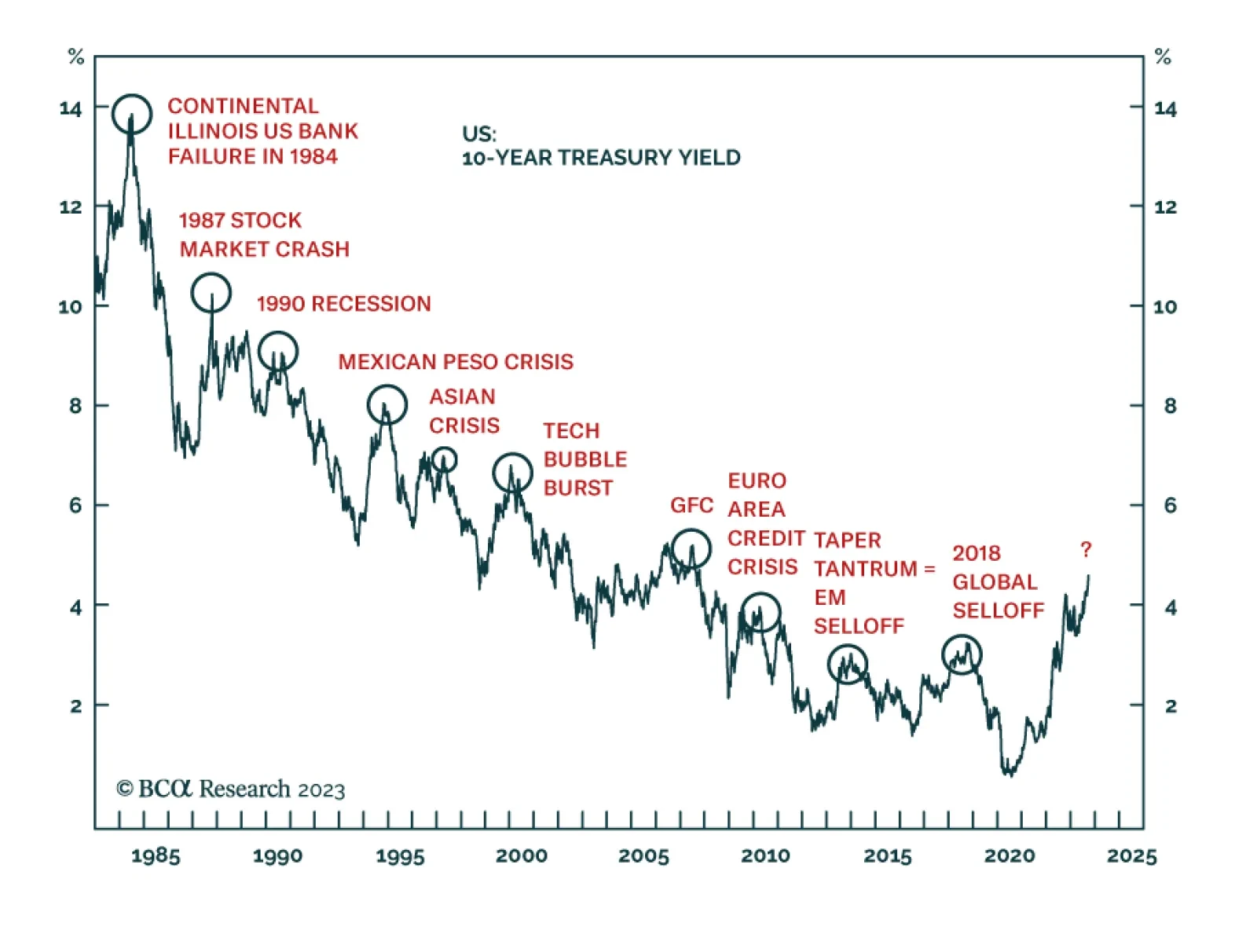

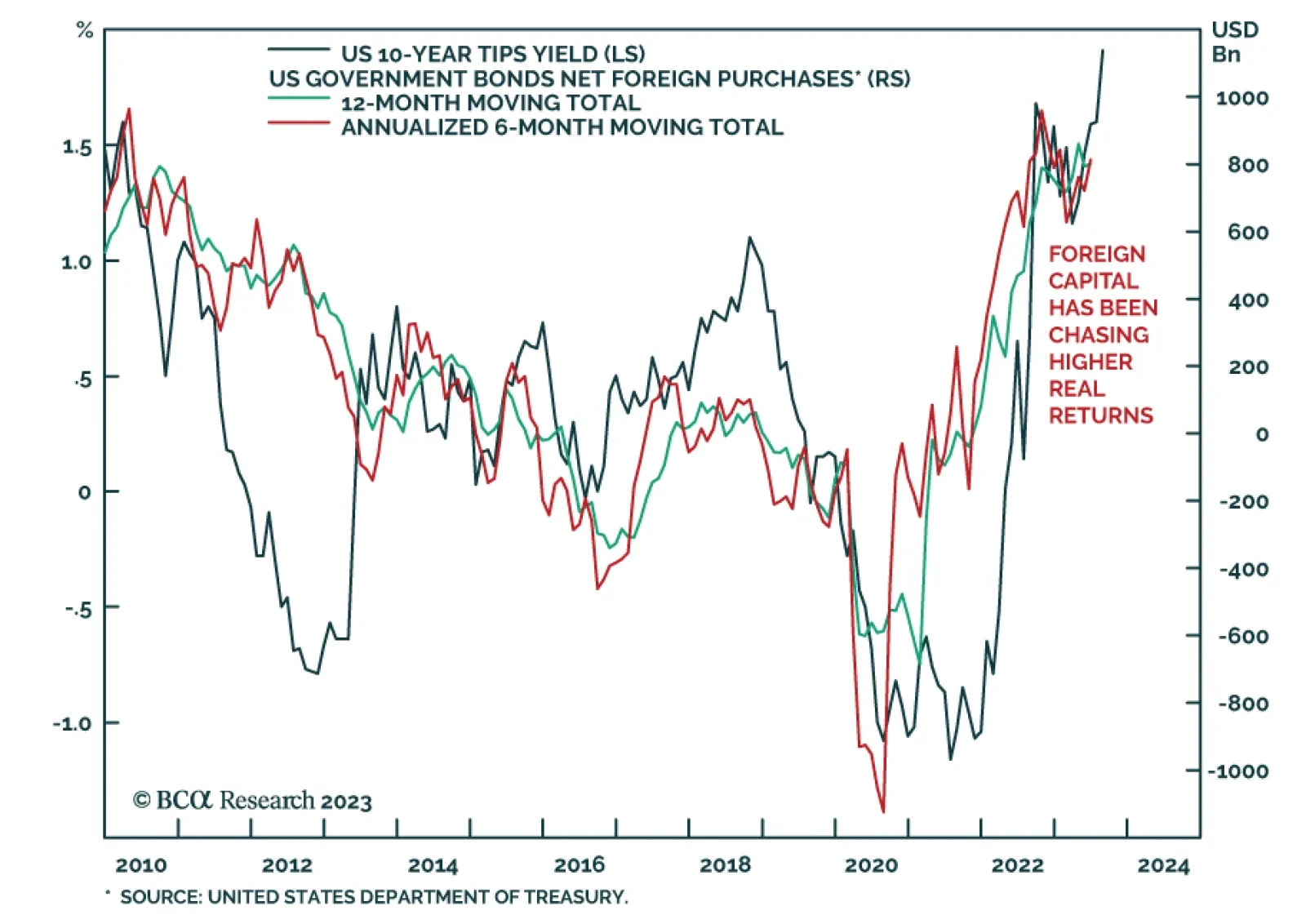

According to BCA Research’s Emerging Markets Strategy service, US Treasury yields are set to overshoot before topping out. The selloff in global bonds is becoming advanced, but there will be more damage to bond…

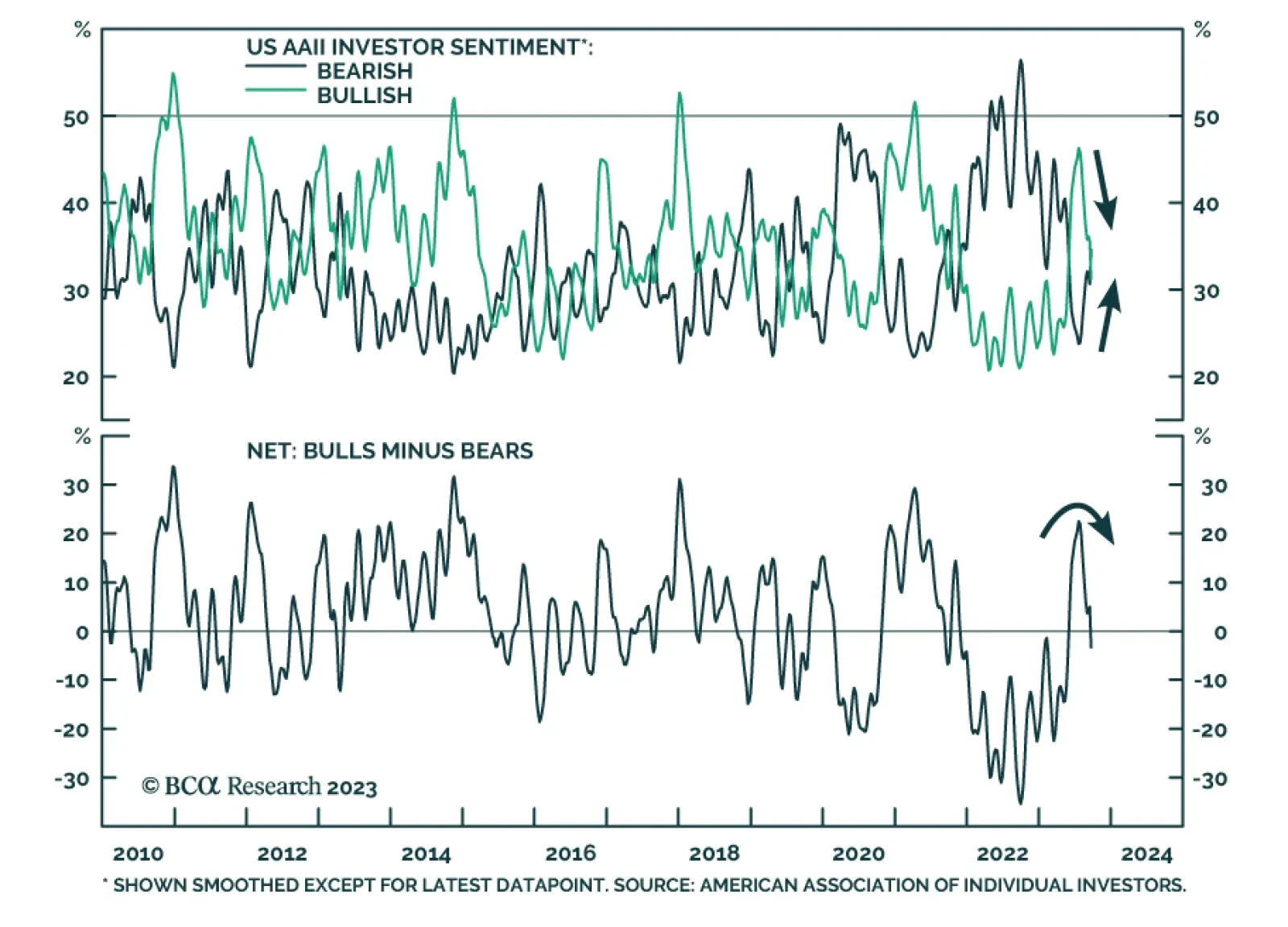

Investor sentiment has turned less optimistic. According to the latest AAII survey, the share of respondents with a bullish outlook has collapsed to 31.3% from its peak of 51.4% two months ago. It is now back down below its…

While Chinese stocks have low valuations and are oversold, their attractiveness is dampened by uncertainties in the magnitude of stimulus and the dismal outlook for corporate profits in the next six to nine months.

Since July, the DXY index is up 4.5% from the lows. On a broader trade-weighted basis, the Federal Reserve’s measure of the nominal dollar is up 2.9%. The usual suspects for dollar strength have been weakness in global…

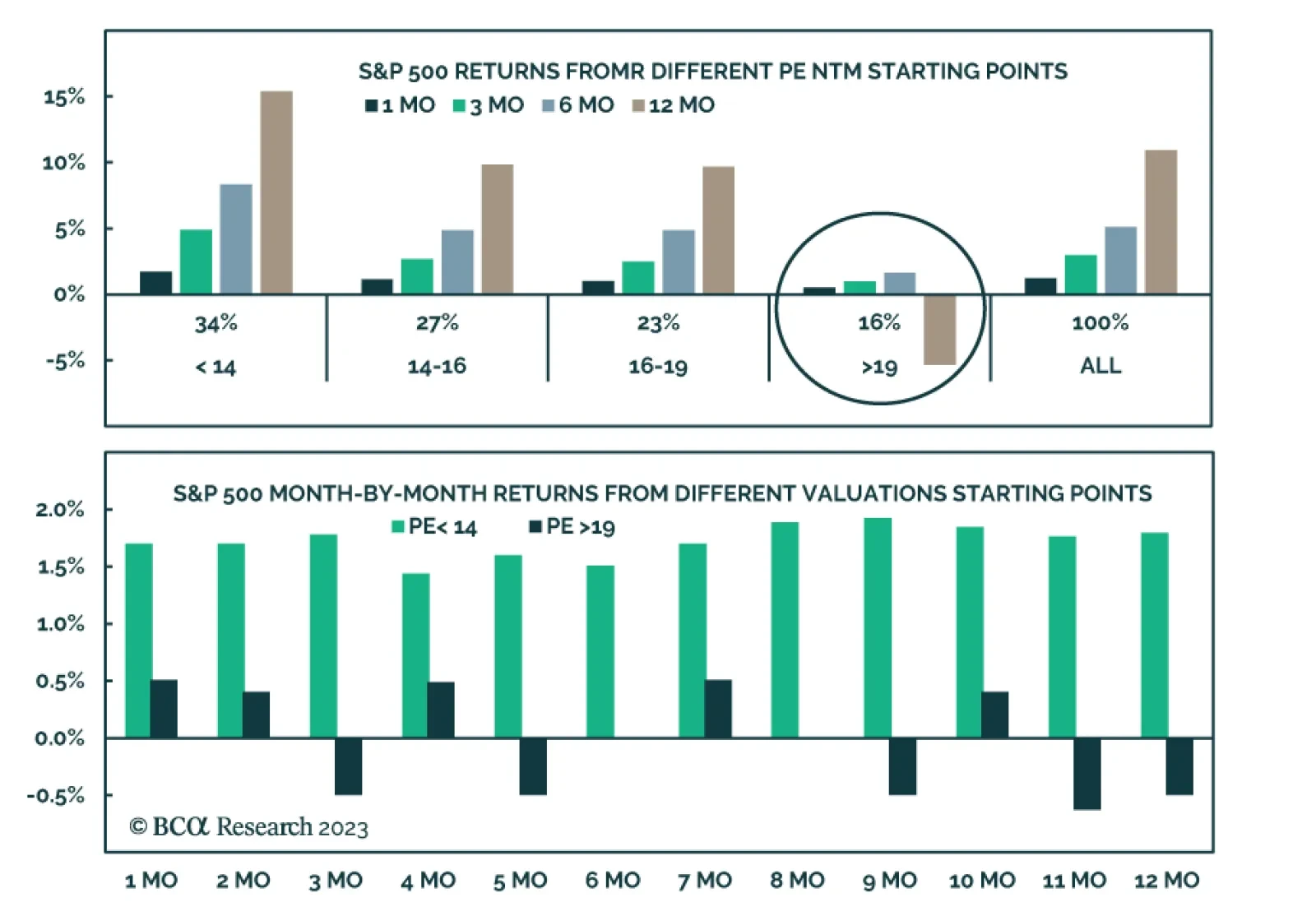

The jubilant summer rally came to a halt in August, with the S&P 500 down 4.4% MTD. A confluence of factors has weighed on the performance of US equities ranging from economic malaise in China to too-hot economic data…

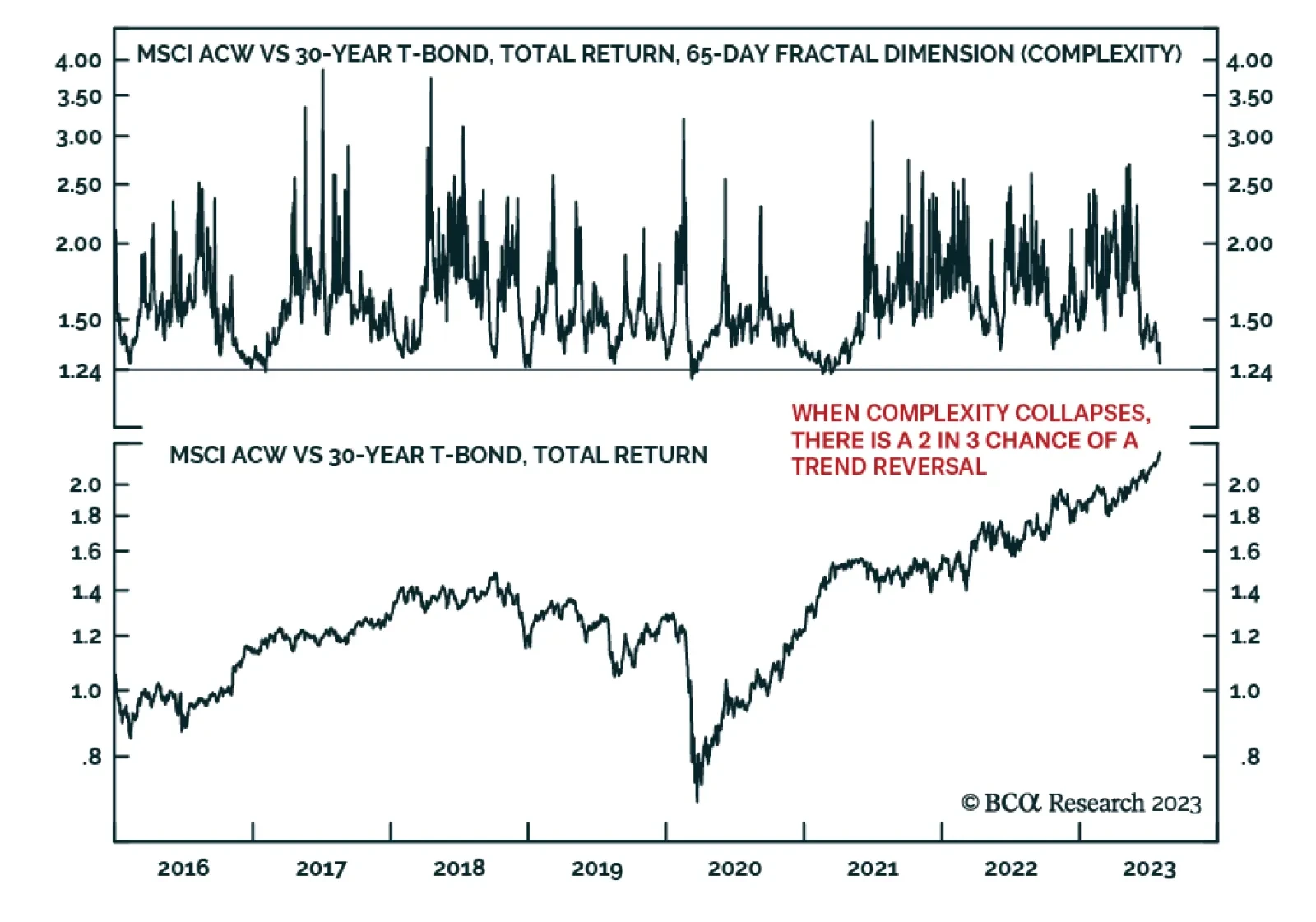

While the bearish bond trade currently has a lot of momentum, we continue to think that Treasury yields are close to a cyclical peak and will be lower on a 6-12 month horizon.

The S&P 500 rally broadened in July, lifting this year’s laggards. Surging long yields are altering the macroeconomic backdrop, as the market absorbs that monetary policy will stay restrictive for a long time. Yet, a move down in…

The recent ‘Goldilocks’ stock market rally is predicated on the hope that developed countries really can kill inflation without killing their economies. But one important warning sign suggests that the rally has gone…