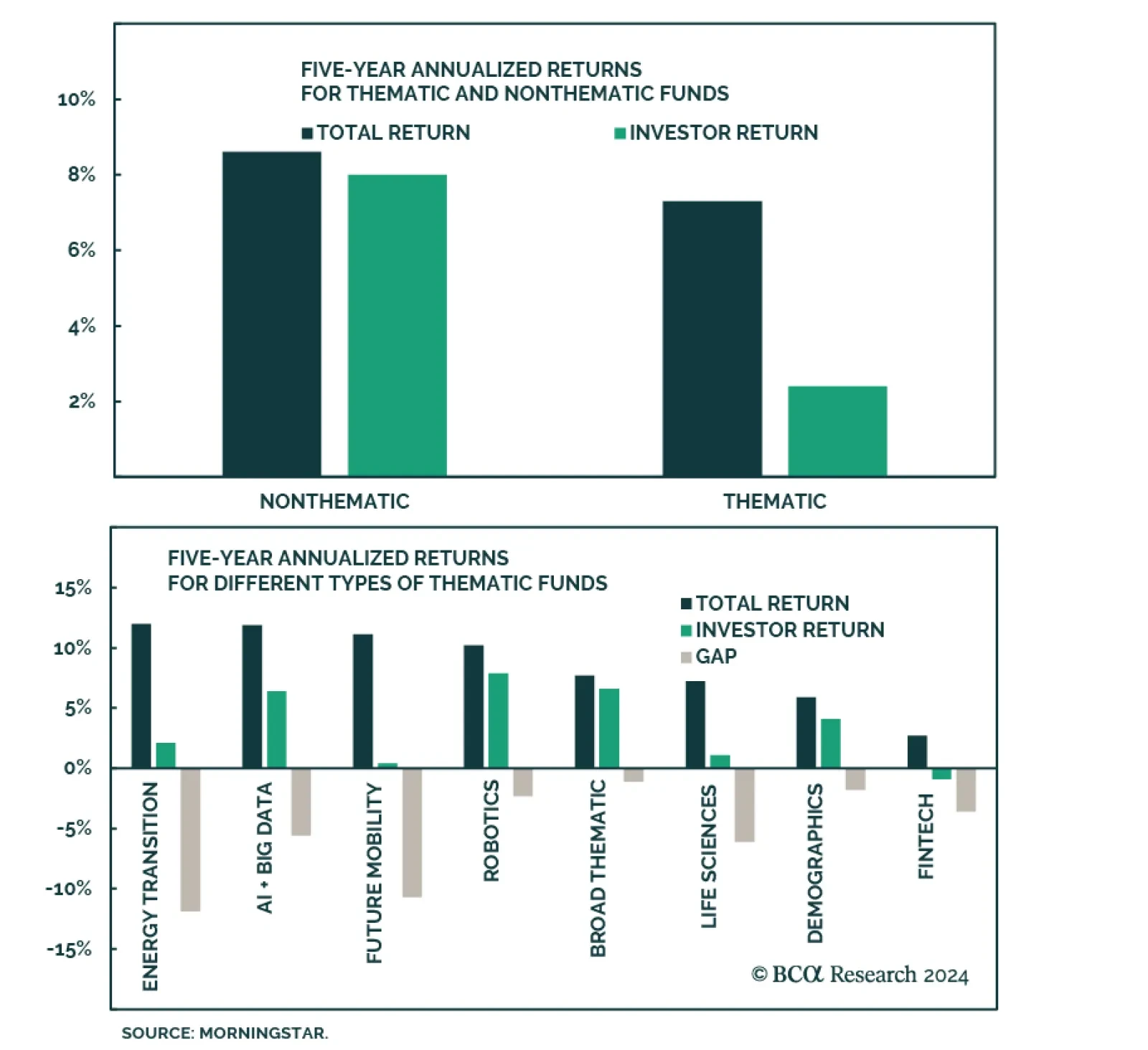

Thematic investing has become increasingly important for investors over the past few years. And yet, in spite of the popularity of thematic strategies, the vast majority of investors underperform when buying into such…

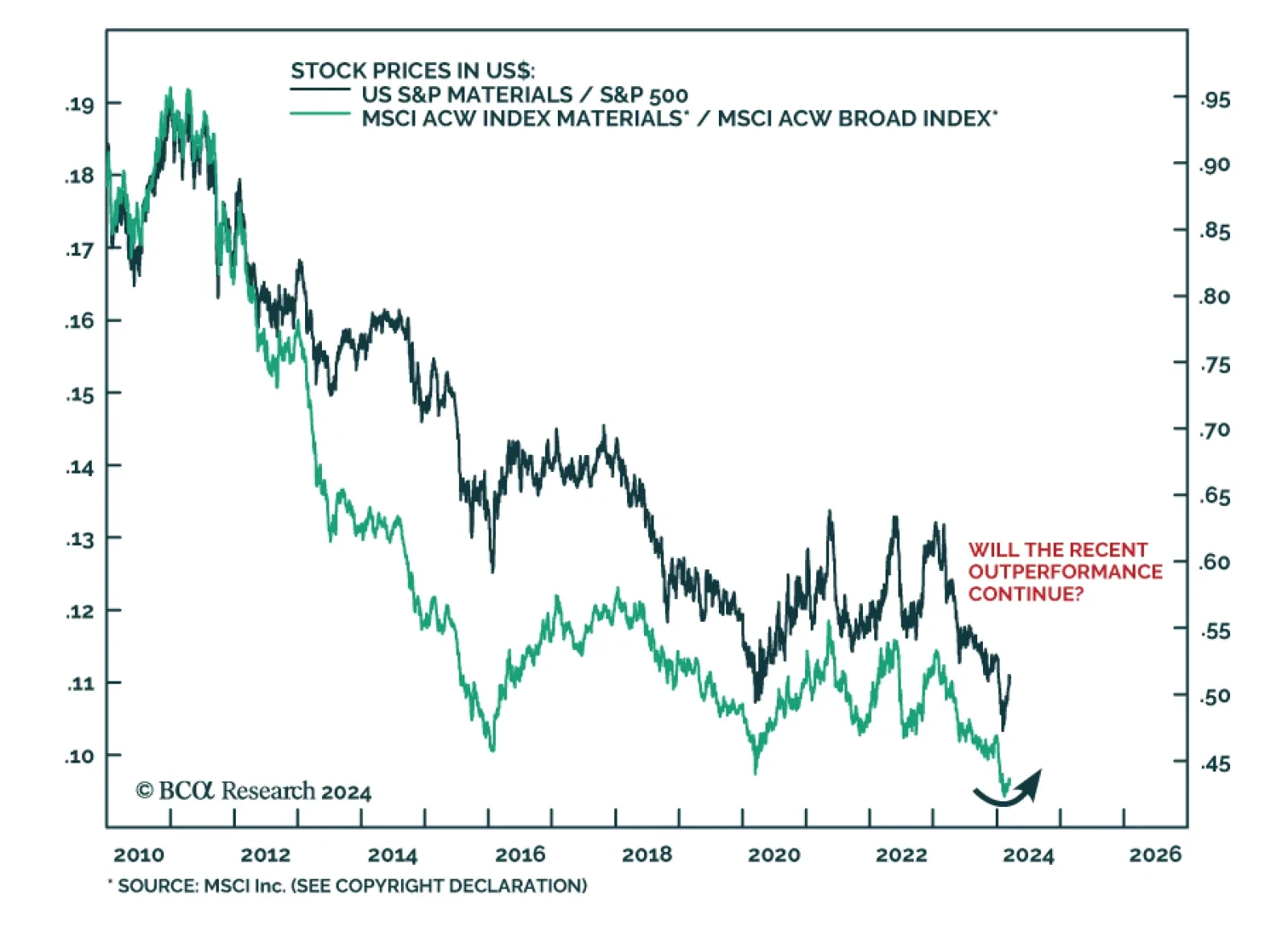

As we highlighted in a recent Insight, dynamics have shifted beneath the surface of the S&P 500. The Materials sector has been rallying sharply since the end of January, gaining 9.9% over this period and taking the top spot…

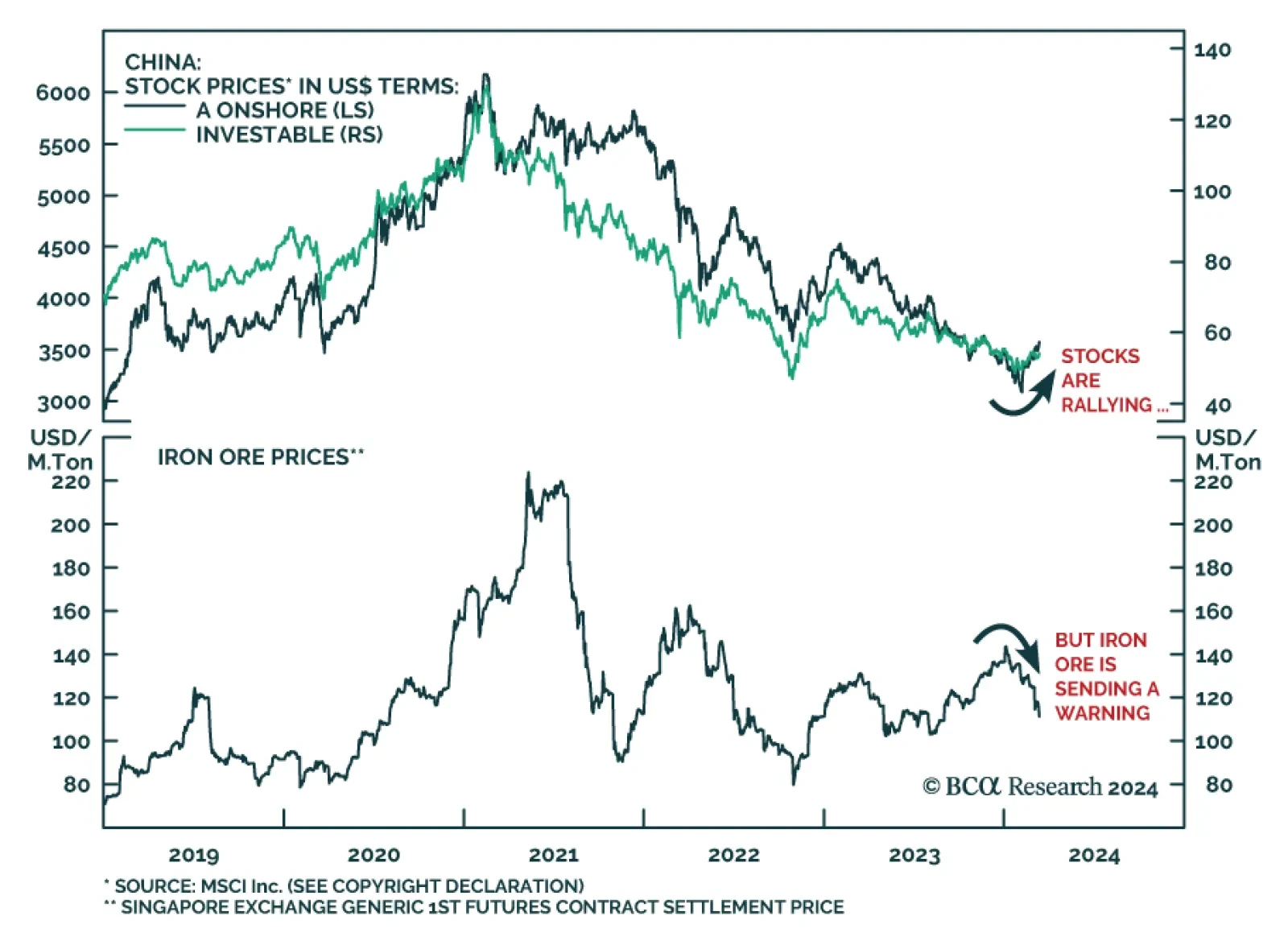

Chinese stocks are experiencing their longest rally since the country’s exit from Covid restrictions over a year ago. The MSCI Onshore and Investable indices (in USD terms) have gained 15.8% and 9.1% respectively since…

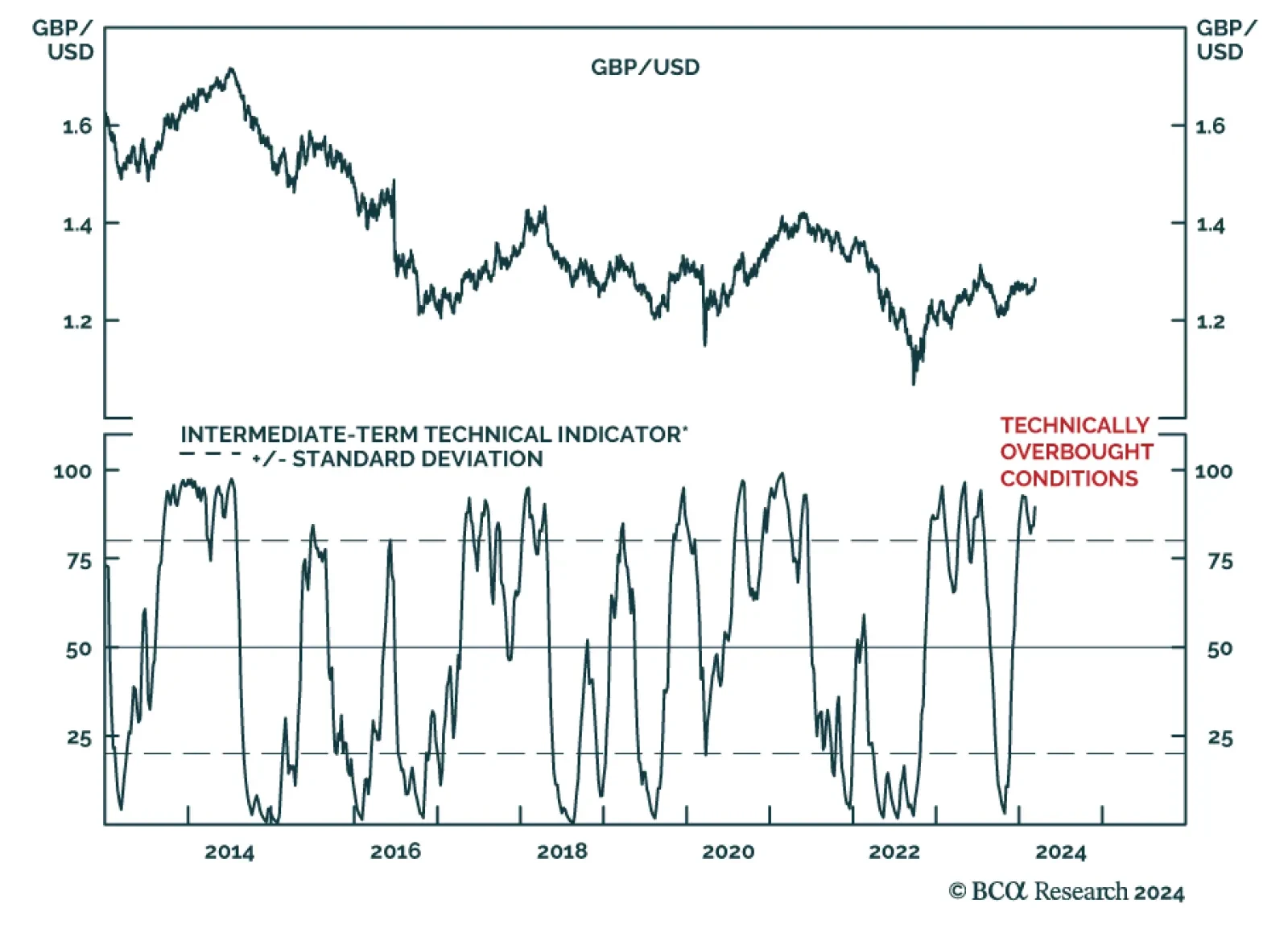

The British pound is the best performing G10 currency so far this year, gaining 0.7% vis-à-vis the US dollar. The outperformance of sterling over the past month coincides with an increase in Citigroup’s UK economic…

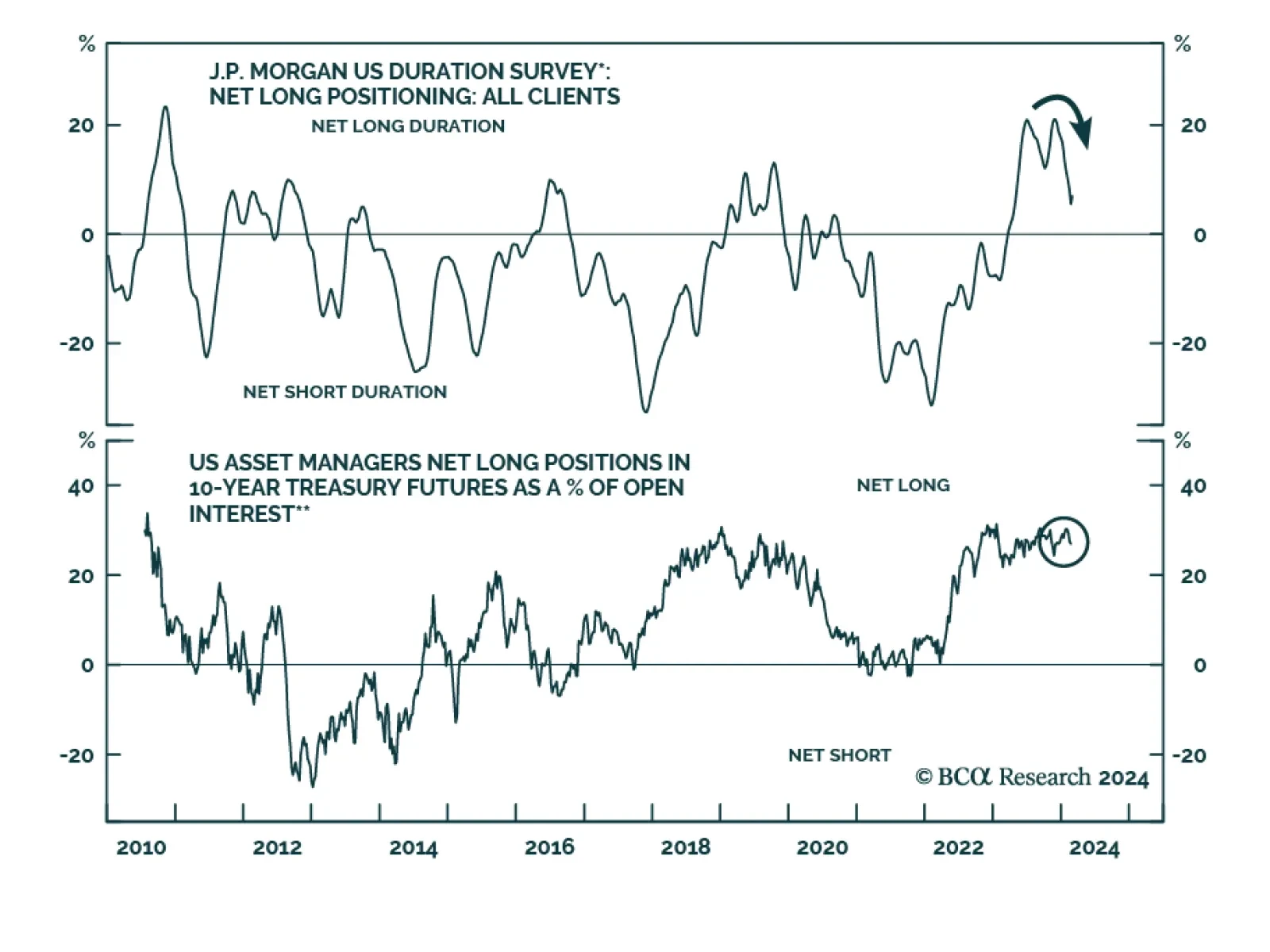

In a recent report, our US Bond strategists argued that while the year-to-date increase in yields has made Treasures more attractive, conditions are not yet in place to extend duration. Instead, they expect that there will be a…

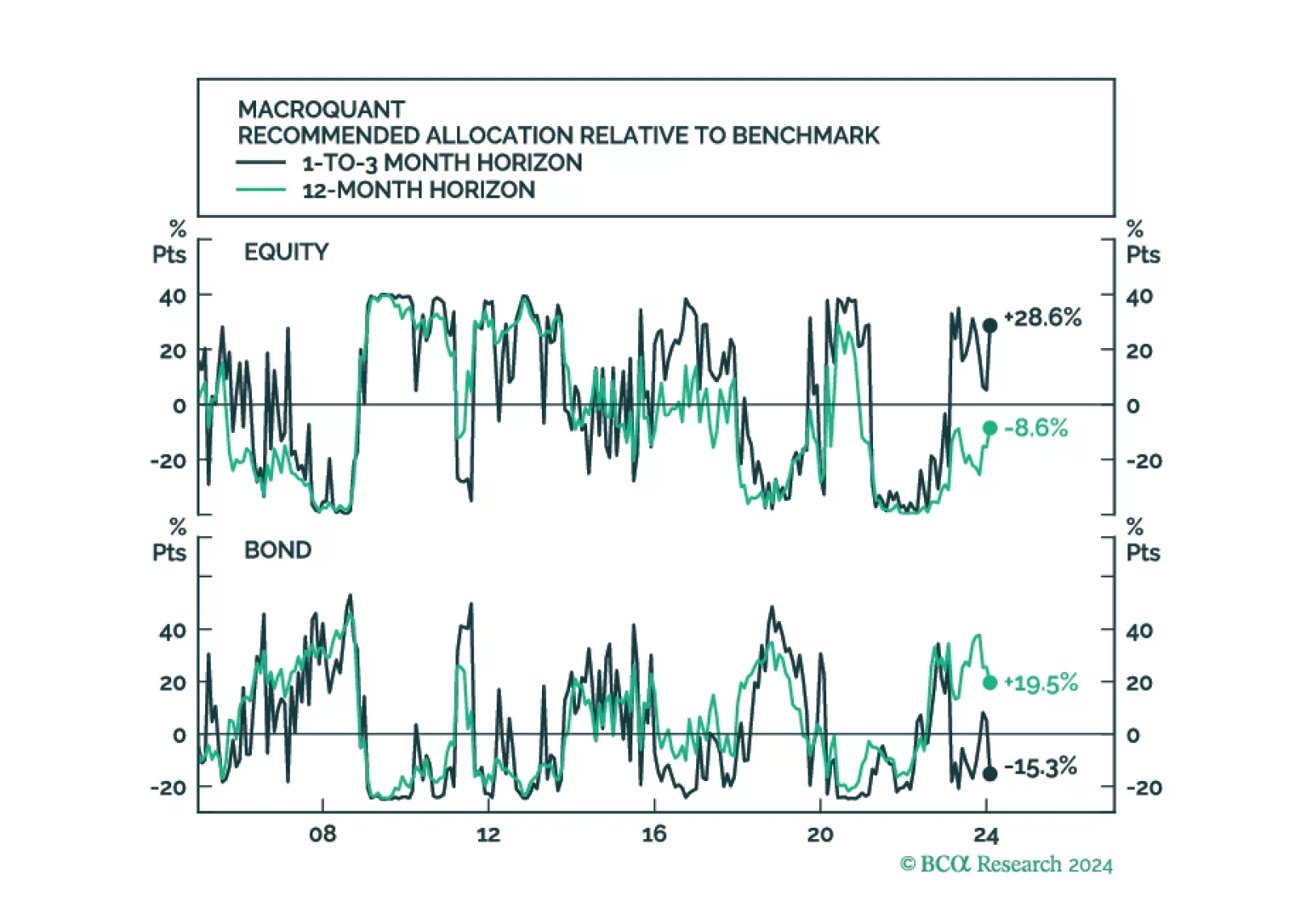

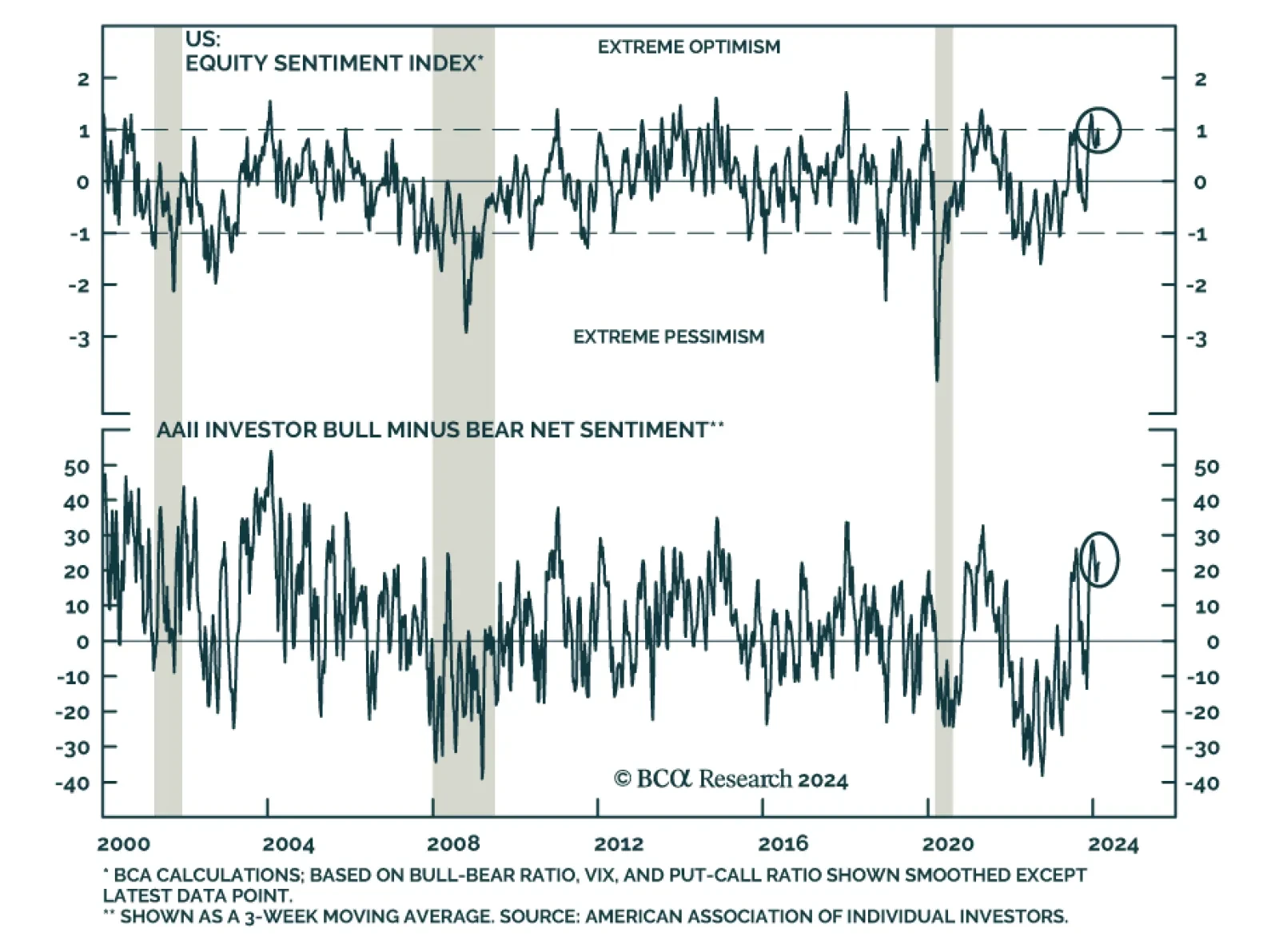

MacroQuant upgraded equities to overweight in February on a tactical short-term (1-to-3 month) horizon, but it continues to see downside risks to stocks on a medium-term (12-month) horizon. Consistent with the model’s relatively…

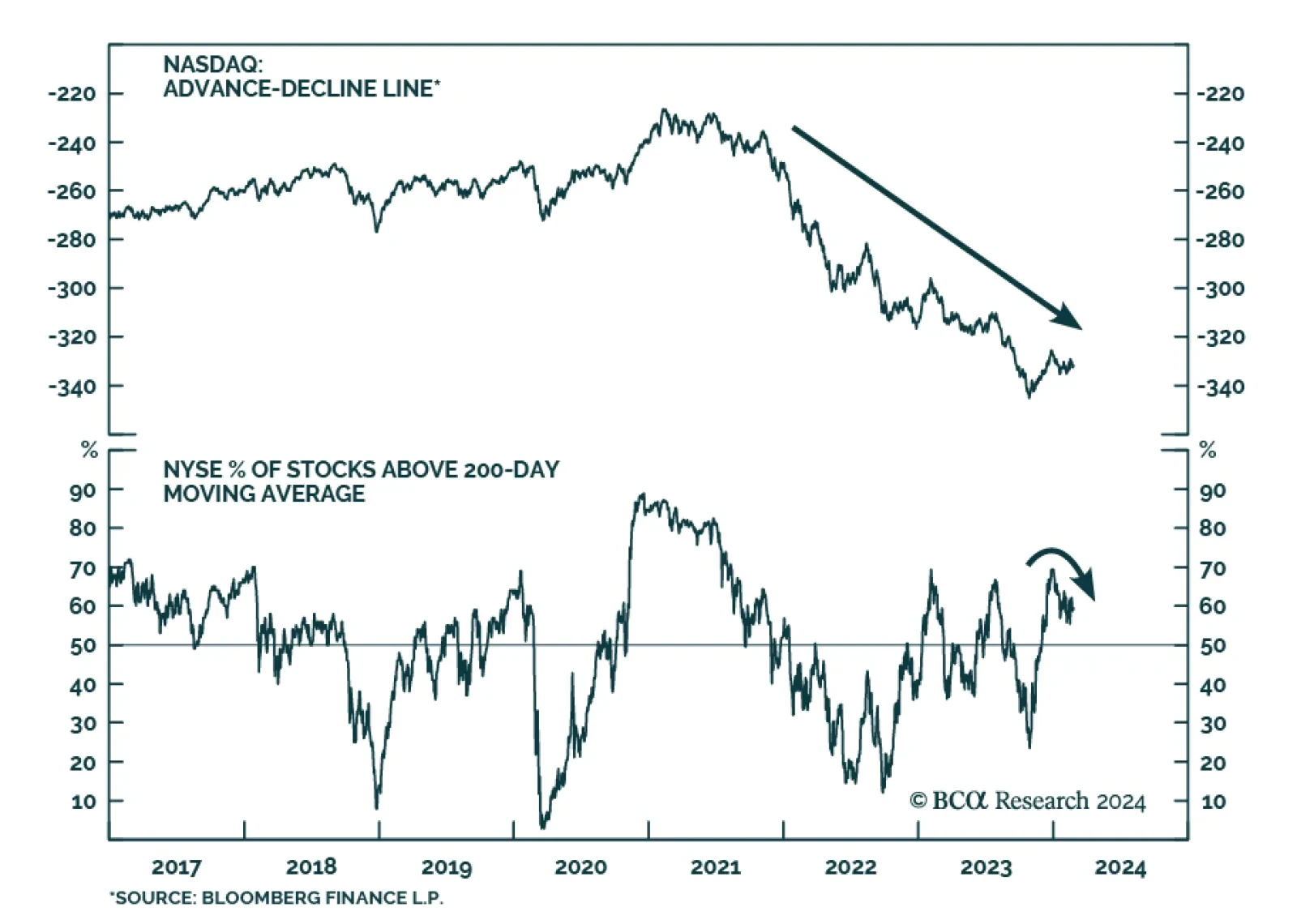

At the headline level, US equity indices are on a tear with the S&P 500 forging a fresh all-time high last week and the NASDAQ on the verge of overtaking its November 2021 record close. However, the rally remains quite narrow…

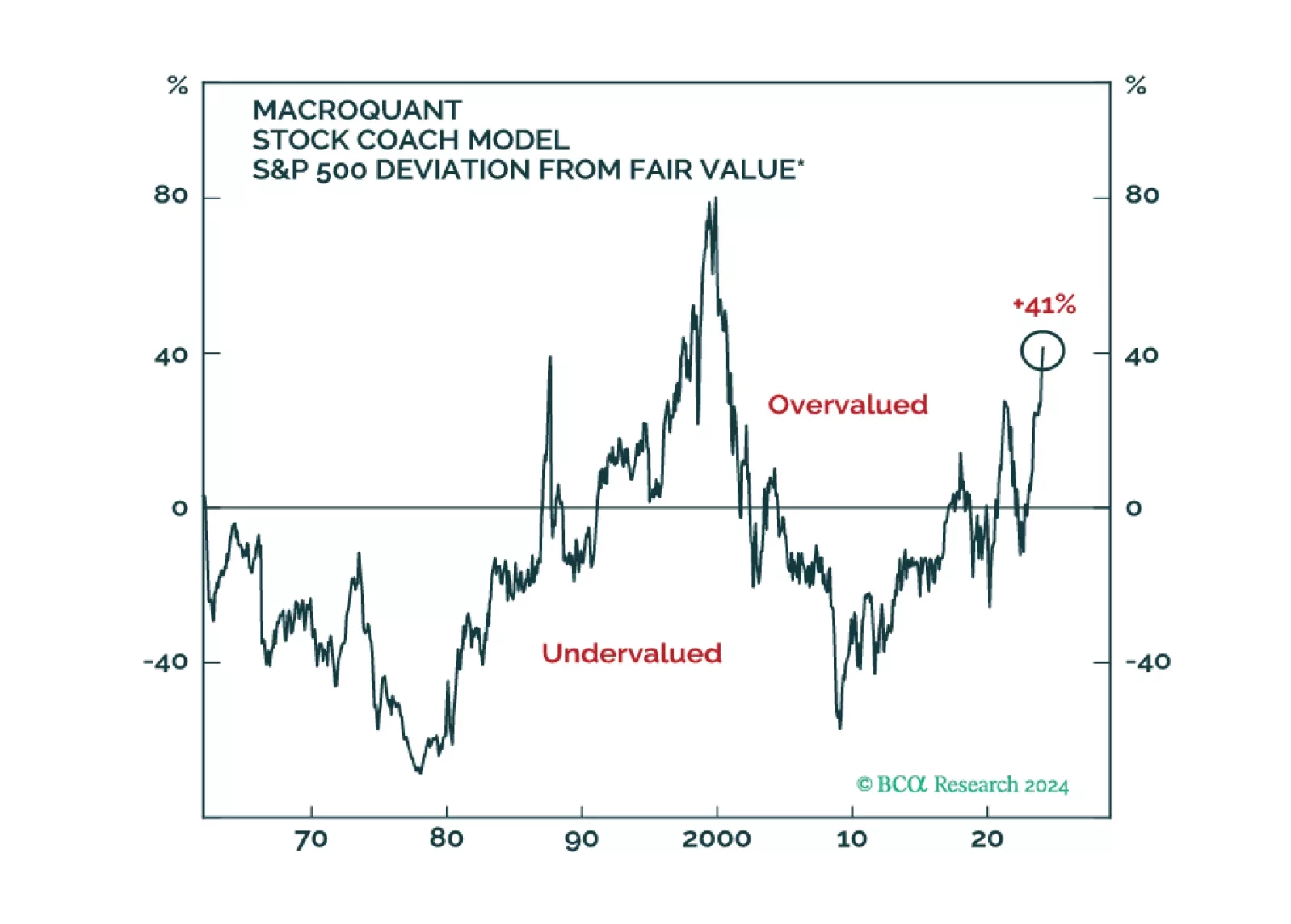

The S&P 500 forged a new all-time high last Thursday and ended the week with a 4.9% year-to-date gain, extending the rally that started in late-October. Interestingly, the recent increase comes even though investors have…

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

Recessions often begin seemingly out of the blue when the economy’s temperature falls enough to set in motion adverse feedback loops that cause unemployment to rise. We expect the US economy to suddenly freeze over towards the end of…