Copper has experienced a roller-coaster ride so far this year, with front-month futures on the Chicago Mercantile Exchange gaining nearly 40% from early February to late May, tumbling nearly 15% in just over five weeks, and…

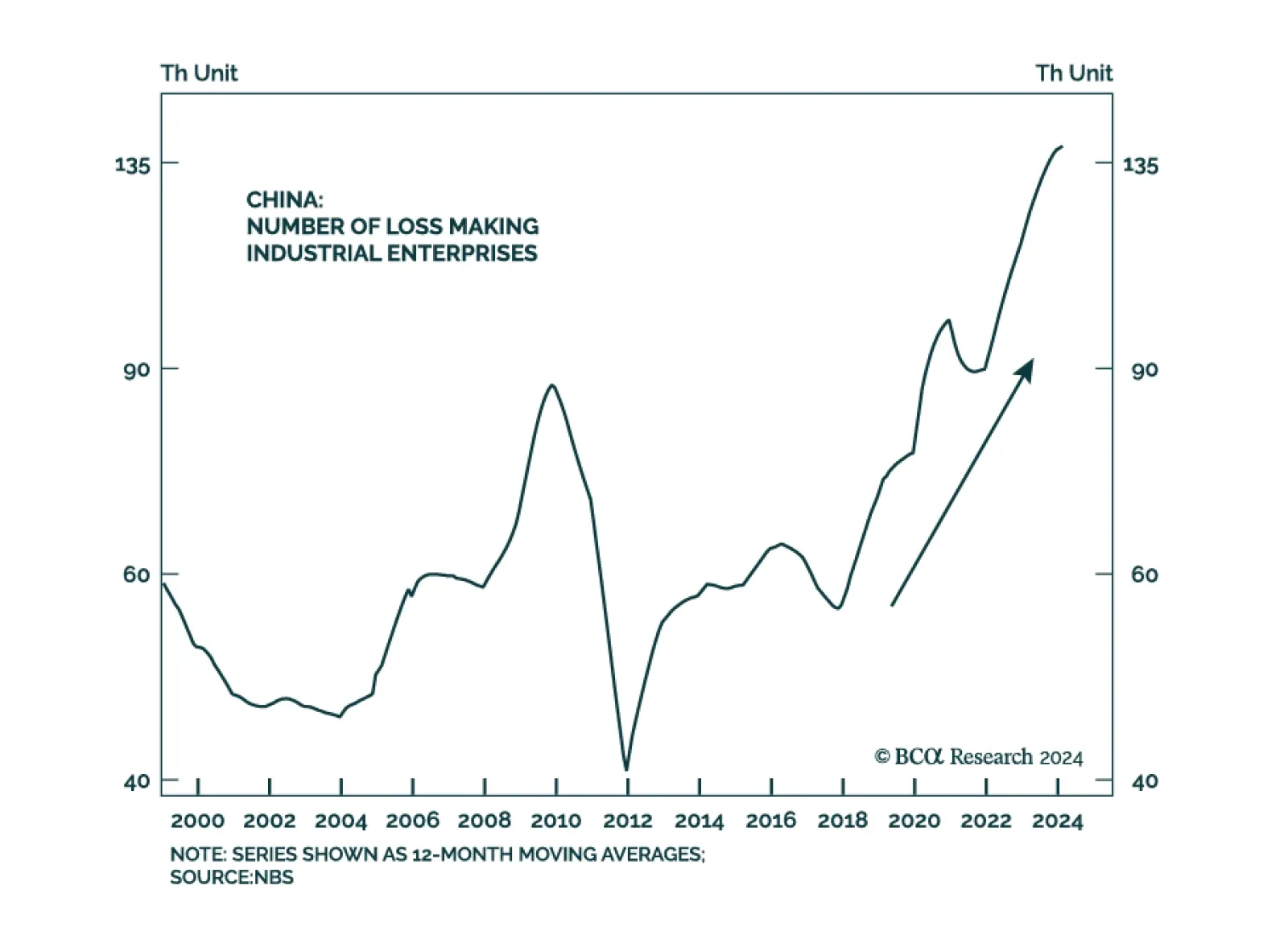

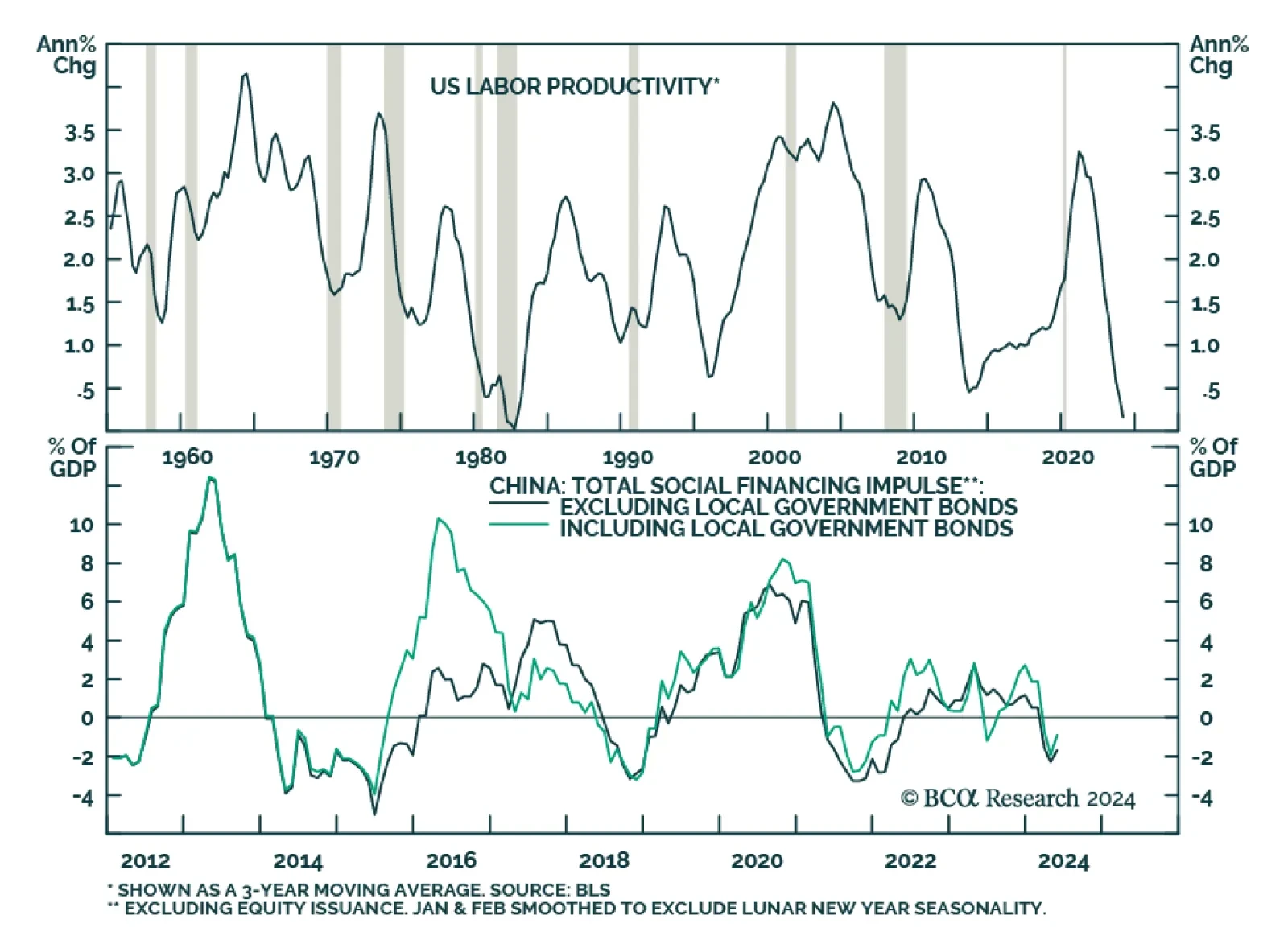

As highlighted in Wednesday’s edition of BCA Live & Unfiltered, the Chinese economy and its financial markets face several daunting challenges. Its demographic outlook is unfavorable, with a low birthrate stifling…

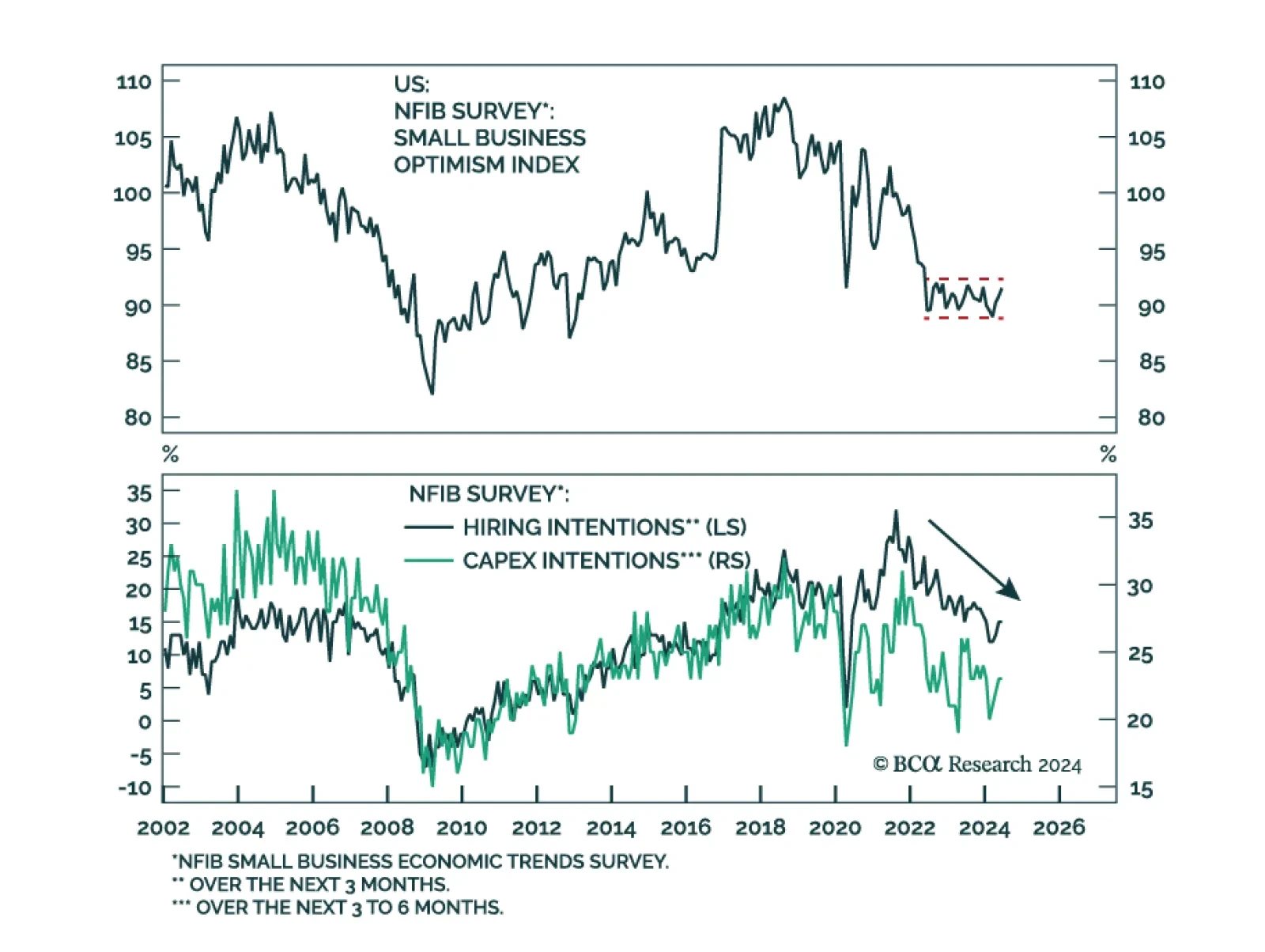

The NFIB Small Business Optimism (SBO) index climbed from 90.5 to 91.5 in June, the highest print this year, topping consensus expectations of a softening to 90.2. On the surface, this appears to be good news. Indeed, small…

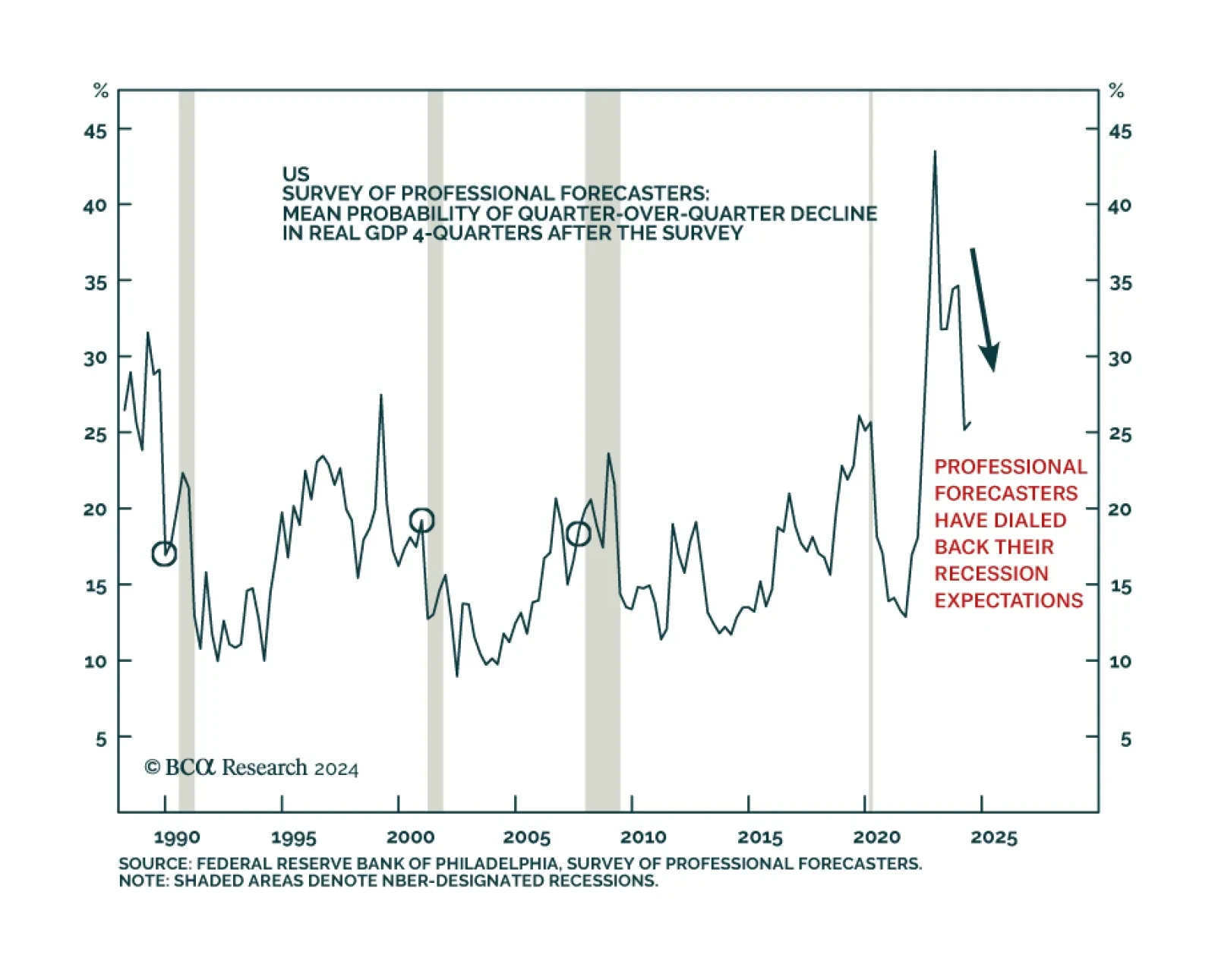

Participants in the Philly Fed’s Survey of Professional Forecasters (SPF) assign a 26% probability to a contraction in US real GDP four quarters from now, down from their 44% peak probability in 2022. The unwieldy…

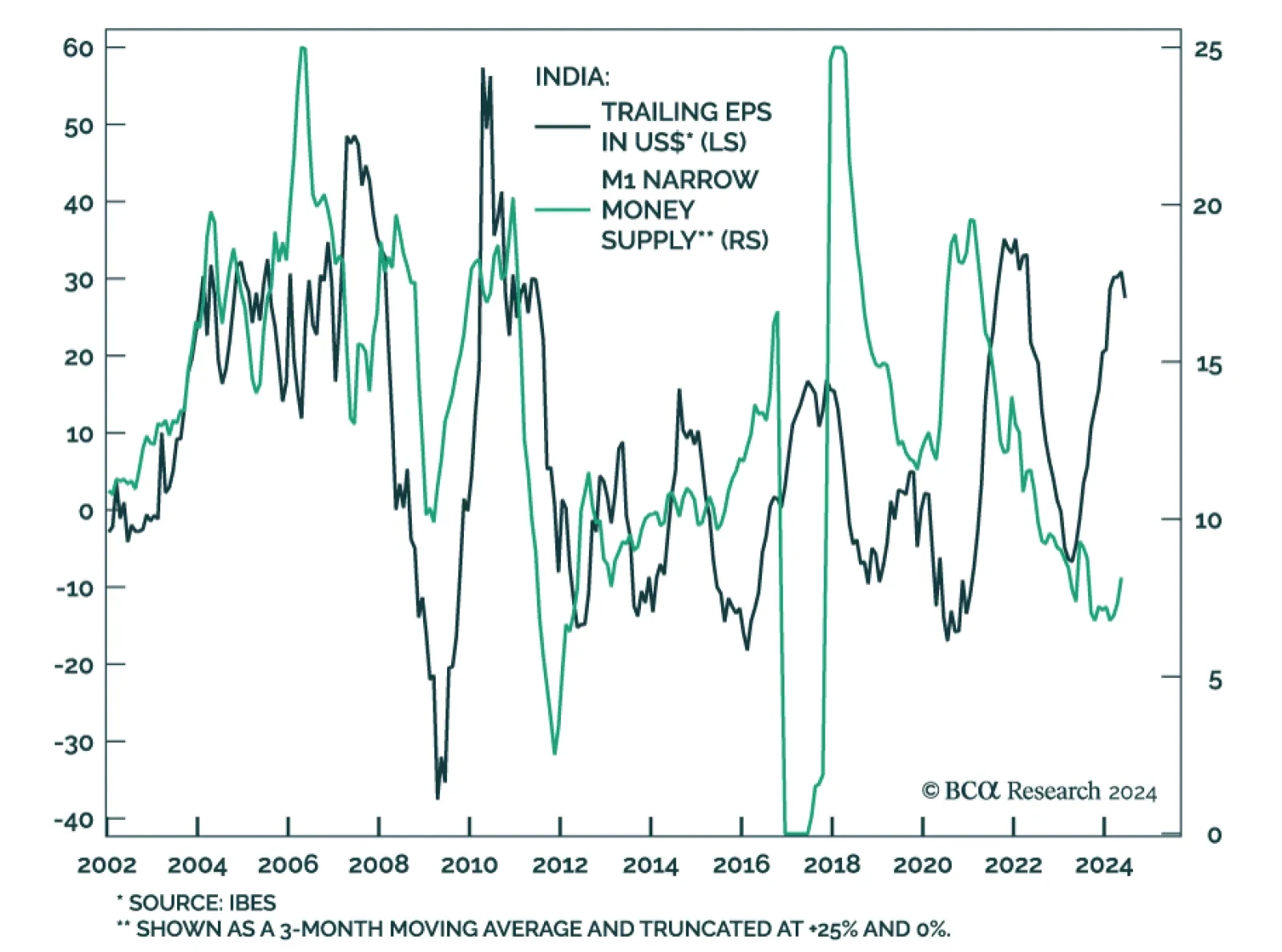

Our colleagues from the Emerging Markets Strategy team argue that investors should brace for a significant correction in Indian stocks in the coming months. They posit that the pillar of Indian corporations' sustained profit…

We expect continued softening in the US economy will lead to decelerating wage growth, muffling the principal consumption driver. Because the US has been the foremost catalyst for global growth in this cycle, a US recession will…

In this week's report, we review the impact of political developments, as well as incoming fundamental data, on our positioning.

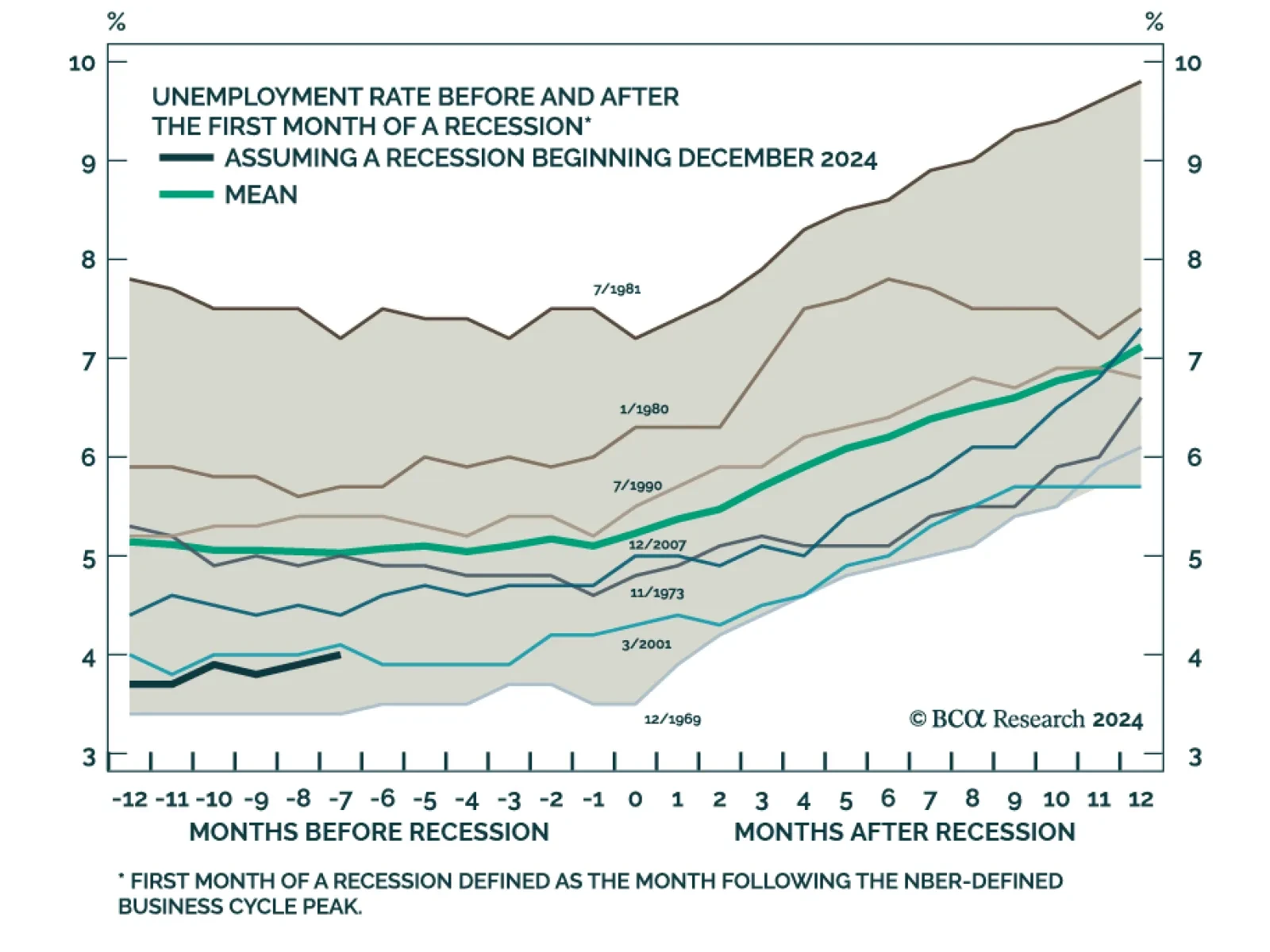

The US unemployment rate stands at just 4.0% today following 27 consecutive sub-4% readings. Does this low unemployment rate guarantee a soft landing in the US economy? Our Global Investment Strategy (GIS) team’s base…

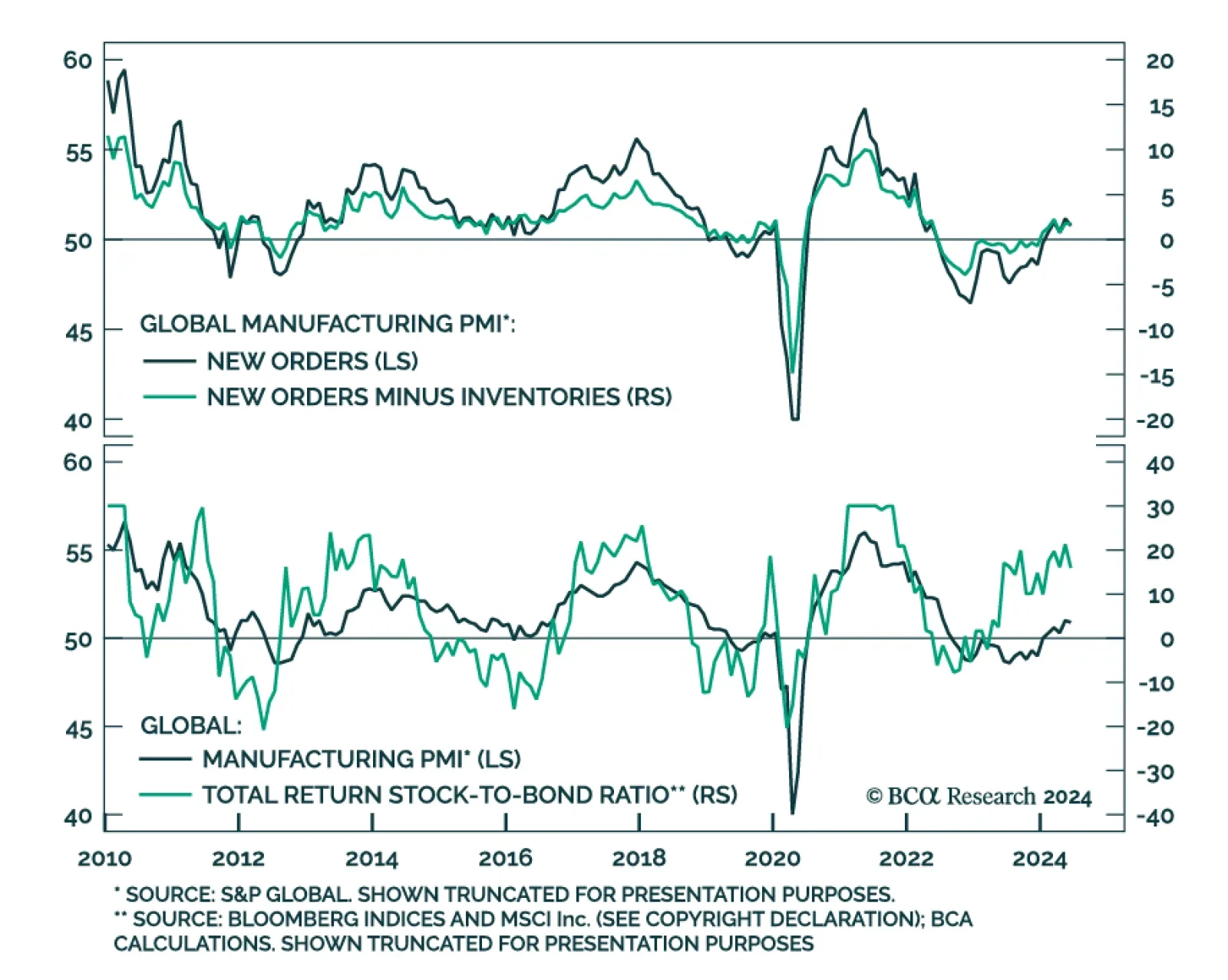

The stabilization in global growth continued in June. The JPM Global Manufacturing PMI came in at 50.9, nearly in line with May’s 22-month high. However, international trade flows deteriorated notably. The new export…

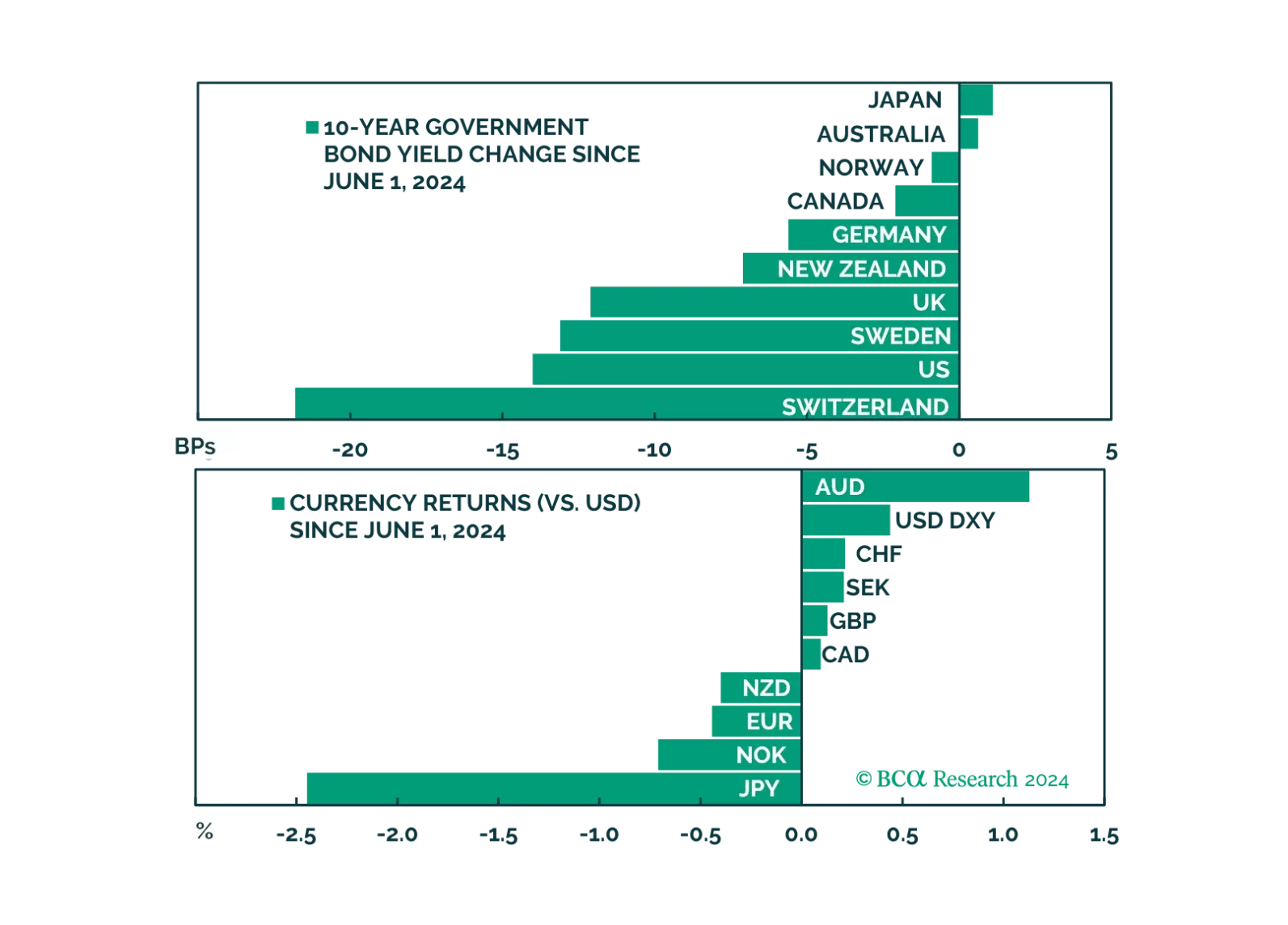

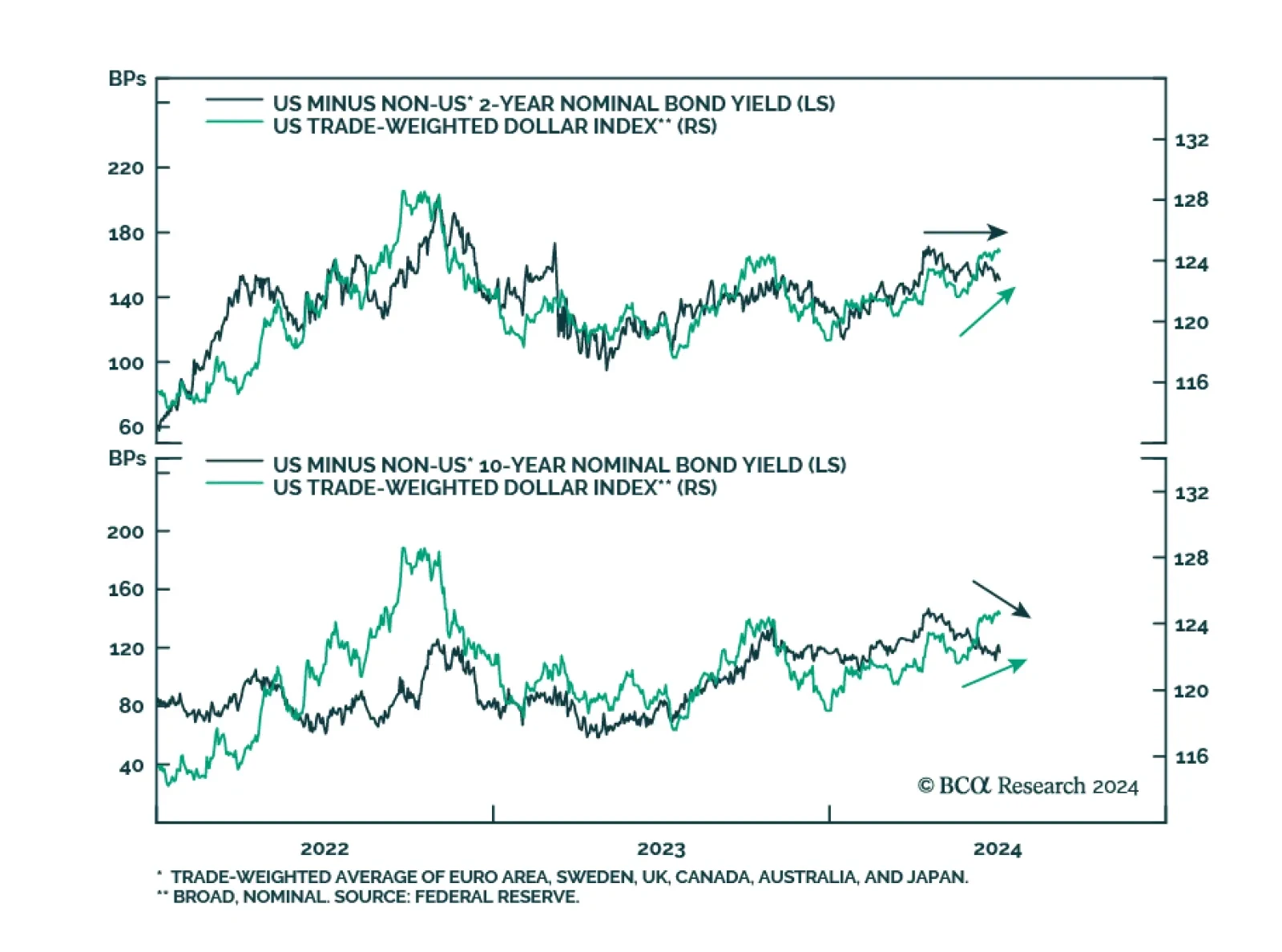

The trade-weighted US dollar ranked among the top performing major asset classes we track in June. It hit a low on June 3rd and has appreciated by 1.5% since then. This is despite no change in short-end rate differentials and an…