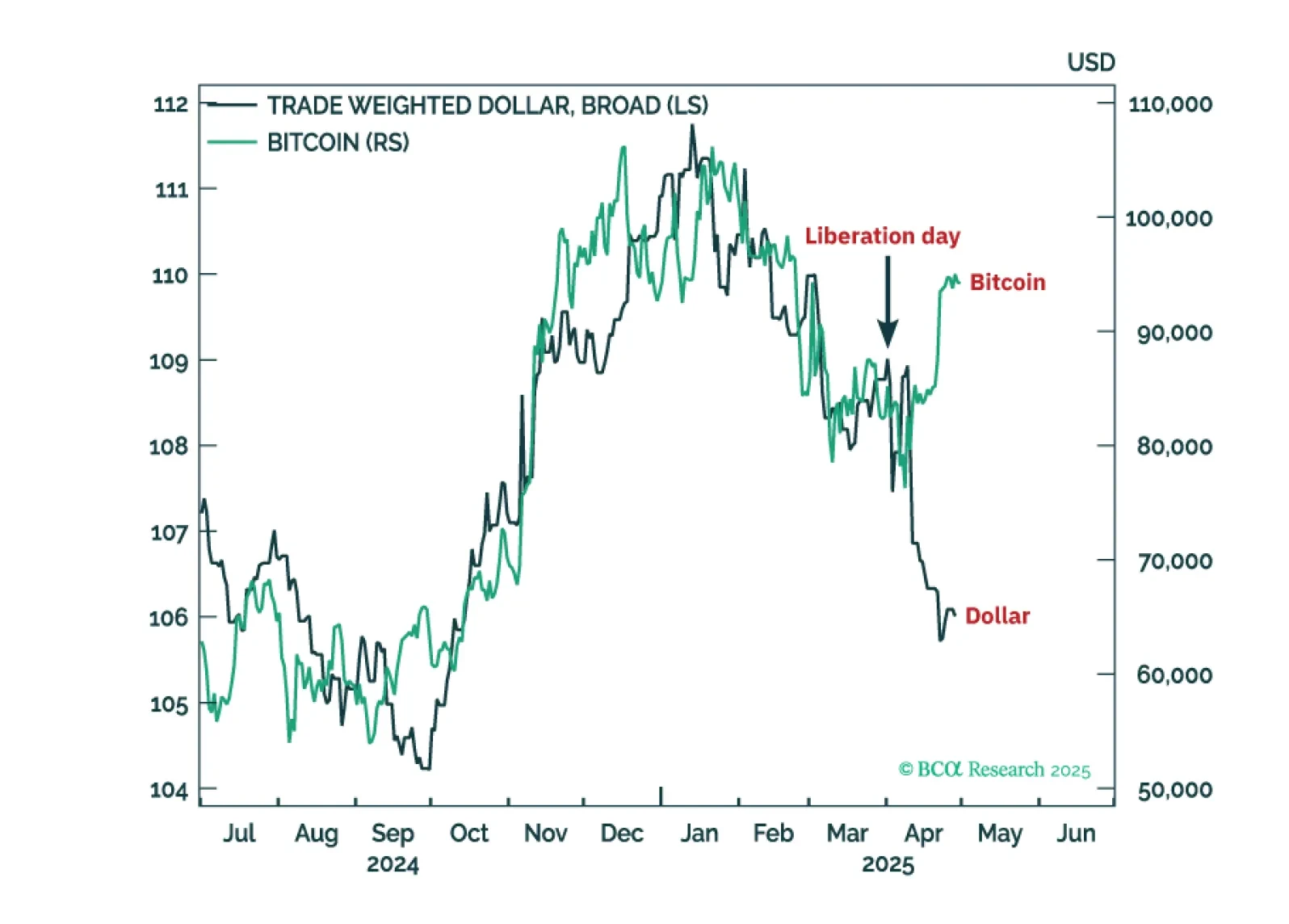

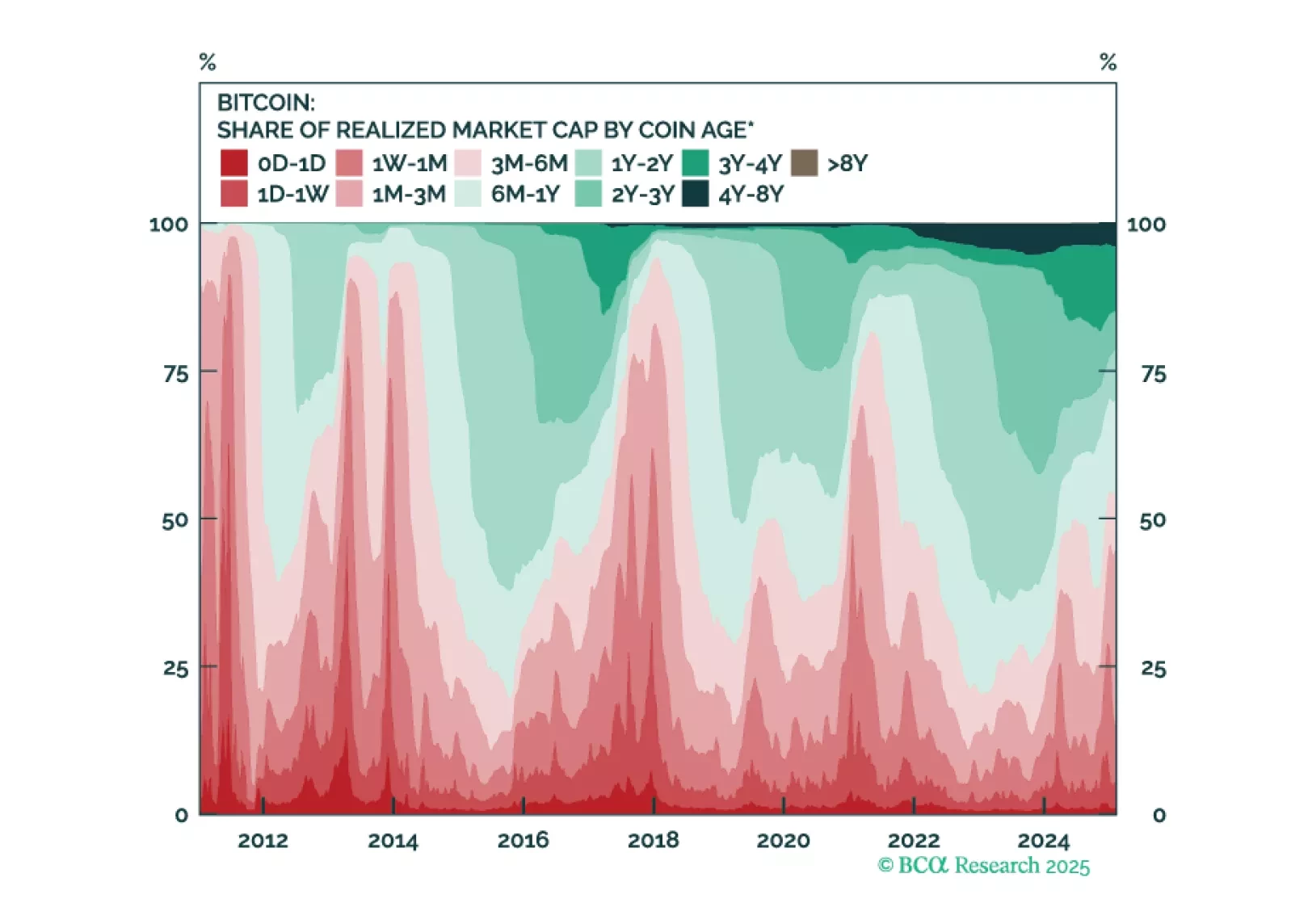

Bitcoin’s recent volatility masks a deeper story – the widest disconnect from traditional macro drivers since 2022. With sentiment now deeply negative and institutional demand still building, the conditions for a realignment with…

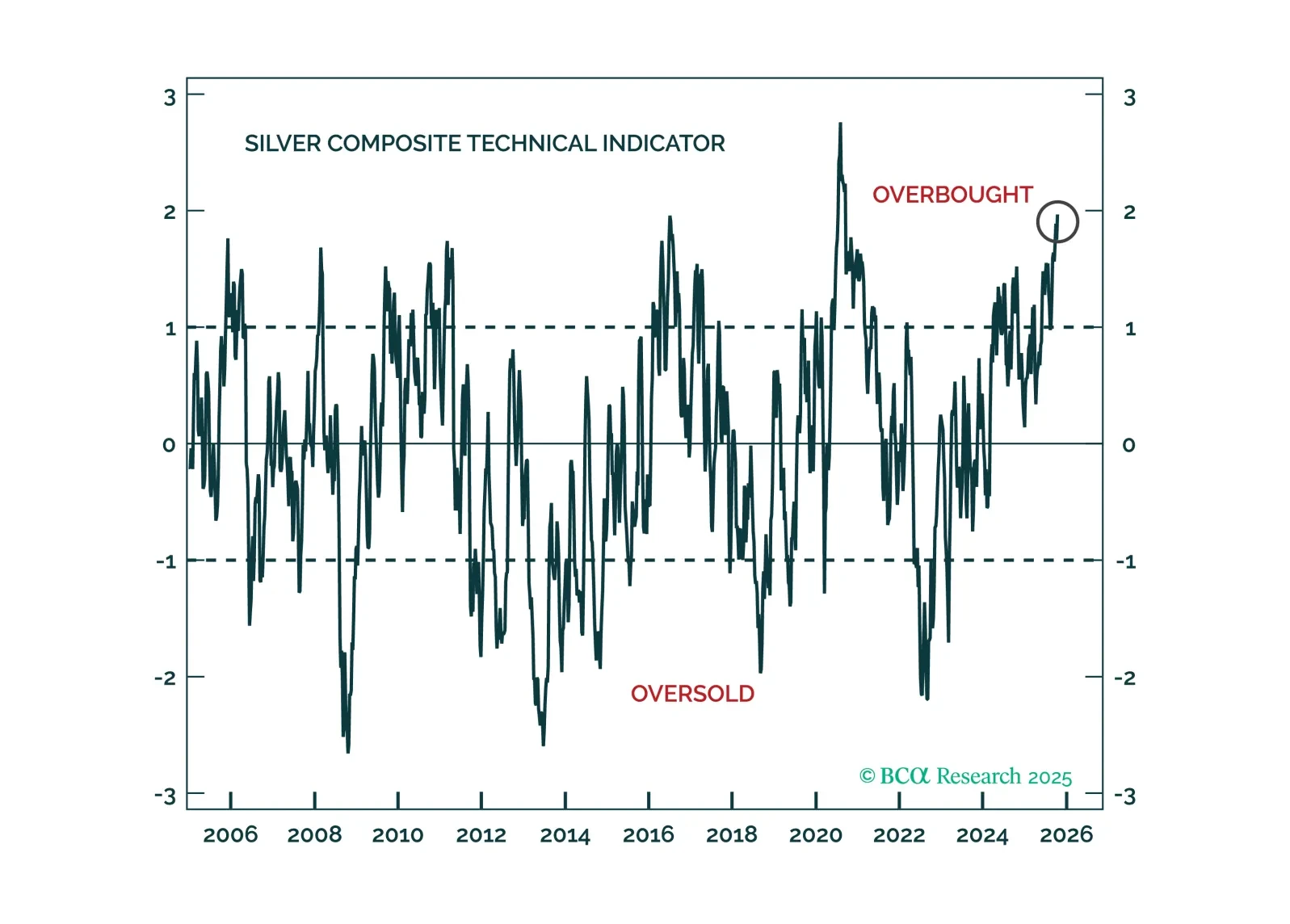

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

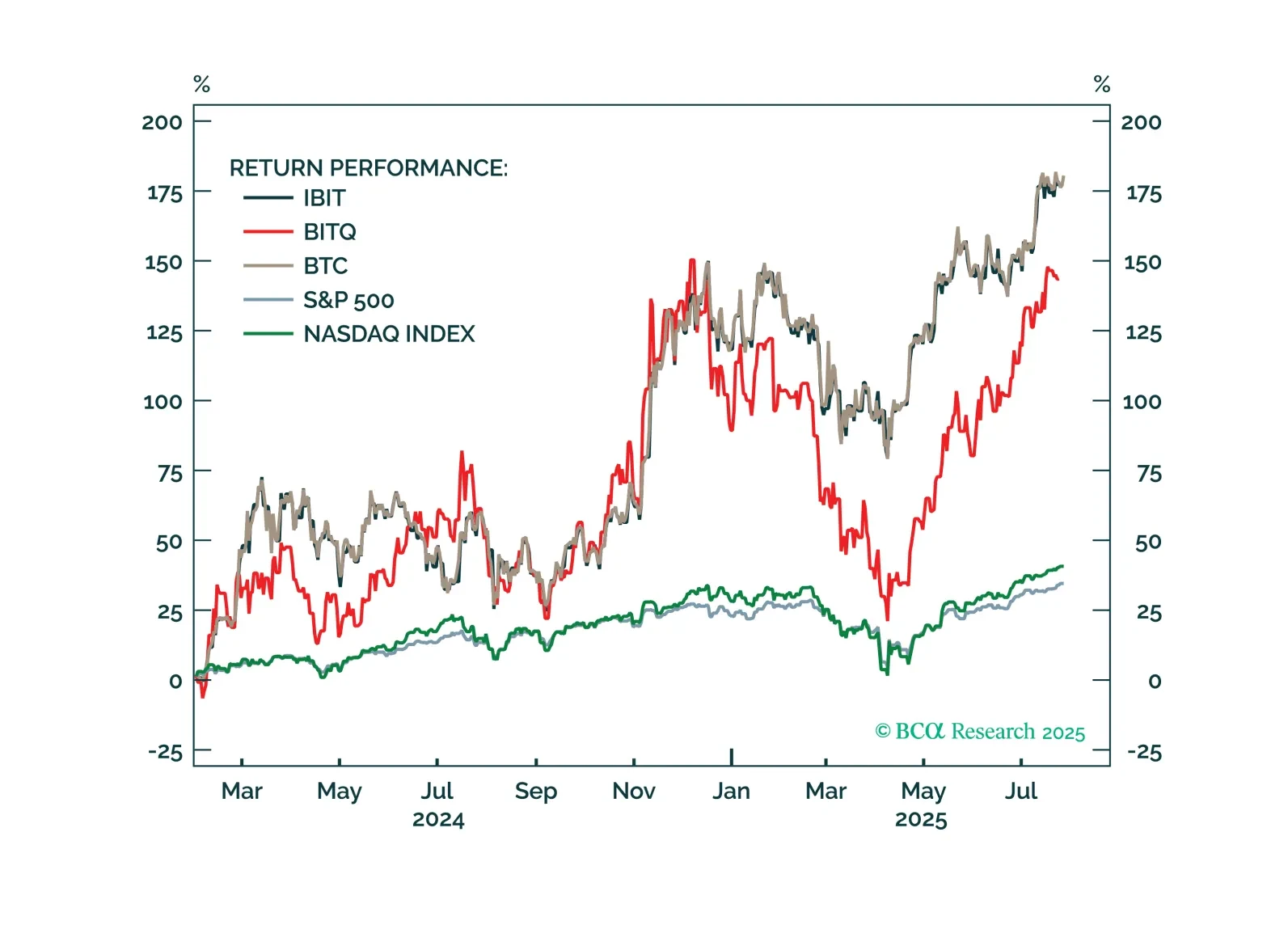

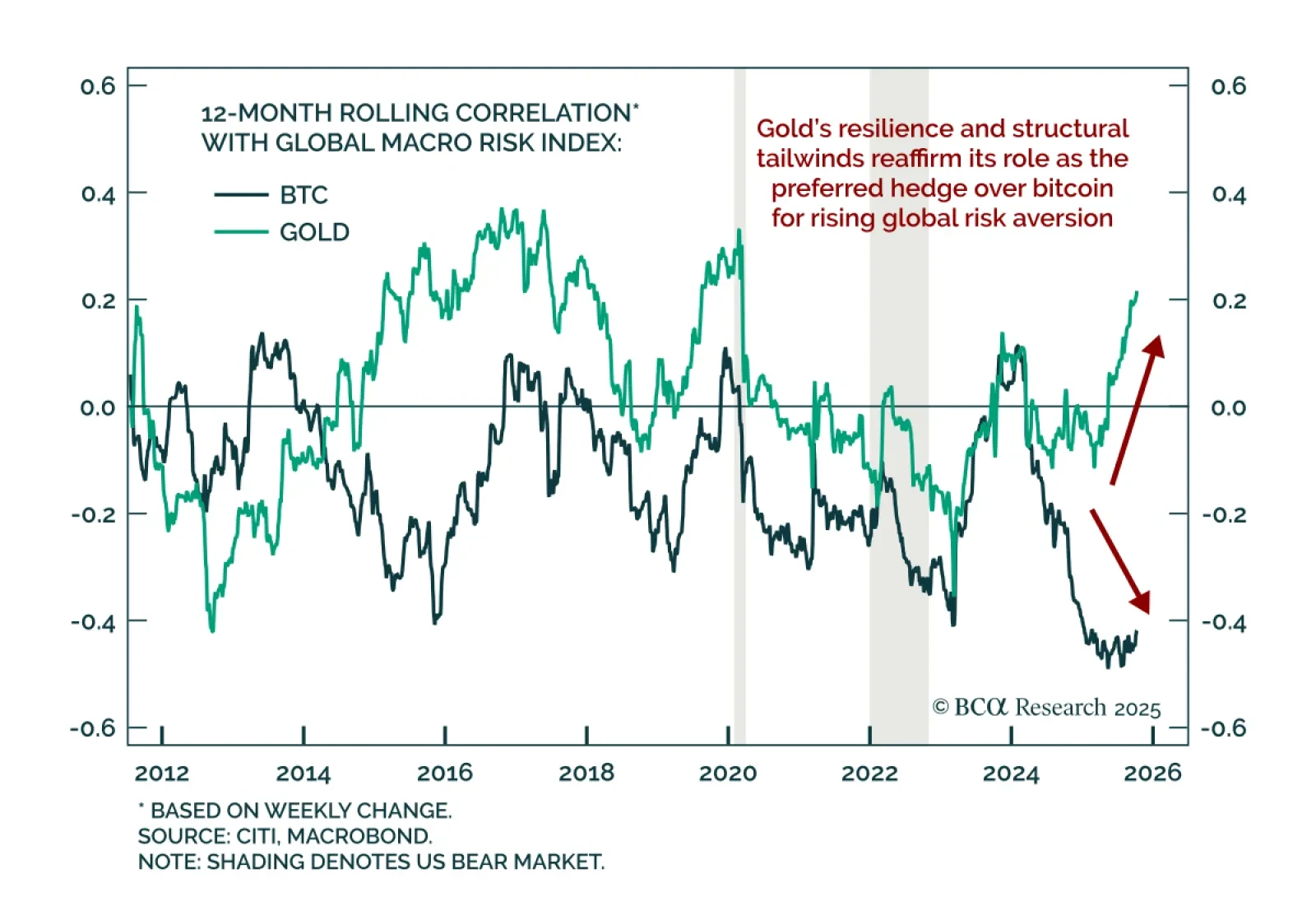

Gold remains a superior hedge asset to bitcoin during global risk-off periods. Both assets have rallied strongly this year, reaching new all-time highs as beneficiaries of the dubbed “debasement trade,” reflecting investor…

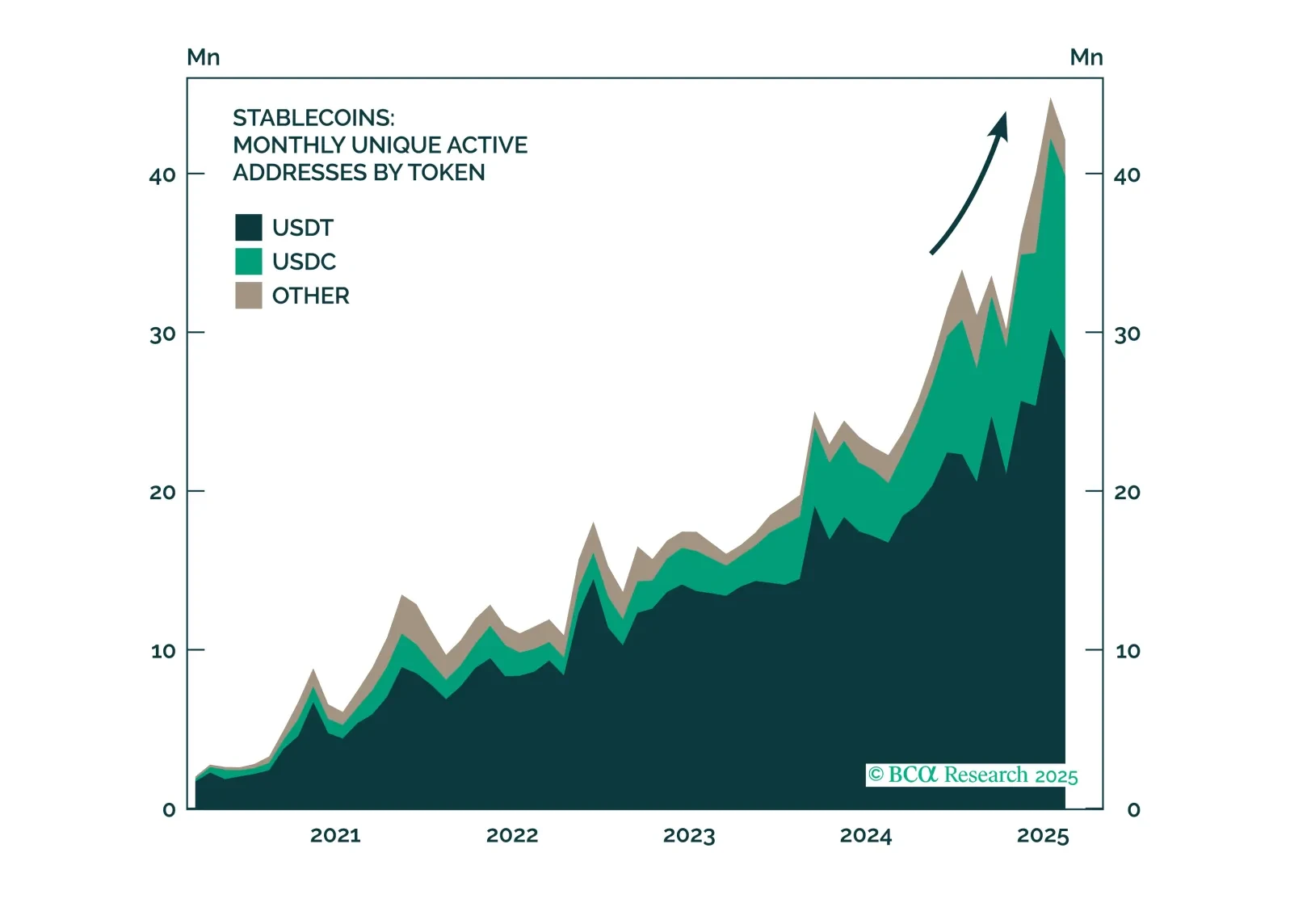

From Treasurys to tokenization, stablecoins are quietly becoming one of the most disruptive forces in global finance, with the power to compress yields, deepen dollar penetration, and shift the balance within crypto markets. Explore…

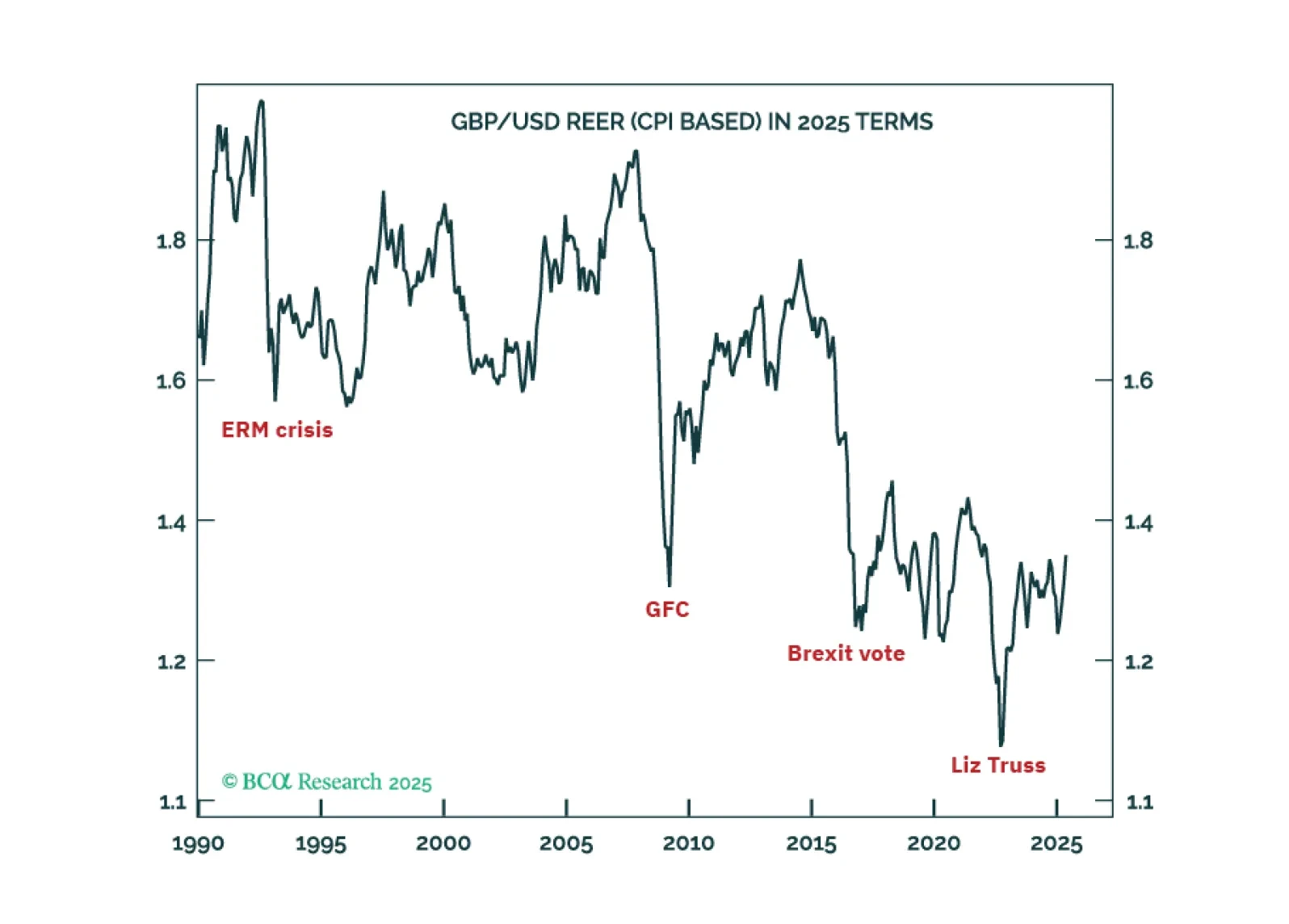

The pound will reach $1.60 if ‘America’s Brexit’ cancels out ‘Britain’s Brexit’. Meanwhile, the flight from the fiat dollar to non-fiat bitcoin will enable the preeminent cryptocurrency to reach $200,000+.

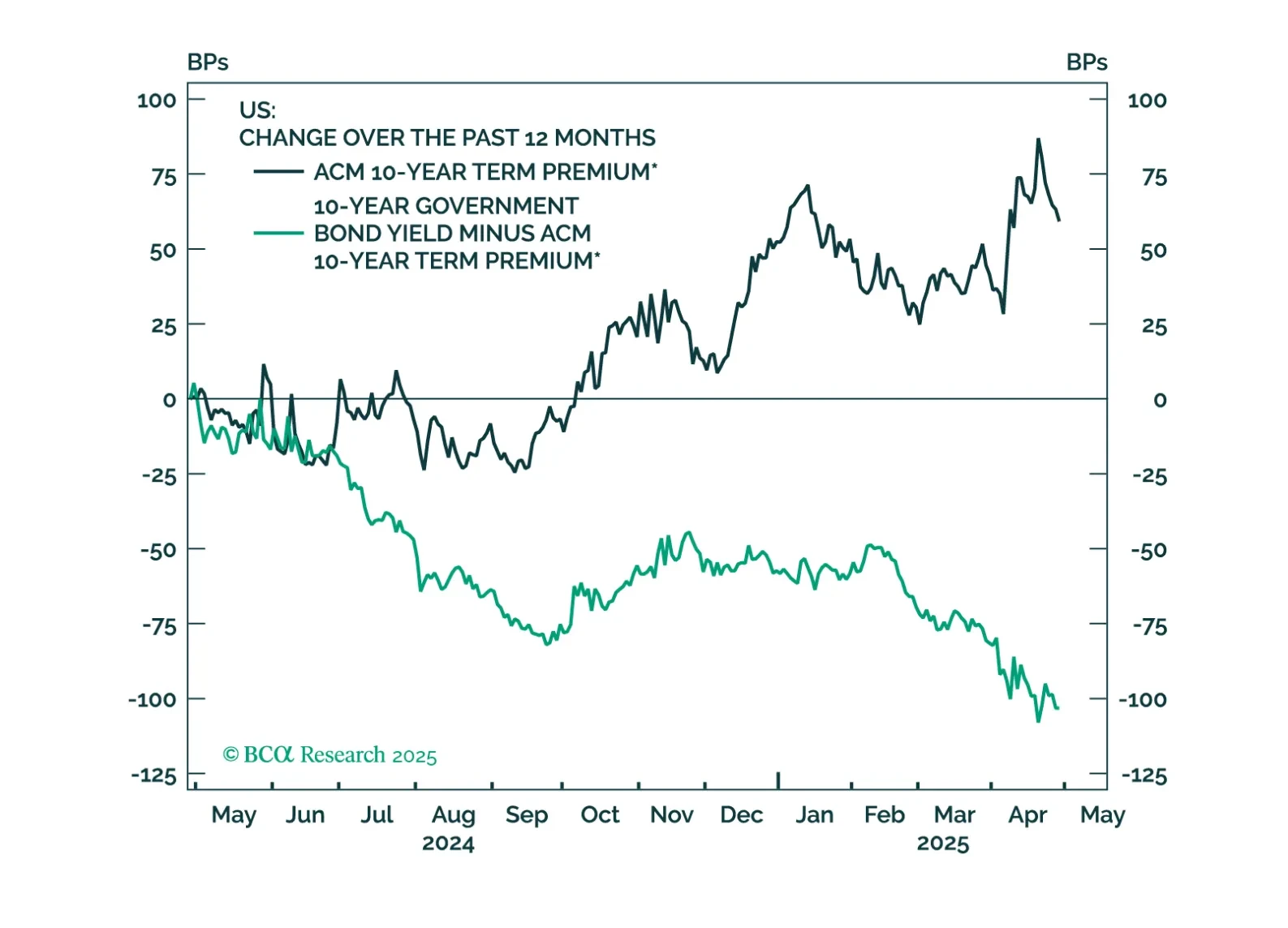

If Trump’s tariffs are ‘America's Brexit’, then UK gilts will recoup ten years of underperformance versus US T-bonds. Meanwhile, as the AI bubble fully deflates, Europe’s stock market valuation versus the US will rerate by about 25…

While most investors spent the month of April frantically refreshing their Twitter feeds for the next tariff announcement, we reiterate our stance that details on tariffs should be left to day traders. Long-term investors should be…

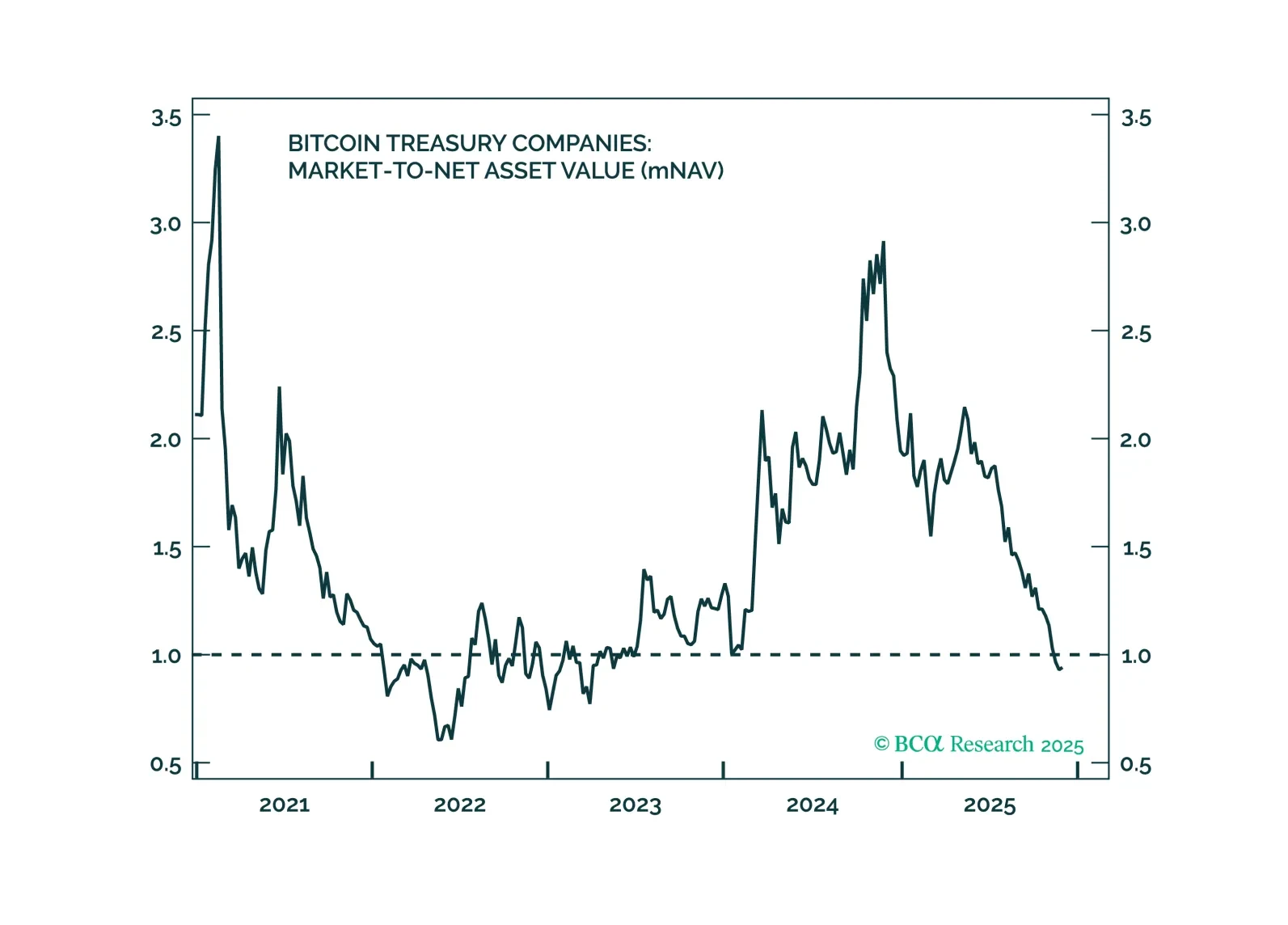

In this report, we reassess our bullish stance on crypto from early 2023, following Bitcoin’s recent all-time highs. While institutional adoption is broadening, there are also signs of excessive exuberance, speculation, and optimism…