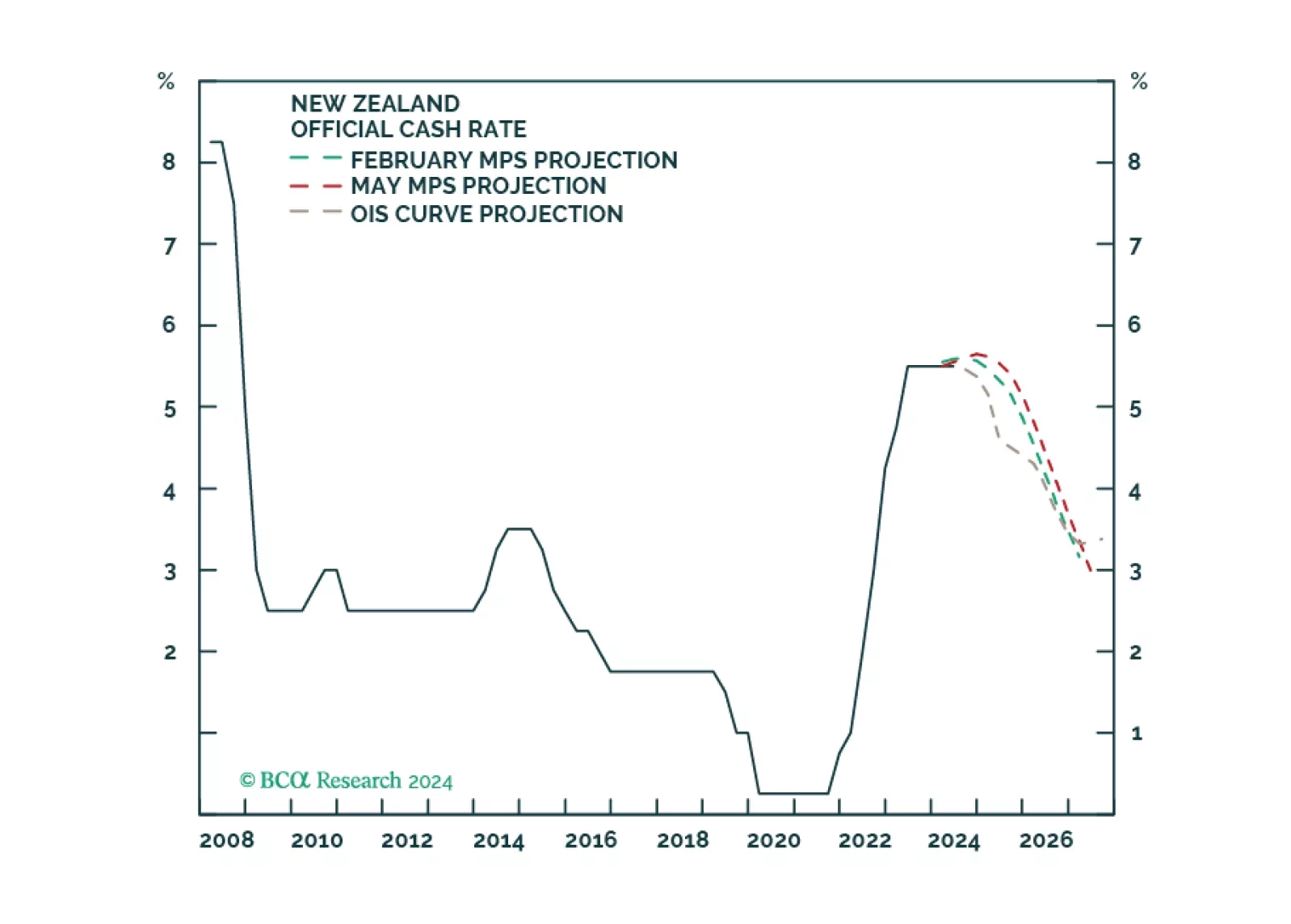

In this Insight, we revisit our "higher for longer" theme for the Reserve Bank of New Zealand, in light of the latest central bank meeting. In conclusion, we are inching towards a more dovish RBNZ ahead. Ergo, we recommend some fixed…

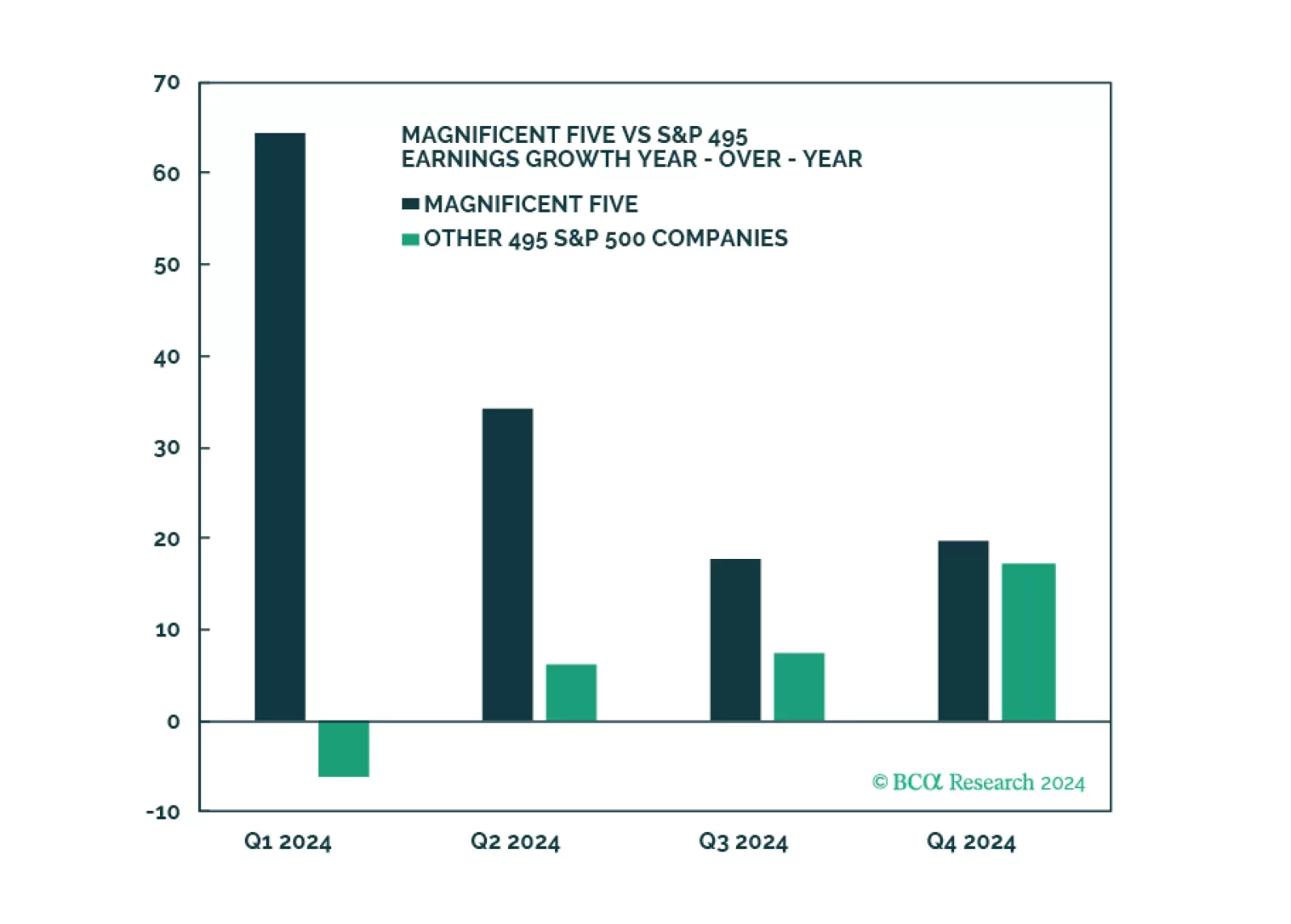

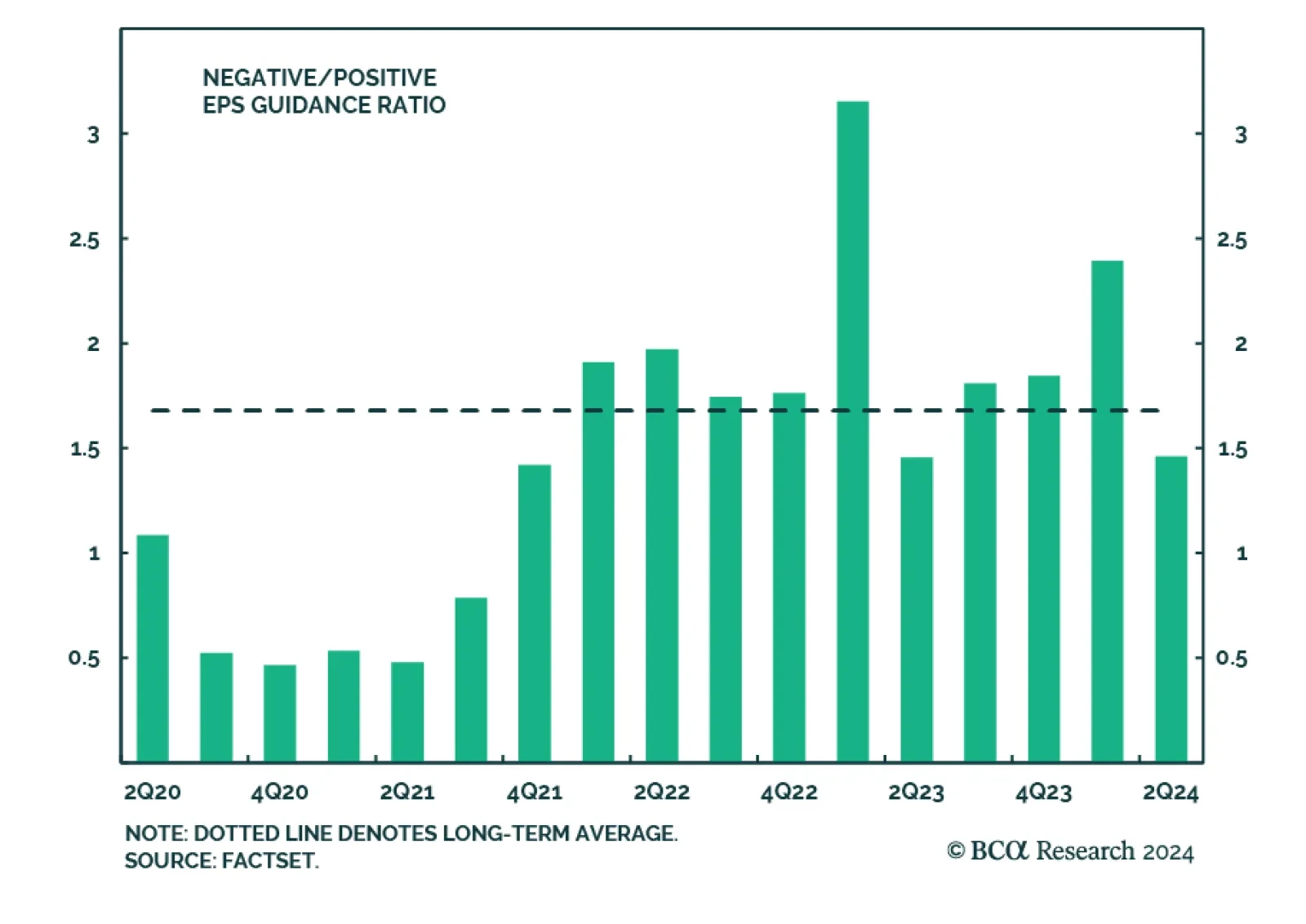

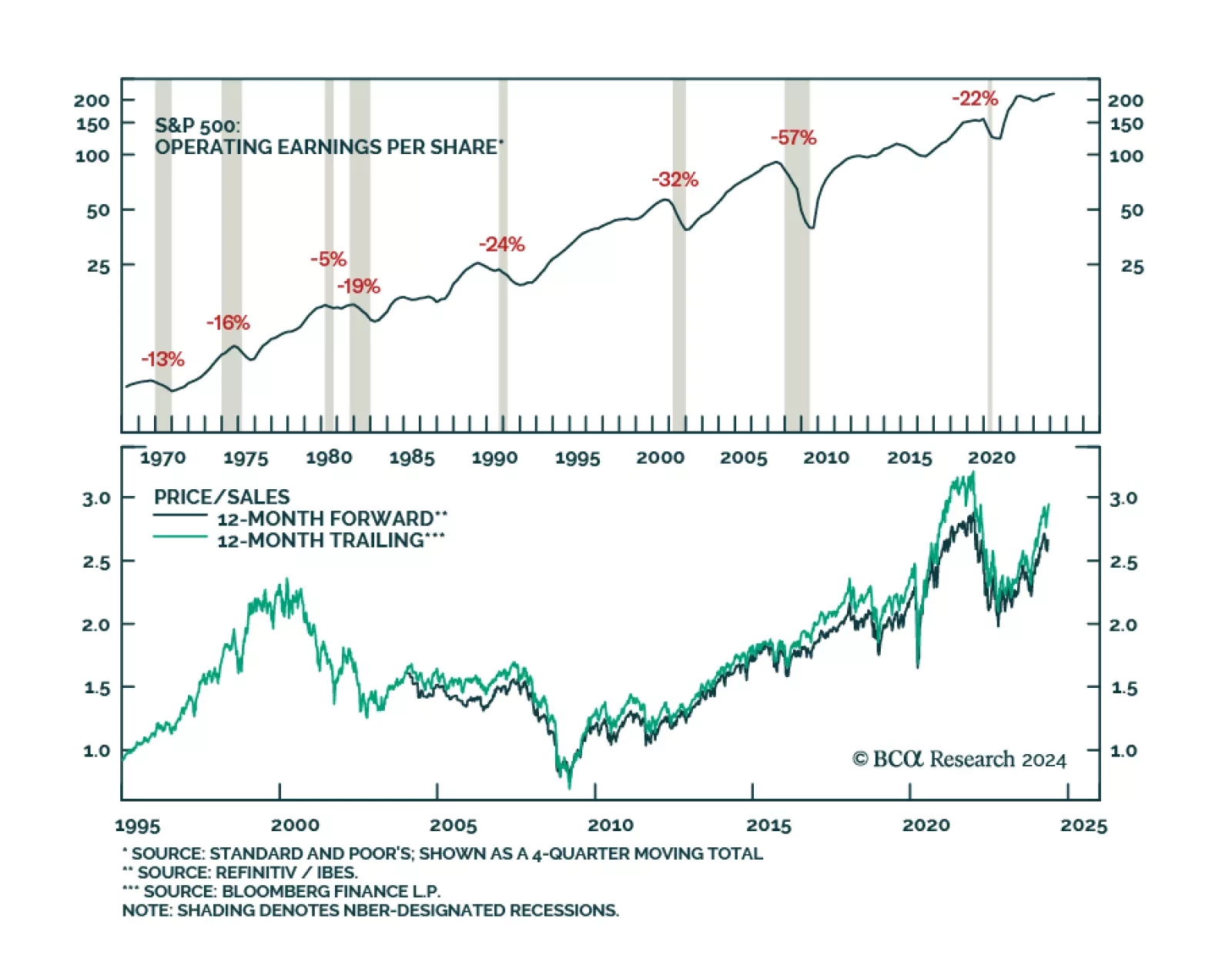

The Q1 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Three-quarters (two-thirds) of companies have topped earnings (sales) expectations in Q1, according to…

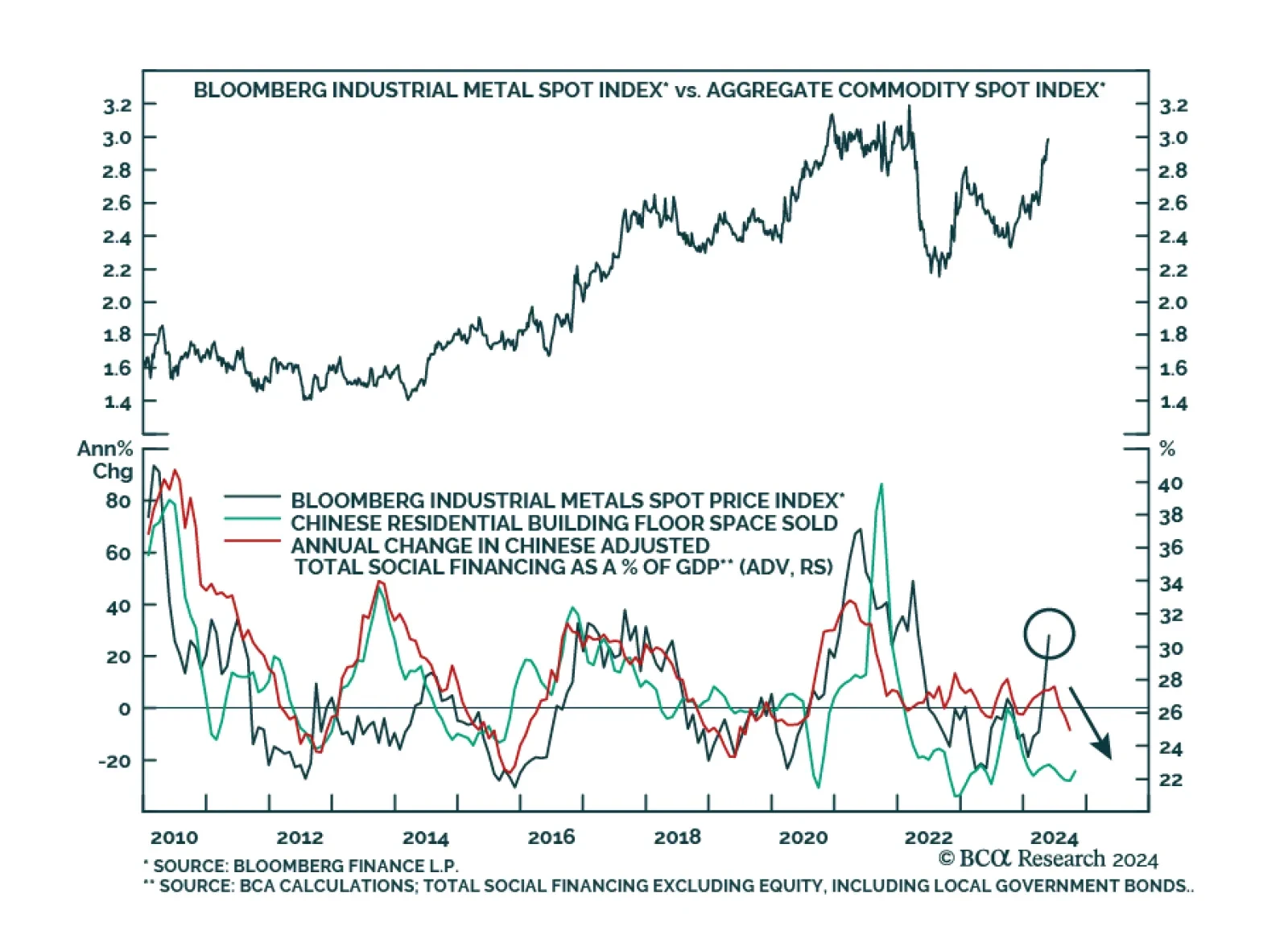

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

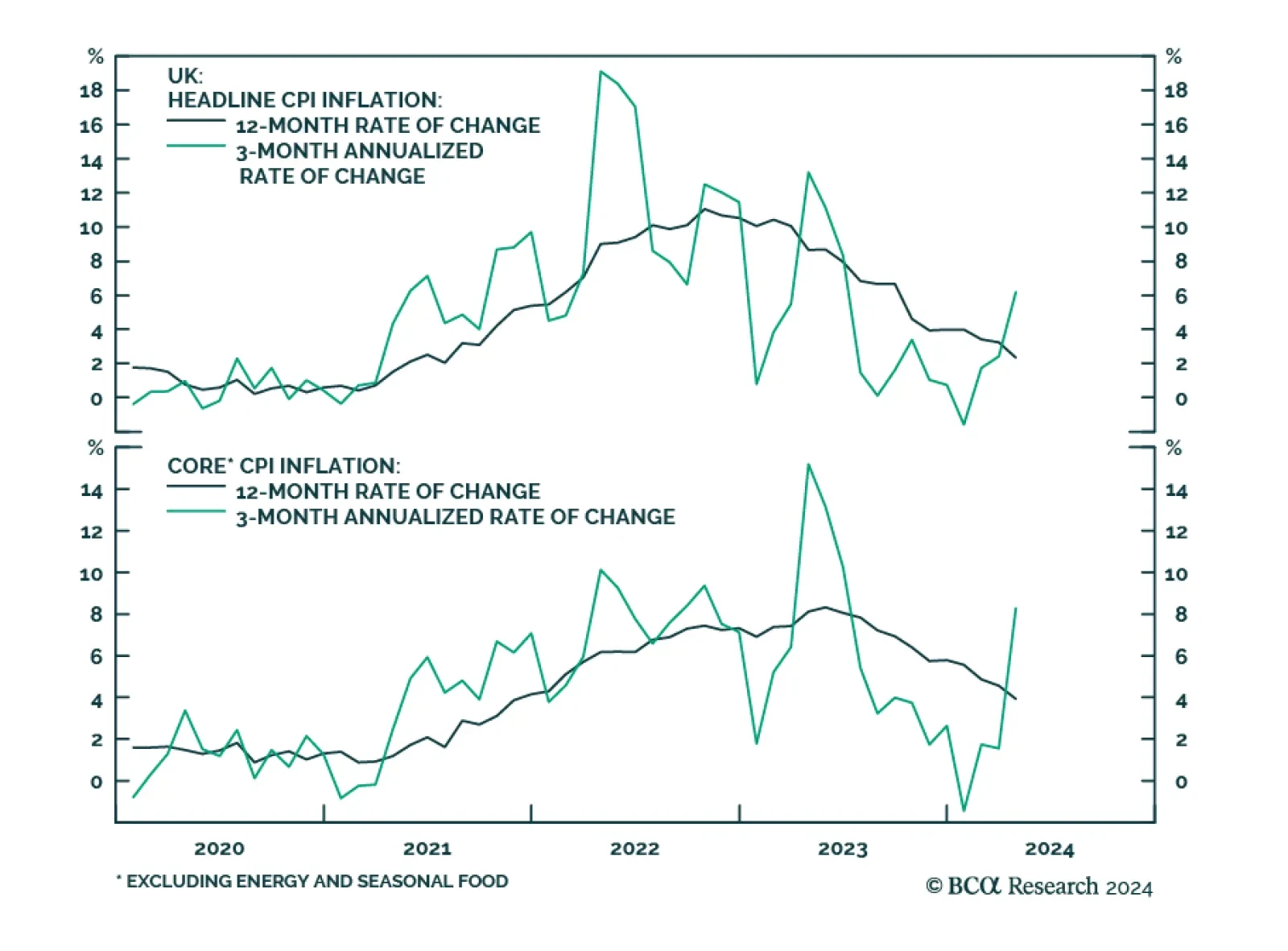

The UK CPI release surprised markets to the upside across the board on Wednesday. Headline CPI increased 2.3% year-on-year, above expectations of 2.1%. Core surprised to the upside as well, moderating from 4.2% to 3.9%y/y, less…

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

An adverse shock is not a recession prerequisite. The empirical record shows that the US economy regularly evolves its way into a contraction with little fanfare. If current cooling trends continue, we project a recession will…

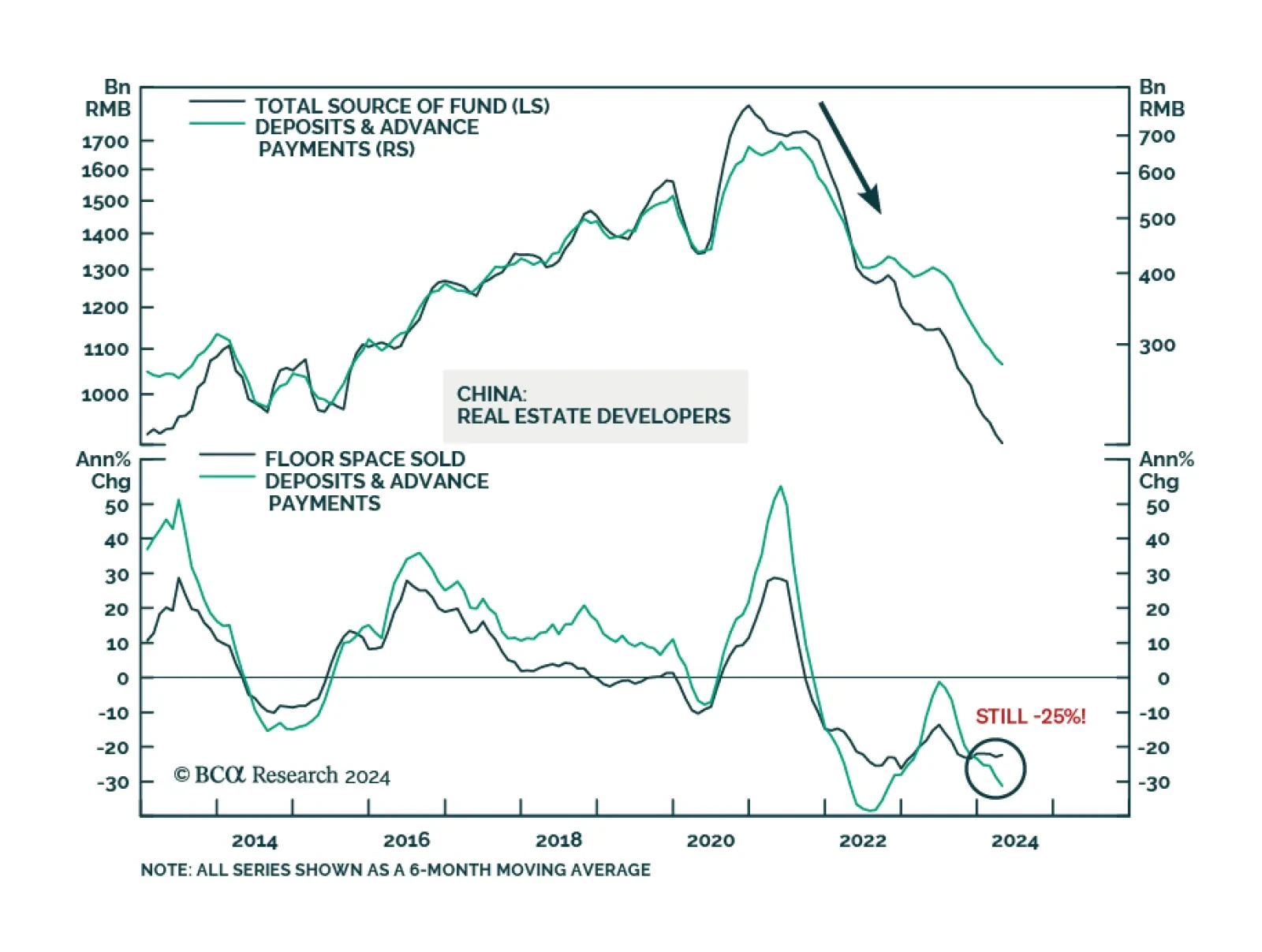

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

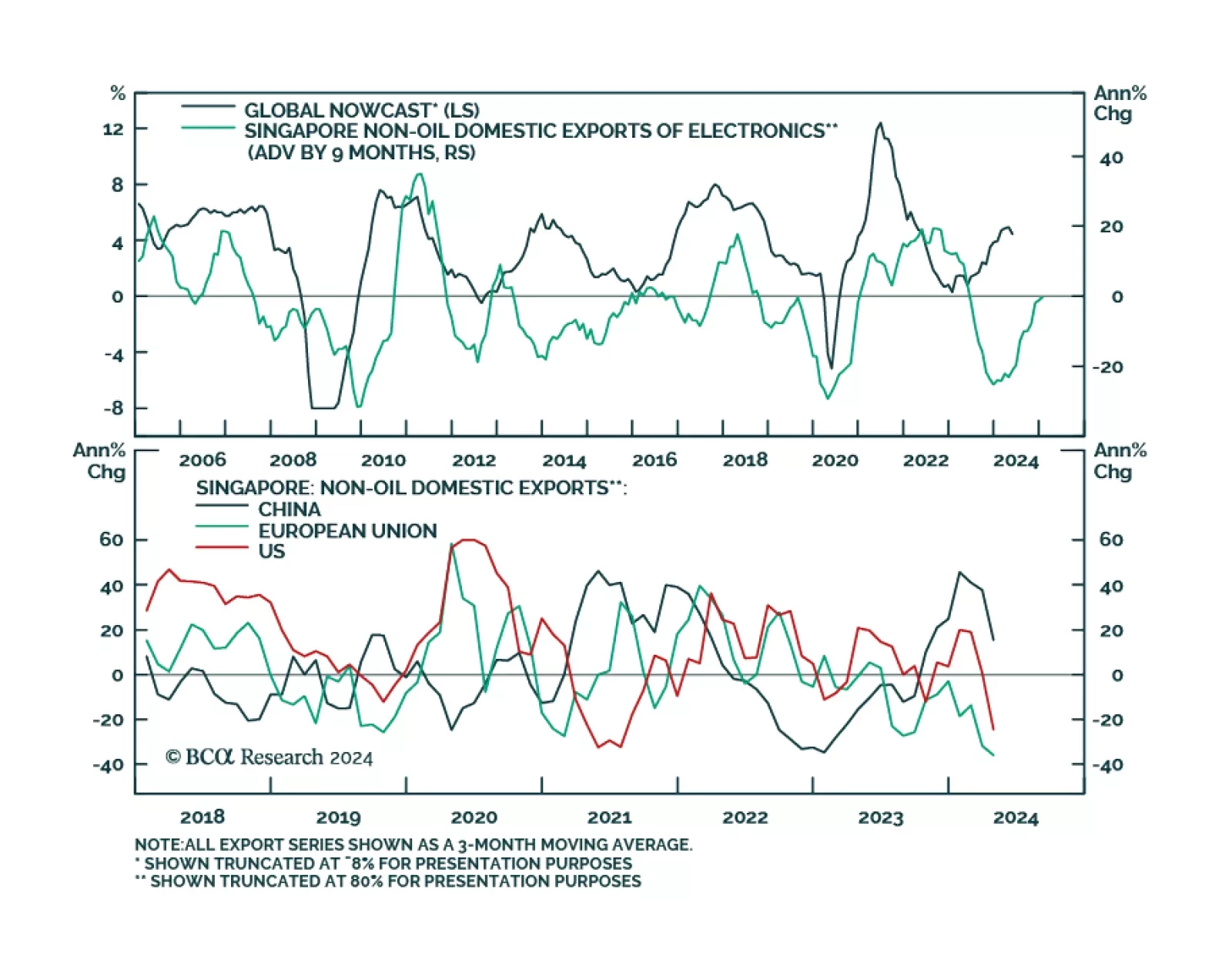

Export dynamics from small open economies are bellwethers for global trade and recent export data out of Taiwan and South Korea suggested robust global growth momentum in March. In April, Singapore’s electronics exports…

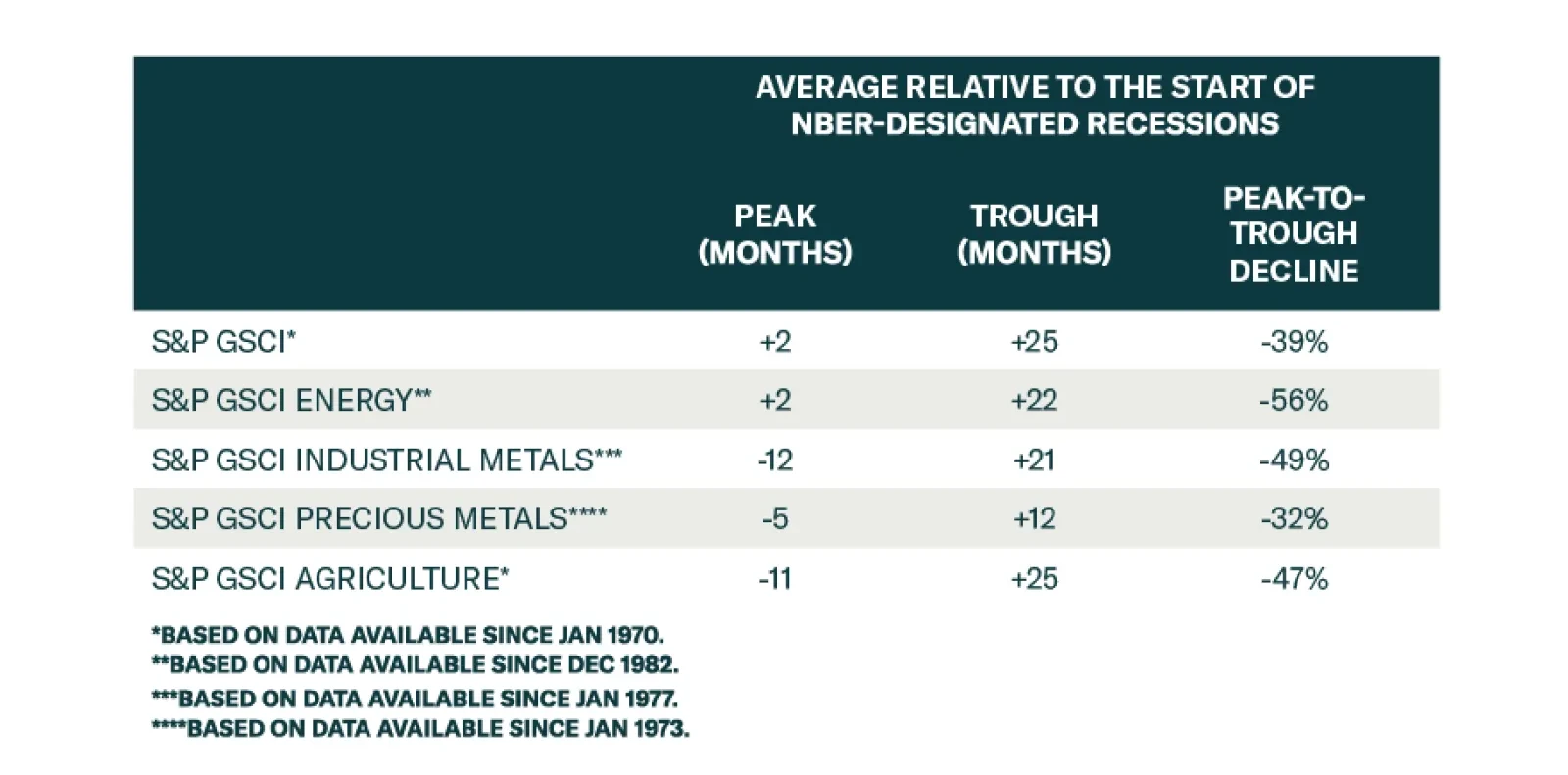

According to BCA Research’s Commodity & Energy Strategy service, among the commodity groups, industrial metals provide the most reliable leading signal that the US economy is heading toward recession. Industrial metals…

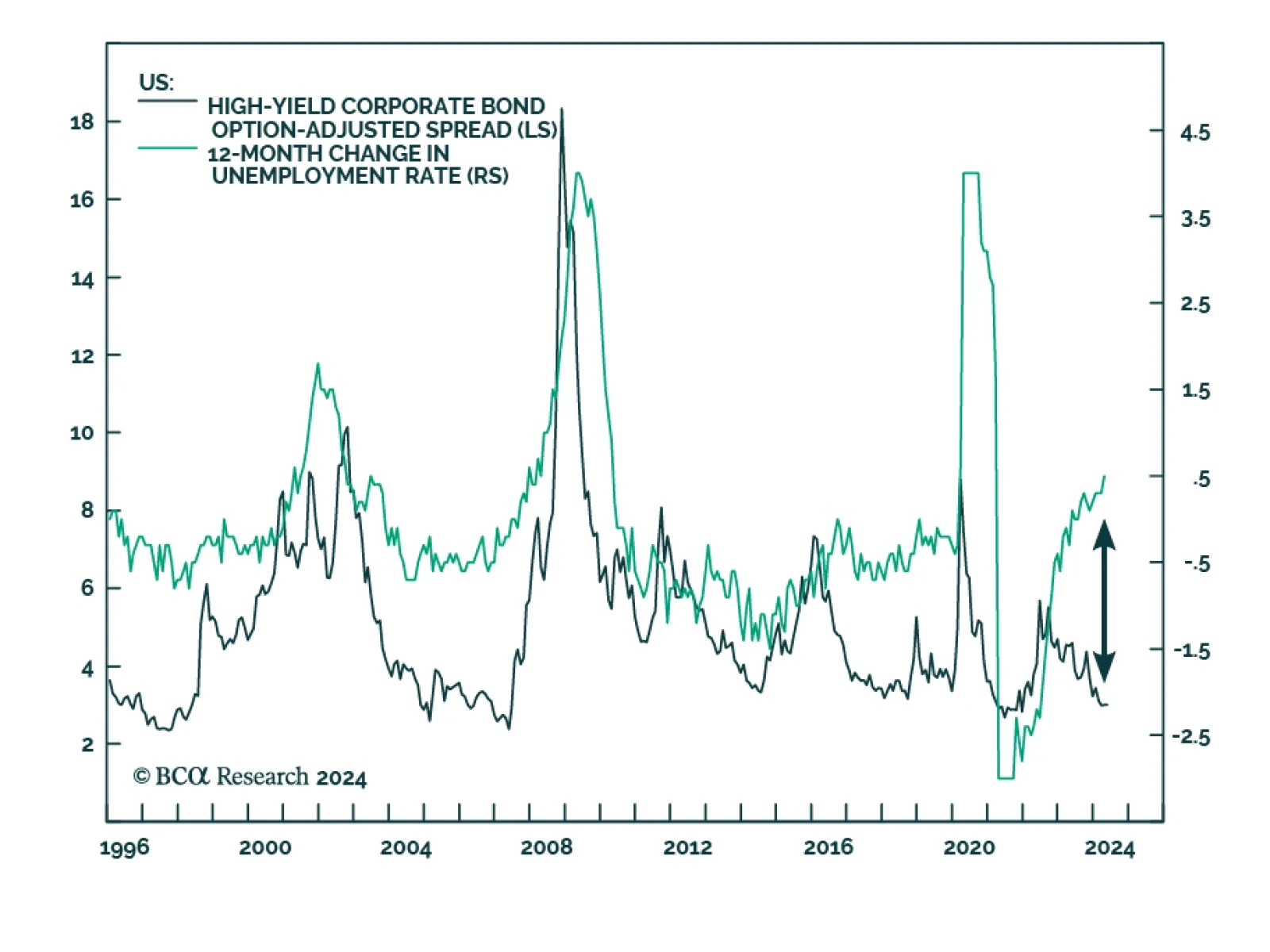

Credit spreads continue to price in a Goldilocks scenario. US investment grade and high-yield OAS have tightened 41 and 137 bps from their October peaks, resulting in handsome outperformance by both sectors relative to duration-…