After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

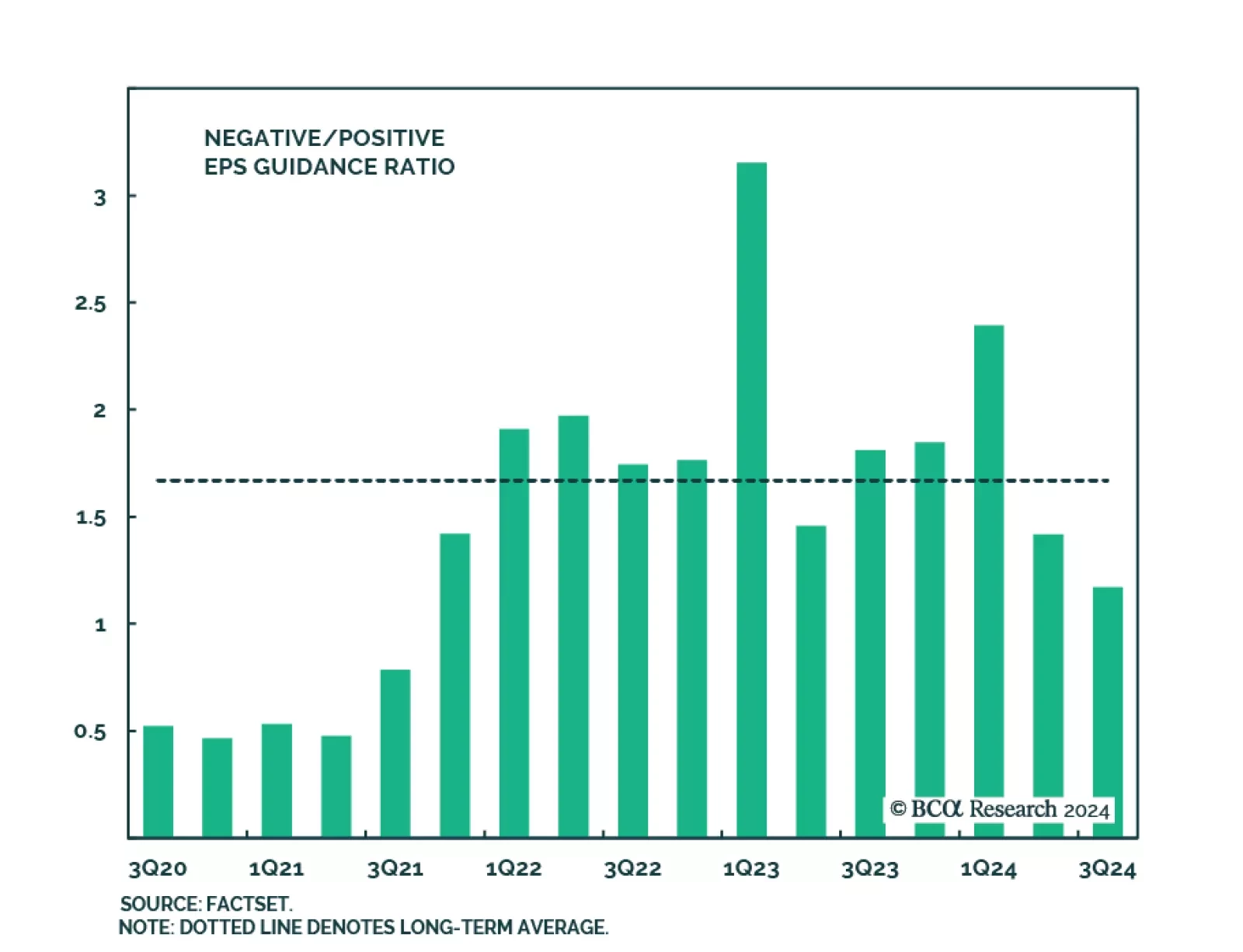

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

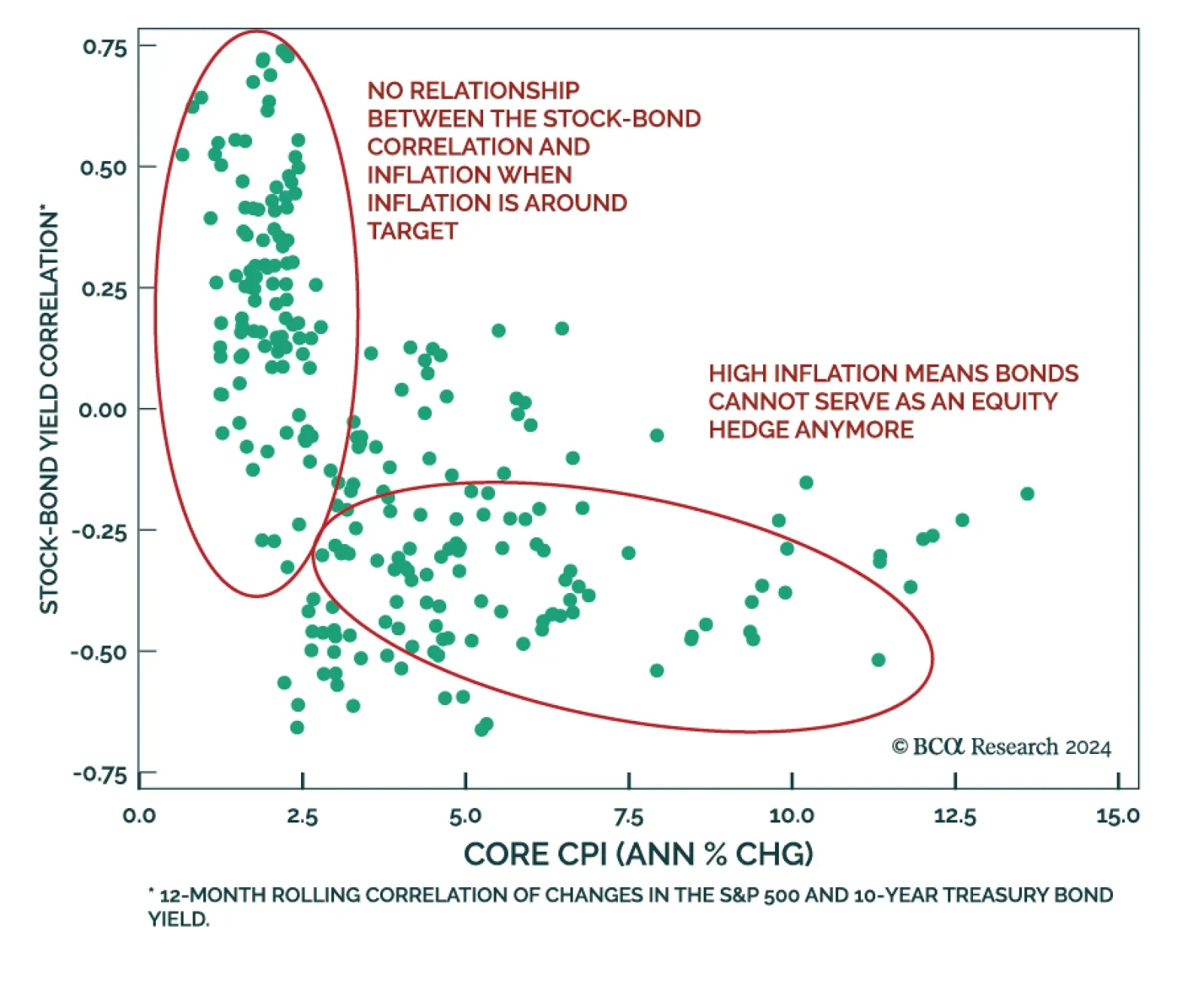

According to BCA Research’s Global Asset Allocation service, while the market action of the past few weeks is pointing to a return to a negative stock-bond correlation, more prints will be needed to confirm things are…

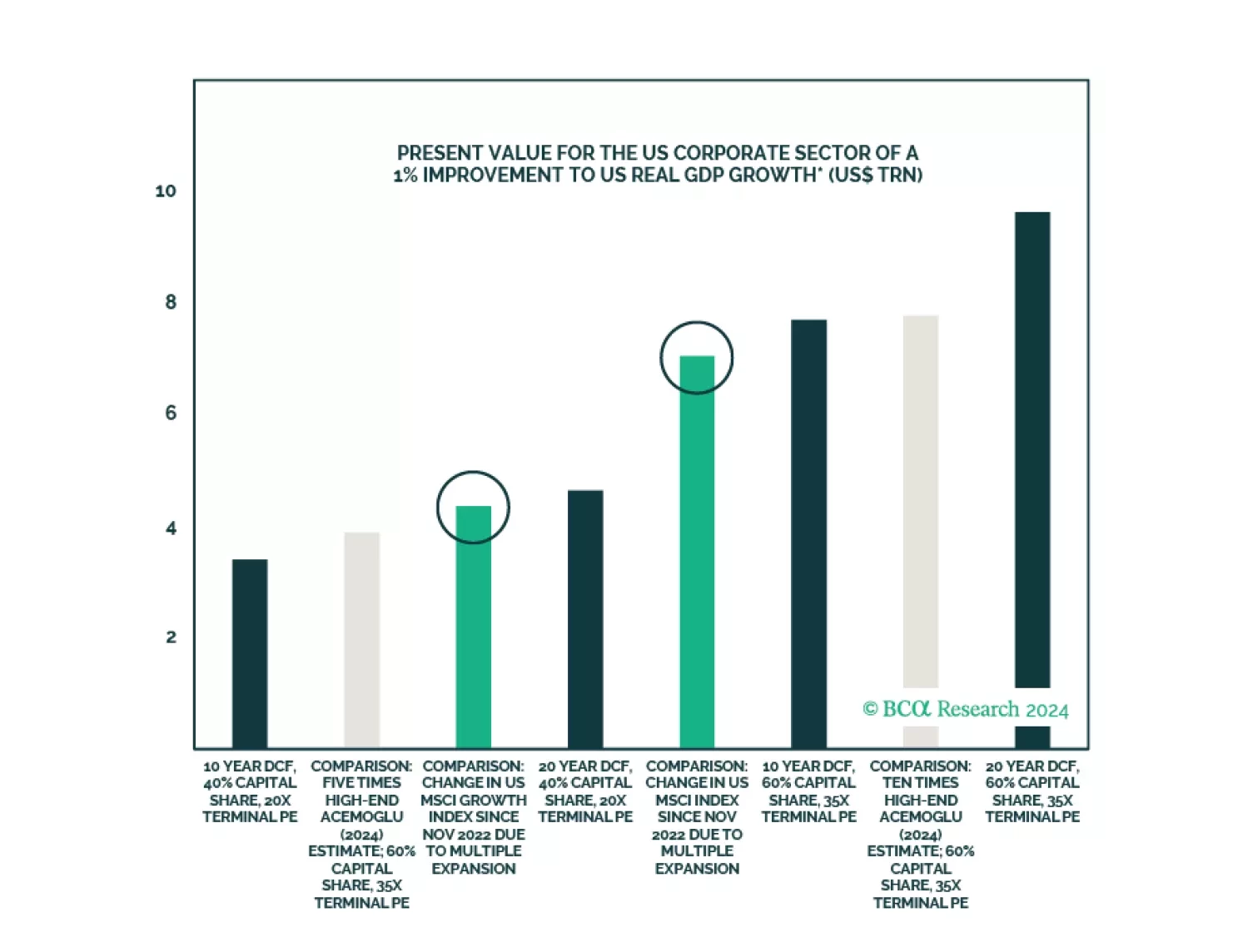

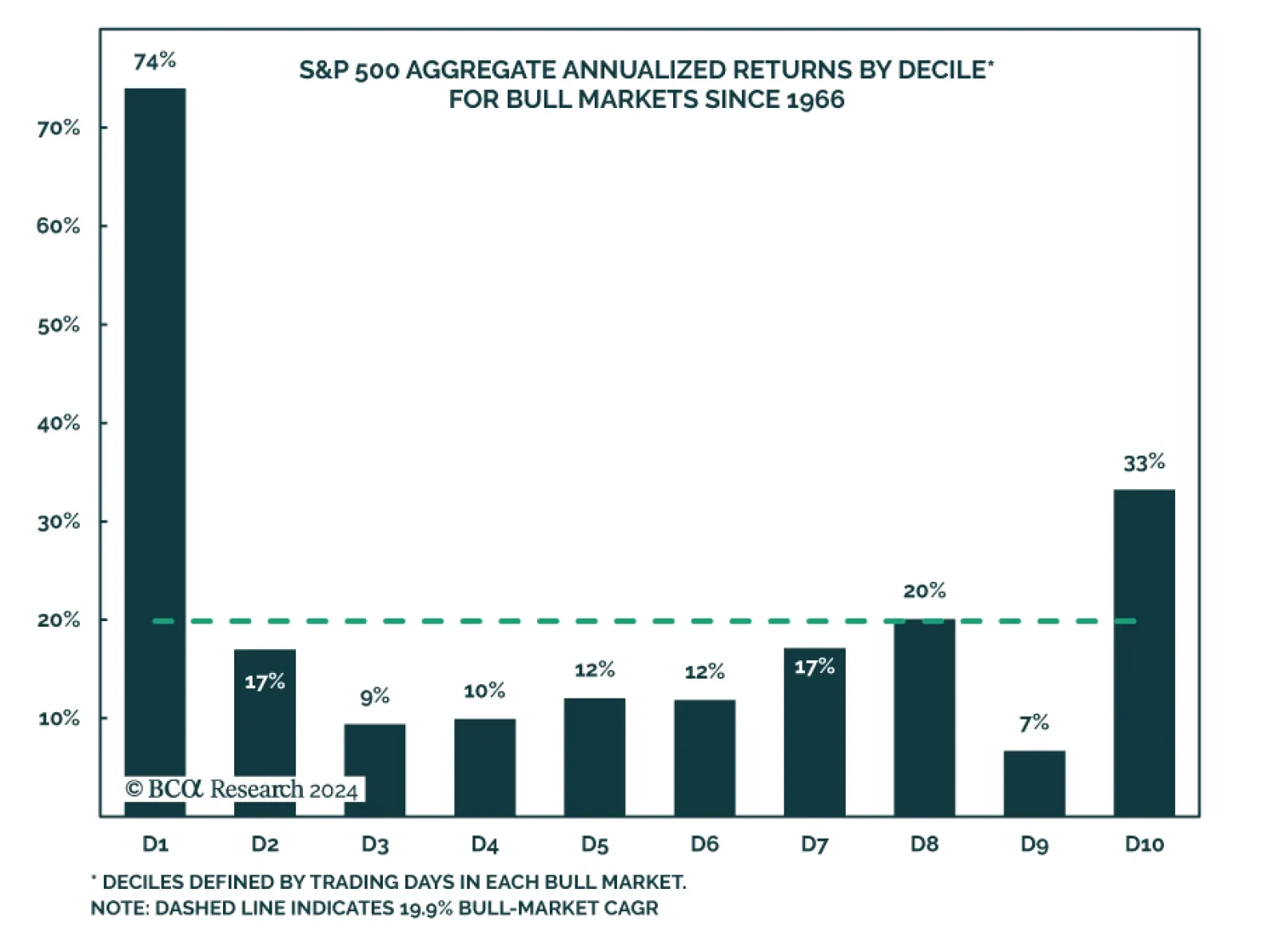

Way back in the 1970s and 1980s, before investment returns were assessed in relation to benchmarks and return of capital had the upper hand over return on capital, BCA researchers were invited to consider the following thought…

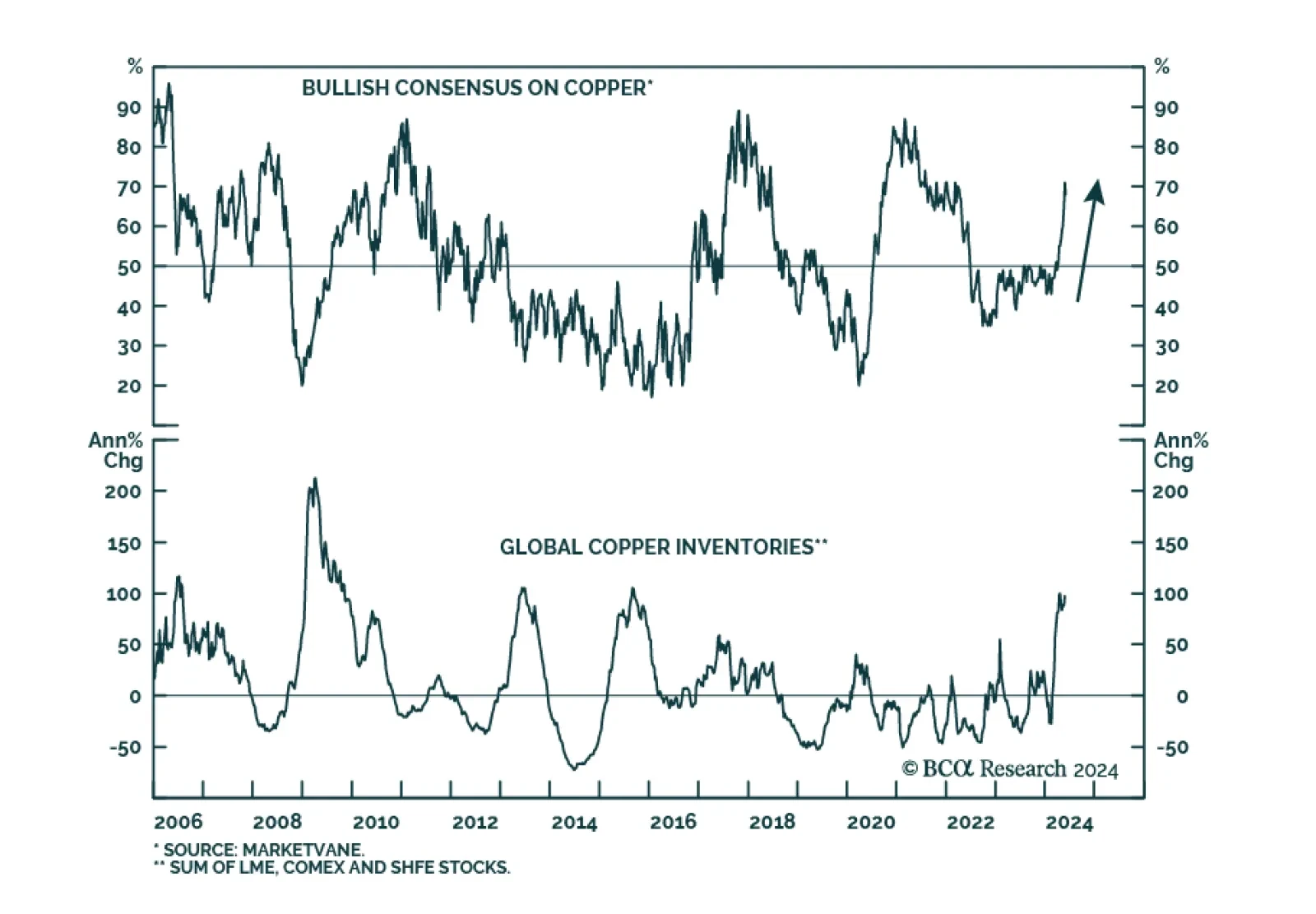

Copper has experienced a roller-coaster ride so far this year, with front-month futures on the Chicago Mercantile Exchange gaining nearly 40% from early February to late May, tumbling nearly 15% in just over five weeks, and…

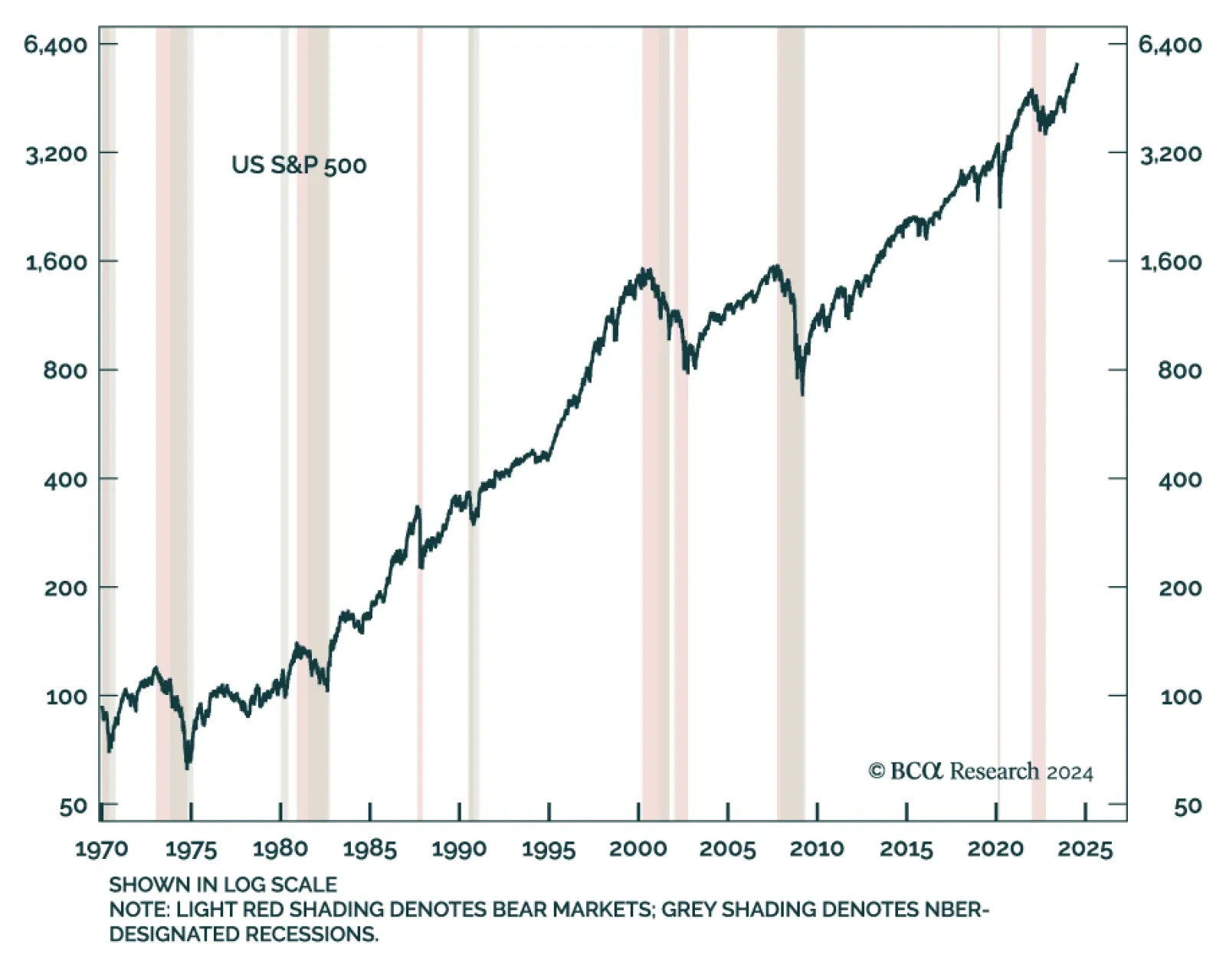

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

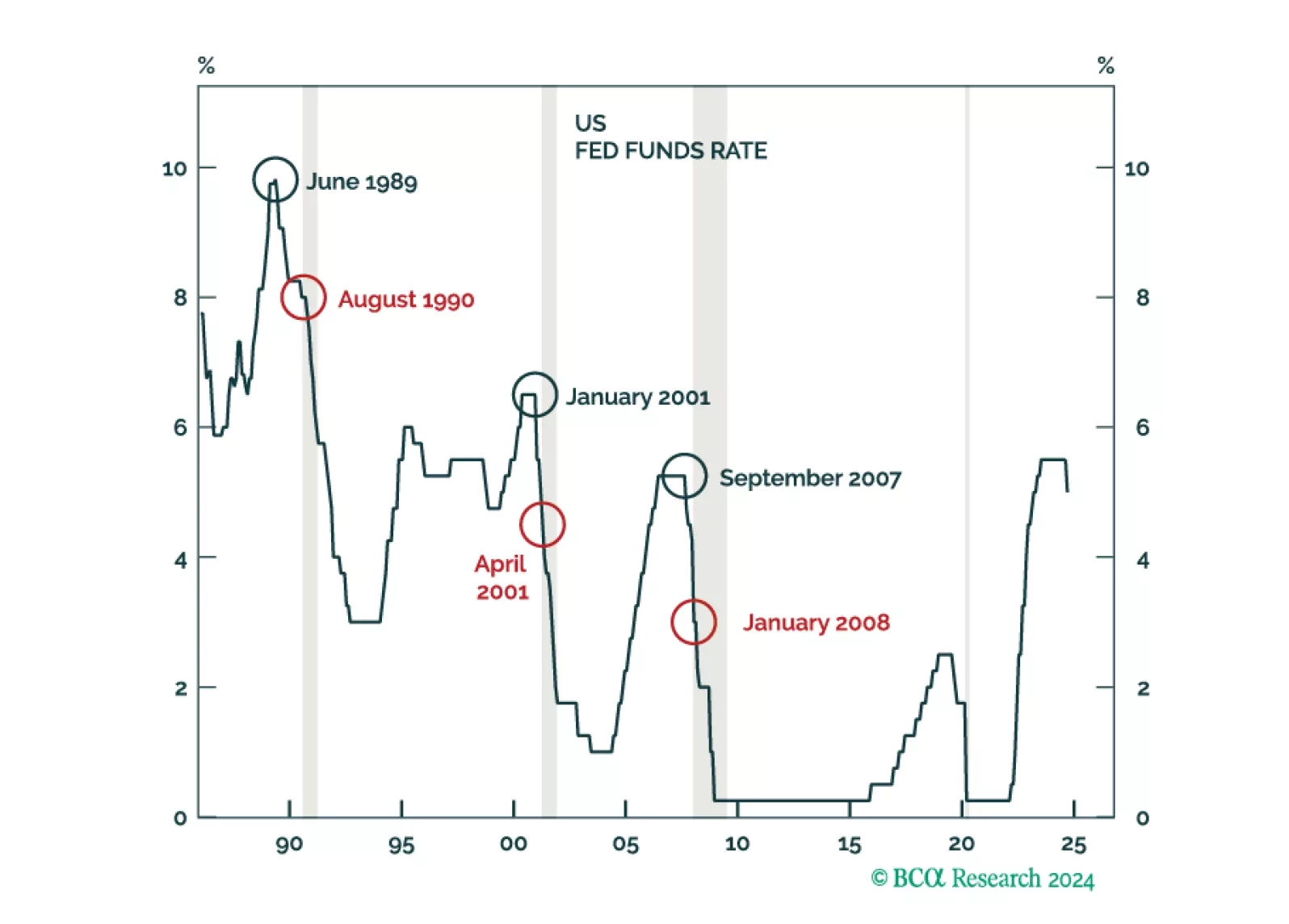

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

BCA Research’s US Investment Strategy service remains tactically neutral with a defensive cyclical bias. The team is resisting the impulse to turn prematurely defensive ahead of the coming recession. Our colleagues…

Copper prices have returned a whopping 25.6% YTD, briefly breaking above USD 5 earlier this month. The red metal accounts for a large share of industrial metals indices and it is being buoyed by the same late-cycle dynamics as…