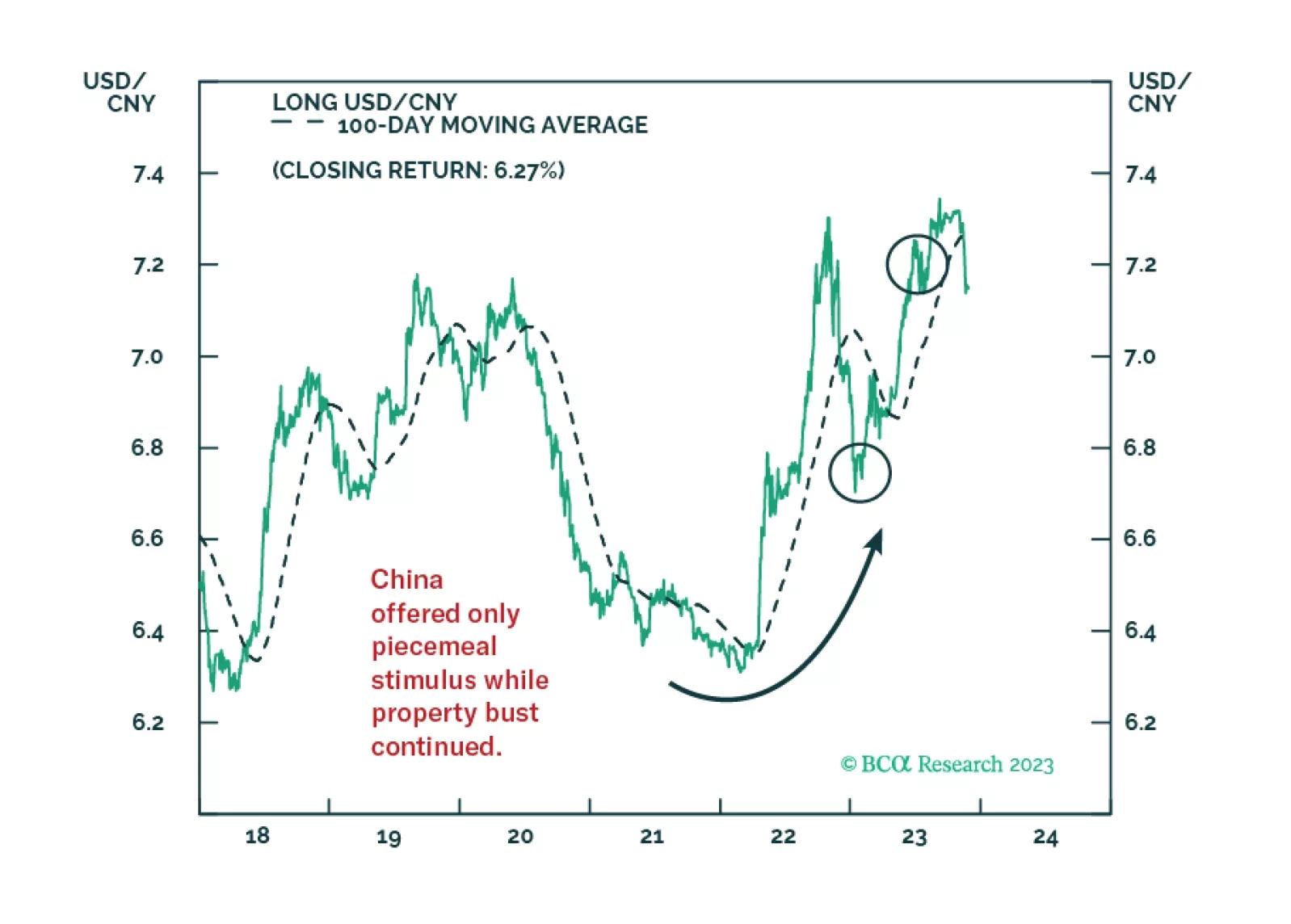

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

Executive Summary Biden Taps China-Bashing Consensus House Speaker Nancy Pelosi’s visit to Taiwan reflects one of our emerging views in 2022: the Biden administration’s willingness to take foreign policy risks…

Executive Summary US biotech is trading at its greatest discount to the market. Ever. Much of biotech’s underperformance is due to transient factors: specifically, the sell-off in long-duration bonds; the focus on delivering a…

Highlights In the short term, the US stock market price will track the 30-year T-bond price, with every 10 bps move in the yield moving the stock market and bond price by 2.5 percent. We think that the bond market will not allow the…

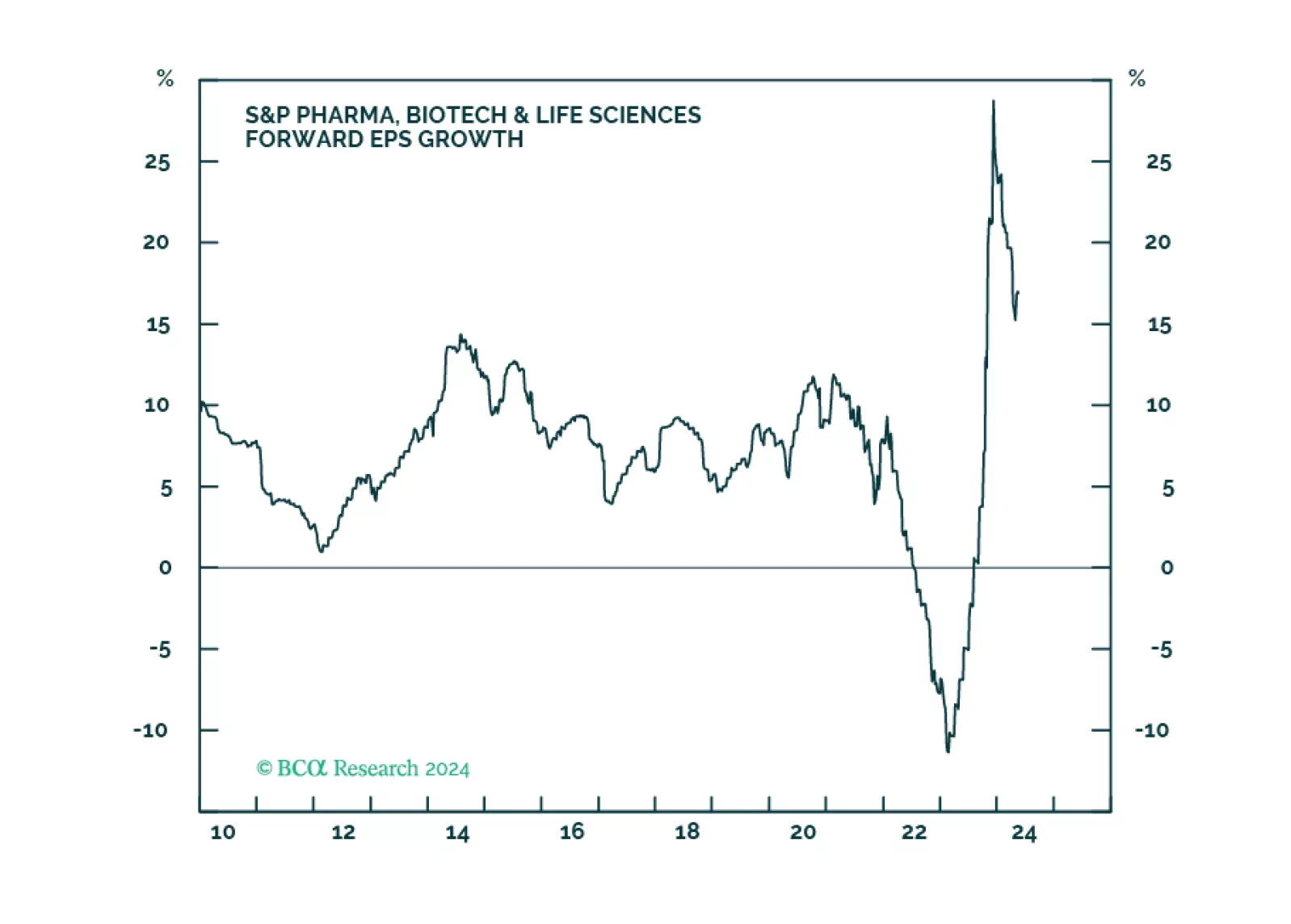

Highlights Upgrade The Health Care Sector To An Overweight: Expressed through an overweight position in Health Care Equipment and Services, and an equal weight position in Pharmaceuticals and Biotech The Sector Faces A Few Tailwinds…

Overweight In last week’s Strategy Report, we made a couple of changes within the health care universe; namely we upgraded pharma to neutral and boosted biotech stocks to overweight both of which lifted the S&P…

Highlights Portfolio Strategy Firming operating metrics, a capex upcycle, rock bottom valuations and deeply oversold conditions all suggest that it no longer pays to be bearish Big Pharma. Upgrade to neutral, today. A looming M&A…

The recently instituted S&P biotech rolling stop got triggered yesterday and we crystalized gains of 5% since the February 2019 inception. This index is now downgraded to neutral, but it does not affect the overall S&P…