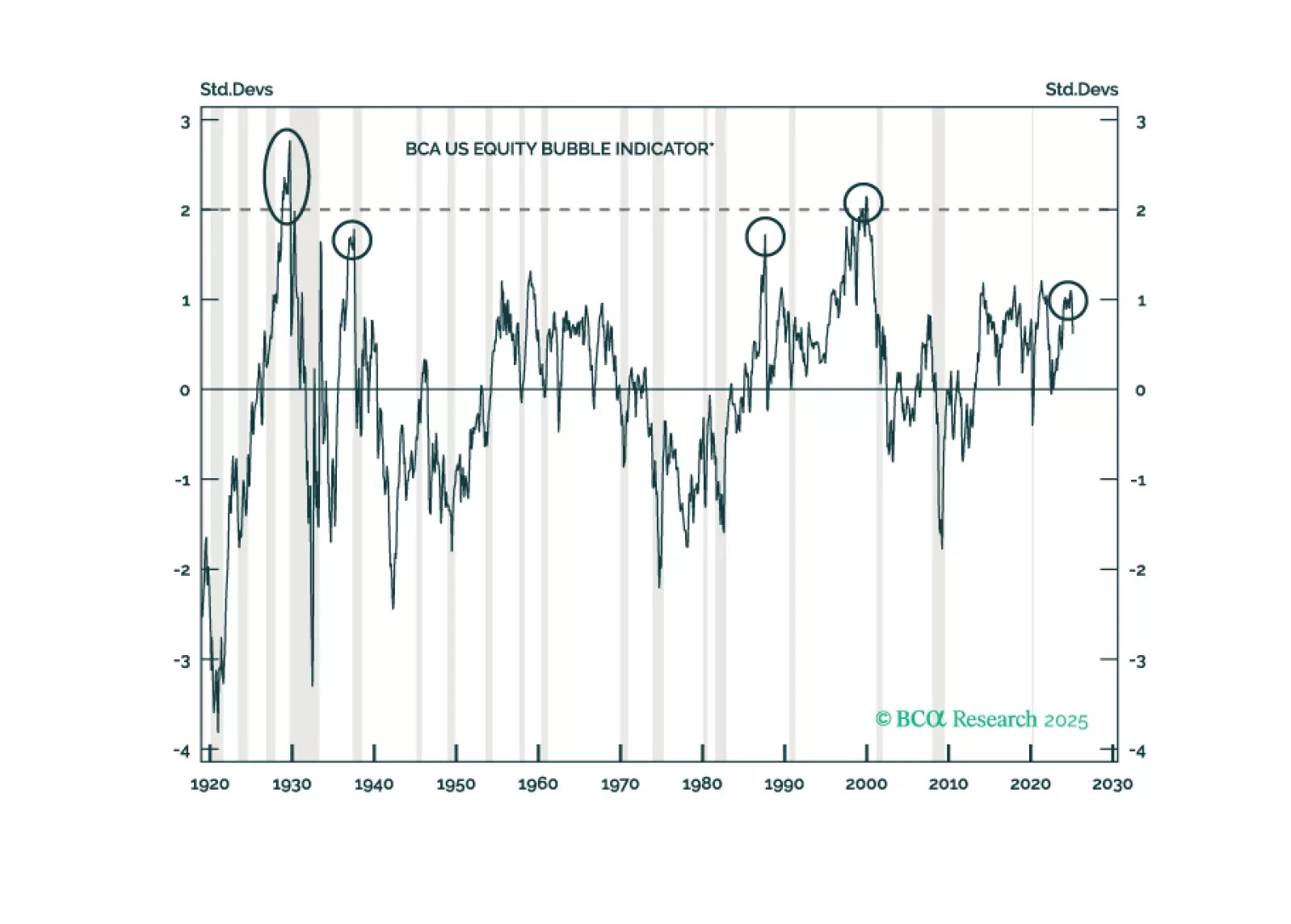

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

Are you sure you are in a trade war-induced selloff and/or recession? Or, is America – writ large – the bubble? Fed a steady dose of fiscal profligacy over the past five years, the US economy and its various associated assets have…

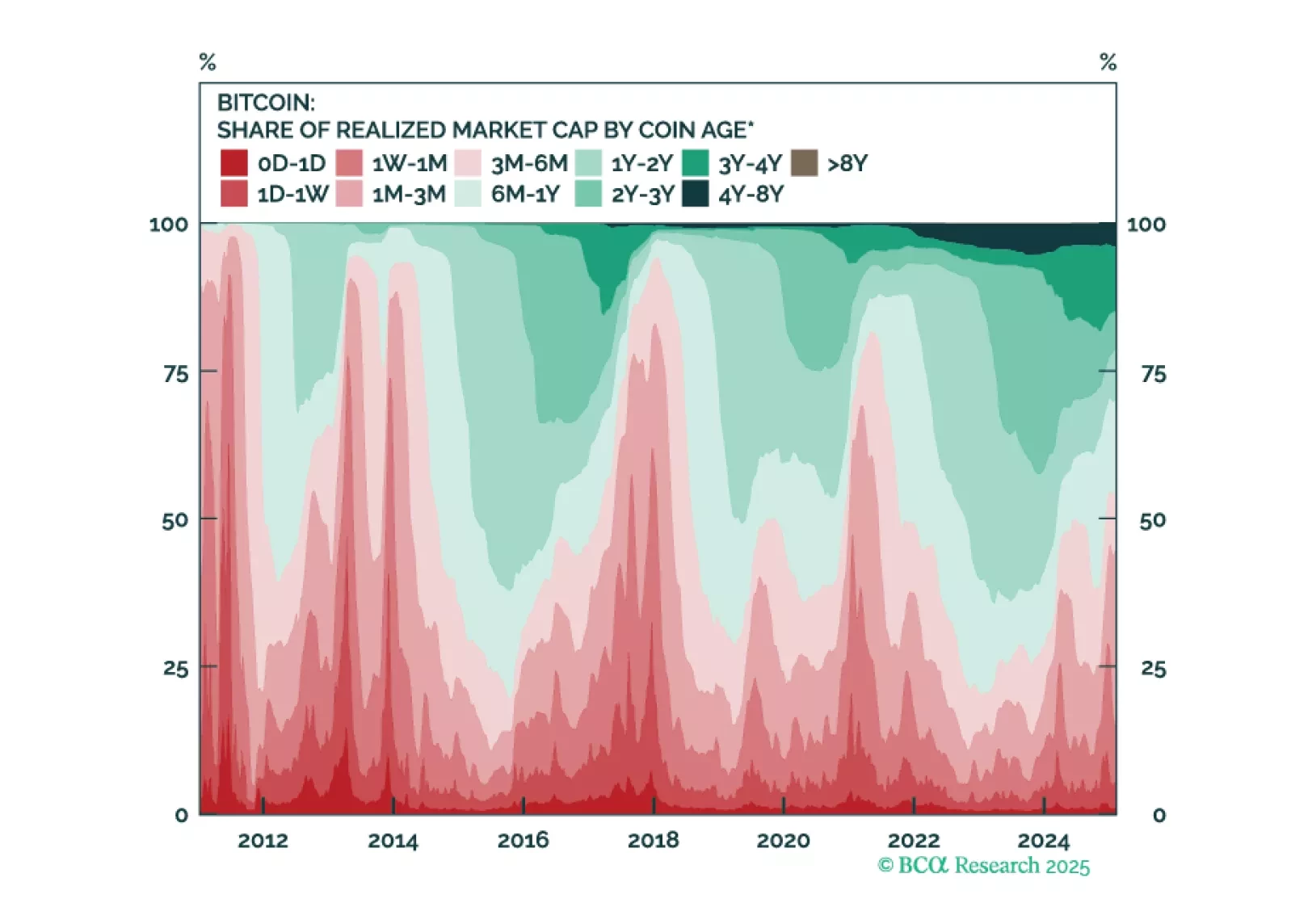

In this report, we reassess our bullish stance on crypto from early 2023, following Bitcoin’s recent all-time highs. While institutional adoption is broadening, there are also signs of excessive exuberance, speculation, and optimism…

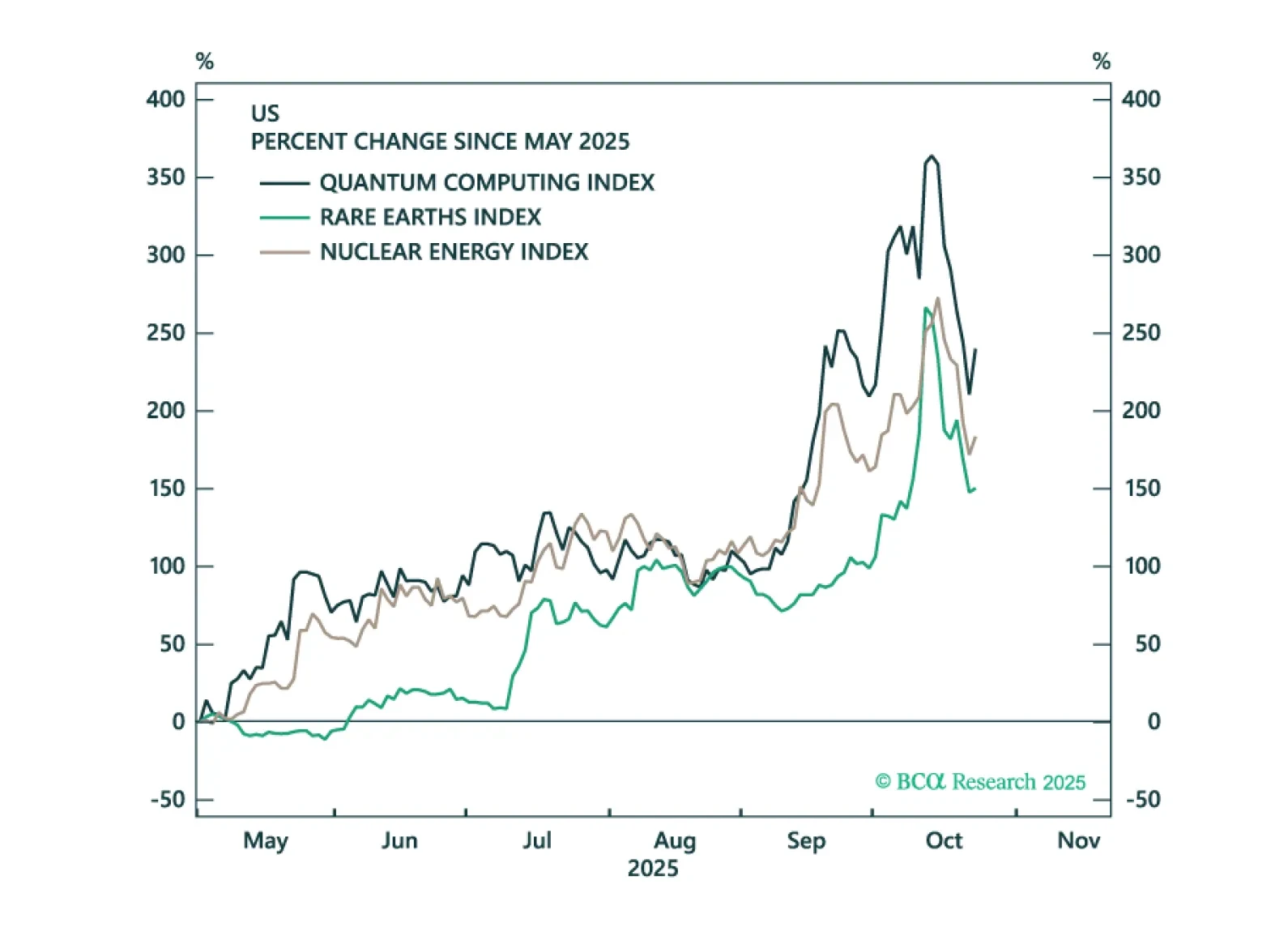

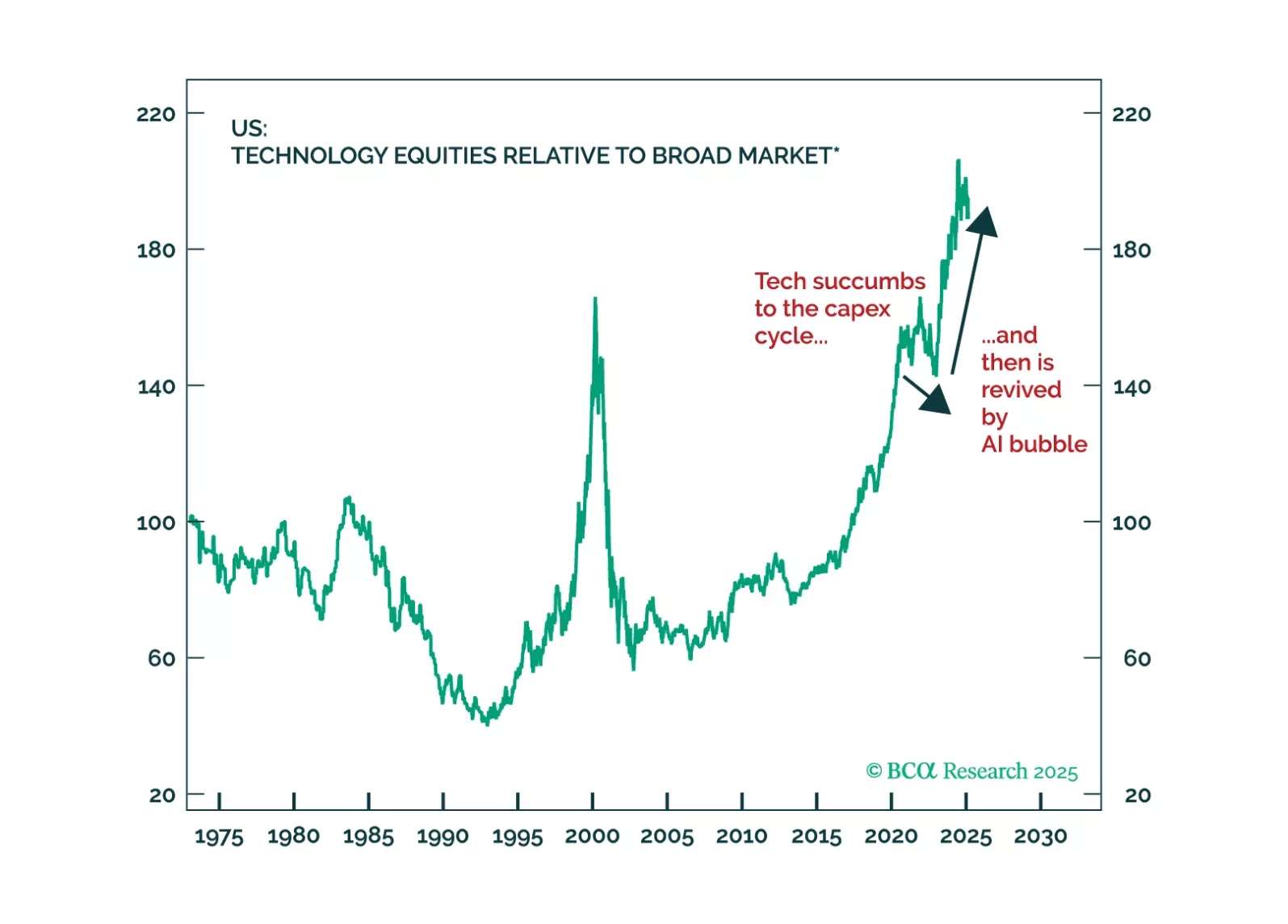

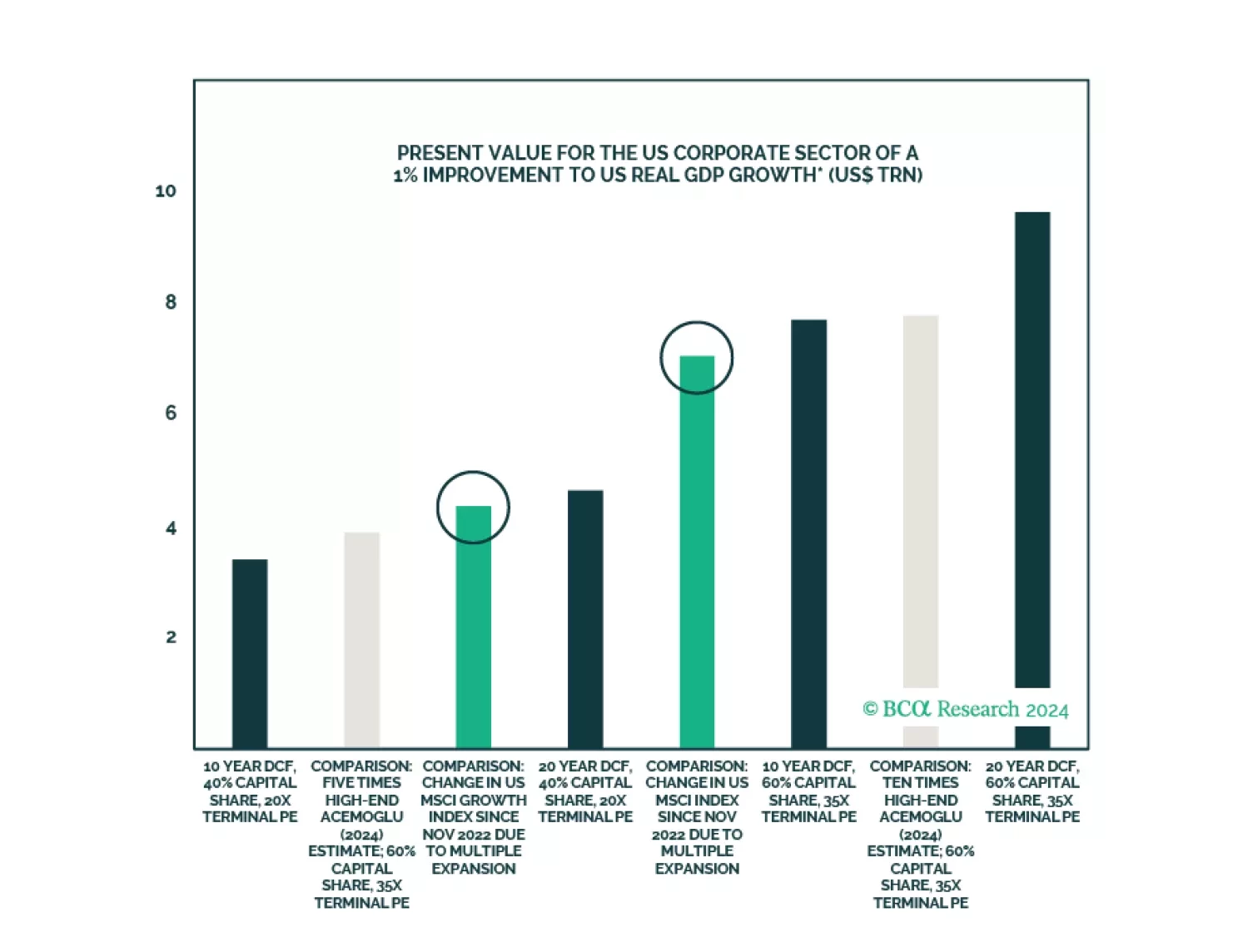

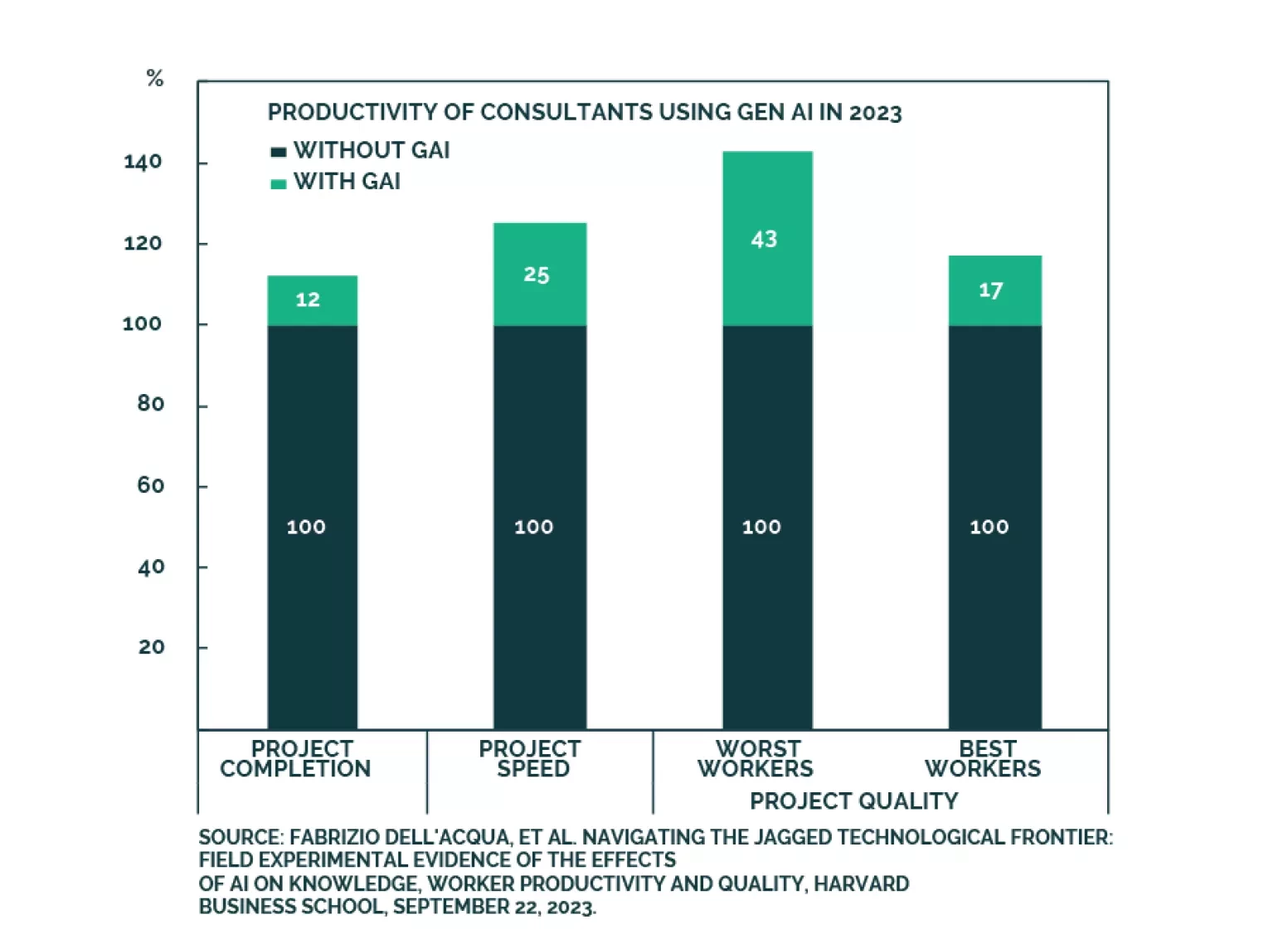

Over the past few weeks, global equities have been hit by rising scepticism over the bullish AI narrative and increasing concerns over global growth. Stocks should stabilize in the near term, but the medium-term direction is to the…

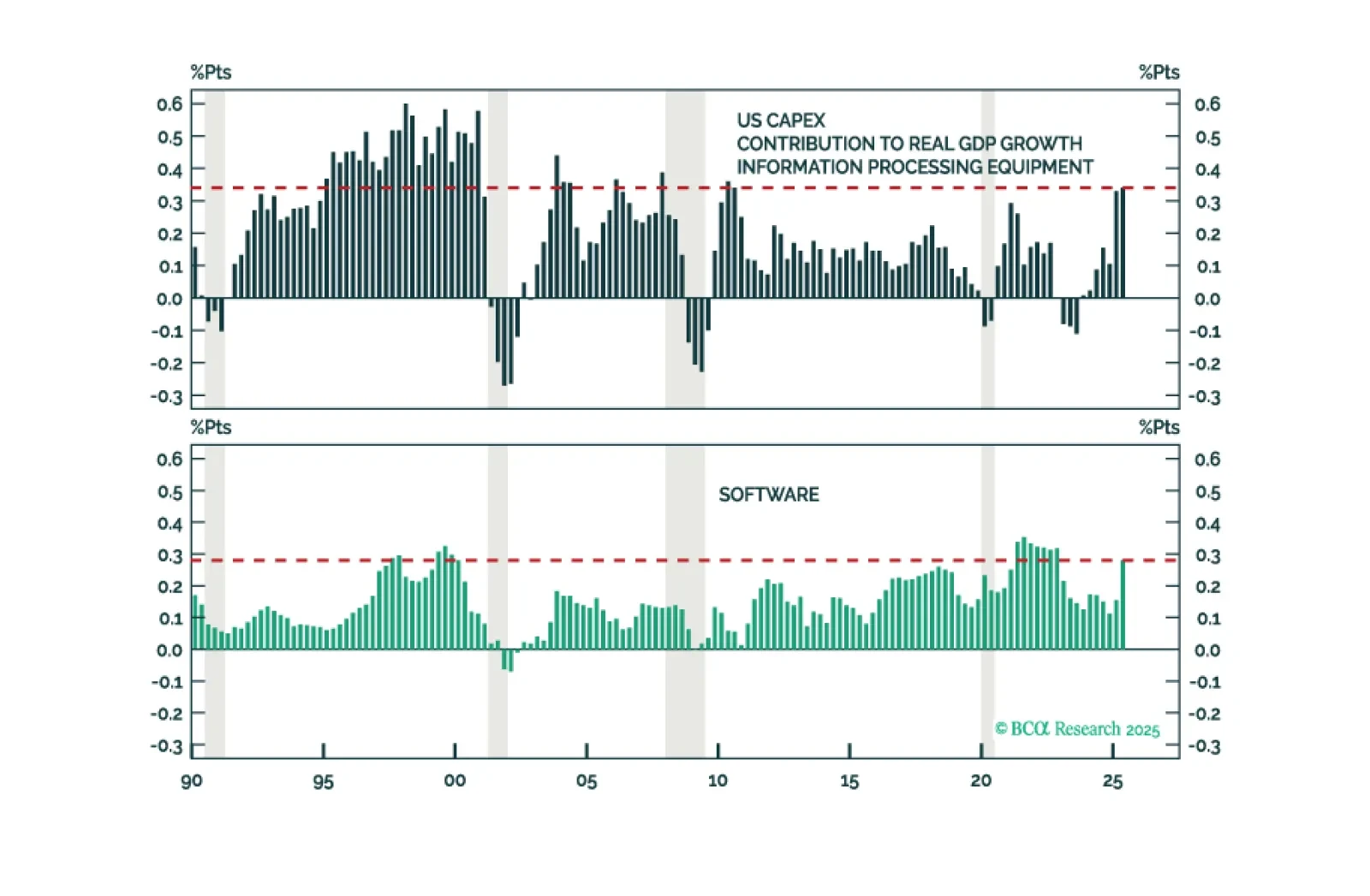

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

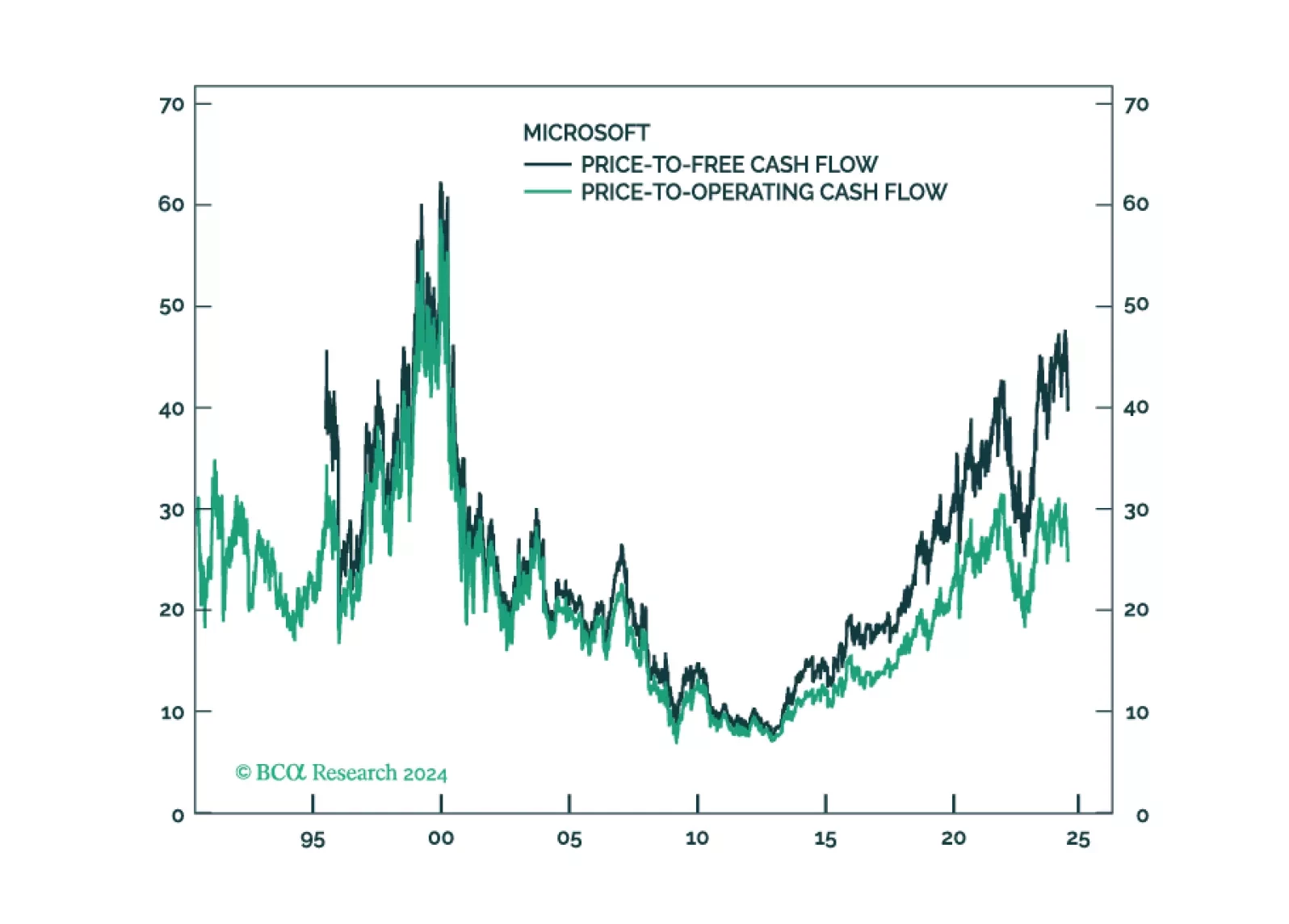

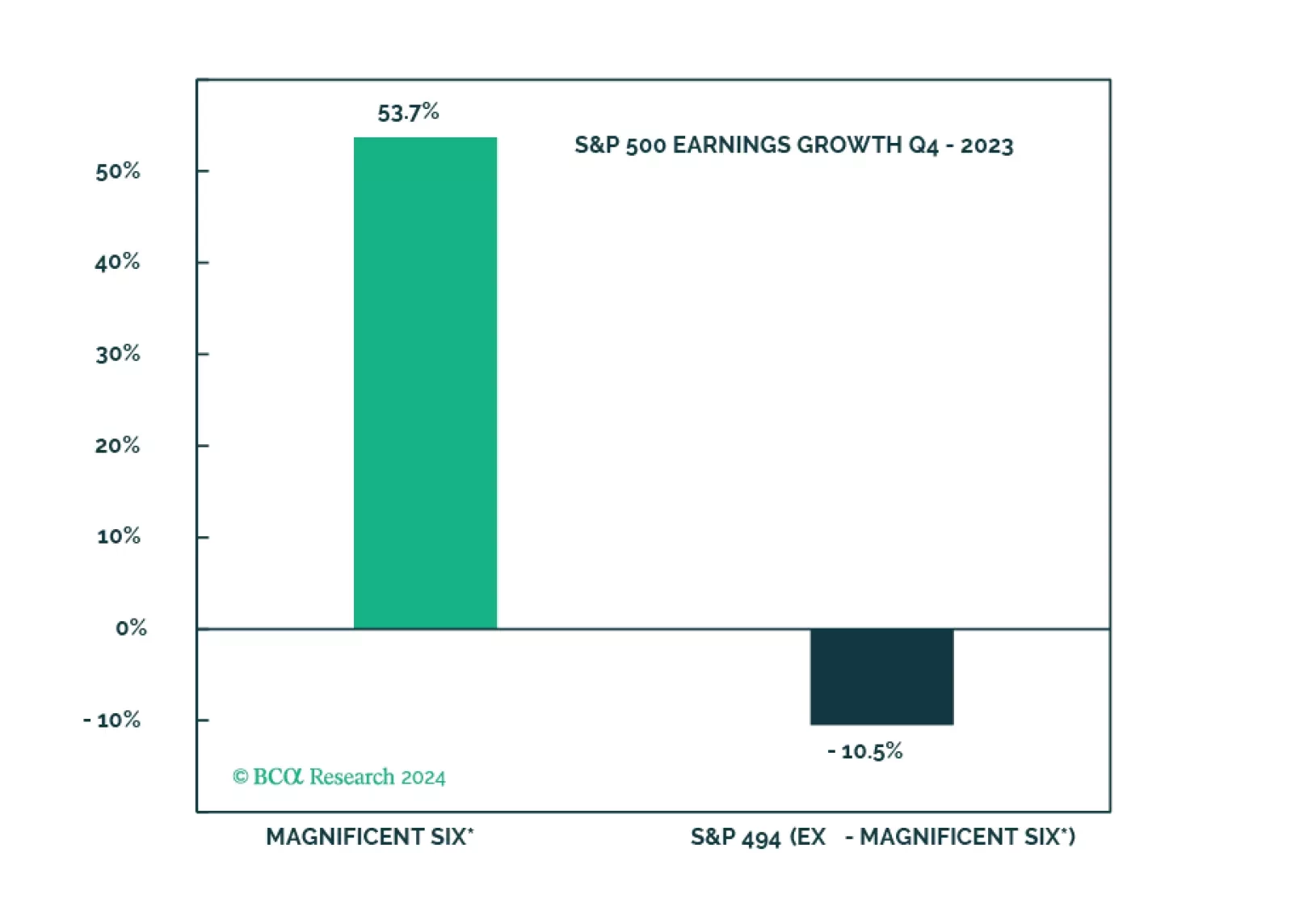

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…