France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

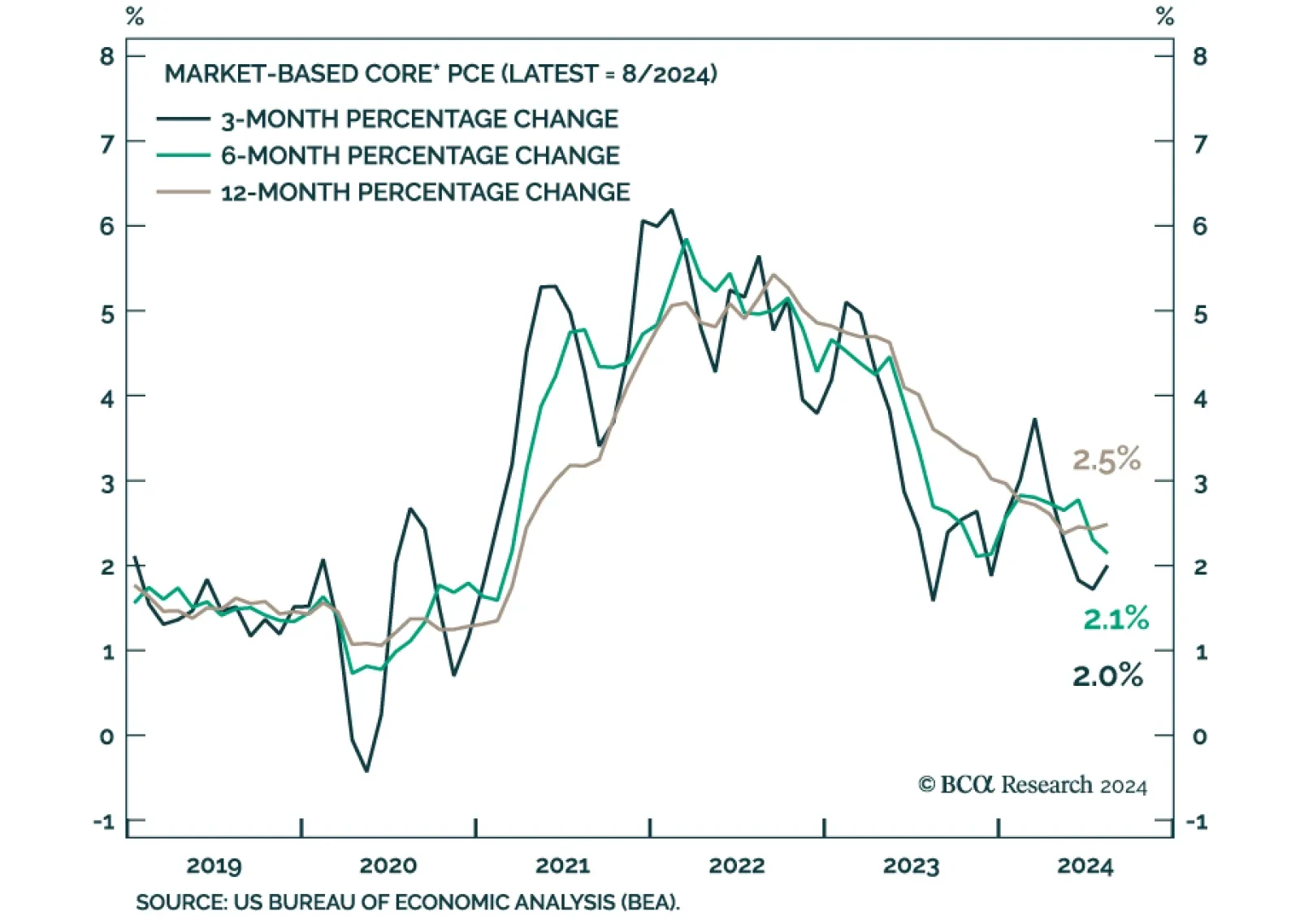

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

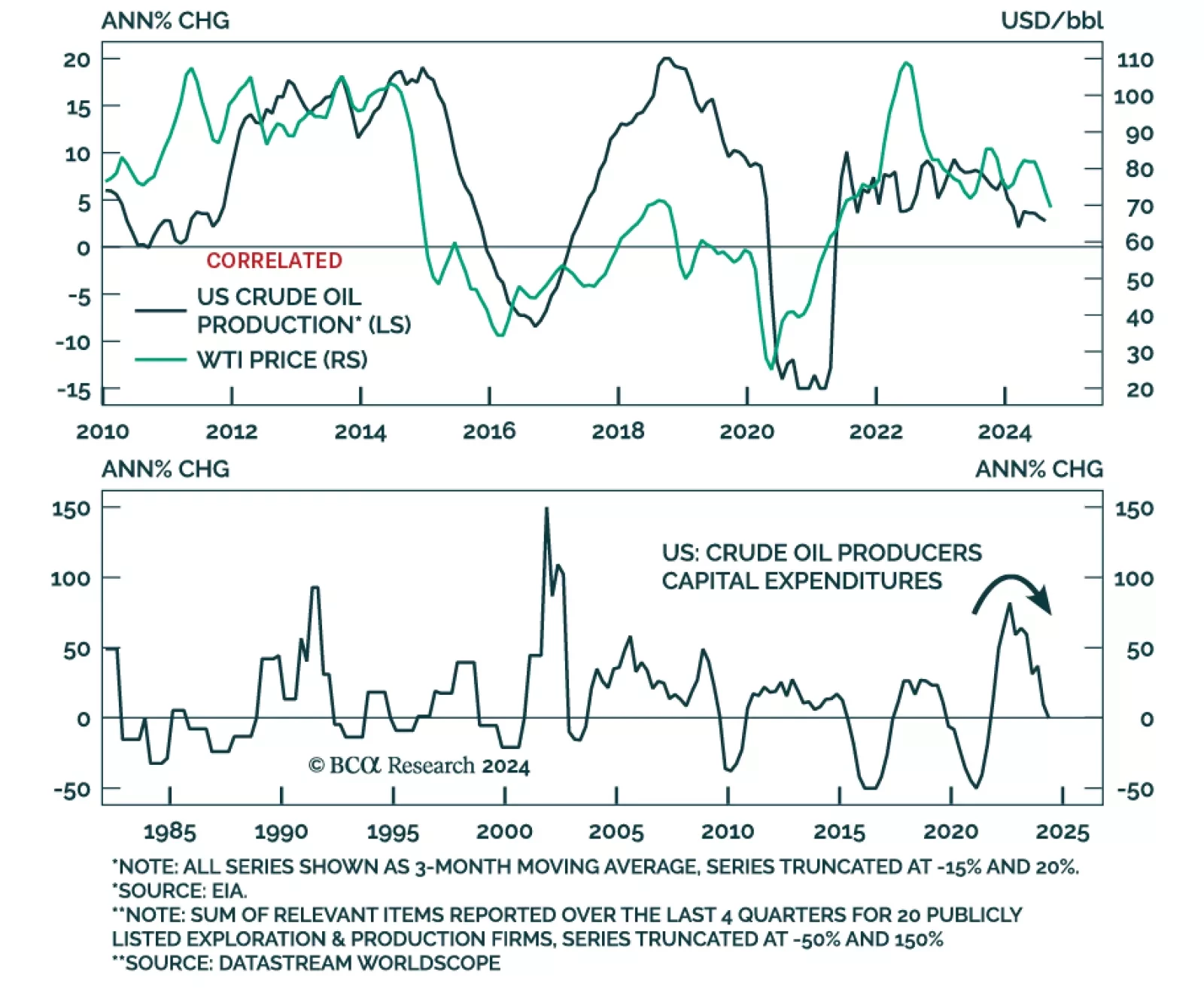

According to BCA Research’s Commodity and Energy strategy service, even though US crude output will continue rising, a meaningful growth acceleration is unlikely. US producers adjust their output in response to market…

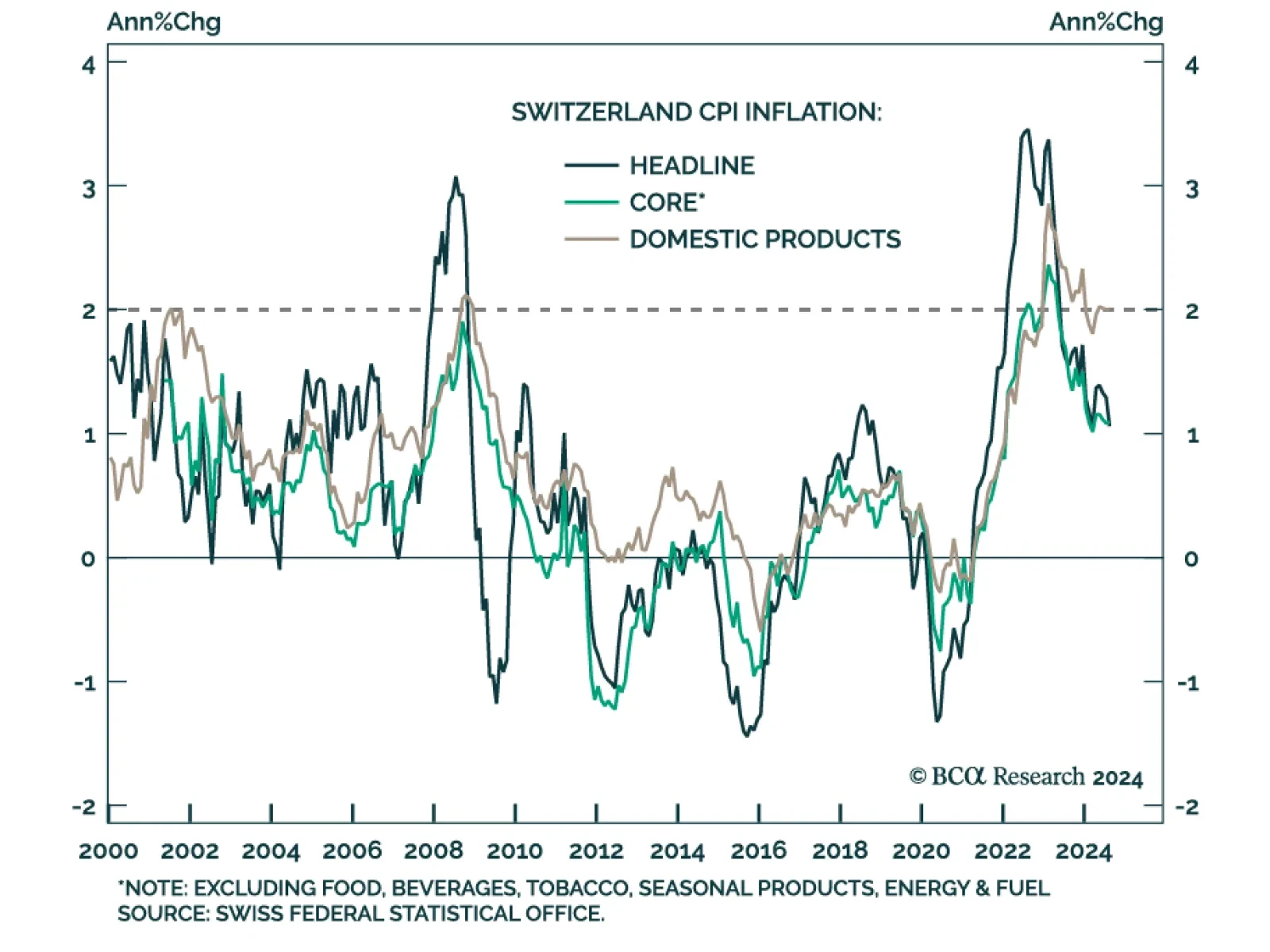

In a widely expected move, the Swiss National Bank (SNB) cut its policy rate for a third consecutive meeting on Thursday, from 1.25% to 1.00%. The move marked President Thomas Jordan’s final policy decision and his incoming…

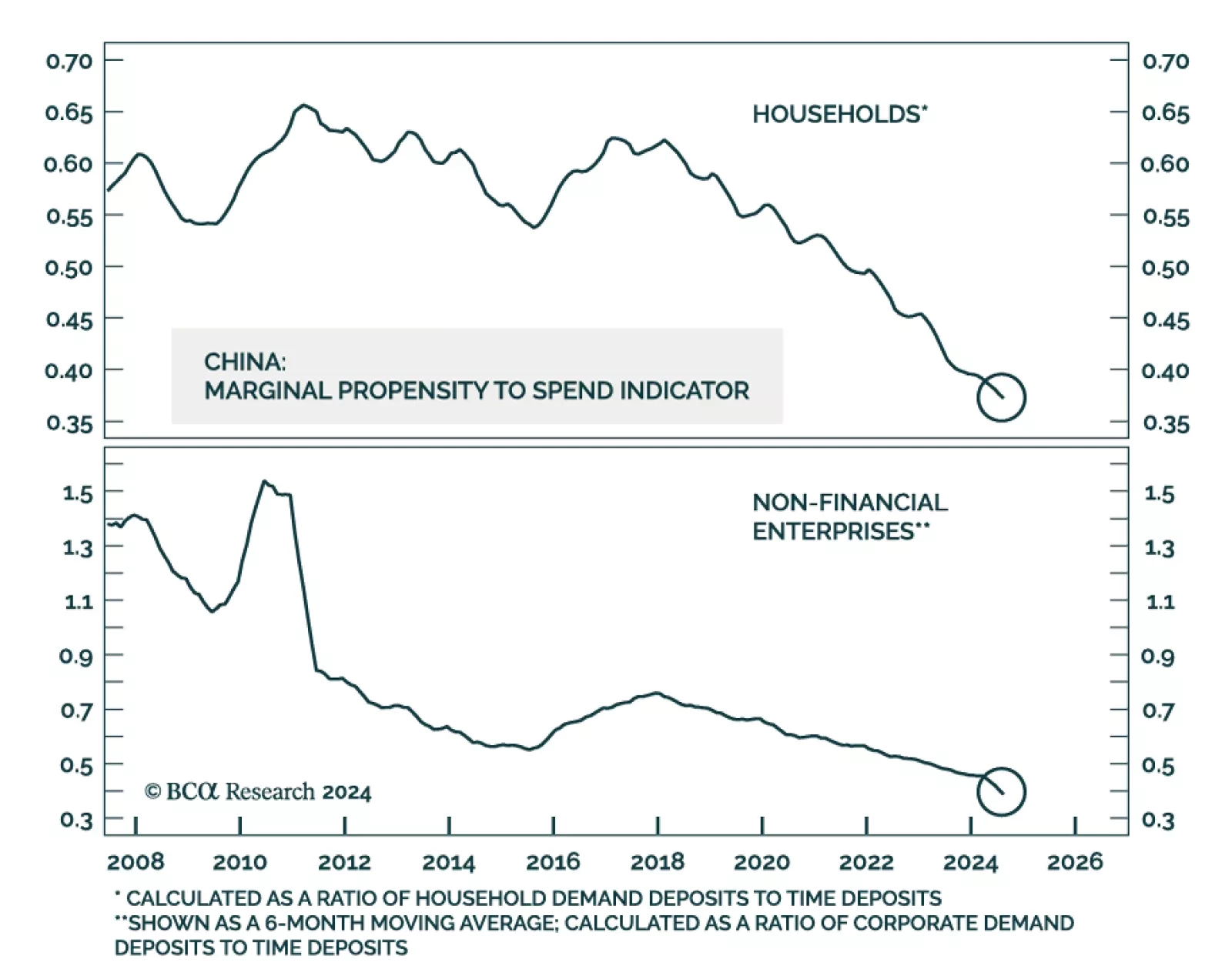

This week has not been short of developments on Chinese policy. After unleashing a monetary policy blitz, the authorities held an unscheduled Politburo meeting resulting in a pledge to take actions towards stabilizing the housing…

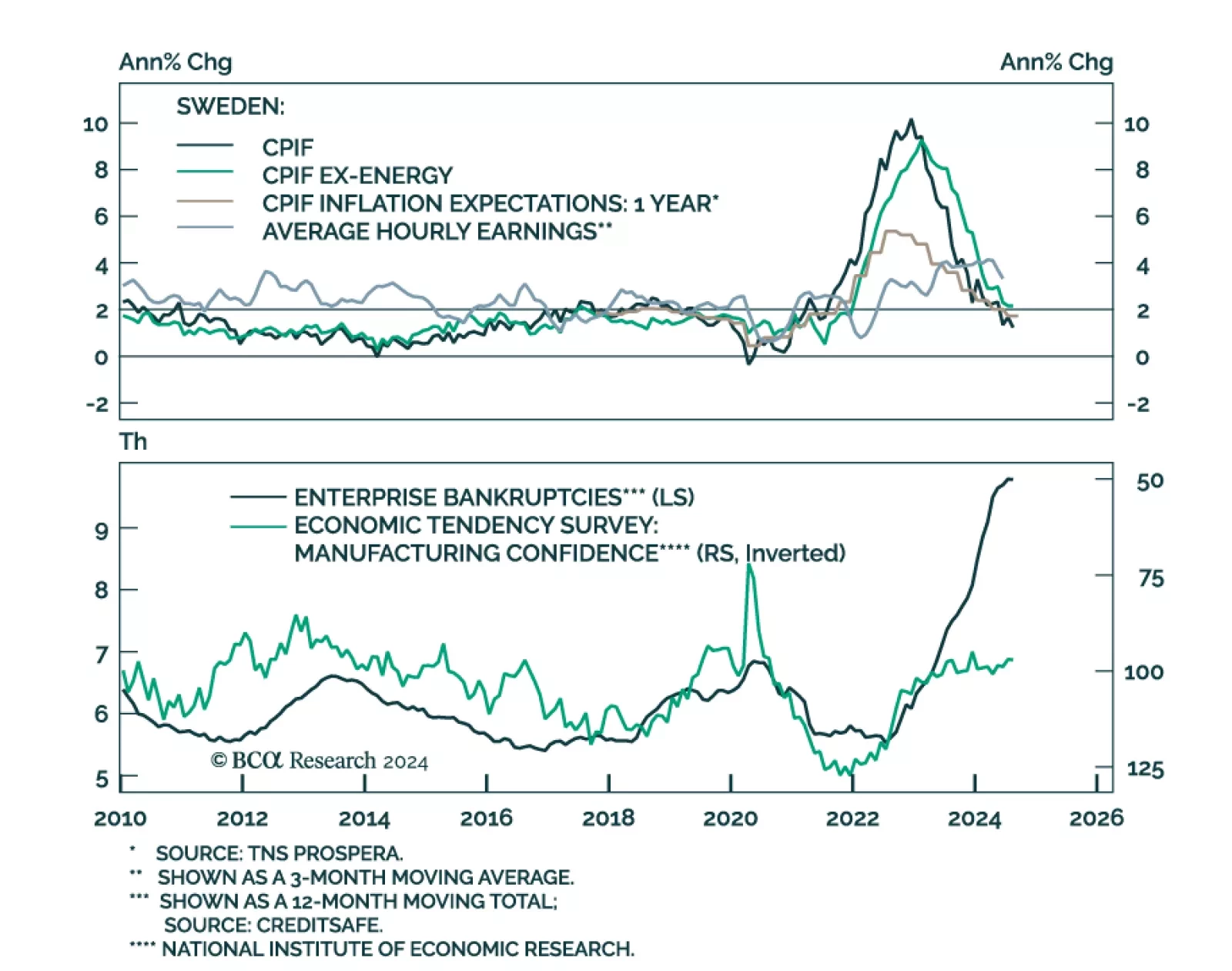

In a widely expected move, the Riksbank lowered its policy rate from 3.5% to 3.25% in September, marking its third cut this year. It embarked on its easing cycle in May, leading many other DM central banks, and has been…

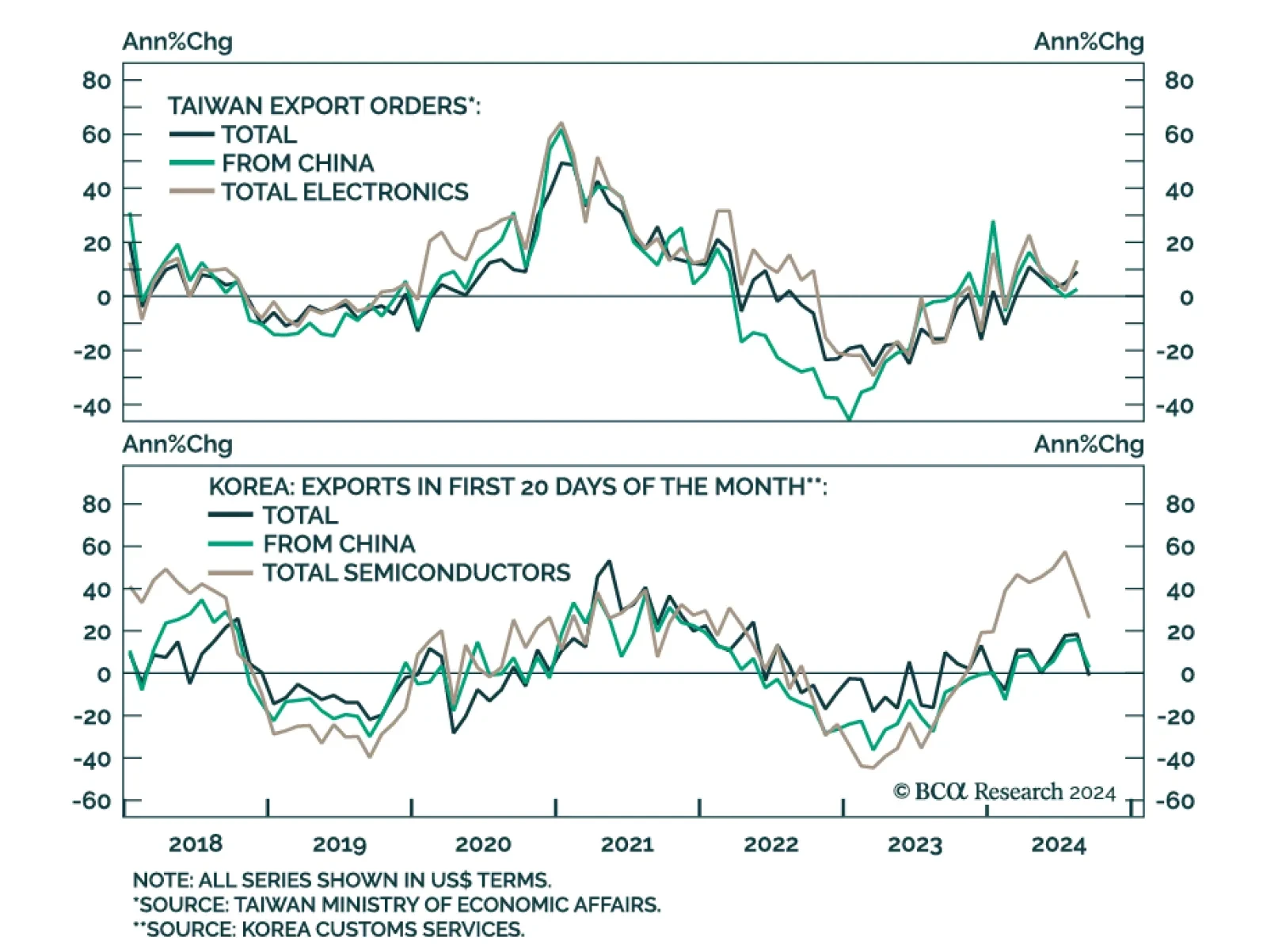

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders accelerated from 4.8% y/y to a faster-than-anticipated 9.1% in August. The faster pace of growth was also broad…

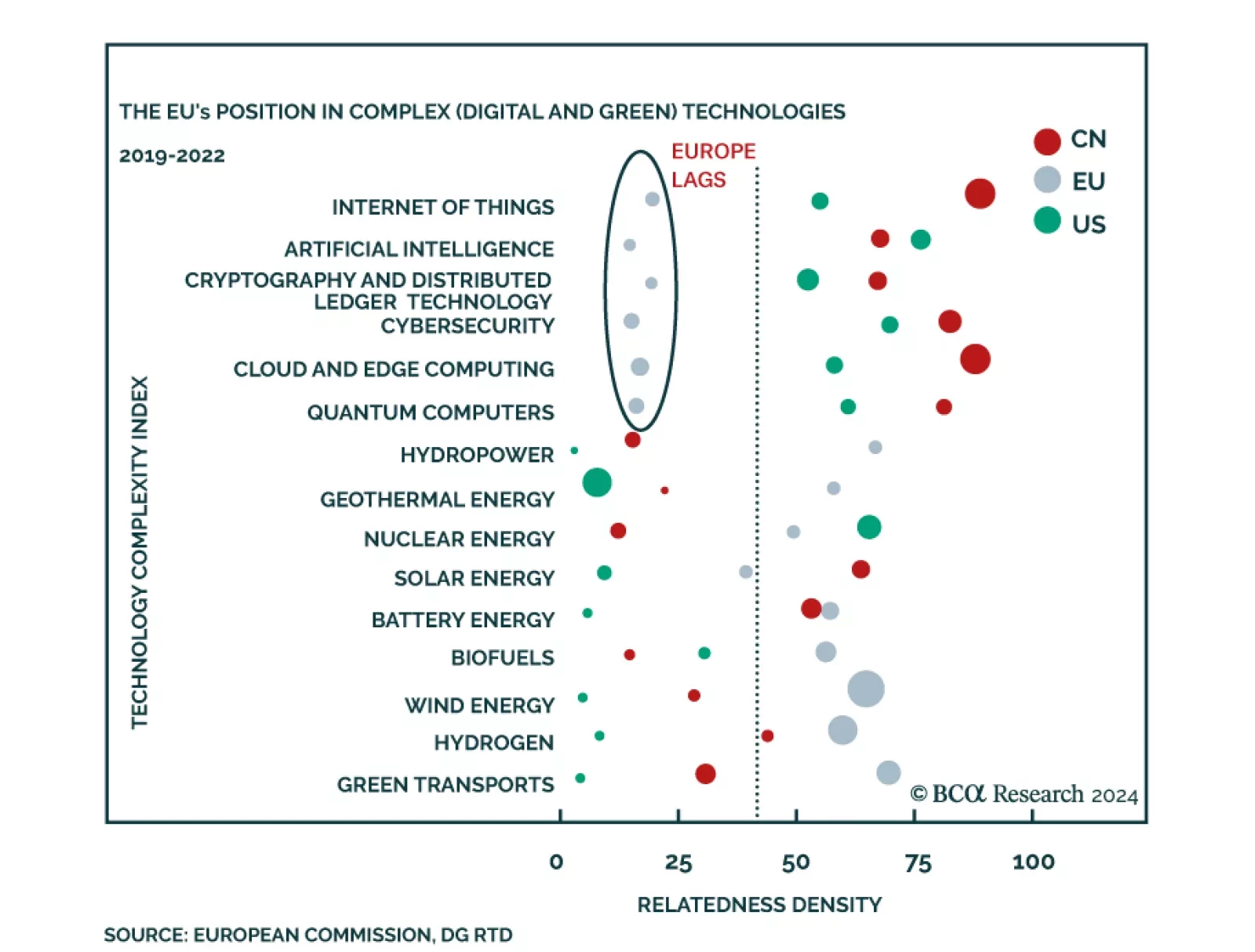

According to BCA Research’s European Investment Strategy, the low rate of innovation in Europe is a major problem for the economy. Not only does it prevent Europe from standing at the technological frontier, but it also…

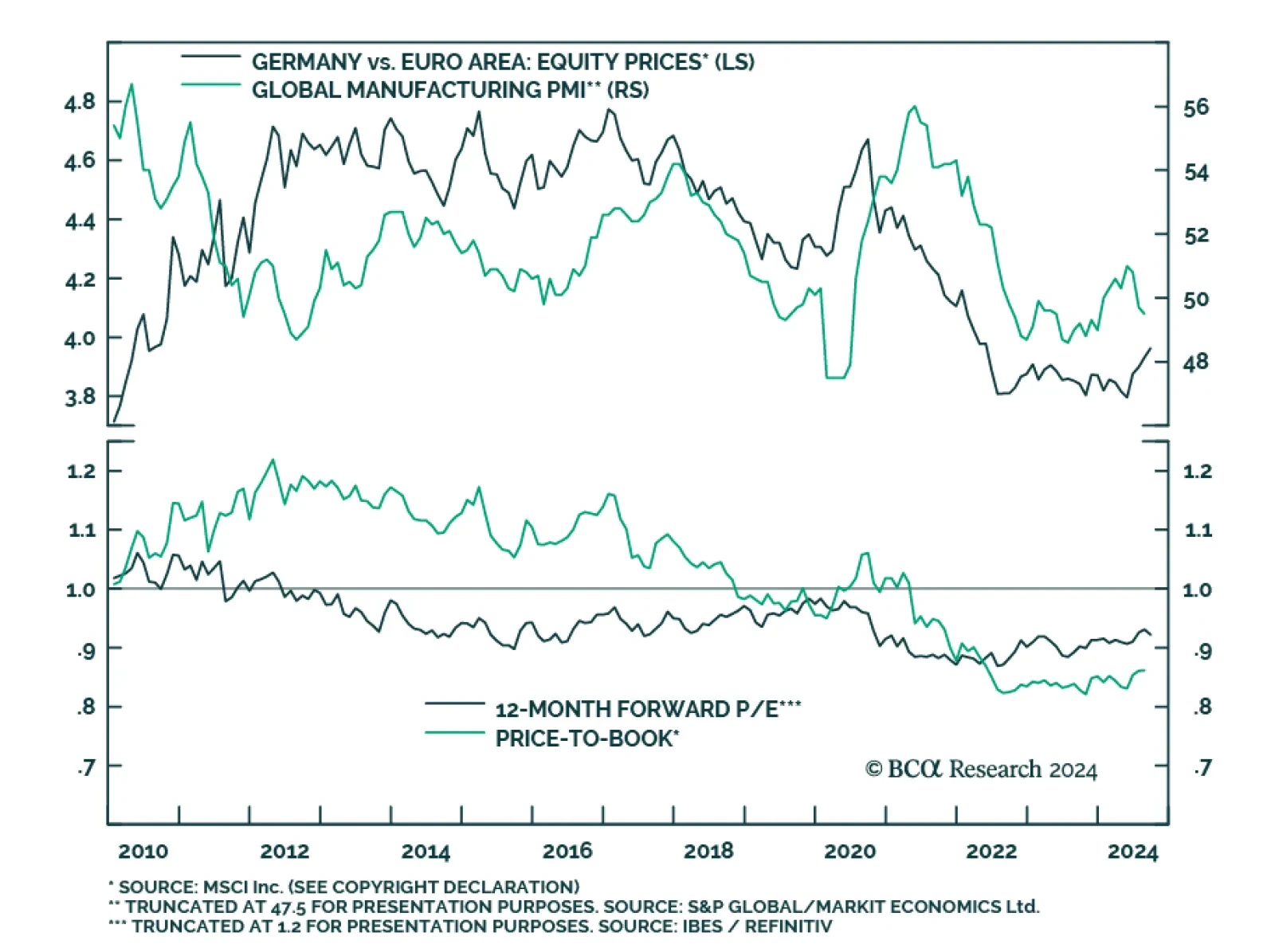

German equities have outperformed their Euro Area peers on a year-to-date basis, with the gap widening since May. The MSCI Germany Index returned nearly 4.5 percentage points more than the MSCI Eurozone index over the latter…

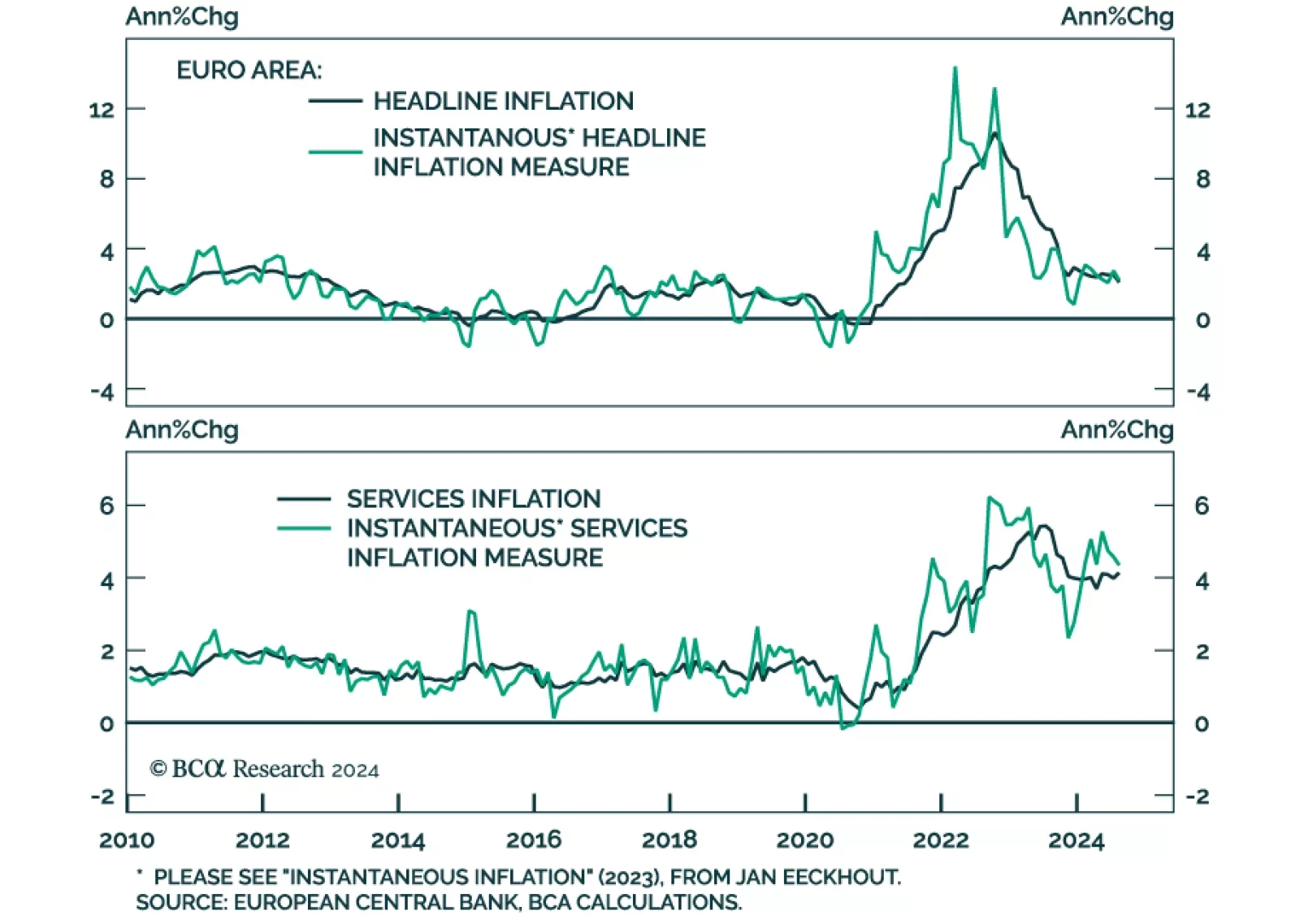

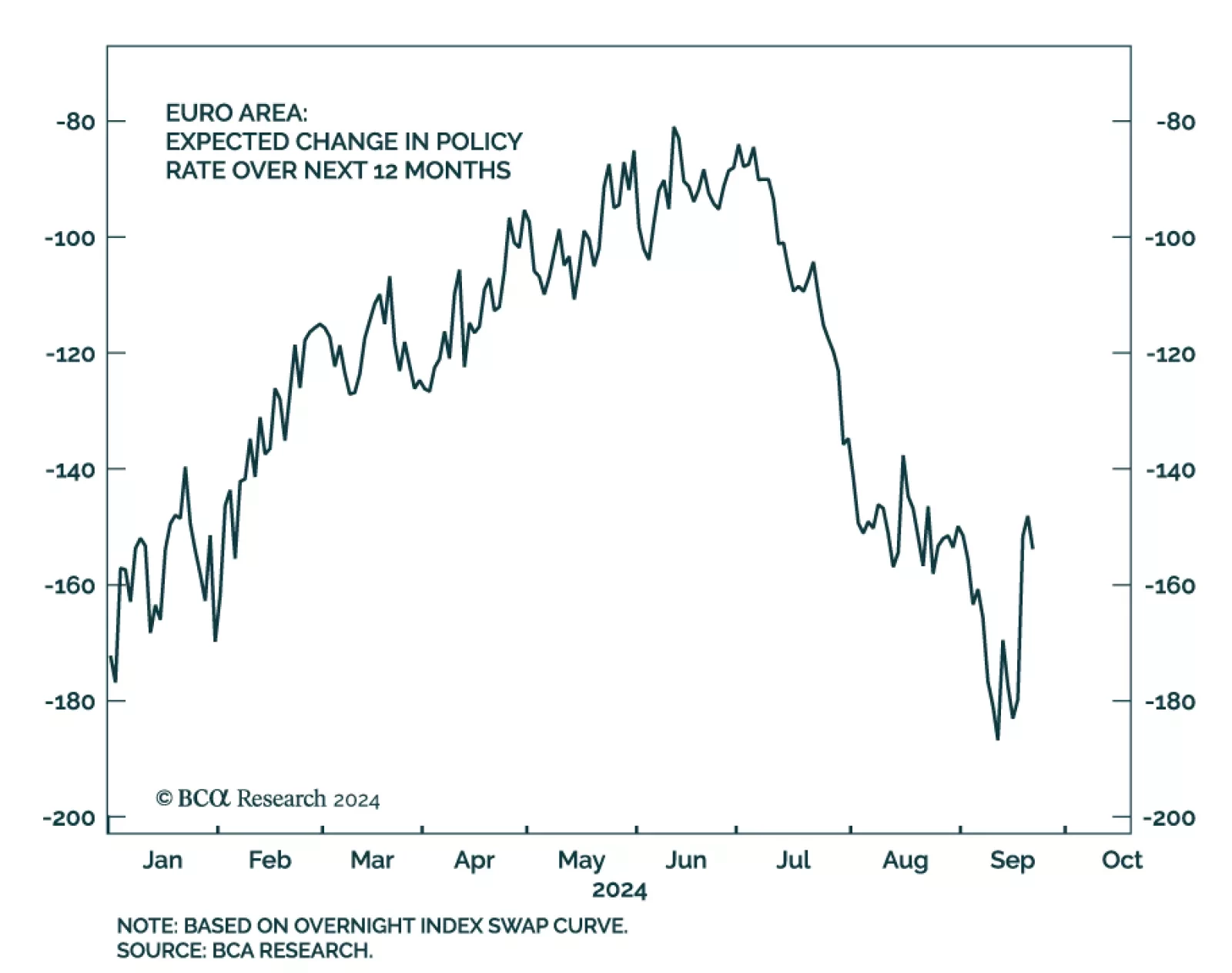

The European Central Bank (ECB) cut rates by 25 bps in September. It did not signal consecutive rate cuts and we highlighted that the short inter-meeting timeframe between September and October provides little scope for ongoing…