This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

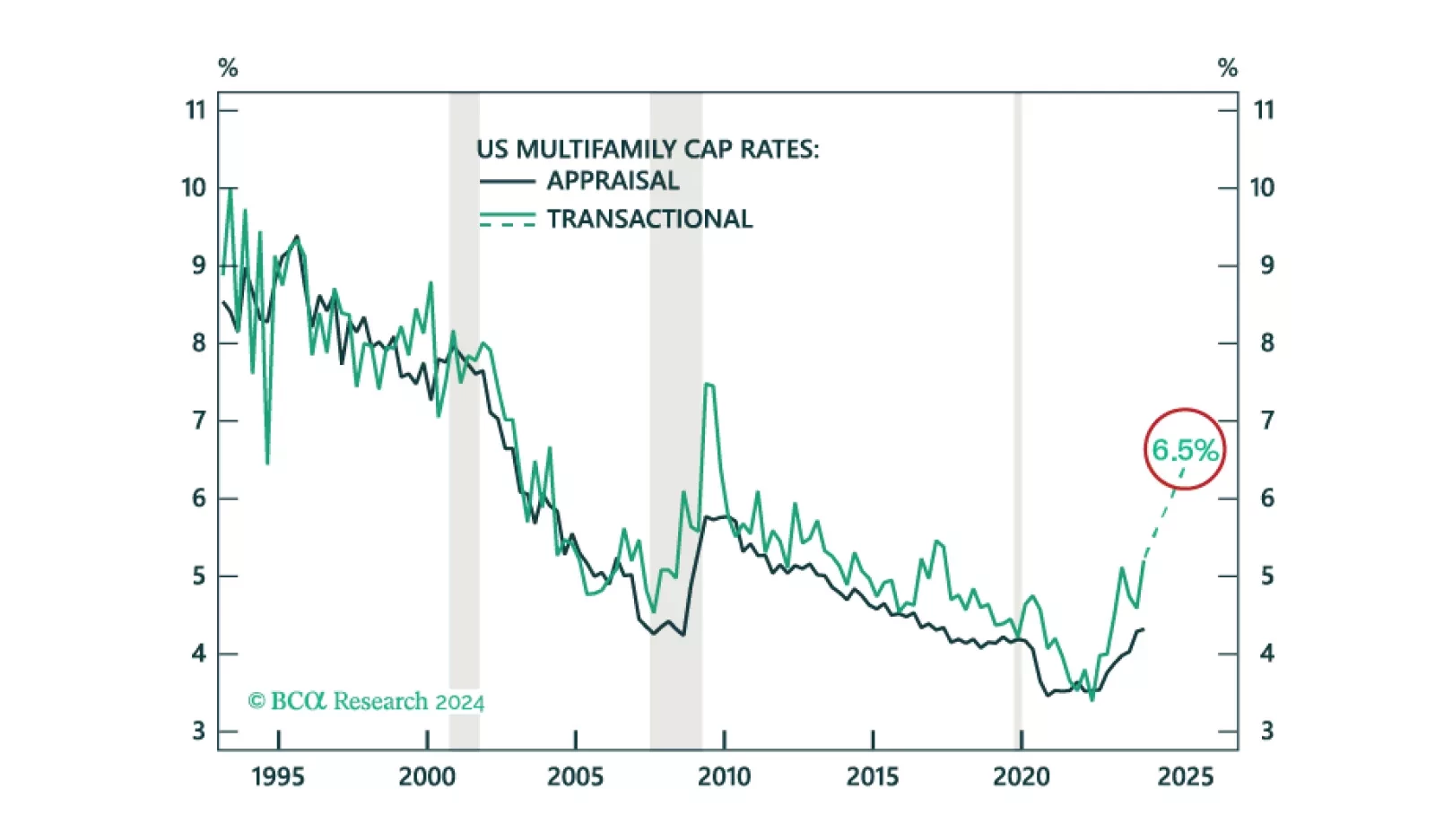

We project US Multifamily cap rates to increase from 5.2% to 6.5%. While we find an unfavorable risk-adjusted return on the asset, especially relative to other opportunities in CRE, cap rates are moving closer to peak.

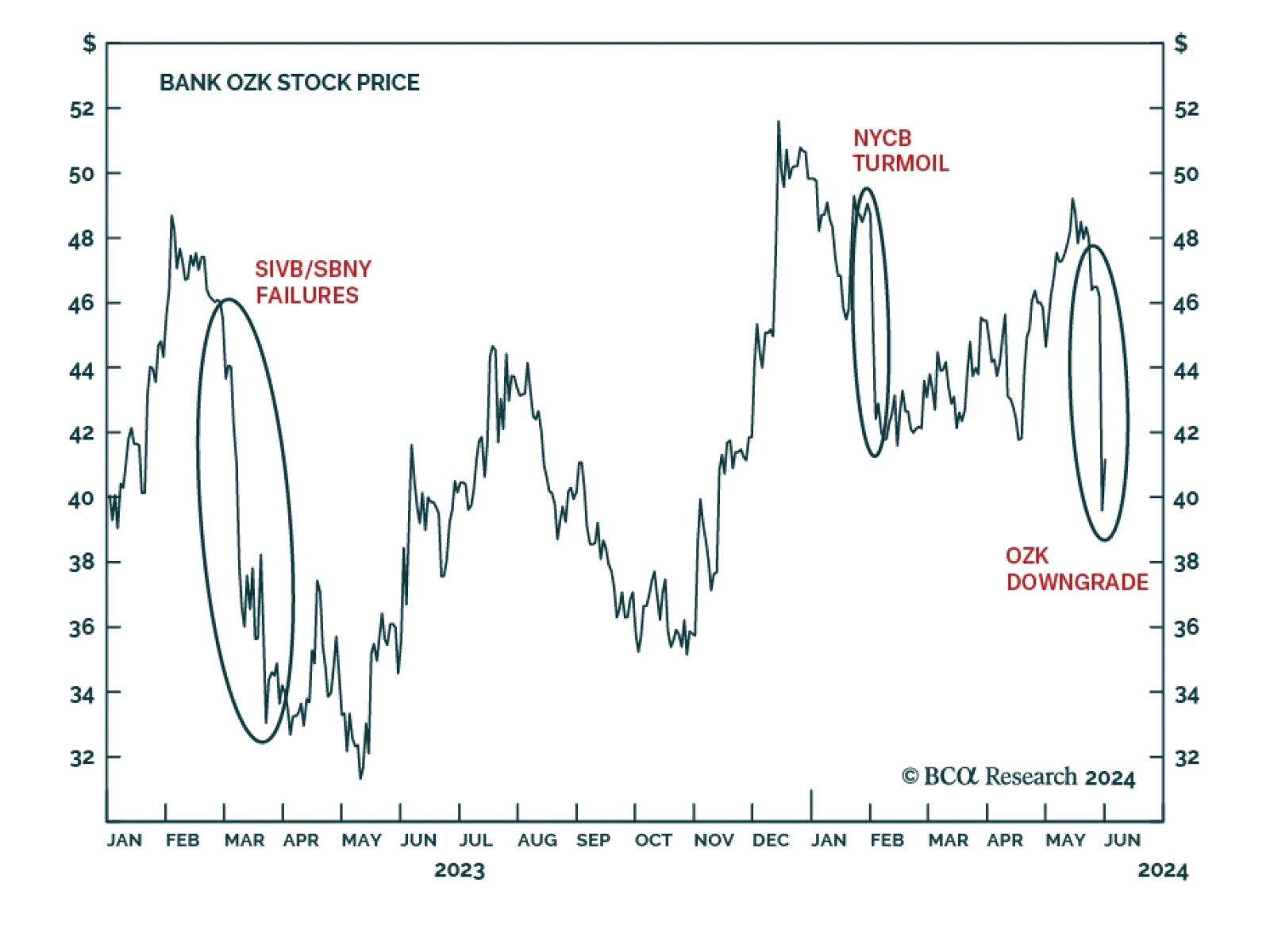

Bank OZK (ticker: OZK) ended Wednesday’s session down over 14%, following a double downgrade from buy to sell by an analyst who raised concerns about loans on two specific development projects. OZK is known for its…

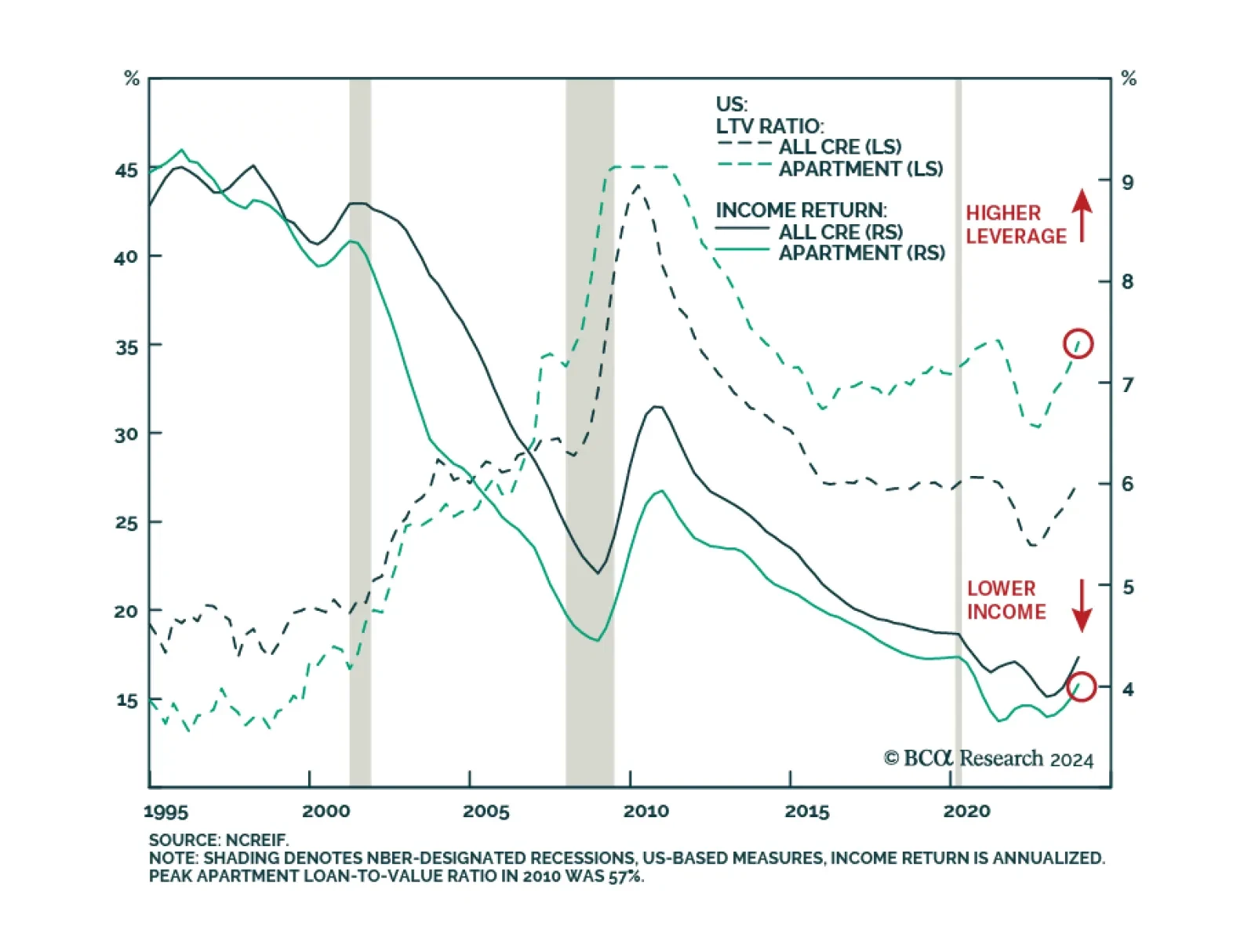

According to BCA Research’s Private Markets & Alternatives service, fundamentals show US Multifamily assets to be akin to picking up pennies in front of a steamroller. Multifamily, and Office, have long served as…

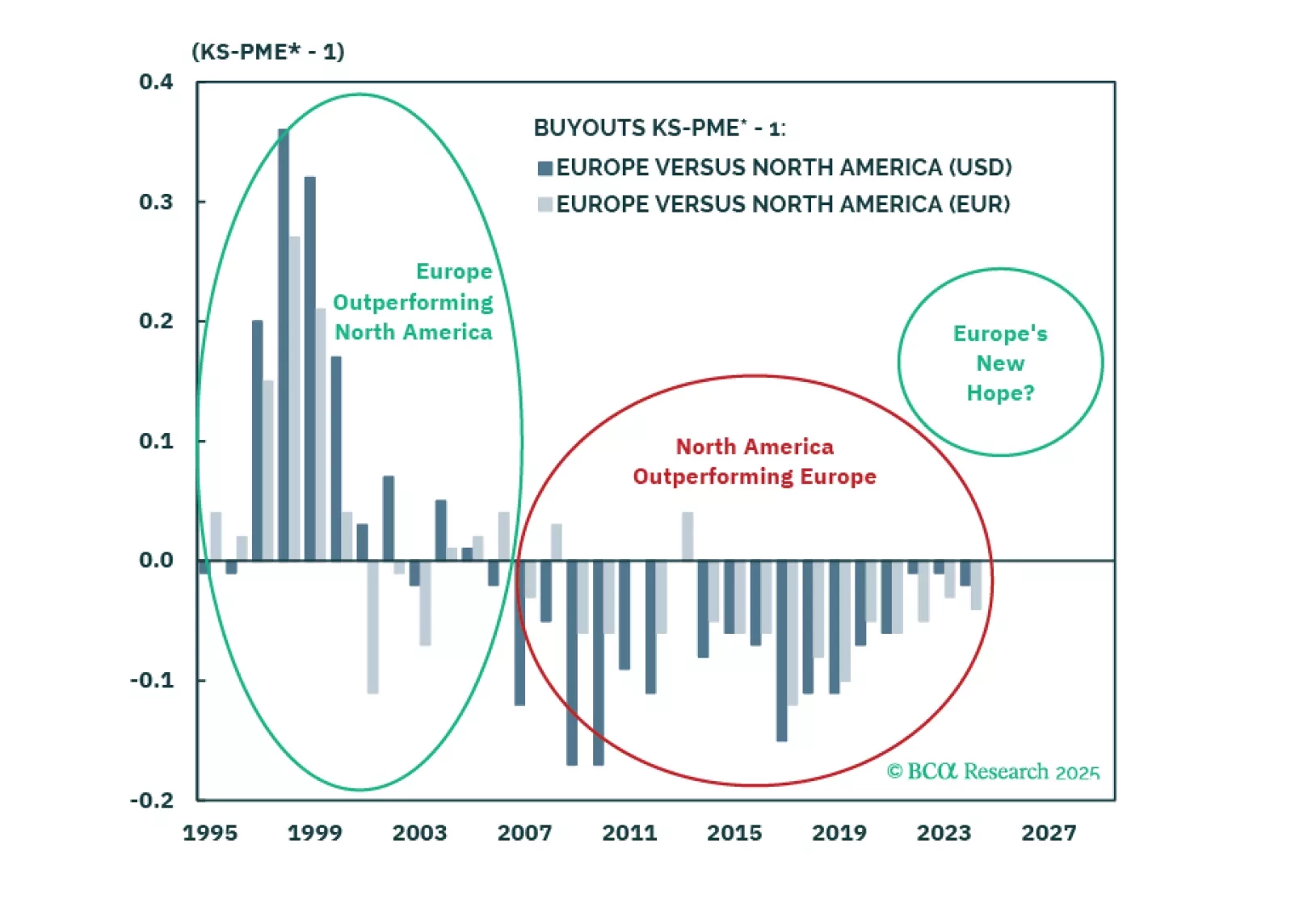

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

This week we are sending you a Style Chart Pack, which now includes a standalone macro section, as well as macro, fundamentals, valuations, technicals, and uses of cash charts for the S&P 500, Defensives vs. Cyclicals, Growth vs…

Overweight We have been bearish this niche S&P sector and delivered alpha to our portfolio both via the cyclical and high-conviction underweights this year. Nevertheless, we do not want to overstay our welcome and the…