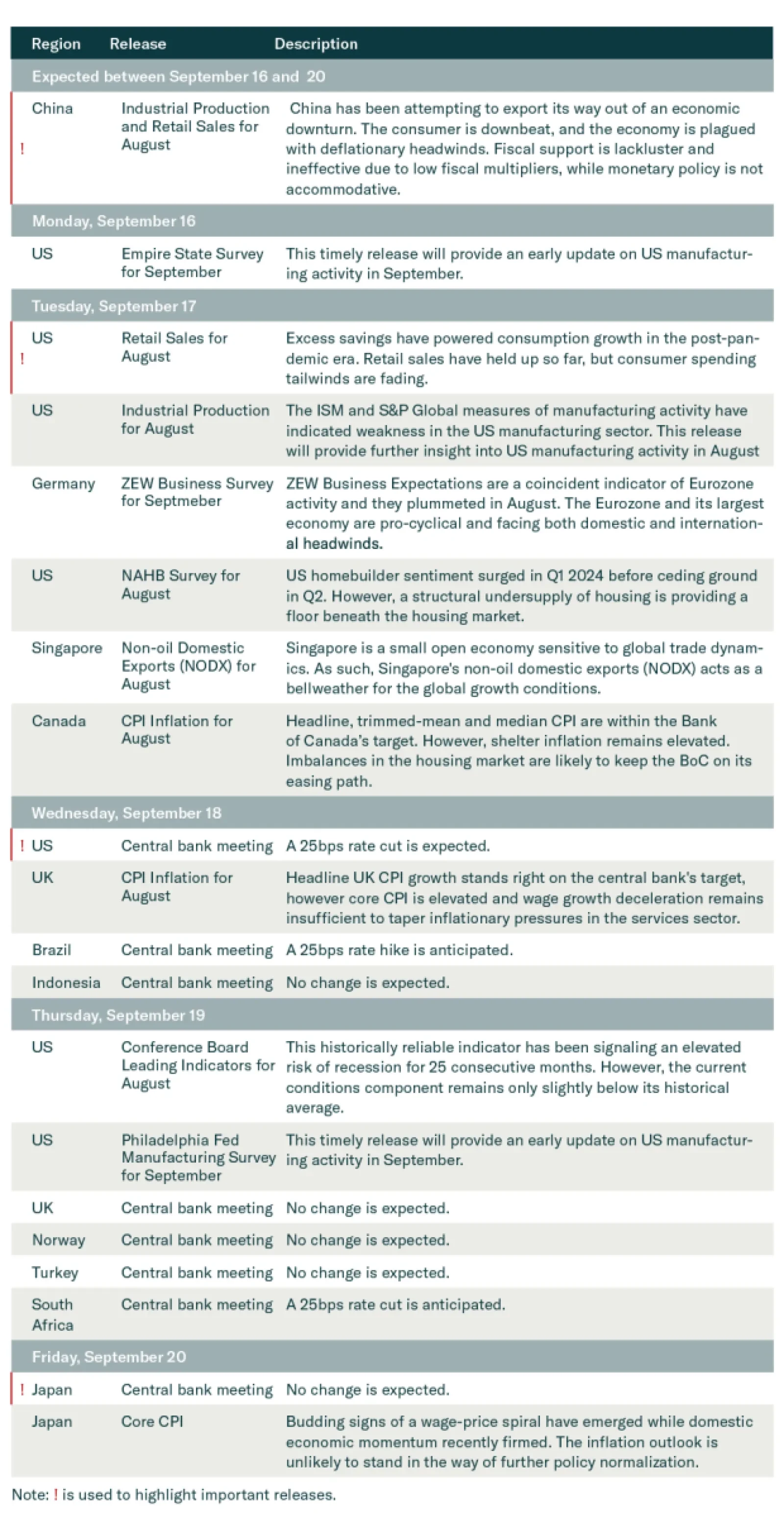

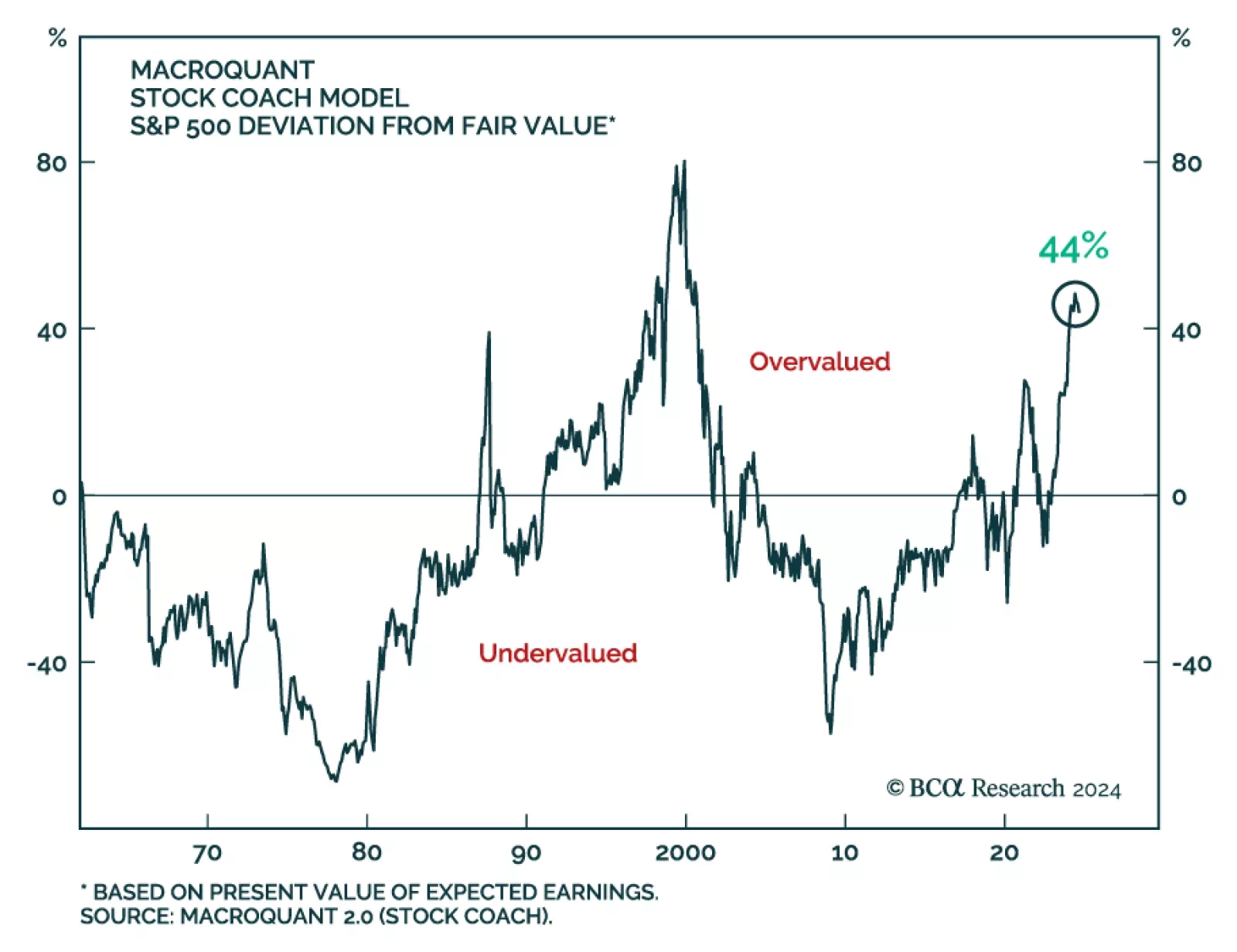

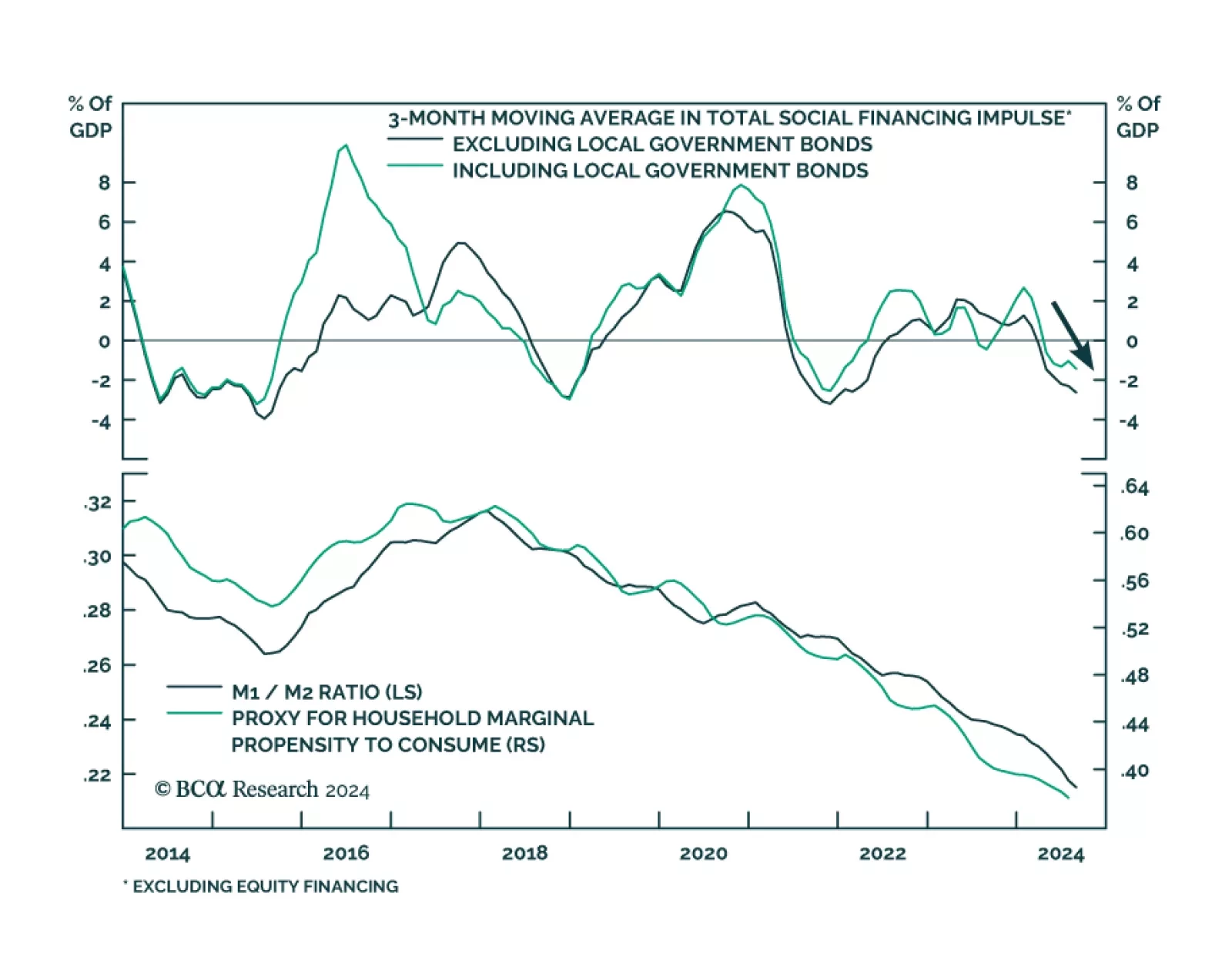

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

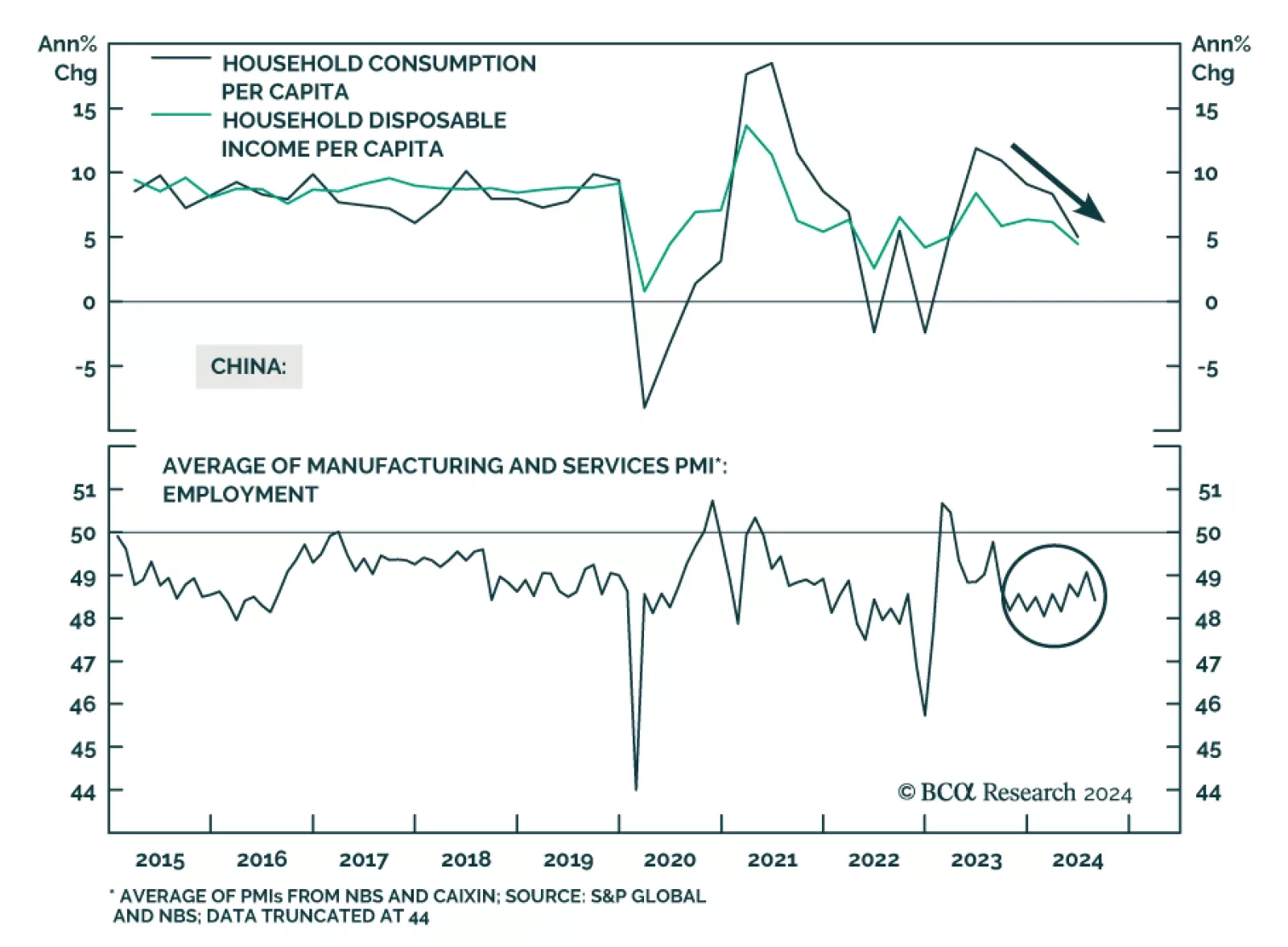

The timeliest of the regional Fed manufacturing surveys sent a positive signal about the state of US manufacturing activity in September. The Empire State manufacturing general business conditions index surprised positively.…

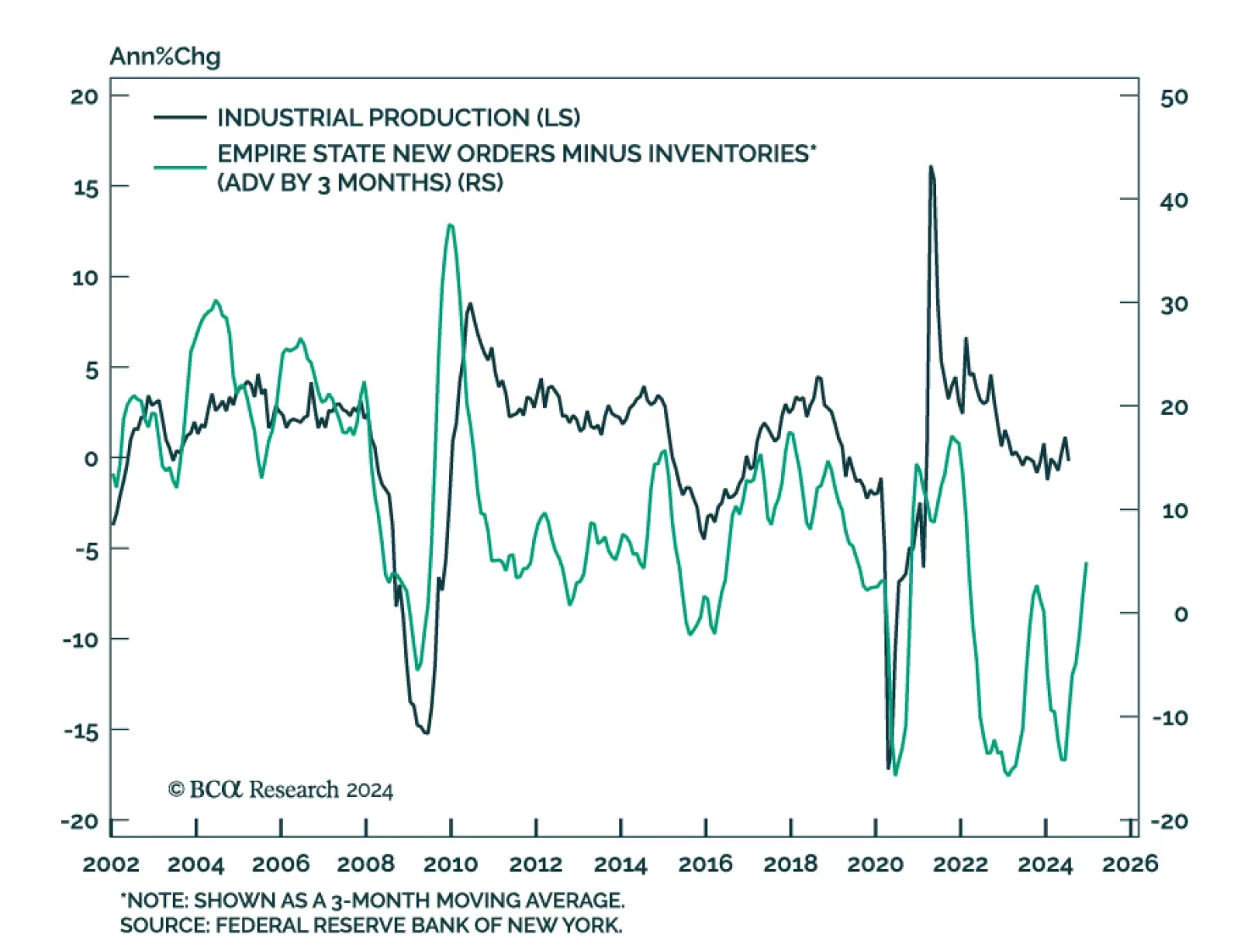

According to BCA Research’s Global Investment Strategy service, the imbalances in the US economy are sizeable enough to generate a mild recession. Unfortunately for equity investors, a mild recession would not preclude a…

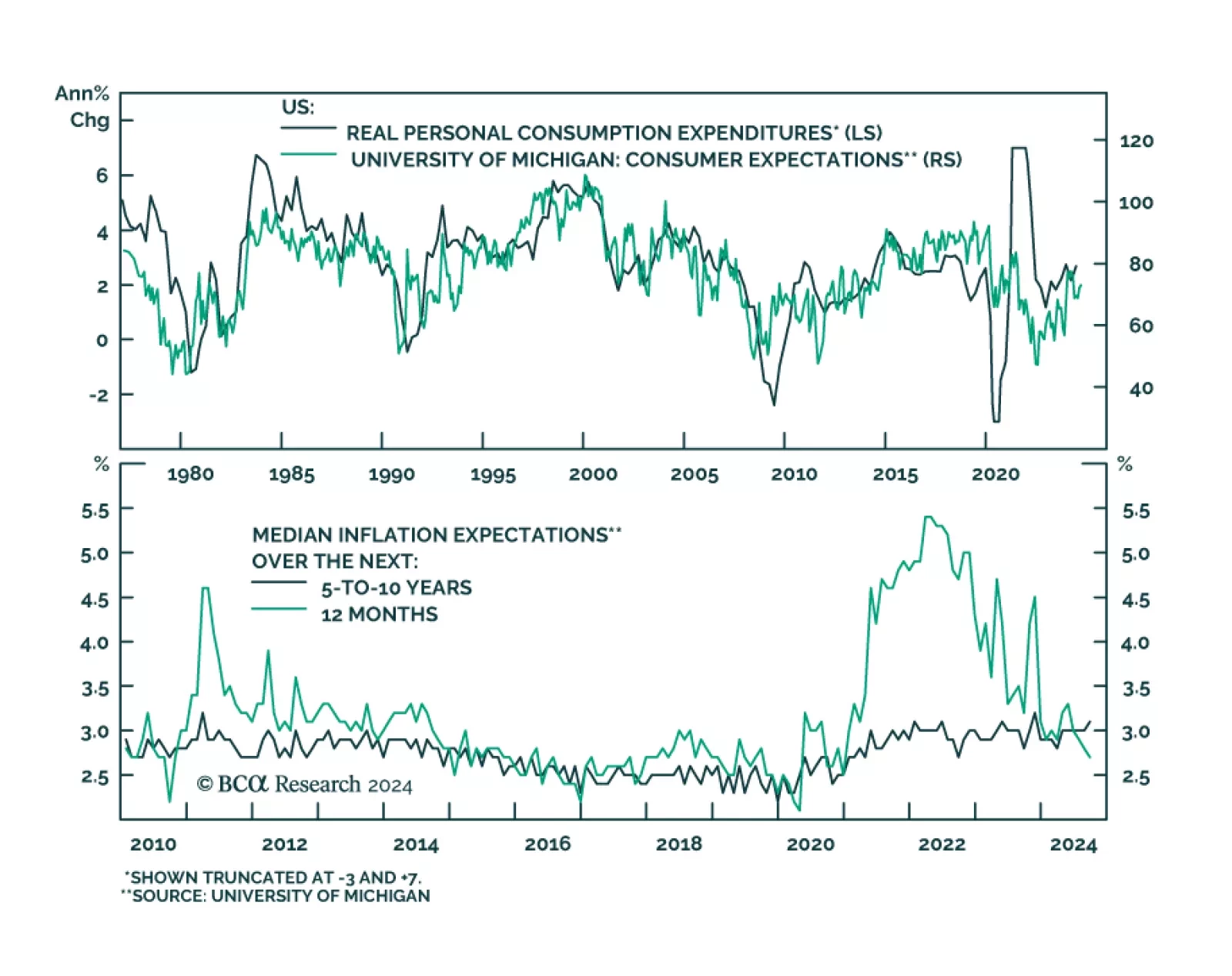

Preliminary estimates suggest that consumer sentiment improved in September. The headline University of Michigan consumer sentiment index increased from 67.9 to a higher-than-projected 68.5. Both the current conditions and…

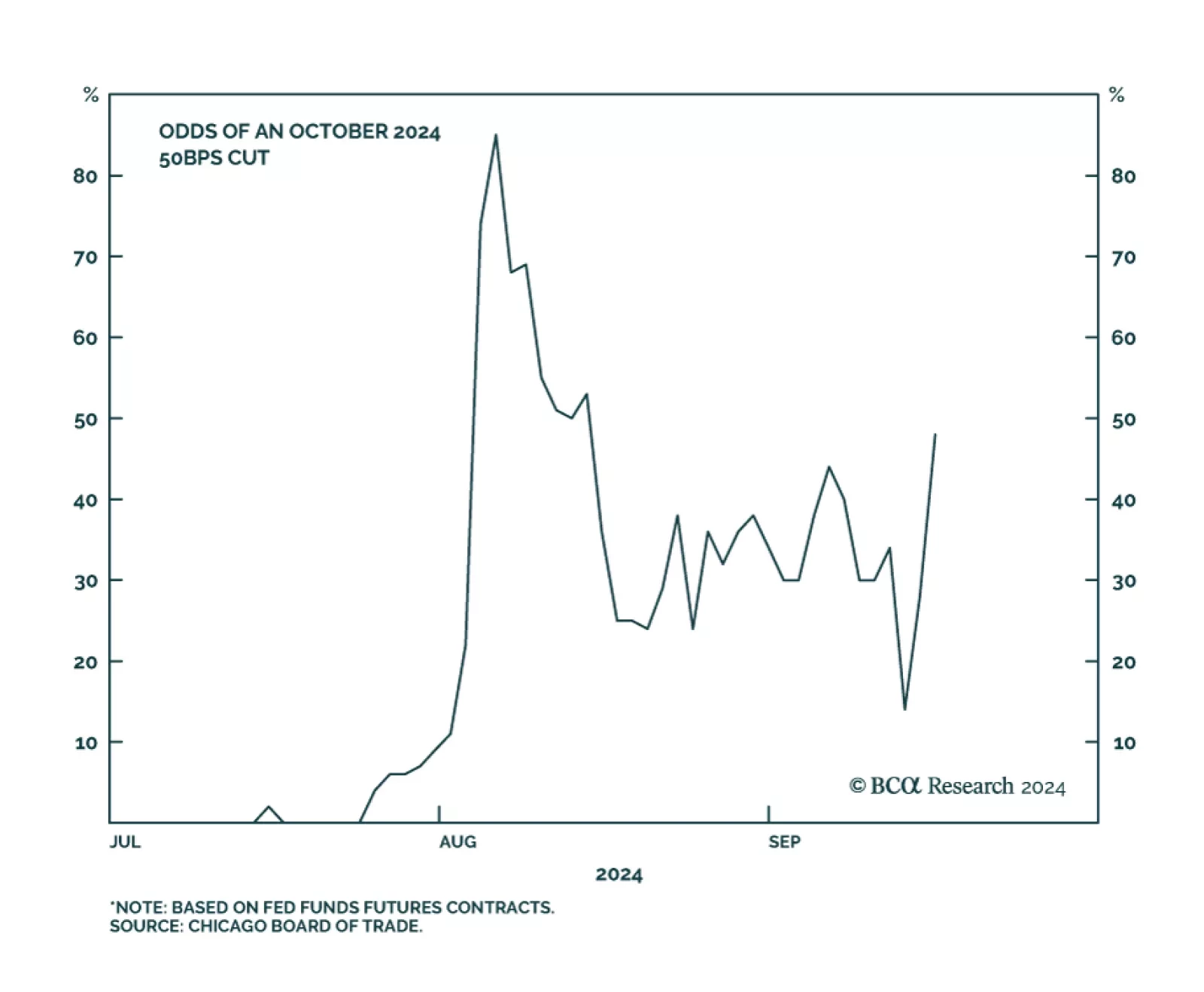

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…

Subdued demand for credit among Chinese private-sector businesses and households persisted through August. Outstanding loan growth decelerated from 8.7% y/y to 8.5%. Moreover, M1’s contraction deepened, from 6.6% to 7.…

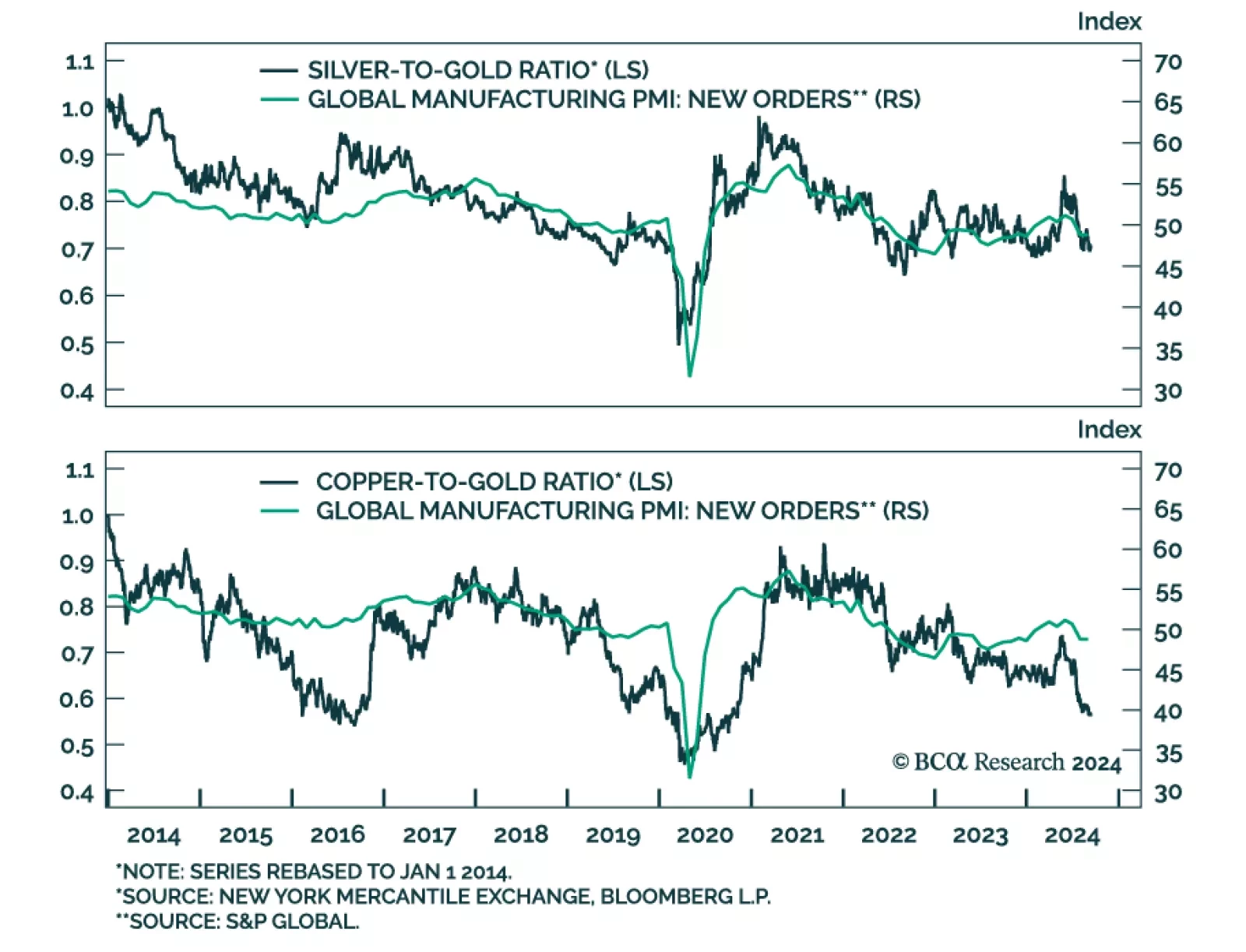

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

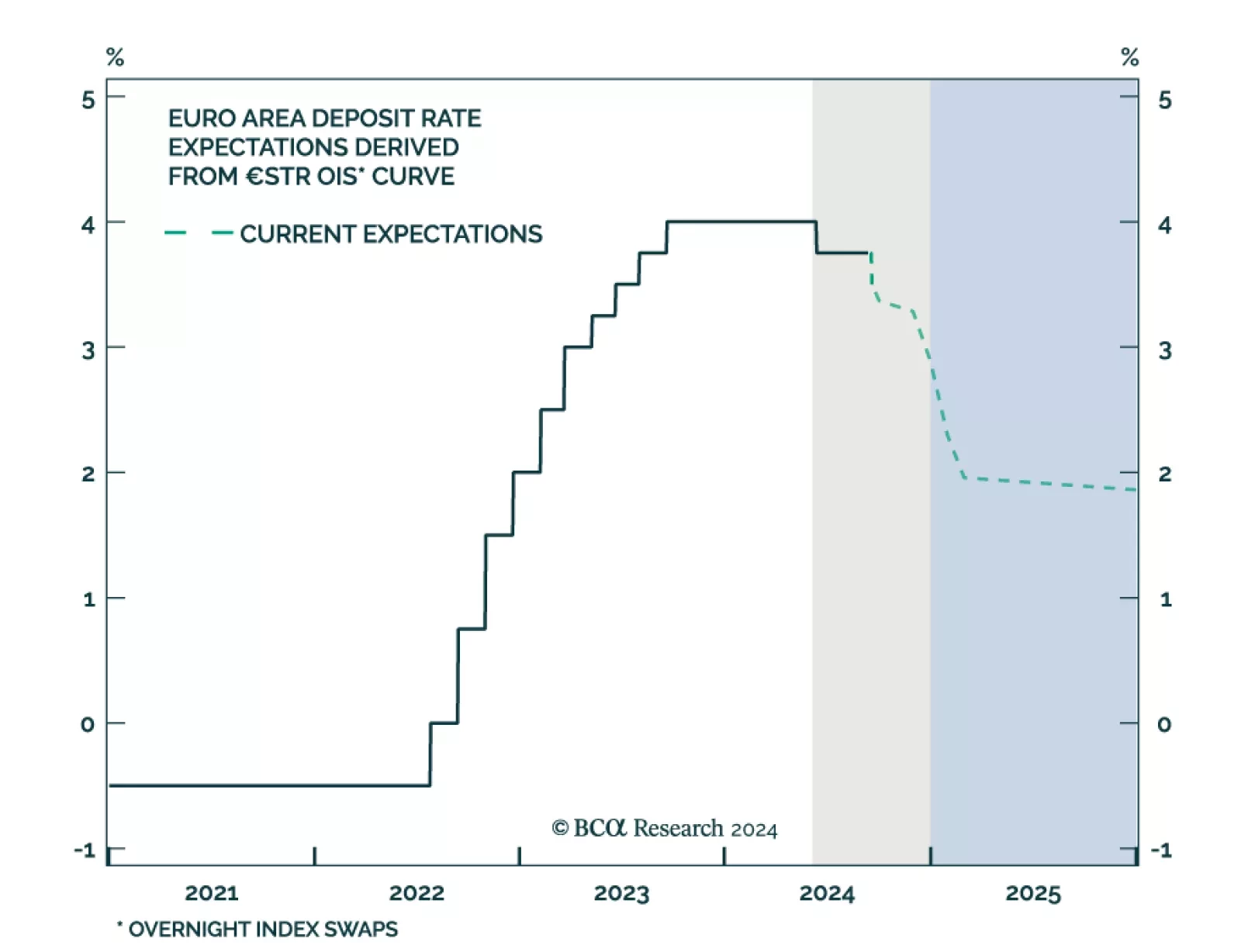

ECB Governing Council members unanimously voted in favor of lowering the deposit facility rate by 25 bps to 3.50% in September, marking the second cut this year. Moreover, expectations for weaker domestic demand led the ECB to…

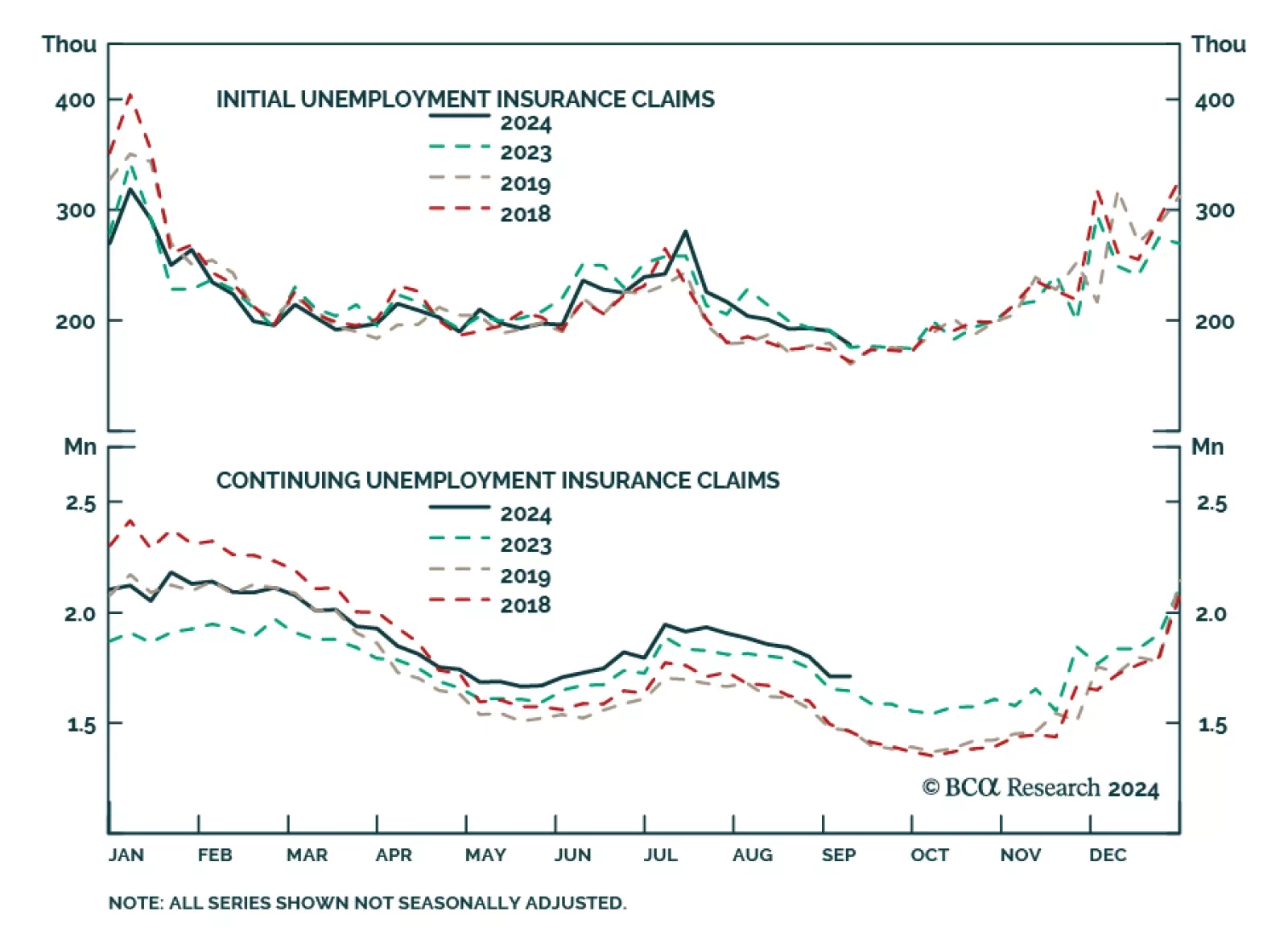

Continued deterioration in labor demand underpins our expectation for a US recession, as it will lead to slower compensation growth, hobbling consumption spending’s main driver. We also previously highlighted that the…