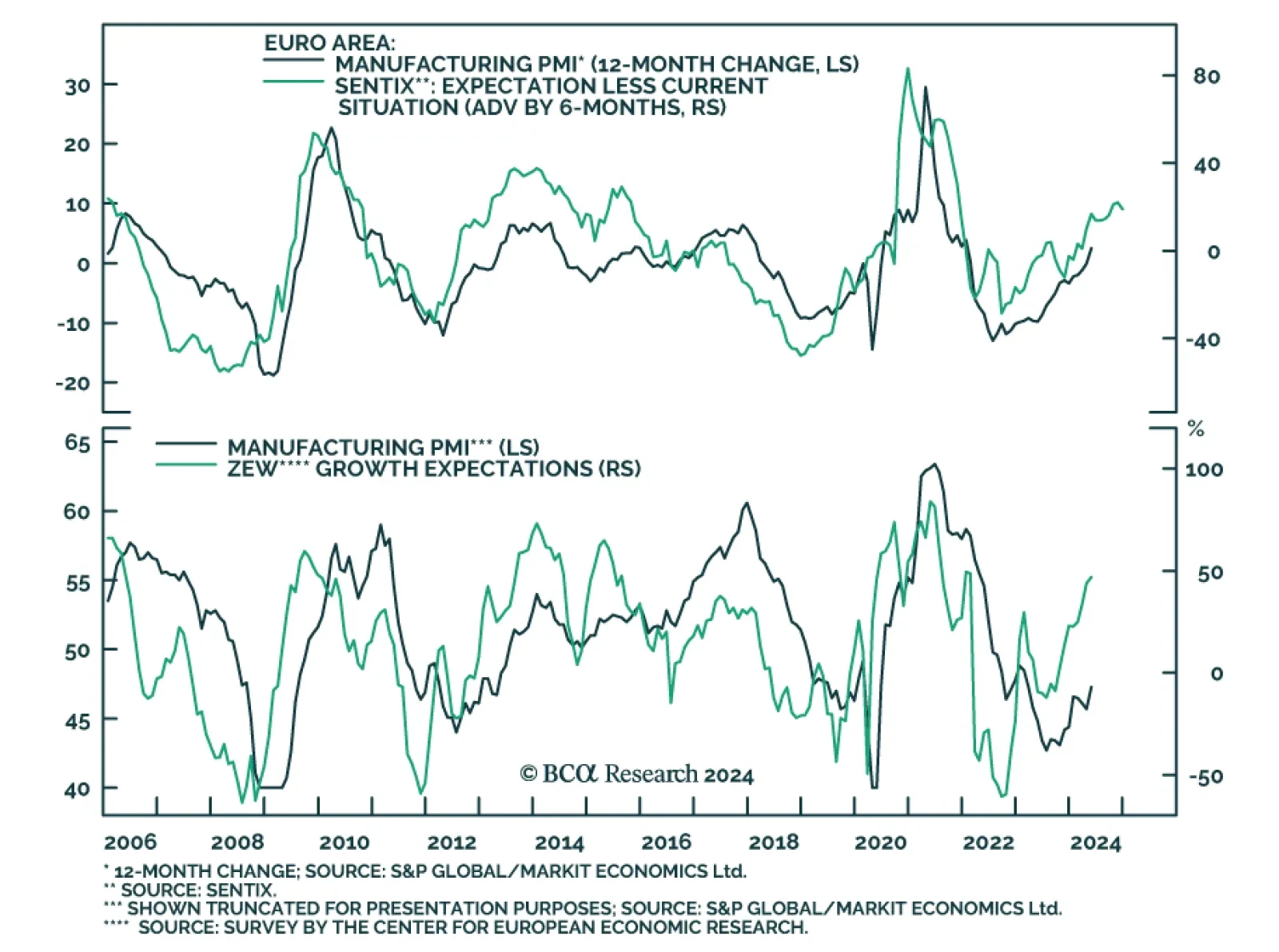

The Eurozone Sentix Economic index improved from -3.6 to 0.3 in June, easily surpassing expectations of a more muted improvement to -1.7. Notably, the Expectation and Current Situation subindices rose to 28-month and 13-month…

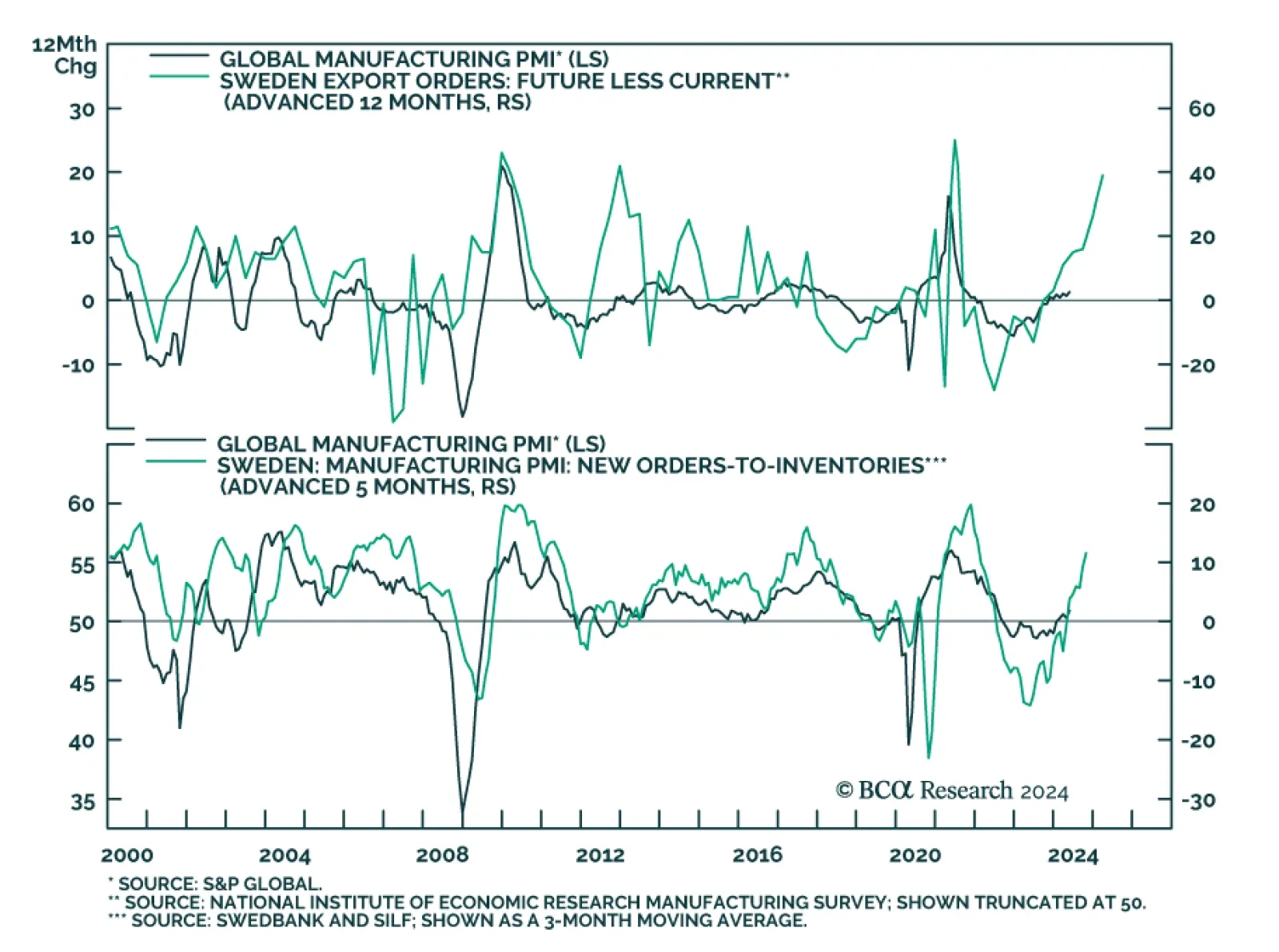

Sweden is a small export-oriented economy and its high sensitivity to global trade makes it a good bellwether of global growth developments. The headwinds from high borrowing costs are relatively more pronounced in Sweden…

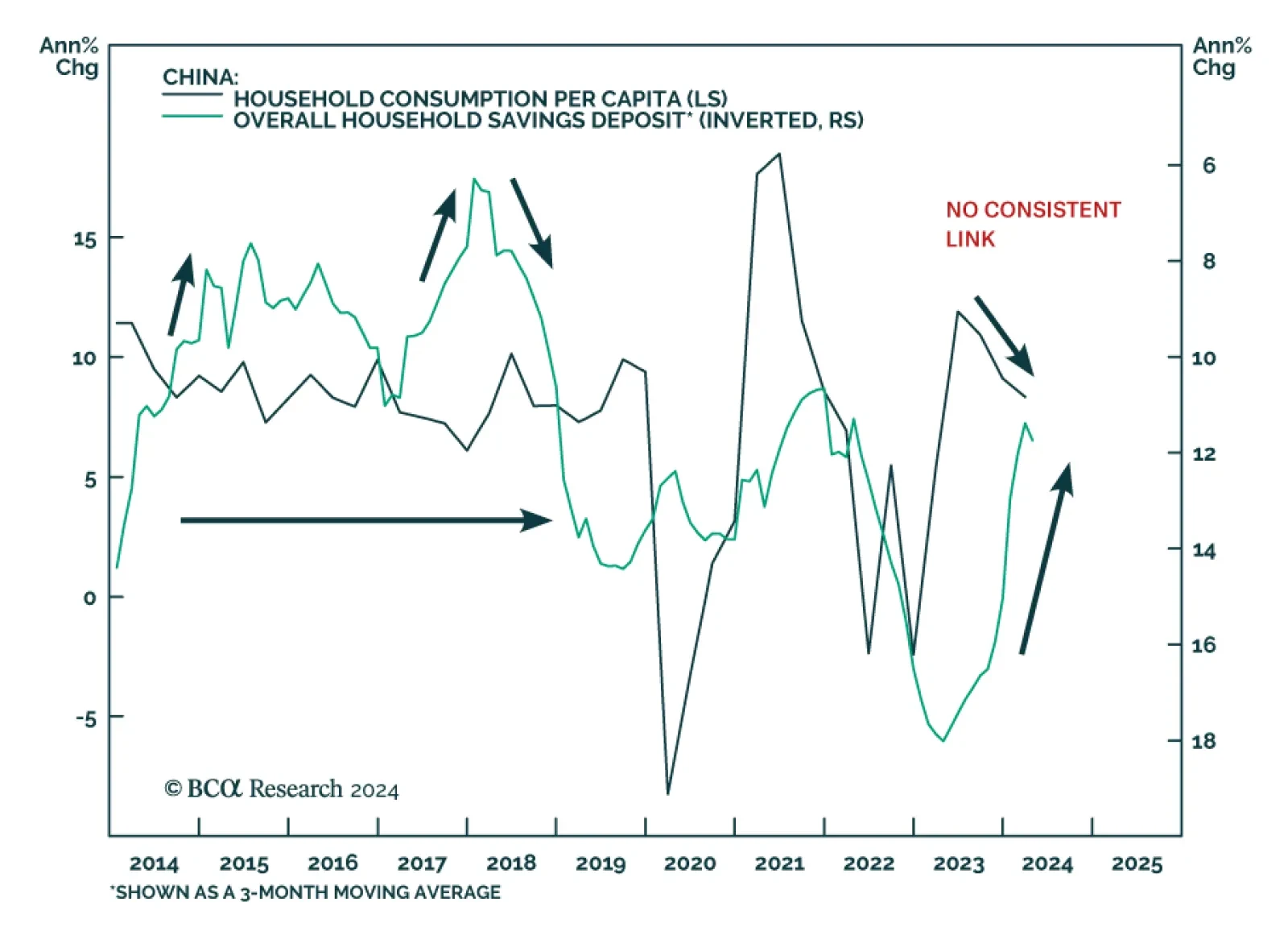

The redeployment of pandemic-era excess savings has been a significant driver of US consumption growth and helped the economy avoid a recession last year. Although pandemic-era fiscal support was less generous in China,…

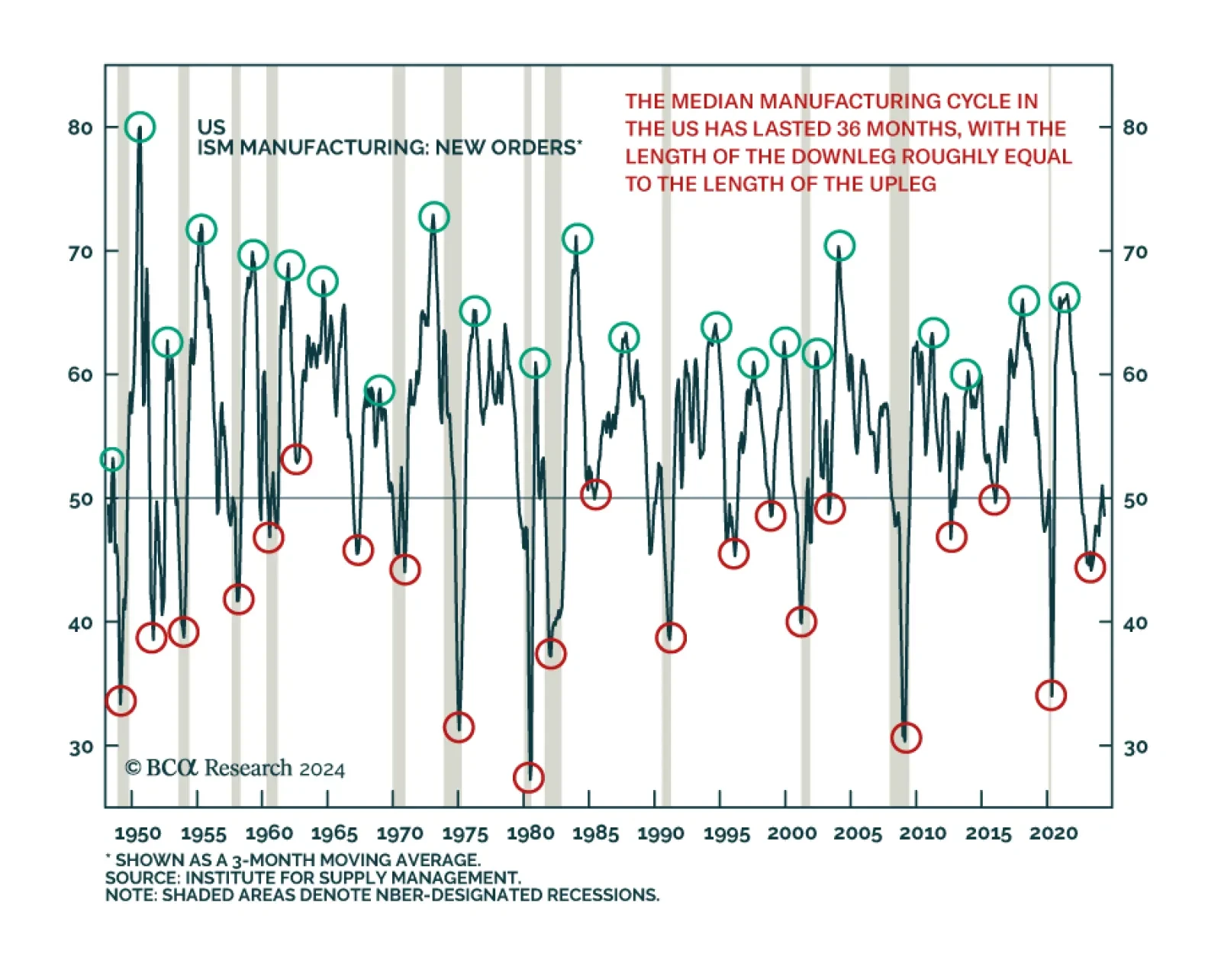

Our colleagues at Global Investment Strategy have shown that postwar US (and global) manufacturing cycles have tended to last 3 years, divided equally between an 18-month up leg and an 18-month down leg. This framework has been a…

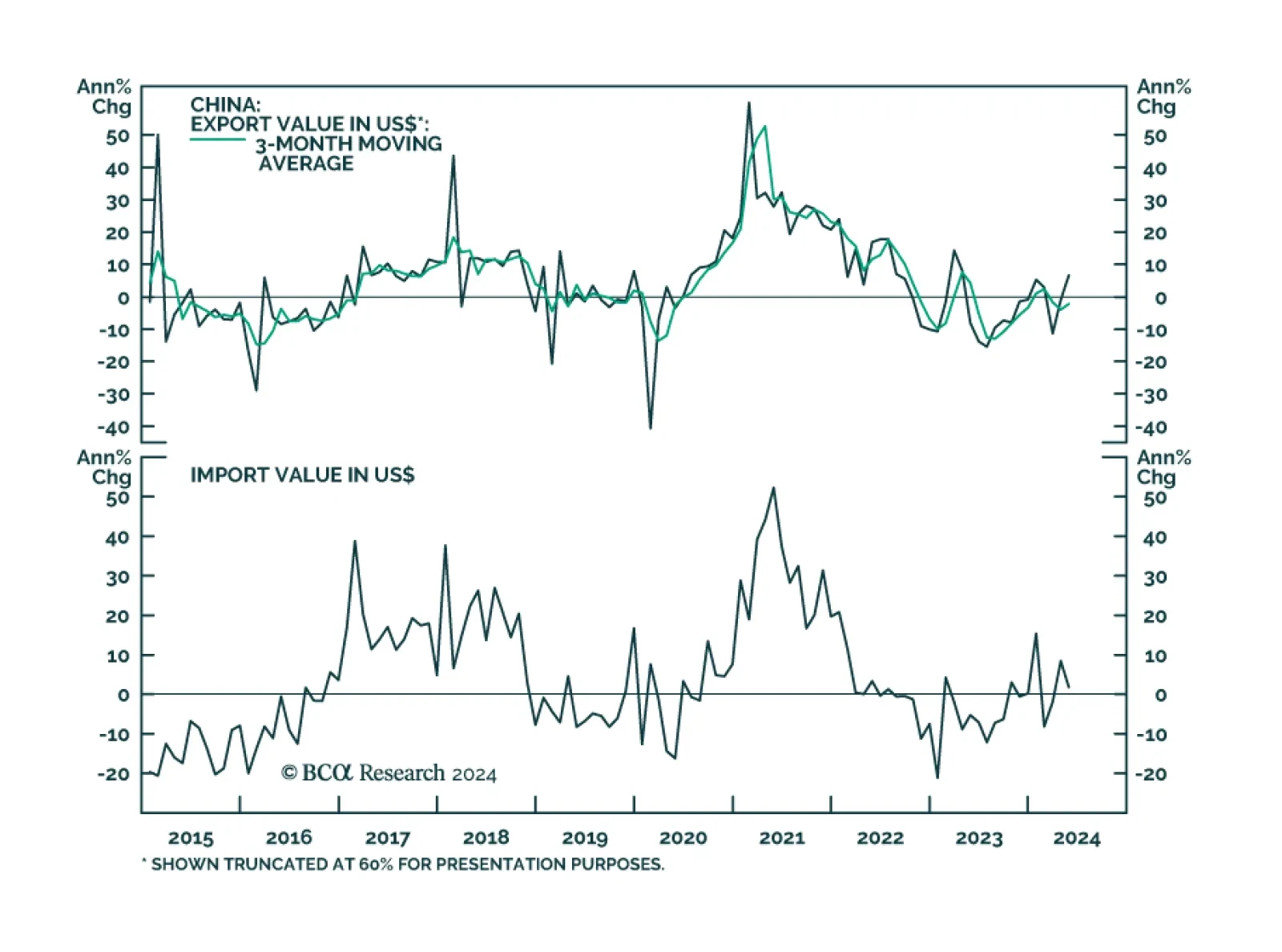

China’s exports in USD terms surged 7.6% y/y in May, from 1.5% in April, surpassing expectations of a 5.7% gain. However, base effects largely overstate the strength of Chinese exports given that they contracted by 8% y/…

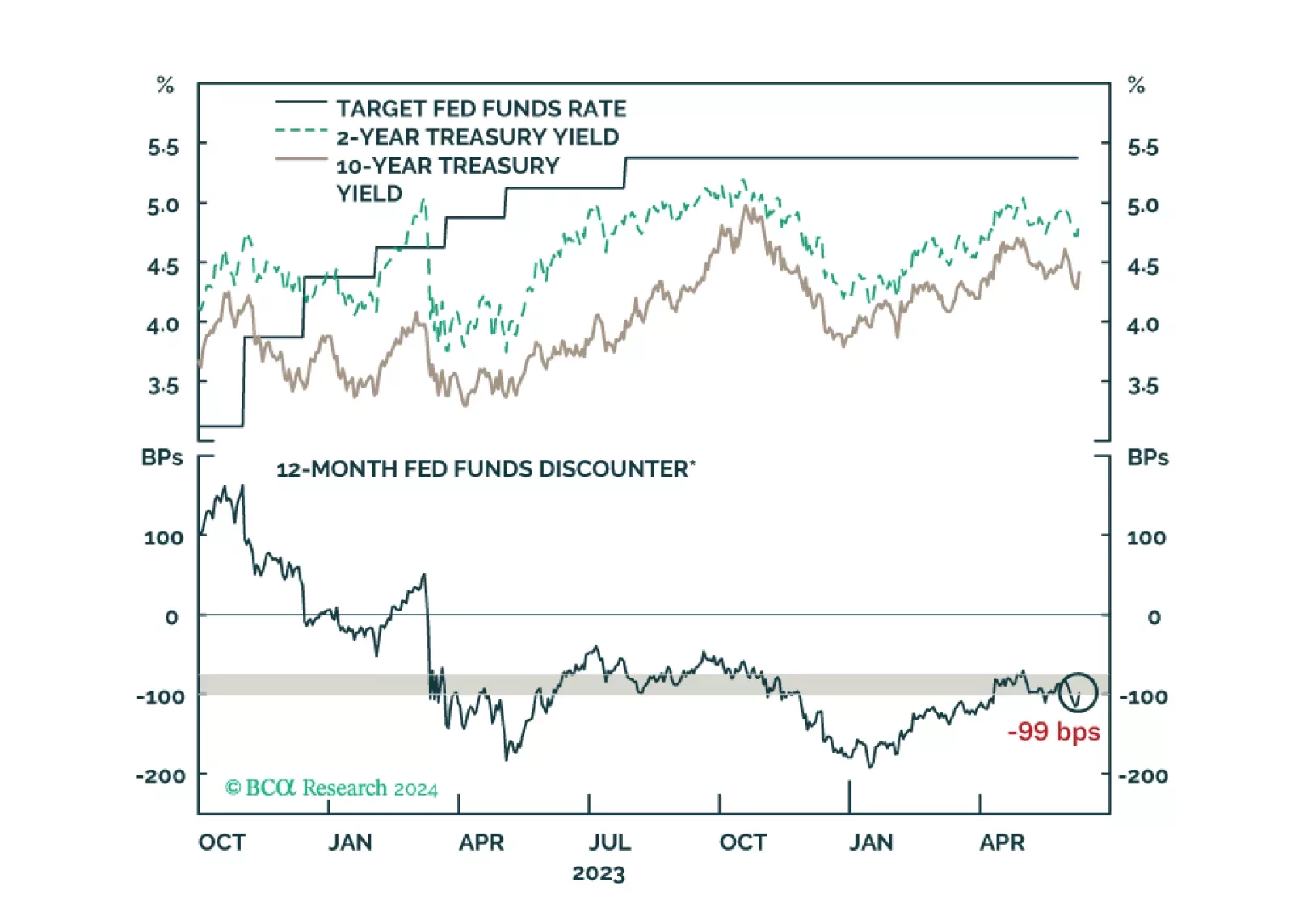

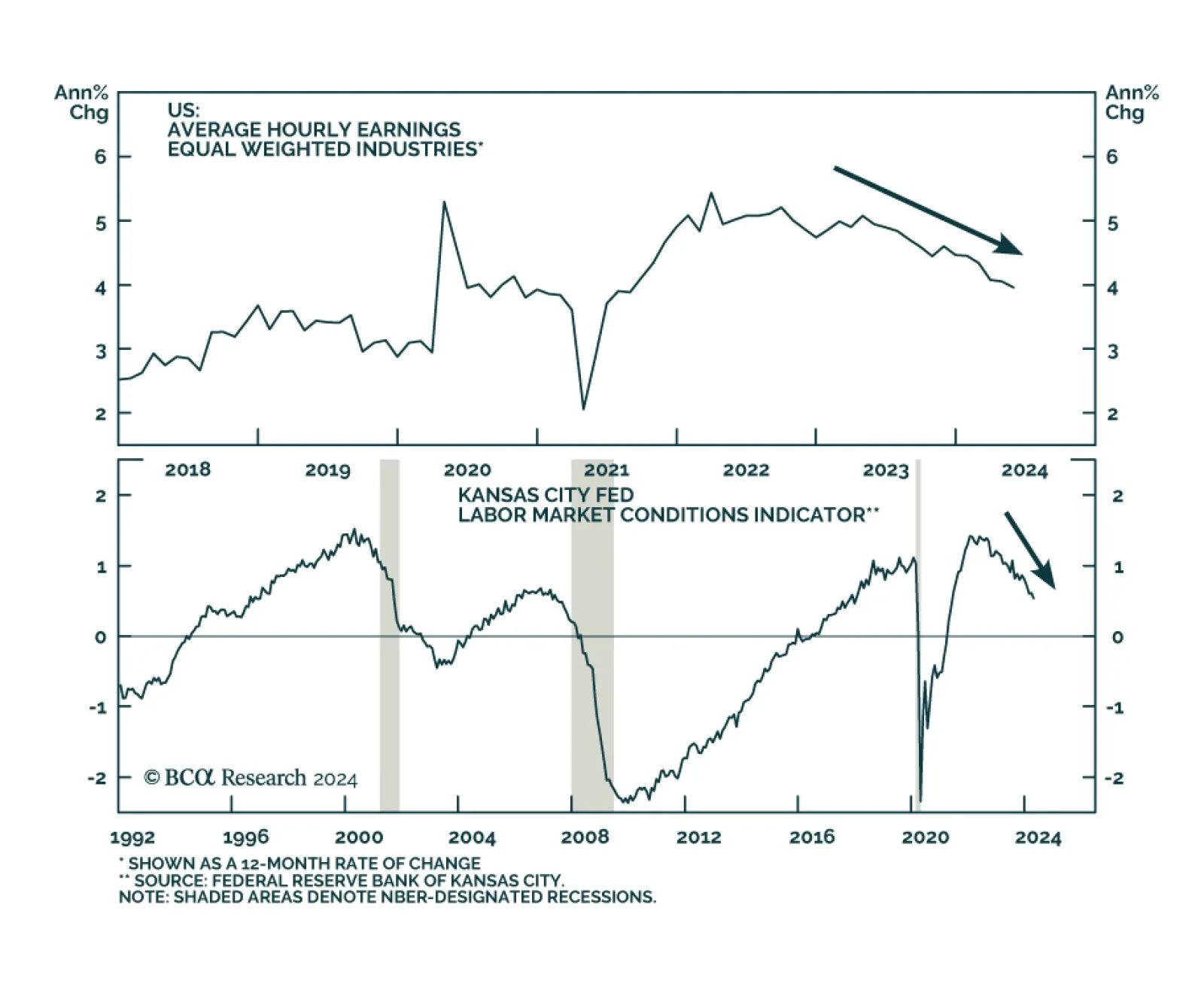

US nonfarm payrolls grew by 272 thousand in May, accelerating from 165 thousand in April, and swamping expectations of 180 thousand. Average hourly earnings increased by 4.1% y/y from an upwardly revised 4.0%. However, the…

US Treasury yields bounced after this morning’s employment report. We offer our updated views about how long the recent trading range will hold.

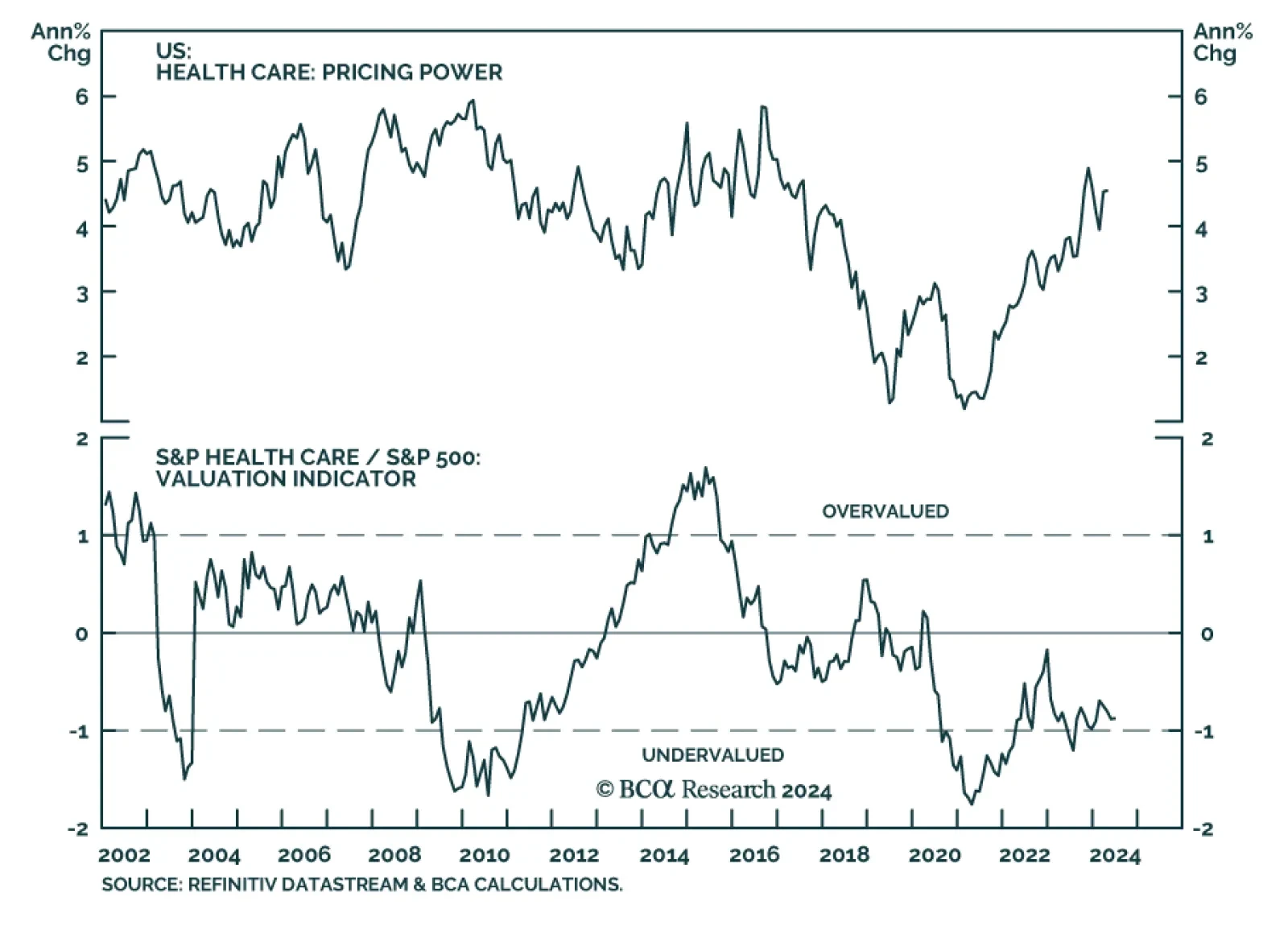

Healthcare has underperformed the S&P 500 by 23% since early 2023. Profit margins have been squeezed since the pandemic revenue windfall dried up and because long-term contracts prevented companies from raising prices in line…

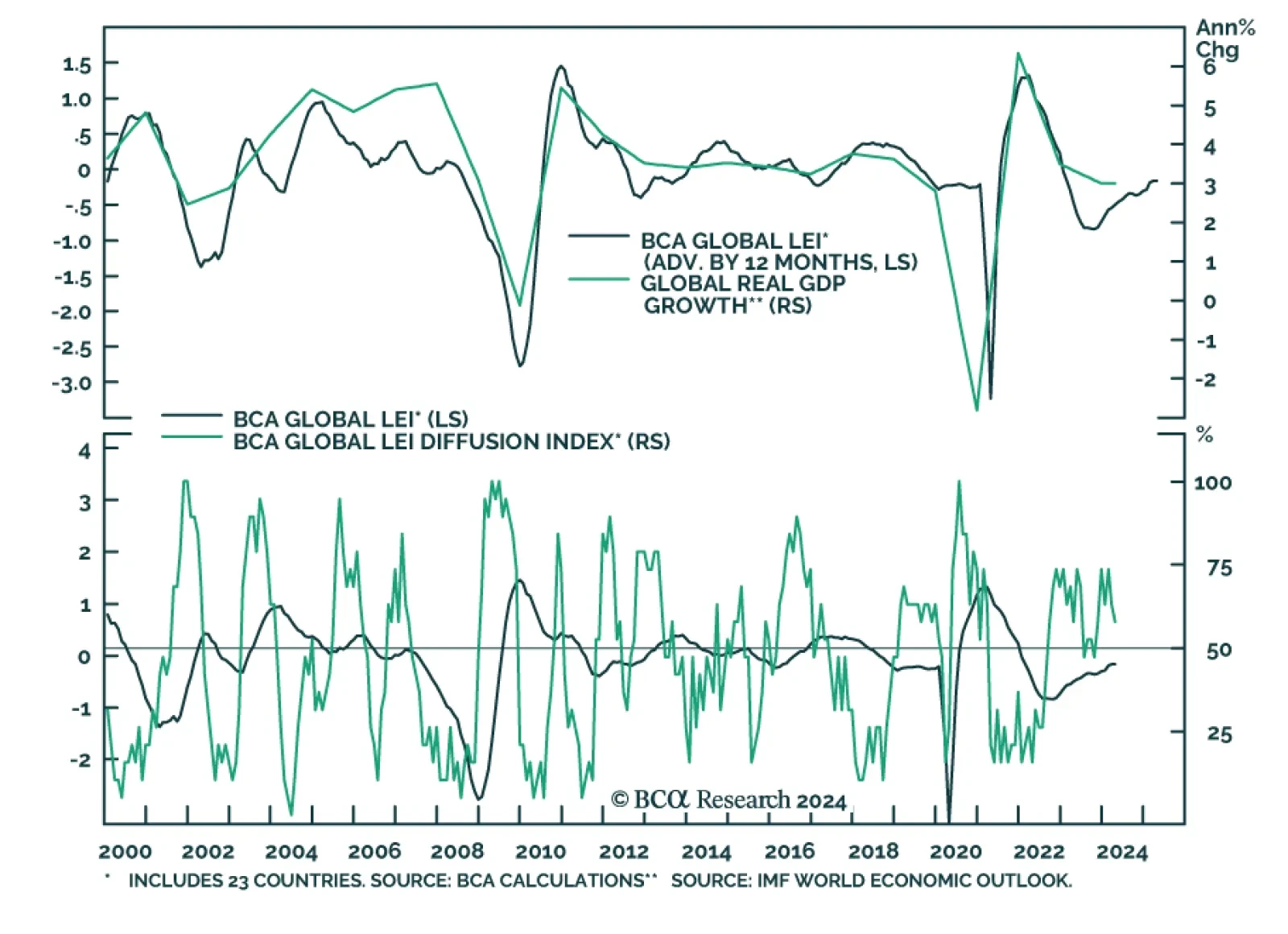

BCA’s Global Leading Economic Indicator has had a good track record of predicting year-on-year changes in the IMF global real GDP growth series. This GDP-weighted average of the standardized leading indicators of 23 DM and…

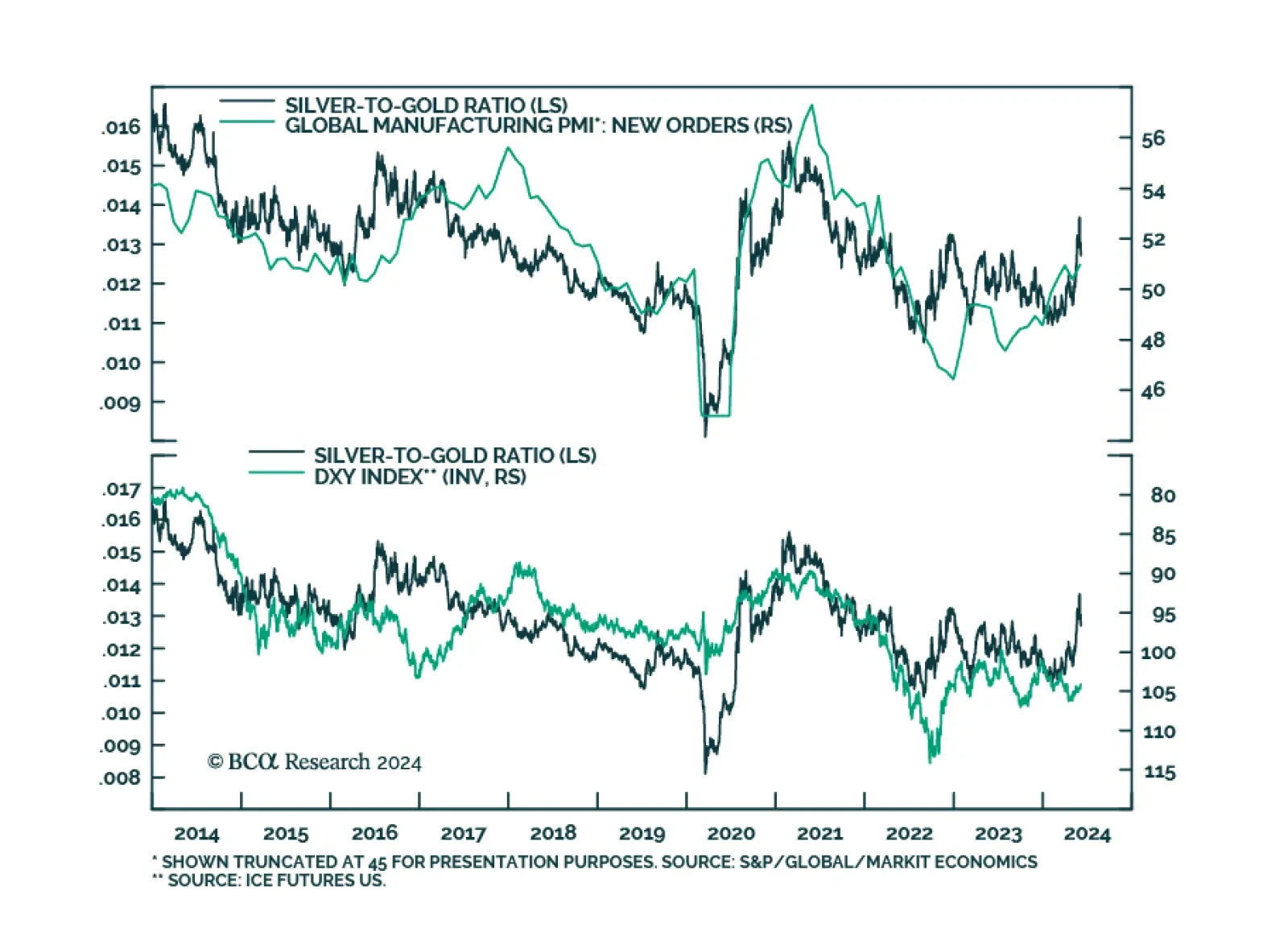

The silver-to-gold ratio has surged close to 10% this year on the back of silver prices catching up to gold. Silver has returned 22% on a YTD basis, against 12% for gold, 13% for industrial metals and 5% for the broad commodity…