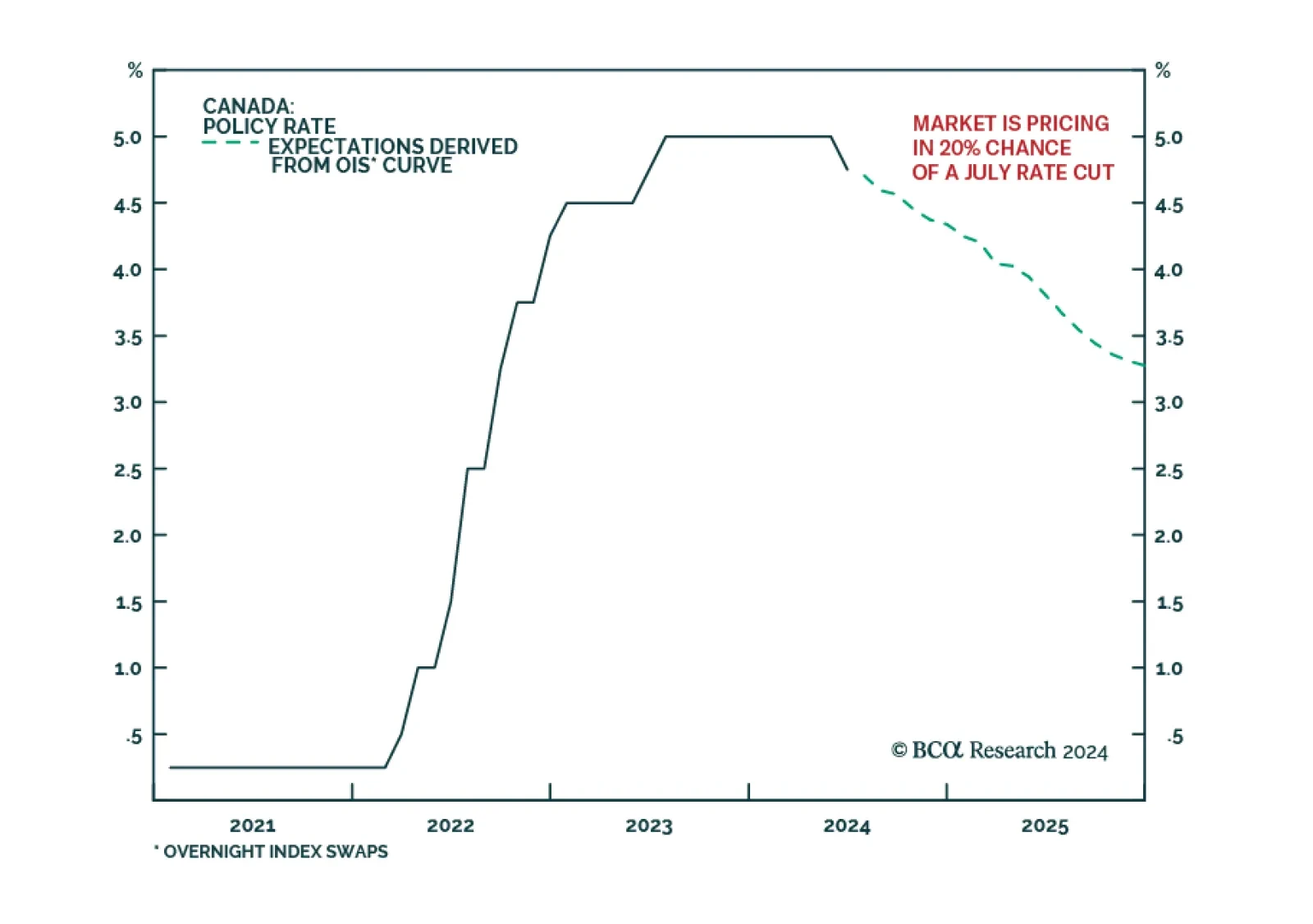

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

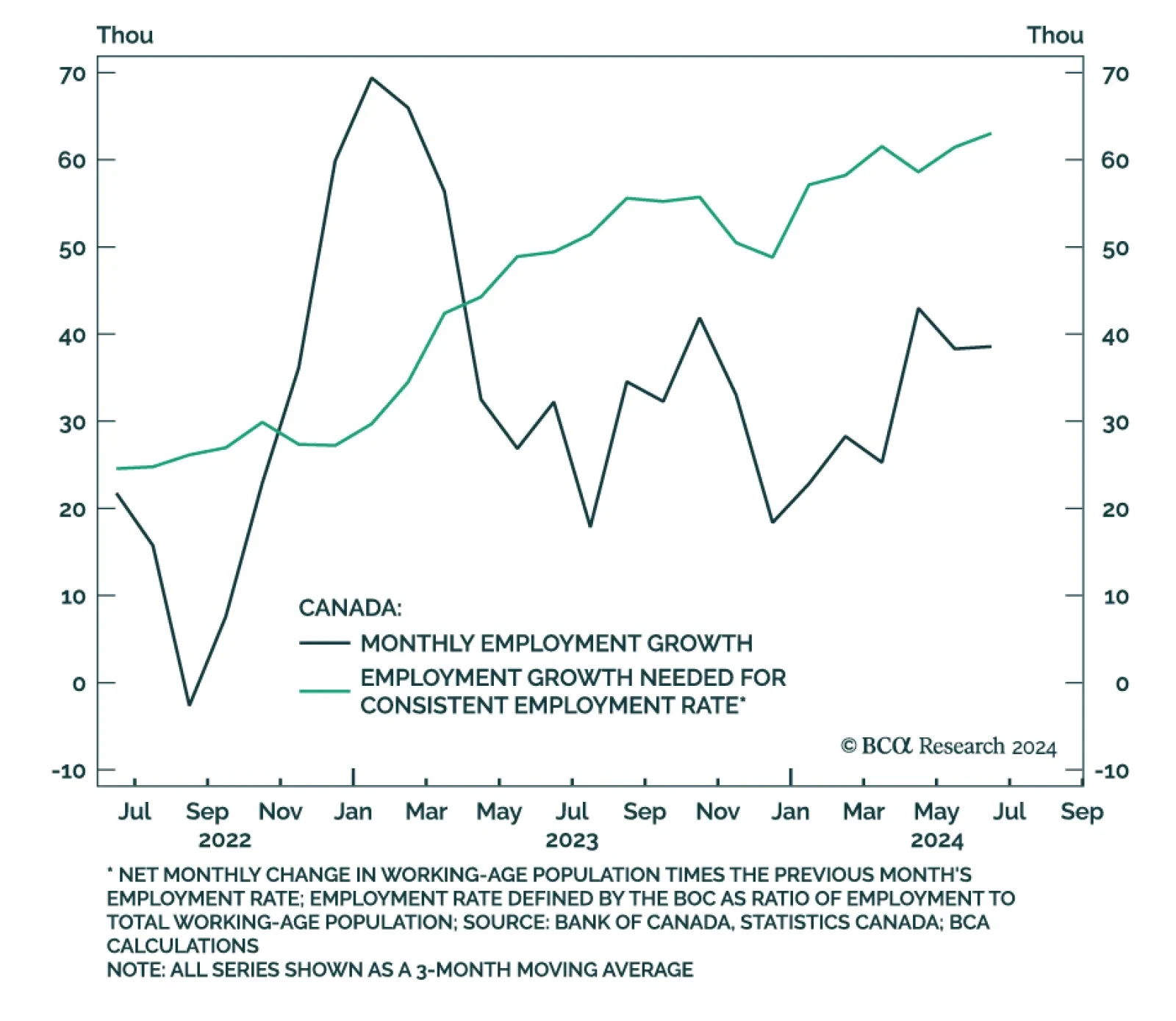

The latest release of the Canadian Labour Force Survey indicated further softening of the labor market in the Great White North. The economy experienced a net loss in total employment, shedding 1,400 jobs compared to market…

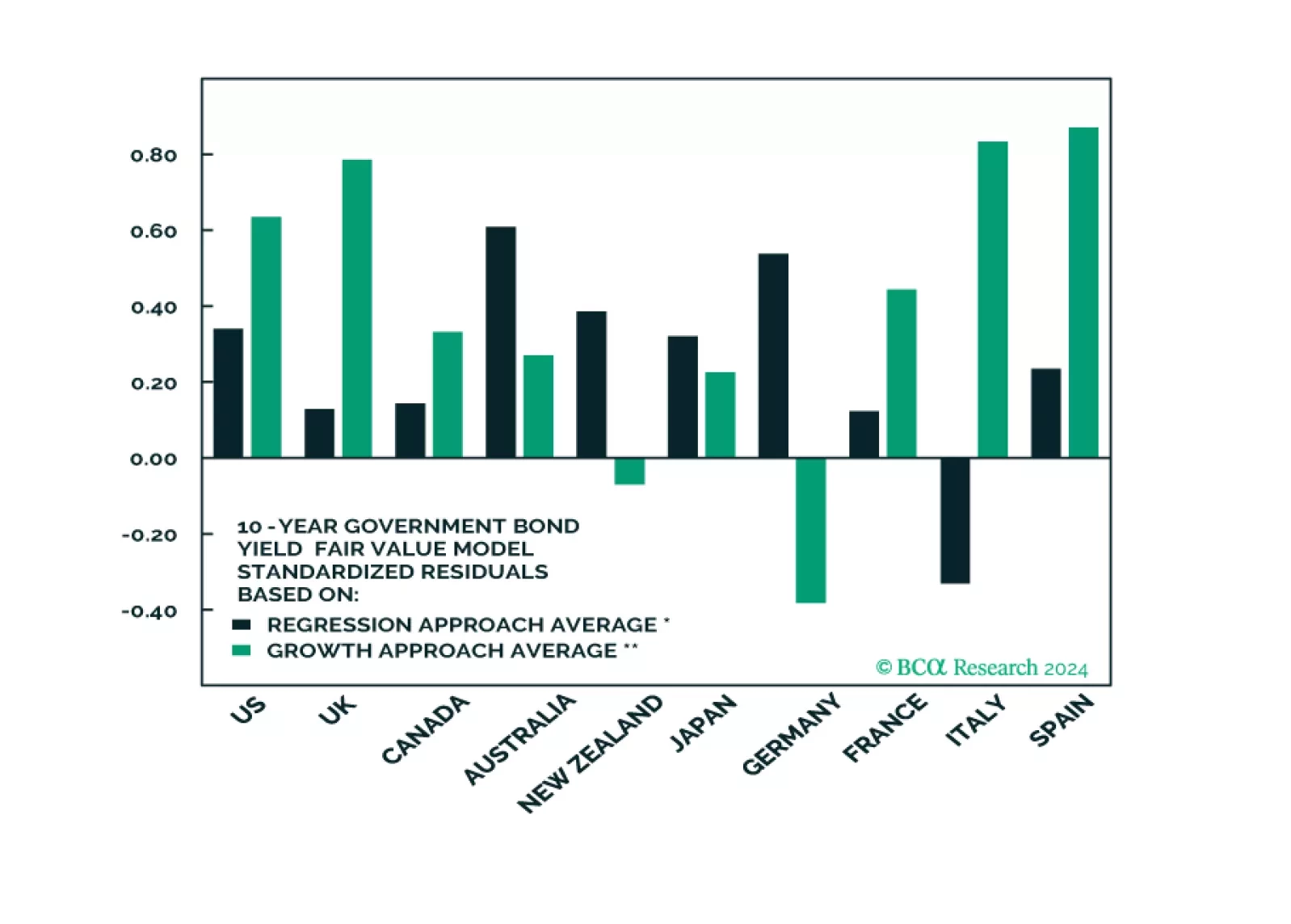

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

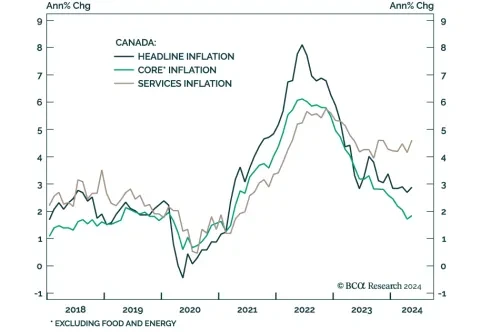

Canada’s headline inflation rate for May surprised to the upside on Tuesday. The 0.6% month-on-month print and 2.9% year-on-year increase came in above expectations of 0.3% m/m and 2.6% y/y, respectively. Both measures…

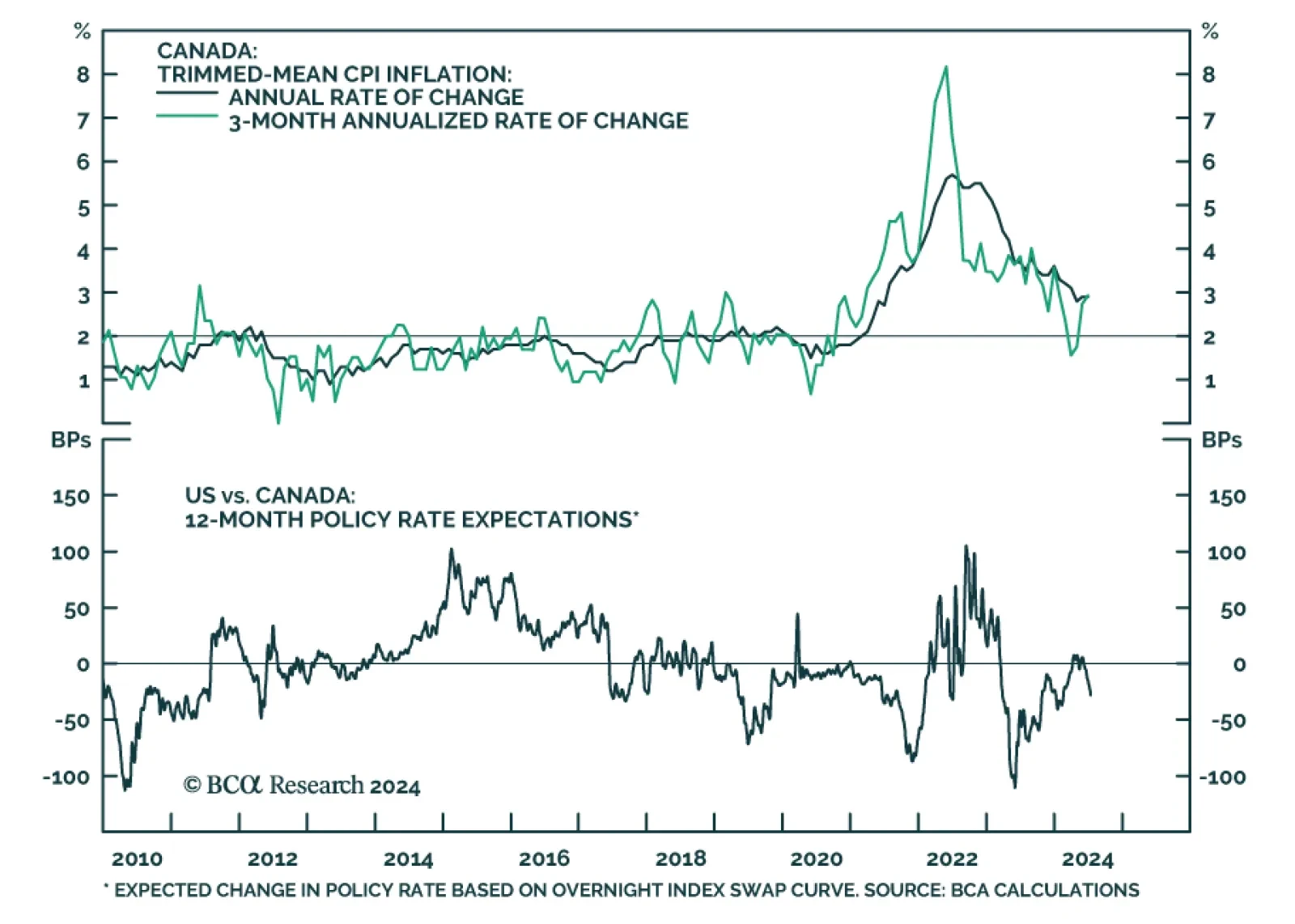

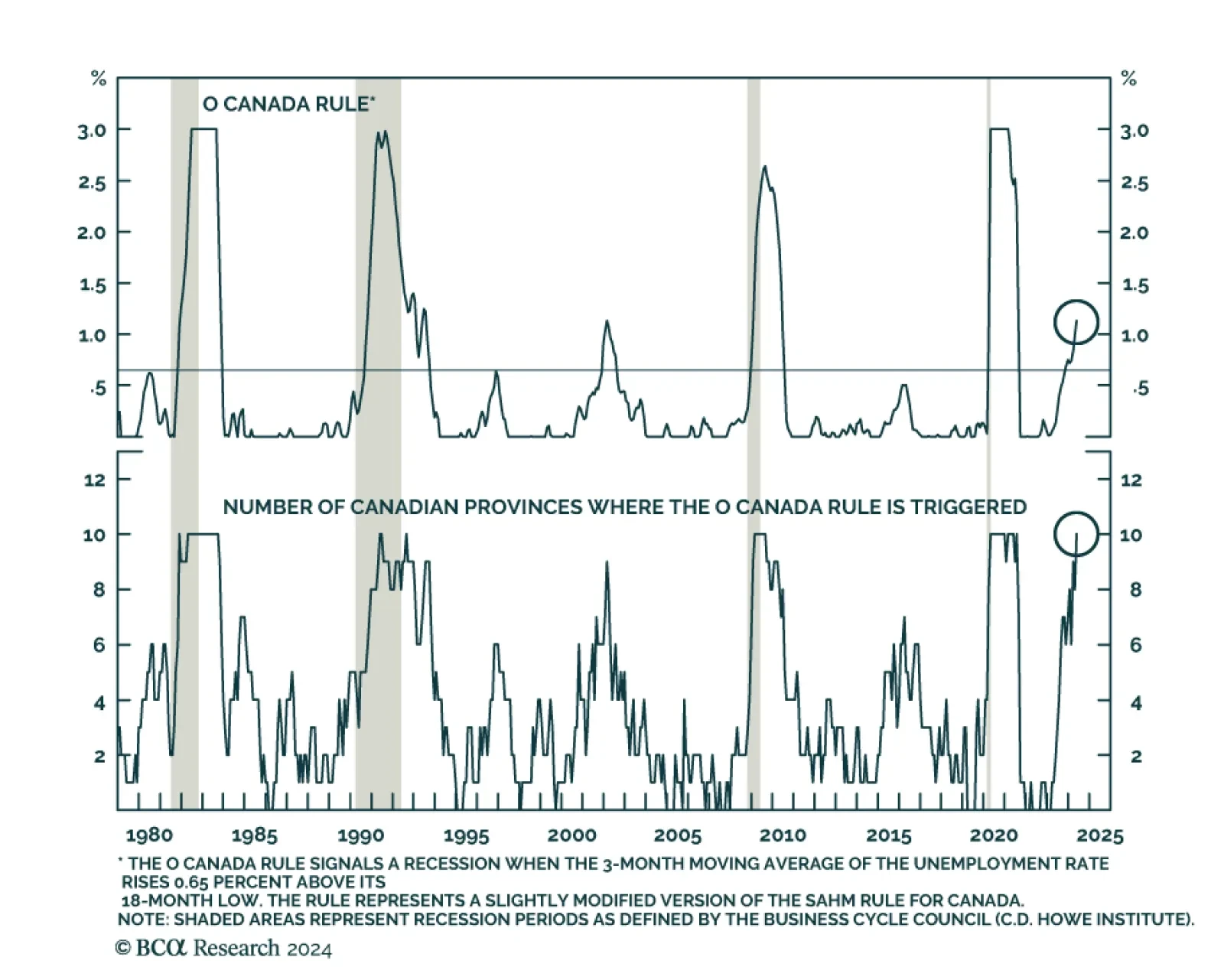

The Bank of Canada (BoC) cut interest rates from 5% to 4.75% in June and another rate cut in July would be warranted. Tight monetary policy is impacting the labor market. The unemployment rate (6.1%) has been on an uptrend…

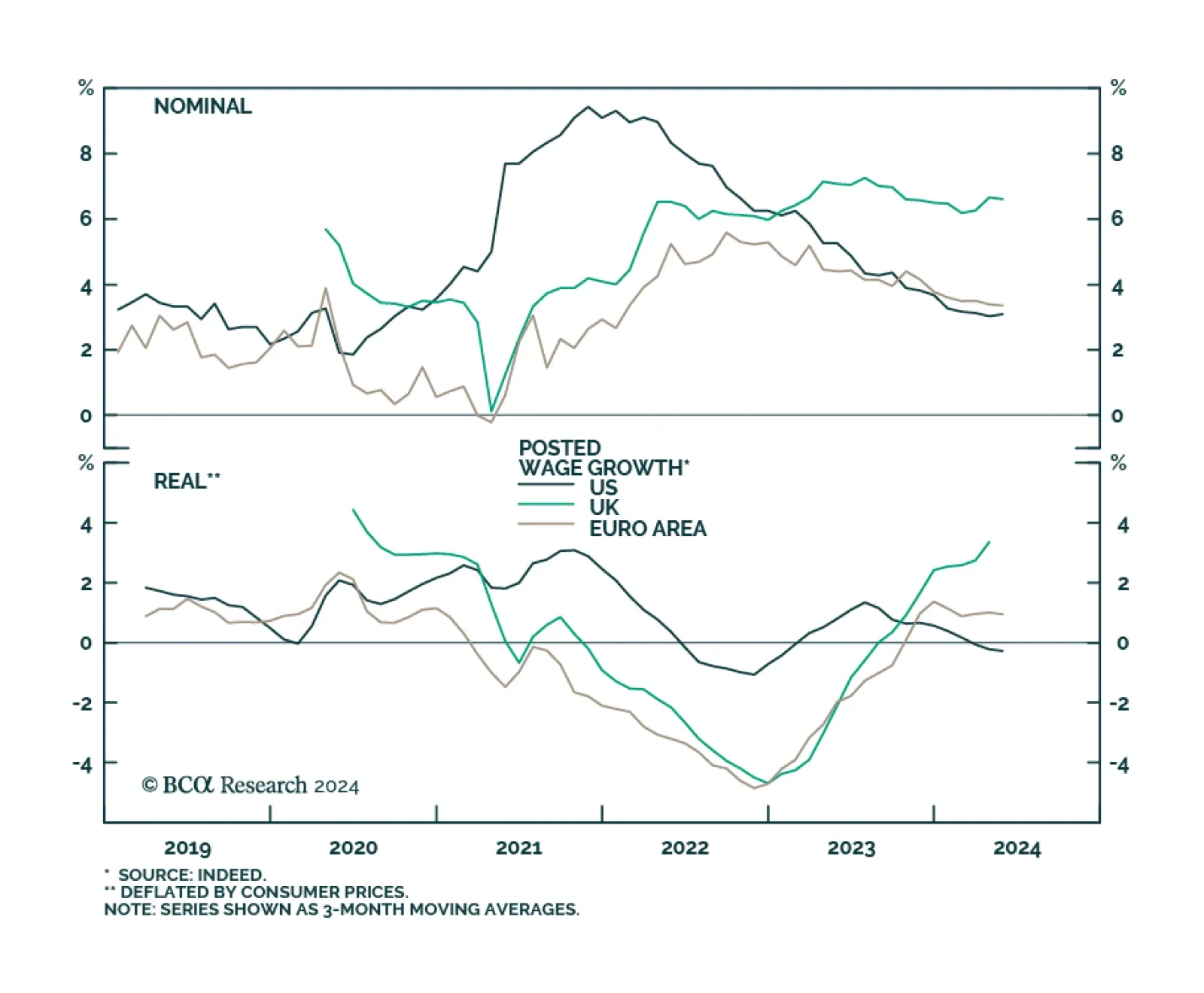

According to BCA Research’s Global Investment Strategy service, aggressive fiscal stimulus and labor market flexibility contributed to the relative strength of the US consumer. However, adverse region-specific effects also…

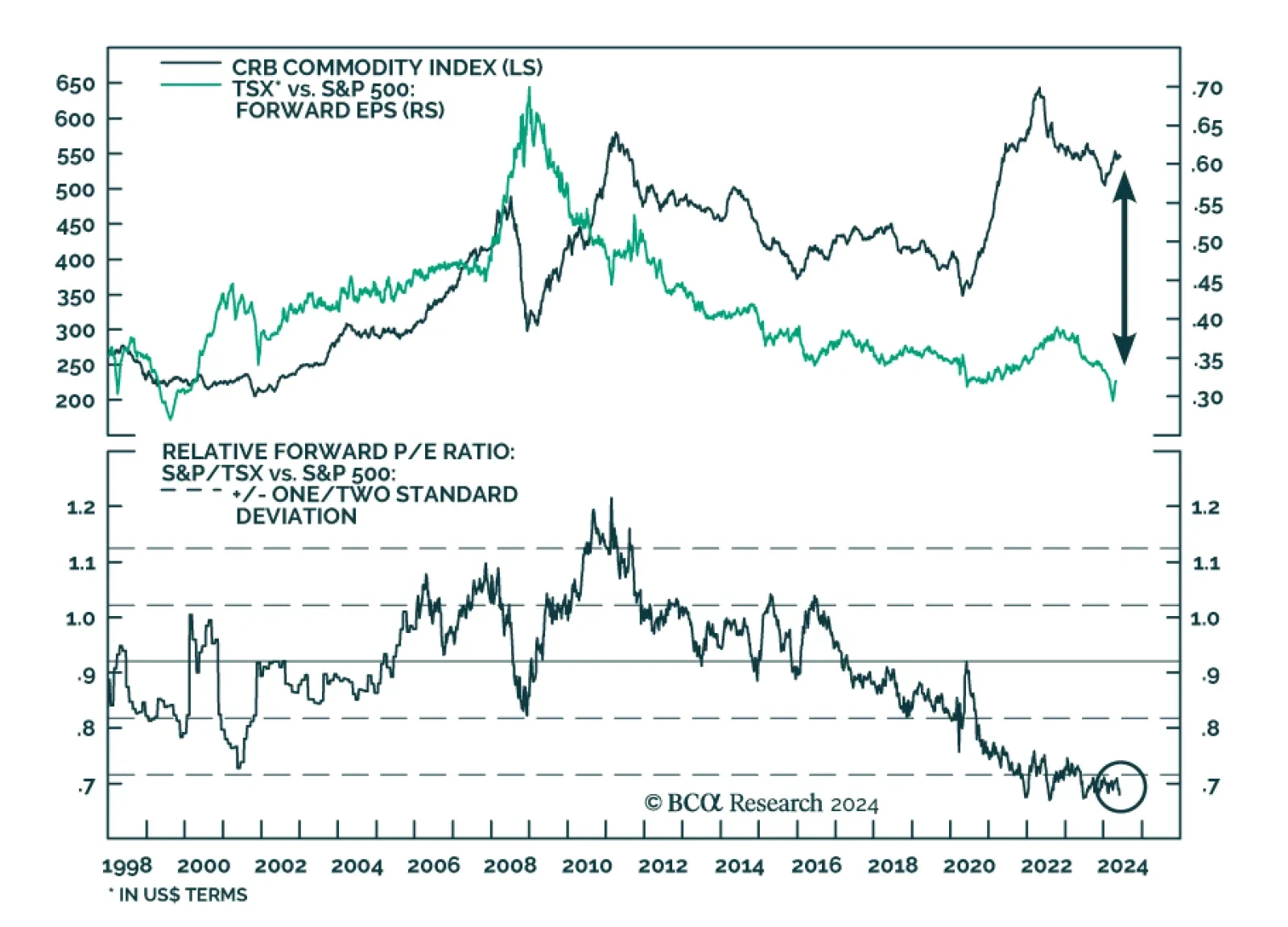

A decade of Canadian equity underperformance has led to a historical discount relative to the S&P 500. Sector composition largely explains this underperformance. Banks and natural resources stocks are overrepresented in the…

The Bank of Canada reduced its policy rate by 25 basis points from 5% to 4.75% on Wednesday, in line with the market consensus. Headline inflation and the BoC’s preferred measures of core inflation are within the BoC’…

Canada’s headline CPI inflation decelerated in April from 2.9% y/y to 2.7% y/y. Notably, core median CPI eased from 2.9% y/y to a softer-than-anticipated 2.6% y/y and core trimmed-mean CPI ticked lower from 3.2% to 2.9…