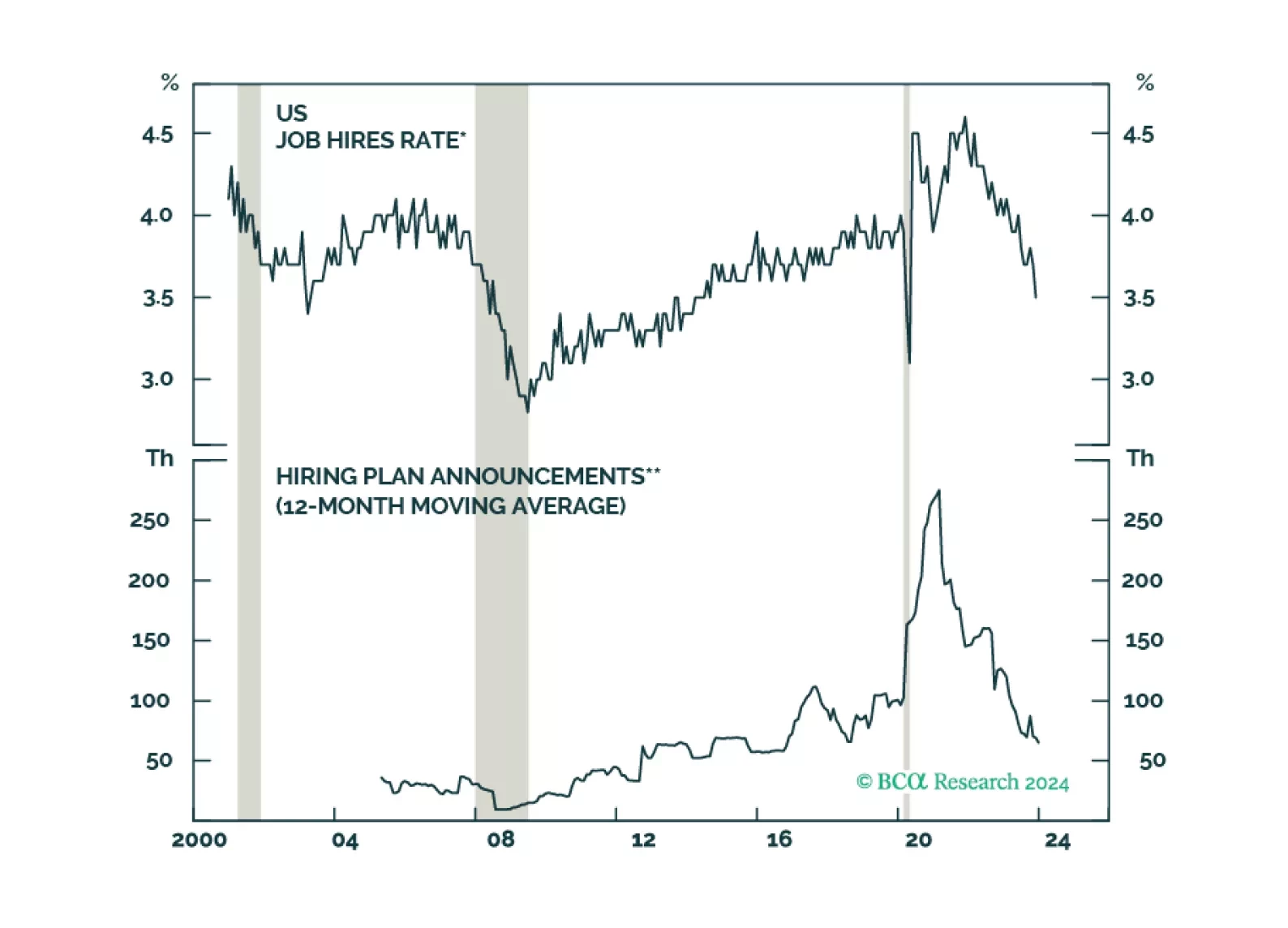

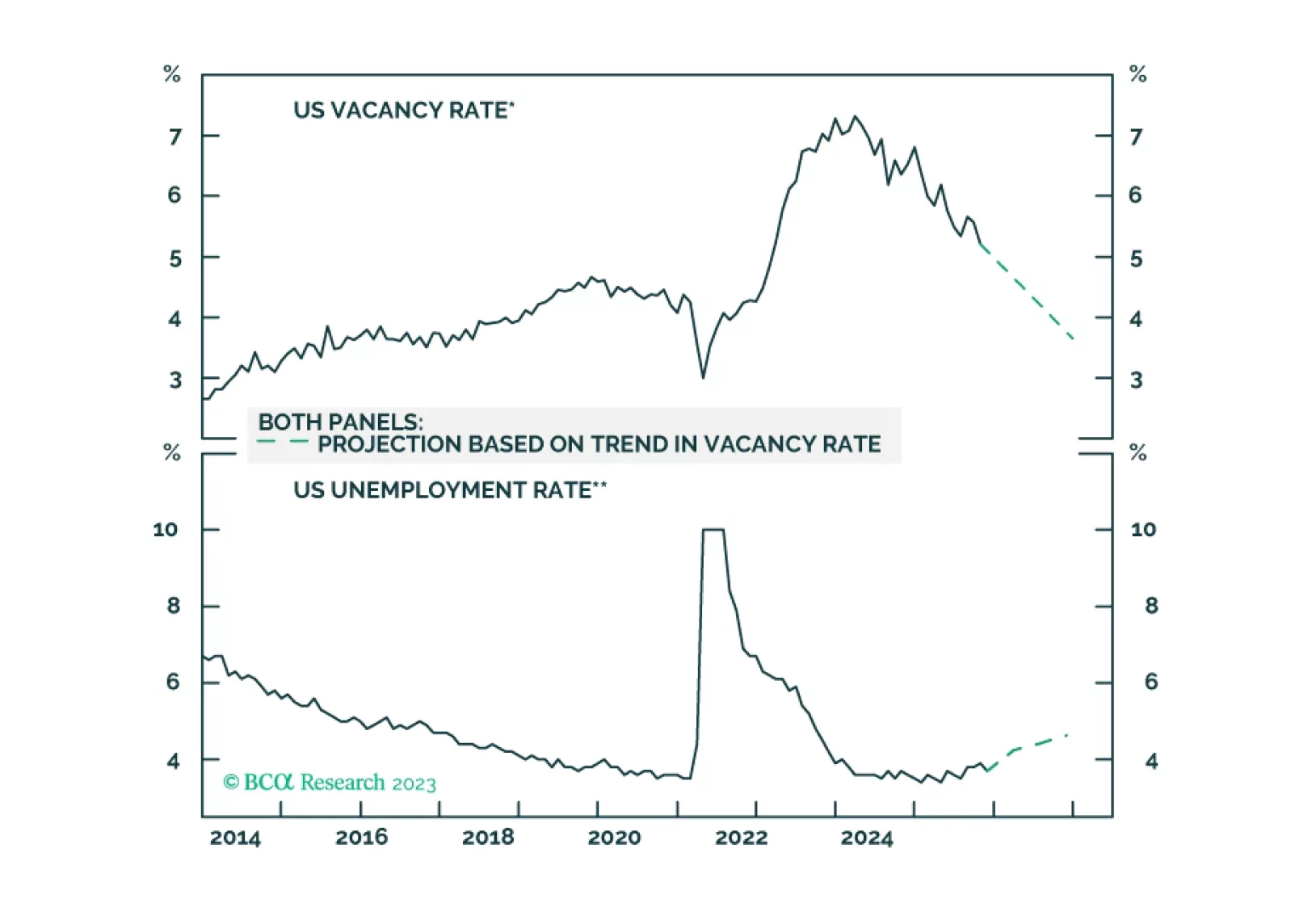

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

Canadian government bond yields jumped on Tuesday, with the 10-year yield rising by nearly 14 basis points. While most other major DM government bonds also sold off, the move in Canadian yields was relatively more pronounced.…

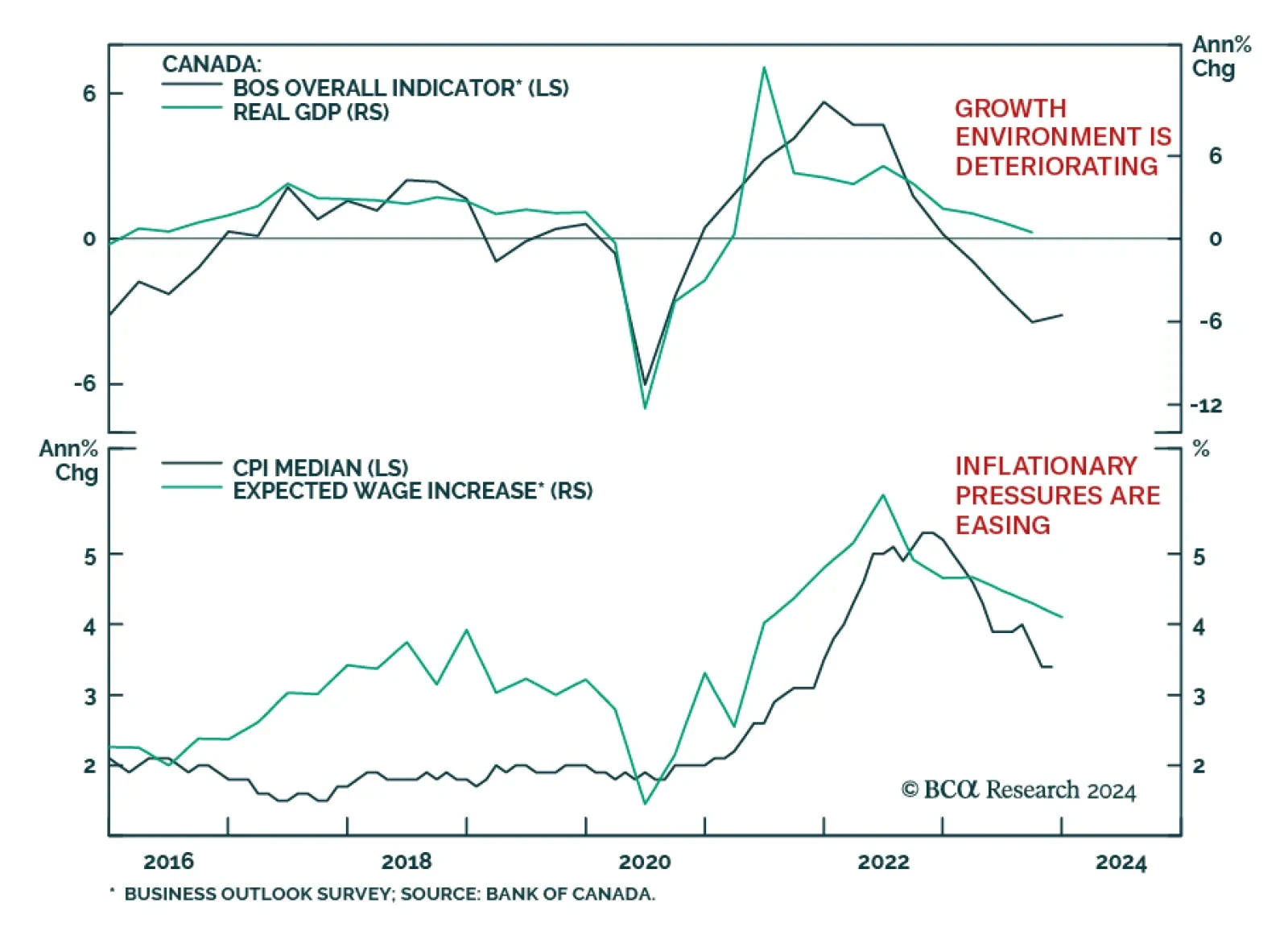

Canada’s Business Outlook Survey (BOS) indicator increased slightly in Q4, suggesting that sentiment stabilized at the end of 2023. In particular, easing inflationary pressures amid weaker demand and greater competition…

Australian CPI inflation fell from 4.9% y/y to a 22-month low of 4.3% y/y in November – slightly below expectations of 4.4%. Underlying measures of core inflation also indicate that price pressures eased in November. The…