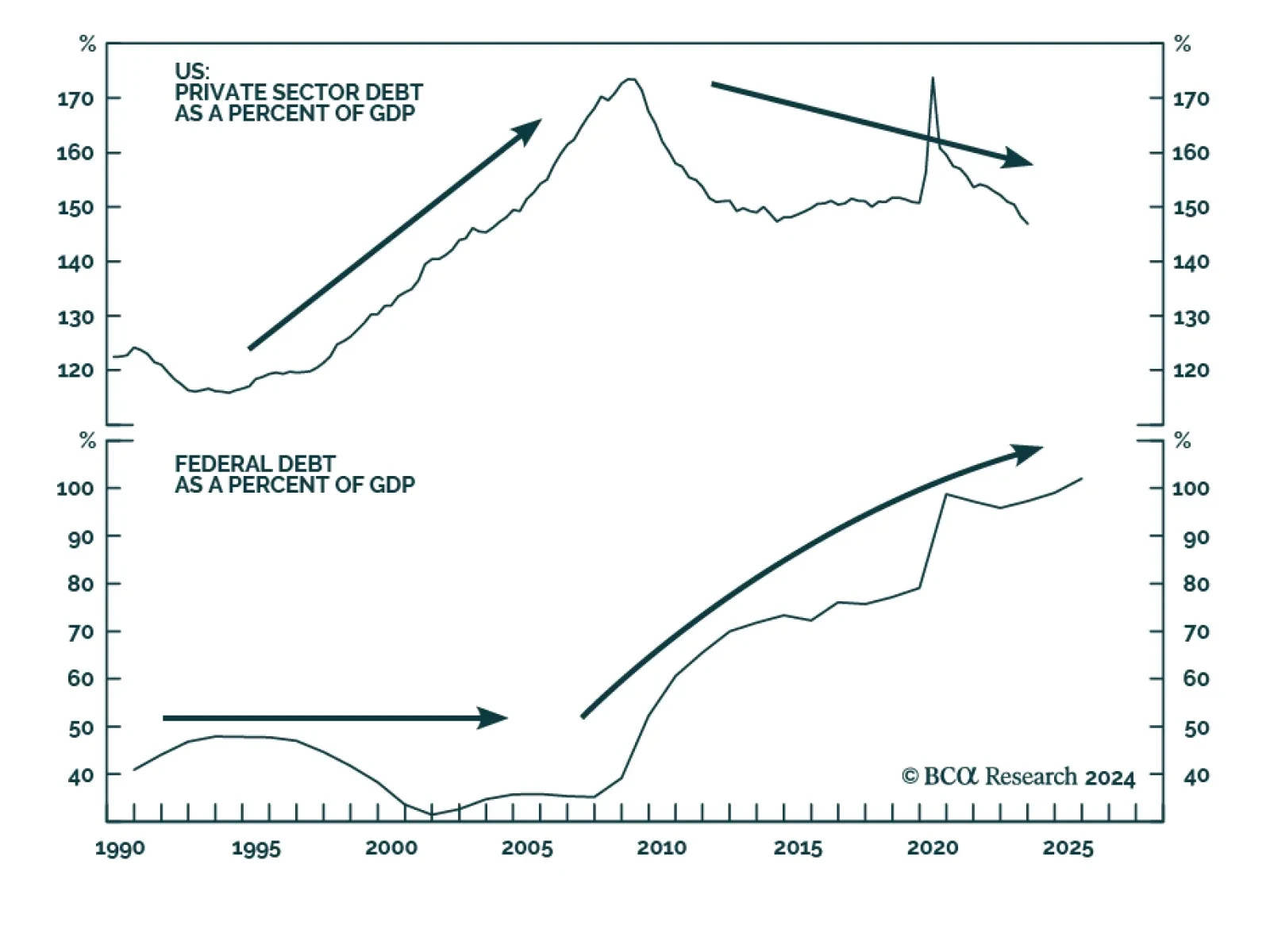

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly…

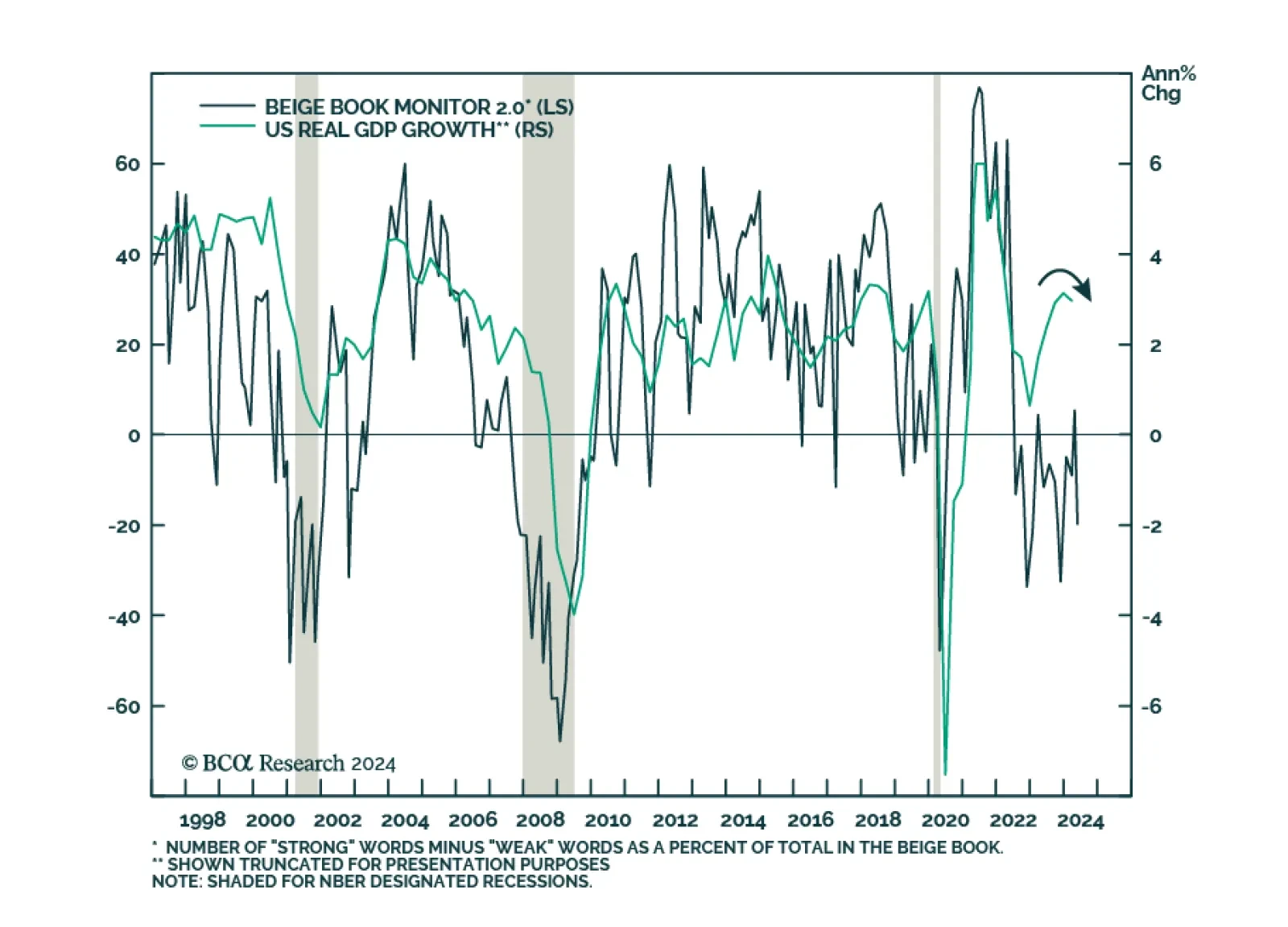

The message from the latest Beige Book release is confirming that US demand is showing signs of slowing down. Of the 12 Federal Reserve districts, 2 reported modest economic growth, 8 reported economic activity was slightly up,…

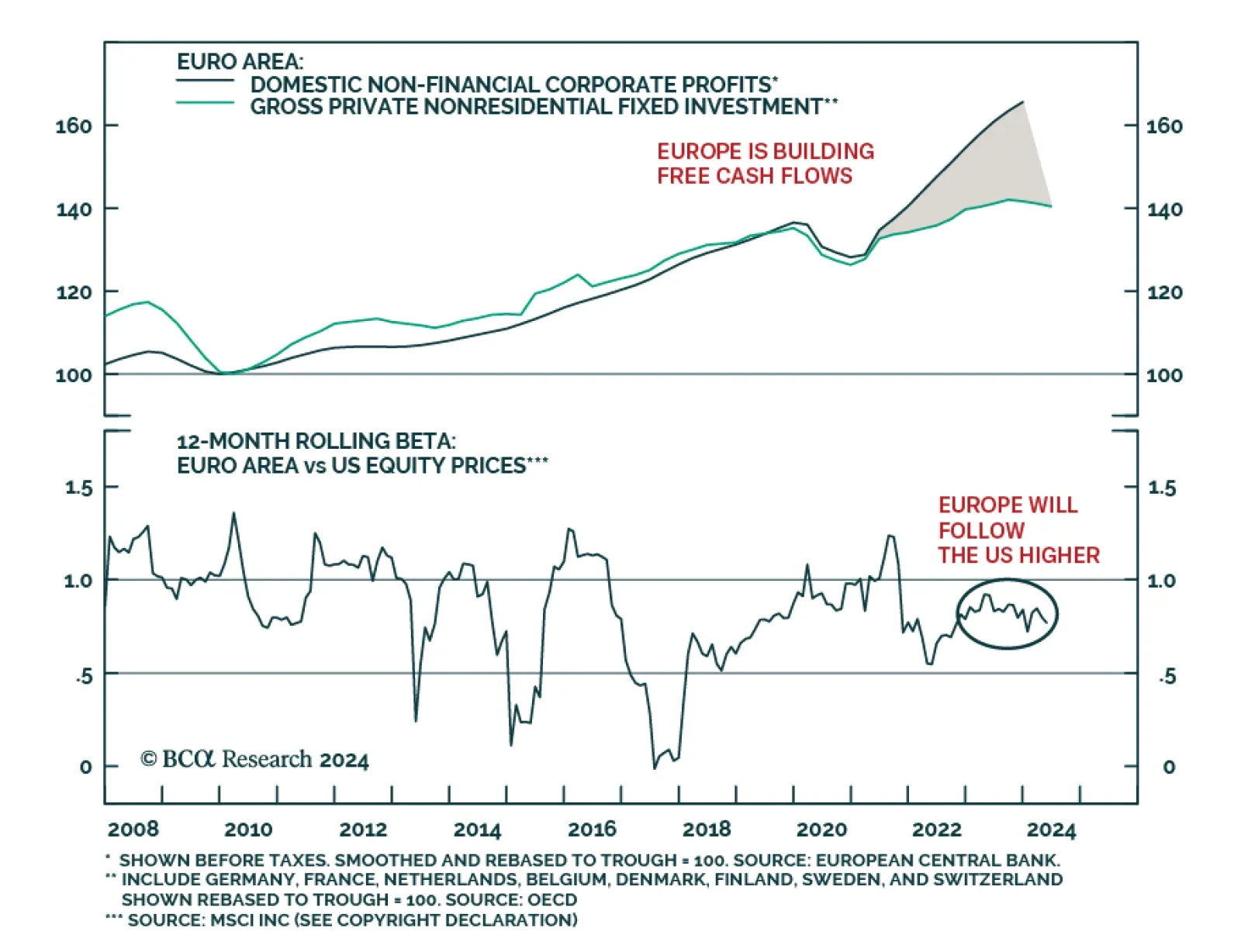

According to BCA Research’s European Investment Strategy service, the money sloshing around the financial system from pandemic-era stimulus measures disconnects near-term prospects for growth from risk asset prices. As a…

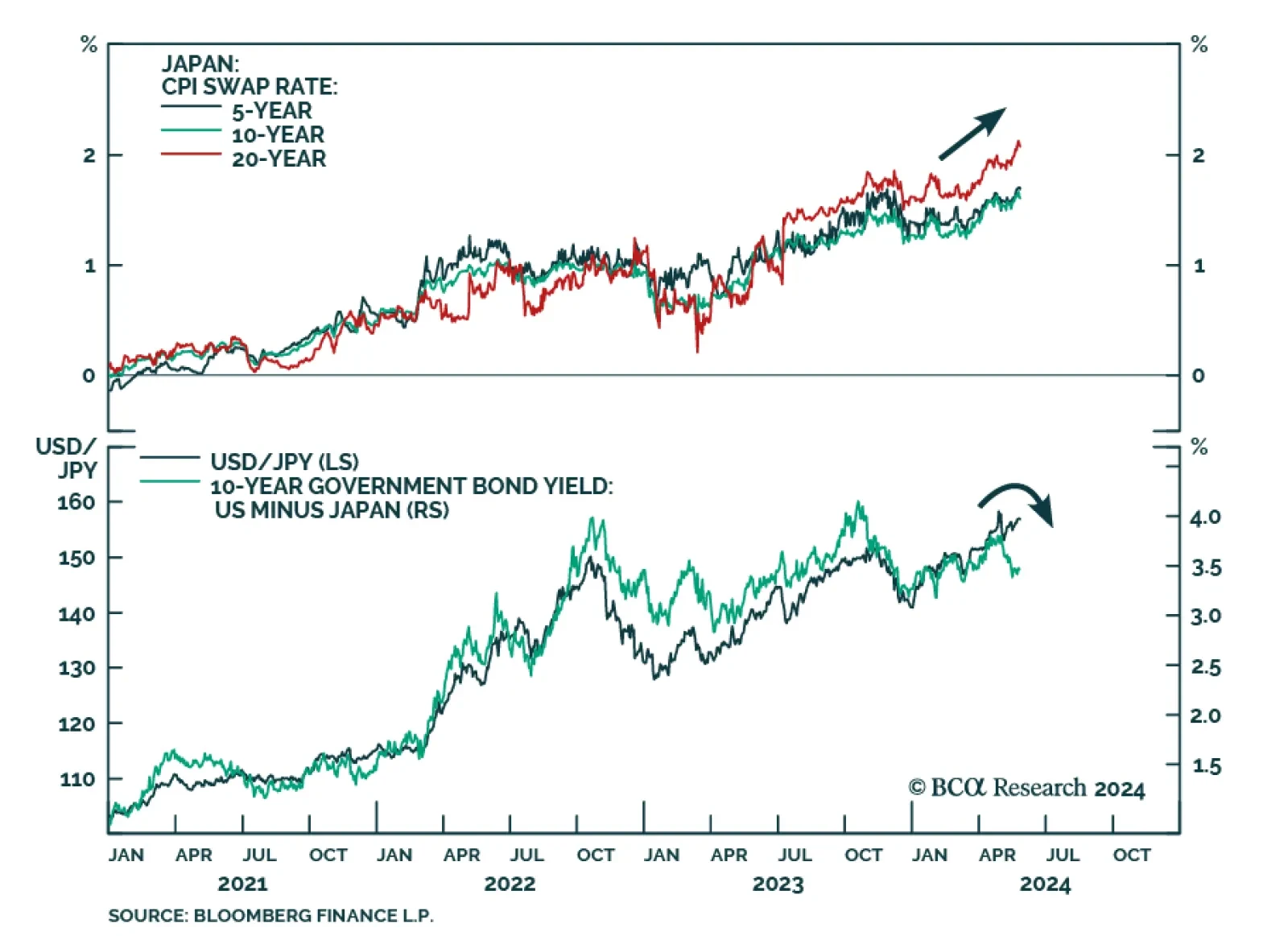

Our Global Investment strategists highlighted back in November 2022 that structural deflationary forces in Japan were weakening, thus setting the stage for inflation to make a historic comeback in Japan. About a year later…

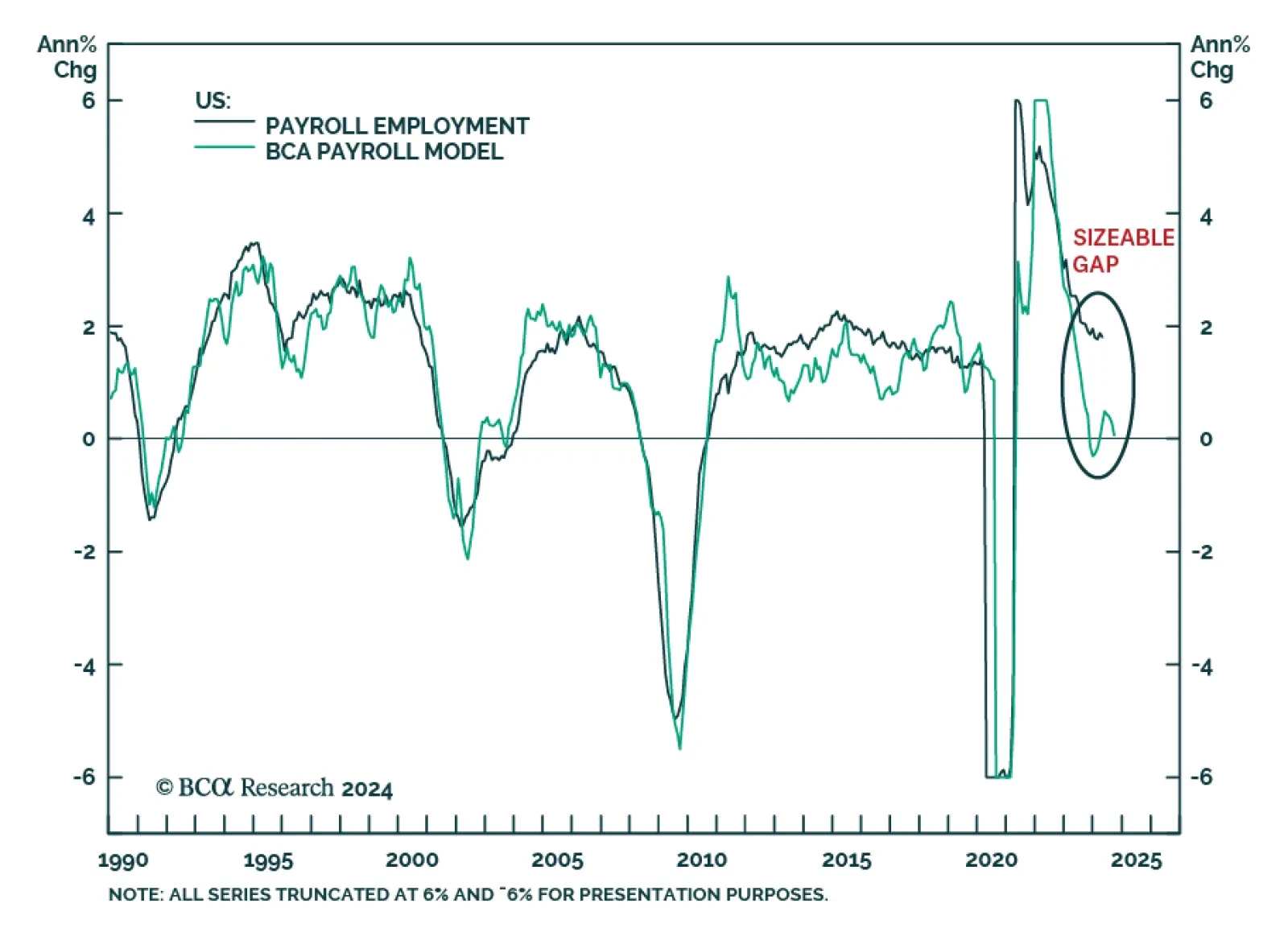

At BCA Research, fundamentals drive our analysis and we use indicators and quantitative metrics as guides to inform our views further. It is our fundamental assessment of the US labor market that underpins our view that softer…

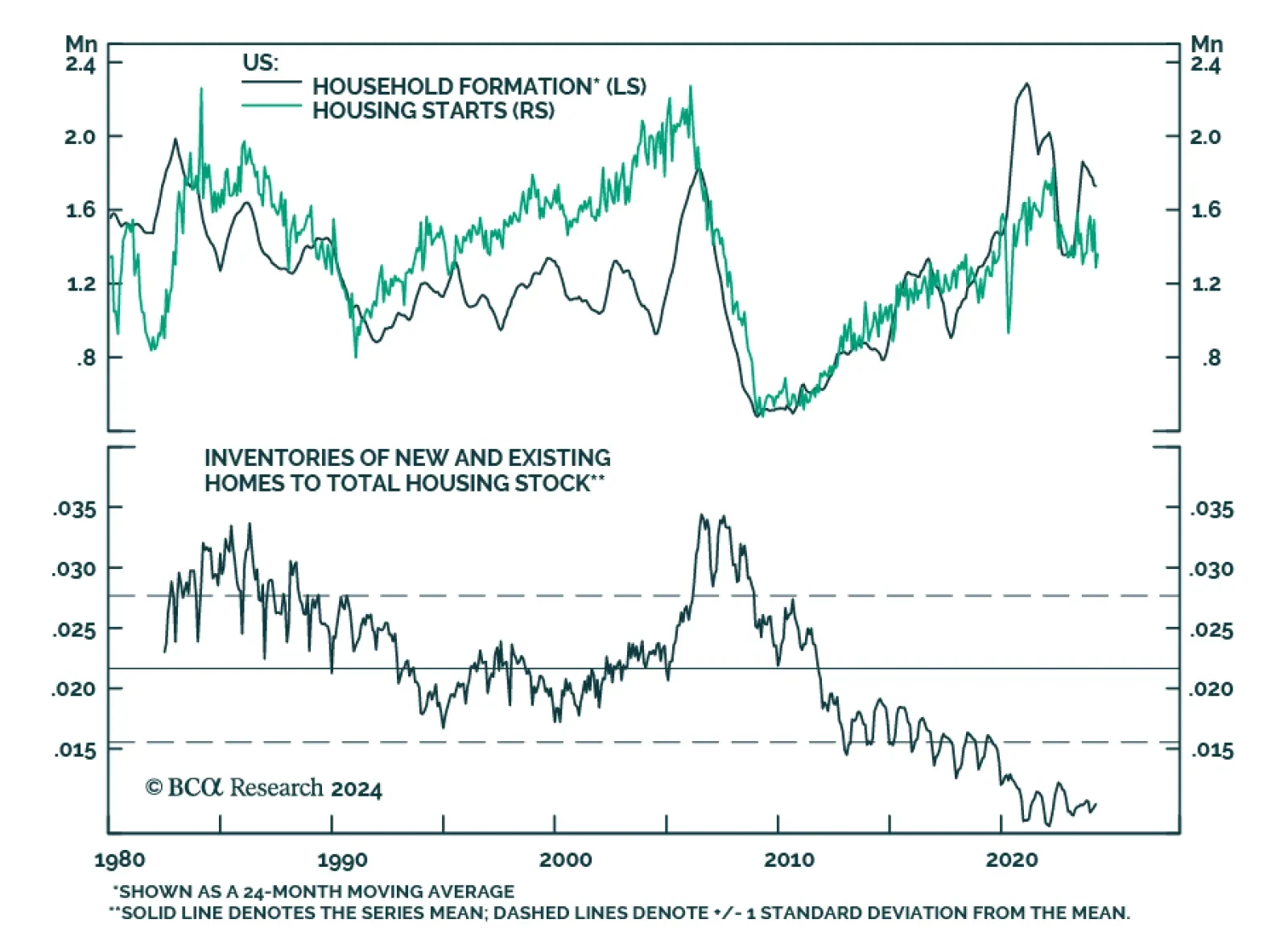

Recent US housing market data has been uninspiring. The FHFA house price index decelerated in March from 1.2% m/m to 0.1% m/m, disappointing expectations of 0.5% m/m, and the S&P CoreLogic 20-City index growth rate…

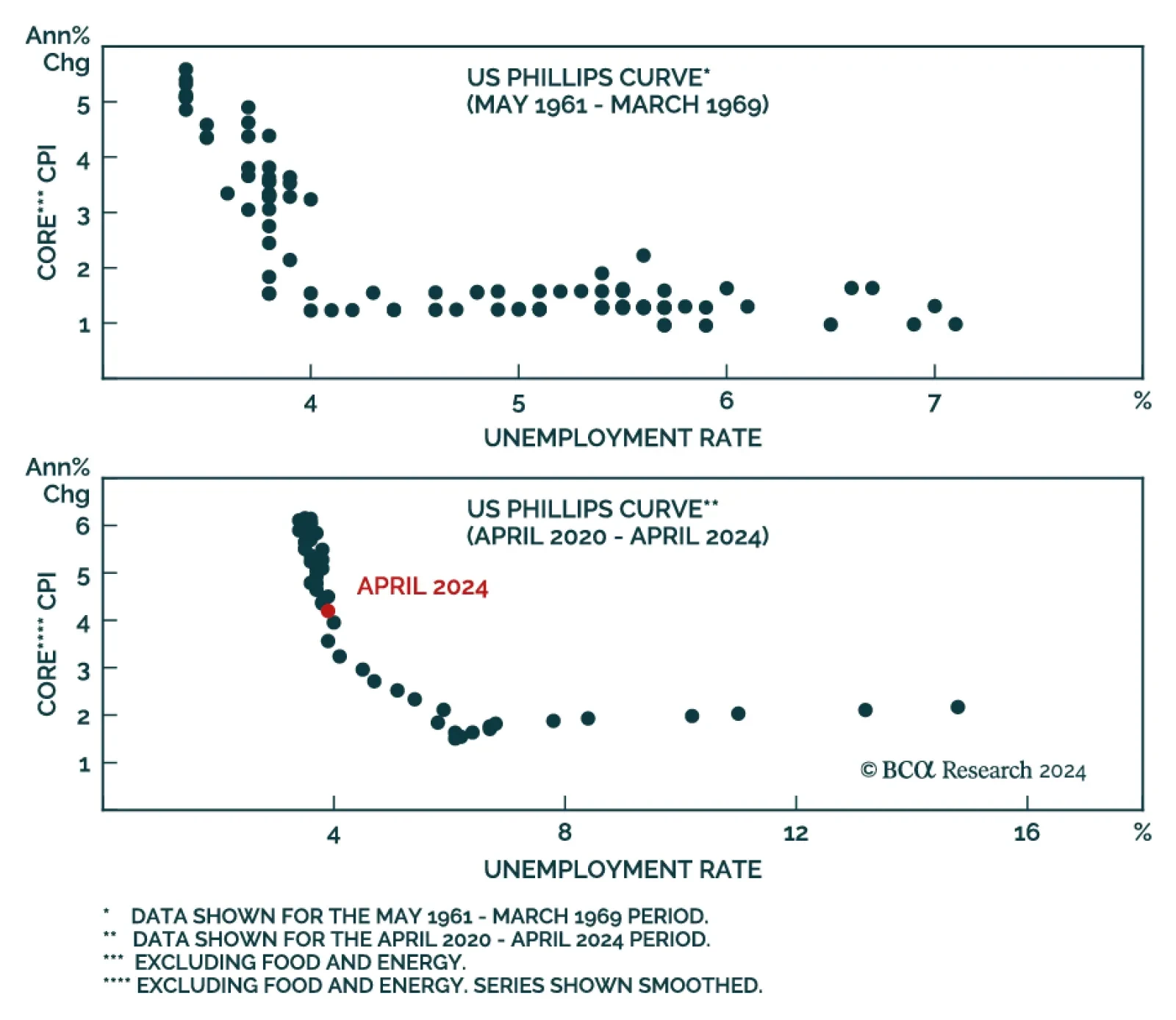

According to BCA Research’s Global Investment Strategy service, there is only a narrow path to a soft landing. Our colleagues estimate a mere 20% chance that the US will avoid a recession before the end of 2025. The US…

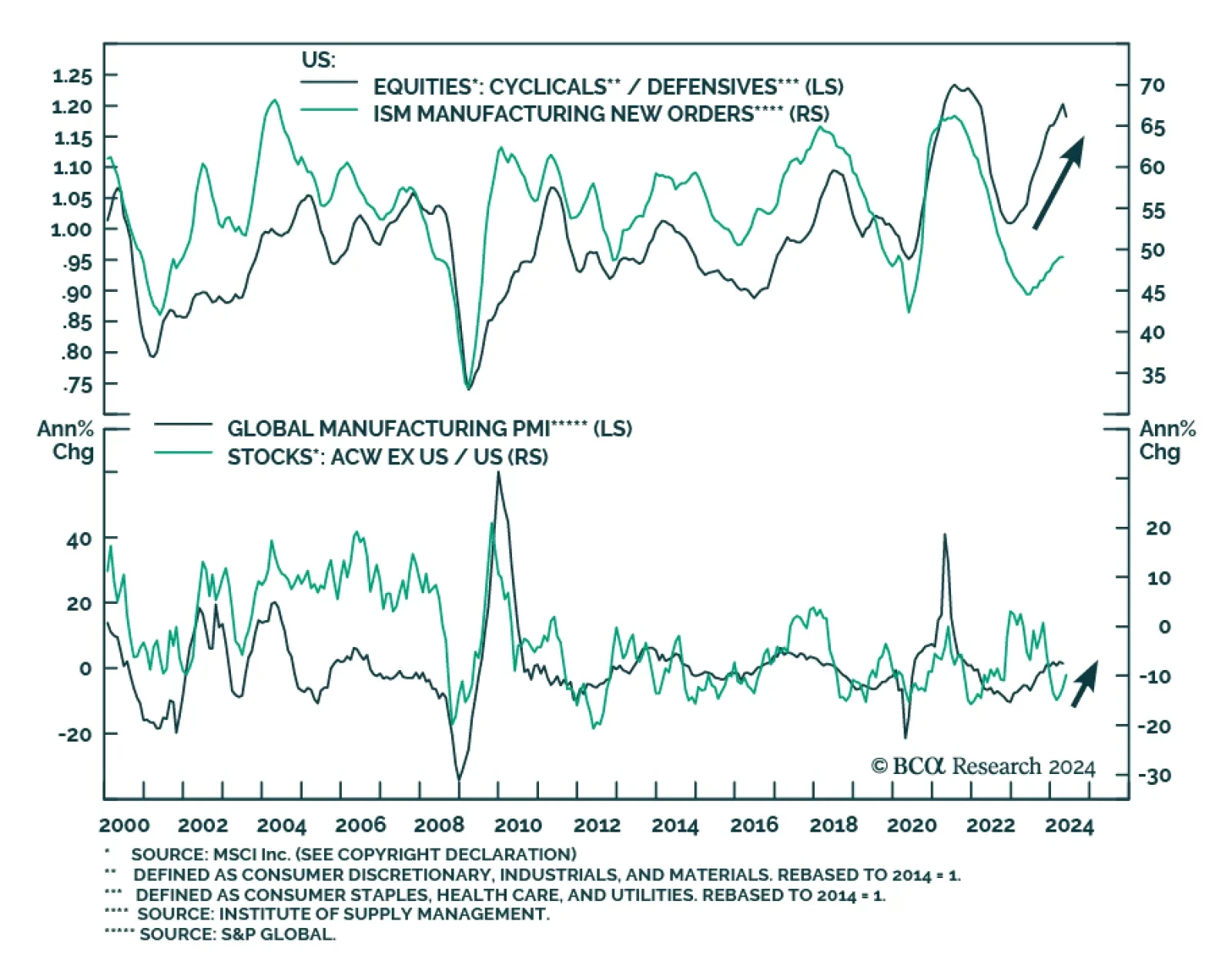

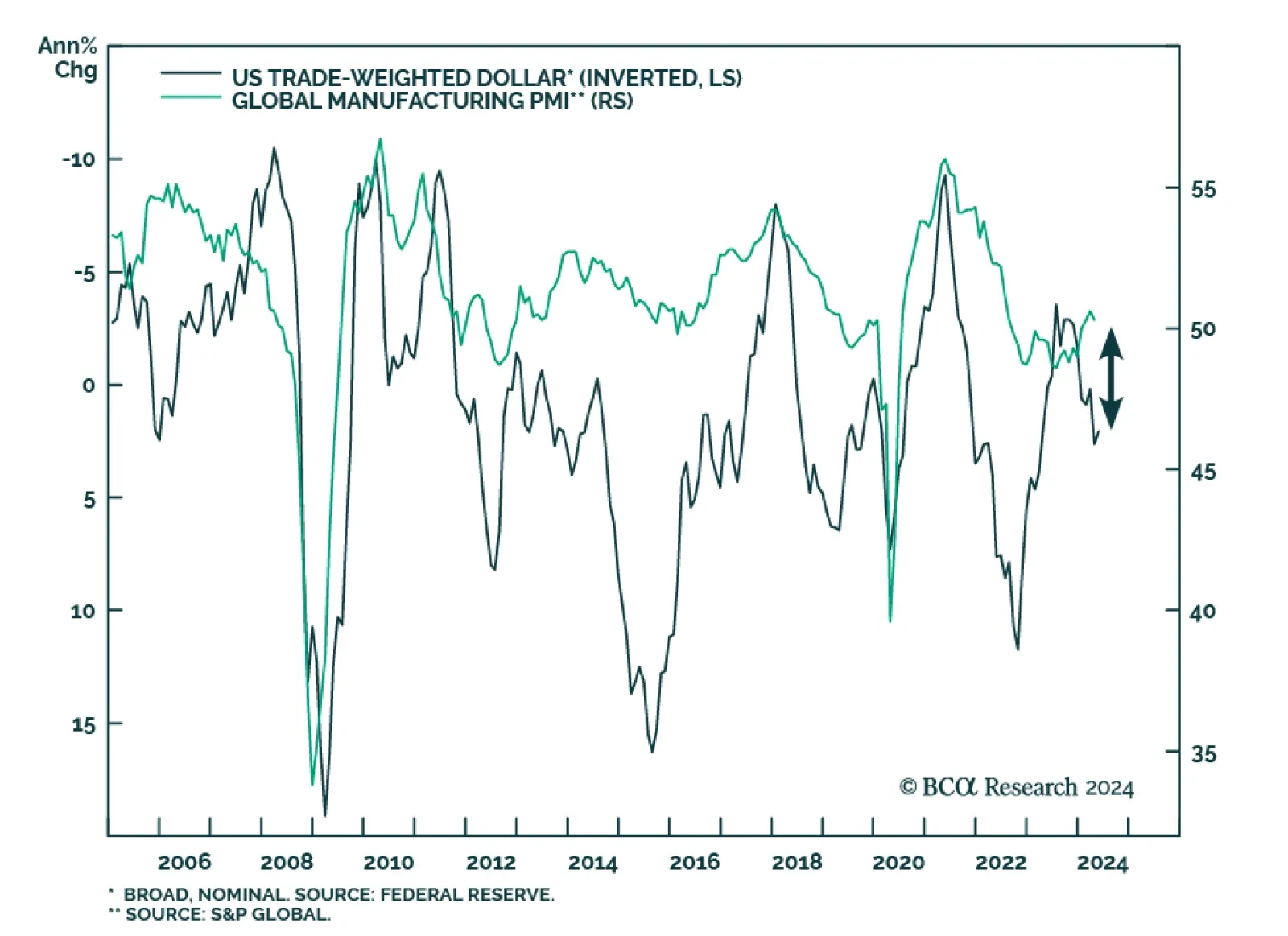

The US manufacturing cycle has followed a surprisingly stable pattern for over seven decades. History suggests that this cycle tends to last for about 36 months, with a down leg spanning 18 months, followed by an up leg…

The greenback typically moves in the opposite direction of global growth. The US economy is indeed more highly geared towards services than manufacturing, compared with the rest of the world. Therefore, when global growth…

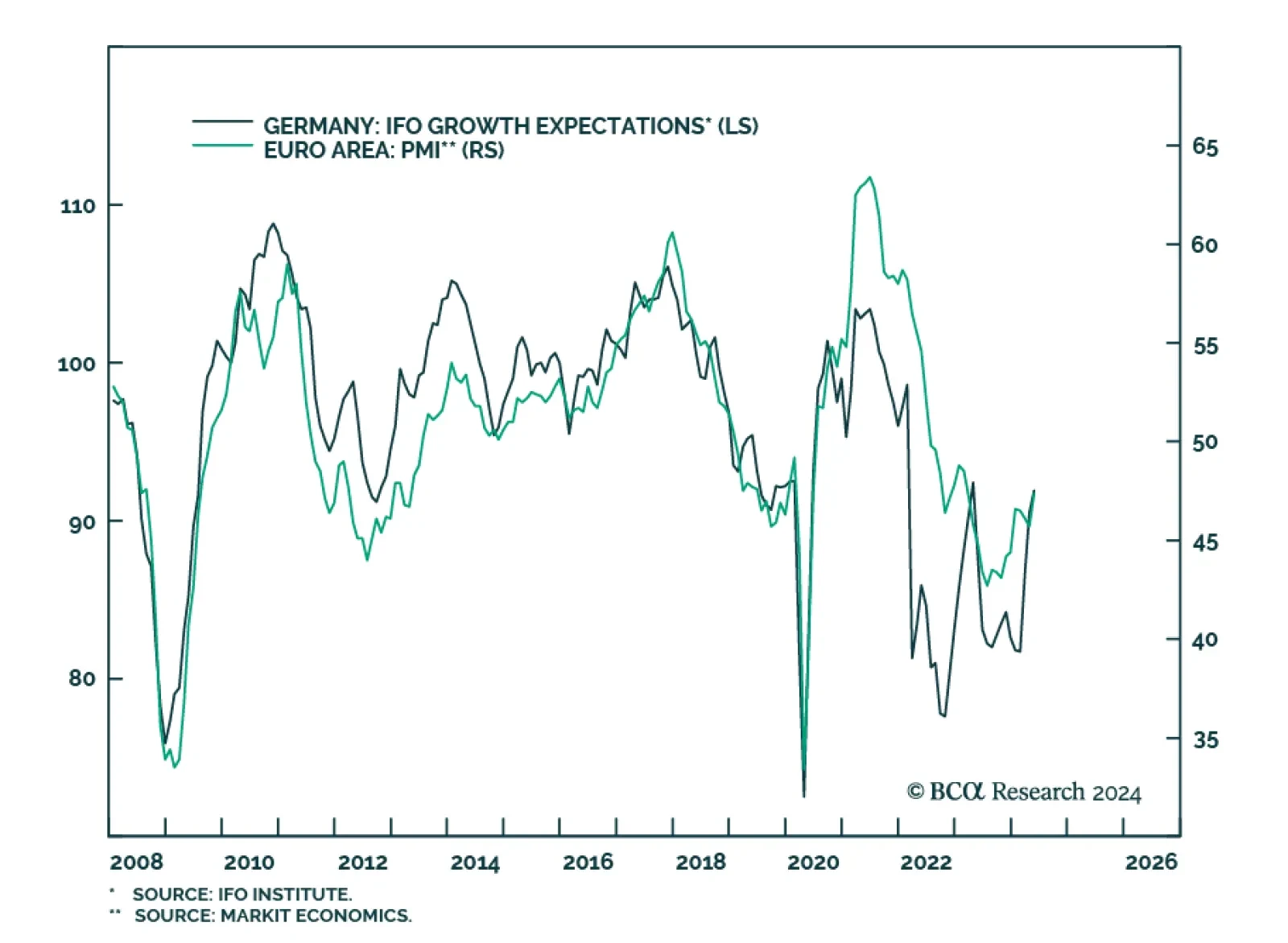

Sentiment among German companies stalled in May, after having firmed for 3 consecutive months. The IFO Business Climate came in at 89.3, unchanged from April, disappointing expectations of further strengthening to 90.4. Although…