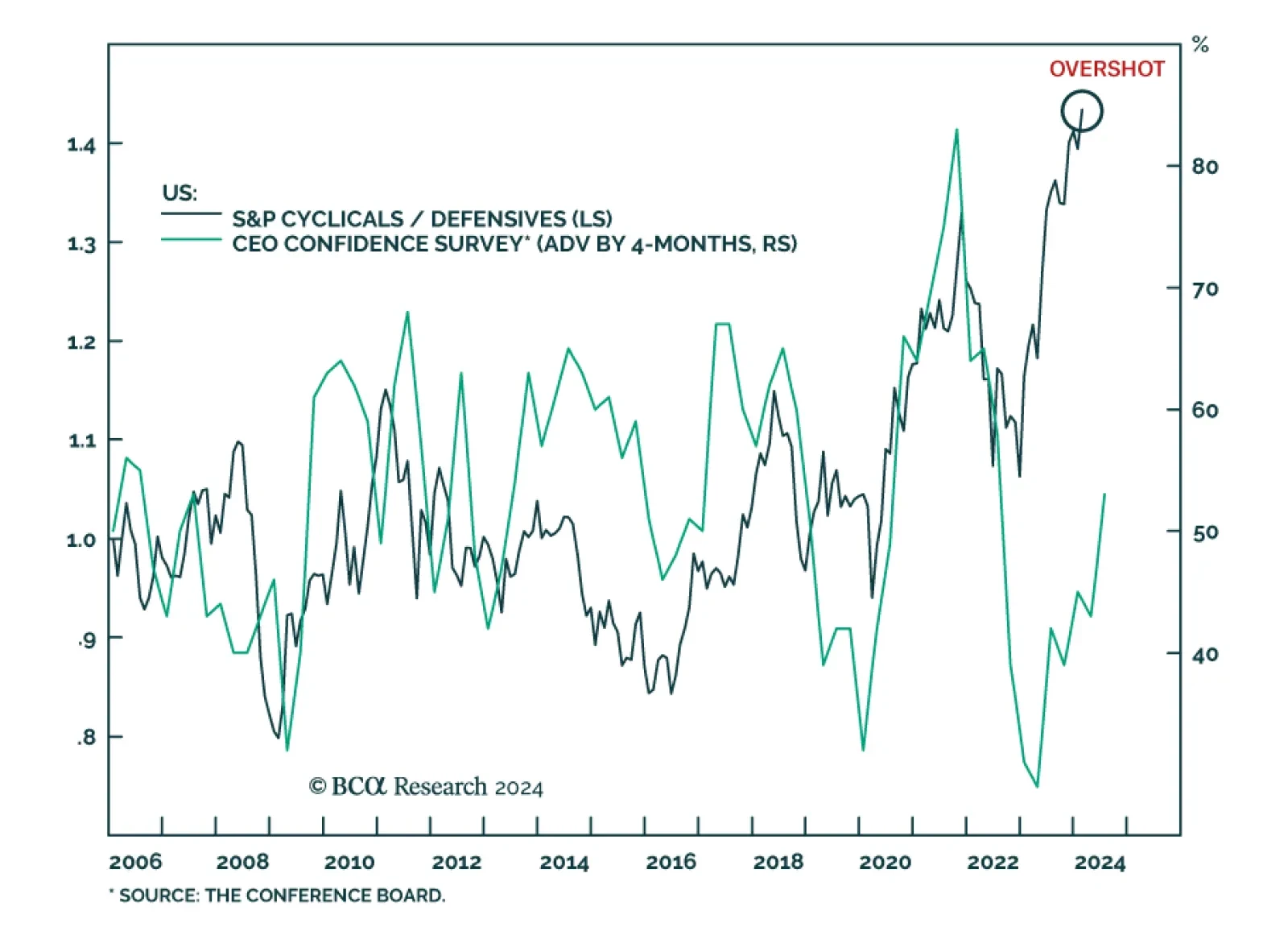

Results of the US Conference Board’s latest quarterly survey show an improvement in sentiment among business leaders. The CEO Confidence measure rose above 50 for the first time in two years – indicating that…

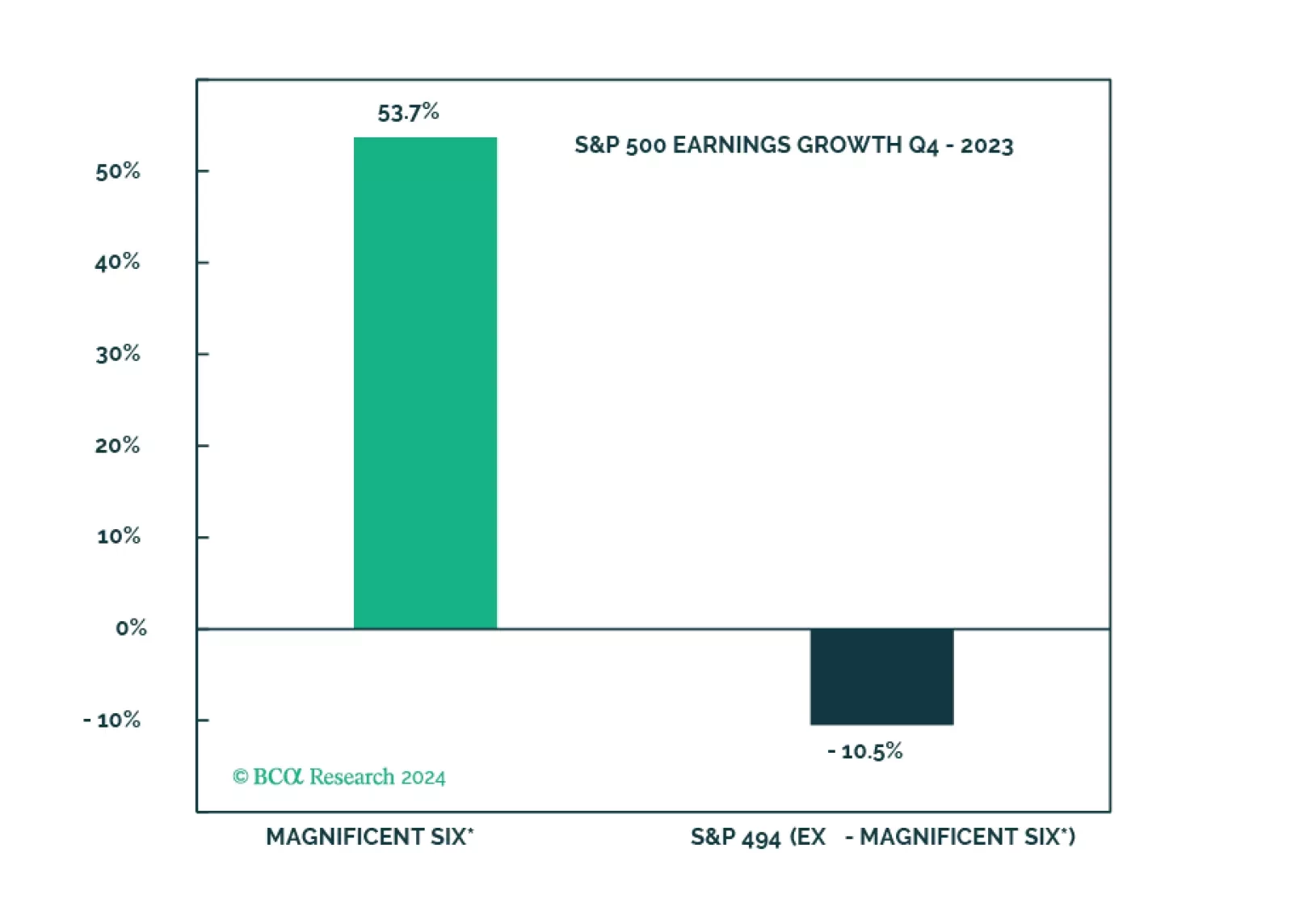

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

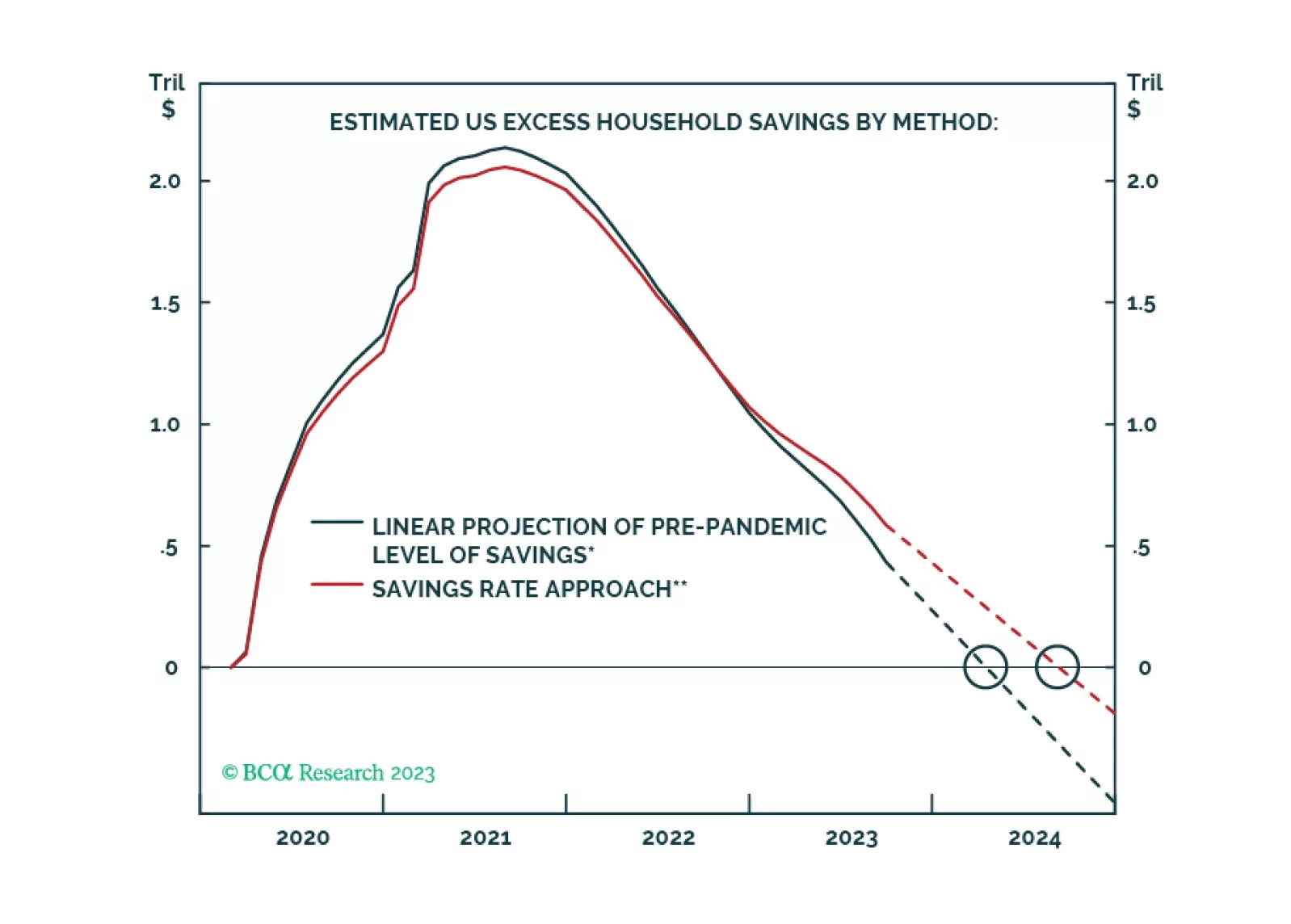

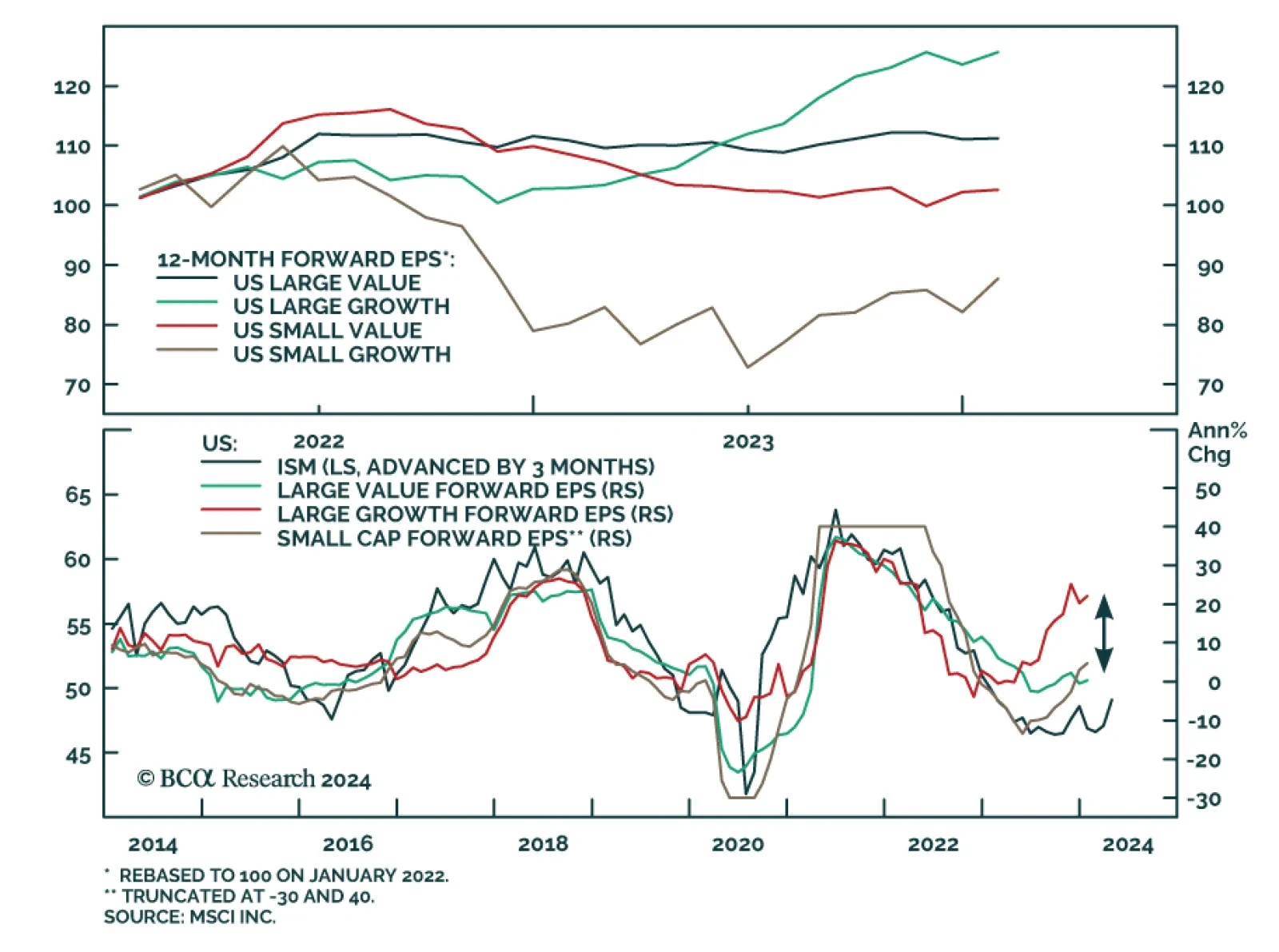

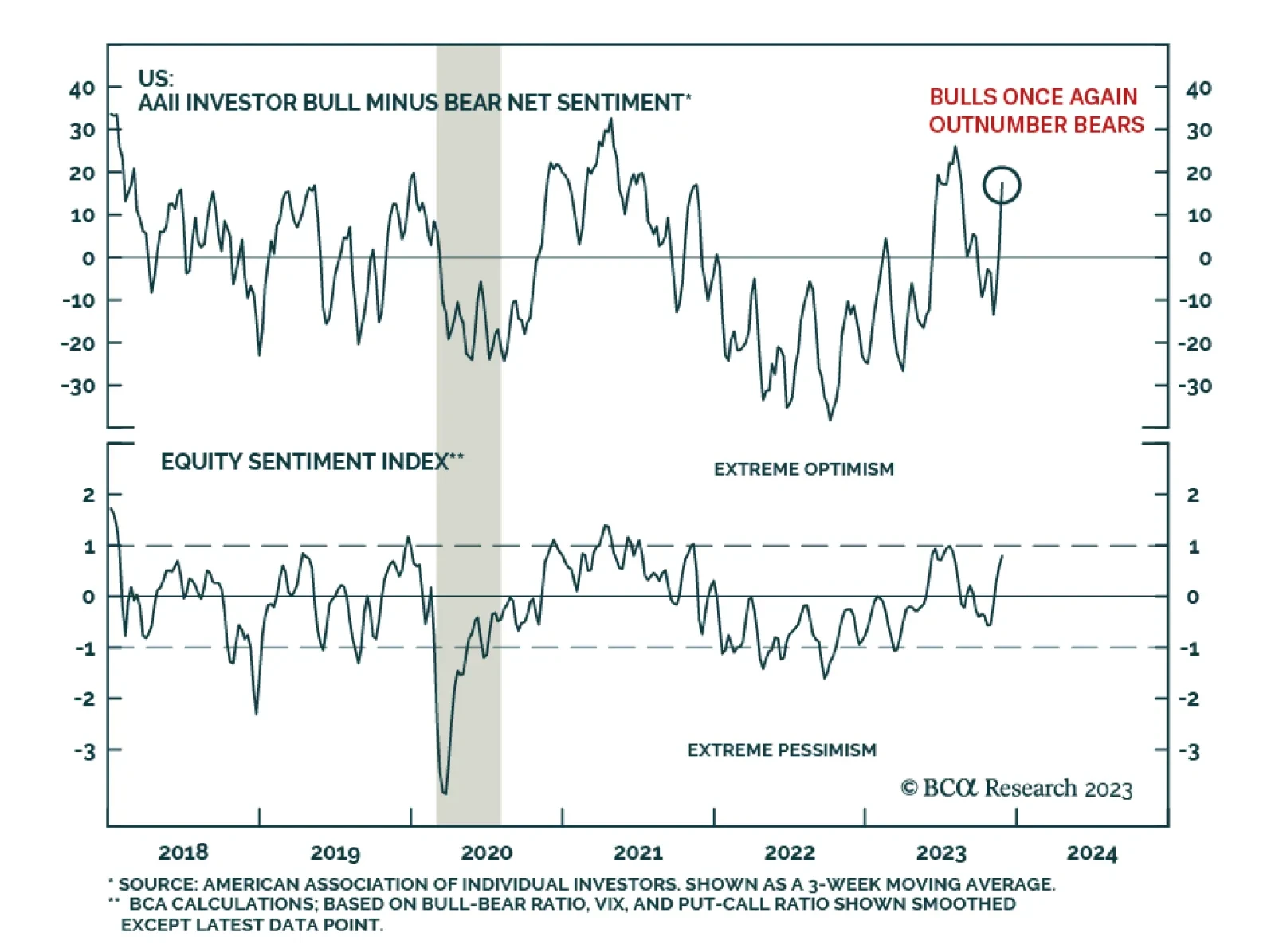

The S&P 500 has started off the new year on a weak footing, dropping by 1.5% in the first week of January. Indeed, by the end of 2023, several indicators were warning that conditions were becoming bearish. In…

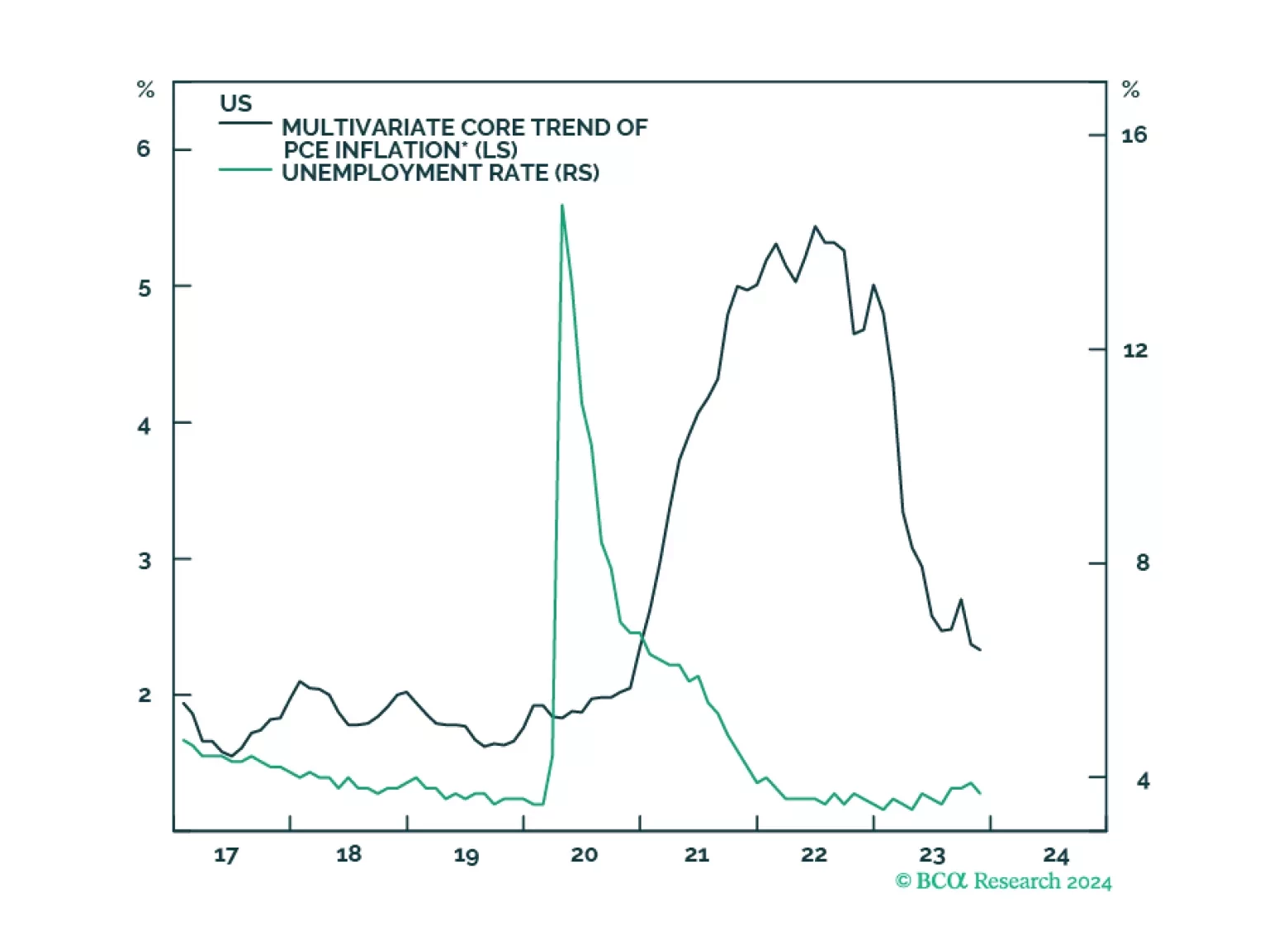

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

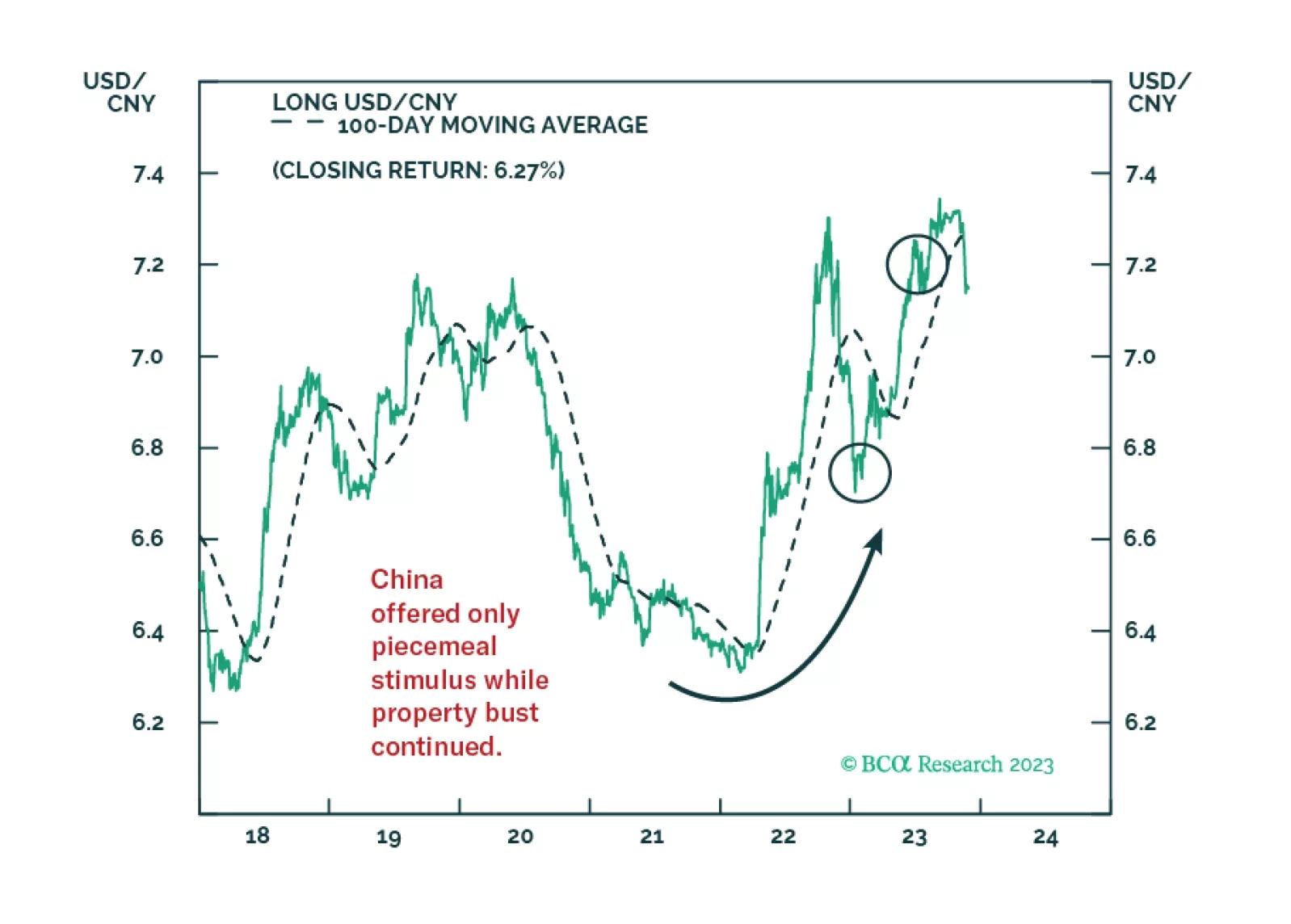

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

After a sharp rally since late-October, the S&P 500 is now on the verge of breaking above its late July year-to-date high and completely erasing the losses incurred over the prior three months. Investor sentiment has also…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

In this report, we go around the globe and survey the near-term outlook for G10 currencies. Our longer-term view on the dollar has been clear, we are sellers. In this report, we review if a tactical sell is also warranted given…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…