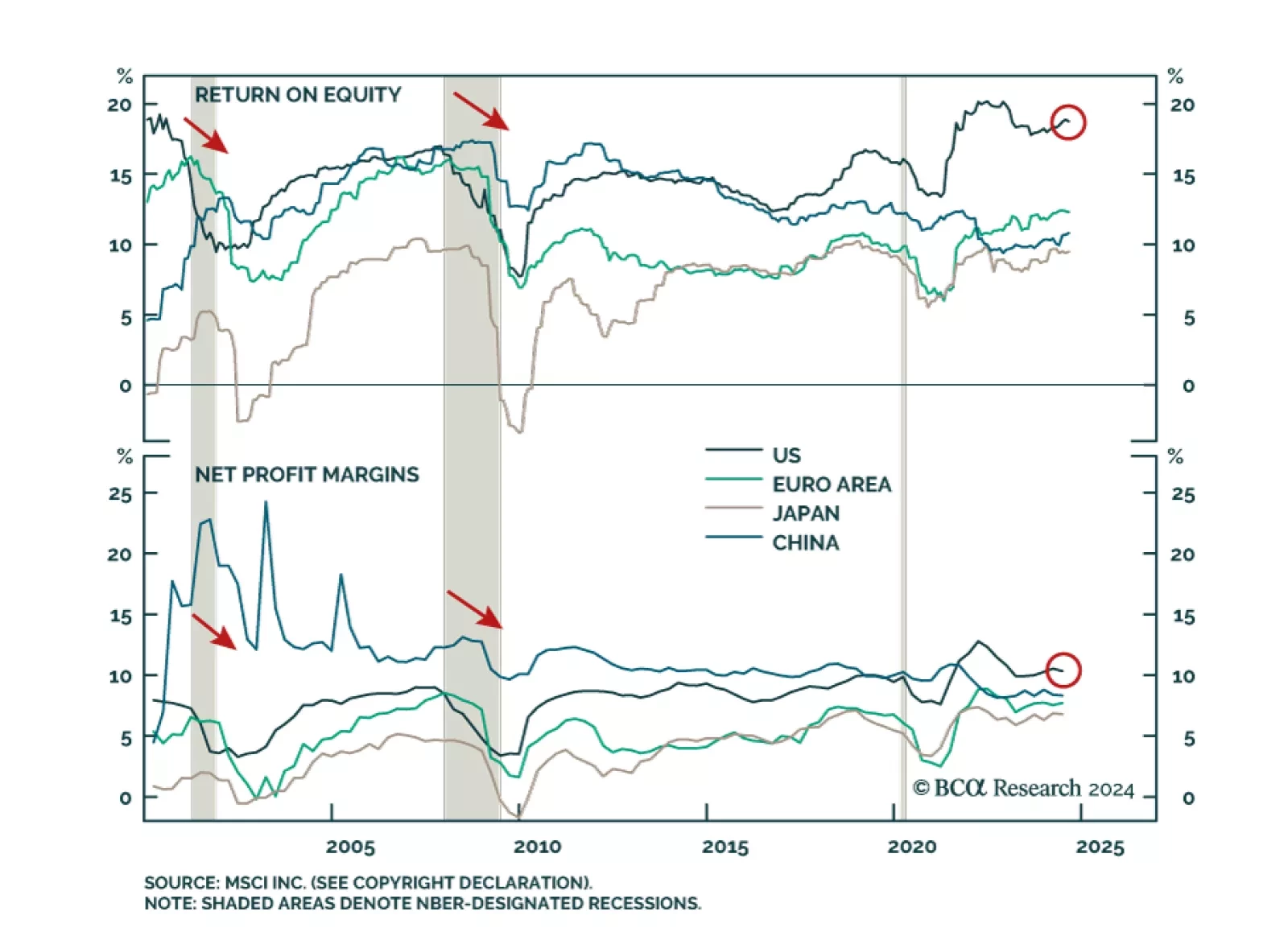

Despite the recent correction, US equity leadership remains intact. The MSCI US index has outperformed global markets by 3.8% in 2024YTD. A 7.8% expansion in forward earnings drove the MSCI US index’ 2024YTD gains which was…

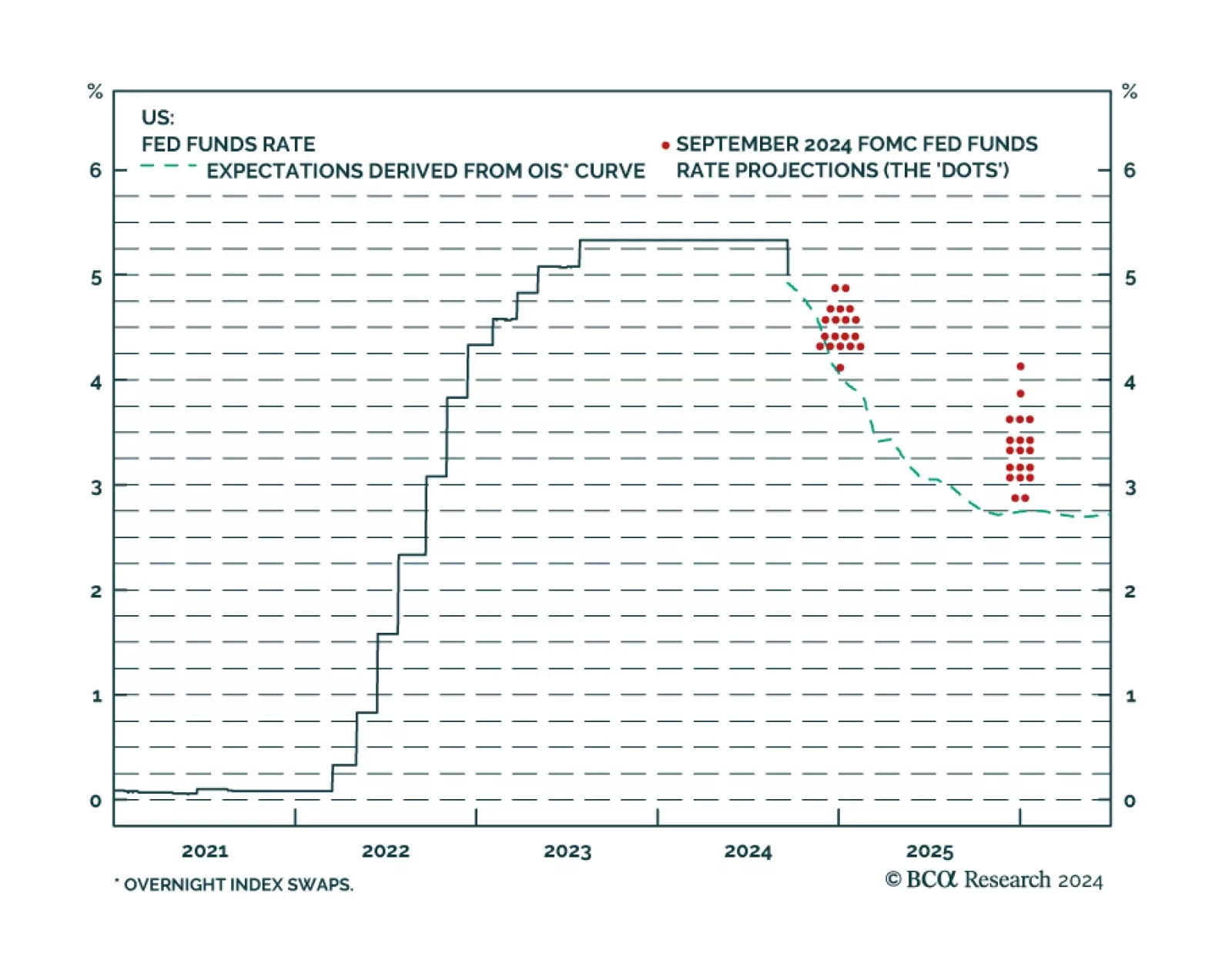

The Fed started its easing cycle with a bang, cutting the policy rate by 50 basis points in September, above consensus expectations but in line with odds embedded in the futures and OIS curves. Our US Bond strategists had…

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

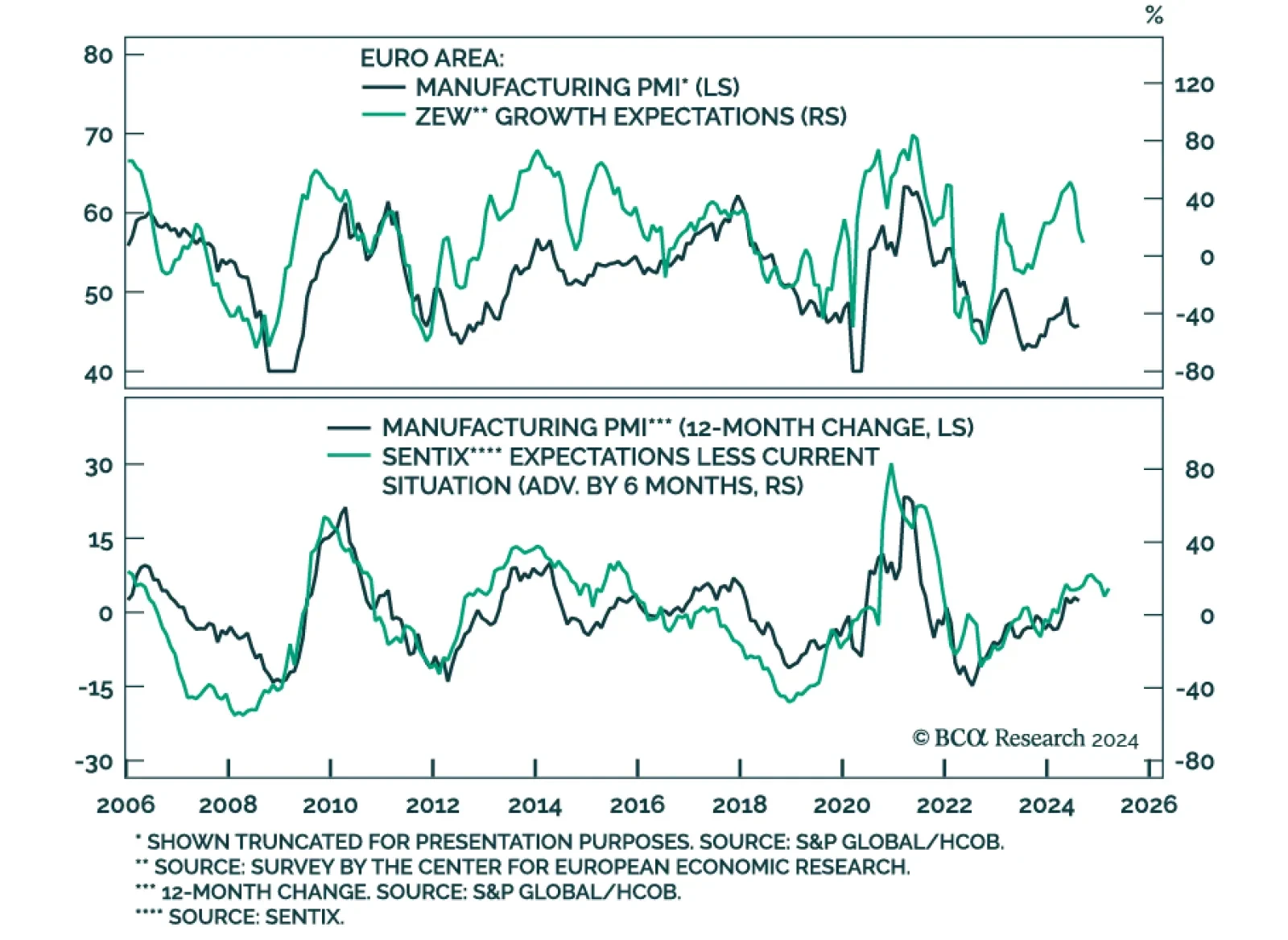

The ZEW survey of both German business expectations and current situation largely disappointed in September, decreasing by 15.6 points to 3.6 and by 7.2 points to -84.5, respectively. The ZEW survey of expectations for…

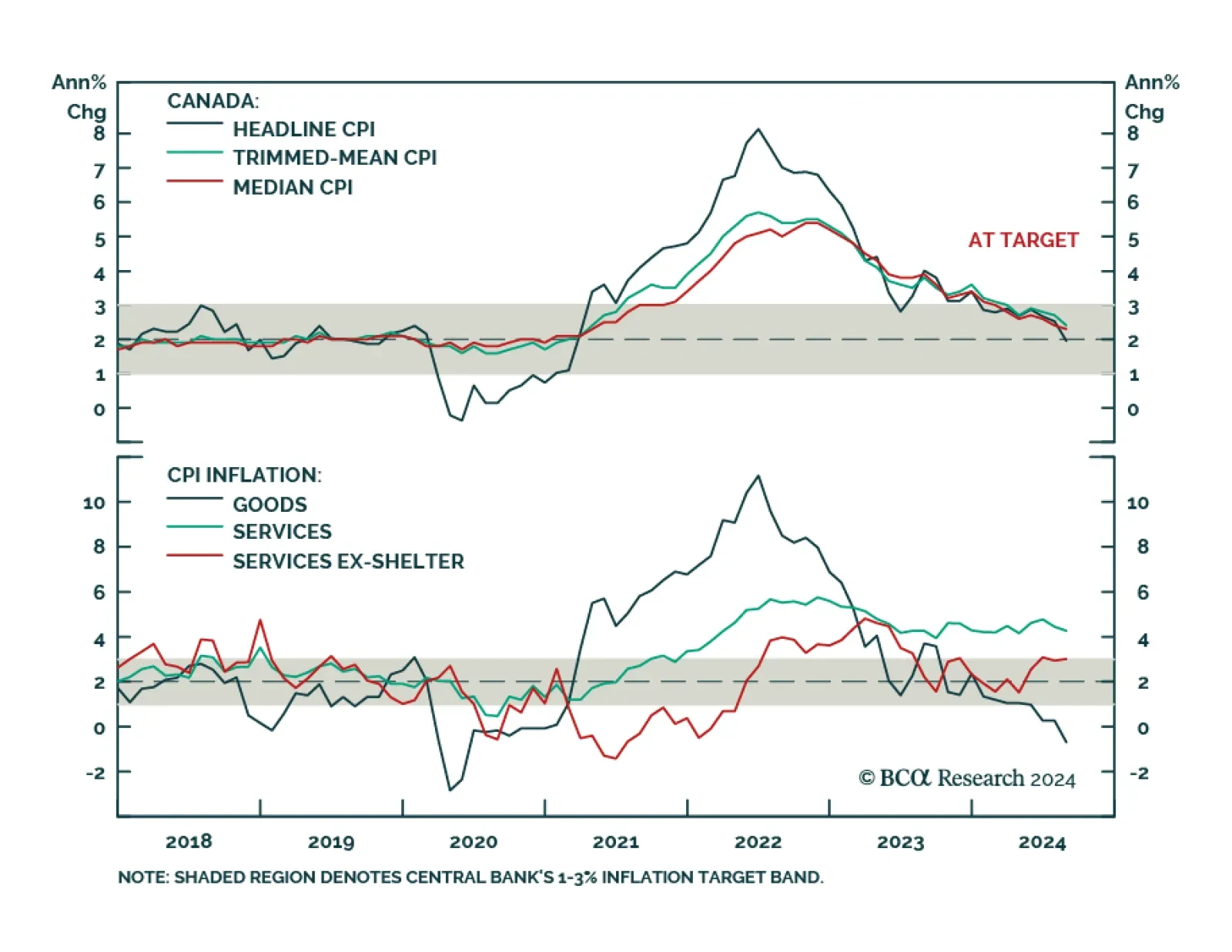

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…

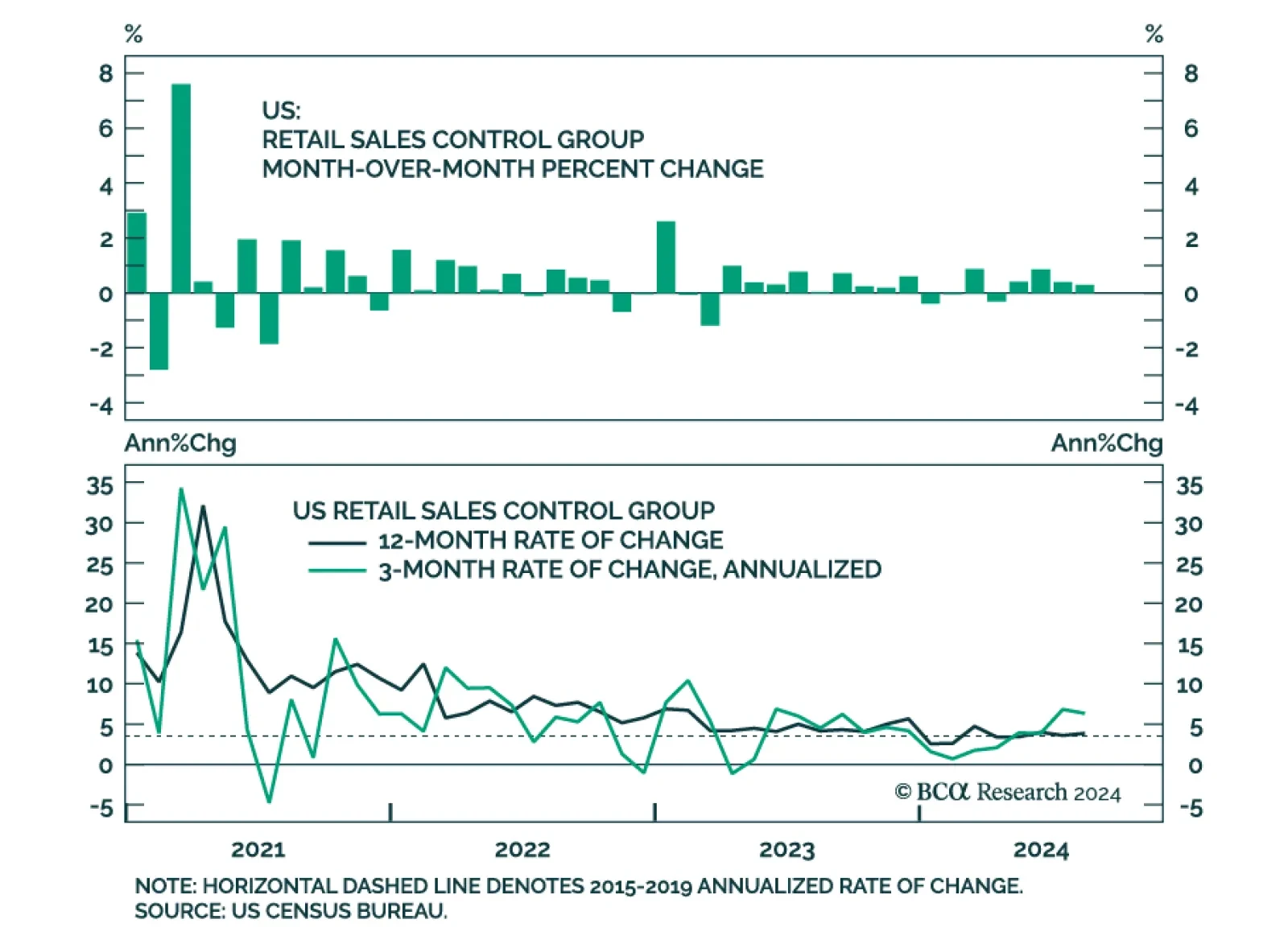

US retail sales grew 0.1% m/m in August and beat expectations of a 0.2% monthly contraction. The positive surprise seemingly spurred equity market gains on Tuesday morning. However, details do not paint as rosy a…

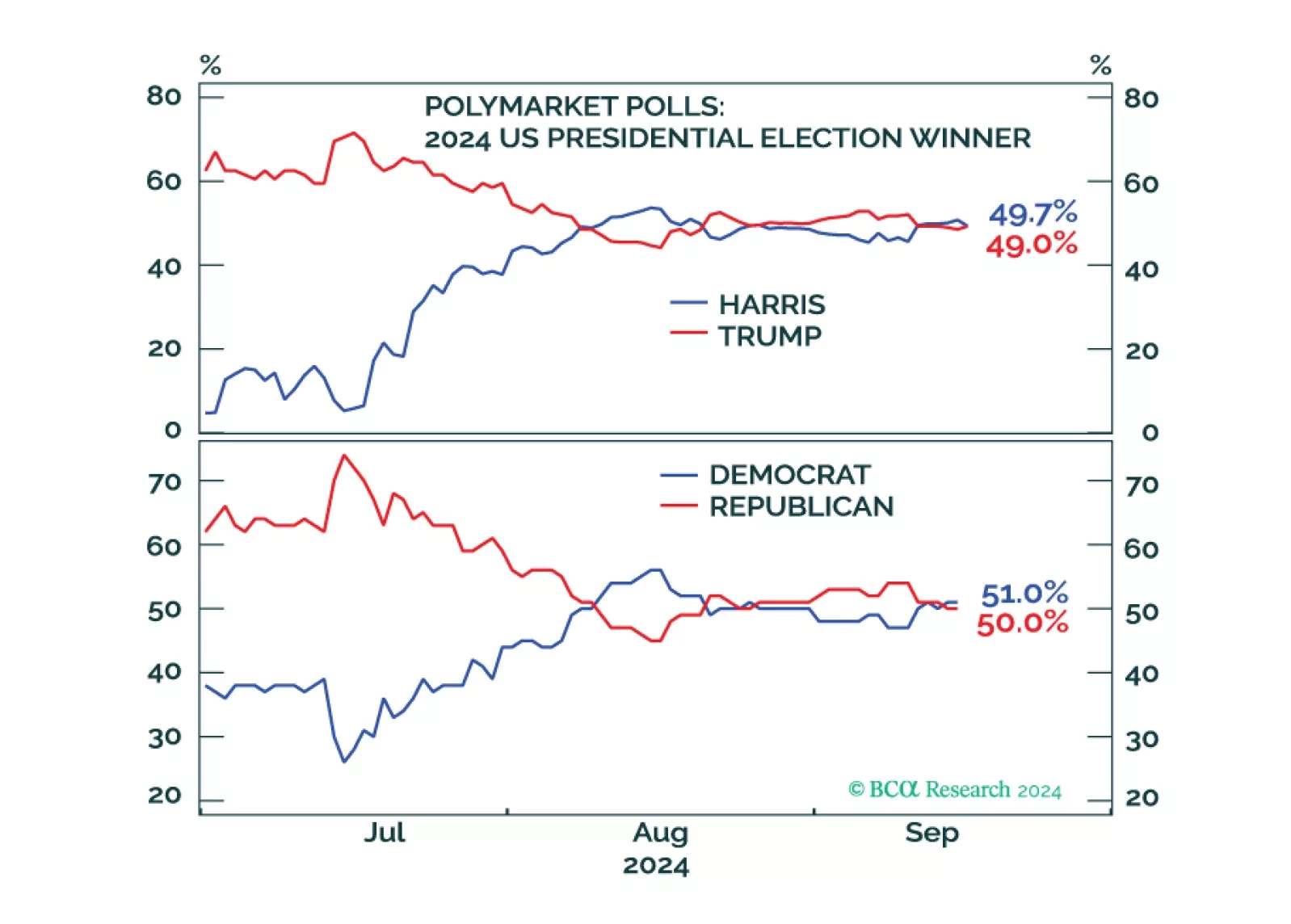

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

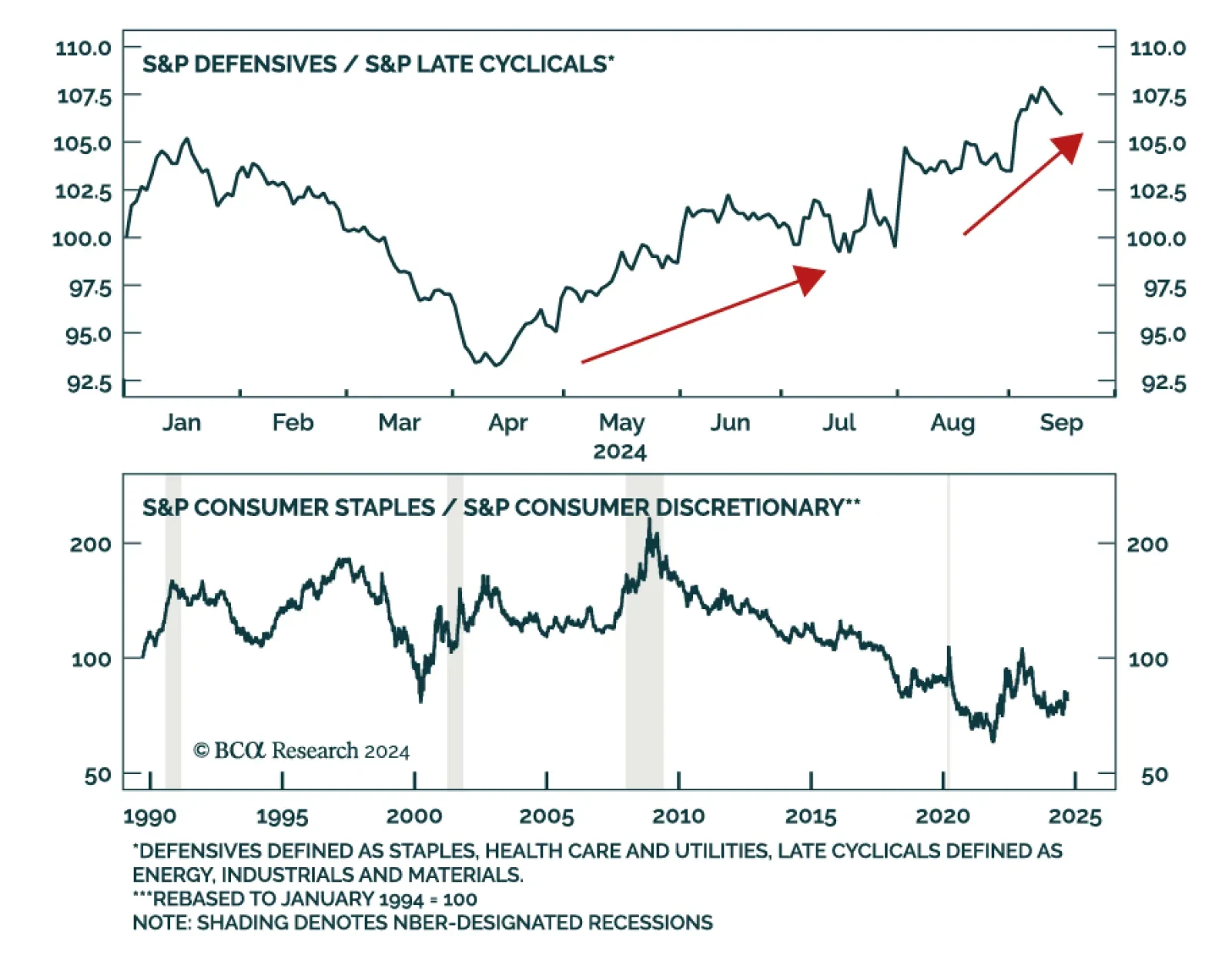

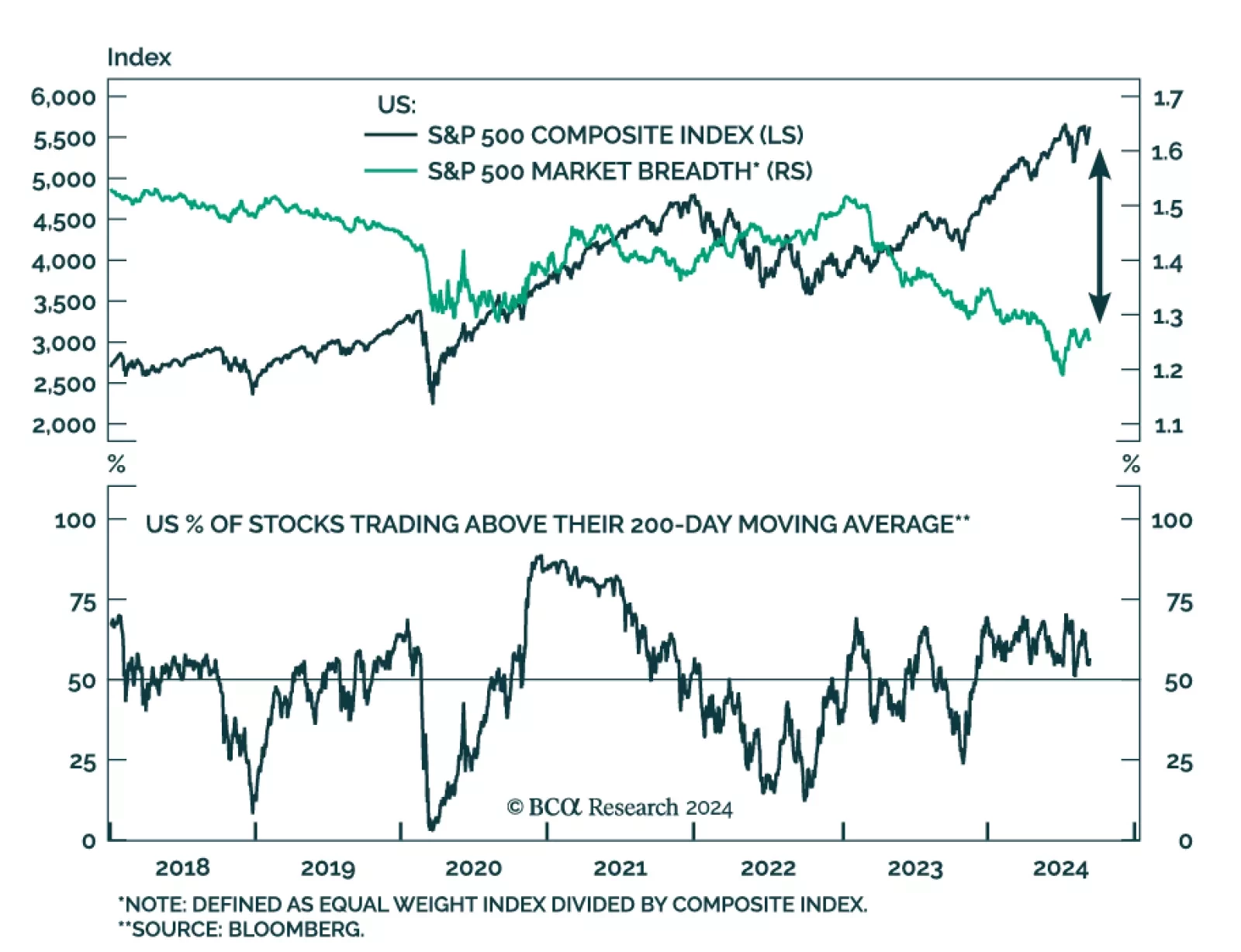

Investors are pricing in a soft landing in the US. Notably, we noted that pro-cyclical assets topped the performance ranking in August. At the same time, the S&P 500 is currently trading only 1% below its all-time highs.…

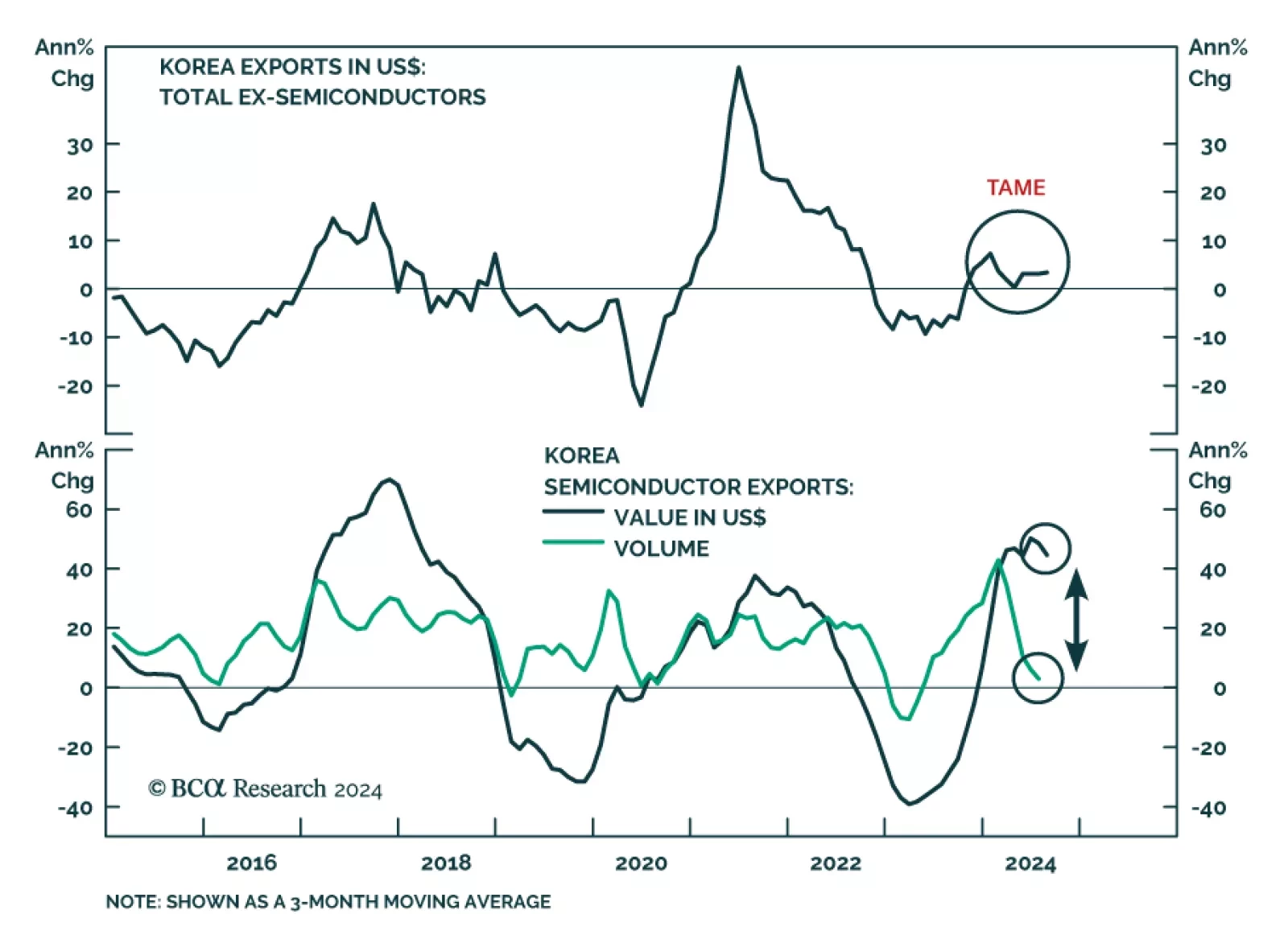

Trade data from small open economies act as a bellwether for global growth developments. In August, Korean exports expanded by 11.4% y/y in USD and 5.7% y/y in KRW terms, marking their eleventh and eighth consecutive month of…