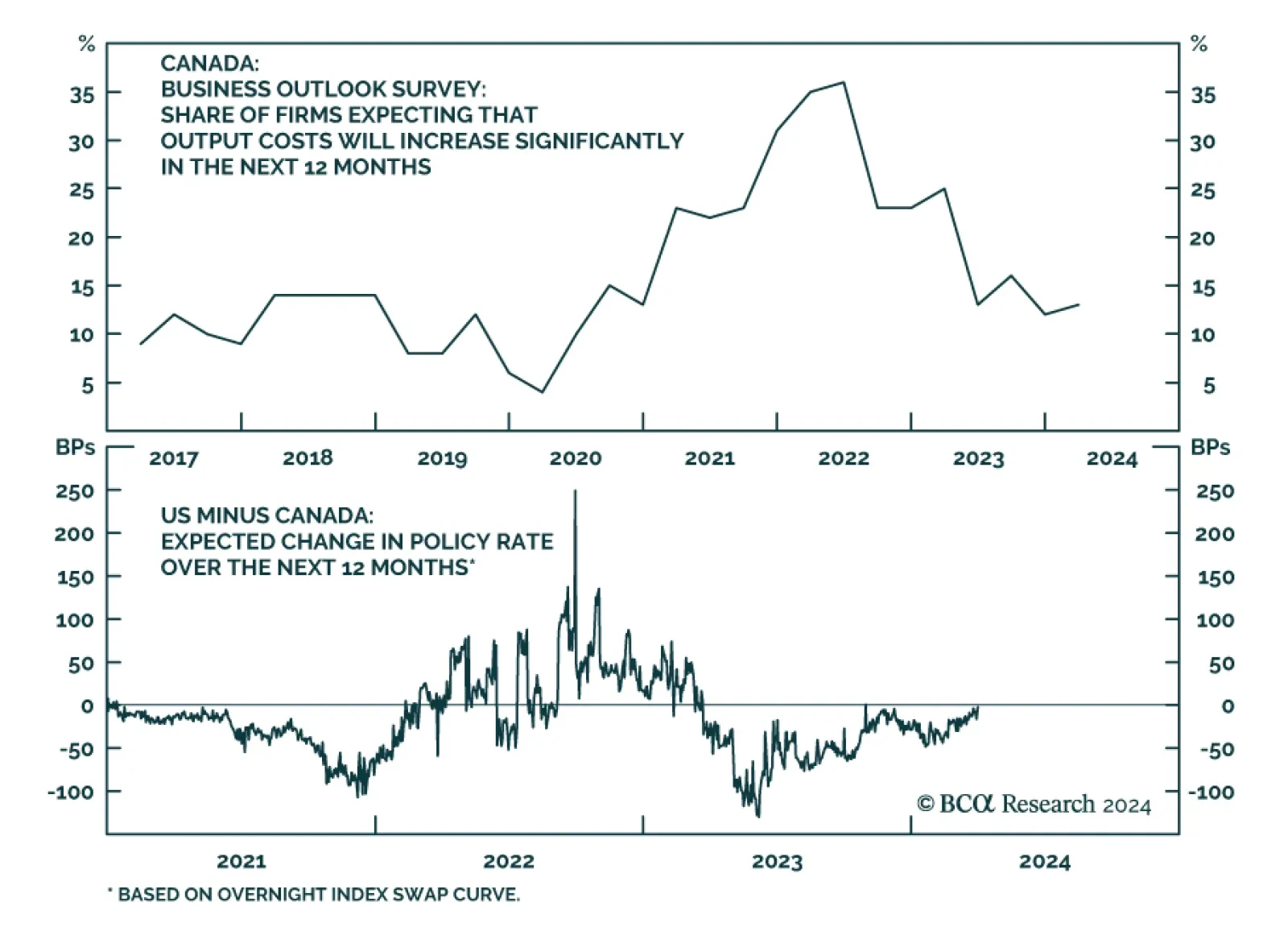

The Bank of Canada released its Business Outlook Survey for the first quarter of this year on Monday. While there are some early signs of stabilization, overall demand continues to be weak. The indicator for future sales growth…

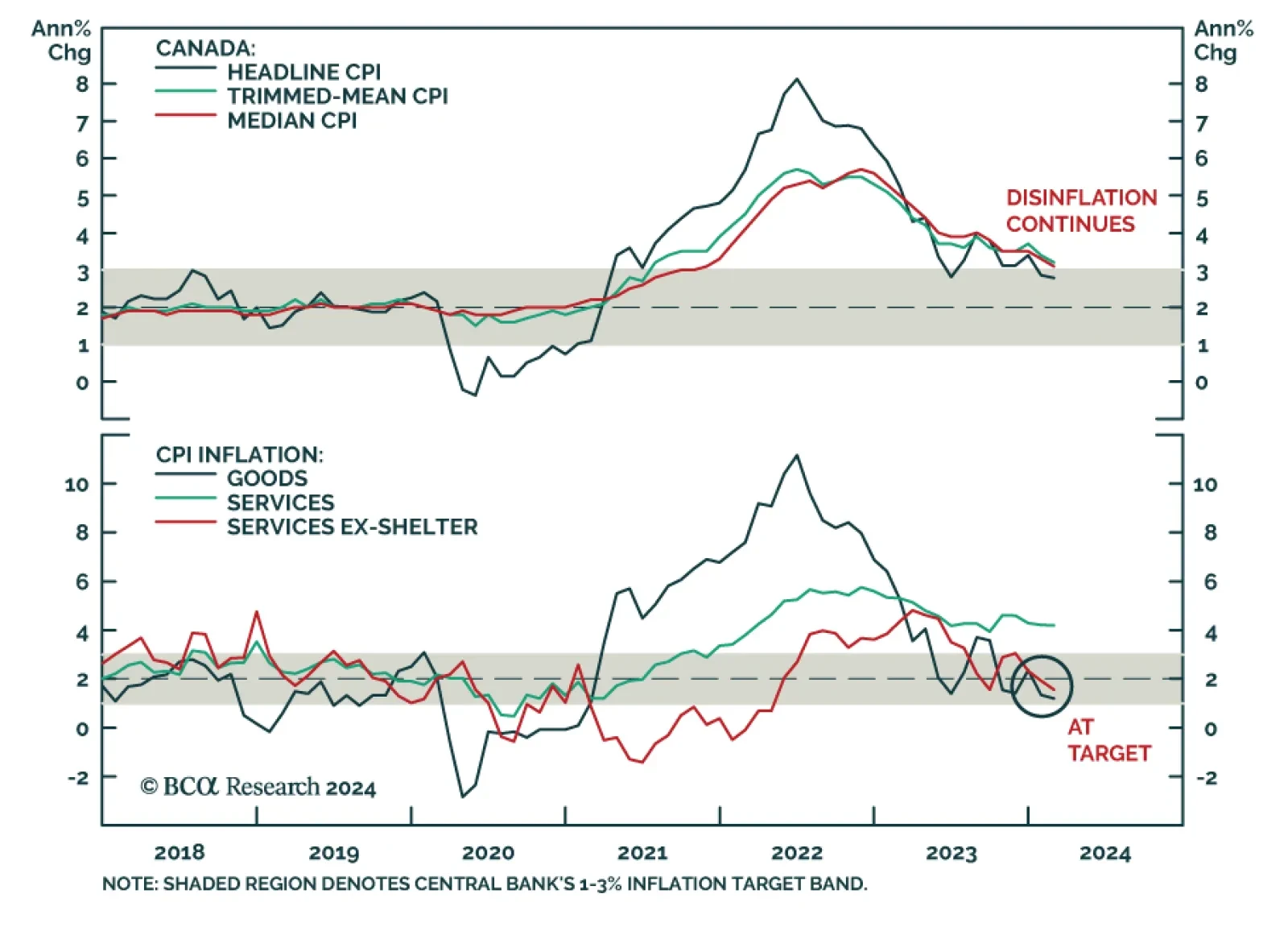

Canada’s CPI release for February shows price pressures continue to ebb with the various measures of inflation all falling below consensus estimates. In particular, headline inflation decelerated from 2.9% y/y to 2.8% y/y…

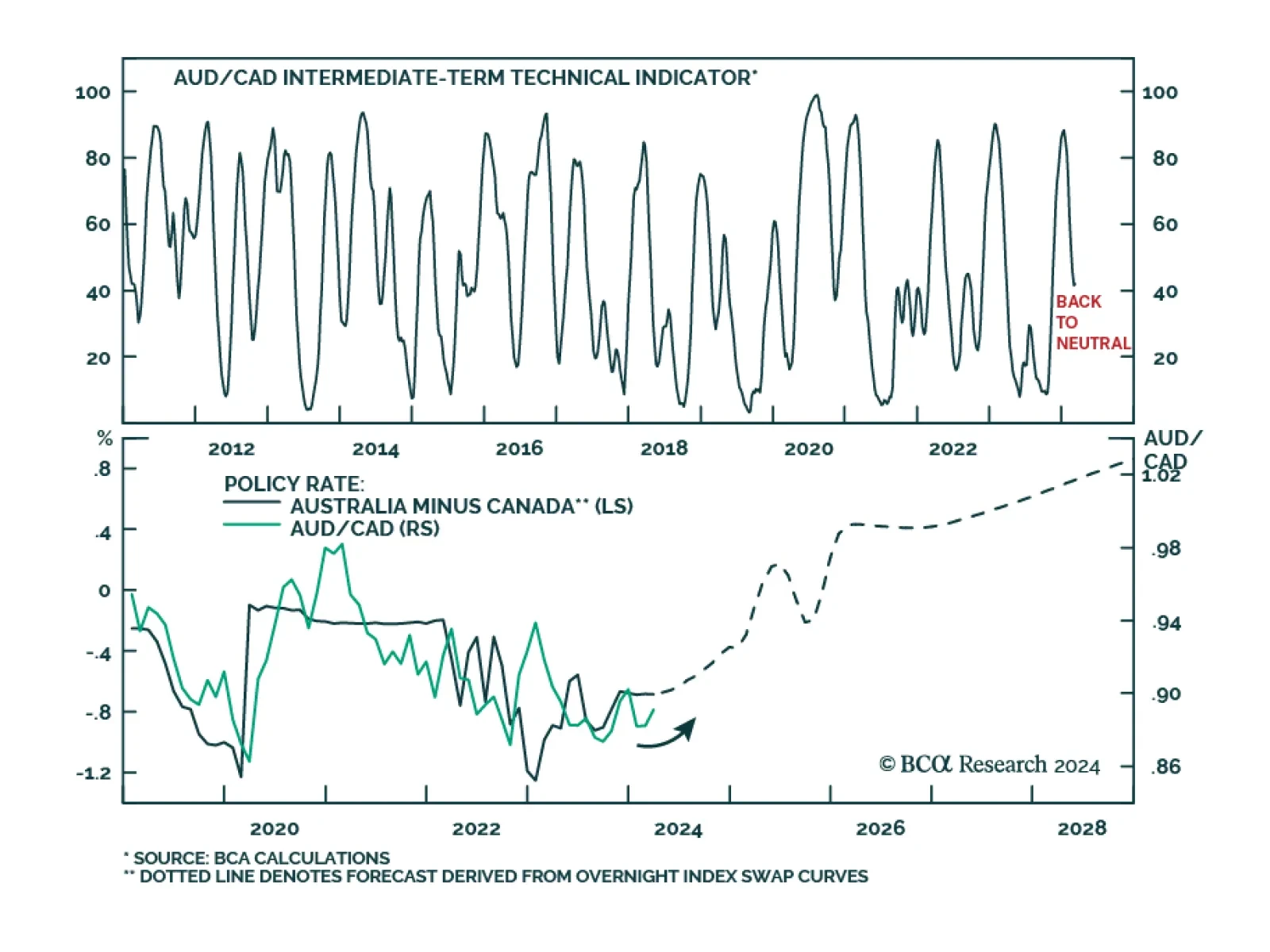

After briefly weakening in January, AUD/CAD has once again been moving higher over the past few weeks. Indeed, BCA’s Intermediate Term Technical Indicator is back to neutral from overbought territory, paving the way for…

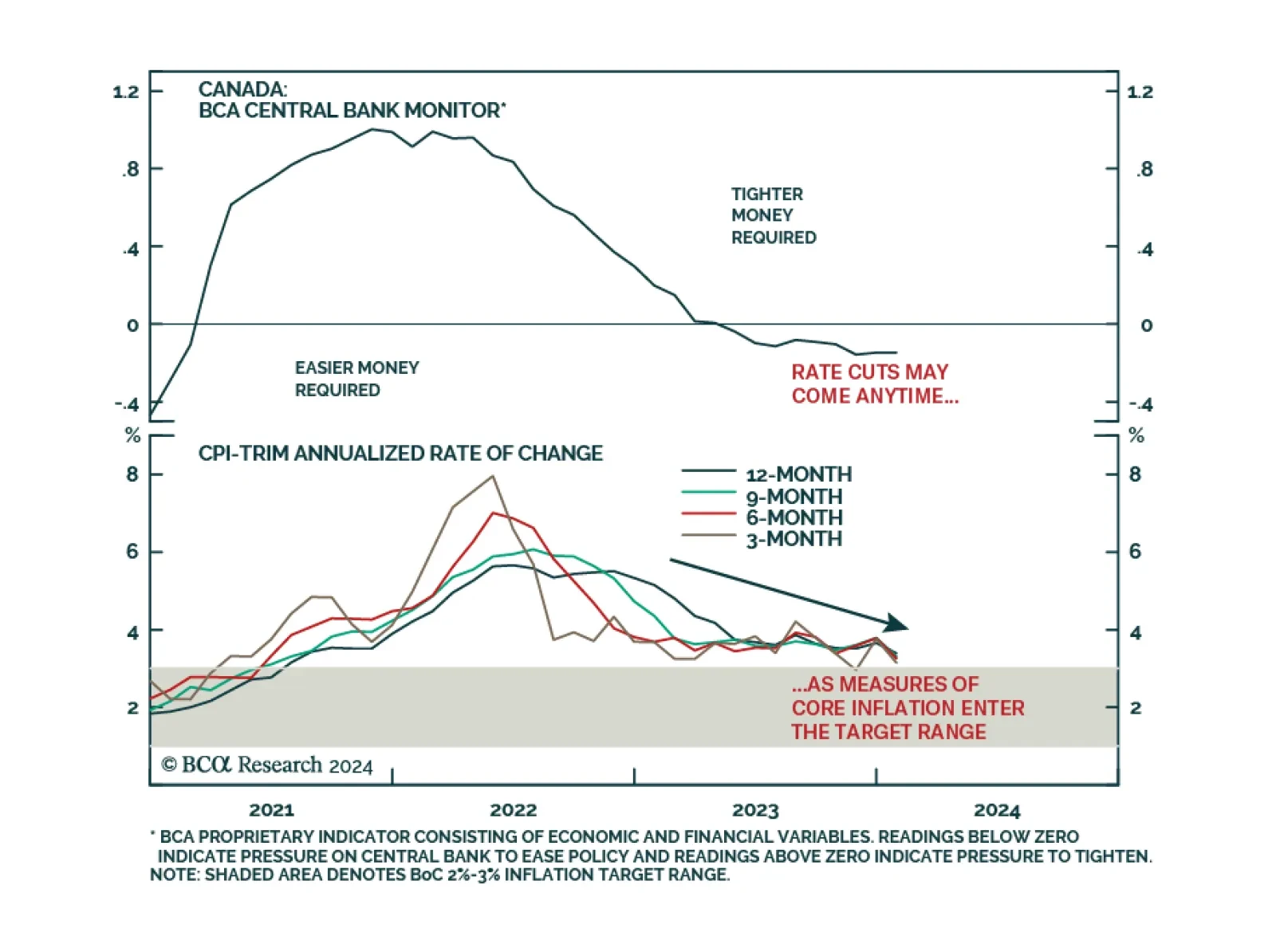

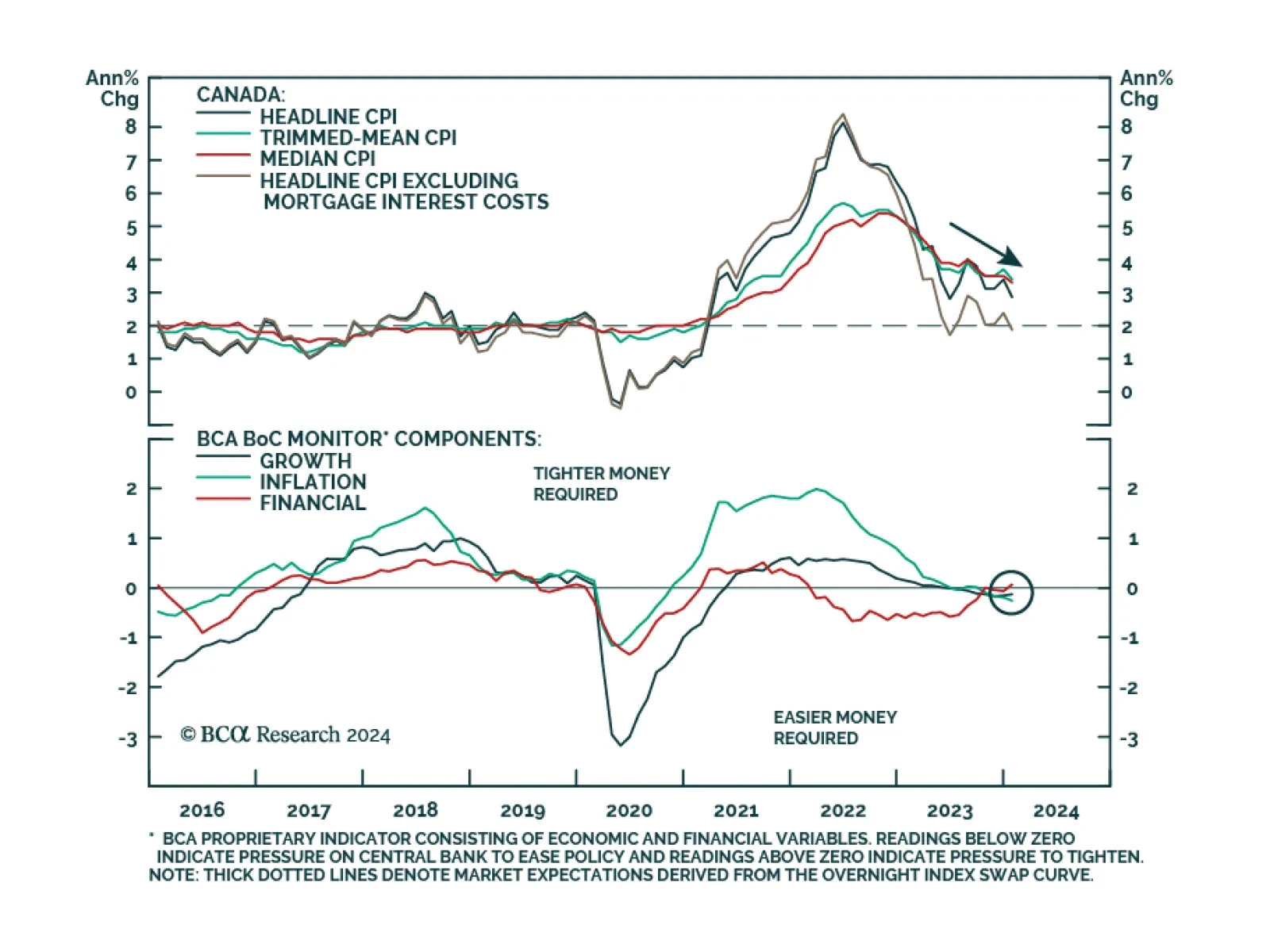

The Bank of Canada (BoC) kept its policy rate steady at 5% for the sixth consecutive meeting yesterday, in line with expectations. The BoC, which has changed its communication policy to now provide a press conference after every…

Canada’s January CPI release shows price pressures cooling last month. Headline CPI eased to 2.9%y/y from 3.4%y/y in December, below expectations of 3.3%y/y. Furthermore, month-over-month inflation fell for the first time…

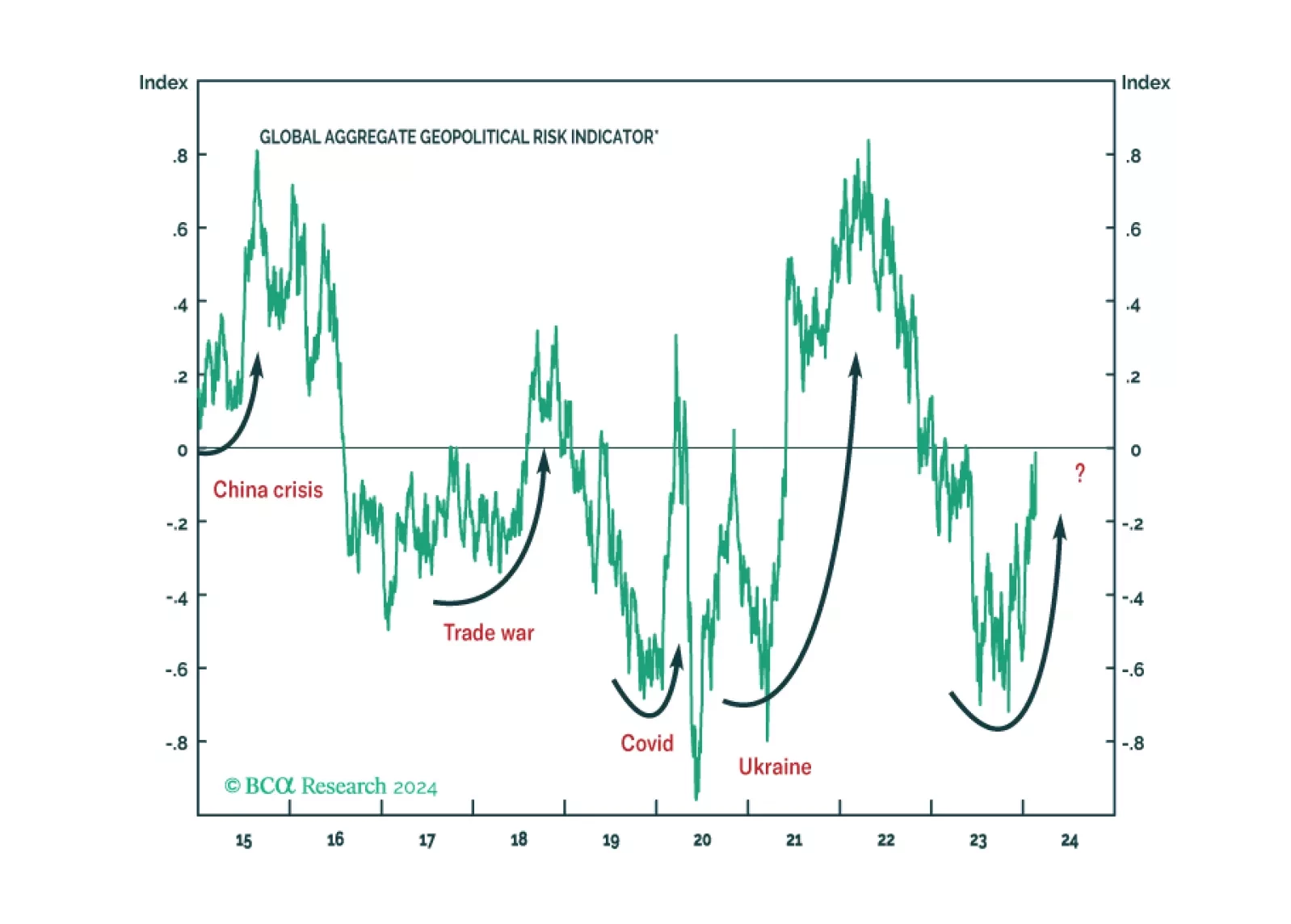

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

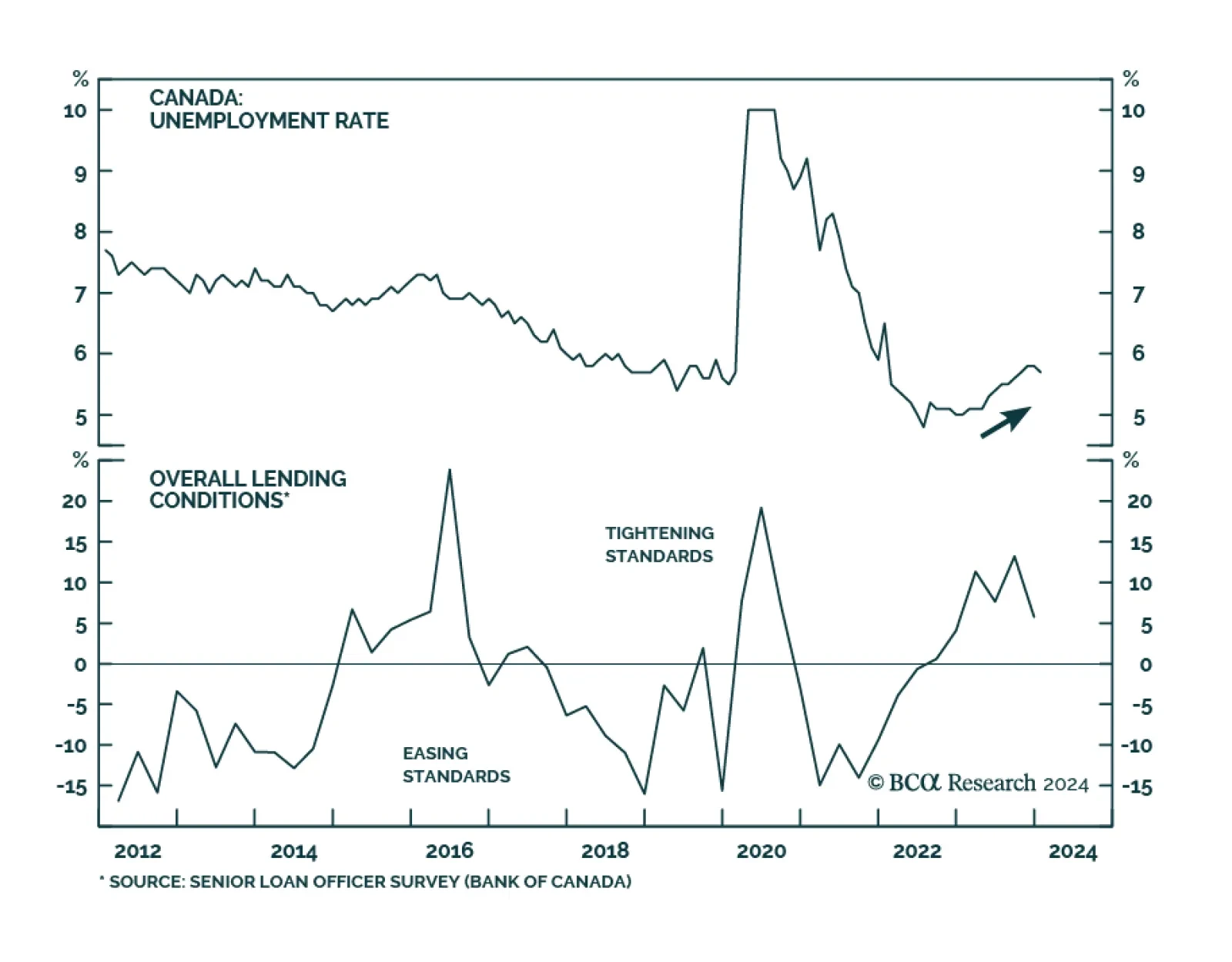

The latest Canadian data suggest that although demand is cooling down, the Canadian economy is not in freefall. The unemployment rate fell for the first time since December 2022, declining by 0.1 percentage points to 5.7%,…

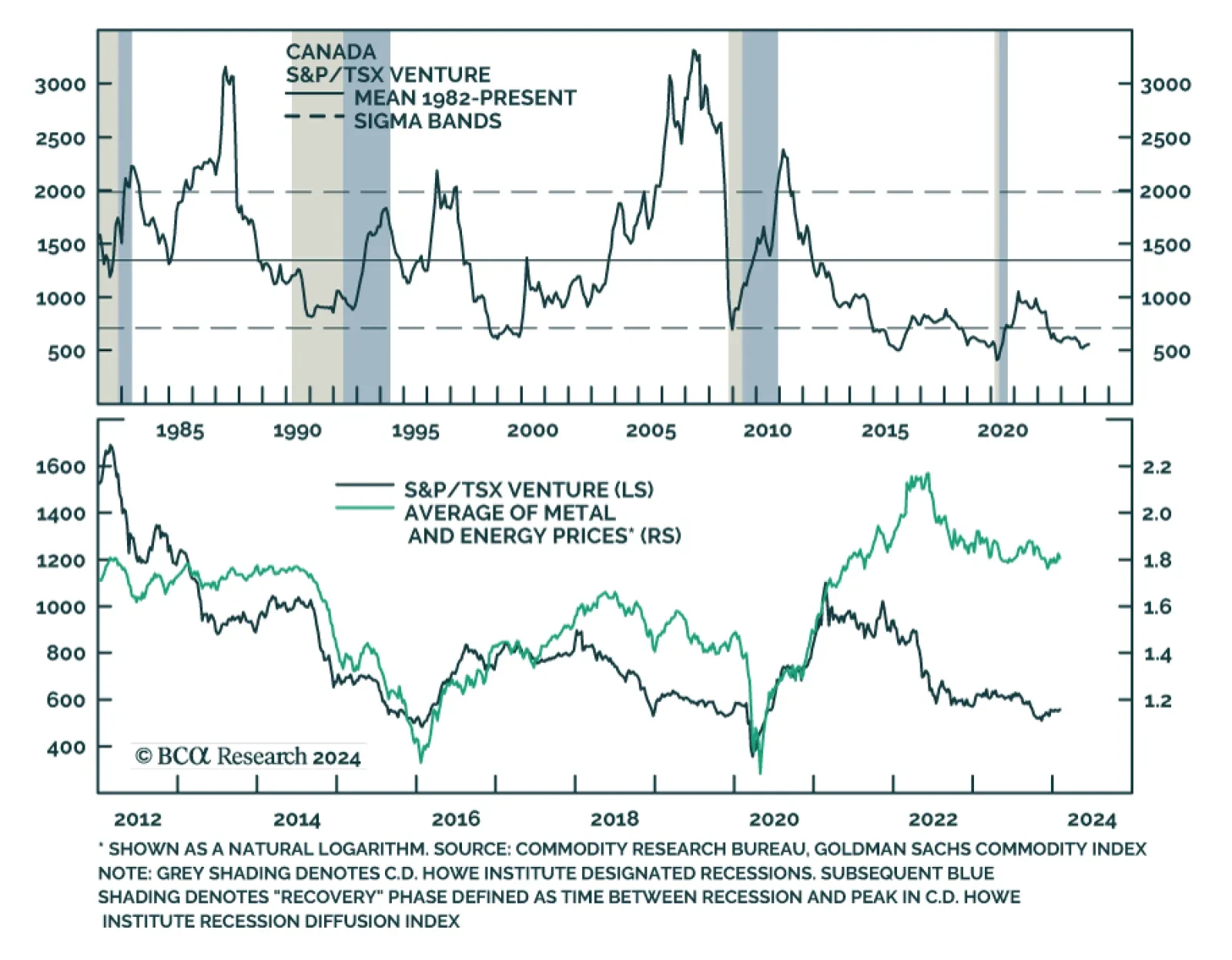

The S&P/TSX Venture Index is a micro-cap index of Canadian companies listed on the TSX Venture Stock Exchange. Nearly two thirds of the index is comprised of material and energy stocks, making the index exposed to…

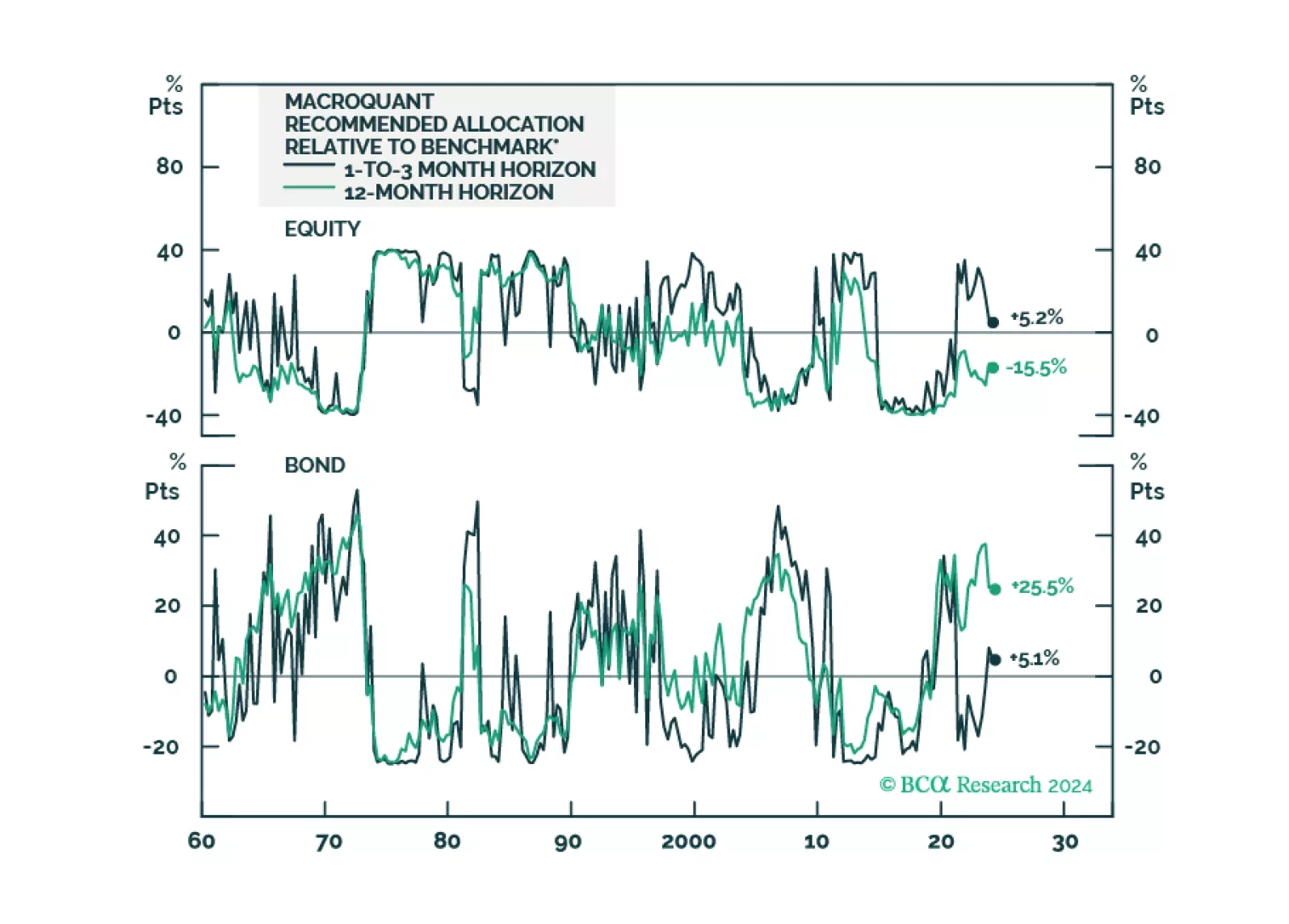

Following the release of the white paper yesterday, today we are sending you the inaugural issue of the MacroQuant Monthly, a report summarizing the output of our next-generation MacroQuant 2.0 model.

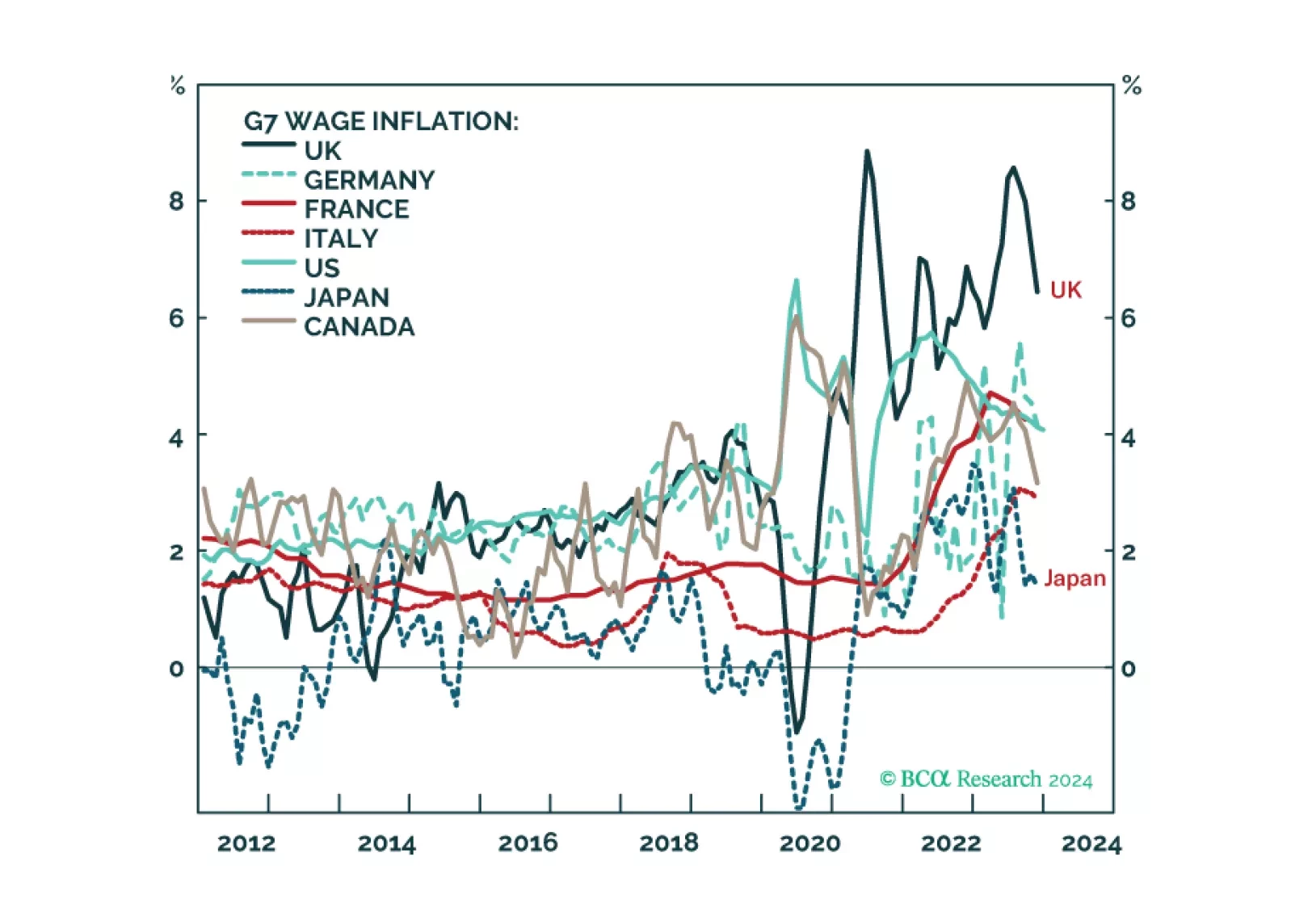

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…